Nasdaq - Stocks are just heading higher!🚀Nasdaq ( TVC:NDQ ) is creating new all time highs:

🔎Analysis summary:

Tech stocks just finished an extremely strong year and we were offered quite a lot of buying opportunities during 2025. Looking at the higher timeframe, we could see a short term retracement going into 2026, but the underlying trend remains totally bullish.

📝Levels to watch:

$25,000

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Nasdaq Composite Index CFD

Nasdaq - Tech is rallying during 2026!💰Nasdaq ( TVC:NDQ ) is remaining totally bullish:

🔎Analysis summary:

The Nasdaq and the entire tech sector is about to finish a very strong year of 2025. Going into 2026, market structure remains totally obvious and is clearly showing massive upside potential. Every major dip, especially going into 2026, leads to a massive buying setup.

📝Levels to watch:

$25,000 and $21,000

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Nasdaq Composite (IXIC) Needs to Break Above Current LevelThe Nasdaq Composite (IXIC) needs to break above the current level to accentuate a bullish outlook failure to break above the current level could resort to a move to the 38.2% Fib level leading to further sell-off.

The Nasdaq Composite, the broadest measure of U.S. technology and growth stocks, climbed sharply this week as investors pushed equities higher in a rally that spanned most major sectors. On Monday, the index rose about 0.5% in a broad-based advance, lifting sentiment across Wall Street and sparking talk that the Nasdaq could still hit a new record before 2026 begins

This move came as part of a wider market surge that saw the S&P 500 also gain about 0.6% and edged closer to its own all-time high. Financials, energy, and materials led the gains, showing that this rally was not limited to just technology stocks. Only consumer staples lagged, which often happens when investors take on more risk.

The Nasdaq Composite’s price action in the past few weeks suggests a market that is stabilizing after bouts of volatility. Looking at the chart, the index has formed a pattern of higher lows, pushing up toward resistance near recent highs. This is generally a bullish structure, indicating buyers remain active even when prices retrace slightly.

One useful way to see this is by watching key moving averages. The Nasdaq has stayed above its longer-term trend lines, such as the 50-day and 200-day moving averages, which often act as support zones for buyers in an uptrend. When the index pulls back to these levels and then rebounds, it signals ongoing confidence in the broader market trend.

IXIC - Support Flipped Resistance Trend LineThis is the monthly chart for IXIC and the trend line encompasses all of price history

A trend line drawn before the .com bubble shows strong support and highs pushing above this trend line

Now however the price is below this trend line while still trending upwards. Price was tested as resistance for the first time along this trend line near the 08 bubble.

Now we see new highs seemingly closer and closer together test this line as resistance which makes me very bearish in the short term on this timeframe.

Nasdaq - The final blow-off top!⚰️Nasdaq ( TVC:NDQ ) can rally a final +25%:

🔎Analysis summary:

Just this month, we witnessed quite some volatility on the Nasdaq with a correction of about -10%. However, bulls immediately stepped in and clearly pushed price higher. Since there is still bullish pressure, a final blow-off top rally in the near future is quite likely.

📝Levels to watch:

$25,000 and $30,000

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Stocks Stage Comeback in Time for Thanksgiving. What's Behind ItIt’s Thanksgiving, and you know what that means. “Hey, sweety, why don't you come here and let us know how your high-beta stocks are doing. Here’s our little investor.”

And for once, the answer isn’t followed by a sigh. Stock traders are heading into the holiday with something they haven’t had in a while — gains and optimism.

Major US indices just logged their fourth straight day of gains, with the Nasdaq Composite on pace for its best Thanksgiving week since 2008.

That’s right: the last time the Nasdaq had a holiday rally this strong, we were still explaining what a “smartphone” was.

This year, it’s all about two things:

A dovish Federal Reserve

An AI trade that refuses to sit idle

Let’s carve into what’s driving this seasonal sprint.

📈 AI Fears Cool Off

The market has spent the past month wrestling with fears that AI stocks were puffing up like an overfilled Thanksgiving parade balloon. But this week, the anxiety faded.

Microsoft NASDAQ:MSFT , CoreWeave NASDAQ:CRWV , Dell NYSE:DELL , and even suddenly-revived AI-adjacent names have found solid footing again. The Nasdaq TVC:IXIC jumped 0.8% on Wednesday, outpacing the other indices and reminding investors that tech still runs this town.

What changed?

No new AI scandals and bubble talk

No shocking spending pivots (thanks, Meta NASDAQ:META )

No high-profile shorts announcing apocalyptic bets (thanks, Burry)

And some great data-center guidance in recent earnings ( thanks, Dell NYSE:DELL )

Even Nvidia NASDAQ:NVDA , which has been under the most scrutiny , clawed back 1.4% Wednesday — though the stock is still well off its early-month peak.

Investors are clearly reshuffling their AI winners, but the trade lives on. A shakeout doesn’t mean a shutdown.

🟩 Breadth Returns: Not Just a Tech Party

All but two sectors of the S&P 500 SP:SPX moved higher Wednesday, pushing the broader index up 0.7%.

The Dow TVC:DJI matched that performance, rising 315 points, with both indices tracking for their best Thanksgiving week since 2012.

Even the defensive sectors joined in. When utilities and consumer staples start partying with semiconductors and mega-cap tech, you know sentiment’s shifting.

🏦 The Fed Is Quietly Setting the Table

Just a week ago, the odds of a December rate cut were a coin toss — roughly 50/50 according to CME FedWatch. Today, that probability has surged to more than 80%.

What a cut could mean to traders:

Cheaper borrowing

Higher valuations

Softer financial conditions

And fewer landmines in the months ahead

Nothing gets markets into the holiday spirit like the smell of potential rate cuts.

This week is also shortened — stock markets are closed Thursday and shut early Friday (ref: the economic calendar ). With fewer trading hours to log, investors often front-load their optimism or their panic. This time, it’s mostly optimism.

🔄 Nvidia Isn’t Gone — It’s Just Taking a Breath

Nvidia’s stock remains sharply lower from its early November highs, but Wednesday’s move showed there’s still life in the AI leader.

Meta NASDAQ:META , Alphabet NASDAQ:GOOGL , and select cloud names have picked up flows as traders diversify their AI bets.

And while Nvidia might not be the main driver of the rally this week (spoiler alert: it’s Google ), its ability to stay positive helped prevent any emotional selling from spreading through tech.

🧁 The Warm, Lightly-Toasted Takeaway

If you were expecting a quiet, uneventful lead-in to the holidays — the market apparently had other plans.

Here’s where we’re at now:

A four-day winning streak,

A revival in Big Tech,

A broad rally across sectors,

And Fed expectations suddenly swinging toward cuts.

Off to you : Will it last through December? With inflation, rate decision, and jobs data, will AI stocks keep marching higher or retreat? Share your view in the comments and, to our US folks, enjoy Thanksgiving!

Tech Sector Goes "Three Black Crows" — Bear Market Cont PatternThree Black Crows is a term used to describe a bearish candlestick pattern that can predict a reversal in an uptrend.

Classic candlestick charts show "Open", "High", "Low" and "Close" prices of a bar for a particular security. For markets moving up, the candlestick is usually white, green or blue. When moving lower they are black or red.

The Three Black Crows pattern consists of three consecutive long-body candles that opened with a gap above or inside the real body of the previous candle, but ultimately closed lower than the previous candle. Often traders use this indicator in combination with other technical indicators or chart patterns to confirm a reversal.

Key points

👉 Three Black Crows is a Bearish candlestick pattern used to predict a reversal to a current uptrend, used along with other technical indicators such as the Relative Strength Index (RSI).

👉 The size of the Three black crow candles, timeframe they appeared on, the gaps when they opened, the downward progression sequence, as well as their shadows can be used to judge whether there is a risk of a pullback on a reversal.

👉 The “Three Black Crows” pattern should be considered finally formed after the sequential closure of all three elements included in it.

👉 The opposite pattern of three black crows is three white soldiers, which indicates a reversal of the downward trend. But maybe more about that another time.

Explanation of the Three Black Crows pattern

Three Black Crows is a visual pattern, which means there is no need to worry about any special calculations when identifying this indicator. The Three Black Crows pattern occurs when the bears outperform the bulls over three consecutive trading bars. The pattern appears on price charts as three bearish long candles with or without short shadows or wicks.

In a typical Three Black Crows appearance, bulls start the time frame with the opening price or gap up, that is, even slightly higher than the previous close, but throughout the time frame the price declines to eventually close below the previous time frame's close.

This trading action will result in a very short or no shadow. Traders often interpret this downward pressure, which lasted across three time frames, as the start of a bearish downtrend.

Example of using Three black crows

As a visual pattern, it is best to use the Three Black Crows as a sign to seek confirmation from other technical indicators. The Three Black Crows pattern and the confidence a trader can put into it depends largely on how well the pattern is formed.

Three Black Crows should ideally be relatively long bearish candles that close at or near the lowest price for the period. In other words, candles should have long real bodies and short or non-existent shadows. If the shadows are stretching, it may simply indicate a slight change in momentum between bulls and bears before the uptrend reasserts itself.

Using trading volume data can make the drawing of the Three Black Crows pattern more accurate. The volume of the last bar during an uptrend leading to the pattern is relatively lower in typical conditions, while the Three Black Crows pattern has relatively high volume in each element of the group.

In this scenario, as in our case, the uptrend was established by a small group of bulls and then reversed by a larger group of bears.

Of course, this could also mean that a large number of small bullish trades collide with an equal or smaller group of high volume bearish trades. However, the actual number of market participants and trades is less important than the final volume that was ultimately recorded during the time frame.

Restrictions on the use of three black crows

If the "Three Black Crows" pattern has already shown significant downward movement, it makes sense to be wary of oversold conditions that could lead to consolidation or a pullback before further downward movement. The best way to assess whether a stock or other asset is oversold is to look at other technical indicators, such as relative strength index (RSI), moving averages, trend lines, or horizontal support and resistance levels.

Many traders typically look to other independent chart patterns or technical indicators to confirm a breakout rather than relying solely on the Three Black Crows pattern.

Overall, it is open to some free interpretation by traders. For example, when assessing the prospects of building a pattern into a longer continuous series consisting of “black crows” or the prospects of a possible rollback.

In addition, other indicators reflect the true pattern of the three black crows. For example, a Three Black Crows pattern may involve a breakout of key support levels, which can independently predict the start of a medium-term downtrend. Using additional patterns and indicators increases the likelihood of a successful trading or exit strategy.

Real example of Three black crows

Since there are a little more than one day left before the closing of the third candle in the combination, the candlestick combination (given in the idea) is a still forming pattern, where (i) each of the three black candles opened above the closing price of the previous one, that is, with a small upward gap, (ii ) further - by the end of the time frame the price decreases below the price at close of the previous time frame, (iii) volumes are increased relative to the last bullish time frame that preceded the appearance of the first of the “three crows”, (iv) the upper and lower wicks of all “black crows” are relatively short and comparable with the main body of the candle.

Historical examples of the Three Black Crows pattern

In unfavorable macroeconomic conditions, the Three Black Crows pattern is generally quite common.

The weekly chart of the S&P500 Index (SPX) below, in particular, shows the occurrence of the pattern in the period starting in January 2022 and in the next 15 months until April 2023 (all crows combinations counted at least from 1-Month High).

As it easy to notice, in each of these cases (marked on the graph below) after the candlestick pattern appeared, the price (after possible consolidations and rollbacks) tended to lower levels, or in any case, sellers sought to repeat the closing price of the last bar in series of the Three Black Crows candlestick pattern.

Bottom Line

👉 As well as in usage of all other technical analysis indicators, it is important to confirm or refute its results using other indicators and analysis of general market conditions.

👉 Does History repeat itself? - Partially, yes.. it does. This is all because financial markets (as well as life) is not an Endless Rainbow, and after lovely sunny days, earlier or later, dark clouds may appear again, and again.

LightWhenever I prepare an idea to publish, well... I don't prepare.

As you may already have realized, my "blog" is not about trading / investment analysis. It is an attempt of mine to describe the indescribable. To smell the un-smellable (like a Greek song said).

My first ideas were an attempt of mine to reach out to others to spark conversation.I wasn't trying to give out any meaningful insight, because I had none. Now I think I have information to share, but Socrates would not agree with me, he is certain that he knows nothing . Since I cannot / don't want to be like Socrates, I will be like Diogenes the Cynic, I like him more... His views on philosophy and the world have grown on me.

And speaking of grown...

Apple has grown. From a seed of a Macintosh in a wooden box, into to a computer that would destroy Orwell's 1984, and then to a pair of smart glasses that would become the dystopia they tried to avoid.

Traders have also grown, most only in their age and appetite. The minds stood still.

And prices have grown higher and higher, but lighter than ever before.

Many analysts develop indicators in reverse. They want profit and shape indicators in a way to satisfy this growing appetite. The appetite of the man who isn't satisfied with the few, cannot be satisfied with the many. I have done this myself in the past.

There are two ways this chart is misleading.

First: Price on top of Bollinger Band can be interpreted as a "strong push", and at the same time an "overextended price". The indicator by itself is not misleading. It is us who don't analyze it properly.

Second: While this indicator calculates a statistical deviation (a pure mathematical idea), it fails in the act. Statistical deviation of trending prices cannot be calculated with ordinary moving averages. Don't listen to me, listen to the scientists from whom I found this, research it yourselves. A secondary problem is log scale.

A portion of traders, whom I call gamblers have grown light minded, it seems. They don't want prices to ... slide backward into oblivion, just as (we / they) have finally begun to see the light.

And just like gamblers, lighter my charts have apparently become. I simply try to shed some light into the darkness of technological / artificially untelligent societies.

Since my publications of indicators have been buried in the darkness, now it is time for them to shine, in simple terms.

And so, fixing analysis needs many steps. I show again the original statistical band:

Our data lives in a log-scaled world of increasing proportions, not increasing amounts. So, we re-shape our/Bollinger's mathematics to survive in this wild world of massive numbers. We then conclude to the log-scaled band:

One of the major problems however has not been fixed. Mathematicians dictate that classical moving averages don't apply in "Time Series Data" i.e. price history. Statistics don't work in trending data.

To fix this issue I have constructed a simplified MA model and applied it in multi-timeframe price data using PineScript.

The MA-Model is not a moving average (it doesn't describe an average price). It is instead one of the infinite trend-nullifying lines, from the base of which statistics are calculated. The band is the same 2-sigma area like the classic Bollinger.

What is the conclusion of this chaotic story, I hear you say...

It is either too simple or too complex.

The simple explanation is that history repeats itself.

Going back to 1998, we see the following:

Price divergences have become apparent from statistics. On the first arrow of each one, price reaches a 2-sigma deviation. On the second arrow of each divergence, price fails to make a second deviation jump, price instead returns to mean.

It is as if prices move in two steps. First they define a trend from a 2-sigma event (either bullish / bearish), then they follow up on the trend, while reverting to mean.

Now in 2025, in a larger timeframe, Apple seems to crave bitter sweets.

The 1998-2000 bubble is dwarfed from this massive chart.

Apple has done it. From the bottom of the world and a sub 1% market share, to conquer the world. It is the most loved brand. Sells the most popular smartphone. Designs the most powerful chips. Shapes future trends. And ironically, this very idea is typed on a modern Apple device.

You have reached the top, when everyone is sure that you will live forever.

And I mean everyone, including me who hypocritically votes against them.

The drop will come when a single person changes their mind.

Be wise. Be safe. Be aware.

-Breen

P.S. I will follow up this idea with some interesting charts on SPX in the following days.

Nasdaq Computer sector & Nasdaq nearing pullback areaNasdaq Computer (IXCO) Is nearing pullback territory (23,717 resistance). IXCO being the largest sector in Nasdaq (IXIC) means the composite index, now that it's over previous resistance, is also looking for a pullback into support (20,160).

It's possible IXCO will break resistance next year and if that happens whatever gains are made will be lost on an eventual drop back into support.

If you have call options on NVDA or other tech companies closing them when IXCO hits 23,717 is highly advisable. If it hits there around this January it could be 2 years before IXCO resumes the uptrend past 23,717. Calls will likely get destroyed during this time.

Another note is lots of tech IPOs are occurring this year with lofty valuations. When this IXCO pullback comes they are likely to get hit hard. It's a great opportunity to short or wait to buy up the ones you like when the pullback is over.

As always good luck and try your best to avoid getting into new tech related trades as this year ends. It's going to be a great idea to have cash ready next year.

Is the Nasdaq a Bubble? A Technical Correction Is PossibleCME_MINI:NQ1!

Here’s a breakdown of the current Nasdaq correction scenarios based on the Nasdaq Futures (NQ1!) chart.

Every time I reached the top of the channel, an adjustment came out.

Based on the monthly chart, it has closed positively for six consecutive months since the tariff reduction, and it is judged to have entered the overbought zone by breaking through the upper Bollinger Band.

While a Santa Rally could still occur in Q4, we expect a short-term correction within one to two weeks.

Your follow and boost would mean a lot. 🚀

I am Korean and I used Google Translate.

Amazon making it's way to next support $280Amazon seems to be overlooked at the moment, but it should start making bigger moves as it approaches $280 resistance (next support).

I see a lot of things that lead me to believe next year will have a big pullback in tech. Until then AMZN looks to have really good risk reward as it's still so close to it's long term trend line with revenue growth steadily increasing.

Good luck!

For Those Trading PalantirPLTR has greatly accelerated it's growth trend lines. Right now PLTR is almost 3 years ahead of it's main long term trend line. What this means is upside potential is diminishing.

I see a lot of long charts for PLTR and wanted to share that support is actually at $134. So if you're a PLTR trader, looking to buy, that's the best area to do it.

If however you're looking to sell, then $230 is your spot.

I feel like people buying PLTR are playing a bit with fire as the fast gains are likely gone and eventually a return to the long term trend line is likely. I don't see that happening at least until IXCO runs into resistance, so until then $134 is the buy area.

Good luck!

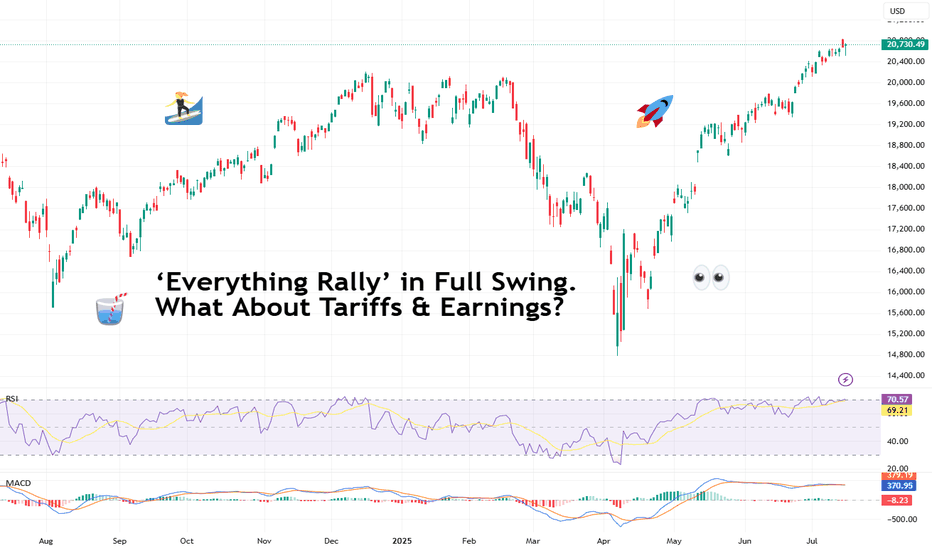

‘Everything Rally’ in Full Swing. What About Tariffs & Earnings?It’s official: we’re witnessing one of those rare, confounding moments when nearly every big risk-on thing is screaming ATH! (All-Time High, for those who haven’t worn out that abbreviation on X this month).

Bitcoin BITSTAMP:BTCUSD blew past $122,000 on Monday — a turbo rally that made anyone who stepped away to brew coffee rethink their life choices.

Meanwhile, Nvidia NASDAQ:NVDA ? It didn’t just approach the $4 trillion milestone — it showed up, took the crown as the world’s most valuable company , and made the Nasdaq Composite NASDAQ:IXIC pop a fresh record close for dessert.

And the S&P 500 SP:SPX ? The broadest slice of US equities did its part too, hitting a record high last week, despite the world’s loudest tariff chatter from Trump 2.0. So, what gives?

💎 Bitcoin: Too Fast to Chart

Let’s start with the fire-breathing dragon. Bitcoin BITSTAMP:BTCUSD rocketed to $122,500 on Monday morning, bruising all those short sellers and juicing up the memes. The OG coin now has a market cap above $2.3 trillion — bigger than most economies, enough to make gold bugs break into cold sweats. (True, it did pare back some of those gains to float at $119,000 Thursday morning.)

What’s fueling it? Institutional FOMO. Forget diamond hands — big money managers, ETF behemoths , and corporates are scooping up every sat they can find.

When you see that, plus macro tailwinds — a weaker dollar, simmering inflation that nudges the Fed toward cuts — the rocket fuel writes itself. But we all know what traders really want to know: is $125,000 next? Short answer: if momentum holds, you bet. Long answer: mind the next Fed move and the tariff chess match.

🎯 Nvidia: From GPUs to GDPs

If you thought Bitcoin’s wild run was the only headline, look again. The real flex this month came from Jensen Huang’s chip juggernaut. Nvidia NASDAQ:NVDA didn’t just break a record — it basically invented a new category for corporate mega-caps.

The world’s biggest semiconductor firm hit the $4 trillion mark — the first company ever to do so. And this isn’t some overnight fad. Back in 2019, Nvidia crossed $100 billion for the first time on the back of crypto mining booms.

Five years later, it’s stacked on 4,000% gains, riding the AI hype like it’s a permanent bull market. Governments, hyperscalers, cloud titans — they’re all shoving billions at Huang’s AI chips.

💻 Nasdaq: AI, Chips, Crypto — Party On

The Nasdaq Composite NASDAQ:IXIC logged yet another record close , up about 7.5% on the year so far.

Just three months ago, this index looked battered — trade war threats, tariff rants, sticky inflation. Who’s doing the heavy lifting? The Magnificent Seven, mostly. But it’s Nvidia’s chart that’s turned this whole index into a de facto AI ETF.

Is it healthy? That depends. As long as earnings season doesn’t break the dream — and there’s no rug-pull from the Fed — traders are letting the momentum do its thing.

🏦 S&P 500: The Record Chaser

What about the S&P 500 SP:SPX — the broadest barometer of America’s corporate muscle? It rose to set its own record high last week before coming down on Friday on renewed tariff jitters.

The Wall Street darling looks less explosive than its tech-packed peer, the Nasdaq. But it’s still up nearly 7% year-to-date — and up 26% from the April dip when tariffs spooked everyone out of their leveraged longs. Now? It’s back in record territory, brushing aside GDP contraction and inflation that won’t quit.

Why? Because the market is forward-looking. Tariffs may sting, but when the Fed hints at cuts and Trump sticks to his MAGA narrative, risk assets catch a bid.

🧨 What About Those Tariffs, Though?

Speaking of tariffs, let’s not pretend they’re not looming. Trump threatened over the weekend to ramp up levies on EU goods to 30% starting August 1 if no new deal emerges. Canada got an earful too: 35% on certain Canadian exports — and Ottawa announced a $21 billion tit-for-tat.

The “pause” on reciprocal tariffs ends in a few weeks. So, is this noise or real risk?

For now, markets are calling the bluff. Investors have tuned out the saber-rattling, choosing to front-run the Fed’s next move instead. If tariffs spark a deeper trade war, stocks may get a reality check. Until then, the melt-up rules.

🔮 What’s Next? Eyes on Earnings

Earnings season is around the corner (be sure to follow the Earnings Calendar ), and you can bet every fund manager is watching Nvidia NASDAQ:NVDA , Microsoft NASDAQ:MSFT , and the rest of the Mag 7 for cracks in the AI gold rush.

If the big names keep printing double-digit revenue growth, investors should be happy. But any hint of deceleration, cautious guidance, or margin pressure could slam the brakes on this record run.

Your turn : Do you see this melt-up stretching into the second half of the year? Or are we due for a rude awakening once the earnings calls roll in? Drop your take below!

Is the Nasdaq in a bubble?On the monthly timeframe, there are no signs of an over-extended, parabolic condition for the Nasdaq Composite(IXIC).

It's interesting to note that for a 25 year period from 1974 to 1999 the overall trend was roughly a positive 23 degree angled climb. We see that again in the current 16 year trend that started in 2009.

Much steeper parabolic periods can be seen in shorter time frames like the 1998-2000 move, where the angle reached 70 degrees. That didn't end well. It's also worth noting that in 1982 and 2020 we saw similar behavior, though slightly less frothy. Both of those periods were also followed by significant retracements.

Maybe we are at the beginning of one of those multi-month, over-extended runs. But not seeing it today. If we are trading at 45,000 or more in 2026, that's a different story...

Stocks Are Crushing It at Record Highs. What’s Behind the Rally?Happy record highs, everyone — confetti, champagne, and yet another all-time high. The Nasdaq NASDAQ:IXIC and the S&P 500 SP:SPX just did it again — notched fresh closing records that have traders flexing their P&Ls like it’s 1999.

If you’ve been on the sidelines, you’re probably staring at the chart asking: How did we add trillions to market cap while my grocery bill still looks like a high-yield bond payment?

Good question. Because these days, stocks are behaving like they live on a separate planet from the actual economy (looking at you, Nvidia NASDAQ:NVDA ).

Let’s pop the hood and see what’s revving this record-breaking machine — and what potholes might lurk ahead.

🤫 Nasdaq: The Comeback Kid of 2025

Take the Nasdaq Composite NASDAQ:IXIC — your favorite tech playground — up a mind-boggling 32% since the April lows . One-third of its total value was minted in three months — as much as $7 trillion added in.

What happened? Well, start with the obvious: the Magnificent Seven are doing the heavy lifting again. Nvidia NASDAQ:NVDA , Microsoft NASDAQ:MSFT , Apple NASDAQ:AAPL , Amazon NASDAQ:AMZN , Alphabet NASDAQ:GOOGL , Meta NASDAQ:META , Tesla NASDAQ:TSLA — they’re the gym rats of this rally.

But here’s the kicker: while the headlines are all “index record highs,” the Mag 7 as a whole are actually down slightly for the year. The hero’s cape belongs mostly to a few standouts: Meta, up 21% this year. Microsoft, up 17%. And Nvidia? Not bad: up a whopping 65% since the April swoon.

When the generals lead, the army follows — at least until they don’t?

🤖 S&P 500: Powered by 7, Dragged by 493

The broad-based S&P 500 also clocked a new record close at 6,173.07 . Everyone loves to toast a new all-time high, but here’s your buzzkill: the “500” in S&P 500 is a bit of a myth these days.

The Magnificent Seven alone account for more than 30% of the index’s total weight. Last year, this elite club rose 57% while the other 493 stocks crawled up just 13%. Strip out the hyper-scalers, and you’ll find most stocks are still limping along, wrestling with tepid growth and stubborn inflation.

So yes — the S&P 500 is soaring. But the S&P 493? Not partying at the same rooftop bar.

💼 Conflicting Data: This Economy Ain’t It (Yet)

Here’s where it gets spicy: GDP actually shrank last quarter — down 0.5% year over year. Inflation is still running hot with May’s PCE figure at 2.7% (the Fed’s target is 2%).

Fed boss Jay Powell and the central bank squad are trying to thread the world’s tiniest policy needle: cut rates enough to juice the economy, but not so much that they stoke a fresh inflation flare-up.

Meanwhile, job numbers are a mixed bag , and corporate revenue hasn’t been setting new records to match those ceiling-high stock valuations.

In short, the disconnect between equity prices and economic reality is growing wider than the spread on your favorite meme coin during an illiquid Sunday afternoon.

👨🏻💻 Tariffs, Tweets, and the Trump Factor

And who could forget the wildcard factor? Trump’s new tariffs. The “reciprocal tariffs,” as he likes to pitch them. One day he’s threatening to slap 50% duties on everything from French wine to German cars. The next, he’s cozying up for “productive” chats with Brussels.

This policy whiplash makes supply chains sweat, but so far, equity traders are shrugging it off — and even cheering. Why? Because in Trump’s world, chaos means central banks might cut rates to cushion the blow. And nothing says “rocket fuel” for risk assets like lower borrowing costs.

Add to that the weird paradox that tariffs — while inflationary in the short run — can also weaken the dollar if the Fed turns dovish. A weaker greenback means US tech giants look cheaper to global investors. So… up we go.

🏛️ The Great Fed Cut Watch

Speaking of cuts: the Fed’s next meeting is in late July, and Wall Street is holding its breath. Rate cuts mean cheaper money — which often means traders load up on risk.

The market is currently pricing in a 90% chance of a cut in September (and an 80% chance of a hold in July). Meanwhile, gold OANDA:XAUUSD — the non-yielding safe haven — is selling off while traders are flocking toward the risk-end of the boat, leaving the safe-haven corner gathering dust.

👀 What’s Next? The Inevitable Hand-Wringing

So — should you pop champagne? Depends.

If you’re a trend follower, record highs are record highs. Momentum is your friend. But if you’re a value purist, these multiples probably make your eye twitch.

Big question: when does this all get too frothy? Will the next earnings season justify these valuations? Markets are forward-looking anyway — even if big tech’s revenue flops, that doesn’t mean money will flow out of the market cap.

After all, we’re halfway through the year and that means it’s time to pop open the Earnings calendar for those spring reports.

Any dip right now may very well be seen as an opportunity to swoop in at a lower price, not as something that indicates there’s something fundamentally wrong with the business.

🫶🏻 The Takeaway: Celebrate, but Stay Focused

The rally is real. The headlines are dazzling. But the same lessons apply: trends don’t last forever, risk doesn’t disappear just because the chart is green, and the Magnificent Seven won’t carry the world on their backs indefinitely.

So have your stop losses placed right, your position sizes sensible , and your eyes on the macro backdrop. Because record highs are fun, but holding the bag isn’t.

Off to you : Are you riding this rocket or waiting for the next dip? Drop your take below — are we so back, or about to crack?

Trump's Second Term Brings Sharpest Market Decline Since 2001It's gone nearly three months or so... (Duh..? WTF.. less than 3 months, really? 🙀) since Donald Trump entered The White House (again).

Those times everyone was on a rush, chatting endless "Blah-Blah-Blah", "I-crypto-czar", "crypto-capital-of-the-world", "we-robot", "mambo-jumbo", "super-duper", AI, VR and so on super hyped bullsh#t.

What's happened next? We all know.. mostly all US stocks and crypto markets turned to 'a Bearish Mode', or to at least to 'a Correction' (that is still actual at this time).

Here's a short educational breakdown for Nasdaq Composite index NASDAQ:IXIC what we think about all of that, at our beloved 💖 @PandorraResearch Team.

Trump's Second Term Brings Sharpest Market Decline Since 2001: Analyzing the recent 15% Stock Market Plunge

President Donald Trump's second term has coincided with a dramatic stock market downturn, with the S&P 500 losing approximately 15% of its value since his January 2025 inauguration. This represents the worst start to a presidential term since George W. Bush in 2001 during the dot-com crash. The decline has erased more than $3 trillion in market value, driven primarily by concerns over trade policies, particularly the implementation of new tariffs.

Market analysts point to growing fears of potential stagflation—a toxic combination of slow economic growth and high inflation—as investor confidence continues to deteriorate despite pre-election expectations of business-friendly policies.

Unprecedented Market Decline Under the New Administration

Historical Context of Presidential Market Performance

The current market downturn stands out in stark relief when compared to previous presidential transitions. The S&P 500 has fallen nearly 10% in the first 10 weeks since Trump's inauguration on January 20, 2025, marking the worst start under a new president since George W. Bush in 2001. This decline is significantly worse than the start of the prior five administrations, with Bush's roughly 18% drop during the dot-com crash being the only steeper decline in recent presidential history. Looking further back, only Richard Nixon experienced a comparable early-term market decline with a 7.2% drop, highlighting the severity of the current situation.

When examining presidential market performance metrics, Trump's second term has already distinguished itself negatively. During the first 50 days, the S&P 500 declined by 6.4%, positioning it among the poorest market starts since 1950. By contrast, the best 50-day starts were achieved by John F. Kennedy (up 9.4%), Barack Obama (up 5.7%), and Bill Clinton (up 4.2%), demonstrating how unusual the current market trajectory is in historical context.

Magnitude of the Current Decline

The scale of market value destruction has been substantial. More than $3 trillion has been erased from the S&P 500's value over approximately 52 trading sessions since Trump's inauguration. By early April 2025, the decline had accelerated to approximately 15% from Inauguration Day, pushing the market dangerously close to bear territory. Market analysts note that if the S&P 500 reaches a 20% decline from its recent peak, it would mark the earliest instance of a bear market during a new administration based on S&P 500 history since 1957.

The tech-heavy Nasdaq Composite has suffered even more severely, with declines exceeding 11% by mid-March. This demonstrates the particular vulnerability of growth stocks that had previously led market gains, now facing the most significant corrections.

Key Factors Driving the Market Downturn

Trade Policy Uncertainty and Tariff Concerns

Trade policy, particularly the implementation and threat of tariffs, has emerged as the primary catalyst for market turmoil. The unpredictable nature of these policies has created significant uncertainty for businesses, investors, and consumers alike. Trump's "on-again, off-again approach to tariffs" has effectively extinguished the optimism that initially buoyed markets following his election victory in November 2024.

The market decline accelerated dramatically after what was termed the "Liberation Day" event, during which Trump announced plans for unprecedented tariff escalation. Two-thirds of the S&P 500's 15% decline occurred after this announcement, prompting Ed Yardeni of Yardeni Research to observe that "Liberation Day has been succeeded by Annihilation Days in the stock market".

Fear of Stagflation and Economic Instability

Many economists have warned that the new tariffs could reaccelerate inflation at a time when economic growth may be slowing, creating conditions for stagflation. This combination is particularly concerning for investors, as it creates a challenging environment for corporate profitability and economic prosperity. The risk that tariffs could trigger this economic condition has effectively neutralized investor optimism regarding other aspects of Trump's agenda, including potential regulatory reforms and tax reductions.

Shift in Market Sentiment

The market has undergone a fundamental transformation in sentiment from the period immediately following Trump's election victory to the current environment. Initially, investors had bid stocks up to record highs, anticipating benefits from tax cuts, deregulation, and business-friendly policies. However, this optimism has been replaced by growing concern about economic direction.

As one market strategist noted, "We have witnessed a significant shift in sentiment. A lot of strategies that previously worked are now failing". The S&P 500 has relinquished all gains made since Trump's November 2024 election victory, representing a striking reversal in market confidence.

Potential Long-Term Implications

Historical Patterns and Future Outlook

Historical analysis suggests that poor market starts during presidential transitions often foreshadow continued challenges. According to SunDial Capital Research strategist Jason Goepfert, rough starts represent a "bad omen" for stocks based on past performance patterns. His analysis indicates that markets typically show a median return of -1.9% six months after such a start, and after a year, they generally remain flat. Among similar historical instances, only four out of ten cases resulted in more gains than losses over the following year.

Administration's Response to Market Decline

Unlike during his first term, when Trump regularly referenced strong stock market performance as evidence of his administration's success, his second-term approach appears markedly different. Some market analysts have noted that "The Trump administration appears to be more accepting of the market's decline, potentially even welcoming a recession to achieve their broader objectives". This shift in attitude has further unsettled investors who previously expected the administration to prioritize market stability.

Technical challenge

The tech-heavy Nasdaq Composite index has recently soared 12% for its best day since January 2001.

But did you know what happened next in 2001? The major upside trend as well as 5-years SMA were shortly broken and market printed extra 40 percent Bearish decline.

Similar with what's happening in 2025..!? Exactly!

Conclusion

Trump's second presidential term has coincided with one of the worst stock market starts in modern American history, comparable only to George W. Bush's entry during the dot-com crash of 2001.

The approximately 15% market decline since inauguration represents a loss of trillions in market value and a complete reversal of the optimism that followed his election. Trade policy uncertainty, particularly regarding tariffs, has emerged as the primary driver of market instability, creating fears of potential stagflation and undermining business confidence.

As historical patterns suggest that poor starts often lead to continued underperformance, investors remain concerned about the market's trajectory through the remainder of 2025 and beyond.

--

Best 'a bad omen' wishes,

Your Beloved @PandorraResearch Team 😎

Can the Nasdaq sustain its rally?NASDAQ:IXIC

SP:SPX

FX_IDC:JPYKRW

Over the past two years, the S&P 500 and Nasdaq have experienced an unprecedented rally. However, now, with the S&P 500 hovering around 6,000 points and the Nasdaq near 20,000, the market appears to have lost its momentum.

I believe that for stock prices to rise further, there must first be a significant market pullback. A major decline implies that someone has already realized substantial gains, and understanding this dynamic is crucial.

Looking further back in time, investors who bought stocks at lower prices will eventually sell them at higher prices. This cycle continues to repeat itself.

There is no such thing as perpetual growth, just as there is no endless decline. Keeping this principle deeply in mind can lead to better investment decisions.

Nasdaq and Next Major SupportThe Nasdaq Composite is about to break above what will be it's next major support. When this happens stocks usually fly quite high. Please remember that it will likely want to hit back into this support at some point. So when you get big gains after this happens, do not enter new positions, just ride them. You also might want to trim some off and wait for the pullback into support before adding new positions.

As always, good luck!

Did We Just Witness AI Black Monday? DeepSeek Shocks Tech StocksPanic sell, panic sell, panic sell! That’s basically how Monday went for Wall Street and those of you who hold Nvidia shares. Or just about any other tech stock — you name it, it likely fell nose first when a big and scary Chinese artificial intelligence startup unveiled its new AI model.

DeepSeek.

What in the world is DeepSeek and why do I hear about it now?

DeepSeek, a Chinese artificial intelligence startup, may have just stripped Nvidia of its untouchable status as the go-to company that develops expensive chips to train AI models. DeepSeek announced it had trained its latest model, a rival of ChatGPT, for the negligible $5.6 million in computing costs. The story gets even crazier: it did it with 2,048 Nvidia H800 GPUs (bought before the US rolled out export restrictions).

That’s a meager 5% of the $100 million OpenAI blew on training its GPT-4 model in late 2023. And, what’s even more, DeepSeek’s model, called R1, churns out responses that are scarily close to the advanced US-bred technology.

Oh, and it’s open source, unlike OpenAI, which was originally open source but shut its doors to the public. It’s also free to use, unlike ChatGPT, which offers a paid tier between $240 and $2,400 a year. DeepSeek’s R1 model is quickly gaining traction among users as it made its way to the top of Apple’s App Store rankings.

DeepSeek has factored in demand from corporations, too. While OpenAI hosts the model on its own platform, its Chinese rival allows you to host this beast on your own hardware, which is a big deal to lots of businesses that work with sensitive data.

The stock market was so shocked by the news that you can get pretty much the same result for a fraction of the cost (and give it to users for free), it ran for the hills. The aftermath — Monday saw more than $1 trillion washed out from the valuation of the Magnificent Seven club. One company specifically took the biggest blow.

Can DeepSeek deep-six Nvidia’s world dominance plans?

Have companies been overpaying for Nvidia’s $30,000 chips? And have investors been overpaying for Nvidia’s shares? Nvidia NVDA pulled in a record $35 billion in Q3 , 2024 and struck a gross margin of 75% and net income of $20 billion.

The Jensen Huang-led company on Monday showed it can also hit records in reverse. Closing down 17% for the cash session, it took the biggest L in history. This was the largest destruction of value for a single company ever — $589 billion . So why was Nvidia particularly hit by DeepSeek’s rise?

Nvidia has been the primary beneficiary of the vast amounts of cash companies spent on AI. Simply because Nvidia makes the semiconductors used to train AI models. But if the same result (or just about the same) could be achieved through far less expensive means, why bother propelling Nvidia to the top echelon of the world’s biggest companies ?

Nvidia has picked up roughly $131 billion over the past two years from the sale of data-center equipment, mostly AI chips. Its client list includes the biggest names in tech, such as Amazon AMZN , Microsoft MSFT , Meta META and Alphabet GOOGL . These four combined have shelled out $343 billion in AI-related capex (capital expenditures) over the past two years. Since the release of ChatGPT, Nvidia shares have surged more than 700%.

Could we be looking at the good old supply and demand equation in play? If DeepSeek’s claims are true, and other companies can do the same (it’s an open-source model), then the scales could turn from undersupply to oversupply.

Can we then see a market crash that’s beyond anything we’ve ever thought possible? Or is that freak-out an unjustified stretch? Share your thoughts in the comment section below.