Oracle’s Cloud Ascent: Powering the Global AI RevolutionOracle has shed its legacy reputation. It now stands as a central pillar of the artificial intelligence era. Recent stock surges reflect a profound transformation in the company’s core identity. This evolution positions Oracle as a formidable challenger to established cloud giants.

The AI Infrastructure Pivot

Oracle Cloud Infrastructure (OCI) currently drives the company’s aggressive growth. A landmark partnership with OpenAI validates Oracle’s high-performance computing capabilities. OpenAI utilizes OCI’s massive GPU clusters to train next-generation models. This collaboration signals a shift in the industry hierarchy.

OCI offers a unique architectural advantage. It uses Remote Direct Memory Access (RDMA) networking. This technology allows GPUs to communicate with extreme efficiency. Consequently, Oracle provides faster training speeds than many competitors. Enterprises now view OCI as the premier destination for AI workloads.

Sovereign Clouds and Geostrategy

Geopolitics now dictates the future of data management. Nations increasingly demand data residency within their own borders. Oracle’s "Sovereign Cloud" strategy directly addresses these national security concerns. The company builds localized data centers for specific government entities.

This geostrategy provides Oracle with a significant competitive moat. It captures high-value contracts that require strict regulatory compliance. Oracle enables digital sovereignty for the European Union and beyond. By aligning technology with policy, Oracle secures long-term global revenue streams.

RDMA: The Science of Speed

Oracle’s success stems from deep scientific innovation in networking. Patent analysis reveals a strong focus on high-speed data interconnects. These patents protect the firm’s ability to scale AI clusters seamlessly. High-tech hardware and software integration remains a core competency.

The company’s engineering focus reduces the "tail latency" common in cloud environments. This precision attracts research institutions and high-tech startups. Oracle’s science-first approach ensures that OCI handles the most demanding computational tasks. The market rewards this technical superiority with higher valuations.

Autonomous Security and Resilience

Cybersecurity threats grow more sophisticated every year. Oracle counters these risks with its Autonomous Database technology. This system utilizes machine learning to patch vulnerabilities without human intervention. Automated defense reduces the risk of data breaches significantly.

The "Zero Trust" architecture embedded in OCI protects sensitive enterprise information. Oracle’s business model emphasizes security as a fundamental feature. This commitment to hardware-level protection builds deep trust with financial institutions. Resilience has become a primary selling point for the Oracle brand.

Management Continuity and Vision

Larry Ellison remains the primary visionary for the company. His focus on integrated vertical stacks pays massive dividends today. Safra Catz provides the operational discipline to execute this complex vision. This leadership duo maintains a rare balance of innovation and fiscal responsibility.

Oracle’s management fosters a culture of engineering excellence. They avoid the bureaucratic hurdles that slow down larger competitors. This agility allowed Oracle to pivot rapidly toward generative AI. Assertive leadership continues to steer the firm through volatile market conditions.

The Macroeconomic Verdict

Macroeconomic trends favor Oracle’s current business model. High interest rates force companies to seek efficient, cost-effective cloud solutions. Oracle’s aggressive pricing and superior performance offer a compelling value proposition. Subscription-based revenue provides stability during economic shifts.

Wall Street analysts remain bullish on Oracle’s capital expenditure strategy. The firm invests billions to expand global data center capacity. These investments convert directly into high-margin cloud services. Oracle’s financial health reflects a perfect alignment of technology and market timing.

Investing

Positional trading strategy in CROMPTONA bit lengthy video but don't miss the details here.

I have shared the aspects which makes this stock worth buying for. Missed the early entry but while analyzing for second entry I got another interesting setup.

Although this is a hypothetical technical analysis, but I will be doing thorough fundamental analysis too for any supporting or contrary views.

AI will KILL SaaS Companies...Right?!Tech Services (SaaS) sector stands at a critical juncture.

The 200-week moving average has supported price every time since 2005, with breaks only during the 2008 financial crisis and the 2022 bear market.

Absent another crash, this could represent a once-in-a-generation entry point for CBOE:IGV and leading SaaS names like NYSE:CRM , NASDAQ:ADBE , and $NOW.

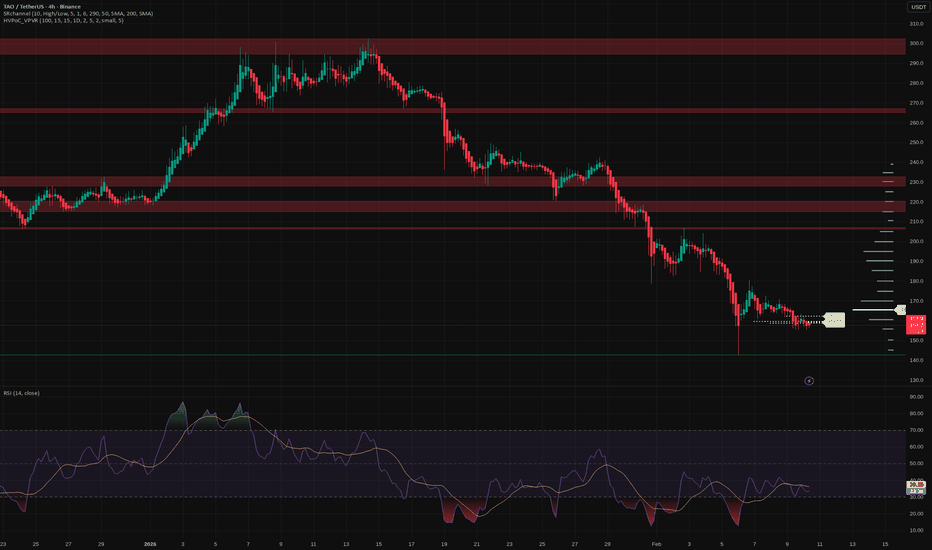

TAO: ready for a bounce? key levels to watch this weekTAO. Tired of watching this AI darling bleed out every 4H candle? After a crazy run on the AI narrative, headlines now talk about profit taking and rotation into “safer” majors, and the chart shows exactly that mood: a controlled grind down with no real capitulation yet.

On the 4H chart price is sitting right on the local demand around 150, with RSI parked in the 30‑35 zone and starting to show a mild bullish divergence. Volume profile is empty below and thick above, so I’m leaning toward a relief pop rather than an immediate cliff. For me the key short term box is 150‑170 – lose it and sellers stay in full control.

My base plan: I’m stalking a bounce long from this demand, targeting the 175‑185 area first, maybe 200 if momentum finally wakes up ✅. If 150 breaks and holds below, I drop the long idea and expect a slide toward 140 and even 130, where the next real liquidity sits. I might be wrong, but right now fading panic here looks better to me than chasing the downside.

The Bullet Proof Engine

🛡️ Self-Funding Security for Institutional Whales ($100k+ Capital)

In the 2026 market, volatility is your engine, but insurance is your brakes. While most high-volume traders operate unprotected, the ******** Architecture transforms a primary expense—*************—into a self-funding investment.

📊 The Institutional ROI Matrix ($100,000 Capital)

This table demonstrates how institutional scale allows for "safe trading" that significantly outperforms unprotected strategies.

| Item | Monthly Cost (Est.) | Monthly Benefit (Est.) | Net Result |

|---|---|---|---|

| Premium | ($250 – $667) | $100,000 Safety Net | 95% Principal Insured |

| Startup Airdrops (VIP 10) | $0 | $3,000–$12,000 | Pure Passive Yield |

| Trading Fee Savings | $0 | $150,000 | Retained Capital |

| TOTALS | ($667) Max | $162,000+ Max | +$161,333 Profit |

⚙️ Strategic Implementation: ********** Account Sprint

To achieve maximum capital efficiency and yield, recruits must follow the Institutional VIP 10

* SubDividing ************

* Churning ************

* Swarm ************

* Airdrop Harvesting: Each sub-account qualifies for its own allocation, maximizing the "Square of VIP Level" multiplier.

* Self-Funding Mechanism: Even at maximum insurance rates ($667/mo), a single successful startup airdrop ($3,000+) covers your security for the entire quarter.

> The Logic: You are essentially buying a $100,000 bulletproof vest and getting paid $2,300+ a month just for wearing it.

>

📋 Final Onboarding Checklist

Before initializing the sprint, ensure the following are complete:

* KYC Verification: Complete KYC 2 on all 10 sub-accounts to unlock the Startup yield section.

* Active Coverage: ************

* Architect Hub: Confirm registration via the Architect Hub to ensure a 20% commission on the $300M+ volume flow.

Every day you aren't in this architecture, you are losing approximately $5,000 in fees and $100 in potential airdrops.

S&P 500 Daily Chart Analysis For Week of Feb 6, 2026Technical Analysis and Outlook:

The Index exhibited notable volatility during the trading session this week, reflecting one of the most robust rebounds observed to date. It has stabilized above the Mean Support level of 6,892 and below the Key Resistance level of 6,993.

It is anticipated that the Index will continue its upward trajectory toward the target of the Outer Index Rally at 7,026, while helming through the newly established Key Resistance level at 6,993.

However, it is imperative to acknowledge that, given the prevailing market conditions, there is a substantial likelihood of a retracement that may lead to revisiting the Mean Support at 6,892, prior to the Index regaining its bullish momentum and progressing toward the projected outcome of the Outer Index Rally at 7,026. At this stage, an In Force retracement is expected to be initiated from that completed target.

EUR/USD Daily Chart Analysis For Week of Feb 6, 2026Technical Analysis and Outlook:

In the past week’s trading session, the Euro has exhibited a limited trading range, having fallen below the Mean Support level of 1.185 and currently trading closely below the Mean Resistance level of 1.183.

It is anticipated that, following the achievement of the letter target, a retracement towards the Mean Support at 1.177 will commence. This retracement is expected to precipitate a renewed downtrend, with the primary target set at the Outer Currency Dip of 1.166, supported by Mean Support levels at 1.177 and 1.168, which will present consequential hurdles. The rebounds are expected to be initiated from the aforementioned support levels and ultimate reached target the Outer Currency Dip 1.166.

Furthermore, market participants should remain vigilant regarding the potential for the currency to experience a gradual intermediate oscillation between the Mean Support at 1.177 and the Mean Resistance at 1.183 before resuming the downward movement.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of Feb 6, 2026Technical Analysis and Outlook:

Bitcoin has experienced a substantial decline this trading week. As outlined in the Bitcoin Daily Chart Analysis for the week of January 30, the cryptocurrency adhered closely to our projections by surpassing the critical Mean Support level at 82,000, ultimately achieving the Outer Coin Dip target at 78,500. Additionally, it fulfilled our long-term objective by reaching the subsequent Outer Coin Dip at 64,000. Following this significant milestone, the digital asset experienced a robust rebound, as anticipated.

Current market analysis indicates a potential downward move to revisit the Main Support level at 62,800 and to reach the Outer Coin Dip at 60,000 before reviving upward momentum.

It is essential to highlight that there may be gradual fluctuations between the Mean Support level of 62,800 and the Mean Resistance level of 71,200 before a breakout in either direction. The target for upward movement is a Mean Resistance of 78,700, while the target for downward movement is an Outer Coin Dip at 44,500.

AVAX: ready for a reversal? key levels and targets for todayAVAX. Tired of watching this one bleed every day? After the latest risk‑off flush across layer‑1 coins, AVAX printed a huge capitulation wick and quickly bounced – classic “everyone got stopped, then price turned” move, according to market chatter. Sentiment is washed out, which is exactly when good mean‑reversion trades usually appear.

On the 4H chart price is recovering above 9 after a spike down into the 7s, with RSI leaving oversold and showing a mild bullish divergence. We’re sitting on fresh local demand around 8.8–8.9 and just under the first big supply block at 9.6–9.8, which lines up with a high‑volume node. So my base case is a short‑term long toward that 9.7–10 area over the next few sessions.

My plan: ✅ look for dip‑buys near 8.9–9.0 with a tight invalidation under 8.75, aiming first at 9.7 and then 10.1 if momentum stays. ⚠️ If price loses 8.8 and starts closing below, I drop the long idea and expect a deeper sweep toward 8.0–7.5 before any real bounce. I might be wrong, but after this kind of panic flush the market usually comes back to “say hi” to the broken support above.

DOT in accumulation zone!Hello followers and haters,

I figured out that almost everyone here hates longterm analysis so I will post another one.

We can see DOT once again in beautiful accumulation zone , zone where I personally started accumulating tokens in previous cycle and in this one as well.

We are looking to take some profits on the FIRST TP where we can expect anywhere from 1 00% to 200% depending on our average buy price.

Second TP will bring us anywhere from 300% to 350%.

If we however drop even lower (WHICH WOULD BE AMAZING) there is an ALL-IN zone where I will be looking to put more money on my buys.

My accumulation is buying some DOT every 2-3 days while we are in the zone.

I marked only 2 TP zones for and as we will move UP in the BULL RUN I will post updates on where my next TP zones are.

Hope this helps, play it smart and stay patience!

CRV low risk high return? Ou YES!Hello followers and haters,

I figured out that almost everyone here hates longterm analysis so I will post another one.

We can see CRV is in our FIRST BUY ZONE , zone where I personally started accumulating tokens just now and will continue as long as we are in the zone.

IF we drop lower to the ALL IN zone as I call them :D I will be putting even more money in this coin. Hopefully we can see that happen as we broke the trendline.

We are looking to take some profits on the FIRST TP where we can expect anywhere from 220% to 270% depending on our average buy price which is an amazing return imo.

Second TP will bring us around 760% from the first buy zone!

IF we drop lower second TP will bring us an amazing 1260%!!! And that is not even an ATH for CRV!

Just to add something to make you think.

From where price is right now if we drop to ALL IN zone we are talking about -30% to -55% drawdown. Are you will to hold this small drawdown in order to get from 220% to possibly over 1200% gain?

As always please play it smart, do not over risk and invest only what you are willing to lose. And most importantly be patient!

ALGO to provide us with some GAINS as well?Hi guys,

Again as seen on the chart and historic price action or ALGO we can clearly see the PAIN points of where price is reacting and providing opportunities.

If we manage to break this trendline my first BUYS will begin at $0.16.

Risk here is holding drawdown of around -26% if price drops towards second area, so yes, in my eyes it is worth it!

Second area of accumulation and buying ALGO would be my ALL IN BUY ZONE from $0.10 to $0.14.

Potential gain from first zone towards our first target - HIGH of this cycle in 2024 is 280%!

Potential gain from ALL IN BUY ZONE is around 400%!

Second TP zone would be of course psychological level $1 where our gains from first buying area would be around 500% and from the second area would be around 700%

Please invest only what you are willing to lose, play it smart and be patient as patience is the key.

Zeta Global: structure reset on the weeklyZeta Global Holdings Corp. operates in marketing technology, providing data-driven customer intelligence and automation solutions for enterprises.

On the weekly chart, ZETA has completed a breakout above the long-term descending trendline and is currently holding a clean retest zone. The key support area sits between 17.8 and 18.4, where the weekly MA100 aligns with the 0.786 Fibonacci retracement. This confluence strengthens the structure and confirms acceptance after the impulse. Volume expanded on the breakout and cooled during the pullback, suggesting controlled price action rather than distribution. Weekly MACD is turning higher after a prolonged reset, while RSI remains above neutral territory, supporting a shift in market phase. Volume profile highlights upside attraction zones, with the first major area near 29–30 and a higher zone around 40.

From a fundamental perspective, the company shows improving financial quality. Market capitalization is around $5B, with consistent positive operating cash flow. Quarterly operating cash flow reached $57.9M, while free cash flow increased to $52.4M, both growing strongly year over year. Revenue continues to expand, with Q4 2025 estimates near $378M and expected EPS of $0.23. ZETA does not pay dividends, focusing instead on reinvestment and growth, while maintaining manageable debt and a solid balance sheet.

This is a higher-timeframe positioning idea where the market gradually reassesses the business after a corrective phase. Calm structure, improving fundamentals, and clear technical logic.

Voyager Technologies, Inc. (VOYG) 1DVoyager Technologies, Inc. (VOYG) is setting up like a textbook case where price spent a long time inside a daily descending channel and finally pushed out. The chart is clean: channel breakout first, then the only part that truly matters, the structure test. My key retest area is 27.81–28.68, and it lines up with Fibonacci 0.786 at 27.81 and 0.702 at 28.68, which is why this zone is where the market usually reveals whether the breakout was real or just a flare. Indicators support the idea of a developing trend: DI+ is around 33.46 above DI− around 10.36, and ADX near 28.93 suggests momentum can keep building as long as the retest holds. MACD leans constructive, and the move came with noticeable volume, so there is real participation, the question is simply the quality of the retest. For upside friction points I have 38 first, then 44, and 51 higher up as logical areas where price may cool off after a successful retest.

Fundamentally VOYG is not a “steady profit” story yet: basic EPS (TTM) is about −1.74, and the next report is expected around Feb 25, 2026 for Q4 2025 with EPS estimate −0.37 and revenue estimate 48.09M. Recent reported revenue was choppy, 34.60M in Q1 2025, 45.67M in Q2, and 39.59M in Q3, so the market will focus on whether the next print confirms acceleration. Cash flow is still heavy, with TTM operating cash flow about −51.46M and TTM free cash flow about −177.97M, but the balance sheet shows a liquidity cushion with cash and equivalents around 413.32M versus very low debt around 1.51M, which matters when funding risk is the main fear.

My approach is straightforward: I watch how price behaves at 27.81–28.68, if the zone holds and demand steps back in, the continuation path remains valid, if it fails, the breakout likely needs a reset. The funny part is that everyone loves the impulse leg, but the real edge usually sits inside that boring retest where patience gets rewarded.

EOSE 1D: Batteries on pauseOn the daily chart EOSE formed a descending wedge following a strong upside impulse. The structure developed through lower highs and lower lows with clear range compression, signaling seller exhaustion rather than the start of a new downtrend. The wedge was broken to the upside and fully worked through with a directional move.

After the completion of the pattern, price shifted into a pullback phase. The current correction represents a standard retracement after the wedge expansion and is now moving toward the key demand area between 12.5 and 13.5, aligned with the base of the wedge and the 0.786 Fibonacci level. This is not structural failure or selling pressure, but a routine test of the base after a completed move.

Volume profile adds important context. The main high-volume node sits in the middle of the range, defining a clear area of balance. The pullback develops through a lower-volume zone, explaining the slow and controlled nature of the decline without downside acceleration. Price is not being rejected, it is rotating back toward a previously active area.

From a structural standpoint, the first reaction area remains near the upper boundary of the former wedge, where prior supply emerged. Acceptance above that area would allow price to expand toward the next higher structural reaction zone above balance. These levels are not targets, but logical points where price is expected to reveal intent.

Momentum indicators confirm a post-expansion pause. MACD remains near the zero line and ADX stays subdued, consistent with redistribution rather than trend development.

The wedge has already played out. Now the market is checking where energy actually accumulates.

SPOT - A Ticking Time Bomb!SPOT Earnings Yield of 1.3% according to current data — meaning you’re getting about 1.3 cents of profit per dollar invested. LOL!

Better you give me your hard-earned money and I'll give you 2% instead of 1.3%. I like to splurge! :)

The Structural Constraint

Spotify cannot scale margins the way Netflix did because:

They don’t own the content

They don’t control input costs

They have to pay out ~70% of every dollar to rights holders

Their pricing power is weak and regulated by deals with labels

The labels decide what happens to Spotify’s margins, not Spotify

This is the definition of a business with a hard economic ceiling.

No amount of subscribers fixes the cost structure.

Spotify’s long-run net margin:

1–2% (When they “beat,” the gains evaporate the next quarter.) If Spotify hit 5% margins — a level they’ve never sustained.

And on a positive note —

THANK YOU for helping me hit 5,000 followers! 🙏🔥

Let’s keep going.

If you find value in the work:

👉 Boost

👉 Follow

👉 Leave a comment

Let’s push to 6,000 and keep building a community rooted in facts, not fairy tales.

AMD CARCKSSSSAMD has multiple cracks in the uptrend

A big, subtle but powerful void in its last attempt to high the upper trendline. Which is more telling of weaness.

A BIG ARS gap below it.

AMD has already lost -22% from its all-time highs. Likely to lose a lot more.

As I have been warning (GTFO & STFO) here for a while, about the entire market.

CAUTION to the permabulls "Buy The Dip" who have no exit strategy. Remember, no matter where the price goes, it's always 100% from zero! You can't "buy the DIP" unless you "SELL the RIP! That's just simple counting. Nothing Fancy!

THANK YOU for getting me to 5,000 followers! 🙏🔥

Let’s keep climbing.

If you enjoy the work:

👉 Drop a solid comment

Let’s push it to 6,000 and keep building a community grounded in truth, not hype.

Why Gold drop 21% from its All Time High

The blue line representing Dollar Index

1. The "Warsh Shock" & The Hawk-Dove Paradox

While he is historically a "hawk" (someone who favors tight money to fight inflation), his nomination is unique because he has recently aligned with the administration's push for lower interest rates. While he wants lower rates, he also wants to aggressively shrink the Fed’s balance sheet (selling off bonds). To the market, this signaled a "regime change" toward a stronger, leaner Dollar.

Market Impact: Investors interpreted this as a move toward higher real yields (the interest you get after inflation). Since gold provides 0% interest, it can't compete when the "real" return on the Dollar rises.

2. The Strong Dollar "Price Tag" Effect

In technical terms, gold and the US Dollar Index (DXY) have a strong inverse correlation (usually between -0.4 and -0.7). Because gold is traded globally in Dollars, when the DXY surged following the Warsh announcement, the "cost" of gold for international buyers skyrocketed. This forced a massive sell-off to "re-price" gold back to a fair value in the now-stronger currency.

3. Shift in Investor Sentiment (The Opportunity Cost) Investors don't just "look for Dollars"; they look for yield.

The Transition: Throughout 2025, gold was a "safe haven" due to Iran tensions and trade war fears. With the recent India Trade Deal and potential de-escalation with Iran, that "fear premium" evaporated.

The Rotation: Investors are now rotating out of "safe" gold and into US Equities (stocks) and high-yield Treasuries, betting that Warsh’s policies will spark a "Reflation Return" (stronger economic growth).

4. The "Margin Call" Cascade

Forced Selling: When the price first dropped, the CME Group raised "margin requirements." This meant traders who had bet on gold using borrowed money were forced to sell their positions immediately to cover their losses. This created a "snowball effect" that turned a small dip into a historic crash.

ETHUSD CRACK! Wave 3 Warning!🚨When it rains, it pours. We’re seeing concurrent breakdowns across multiple asset classes, consistent with the risks I’ve been flagging for some time.

ETH is at stage 5️⃣ Panic / Liquidity Event, more on this later.

ETH is now down -47% from ATH, after Wave 1 down.

ETH has been trading below the Death Cross X countertrend Wave 2, flagging out "Deeking"(Honey ticking)

Now it is Cracking the Flag. (Like many other asset classes)

🚩 Warning us that Wave 3 down is coming!

1️⃣ Early Drop (-5% to -10%) — Denial Phase

2️⃣ Correction Phase (-10% to -20%) — Reassurance Phase

3️⃣ Official Bear Market (-20%) — Commitment Trap

4️⃣ Deep Decline (-30%) — Moral Pressure Phase

5️⃣ Panic / Liquidity Event (-40% to -50%) — Narrative Flip

6️⃣ Late Stage / Bear Rally — False Hope

At Stage 5️⃣ Panic, you will hear these phrases.

“This was a black swan”

“No one could’ve predicted this”

“It’s different this time — but markets adapt”

“Valuations are now attractive”

“Big Money won’t allow a collapse”

📌 Translation: The damage is done. Rewrite history.

I need to make another post to get you all ready for what is to come, so you don't get suckered like I did when I was first starting out.

I paid the price, so you don't have to.

#FAFO

If you enjoy the work:

👉 Drop a solid comment

Let’s push it to 6,000 and keep building a community grounded in raw truth, not hype.

BTC Ready To CRACK!This chart is pretty much self-explanatory as per BKC rules.

Wave 1 thrusts down

Wave 2 counter trend rising wedge with 3 waves and hook

Wave 3 down is about to begin.

Clear price action is way below the Death Cross.

I’ll say it again: the JPY carry trade is breaking, and it’s hitting crypto.

By crypto-bro expert logic, a weaker dollar should mean crypto goes up. That’s not what’s happening, is it?

Why? Because they don’t understand how the monetary system actually works.

They looked smart while the trend did the work for them. Now the trend is gone—and reality is doing the explaining.

Men are now taking the boys' money like candy without even a mask on in the light of day!

BTC is now at stage 4 where the experts try to motivate fools.

4️⃣ Deep Decline (-30%) — Moral Pressure Phase

“Buy when there’s blood in the streets”

“This is how generational wealth is made”

“The smart money is buying”

“Be greedy when others are fearful”

“This is once-in-a-decade”

📌 Translation: We need new buyers to absorb forced selling.

#FAFO

If you enjoy the work:

👉 Drop a solid comment

Let’s push it to 6,000 and keep building a community grounded in raw truth, not hype.

SOLUSD KEY AREASolana is entering a danger zone after double-topping while also forming a head-and-shoulders structure.

That combination matters.

The chart has already cracked once. That’s your warning shot.

If you’re not in SOL yet and you’re bullish:

This is the only area where a long makes sense—with a clearly defined stop. No stop, no trade.

If you’re bearish and looking to short:

Don’t front-run it. Wait for the next crack and trade against this level once it fails.

If you already own SOL and are inhaling hopium:

You do not want to see this level break. If it does, downside can accelerate fast.

Lastly, why are Cryptos down -50% and the $ down -10% +?

This is where discipline matters.

Don’t FAFO.

If you enjoy the work: 👉 Drop a solid comment. Let’s push it to 6,000 and keep building a community grounded in raw truth, not hype.

S&P 500 Daily Chart Analysis For Week of Jan 30, 2026Technical Analysis and Outlook:

The Index exhibited considerable volatility during the trading session this week, ultimately finding support at the Mean Support level of 6,897. Following this decline, the Index demonstrated a robust rebound and has stabilized just below the Key Resistance level of 6,977.

It is anticipated that the Index will maintain an upward trajectory towards the outstanding target of the Outer Index Rally at 7,026, and contrive the route through the newly established Key Resistance level at 7,000.

Nonetheless, it is crucial to recognize that, given the current market conditions, there is a significant probability of a retracement that may revisit the Mean Support at 6,897 before the Index regains bullish momentum and progresses towards the foretold outcome of the Outer Index Rally at 7,026 in the previous Daily Chart Analysis. At this juncture, a renewed In Force retracement is expected to be initiated from that level.

EUR/USD Daily Chart Analysis For Week of Jan 30, 2026Technical Analysis and Outlook:

Over the past week, the Euro trading session has demonstrated a substantial upward trajectory, surpassing the Interim Inner Currency Rally target of 1.186 and successfully retesting the completed Outer Currency Rally level at 1.191. Upon reaching this target, the Euro achieved the outstanding Outer Currency Rally level of 1.208, thereby activating a retracement towards the current Mean Support at 1.185.

It is anticipated that this retracement will continue toward the Mean Support at 1.178, with the potential extension to the Mean Support at 1.173. At this juncture, a renewed Inner Rebound is expected to initiate from the forenamed support levels.

Furthermore, market participants should be cognizant of the likelihood that the currency will exhibit a gradual intermediate gyration between the Mean Support at 1.185 and the Mean Resistance at 1.191 before resuming the retracement.