You See the Signals, So Why Are You Still Losing Money?The Crypto Conundrum: You See the Signals, So Why Are You Still Losing Money?

Every morning, thousands of traders boot up their rigs. Their screens light up with flashing RSI, MACD, and moving averages. Crypto Twitter is buzzing with analysts calling the next big move. All the information you could ever want is right at your fingertips. So why, by the end of the week, is your account balance smaller than when you started?

Let’s get one thing straight: the problem isn’t the indicators or the analysts. The problem is the "wetware"—the trader sitting in the chair.

You’re not losing because the signals are wrong. You’re losing because of how you react to them. Let's break down the real reasons your account is bleeding.

Reason #1: Psychology Trumps Logic. Every Single Time.

This is the #1 account killer. The market is an arena ruled by the twin demons of Fear and Greed. Your brilliant technical analysis is just a spectator.

FOMO (Fear Of Missing Out) – The Rocket Ship Trap

The Scene: Some altcoin, let's call it $WAGMI, has pumped 30% in an hour. Every indicator is screaming "overbought." Analysts are saying the news is already priced in. But all you see is a giant green candle. Your brain screams, "What if this thing 100x's? I gotta get in on this rocket ship!"

The Action: You ape in at the top.

The Result: The early buyers start taking profits, and the price nosedives. You're left holding the bag, wondering what went wrong and blaming "market manipulation."

The Mistake: You let an emotional impulse override every logical signal in front of you.

FUD (Fear, Uncertainty, and Doubt) – The Paper Hands Plague

The Scene: You entered a trade following your rules perfectly. The price bounced off a key support level, and the RSI showed a bullish divergence. But an hour later, the market dips slightly, and you're down 2%. A vague headline about crypto regulation in some far-off country flashes across your feed.

The Action: Panic. You slam the "close position" button to "cut your losses before it gets worse."

The Result: A few hours later, the price reverses and rips upward, hitting the exact target you originally set for a 15% gain.

The Mistake: You abandoned your own system because you got spooked by market "noise."

Reason #2: You Have No System. You Have a Gambling Habit.

An indicator signal isn't a magic bullet; it's just one piece of the puzzle.

"Indicator Soup"

The Scene: Your chart is a mess. You’ve got RSI, MACD, Stochastic, Bollinger Bands, and the Ichimoku Cloud all layered on top of each other. One says buy, another says sell, and a third is neutral.

The Action: You either freeze up from "paralysis by analysis" or, even worse, you cherry-pick the one signal that confirms what you wanted to do anyway.

The Result: A series of chaotic, random trades. Any profits are pure luck; the losses are inevitable.

The Mistake: Believing that more indicators equal more certainty. In reality, it just creates noise and confusion.

Ignoring the Stop-Loss: The Ultimate Sin

The Scene: You enter a long position based on a solid signal. But the price immediately starts moving against you. You told yourself you'd exit at a 5% loss, but as the price hits your stop level, you think, "It's gotta turn around any second now. I don't want to lock in a loss."

The Action: You delete your stop-loss, turning what was supposed to be a quick trade into a long-term "investment" you never wanted.

The Result: That 5% loss snowballs into a 20%, then 50% loss, tying up your capital and killing your account.

The Mistake: You violated the golden rule of trading: protect your capital. Hope is not a strategy.

Reason #3: You're Missing the Forest for the Trees

Indicators are useless without understanding the broader market context.

The Scene: The RSI on the 4-hour chart is deep in "oversold" territory—a classic buy signal.

The Action: You go long.

The Result: The price keeps tanking. Why? Because you failed to zoom out. On the daily chart, the asset is in a brutal, multi-month downtrend. A bullish signal in a bear market is often just a bull trap, a brief pause before the next leg down.

The Mistake: You analyzed a single timeframe in a vacuum, ignoring the primary trend.

So, What's the Fix? It's All About Strategy.

A real trading strategy isn't just "buy when the green line crosses the red one." It's a non-negotiable set of rules that dictates your every move. It must include:

Entry Trigger: Exactly what conditions must be met to open a position.

Example: The price must be above the 200-day EMA (confirming an uptrend), and MACD must have a bullish cross on the 4-hour chart.

Stop-Loss (Your Exit for a Loss): A pre-defined price point where you get out, no questions asked. This is your insurance policy against catastrophic loss.

Example: Place the stop-loss just below the most recent swing low.

Take-Profit (Your Exit for a Win): A pre-defined target where you lock in gains. Your potential profit should always be significantly larger than your potential loss (a good Risk/Reward Ratio is at least 2:1).

Example: If your stop-loss is 3% below your entry, your first take-profit target should be at least 6% above it.

A Simple, No-Nonsense Strategy Framework:

Concept: Trade with the trend, not against it.

Toolkit: The 200-day Exponential Moving Average (EMA) for the main trend, and basic support/resistance levels.

The Rules:

If the price is above the 200 EMA on the daily chart, you ONLY look for buys (longs).

Wait for the price to pull back to a key support level.

Enter a long position ONLY when you see a confirmation signal at that level (like a bullish engulfing candle).

Place your stop-loss below that support level. Place your take-profit at the next resistance level.

If the price is below the 200 EMA, you do the exact opposite and ONLY look for sells (shorts).

The Bottom Line

Indicators, charts, and expert analysis are just tools. In the hands of a disciplined craftsman, they can build wealth. In the hands of an emotional amateur, they’re just a way to smash your own thumb.

You lose money not because your tools are bad, but because you lack a plan, discipline, and risk management. Success in trading isn't about finding a holy grail indicator. It’s about the boring, repetitive work of following your rules, day in and day out.

The market doesn't pay you for being smart; it pays you for being disciplined. Period.

Indicators

How Many Indicators Are Too Many?

I have been trading for around 5 years and in that time, I lost money and hope more often than I can count. A common coping strategy I use when in a time of loss is to strip all the "completely useless" indicators from my charts. And 6 months later, I have more than I had before.

Recently, I have actually started to earn small amounts of money from the markets consistently but my indicator problem persists. The picture above is an example of just some of the indicators I use. So now I ask the question,

-How many indicators are too many?

There really is not an answer despite what those on reddit might tell you. I seem to always have this fantasy that I will find the perfect chart set-up with all my indicators telling me just what I want to know. And of course TradingView has Pinscript which only makes my habit worse by allowing me to create exactly what I want.

As I was thinking about chart layouts this morning I came to a conclusion that my trading will always be evolving and the way in which I view the visual output of markets will change as well. There will most likely never be a chart set-up that I will use for the next 20 years. Even when I find my edge, the process of trading will still evolve. My "edge" will never be an indicator or a set of indicators .

So I wrote this to try and help those that are experiencing the same dilemma. Just know that you are not alone in your obsession with finding that perfect layout. Add 100 indicators to your chart and then delete them all when you feel they don't belong. You will never find that perfect indicator but but neither will you stop looking. It may seems like it is all a waste of time but I assure you that everything you experience in trading is worth it and progress does happen .

Safe Trading, Frank

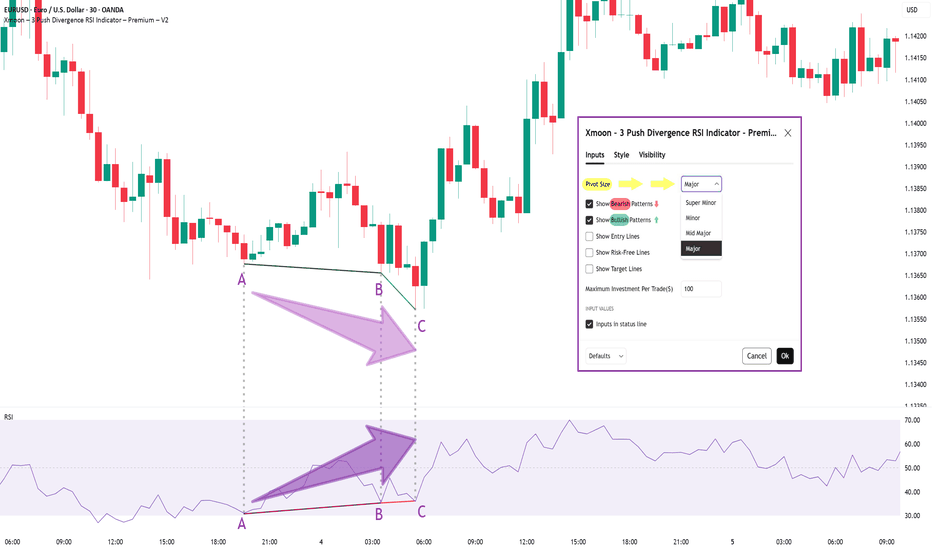

Xmoon Indicator Tutorial – Part 2 – Pivots🔻🔻🔻+ Persian translation below 🔻🔻🔻

🔹 What Is a Pivot?

In the Xmoon strategy, every high or low that forms on the chart is considered a pivot.

The number of candles between two highs or two lows defines the size of the pivot.

The more candles there are between them, the larger and more reliable the pivot becomes.

🔸 Types of Pivots in the Xmoon Indicator Settings

In the settings panel, you can choose which types of pivots the patterns should be based on.

There are 4 pivot types :

• Super Minor → the smallest pivot

• Minor

• Mid Major

• Major → the largest pivot

⏫ As you move from Super Minor to Major, the strength of the pivot increases — but the number of signals decreases.

⚖️ Choosing the Right Pivot = Your Trading Style

• Want more signals? → Use smaller pivots like Minor or Super Minor

• Prefer higher accuracy and lower risk? → Use larger pivots like Major or Mid Major

💡 Pro Tip: On higher timeframes, pivots perform better and help reduce risk.

✍️ Summary

If you're looking for frequent signals, trade on lower timeframes, and can handle higher volatility and pressure, then smaller pivots like Super Minor and Minor are a better choice.

But if you prefer quality over quantity, work on higher timeframes, and value clarity, peace of mind, and higher success rates, then larger pivots like Mid Major and Major are the way to go.

📣 If you have any questions or need guidance, feel free to ask us. We’d be happy to help.

🔻🔻🔻 Persian Section – بخش فارسی 🔻🔻🔻

🔹 پیوت چیست؟

در استراتژی ایکسمون، هر قله یا درهای که روی چارت شکل میگیرد، یک پیوت محسوب می شود

فاصله زمانی بین دو قله یا دو دره (یعنی تعداد کندلهایی که بینشان قرار دارد) اندازهی پیوت را مشخص میکند

هرچه تعداد کندل بین دو سقف یا کف بیشتر باشد، آن پیوت بزرگتر و معتبرتر است

🔸 انواع پیوت در تنظیمات اندیکاتور ایکسمون

در بخش تنظیمات، میتوانید مشخص کنید که الگوها بر اساس چه نوع پیوتهایی شناسایی شوند

ما ۴ نوع پیوت داریم

• سوپر مینور ← کوچکترین پیوت

• مینور

• میدماژور

• ماژور ← بزرگترین پیوت

⏫ هرچه از سوپرمینور به سمت ماژور برویم، قدرت پیوت بیشتر میشود، ولی تعداد سیگنالها کمتر می شود

⚖️ انتخاب پیوت مناسب = سبک معاملاتی شما

• به دنبال سیگنال زیاد هستید ← پیوت کوچک تر = مینور و سوپرمینور

• به دنبال دقت بیشتر و ریسک کمتر هستید← پیوت بزرگتر = ماژور و میدماژور

💡 نکته حرفهای: در تایمفریمهای بالا، پیوتها عملکرد بهتری دارند و به کنترل ریسک کمک میکنند

✍️ جمعبندی

اگر دنبال سیگنالهای زیاد هستید، در تایمفریمهای کوچکتر کار میکنید و میتونید نوسانات و فشار روانی بالاتر رو تحمل کنید، پیوتهای کوچکتر مثل سوپرمینور و مینور انتخاب مناسبتری هستند

اما اگر در تایم فریم های بزرگتر کار می کنید و کیفیت سیگنال، آرامش ذهنی و احتمال موفقیت برایتان مهمتر است، پیوتهای بزرگتر مثل میدماژور و ماژور انتخاب بهتری هستند

📣 اگر سوالی دارید یا نیاز به راهنمایی دارید، خوشحال میشویم از ما بپرسید

با کمال میل در خدمتتان هستیم

Xmoon Indicator Tutorial – Part 1 – Strategy🔻🔻🔻+ Persian version below🔻🔻🔻

📘 Xmoon Indicator Tutorial – Part 1

🎯 3Push Divergence RSI Strategy

🔥 The core of the Xmoon indicator

is built upon one of the most powerful strategies in technical analysis:

The advanced 3Push Divergence RSI pattern

🔁 A pattern that typically appears at key market turning points.

📉 When the price moves in the same direction three consecutive times on pivot points (e.g., making lower lows or higher highs), but the RSI shows the opposite behavior, it indicates a clear divergence !

💡 This divergence can act as a strong signal for a potential trend reversal.

🎯 The Xmoon Indicator is designed to detect this critical moment.

⚙️ Xmoon Indicator Settings Panel

The Xmoon settings panel offers the following options:

🔸 Pattern Type Selection: In the first and second lines, you can specify which type of pattern should be displayed: only bullish patterns or only bearish ones. You can also check both options.

🔸 Pivot Type Selection: From the dropdown menu, you can choose one of four pivot types:

“Super Minor”, “Minor”, “Mid-Major”, and “Major”, ordered from smallest to largest.

📌 Educational Note: The greater the distance (in candle count) between two lows or two highs, the larger the pivot is considered.

A Major Pivot is the largest among them.

✅ Larger Pivot = Higher Accuracy

❗ But naturally = Fewer Signals

📣 If you have any questions or need guidance, feel free to ask us. We’d be happy to help.

🔻🔻🔻بخش فارسی – Persian Section 🔻🔻🔻

📘 آموزش اندیکاتور ایکسمون - قسمت اول

🎯 استراتژی سهپوش واگرایی (3Push Divergence RSI)

🔥 هسته اصلی ایکسمون

بر پایه یکی از قویترین استراتژیهای تحلیل تکنیکال طراحی شده است

الگوی پیشرفته سهپوش واگرایی

🔁 الگویی که معمولاً در نقاط چرخش مهم بازار ظاهر میشود

📉 وقتی قیمت سه بار پشت سر هم روی نقاط پیوت ، در یک جهت حرکت میکند (مثلاً کفهای پایینتر یا سقفهای بالاتر میسازد) ، اما آر-اِس-آی خلاف آن را نشان میدهد، یعنی یک واگرایی آشکار رخ داده است

💡این واگرایی میتواند سیگنالی قوی برای برگشت روند باشد

🎯 اندیکاتور ایکسمون این لحظه را شناسایی میکند

⚙️ پنجره تنظیمات اندیکاتور ایکسمون

در بخش تنظیمات اندیکاتور ایکسمون، امکاناتی در اختیار شما قرار دارند

🔸 انتخاب نوع الگو: در خط اول و دوم میتوانید مشخص کنید چه نوع الگویی نمایش داده شود

فقط الگوهای صعودی یا فقط نزولی. همچنین می توانید تیک هر دو گزینه را بزنید

🔸 انتخاب نوع پیوتها: از پنجره کشویی بالا، می توانید یکی از ۴ نوع پیوت را انتخاب کنید

پیوت ها به ترتیب از کوچک به بزرگ عبارتند از: سوپر مینور ، مینور ، میدماژور و ماژور

📌 نکته آموزشی: هرچه فاصله بین دو کف یا دو سقف بیشتر باشد (یعنی تعداد کندلهای بین آنها زیادتر باشد)، آن پیوت، بزرگتر محسوب میشود

پیوت ماژور از بقیه بزرگ تر است

✅ پیوت بزرگتر = دقت بالاتر

❗ اما طبیعتاً = تعداد سیگنال کمتر

📣 اگر سوالی دارید یا نیاز به راهنمایی دارید، خوشحال میشویم از ما بپرسید

با کمال میل در خدمتتان هستیم

Mastering the Bollinger Bands- How to use it in trading?What is the Bollinger Bands

Bollinger Bands is a popular technical analysis tool developed by John Bollinger in the 1980s. It is designed to measure market volatility and provide signals for potential price reversals or trend continuations. The Bollinger Bands consist of three lines: a simple moving average in the middle, usually calculated over 20 periods, and two outer bands that are placed a set number of standard deviations above and below the moving average. These outer bands automatically adjust to market conditions, expanding and contracting based on price volatility. The indicator is widely used by traders to understand the relative highs and lows of a financial instrument in relation to recent price action.

What will be discussed?

- How does it work with the lower band and upper band?

- What does the narrowing mean?

- What does the widening mean?

- How to trade with the Bollingers Bands?

-------------------------

How does it work with the lower band and upper band?

The upper band and the lower band serve as dynamic levels of resistance and support. When the price of an asset touches or exceeds the upper band, it may be considered overbought, suggesting that a reversal or pullback could be near. Conversely, when the price approaches or breaks below the lower band, the asset may be viewed as oversold, indicating a potential rebound. These bands do not generate definitive buy or sell signals on their own but instead help traders assess market conditions. The interaction of price with the upper and lower bands often provides visual cues about the momentum and direction of the market, allowing for more informed decision-making.

-------------------------

What does the narrowing mean?

The narrowing of the Bollinger Bands occurs when the price becomes less volatile over time. This contraction indicates a period of consolidation or low market activity, where the price is trading in a tighter range. Narrowing bands are often interpreted as a signal that a significant price movement may be coming soon, as low volatility tends to precede high volatility. This phase is sometimes referred to as the "squeeze," and traders closely monitor it to anticipate breakout opportunities. The direction of the breakout, whether upward or downward, is not predicted by the narrowing itself but usually follows shortly after the bands have contracted.

-------------------------

What does the widening mean?

The widening of the Bollinger Bands reflects increasing market volatility. When the price starts to move rapidly either up or down, the bands spread further apart to accommodate this movement. This expansion typically confirms that a new trend is underway or that a breakout has occurred. The wider the bands become, the greater the degree of price fluctuation. During these times, traders may observe stronger momentum in the market, and the continuation of the move may be supported by the growing distance between the bands. However, extremely wide bands may also suggest that a reversal could be nearing, as the market can become overstretched in either direction.

-------------------------

How to trade with the Bollinger Bands?

Trading with Bollinger Bands involves using the bands to identify entry and exit points based on the behavior of price in relation to the upper and lower bands. One common approach is to buy when the price touches or breaks below the lower band and shows signs of bouncing back, and to sell when the price reaches or moves above the upper band and begins to retreat. Another strategy involves waiting for the bands to narrow significantly and then entering a trade in the direction of the breakout that follows. Traders often use Bollinger Bands in combination with other indicators such as RSI, MACD, or volume to confirm signals and reduce the risk of false breakouts. It is important to remember that Bollinger Bands are not predictive on their own but are most effective when used as part of a broader technical analysis framework.

-------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

How to Trade Smart Money Concepts (SMC)\ How to Trade Smart Money Concepts (SMC)\

\ This article explores the foundation, key tools, and practical insights of Smart Money Concepts — and why it’s worth your attention.\

In today's fast-changing financial landscape, Smart Money Concepts (SMC) has become a popular strategy among modern traders. But what is SMC exactly, and how can it improve your trading decisions? This article breaks it down in a simple, professional way for traders at all levels.

---

\ What Are Smart Money Concepts?\

SMC is a trading approach based on the belief that large institutions ("smart money") like banks and hedge funds control most of the market's movements. These institutions often move the market in ways that confuse or trap retail traders. The goal of SMC is to understand and follow the footsteps of these big players.

Instead of relying on simple patterns or indicators, SMC focuses on:

\ - Market structure\

\ - Supply and demand zones\

\ - Liquidity pools\

By aligning your trades with the behavior of smart money, you can position yourself more strategically in the market.

---

\ Key SMC Concepts Explained\

\ Order Blocks\

Order blocks are zones on the chart where large institutions have placed significant buy or sell orders. These zones often lead to strong price reactions and act as hidden support or resistance levels. Order blocks are considered more precise than traditional supply and demand areas.

Example: ()

\ Fair Value Gap (FVG)\

A Fair Value Gap occurs when price moves sharply in one direction, leaving a gap or imbalance in the price action. These areas often get filled later and can act as magnets for price.

In a bearish move, the FVG is the gap between the low of the previous candle and the high of the next one. In a bullish move, it's the reverse.

Example: ()

\ Timeframe Consideration\

If you can’t monitor charts during the day, avoid relying on 5–30 minute setups. Consider 4H or daily timeframes for clearer signals and more manageable trading decisions.

\ Liquidity\

Liquidity refers to price zones where lots of pending orders exist. These are usually at obvious highs, lows, or trendlines. Smart money often targets these areas to trigger stop-losses and generate movement.

One common tool to identify liquidity is a "pivot point," which is a candle with a lower low or higher high than its neighbors.

Example: ()

\ Break of Structure (BOS)\

BOS occurs when price breaks above or below a previous high or low, signaling a possible trend continuation.

Example: ()

\ Change of Character (ChoCH)\

ChoCH happens when the market changes direction. For example, if price breaks a higher low in an uptrend, it may signal a reversal.

Example: ()

Combined with BOS: ()

---

\ How SMC Compares to Wyckoff\

The idea of "smart money" isn't new. Richard D. Wyckoff, a pioneer in technical analysis, laid the foundation for understanding market cycles driven by institutions. His price cycle theory includes four phases:

\ 1. Accumulation\

Smart money buys while the public is unaware.

\ 2. Markup\

Price rises as smart money pushes the market.

\ 3. Distribution\

Smart money sells into public buying.

\ 4. Markdown\

Price falls as the cycle completes.

SMC borrows from this logic but focuses more on structure and liquidity zones. Still, the core idea is the same: understand what big players are doing, and follow them.

\ For deeper insights into Wyckoff, explore additional resources focused on accumulation/distribution cycles.\

---

\ Summary\

Smart Money Concepts give traders a deeper look into market mechanics. By focusing on order blocks, fair value gaps, liquidity, and structure breaks, SMC helps identify high-probability trade setups based on institutional behavior.

It may seem complex at first, but once you understand the basics, SMC can become a powerful tool in your trading strategy. Whether you’re new or experienced, aligning with smart money can improve your edge in the market.

Sharing the advanced Bollinger Bands strategyHere are the Bollinger Band trading tips: *

📌 If you break above the upper band and then drop back down through it, confirm a short signal!

📌 If you drop below the lower band and then move back up through it, confirm a long signal!

📌 If you continue to drop below the middle band, add to your short position; if you break above the middle band, add to your long position!

Pretty straightforward, right? This means you won’t be waiting for the middle band to signal before acting; you’ll be ahead of the game, capturing market turning points!

Let’s break it down with some examples:

1. When Bitcoin breaks above the upper Bollinger Band, it looks strong, but quickly drops back below:

➡️ That’s a “bull trap”—time to go short!

2. If Bitcoin crashes below the lower band and then pops back up:

➡️ Bears are running out of steam—time to go long and grab that rebound!

3. If the price keeps moving above the middle band:

➡️ Add to your long or short positions to ride the trend without being greedy or hesitant.

Why is this method powerful?

It combines “edge recognition + trend confirmation” for double protection:

1. Edge Recognition—spot the turning point and act early.

2. Trend Confirmation—wait for the middle band breakout and then confidently add positions!

You won’t be reacting after the fact; you’ll be ahead of the curve, increasing your positions in the trend’s middle and locking in profits at the end. This is the rhythm of professional traders and the core logic of systematic profits!

Who is this method for?

- You want precise entry and exit points.

- You’re tired of “chasing highs and cutting losses.”

- You want a clear, executable trading system.

- You want to go from “I see the chart but don’t act” to “I see the signal and take action.”

Follow for more. Make sure to like this if you found it useful.

Volume Speaks Louder: My Custom Volume Indicator for Futures

My Indicator Philosophy: Think Complex, Model Simple

In my first “Modeling 101” class as an undergrad, I learned a mantra that’s stuck with me ever since: “Think complex, but model simple.” In other words, you can imagine all the complexities of a system, but your actual model doesn’t have to be a giant non-convex, nonlinear neural network or LLM—sometimes a straightforward, rule-based approach is all you need.

With that principle in mind, and given my passion for trading, I set out to invent an indicator that was both unique and useful. I knew countless indicators already existed, each reflecting its creator’s priorities—but none captured my goal: seeing what traders themselves are thinking in real time . After all, news is one driver of the market, but you can’t control or predict news. What you can observe is how traders react—especially intraday—so I wanted a simple way to gauge that reaction.

Why intraday volume ? Most retail traders (myself included) focus on shorter timeframes. When they decide to jump into a trade, they’re thinking within the boundaries of a single trading day. They rarely carry yesterday’s logic into today—everything “resets” overnight. If I wanted to see what intraday traders were thinking, I needed something that also resets daily. Price alone didn’t do it, because price continuously moves and never truly “starts over” each morning. Volume, however, does reset at the close. And volume behaves like buying/selling pressure—except that raw volume numbers are always positive, so they don’t tell you who is winning: buyers or sellers?

To turn volume into a “signed” metric, I simply use the candle’s color as a sign function. In Pine Script, that looks like:

isGreenBar = close >= open

isRedBar = close < open

if (not na(priceAtStartHour))

summedVolume += isGreenBar ? volume : -volume

This way, green candles add volume and red candles subtract volume, giving me positive values when buying pressure dominates and negative values when selling pressure dominates. By summing those signed volumes throughout the day, I get a single metric—let’s call it SummedVolume—that truly reflects intraday sentiment.

Because I focus on futures markets (which have a session close at 18:00 ET), SummedVolume needs to reset exactly at session close. In Pine, that reset is as simple as:

if (isStartOfSession())

priceAtStartHour := close

summedVolume := 0.0

Once that bar (6 PM ET) appears, everything zeroes out and a fresh count begins.

SummedVolume isn’t just descriptive—it generates actionable signals. When SummedVolume rises above a user-defined Long Threshold, that suggests intraday buying pressure is strong enough to consider a long entry. Conversely, when SummedVolume falls below a Short Threshold, that points to below-the-surface selling pressure, flagging a potential short. You can fine-tune those thresholds however you like, but the core idea remains:

• Positive SummedVolume ⇒ net buying pressure (bullish)

• Negative SummedVolume ⇒ net selling pressure (bearish)

Why do I think it works: Retail/intraday traders think in discrete days. They reset their mindset at the close. Volume naturally resets at session close, so by signing volume with candle color, I capture whether intraday participants are predominantly buying or selling—right now.

Once again: “Think complex, model simple.” My Daily Volume Delta (DVD) indicator may look deceptively simple, but five years of backtesting have proven its edge. It’s a standalone gauge of intraday sentiment, and it can easily be combined with other signals—moving averages, volatility bands, whatever you like—to amplify your strategy. So if you want a fresh lens on intraday momentum, give SummedVolume a try.

Do You Know the Difference Between an Indicator and a Strategy?A lot of traders jump into Pine Script or apply a script on TradingView without understanding one key difference:

Indicators and Strategies are not the same — especially when it comes to real-time performance and backtesting.

---

What’s the Key Difference?

Indicators

Indicators are visual tools designed to help you analyze price action in real time . They do not track trade performance or simulate trades automatically.

You can use them to:

- Generate signals

- Stack confluences

- Set custom alerts

- Overlay custom visuals on charts

Best for: Chart analysis, signal confirmation, and manual or semi-automated alerts.

---

Strategies

Strategies are built for backtesting . They simulate how your trade logic would have performed historically, using `strategy.entry`, `strategy.exit`, and related functions.

They automatically calculate:

- Hypothetical P&L

- Win/loss ratio

- Drawdowns

Best for: Validating trade logic, optimizing entries and exits, performance tracking.

---

But Here’s the Catch

Many traders assume that once a strategy backtest looks good, it will behave exactly the same in live trading. This assumption can lead to poor decision-making.

❌ Why Forward Testing Isn't Perfect

When you set alerts based on a strategy, you're asking a backtest engine to behave like a live trading engine — and that’s not what it was designed for.

TradingView strategies:

- Only execute on candle close

- Do not simulate intrabar price action

- Do not account for slippage

- Do not reflect real-time market volatility

So:

- Your strategy alert may fire late compared to actual price movement

- Your SL/TP may be hit within a candle, but the strategy won’t know until close

- You may see better backtest results than what happens live

---

Takeaway

If you're using strategies with alerts, it’s critical to understand these constraints:

TradingView’s strategy engine is optimized for historical testing, not for real-time execution. It provides insight into the validity of your logic — but it’s not a replacement for a live execution engine.

Best Practice Recommendations:

- Always forward-test on a demo or paper account first

- Monitor how alerts perform in real-time

- Be ready to adjust parameters based on your asset and timeframe

If you need better responsiveness or real-time adaptability, consider using indicators to generate your alerts. Indicators react to price in real time and are often more suitable for live market conditions.

---

Final Note

Some strategies are built with these limitations in mind. They can still be useful in real-time trading as long as you're aware of how they work.

Transparency is key. Backtesting is a guide, not a guarantee.

Trade smart, stay informed.

Feel free to reach out if you have questions or insights to share!

About the Volume OBV indicator...

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

I think TradingView is attractive because users can create charts as they want.

However, since the number of indicators that can be added to the chart is limited depending on the plan, you have to add indicators that fit your plan.

As a result, I ended up integrating multiple indicators into one indicator.

-

The HA-MS indicator in this chart is a public indicator.

If you search the Internet, you can find detailed explanations on how to interpret the OBV indicator.

I expressed it as follows to make this interpretation method more realistic.

The body color of the candlestick is indicated by the 4-stage OBV indicator.

The OBV indicator is distinguished in the same way as the Price Channel indicator.

You can interpret it like the Bollinger Band.

That is, if the middle line that divides 2 and 3 rises by more than 3, you can interpret that the buying force is increasing.

1: It means below the lower line of the Price Channel and is indicated in dark red.

If you enter this section, there is a high possibility of a sharp decline.

You should check the support and resistance points because it is likely to stop falling soon and rise to 2.

2: It means between the lower line and the middle line of the Price Channel and is indicated in red.

This section is likely to show a weak downward sideways movement.

Therefore, if it rises from 1->2, there is a possibility of a short rise. However, if it fails to rise to 3, it is likely to fall back to 1, so it is recommended to make short trades.

3: It means between the middle line and the upper line of the Price Channel and is displayed in green.

This section is likely to show a weak upward sideways movement.

If it rises from 2 -> 3 and shows a sideways movement, you should focus on finding a buying point.

4: It means above the upper line of the Price Channel and is displayed in dark green.

If it enters this section, there is a high possibility of a sharp rise.

Since it is likely to stop rising soon and fall to 3, you should check the support and resistance points.

-

What we should pay attention to is when it changes from 1 -> 2, 4 -> 3.

As explained above, 1 is a section located below the lower line of the Price Channel, so there is a high possibility of a sharp fall.

4 is a section located above the upper line of the Price Channel, so there is a high possibility of a sharp rise.

Therefore, you can proceed with an aggressive buy when it changes from 1 -> 2, and you can proceed with a sell when it changes from 4 -> 3.

In the case of futures, it can be used as reference information for entering and liquidating LONG and SHORT positions.

-

They say that the only things you need on a chart are price and trading volume.

However, it is not easy to interpret this in reality.

To compensate for this, we hid the colors of the existing candles and displayed them in 4 stages of OBV so that you can intuitively see which stage the current price is at.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

Chart Analysis and Trading Strategy (2)

Hello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

If you look at the candle that the finger is pointing to, you can see that it is a bearish candle with Open > Close.

If you look at this on a 30m chart, you can see that it moves as follows and forms lows and highs.

These candle movements come together to form a candle arrangement, and by looking at this, we ultimately set support and resistance points.

As your understanding of candles deepens, you will study charts in various ways.

The reason is that you may know it when you look at the chart, but you cannot when you trade.

That is, because the understanding of candles is not clear.

As you study the charts over and over again, you will learn that charts tend to converge to the median and average values.

You learn that they converge to the median and average values while studying various indicators, but you end up not knowing what you can learn from them.

What is important in the arrangement of candles is that the arrangement of the Open and Close bodies and the Low and High tails that make up the candles play an important role in setting support and resistance points.

I recommend that you understand this explanation through the Internet or a book.

The reason is that it is something that requires a lot of time investment to acquire.

-

The HA-MS indicator was created to quickly display support and resistance points as objective information.

Therefore, you can see that when the channel composed of the HA-Low indicator and the HA-High indicator is broken, a trend is formed, and if not, a sideways movement is shown.

The HA-Low, HA-High indicators are indicators created by combining the arrangement of candles and the RSI indicator on the Heikin-Ashi chart.

Therefore, the trading strategy is used to create a trading strategy depending on whether there is support near the HA-Low, HA-High indicators.

The other indicators, BW(0), BW(100), DOM(-60), and DOM(60), are used as support and resistance to create a detailed response strategy.

-

Based on this information, trading should be divided into trading in the sideways section and trading in the trend to create a trading strategy.

This trading time is created based on whether there is support in the HA-Low, HA-High indicators.

Since it is made of indicators, I think it provides objective information for chart interpretation with others, reducing the room for controversy.

This is the fundamental reason for using indicators.

It is because we can share objective information with each other.

-

In trading within the sideways section, information about the trend is not particularly necessary.

If you set the sideways section with your own indicator or support and resistance points, you can trade based on whether there is support at the end of that section.

-

However, when you leave the sideways section, information about the trend is necessary.

That is why we use the M-Signal indicator and Trend Cloud indicator on the 1D, 1W, and 1M charts as indicators for the trend.

For short-term information, you can use the M-Signal indicator and Trend Cloud indicator on the 1D chart.

If the Trend Cloud indicator is displayed in green and the price is maintained above the M-Signal indicator on the 1D chart, it can be interpreted that there is a high possibility of a turn to an uptrend.

If not, it can be interpreted that there is a high possibility of a downtrend.

The mid- to long-term trend can be identified by checking the arrangement status of the M-Signal indicator on the 1W chart and the M-Signal indicator on the 1M chart.

That is, if the M-Signal on the 1W chart > the M-Signal on the 1M chart, it can be interpreted that the mid- to long-term trend is maintaining an uptrend.

Therefore, in order to continue the uptrend from a long-term perspective, the price must be maintained above the M-Signal indicator on the 1M chart.

If not, it is recommended to make short trades if possible.

-

To better set the support and resistance points, look at the 1M chart > 1W chart > 1M chart in that order and draw a horizontal line on the indicators (HA-Low, HA-High, BW(0), BW(100), DOM(-60), DOM(60)) displayed on the chart and mark them on the chart.

Mark the support and resistance points on the chart as above.

This marks the support and resistance points with the low and high points.

-

It is not easy to start trading at the low or high points every time.

Therefore, as I mentioned earlier, it is important to create a detailed response strategy based on the median and average values.

For this, the StochRSI 50 indicator is displayed.

In addition, the Close of the Heikin-Ashi chart of the 1D chart, which can be usefully utilized when trading below the 1D chart, is added.

-------------------------------------------------

The information I mentioned above is ultimately information that can be obtained through chart analysis.

You can create a trading strategy by deciding whether to check it directly with your eyes and indicate support and resistance points, or to use an indicator that can be checked more quickly.

Chart analysis is about understanding the movement of the chart, and actual trading is conducted according to the trading strategy.

You may think that chart analysis is the trading strategy, but it is not.

No matter how well you analyze charts with your eyes, if you analyze charts when your psychological state is unstable due to subjective thoughts based on various information other than the chart, as I mentioned earlier, you may end up trading in the wrong direction.

To prevent this, it is necessary to use indicators so that subjective thoughts are not applied.

Even if you start trading at the support and resistance points created by the indicator, and it goes in the opposite direction and you suffer a loss, the influence will be weak.

The reason is that you created a trading strategy with the support and resistance points created by the indicator in advance.

Things to consider when starting a trade in a trading strategy are:

1. When to buy or how to buy

2. When to cut loss or how to cut loss

3. How to realize profit

For this reason, it is important to set support and resistance points through chart analysis.

-

It is better to do chart analysis briefly.

If you spend too much time analyzing charts, you may end up being trapped in your own subjective thoughts, so be careful.

I think you can tell whether you will do chart analysis in an analyst-like manner or in a chart analysis necessary for trading by looking at how the support and resistance points are marked on the chart.

The ideas of chart analysis often do not include things that need to be considered when starting a trade.

Therefore, in order to apply them to actual trading, you need to create a trading strategy through chart analysis.

The chart analysis for trading reduces the need for separate chart analysis because the information necessary for the trading strategy is displayed on the chart.

However, it may need to change depending on your investment style or the time frame chart you are actually trading on, but it can be advantageous for trading because the support and resistance points are marked.

To ensure this, you need to create an indicator and receive support and resistance points as objective information.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

Bollinger Bands — Enhanced Classic Tool for Technical AnalysisBollinger Bands — Enhanced Classic Tool for Technical Analysis

Bollinger Bands are a classic technical analysis tool designed to identify short-term trends and gauge market volatility. We’ve upgraded their functionality to make them even more intuitive and precise for trading decisions.

What’s New in Our Bollinger Bands:

Color-Coded Trend Identification

The band color automatically shifts with short-term trend reversals. This allows traders to quickly spot trend direction and decide when to enter trades.

Band Width

Reflects current volatility levels and price momentum. Narrow bands signal consolidation (accumulation/distribution), while wide bands indicate high volatility and potential trend initiation.

Dynamic Support & Resistance Levels

The outer bands, calculated as standard deviations from the moving average, act as dynamic reference points for entry and exit levels.

Gradient Zones

The bands are divided into four gradient zones, highlighting optimal areas for position sizing. Buy near the lower zones, sell near the upper zones—simple yet effective.

How to Use Bollinger Bands in Trading:

1. Identify Short-Term Trends

Bullish Trend: Green bands signal a bullish market.

Bearish Trend: Red bands indicate bearish sentiment.

2. Assess Volatility & Choose Strategies

Wide Bands: High volatility, strong trend initiation. Consider breakout strategies.

Medium Bands: Range-bound markets. Trade bounces from band boundaries.

Narrow Bands: Consolidation (accumulation/distribution), often preceding strong price impulses.

Pro Tip: A sharp band contraction often precedes explosive price movements.

Volatility Assessment Examples

High Volatility + Trend:

Wide band expansion signals a strong bullish trend (green bands).

Medium Volatility + Range:

Moderate band width and frequent color shifts suggest choppy markets—ideal for boundary bounce trades.

Low Volatility + Breakouts:

A narrow band breakout (green bands) confirms a strong bullish impulse.

Trading Bounces from Band Boundaries

Prices tend to revert to the moving average (midline). This makes Bollinger Bands a powerful tool for swing traders:

Lower Band (Support): Oversold zone—consider long positions.

Upper Band (Resistance): Overbought zone—consider short positions.

Bounce trades work best in sideways markets or unclear trends. Avoid bounce strategies during band expansion (new trend formation).

Example Trades

Short on Upper Band Rejection:

Price stalls at the upper band in a bearish macro trend, offering a high-probability short entry.

Long on Lower Band Rebound:

Price bounces from the lower band in a bullish macro trend, confirming a long opportunity.

Additional Confirmation Tips

Combine Bollinger Bounce signals with:

Midas Multi-Indicator: Whale activity detection, trend ribbon reversals.

Oscillator Overextension: RSI, Stochastic, or MACD divergence.

Price Momentum: Volume spikes or candlestick patterns.

Refine entries by aligning band signals with broader market context and multi-timeframe analysis.

Understanding Parabolic SAR: A Guide to Trend ReversalsThe Parabolic SAR (Stop and Reverse) is a popular technical analysis tool that helps traders identify trend direction and potential reversal points. Developed by J. Welles Wilder, the Parabolic SAR is particularly useful in trending markets and provides straightforward buy and sell signals.

What is Parabolic SAR?

The Parabolic SAR is a series of dots plotted above or below the price on a chart:

- Dots Below the Price: Indicate an uptrend.

- Dots Above the Price: Indicate a downtrend.

The "SAR" stands for "Stop and Reverse," reflecting the tool's ability to signal when a trend might reverse direction.

How Parabolic SAR Works

The Parabolic SAR formula calculates the position of the dots based on:

- EP (Extreme Point): The highest high or lowest low in the current trend.

- AF (Acceleration Factor): A multiplier that increases over time to speed up the SAR's responsiveness.

As the trend progresses, the dots move closer to the price, acting as a trailing stop level. When the price crosses the dots, a reversal signal is generated.

Key Features of Parabolic SAR

1. Trend Direction:

- Dots below the price indicate a bullish trend.

- Dots above the price indicate a bearish trend.

2. Reversal Signals:

- When the price crosses above or below the SAR dots, it suggests a potential reversal.

3. Trailing Stop:

- The SAR level can be used as a trailing stop to protect profits in a trending market.

How to Use Parabolic SAR in Trading

1. Identifying Trends:

- Use the position of the SAR dots to confirm whether the market is in an uptrend or downtrend.

2. Spotting Reversals:

- A change in the position of the SAR dots (from below to above or vice versa) indicates a potential trend reversal.

3. Setting Stop-Loss Orders:

- Place stop-loss orders at the SAR level to minimize risk.

4. Combine with Other Indicators:

- Pair the Parabolic SAR with moving averages, RSI, or MACD to validate signals and reduce the likelihood of false reversals.

Strengths of Parabolic SAR

- Simplicity: Easy to interpret and apply.

- Clear Signals: Provides unambiguous buy and sell signals.

- Effective in Trending Markets: Works well in markets with sustained uptrends or downtrends.

Limitations of Parabolic SAR

- Ineffectiveness in Sideways Markets: Generates false signals in choppy or range-bound conditions.

- Fixed Parameters: The default settings (e.g., AF starts at 0.02 and increments by 0.02) may not suit all market conditions. Adjusting these parameters can improve accuracy.

Best Practices for Using Parabolic SAR

1. Avoid Flat Markets:

- Use Parabolic SAR only in trending markets to minimize false signals.

2. Adjust Parameters:

- Experiment with the acceleration factor to tailor the indicator to the specific asset or timeframe.

3. Combine with Other Tools:

- Use additional indicators or chart patterns to confirm Parabolic SAR signals.

Example of Parabolic SAR in Action

Imagine Bitcoin (BTC) is trading at $94,000 in an uptrend. The Parabolic SAR dots appear below the price, confirming the bullish trend. As BTC rises to $98,000, the dots gradually move closer to the price. If the price falls and crosses the SAR dots, the dots shift above the price, signaling a potential downtrend and a sell opportunity.

Conclusion

The Parabolic SAR is a powerful yet straightforward tool for identifying trends and potential reversals. While it excels in trending markets, traders should be cautious in sideways markets where it may produce false signals. Combine it with other indicators and sound risk management practices to enhance its effectiveness. Regular practice and adjustments to the settings can help traders maximize its potential.

HOW-TO use the Rainbow Indicator? (full guide)Below is a complete instruction on how to use the Rainbow Indicator along with examples. This indicator is an important facet of my decision-making system because it allows me to answer two important questions:

- At what price should I make a trade with the selected shares?

- In what volume?

Part 1: Darts Set

My concept of investing in stocks is buying great companies during a sell-off . Of course, this idea is not unique. One way or another, this was said by the luminaries of value investing – Benjamin Graham and Warren Buffett. However, the implementation of this concept may vary depending on the preferences of each investor.To find great companies, I use the Fundamental strength indicator , and to plan opening and closing positions I use the Rainbow indicator.

To begin your acquaintance with the Rainbow Indicator, I would like to invite you to take part in a mental experiment. Imagine two small rooms for a game of darts. Each room has a different target hanging in it. It can be anywhere: center, left, right, bottom, or top.

Target #1 from the first room looks like a small red circle.

Target #2 from the second room looks like a larger red circle.

You get a reward for hitting the target, calculated according to the following principle: the smaller the target in relation to the wall surface, the greater the reward you get.

You have 100 darts in your hand, that is 100 attempts to hit the target. For each attempt, you pay $10. So to play this unusual game of darts, you take with you $1,000. Now, the most important condition is that you play in absolute darkness . So you don't know exactly what part of the wall the target is hanging in, so all your years of darts practice don't matter here.

The question is: Which room will you choose?

This is where you begin to think. Since your skills and experience are almost completely untapped in this game, all of your attempts to hit a target will be random. This is a useful observation because it allows you to apply the theory of probability. The password is Jacob Bernoulli. This is the mathematician who derived the formula by which you can calculate the probability of a successful outcome for a limited number of attempts.

In our case, a successful outcome is a dart hitting the target as many times as necessary in order to, at least, not lose anything. In the case of Target #1, it is one hit or more. In the case of Target 2, it is 10 hits or more.

The probability of hitting Target #1 is 1/100 or 1% (since the target area occupies 1% of the wall area).

The probability of hitting Target #2 is 10/100 or 10% (since the target area occupies 10% of the wall area).

The number of attempts is equal to the number of darts - 100.

Now we have all the data to calculate.

So, Bernoulli's formula :

According to this formula:

- The probability of one or more hits on Target #1 is 63% (out of 100%).

- The probability of ten or more hits on Target #2 is 55% (out of 100%).

You may say, "I think we should go to the first room". However, take your time with this conclusion because it is interesting to calculate the probability of not hitting the target even once, i.e., losing $1,000.

We calculate using the same formula:

- The probability of not hitting Target #1 is 37% (out of 100%).

- The probability of not hitting Target #2 is 0.0027% (out of 100%).

If we calculate the ratio of the probability of a successful outcome to the probability of losing the whole amount, we get:

- For the first room = 1.7

- For the second room = 20370

You know, I like the second room better.

This mental experiment reflects my approach to investing in stocks. The first room is an example of a strategy where you try to find the perfect entry point - to buy at a price below which the stock will not fall. The second room reflects an approach where you're not chasing a specific price level, but thinking in price ranges. In both cases, you'll have plenty of attempts, but in the first room, the risk of losing everything is much greater than in the second room.

Now let me show you my target, which is a visual interpretation of the Rainbow Indicator.

It also hangs on the wall, in absolute darkness, and only becomes visible after I have used all the darts. Before the game starts, I announce the color where I want to go. The probability of hitting decreases from blue to green, and then to orange and red. That is, the smaller the color area, the less likely it is to successfully hit the selected color. However, the size of the reward also increases according to the same principle - the smaller the area of color, the greater the reward.

Throwing a dart is an attempt to close a position with a profit.

Hitting the selected color is a position closed with a profit.

Missing the selected color means the position is closed at a loss.

Now imagine that in the absolutely dark room where I am, I have a flashlight. Thanks to it, I have the opportunity to see in which part of the wall the target is located. This gives me a significant advantage because now I throw darts not blindly, but with a precise understanding of where I am aiming. Light shining on the wall increases the probability of a successful outcome, which can also be estimated using the Bernoulli formula.

Let's say I have 100 darts in my hands, that is, one hundred attempts to hit the chosen target. The probability of a dart hitting a red target (without the help of a flashlight) is 10%, and with the help of a flashlight, for example, 15%. That is, my ability to throw darts improves the probability of hitting the target by 5%. For hitting the red target, I get $100, and for each throw I pay $10. In this case, the probability of hitting the red target ten or more times is 94.49% (out of 100%) versus 55% (out of 100%) without a flashlight. In other words, under these game conditions and the assumptions made, if I try all 100 darts, the probability of recouping all my expenses will be 94.49% if I aim only at the red target.

In my decision-making system, such a "flashlight" is the Fundamental strength indicator, dynamics of cash flows, the P/E ratio and the absence of critical news. And the darts set (target and darts) is a metaphor for the Rainbow Indicator. However, please note that all probabilities of positive outcomes are assumptions and are provided only for the purpose of example and understanding of the approach I have chosen. Stocks of public companies are not a guaranteed income instrument, nor are any indicators associated with them.

Part 2: Margin of safety

The idea to create the Rainbow Indicator came to me thanks to the concept of "margin of safety" coined by the father of value investing, Benjamin Graham. According to his idea, it is reasonable to buy shares of a company only when the price offered by the market is lower than the "intrinsic value" calculated based on financial statements. The value of this difference is the "margin of safety". At the same time, the indicator does not copy Graham's idea but develops it relying on my own methodology.

So, according to Graham, the "margin of safety" is a good discount to the intrinsic value of the company. That is, if a company's stock is trading at prices that are well below the company's intrinsic value (on a per-share basis), it's a good opportunity to consider buying it. In this case, you will have a certain margin of safety in case the company is in financial distress and its stock price goes down. Accordingly, the greater the discount, the better.

When it comes to the intrinsic value of a company, there are many approaches to determining it - from calculating the Price-to-book value financial ratio to the discounted cash flow method. As for my approach, I don’t try to find the coveted intrinsic value/cost, but I try to understand how fundamentally strong the company in front of me is, and how many years it will take to pay off my investment in it.

To decide to buy shares, I use the following sequence of actions:

- Determining fundamental strength of a company and analysis of cash flows using the Fundamental Strength Indicator.

- Analysis of the recoupment period of investments using P/E ratio .

- Analysis of critical news .

- Analysis of the current price using Rainbow Indicator.

To decide to sell shares, I use:

- Analysis of the current price using Rainbow Indicator.

- Or The Rule of Replacement of Stocks in a Portfolio .

- Or Force majeure Position Closing Rule .

Thus, the Rainbow indicator is always used in tandem with other indicators and analysis methods when buying stocks. However, in the case of selling previously purchased shares, I can only use the Rainbow indicator or one of the rules that I will discuss below. Next, we will consider the methodology for calculating the Rainbow Indicator.

Indicator calculation methodology

The Rainbow indicator starts with a simple moving average of one year (this is the thick red line in the center). Hereinafter, a year will mean the last 252 trading days.

Applying a moving average of this length - is a good way to smooth out sharp price fluctuations which can happen during a year as much as possible, keeping the trend direction as much as possible. Thus, the moving average becomes for me the center of fluctuations of the imaginary pendulum of the market price.

Then the deviations are calculated from the center of fluctuations. To achieve this, a certain number of earnings per share is subtracted from and added to the moving average. This is the diluted EPS of the last year.

Deviations with a "-" sign from the Lower Rainbow of four colors:

- The Blue Spectrum of the Lower Rainbow begins with a deflection of -4 EPS and ends with a deflection of -8 EPS.

- The Green Spectrum of the Lower Rainbow begins with a deflection of -8 EPS and ends with a deflection of -16 EPS.

- The Orange Spectrum of the Lower Rainbow begins with a deflection of -16 EPS and ends with a deflection of -32 EPS.

- The Red Spectrum of the Lower Rainbow begins with a deflection of -32 EPS and goes to infinity.

The Lower Rainbow is used to determine the price ranges that can be considered for buying stocks. It is in the spectra of the Lower Rainbow that the very "margin of safety" according to my methodology is located. The Lower Rainbow has the boundaries between the spectra as a solid line . And only the Red Spectrum of the Lower Rainbow has only one boundary.

Deviations with a "+" sign from the Upper Rainbow of four similar colors:

- The Red Spectrum of the Upper Rainbow begins with a deflection of 0 EPS and ends with a deflection of +4 EPS.

- The Orange Spectrum of the Upper Rainbow begins with a deflection of +4 EPS and ends with a deflection of +8 EPS.

- The Green Spectrum top rainbow begins with a deflection of +8 EPS and ends with a deflection of +16 EPS.

- The Blue Spectrum of the Upper Rainbow begins with a deflection of +16 EPS and goes to infinity.

The Upper Rainbow is used to determine the price ranges that can be considered for selling stocks already purchased. The top rainbow has boundaries between the spectra in the form of crosses . And only the Blue Spectrum of the Upper Rainbow has only one boundary.

The presence of the Empty Area (the size of 4 EPS) above the Lower Rainbow creates some asymmetry between the two rainbows - the Lower Rainbow looks wider than the Upper Rainbow. This asymmetry is deliberate because the market tends to fall much faster and deeper than it grows . Therefore, a wider Lower Rainbow is conducive to buying stocks at a good discount during a period of massive "sell-offs".

The situation when the Lower Rainbow is below the center of fluctuations (the thick red line) and the Upper Rainbow is above the center of fluctuations is called an Obverse . It is only possible to buy a stock in an Obverse situation.

The situation when the Lower Rainbow is above the center of fluctuations and the Upper Rainbow is below the center of fluctuations is called Reverse . In this situation, the stock cannot be considered for purchase , according to my approach.

Selling a previously purchased stock is possible in both situations: Reverse and Obverse. After loading the indicator, you can see a hint next to the closing price - Reverse or Obverse now.

Because the size of the deviation from the center of fluctuation depends on the size of the diluted EPS, several important conclusions can be made:

- The increase in the width of both rainbows in the Obverse situation tells me about the growth of profits in the companies.

- The decrease in the width of both rainbows in the Obverse situation tells me about a decrease in profits in the companies.

- The increase in the width of both rainbows in the Reverse situation tells me about the growth of losses in the companies.

- The decrease in the width of both rainbows in the Reverse situation tells me about the decrease in losses in the companies.

- The higher the company's level of profit, the larger my "margin of safety" should be. This will provide the necessary margin of safety in the event of a transition to a cycle of declining financial results. The corresponding width of the Lower Rainbow will just create this "reserve".

- The growth in profit in the company (after buying its shares) will allow me to stay in the position longer due to the expansion of the Upper Rainbow.

- A decrease in profit in the company (after buying its shares) will allow me to close the position faster due to the narrowing of the Upper Rainbow.

So the Rainbow indicator shows me a price range that can be considered for purchase if all the necessary conditions are met. By being in this price range, my investment will have a certain margin of safety or "margin of safety." It will also tell me when to exit a stock position based on the company's earnings analysis.

Part 3: Crazy Mr. Market

The Fundamental strength of a company influences the long-term price performance of its shares. This is a thesis that I believe in and use in my work. A company that does not live in debt and quickly converts its goods or services into money will be appreciated by the market. This all sounds good, you say, but what should an investor do who needs to decide here and now? Moreover, one has to act in conditions of constant changes in market sentiment. Current talk about the company's excellent prospects can be replaced by a pessimistic view of it literally the next day. Therefore, the stock price chart of any companies, regardless of its fundamental strength, can resemble the chaotic drawings of preschool children.

Working with such uncertainty required me to develop my own attitude towards it. Benjamin Graham's idea of market madness was of invaluable help to me in this. Imagine that the market is your business partner, "Mr. Market". Every day, he comes to your office to check in and offer you a deal with shares of your mutual companies. Sometimes he wants to buy your share, sometimes he intends to sell his. And each time he offers a price at random, relying only on his intuition. When he is in a panic and afraid of everything, he wants to get rid of his shares. When he feels euphoria and blind faith in the future, he wants to buy your share. This is how crazy your partner is.

Why is he acting like this? According to Graham, this is how all investors behave who do not understand the real value/cost of what they own. They jump from side to side and do it with the regularity of a "maniac" every day. The smart investor's job is to understand the fundamental value of your business and just wait for the next visit from crazy Mr. Market. If he panics and offers to buy his stocks at a surprisingly low price, take them and wish him luck. If he begs you to sell him stocks and quotes an unusually high price, sell them and wish him luck. The Rainbow indicator is used to evaluate these two poles.

Now let's look at the conditions of opening and closing a position according to the indicator.

So, the Lower Rainbow has four differently colored spectra: blue, green, orange, and red. Each one highlights the desired range of prices acceptable for buying in an Obverse situation. The Blue Spectrum is upper regarding the Green Spectrum, and the Green Spectrum is lower regarding the Blue Spectrum, etc.

- If the current price is in the Blue Spectrum of the Lower Rainbow, that is a reason to consider that company for buying the first portion (*) of the stock.

- If the current price has fallen below (into the Green Spectrum of the Lower Rainbow), that is a reason to consider this company to buy a second portion of the stock.

- If the current price has fallen below (into the Orange Spectrum of the Lower Rainbow), it is a reason to consider this company to buy a third portion of the stock.

- If the current price has fallen below (into the Red Spectrum of the Lower Rainbow), that is a reason to consider that company to buy a fourth portion of the stock.

(*) The logic of the Rainbow Indicator implies that no more than 4 portions of one company's stock can be purchased. One portion refers to the number of shares you can consider buying at the current price (depending on your account size and personal diversification ratio - see information below).

The Upper Rainbow also has four differently colored spectra: blue, green, orange, and red. Each of them highlights the appropriate range of prices acceptable for closing an open position.

- If the current price is in the Red Spectrum of the Upper Rainbow, I close one portion of an open position bought in the Red Spectrum of the Lower Rainbow.

- If the current price is in the Orange Spectrum of the Upper Rainbow, I close one portion of an open position bought in the Orange Spectrum of the Lower Rainbow.

- If the current price is in the Green Spectrum of the Upper Rainbow, I close one portion of an open position bought in the Green Spectrum of the Lower Rainbow.

- If the current price is in the Blue Spectrum of the Upper Rainbow, I close one portion of an open position bought in the Blue Spectrum of the Lower Rainbow.

This position-closing logic applies to both the Obverse and Reverse situations. In both cases, the position is closed in portions in four steps. However, there are 3 exceptions to this rule when it is possible to close an entire position in whole rather than in parts:

1. If there is a Reverse situation and the current price is above the thick red line.

2.if I decide to invest in another company and I do not have enough free finances to purchase the required number of shares (Portfolio Replacement Rule).

3. If I learn of events that pose a real threat to the continued existence of the companies (for example, filing for bankruptcy), I can close the position earlier, without waiting for the price to fall into the corresponding Upper Rainbow spectrum (Force majeure Position Closing Rule).

So, the basic scenario of opening and closing a position assumes the gradual purchase of shares in 4 stages and their gradual sale in 4 stages. However, there is a situation where one of the stages is skipped in the case of buying shares and in the case of selling them. For example, because the Fundamental Strength Indicator and the P/E ratio became acceptable for me only at a certain stage (spectrum) or the moment was missed for a transaction due to technical reasons. In such cases, I buy or sell more than one portion of a stock in the spectrum I am in. The number of additional portions will depend on the number of missed spectra.

For example, if I have no position in the stock of the company in question, all conditions for buying the stock have been met, and the current price is in the Orange Spectrum of the Lower Rainbow, I can buy three portions of the stock at once (for the Blue, Green, and Orange Spectrum). I will sell these three portions in the corresponding Upper Rainbow spectra (orange, green, and blue). However, if, for some reason, the Orange Spectrum of the Upper Rainbow was missed, and the current price is in the Green Spectrum - I will sell two portions of the three (in the Green Spectrum). I will sell the last, third portion only when the price reaches the Blue Spectrum of the Upper Rainbow.

The table also contains additional information in the form of the current value of the company's market capitalization and P/E ratio. This allows me to use these two indicators within one indicator.

Returning to the madness of the market, I would like to mention that this is a reality that cannot be fought, but can be used to achieve results. To get a sense of this, I will give an example of one of the stereotypes of an investor who uses fundamental analysis in his work.His thinking might be: If I valued a company on its financial performance and bought it, then I should stay in the position long enough to justify my expenses of analysis. In this way, the investor deliberately deprives himself of flexibility in decision-making. He will be completely at a loss if the financial performance starts to deteriorate rapidly and the stock price starts to decline rapidly. It is surprising that the same condition will occur in the case of a rapid upward price movement. The investor will torment himself with the question "what to do?" because I just bought stocks of this company, expecting to hold them for the long term. It is at moments like these that I'm aware of the value of the Rainbow Indicator. If it is not a force majeure or a Reverse situation, I just wait until the price reaches the Upper Rainbow. Thus, I can close the position in a year, in a month or in a few weeks. I don't have a goal to hold an open position for a long time, but I do have a goal to constantly adhere to the chosen investment strategy.

Part 4: Diversification Ratio

If the price is in the Lower Rainbow range and all other criteria are met, it is a good time to ask yourself, "How many shares to buy?" To answer this question, I need to understand how many companies I plan to invest in. Here I adhere to the principle of diversification - that is, distributing investments between the shares of several companies. What is this for? To reduce the impact of any company on the portfolio as a whole. Remember the old saying: don't put all your eggs in one basket. Like baskets, stocks can fall and companies can file for bankruptcy and leave the exchange. In this regard, diversification is a way to avoid losing capital due to investing in only one company.

How do I determine the minimum number of companies for a portfolio? This amount depends on my attitude towards the capital that I will use to invest in stocks. If I accept the risk of losing 100% of my capital, then I can only invest in one company. It can be said that in this case there is no diversification. If I accept the risk of losing 50% of my capital, then I should invest in at least two companies, and so on. I just divide 100% by the percentage of capital that I can safely lose. The resulting number, rounded to the nearest whole number, is the minimum number of companies for my portfolio.

As for the maximum value, it is also easy to determine. To achieve this, you need to multiply the minimum number of companies by four (this is how many spectra the Lower or Upper Rainbow of the indicator contains). How many companies I end up with in my portfolio will depend on from this set of factors. However, this amount will always fluctuate between the minimum and maximum, calculated according to the principle described above.

I call the maximum possible number of companies in a portfolio the diversification coefficient. It is this coefficient that is involved in calculating the number of shares needed to be purchased in a particular spectrum of the Lower Rainbow. How does this work? Let's go to the indicator settings and fill in the necessary fields for the calculation.

+ Cash in - Cash out +/- Closed Profit/Loss + Dividends - Fees - Taxes

+Cash in - the number of finances deposited into my account

-Cash out - the number of finances withdrawn from my account

+/-Closed Profit/Loss - profit or loss on closed positions

+Dividends - dividends received on the account

-Fees - broker and exchange commission

-Taxes - taxes debited from the account

Diversification coefficient

The diversification coefficient determines how diversified I want my portfolio to be. For example, a diversification coefficient of 20 means that I plan to buy 20 share portions of different companies, but no more than 4 portions per company (based on the number of Lower Rainbow spectra).

The cost of purchased shares of this company (fees excluded)

Here, I specify the amount of already purchased shares of the company in question in the currency of my portfolio. For example, if at this point, I have purchased 1000 shares at $300 per share, and my portfolio is expressed in $, I enter - $300,000.

The cost of all purchased shares in the portfolio (fees excluded)

Here, I enter the amount of all purchased shares for all companies in the currency of my portfolio (without commissions spent on the purchase). This is necessary to determine the amount of available funds available to purchase shares.

After entering all the necessary data, I move on to the checkbox, by checking which I confirm that the company in question has successfully passed all preliminary stages of analysis (Fundamental strength indicator, P/E ratio, critical news). Without the check, the calculation is not performed. This is done intentionally because the use of the Rainbow Indicator for the purpose of purchasing shares is possible only after passing all the preliminary stages. Next, I click "Ok" and get the calculation in the form of a table on the left.

Market Capitalization

The value of a company's market capitalization, expressed in the currency of its stock price.

Price / EPS Diluted

Current value of the P/E ratio.

Free cash in portfolio

This is the amount of free cash available to purchase stocks. Please note that the price of the stock and the funds in your portfolio must be denominated in the same currency. On TradingView, you can choose which currency to display the stock price in.

Cash amount for one portion

The amount of cash needed to buy one portion of a stock. This depends on the diversification ratio entered. If you divide this value + Cash in - Cash out +/- Closed Profit/Loss + Dividends - Fees - Taxes by the diversification coefficient, you get Cash amount for one portion .

Potential portions amount

Number of portions, available for purchase at the current price. It can be a fractional number.

Cash amount to buy

The amount of cash needed to buy portions available for purchase at the current price.

Shares amount to buy

Number of shares in portions available for purchase at the current price.

Thus, the diversification ratio is a significant parameter of my stocks' investment strategy. It shows both the limit on the number of companies and the limit on the number of portions for the portfolio. It also participates in calculating the number of finances and shares to purchase at the current price level.

Changing the diversification coefficient is possible already during the process of investing in stocks. If my capital ( + Cash in - Cash out +/- Closed Profit/Loss + Dividends - Fees - Taxes ) has changed significantly (by more than Cash amount for one portion ), I always ask myself the same question: "What risk (as a percentage of capital) is acceptable for me now?" If the answer involves a change in the minimum number of companies in the portfolio, then the diversification ratio will also be recalculated. Therefore, the number of finances needed to purchase one portion will also change. We can say that the diversification ratio controls the distribution of finances among my investments.

Part 5: Prioritization and Exceptions to the Rainbow Indicator Rules