Ethereum Slips: Distribution Phase or Setup for a Higher Low?Ethereum on the H1 timeframe has transitioned from a clean bullish expansion into a corrective bearish structure after failing to sustain momentum near the recent highs. The prior series of consolidation boxes highlights a clear stair-step advance, but the loss of bullish follow-through at the top marked the beginning of distribution, followed by a decisive break into a descending channel.

Price is currently trading within this downward-sloping channel, respecting both the upper and lower boundaries with consistent lower highs and lower lows. The recent bearish impulse pushed ETH back toward the 3,100 area, a level that previously acted as a reaction zone during the earlier consolidation phase. This suggests the market is revisiting prior liquidity rather than entering an immediate trend reversal.

As long as price remains capped below the upper boundary of the descending channel, the corrective structure stays intact. Any short-term rebound from current levels is likely to be corrective in nature, potentially rotating back toward the mid-channel region where selling pressure may re-emerge. Failure to reclaim and hold above the channel resistance keeps downside risk active.

If selling pressure resumes, ETH could extend lower toward the 3,000 psychological level and potentially deeper into the 2,900 region, where the lower channel boundary aligns with a larger liquidity pool. Such a move would represent a deeper correction within the broader structure rather than confirmation of a full bearish trend shift, provided higher-timeframe support remains intact.

Alternatively, a strong bullish reaction from current levels followed by a clean break and acceptance above the descending channel would invalidate the bearish corrective scenario. In that case, Ethereum could transition back into expansion mode, targeting higher resistance zones and resuming its broader bullish trajectory.

LONG

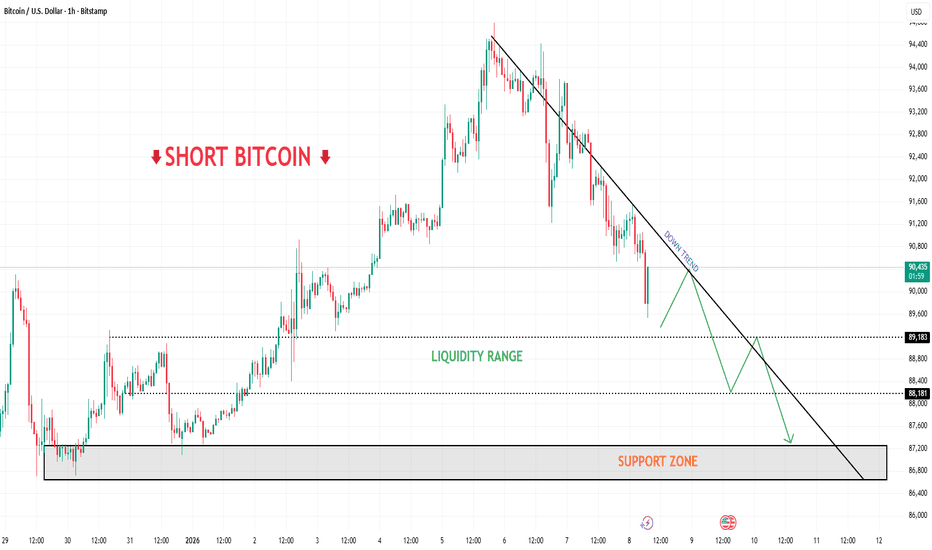

Bitcoin Breakdown Confirmed — Liquidity Below Is CallingPrice is firmly respecting the descending trendline, confirming a clear bearish market structure after the breakdown from the prior high. Selling pressure remains dominant, with each recovery failing to reclaim structure.

A corrective pullback toward the 90,400–90,600 area may occur, but this zone is expected to act as sell-side resistance as long as price remains below the downtrend line.

Failure to reclaim the trendline keeps the bearish bias intact, opening the path toward the liquidity range at 89,200–88,200. A decisive break below this range would expose the major support zone around 87,000–86,800, where a stronger reaction may finally emerge. Only a strong close above the trendline would invalidate the short-term bearish scenario.

A Familiar Scenario — Downtrend Remains the Dominant BiasBitcoin is now firmly trading in a clear downtrend, which is the main narrative on the H1 timeframe. After failing to hold above the prior highs, price has transitioned from a bullish expansion into a sequence of lower highs and lower lows, confirming that sellers have taken control of market structure.

Recent price action shows repeated rejection from former support levels, which are now acting as resistance. Each recovery attempt is corrective and short-lived, reinforcing the idea that the broader bias remains bearish rather than range-bound or bullish.

The structure clearly favors continuation to the downside. Pullbacks lack momentum, while bearish legs are impulsive and decisive a classic sign of trend strength. Price is currently consolidating below a key resistance area, suggesting distribution before continuation, not accumulation.

The highlighted range between $80,000 – $91,000 reflects temporary consolidation within a downtrend, not a stable trading range. As long as price remains capped below the upper boundary, downside pressure is expected to persist.

Resistance:

91,000 – 91,500 (key structural resistance)

94,800 (major trend invalidation level)

Support:

87,500 – 88,000 (next downside target)

Below this zone opens room for further bearish extension

➡️ Primary Scenario (Downtrend Continuation):

Price remains below the 91k resistance and continues to form lower highs. A breakdown from the current consolidation would likely trigger the next bearish leg, extending toward the 87.5k area and potentially lower.

⚠️ Risk Scenario:

Only a strong bullish breakout and acceptance back above 91.5k would invalidate the downtrend narrative. Until that happens, upside moves should be treated as corrective rallies within a bearish trend.

Bitcoin Is Holding Demand — Bulls May Be Setting Up the Next Price is reacting positively from a well-defined demand zone around 89,700–90,000, where selling pressure has been absorbed after the recent pullback. Despite the prior correction, the broader structure remains constructive as buyers defend this key area.

A sustained hold above the demand zone opens the door for a bullish recovery toward 91,400–92,300, where price may pause near the EMA and prior intraday resistance.

If bullish momentum strengthens and price breaks and closes above 92,300, the upside continuation scenario comes into play, targeting 93,200–93,700 as the next expansion zone. As long as price holds above 89,700, the upside scenario remains the primary focus.

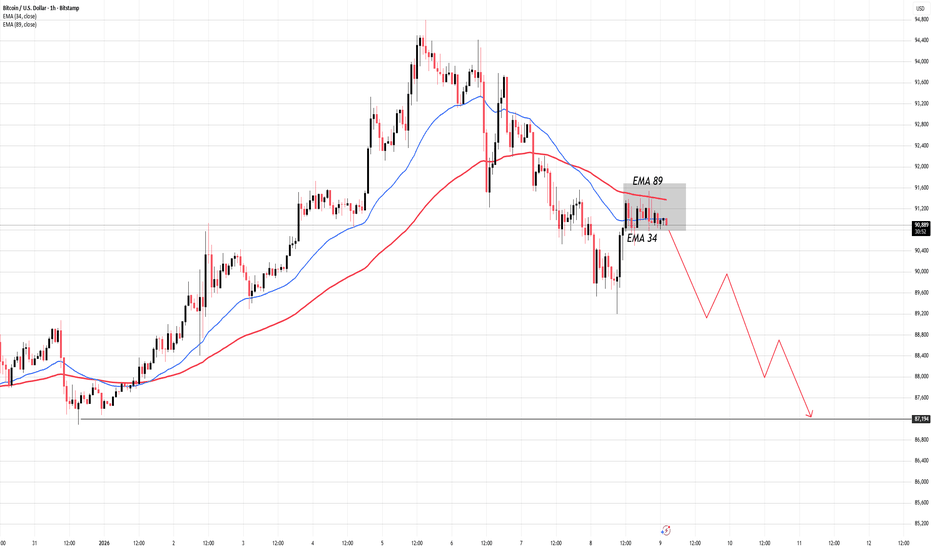

EMA Rejection in Play — Is BTC Setting Up for the Next Bearish Market Context & Structure

Bitcoin is currently trading in a clear bearish market structure on the H1 timeframe. After completing a bullish expansion, price has transitioned into a sustained downtrend, marked by a sequence of lower highs and lower lows. The recent recovery attempts are corrective in nature and have failed to reclaim prior structural levels.

At this stage, price is not showing signs of accumulation. Instead, it is consolidating below key dynamic resistance, indicating that sellers remain in control.

EMA Behavior & Price Action

Price is now reacting directly into the EMA resistance cluster, with EMA 34 acting as short-term resistance and EMA 89 as the higher dynamic ceiling. This EMA alignment is bearish:

- EMA 34 is below EMA 89

- Both EMAs are sloping downward

- Price is trading below both averages

This configuration typically supports a sell-the-rally framework, not a dip-buying environment. The current consolidation near EMA 34 reflects weak bullish momentum, often seen before continuation to the downside rather than a trend reversal.

Repeated failures to close above EMA 34, combined with rejection wicks near EMA 89, strongly suggest that buyers lack strength and that upside moves are being absorbed.

Key Levels

Dynamic Resistance:

- EMA 34 ~ 90,900

- EMA 89 ~ 91,300 (major dynamic resistance zone)

Static Support:

- 89,200 (minor reaction level)

- 87,200 – 87,400 (major downside support / liquidity target)

➡️ Primary Scenario (Bearish Continuation):

Price fails to break and accept above EMA 34–EMA 89 resistance. A rejection from this EMA zone would confirm continuation of the bearish structure, opening the path toward the 89.2k level first, followed by a deeper move into the 87.2k support zone.

This scenario aligns with classic EMA pullback continuation behavior in a downtrend.

⚠️ Risk Scenario:

If price manages a strong bullish close above EMA 89 with follow-through and acceptance, the bearish continuation thesis would be invalidated. In that case, BTC could transition into a broader consolidation or corrective recovery rather than immediate downside continuation.

EURUSD Sellers In Panic! BUY!

My dear followers,

This is my opinion on the EURUSD next move:

The asset is approaching an important pivot point 1.1632

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 1.1680

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GOLD BULLISH BIAS RIGHT NOW| LONG

GOLD SIGNAL

Trade Direction: long

Entry Level: 4,427.50

Target Level: 4,459.93

Stop Loss: 4,405.83

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NG1! BULLS WILL DOMINATE THE MARKET|LONG

NG1! SIGNAL

Trade Direction: short

Entry Level: 3.344

Target Level: 3.469

Stop Loss: 3.260

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

AUDUSD Massive Long! BUY!

My dear friends,

Please, find my technical outlook for AUDUSD below:

The instrument tests an important psychological level 0.6675

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 0.6699

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

BTCUSDT Long: Holding Above Demand, Eyes on 91,800 RetestHello traders! Here’s a clear technical breakdown of BTCUSDT (3H) based on the current chart structure. BTCUSDT initially traded within a well-defined descending channel, where price consistently respected the lower highs and lower lows, confirming strong bearish pressure. This bearish structure eventually reached a key pivot point, from which price reversed and broke out of the descending channel to the upside. This breakout marked a structural shift and initiated a new ascending channel, signaling a transition from bearish to bullish control. Following this rejection, BTCUSDT moved into a range, highlighting temporary equilibrium between buyers and sellers. From this range, price attempted another push higher, once again testing the supply zone. The most recent price action shows rejection from the same area, reinforcing the importance of this resistance.

Currently, BTCUSDT is consolidating between clearly defined Demand (~89,600) and Supply (~91,800) zones after transitioning from a descending channel into an ascending structure. Despite the recent rejection from the supply zone, the overall market structure remains bullish as long as price holds above the key demand area.

My primary scenario: long bias remains valid as long as BTCUSDT holds above the 89,600 Demand Zone and no strong bearish acceptance occurs below this level. I expect buyers to continue defending the demand area, forming a higher low or showing a clear bullish reaction (long lower wicks, impulsive bounce, or an internal break of structure). Once buyer strength is confirmed, a move toward: TP1: a retest of the 91,800 Supply Zone. TP2: in case of a clean breakout and acceptance above 91,800, continuation toward new local highs. Manage your risk!

EURUSD Long: Compression Near Key Zones Signals Upcoming MoveHello traders! Here’s a clear technical breakdown of EURUSD (1H) based on the current chart structure. EURUSD previously traded within a well-defined ascending structure, respecting a rising trend line that acted as dynamic support during multiple pullbacks. This bullish phase showed consistent higher lows, confirming buyer control. After the impulsive upside move, price entered a consolidation range, highlighted on the chart, where buyers and sellers temporarily reached equilibrium. From this range, EURUSD executed a bullish breakout, confirming continuation and pushing price toward the upper structure. However, as price approached the Supply Zone around 1.1720–1.1750, bullish momentum started to fade. Multiple reactions, including fake breakouts and rejections near the pivot point, clearly signal strong selling pressure in this area. A descending Supply Line now caps price, reinforcing bearish pressure from above.

Currently, on the downside, price recently swept below short-term support, forming a fake breakout into the Demand Zone around 1.1670, which aligns with an ascending Demand Line. The quick recovery from this area suggests active buyers defending demand and preventing deeper downside for now. Currently, EURUSD is compressing between demand support and descending supply resistance, indicating a tightening structure and an upcoming directional move.

My scenario: as long as EURUSD holds above the 1.1670 Demand Zone and respects the rising demand line, a corrective bounce toward the 1.1710–1.1720 Supply Zone is possible. This area remains a key decision point. A strong rejection there would favor renewed bearish continuation, while a clean breakout and acceptance above supply would invalidate the bearish pressure and open the door for bullish continuation. Manage your risk!

BTCUSDT: Bullish Structure Intact - Targeting 93K ResistanceHello everyone, here is my breakdown of the current BTCUSDT setup.

Market Analysis

BTCUSDT previously traded inside a well-defined consolidation range, where price moved sideways and volatility was compressed, showing balance between buyers and sellers. During this phase, multiple internal swings failed to establish a clear trend direction. Before the range, price experienced several fake breakouts near the upper highs, highlighting strong selling pressure inside the 93,000 Resistance Zone, where buyers repeatedly failed to gain acceptance.

Currently, price is trading above the support zone and consolidating below the key 93,000 Resistance, where selling pressure previously emerged. The structure remains constructive, with higher highs and higher lows still intact, suggesting the move is corrective rather than a full reversal.

My Scenario & Strategy

My primary scenario: as long as BTCUSDT holds above the 90,800 Support Zone and respects the rising trend line, the bullish bias remains valid. I expect price to consolidate and potentially push higher toward the 93,000 Resistance, which acts as the next major upside objective (TP1). A clean breakout and acceptance above the resistance zone would confirm bullish continuation and open the door for further upside expansion.

However, a decisive breakdown below support and the trend line would invalidate the long setup and signal a return to range behavior or deeper correction. For now, buyers remain in control while support holds.

That's the setup I'm tracking. Thank you for your attention, and always manage your risk.

NZDUSD Will Go Higher From Support! Buy!

Here is our detailed technical review for NZDUSD.

Time Frame: 4h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 0.572.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 0.576 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

BTC Coils at a Critical Breakout PointBitcoin remains within a broader bullish market structure, supported by a rising trendline that has guided price action since the impulsive breakout. After printing a local high near the 94.8k area, price has transitioned into a consolidation phase, forming a series of lower highs while still maintaining higher lows a classic compression structure within an uptrend.

This price behavior reflects temporary equilibrium rather than trend exhaustion. The market is digesting prior gains, with volatility contracting as price coils between dynamic support and descending resistance.

The ascending trendline continues to act as structural support, while the descending trendline caps upside attempts, creating a tightening triangle. Price is also hovering around the EMA 50, which has flattened and is acting as short-term balance rather than directional momentum.

This setup typically precedes expansion. As long as price holds above the rising trendline and does Key Levels

Resistance:

Descending trendline near 93.2k–93.6k

Major supply above 94.8k

Support:

Rising trendline / structural support around 92.2k–92.6k

Deeper support near 90.4k (structure invalidation)

EMA / Dynamic Level:

EMA 50 around 92.8k (short-term equilibrium)not break structure to the downside, the bullish bias remains intact.

➡️ Primary Scenario:

Price continues to compress within the triangle before breaking above the descending resistance. A confirmed breakout and acceptance above this trendline would open the path toward the 94.8k high, with potential continuation toward the 96k area as bullish momentum expands.

⚠️ Risk Scenario:

A breakdown below the rising trendline with acceptance under EMA support would invalidate the bullish continuation setup. This would likely trigger a deeper corrective move toward the 90.4k zone before the market attempts to rebuild structure.

The Bullish Counter-Strike: Can EURUSD Break the Shackles Hello everyone,

On the H1 timeframe, the key focus right now is not the volatility seen in the previous sessions, but how EURUSD is reacting after a strong rejection from the lower support zone and its subsequent push into a cluster of intermediate supply levels.

Structurally, the market has transitioned from a sharp impulsive decline into a potential trend reversal phase, marked by a V-shaped recovery off the 1.1670 lows. Currently, price is consolidating just below the 1.1730 mark, attempting to establish a higher low. The most recent candle price action shows a consolidation phase where buyers are absorbing the remaining sell-side pressure before attempting the next leg higher.

Following the aggressive bounce from the primary Support Zone, EURUSD is now rotating toward the first major hurdle around the 1.1742–1.1754 range. This area is technically important: it represents a prior breakdown point where the previous bearish momentum accelerated. The current price action suggests that the bulls are in control of the short-term narrative, but they face a series of "step-like" resistance zones that must be reclaimed to confirm a structural shift.

From a price action perspective, we are observing a classic accumulation pattern. The move higher appears impulsive, while the minor pullbacks are corrective and shallow, which is a hallmark of budding bullish strength. As long as price holds above the newly formed local support at 1.1723, the immediate bias remains skewed toward a breakout.

The projected path on the chart reflects this logic:

- A successful retest of the 1.1723–1.1730 level to confirm a solid base.

- An impulsive breakout through the 1.1750 resistance tier.

- A technical rally toward the primary Resistance Zone near the 1.1790–1.1800 psychological level.

Only a clean breakdown and acceptance back below the 1.1710 support zone would invalidate this recovery scenario and suggest that the bearish trend is resuming. Conversely, a reclaim of the 1.1760 level would be the first definitive signal that the mid-term bearish pressure has faded and a larger recovery is underway.

Until the breakout through the upper resistance tiers occurs, EURUSD is in a rebalancing phase. Patience around these intermediate supply zones remains critical to avoid being caught in a range-bound trap.

Wishing you all effective and disciplined trading.

Mid-Pullback or Momentum Reset? BTC Holds a Critical Bullish Market Context & Structure

Bitcoin remains in a well-defined bullish market structure following a strong impulsive expansion from the prior accumulation phase. The sequence of higher highs and higher lows is still intact, confirming that the broader trend remains constructive despite recent volatility.

After printing a local high near the upper resistance zone, price has transitioned into a corrective phase. This pullback is occurring within structure, not as a reversal signal. Current price action reflects short-term distribution and profit-taking rather than aggressive selling pressure.

Technical Confluence

The recent sell-off failed to break the most critical higher low, indicating that buyers are still defending key structural levels. Price is currently consolidating between a well-defined support zone and overhead resistance, forming a mid-range equilibrium typical after a strong impulse leg.

This consolidation sits above the previous breakout area, suggesting the market is rebalancing before the next directional move. As long as price holds above the structural support zone, the bullish framework remains valid.

Resistance: 94,200 – 94,800 (distribution / rejection zone)

Support:

92,200 – 92,600 (structural demand)

90,400 (major invalidation level)

Scenarios

➡️ Primary Scenario:

Price holds above the 92.2k–92.6k support zone and forms a higher low. A bullish reaction from this area opens the path for continuation toward the 94.8k resistance, with potential extension into new highs if acceptance occurs above supply.

⚠️ Risk Scenario:

A clean breakdown and acceptance below the support zone would invalidate the immediate bullish continuation. In that case, BTC may enter a deeper corrective phase toward the 90.4k level before any meaningful upside attempt resumes.

AUDUSD Will Go Up From Support! Long!

Take a look at our analysis for AUDUSD.

Time Frame: 1h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The price is testing a key support 0.668.

Current market trend & oversold RSI makes me think that buyers will push the price. I will anticipate a bullish movement at least to 0.670 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Like and subscribe and comment my ideas if you enjoy them!

EURUSD Defends Demand — Is a Bullish Reversal Setting Up?EURUSD on H1 has been trading under sustained bearish pressure, forming a clear descending trendline that has capped price action over the past sessions. Lower highs remain intact, confirming that sellers are still in control of the broader short-term structure.

However, the recent sell-off has now pushed price into a well-defined support zone around 1.1665–1.1680, where downside momentum has started to slow. The sharp reaction from this area suggests active buyer participation and hints at a potential short-term corrective rebound rather than immediate continuation lower.

At the moment, price is consolidating just above this support zone, while still trading below the descending trendline. This creates a compression scenario: buyers are defending demand from below, while sellers remain positioned at trendline resistance.

This is a key decision area. As long as the support zone holds, the market has room to attempt a recovery toward the upper structure. A failure here, however, would reopen downside risk.

Bullish scenario: If price holds above the 1.1665–1.1680 support zone and breaks above the descending trendline with acceptance, a corrective move toward 1.1720, followed by 1.1760–1.1770, becomes likely.

Bearish scenario: A confirmed breakdown and close below the support zone would invalidate the bullish recovery idea and expose further downside toward 1.1630 and potentially 1.1600.

For now, patience is essential. The market is sitting at a high-impact support level, and the next high-probability trade will come from confirmation, not anticipation.

EURUSD at Major Support — Hold for Reversal or BreakPrice is testing a well-defined support zone around 1.1670–1.1680, where selling pressure has slowed after an extended bearish move. This area represents a critical decision point for short-term direction.

A strong hold above support could trigger a corrective recovery toward 1.1700–1.1725, with further upside potential toward 1.1740–1.1780 if buyers regain momentum and reclaim the moving average.

However, a clean break and close below 1.1670 would confirm bearish continuation, exposing downside liquidity toward 1.1650 → 1.1630, with extension risk toward 1.1600. Price reaction at this support will define the next directional move.

Are Lower Highs Setting Up a Deeper Sell-Off?Hello traders! Here’s a clear technical breakdown of ETHUSD (1H) based on the current chart structure.

Ethereum has transitioned from a previously bullish environment into a clear bearish market structure, defined by a sequence of lower highs (LH) and lower lows (LL). After failing to sustain price above the recent swing highs, sellers stepped in aggressively, forcing a breakdown through multiple structure levels.

The sharp impulsive move lower confirms bearish momentum, while subsequent pullbacks have remained corrective, consistently forming lower highs beneath prior support now acting as resistance. This price behavior reflects a market that has shifted control decisively to sellers.

Key Supply / Structure Resistance:

The 3,130–3,150 region now acts as a critical supply zone, where previous support was broken and sellers have defended retracement attempts. This area is also aligned with the EMA, reinforcing bearish pressure.

Intermediate Resistance:

The 3,090–3,100 level represents a minor structure cap. Any pullback into this zone that fails would likely form another lower high.

Major Downside Demand / Liquidity Target:

The 3,020 area is the next significant demand zone, aligning with projected structure continuation and liquidity resting below recent lows.

Currently, ETH is trading after printing a fresh lower low, placing the market in continuation mode rather than exhaustion. Price is attempting a minor bounce, but as long as retracements remain capped below supply, this move should be treated as bearish corrective price action.

Momentum remains with sellers unless structure is reclaimed.

As long as Ethereum remains below the 3,130–3,150 supply zone, the bearish structure stays valid. Any pullback that stalls below this area is likely to form a lower high, opening the door for continuation toward the 3,020 demand zone and potentially lower if sell-side momentum accelerates.

A structural invalidation would only occur if price reclaims and holds above the broken resistance with strong bullish acceptance. Until then, rallies should be viewed as sell-side corrective moves, not reversals.

For now, the trend is down and controlled by sellers.

GBP/USD BULLS ARE GAINING STRENGTH|LONG

GBP/USD SIGNAL

Trade Direction: long

Entry Level: 1.341

Target Level: 1.344

Stop Loss: 1.339

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Bitcoin Remains Under Pressure — Sellers Still in Full ControlPrice is trending firmly below the descending trendline and the EMA50, confirming a sustained bearish market structure with lower highs and lower lows intact. Recent pullbacks are being sold aggressively, showing no meaningful sign of demand stepping in.

A minor bounce toward the 90,800–91,000 area is likely to act as a corrective retest of structure rather than a reversal, where sellers may re-enter positions.

As long as price remains below the trendline, downside continuation is favored, exposing key liquidity targets at 89,300, followed by 88,800–88,400. Only a strong reclaim and close above 91,300 would invalidate the bearish scenario and signal a shift in short-term momentum.