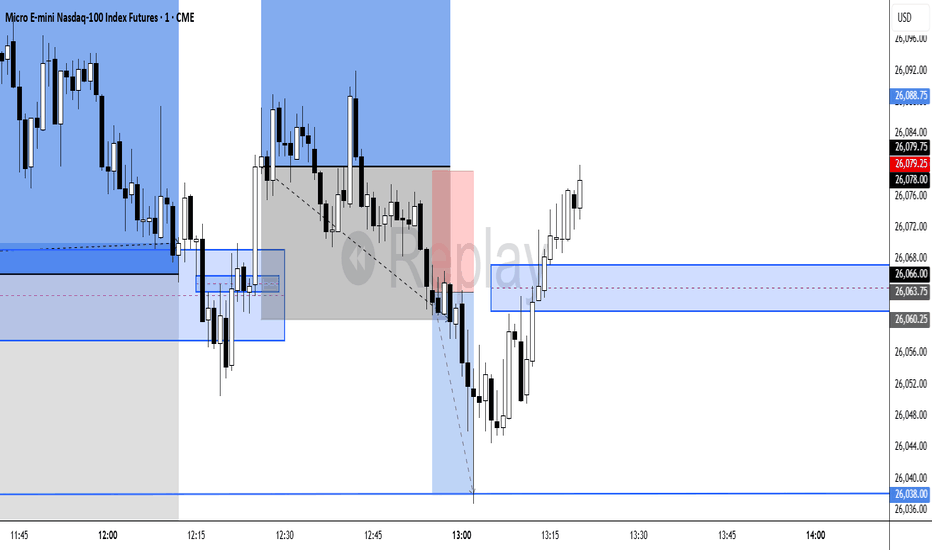

MNQ Daily Analysis - Thursday January 29 part 1As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

Ict

MNQ Daily Analysis - Wednesday January 280-2 / -$337

---------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Daily Analysis - Tuesday January 27 part 22-1 day / +$102

small positions today, none risked more than $130.

--------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Daily Analysis - Monday January 26 part 2/Tue Jan 27 part 10-0-1 $0 on Monday. Tuesday started in this same video.

------------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

EURAUD BEARISH BIAS|SHORT|

✅EURAUD trades into a premium supply zone after a corrective pullback. Bearish displacement hints at smart money distribution, with downside liquidity resting below recent lows. Expect continuation lower. Time Frame 3H.

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

USDCHF FREE SIGNAL|SHORT|

✅USDCHF taps premium supply after buy-side liquidity run. Bearish displacement and rejection from the zone suggest mitigation in play, favoring a downside move toward resting sell-side liquidity.

—————————

Entry: 0.7732

Stop Loss: 0.7751

Take Profit: 0.7704

Time Frame: 2H

—————————

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

XAUUSD: Smart Money Is Offloading While Retail Keeps BuyingOn XAUUSD, we still observe a bullish market structure, but price is clearly in an extended condition after the vertical impulse that pushed quotations toward the 5,150 area. The rejection candle formed after the high signals selling pressure and a potential start of a corrective phase toward the first dynamic demand zone around 4,900–4,800, aligning with the short-term ascending channel that has now been broken to the downside. The daily RSI is also exiting overbought territory, indicating weakening momentum and a likely sideways-to-bearish rotation in the near term.

From the COT Report, we can see a gradual reduction in long exposure from Non-Commercial traders, while Commercial players continue increasing their short hedges. This is a typical late-trend dynamic where smart money starts reducing risk. Rising open interest suggests the market is preparing for a directional move, but the current positioning favors a pullback scenario rather than immediate bullish continuation.

Gold seasonality shows that after January’s strength, February has historically been associated with consolidation or corrective phases before a potential new bullish leg into spring. This supports the idea of a technical retracement toward inefficiency zones left open during the recent rally.

From an FX Sentiment perspective, retail traders remain predominantly long (above 60%), which is generally considered a contrarian signal, statistically favoring further downside or liquidity sweeps before any continuation of the primary trend.

Trading Scenario:

As long as price remains below the 5,200–5,250 resistance area, the short-term bias remains corrective, with potential downside targets at 4,950 and then 4,800, where we will assess new bullish continuation structures. Only a strong reclaim above recent highs would reactivate the bullish leg toward new all-time highs.

AUD/USD: 90% of Traders Are Short… and Price Keeps RallyingAUD/USD has completed a clean and impulsive breakout above a major daily supply zone, which is now acting as structural support. This move marks a clear regime shift from the previous consolidation phase into a trend continuation environment.

From a price action perspective, the daily chart shows a well-defined bullish structure, with higher highs and higher lows developing inside an ascending channel. The breakout occurred with strong range expansion and decisive daily closes, signaling institutional participation rather than a retail-driven spike. Any pullback into the former supply area should be interpreted as a technical retest, not as a bearish signal, as long as daily structure holds.

Looking at the COT data, positioning remains supportive of further upside. Commercials continue to build short exposure on AUD (hedging activity), while Non-Commercials are still not aggressively long. This tells us the market is not crowded on the long side, leaving room for additional upside. At the same time, the US Dollar Index COT structure remains weak, reinforcing the bearish pressure on USD and indirectly supporting AUD/USD strength.

The seasonality component adds another layer of confluence. Historically, late January through February tends to be a positive seasonal window for AUD/USD, especially following prolonged accumulation phases. This timing aligns well with the current technical breakout.

On the FX sentiment side, positioning is extremely one-sided: over 90% of retail traders are short AUD/USD. This represents a classic contrarian setup, often observed during the early or mid-stages of sustained bullish trends. As long as retail remains heavily short, the probability of further upside pressure and short squeezes remains elevated.

Operational conclusion: the broader context supports a bullish continuation bias. Pullbacks toward the former supply (now demand) zone are technically constructive and offer potential trend-following opportunities. Only a daily close back below the reclaimed structure would invalidate the bullish scenario. Until then, downside moves should be viewed as opportunities, not weakness.

NZDUSD: 94% Retail SHORT…NZDUSD is flashing a classic squeeze setup where positioning and crowd sentiment are leaning the wrong way while price is breaking structure on the Daily. FX Sentiment shows an extreme imbalance with 94% of traders short vs 6% long, a contrarian tailwind that typically supports further upside as shorts get forced to cover.

On the COT (as of 2026-01-20) the picture is similar: NZD non-commercials are heavily net short (large short inventory still dominant), while commercials remain strongly net long, which often aligns with “smart hedging” supporting the underlying. On the USD side, DXY non-commercials are net short, which adds fuel to NZDUSD upside if USD stays offered.

Seasonality is mixed but not a headwind: longer lookbacks show January slightly negative on average, while the most recent window (5Y) has been positive—net effect is “neutral-to-supportive” into late Jan/early Feb, especially when a trend reversal is already in motion. Daily chart: price has cleanly broken the descending channel and printed an impulsive rally into the upper supply region (gray zone). From here the highest-probability path is either (1) shallow consolidation and continuation if bulls can hold above the broken structure, or (2) a controlled pullback into the first demand/flip area before the next leg higher.

Key levels to map the trade: 0.592–0.605 supply (current reaction zone), 0.5814 as the primary bullish pivot/flip (previous structure + breakout base), 0.5734 as deeper invalidation (loss of the breakout shelf), and upside magnets at 0.605/0.610 (prior supply/weekly liquidity).

Bias stays bullish while above 0.5814; a pullback that holds this area would be the “clean” continuation trigger, and if price accepts above 0.605 the squeeze can accelerate quickly given the positioning/sentiment backdrop.

CADJPY Daily: Premium Zone RejectionCADJPY remains in a solid bullish Daily structure (higher highs/higher lows) and is still respecting the ascending channel, but price is now trading inside a major Daily supply/premium zone where the probability of a deeper correction is rising. The latest candles are showing rejection from the highs and RSI is rolling over, signaling weakening momentum right at a key technical area. Below current price, the first major demand/support sits at 112.70–113.00, and if that level fails the next downside target becomes 110.00. Retail sentiment is ~60% short (contrarian supportive, potential squeeze risk), but sentiment alone is not enough to justify longs into supply. COT still points to structural JPY weakness (speculators net-short), keeping the macro bias supportive for CADJPY, but the technical context favors a pullback before continuation. Seasonality in January is mixed/soft for both JPY and CAD, reinforcing the idea of a corrective phase rather than a clean trend acceleration. Plan: avoid chasing longs into supply, wait for confirmation—either a rejection and breakdown targeting 112.70–113.00 then 110.00, or a breakout/acceptance above supply followed by a retest before considering continuation entries.

EURAUD: Retail Is 83% LONG… Next Leg Could Still Be DownLooking at EURAUD on the daily timeframe, my bias remains bearish. The structure is clear: lower highs, lower lows, strong downside impulses, and weak pullbacks. Price is currently around 1.70, a key decision area where the market could either build a technical retracement or continue directly toward lower demand zones.

Retail sentiment shows around 83% of traders are long on EURAUD. I read this from a contrarian perspective, especially in a trending market. When positioning is heavily skewed against the main direction, it often acts as fuel for continuation rather than reversal.

From the COT perspective, speculators remain strongly net long on the euro, while AUD positioning is lighter. To me, this suggests possible crowding on the euro side, where profit-taking could add further downside pressure on the pair. Even if the euro positioning is technically positive, price action does not currently support a bullish EURAUD scenario.

Seasonality also aligns with this view, as January has historically not been particularly supportive for the euro, while AUD performance tends to be more mixed. It’s not a standalone signal, but it doesn’t contradict the bearish structure.

Technically, I’m watching the 1.724–1.732 resistance zone as the first potential reaction area on a pullback. Higher up, the 1.75–1.79 supply cluster would be a premium area to look for weakness. On the downside, my key references remain 1.69, then 1.67–1.68 demand, and in extension 1.64–1.65.

As long as price respects the bearish daily structure, I view retracements as opportunities, not reversals. This bias would only shift if the market reclaims and holds above 1.73, and especially above 1.75, where the structure would begin to change.

USDJPY FREE SIGNAL|SHORT|

✅USDJPY strong bearish displacement after tapping premium supply. Price mitigated the zone and shows weak bullish follow-through, suggesting a distribution phase. Expect continuation lower toward the marked imbalance.

—————————

Entry: 154.54

Stop Loss: 154.90

Take Profit: 154.08

Time Frame: 5H

—————————

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

GBPUSD Delivered GBPUSD H4 — Delivered Exactly as Planned ✅

Price ran liquidity, tapped into premium,

then reacted perfectly from our marked zone.

No indicators.

No guesswork.

Just HTF bias + liquidity + location.

This is why we wait.

This is why we plan.

This is why patience pays.

Market did exactly what it was supposed to do.

📍 ERL → IRL

📍 Premium → Reaction

📍 Structure respected

Execution > Emotion.

MNQ Friday Outlook | Equilibrium Chop ExpectedExpecting equilibrium chop today on MNQ.

Key observations:

✅ London swept the Asian range (25,725)

✅ Breaker held clean at 25,800

⚖️ Now sitting at EQ ~25,865

Upside: BSL at 26,032 is the magnet

Downside: Break below 25,800 = discount retest

Opening range will confirm direction. Friday typically sees consolidation after mid-week moves.

PriceCipher indicator mapping the PD arrays.

#NQ #Futures #ICT #Trading

GBPUSD M30 HTF Supply Rejection and Bearish Continuation📝 Description

FX:GBPUSD has shown a clear bearish impulse after failing to sustain above the recent intraday highs. Price is currently consolidating below multiple 30-minute Fair Value Gaps, indicating a corrective pullback within a broader bearish structure rather than a bullish trend reversal.

________________________________________

📉 Signal / Analysis

Primary Bias: Bearish below the M30 FVG

Preferred Setup:

• Entry: 1.3780

• Stop Loss: Above 1.3791

• TP1: 1.3769

• TP2: 1.3747

• TP3: 1.3725

________________________________________

🧠 ICT & SMC Notes

• Rejection from stacked M30 Fair Value Gaps aligned with descending channel resistance

• Bearish market structure maintained with consistent lower highs

• No bullish displacement or acceptance above premium zones

________________________________________

📌 Summary

As long as GBPUSD remains capped below the 1.3795–1.3820 resistance zone, bearish continuation remains the preferred scenario. The current price action is viewed as a corrective pause before a potential continuation toward deeper sell-side liquidity.

________________________________________

🌍 Fundamental Notes / Sentiment

Relative USD strength and the lack of supportive macro catalysts for the British Pound continue to pressure GBPUSD. With risk sentiment remaining cautious, downside continuation is favored in the short term.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

GOLD REBOUND FROM 5000$ LEVEL|LONG|

✅XAUUSD delivers a sharp sell-side liquidity sweep into a higher-timeframe demand zone. Strong bullish reaction suggests accumulation. Look for displacement and continuation higher toward the next premium target. Time Frame 2H.

LONG🚀

✅Like and subscribe to never miss a new idea!✅

GBPUSD H4 FrameWork GU H4 – Clean Breakdown (Bearish Bias)

• HTF Context:

Price traded into premium territory after an impulsive move up.

This area aligns with H4 supply / internal liquidity, not a buy zone.

• Structure Shift:

We got a Market Structure Shift (MSS) to the downside, confirming weakness and a change in intent.

• Liquidity Logic:

• Buy-side liquidity was taken

• Price failed to hold highs

• Displacement to the downside confirms distribution

• Entry Logic:

Price retraced into a bearish OB / FVG zone, offering a high-probability sell entry.

• Target:

Price is engineered to deliver toward H4 / D1 IRL in discount

(where unfilled liquidity remains).

• Key Insight:

❌ Buying here = chasing liquidity

✅ Selling aligns with HTF bias + structure + delivery

Keep it simple 🤌

EURUSD Bearish Continuation Toward LiquidityQuick Summary

The bearish outlook on EURUSD remains valid and Price may retrace higher toward 1.19617

After that a downside move is expected to break the equal lows formed today

This move would support continuation of the bearish trend toward the liquidity void left over the past two weeks

Full Analysis

The bearish view on EURUSD continues to hold despite short term price fluctuations

A corrective move higher is possible with price expected to reach the 1.19617 level

This upside move is considered a retracement rather than a trend reversal

From that area the market may resume its decline and target the equal lows formed earlier today

These equal lows represent a clear liquidity pool that often attracts price during bearish conditions

Breaking them would open the path for continuation of the broader downtrend

The ultimate objective of this move is the liquidity void that EURUSD has left behind over the past two weeks

That imbalance remains a strong magnet for price and supports the expectation of further downside

As long as price remains below recent highs the bearish scenario stays active

Any upward movement is viewed as an opportunity for continuation rather than a change in market direction

EURUSD Monthly Supply ReactionQuick Summary

the Price has reacted from a monthly supply zone and Further downside on EURUSD is possible

A sell setup may develop from the 1.20031 level and Entry should only be considered after a clear rejection signal

The main target is the previous low at 1.18955

Full Analysis

After price interacted with the monthly supply zone EURUSD shows potential for further downside movement

This area represents higher timeframe resistance and often acts as a strong turning point

A continuation of the decline may develop from the 1.20031 level

However selling directly from this area is not recommended without confirmation

The sell setup becomes stronger only if a clear rejection appears

This can be in the form of a reversal candle or an internal change of character which would confirm seller participation

If such confirmation is present the market is expected to target the previous low at 1.18955

This level represents a natural liquidity objective following the reaction from monthly supply

SILVER FREE SIGNAL|SHORT|

✅SILVER taps a higher-timeframe premium supply and shows bearish displacement, confirming rejection from an ICT POI. Expect continuation lower toward resting sell-side liquidity.

—————————

Entry: 116.45$

Stop Loss: 121.69$

Take Profit: 109.00$

Time Frame: 1H

—————————

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

MNQ Friday Outlook | Consolidation & Liquidity Build📊 MNQ Weekly Close Setup — Jan 30, 2026

Thursday's session swept the IPDA 20 Day High and delivered an 800+ point selloff into discount arrays. After a move like that, Friday typically consolidates.

✅ Documented this move on Twitter before it happened.

🎯 EXPECTATION: Equilibrium Consolidation

Price will likely hover around equilibrium, building:

• Sell Side Liquidity (SSL) below

• Buy Side Liquidity (BSL) above

This creates a trap — shorts get enticed by the "continuation" narrative.

📍 LEVELS TO WATCH:

• HTF Breaker + Order Block (formed before the run down)

• Equilibrium of the current range

• Discount arrays as support

⚠️ TWO SCENARIOS:

1️⃣ Consolidation → Push into HTF Breaker/OB

Shorts pile in, get squeezed into the breaker zone

2️⃣ Sideways Chop → Wait for Next Week

Low volume Friday grind, real move comes Monday

Either way — no need to force it. Let liquidity form, then strike.

📝 Will update Friday AM before market open if anything changes.