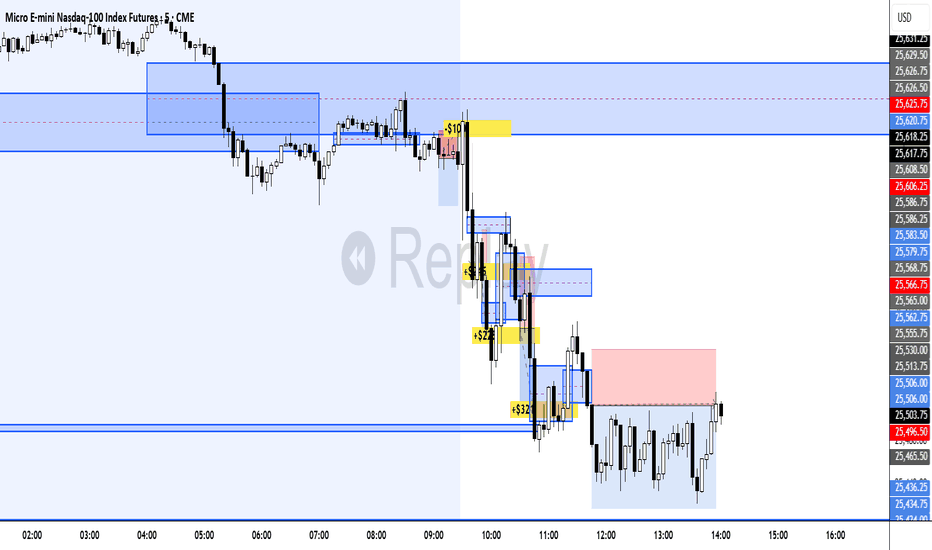

MNQ Daily Analysis & Replay - Wednesday January 14 2026 - part 3Great day, pure trend reaction and continuations: 4-1-1 / +$861

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

Multiple Time Frame Analysis

MNQ Daily Analysis & Replay - Wednesday January 14 2026 - part 2As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Daily Analysis & Replay - Wednesday January 14 2026 - part 1As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

Short trade

Sell-Side Trade — YGGUSDT.P (15m)

Pair: YGGUSDT

Bias: Sell-side

Date: Fri 16th Jan 2026

Session: London Session AM

Time: 10:15 am (UK)

Entry TF: 15-minute

🎯 Execution Levels

Entry: 0.07067

Take Profit: 0.06853 (3.02%)

Stop Loss: 0.07093 (0.36%)

Risk–Reward: RR 8.23

Sentiment & Session Context

Price expanded into premium during the London session before failing to hold above prior highs. Rejection from internal FVGs and a clean break in short-term structure confirmed distribution. London AM provided the sell-side displacement, with price targeting inefficiencies and sell-side liquidity resting below.

Bias Going Forward

Valid while: Price remains below the London highs / premium PD array

Invalidation: Acceptance back above 0.07093 with displacement

Expectation: Continued mean reversion into sell-side liquidity

S&P 500 to 10,000 inside the next 4 years - December 2025** This is an outlook for the next 3 to 4 years **

** The bull market is not yet done, sorry bears **

Yes, read that right, 10,000 or 10k for the S&P 500.

The markets shall continue to grind higher during this 10-year bear market everyone is talking about.

Upwards and onwards for investors as unemployment numbers rise, graduates question the mysterious reason why their unable to land employment on the degree they just dropped $150k on; inflation runs out of control, working people struggle, the market is just not going to care. The best opportunities come at a time when you don’t have the money to invest, have you ever noticed that?

The story so far

A crash is coming, have you heard? Our ears are ringing out 24/7 with noise on the most predictable crash since computer user Dave reports an uninterrupted hour of use on Windows Vista.

News of an AI bubble the size of Jupiter that is about to collapse in on itself and create a new star only seem to gather pace. The same finance prophets on Youtube with a hoodie in a rented flat forecasting which way the FED will move on rates. A 40 minute video to deliver a single sentence titled:

“EMERGENCY VIDEO: Market collapse (MUST WATCH before tomorrow!!)”, 10 seconds in “And Today’s video is sponsored by…. ” and if it’s not a sponsorship, it’s a course they’re trying shill. Many story tellers weren’t yet out of school during the dom com crash, but they’re now they’re experts of it.

Finally we have “a recession is coming” brigade. Of course it is. There’s always a recession coming. It’s like winter in Game of Thrones, they’ve been warning us for ages. Haven’t you heard? Recessions are now cancelled thanks to money printing and low interest rates. Capitalism RIP, all hale zombie companies.

In summary there’s no shortage of doom and gloom. Everyone is saying it.

So what am I missing?

Let’s break this down as painless as possible so as not to challenge waining attention spans. You’ll need a cuppa before reading this, for the people of the commonwealth, you know of what I speak. A proper builders brew.

Take your time to digest this content, there's no rush (did I mention it's a 5 month candle chart?). If you’re serious about separating yourself from the media noise to the News on the chart, then you're in for a treat. It is proper headline material. When you’re done, you'll pinch yourself, did he just tell me all this for free? What’s in it for him? (Absolutely nothing). Tradingview might bump $100 my way like Xerxes bearing gifts, but in the end the content of this idea may radically change the way your view the market today.

The contents:

1. Is the stock market in a bubble?

2. What about this 10 year bear market people are talking about?

3. A yield curve inversion printed, isn't a monster recession is due?

Is the stock market in a bubble?

No. A handful of stocks are.

The so-called “magnificent seven” stocks that make up about 40% of the market, Yeah, they’re in a bubble. No dispute from me there on that. It has never been riskier to be an index only fund investor. Especially if you're close to retirement. Now I’m not about to carve a new set of stone tablets explaining why, if you want the full sermon, that’s on my website.

Here’s the short version: a tiny bunch of tech darlings are bending the whole market out of shape. If you’re only invested in index funds, then you’re basically strapped to the front of the roller coaster hoping the bolts hold should those seven stocks decide to puke 20% in a week.

Suffice to say, a handful of stocks, tech stocks, are distorting the entire market. Index only investors are exposed to a greater risk than at any point in those past 20 years should the magnificent seven decide to sell off quickly. But what if they don’t? What if they just sell off slowly? Which is my thesis here.

In the final 12 months leading up to the dot com crash, during the 1999-2000 period, the Nasdaq returned 160%. RSI was at 97 as shown on the 3 month chart below. Now that’s a bubble.

In the past twelve months the Nasdaq has returned 20%. That’s not a bubble, that’s just a decent year. Above average, nice not insane. Yet people are acting like it’s 1999 all over again.

A similar story for the S&P 500 as shown on the 3 month chart below.

In the five years leading up to the crashes of 1929 and 2000 the market saw a return of 230% with RSI at 94 and 96, respectively. Today the market has returned 60% over the last 5 years with RSI @ 74. Adjusted for recent US inflation, and it’s roughly 30% real return!

The two periods often recited the most by doomsayers, 1929 and 2000, exhibit conditions not found in today’s market. Fact.

What about this 10 year bear market people are talking about?

Warren Buffet, perhaps the most famous investor in the world, has amassed a cash pile the size of the size of Fort Knox. Legendary short seller Michael Burry is quoted as having Puts on the overbought tech stocks, that’s fair. The masses have translated all this as a short position on the stock market. It seems everyone is preparing for Armageddon. My question, why are the masses so convinced of a stock market crash?

“Whenever you find yourself on the side of the majority, it is time to pause and reflect.”

Mark Twain

Let’s talk about the main 5 month chart above… There’s so many amazing things going on in this one chart, could spend hours talking about it. Will save that for Patrons, but the key points exist around support and resistance.

You’ll remember the “ Bitcoin in multi year collapse back to $1k - December 2025 ” publication?

It is of no surprise to me the Bitcoin chart now indicates a macro inverse relationship to the S&P 490 (minus tech stocks). Bitcoin is a tech stock all but in name, it follows the tech stock assets like a lost puppy.

If you strip away the blotted tech sector you realise we’re in for a bumper rally in the stock market in the coming years. This happens as a result of money flooding out of the blotted tech sector (that includes crypto). These sectors are about to crash straight through the floor towards middle earth.

When the masses catch on that businesses are not finding value in AI tools beyond generating cat videos on Youtube, the bottom falls out of those bankrupt entities, with hundreds of billions of dollars looking for a new home. That’s when investors pivot to value . Sometimes I feel like I’m the only one with this information when I scan through the feeds, how is this not the most obvious trade of the decade?

For the first time in 96 years the S&P 500 breaks out of resistance. Why is no one else talking about this?

2025 was the year it happened and yet not a whisper. The 1st resistance test occurred in July 1929. The 2nd in January 2000. The breakout occurred in the first half of 2025 and will be confirmed by January 1st, 2026 providing the index closes the year above 6530-6550 area. 12 trading days from now.

The 18 year business cycle, roughly 6574 days (the orange boxes) is shown together with the black boxes representing the 10 year bear markets in-between (14 years until past resistance is broken - pink boxes).

Should you not know, The 18 year business cycle, In modern market economies (especially the US and UK), they are repeated cycles where:

Land & property prices rise for about 14 years

Then there’s about 4 years of crisis, crash, and recovery

Together that’s roughly an 18-year land / real-estate business cycle, a pattern that is argued to show up again and again.

When we remove the darlings of the stock market you find the valuation for the S&P 490 suggests that the vast majority of the US market is currently priced near a level of Fair Value relative to GDP, provided that the current economic structure persists.

The high majority of influencers and financial experts talk about the end of the business cycle, there’s even “how to prepare for the crash” videos. If we look left, it is clear, the 18 year business cycle is far from over. So why are you bearish?

A yield curve inversion printed, isn't a monster recession is due?

There is a general assumption that recessions mean bad things for the stock market. You’re thinking it right now aren’t you? “ Of course they are Ww - everything will crash in a recession! ”

Listen…. you couldn’t be more wrong.

Ready for some dazzle? This level of dazzle wins your Harvard scholarships when meritocracy isn’t an option for you. And it’s free, without the monstrous loan debt at the end. Can you believe that?

What if I told you the stock market does not care about recessions?

Let’s overlay every US recession on the same 5 month chart. The vertical grey areas.

There has been 14 US recessions over the last 96 years. The majority, that is 9 of them, occurred during a bear market. The recessions that saw the largest drop in the stock market, 1929 and 2000, were known overbought bubble periods. We know that is not representative of the current market as discussed in the first section.

Here is the dazzle. Focus on the recession during the business cycles. What do you notice?

The recessions during business cycles (blue circles) never saw a stock market correction greater than 10%. In other word, utterly irrelevant.

Conclusions

Let’s land this gently, before someone hyperventilates into their keyboard. The S&P 500 is not in a bubble.

A handful of stocks are and that distinction matters far more than most people are prepared to admit. Yes, the Magnificent Seven are stretched. Yes, AI enthusiasm has reached “my toaster is sentient” levels. But the rest of the market? Strip away the tech confetti and you’re left with something far less dramatic and far more dangerous to bears: a structurally healthy market breaking a 96-year resistance. Not testing it.

Not flirting with it.

Breaking it.

And doing so while the internet is convinced the sky is falling.

This is where people get confused. They expect crashes to announce themselves loudly, with sirens and YouTube thumbnails. They don’t. Crashes arrive when optimism is universal, not when fear is a full-time job. Right now, fear is working overtime.

If history rhymes, and markets are essentially drunk poets with a spreadsheet, then the evidence points to continued upside over the next 3–4 years, not a sudden plunge into a 10-year ice age. Now that does not mean straight up. Expect:

Volatility

Rotation

Pullbacks that feel terrifying in real time and irrelevant in hindsight

What it does not suggest is the end of capitalism every time the RSI sneezes. The 18-year business cycle is not complete. The long-term channel remains intact. RSI conditions are elevated but nowhere near the manic extremes seen in 1929 or 2000. Those periods were bubbles. This is not.

Here’s the uncomfortable bit for many:

The biggest risk right now isn’t being long. it’s being so convinced a crash is imminent that you miss the next leg entirely. Especially if you’re hiding in cash waiting for a disaster that keeps failing to show up. And before anyone shouts “What about tech collapsing?!”, yes — that’s precisely the point. If capital rotates out of bloated tech and into value, industrials, energy, financials, and boring businesses that actually make money, the index doesn’t die. It grinds higher while everyone argues about why their favourite stock stopped working.

S&P 500 to 10,000 isn’t a fantasy screamed into the void.

It’s the logical outcome of structure, cycles, and history, assuming capitalism doesn’t suddenly apologise and shut down.

And if it does?

Well, none of us will be worrying about our portfolios anyway.

Ww

Disclaimer

===================================

This is not financial advice.

It is not a signal, a promise, or a guarantee that markets will behave politely while you feel clever. Markets can remain irrational longer than you can remain solvent, especially if you’re trading leverage, emotion, or YouTube confidence.

This outlook is based on historical price behaviour, long-term cycles, and observable market structure. If those conditions change, the thesis changes. Blind loyalty to an idea after the data disagrees isn’t conviction, it’s just stubbornness in a nicer font.

If you’re looking for certainty, reassurance, or someone to blame later, this will disappoint you.

If you’re looking for probabilities, context, and a framework that doesn’t rely on shouting “CRASH” every six months, you're welcome. Ww

Short trade

Sell-Side Trade — BTCUSDT (15m)

Pair: BTCUSDT

Bias: Sell-side

Date: Fri 16th Jan 2026

Session: London Session AM

Time: 5:00 am (UK)

Entry TF: 15-minute

Execution Levels

Entry: 95,525.7

Take Profit: 94,140.5 (1.45%)

Stop Loss: 95,623.3 (0.10%)

Risk–Reward: RR 14.19

Session-Based Narrative

🌏 Tokyo Session

Price formed a tight consolidation beneath resistance.

Liquidity was engineered but not expanded.

Typical range-building and inducement behaviour.

➡️ Sentiment: Neutral → Bearish setup

🇬🇧 London Session

London attempted continuation but failed to reclaim premium.

Multiple reactions at FVGs and prior highs without displacement.

Structure showed weak bullish follow-through.

➡️ Sentiment: Distribution

🇺🇸 New York Session

NY delivered sell-side displacement, breaking internal structure.

Buy-side liquidity above was left untapped → confirmation of failed continuation.

Price began targeting sell-side liquidity and inefficiencies below.

➡️ Sentiment: Bearish continuation

Trade Thesis Summary

Following a completed bullish expansion, BTCUSDT entered a distribution phase marked by failure to hold premium pricing and repeated rejection from higher-timeframe supply. London and New York sessions confirmed bearish intent through internal structure breaks and sell-side displacement. With buy-side liquidity exhausted and inefficiencies resting below, price is expected to continue lower toward sell-side targets.

XRPUSDT M15 Liquidity Sweep and Corrective Bullish Setup📝 Description

XRP swept short-term sell-side liquidity on M15 and is now stabilizing above the local demand zone. The current move appears corrective after the sell-off, suggesting a potential bullish reaction toward nearby imbalance levels.

________________________________________

📈 Signal / Analysis

Primary Bias: Bullish while price holds above the M15 liquidity sweep low

Preferred Setup:

• Entry: 2.063

• Stop Loss: Below 2.057

• TP1: 2.074

• TP2: 2.082

• TP3: 2.088 (M30 FVG / descending trendline reaction)

________________________________________

🎯 ICT & SMC Notes

• Clear sell-side liquidity sweep on M15

• Price holding above local demand confirms reaction potential

• Upside targets aligned with unfilled FVG levels

________________________________________

🧩 Summary

As long as price remains above the swept liquidity low, XRP is positioned for a corrective bullish move toward higher PD arrays.

________________________________________

🌍 Fundamental Notes / Sentiment

No immediate negative catalyst affecting XRP sentiment. In a neutral crypto environment, short-term liquidity-driven rebounds remain technically supported.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

Long trade

5min TF overview and entry

Pair YGG

Buyside trade

LND Session AM

Thu 15th Jan 26

4.15 am

Entry 0.07274

Profit level 0.07274 (5.52%)

Stop level 0.06878 (25.4%)

RR 25.4

Neutral → Bearish corrective within a broader bullish impulse

The price is transitioning from expansion into distribution, with sell-side pressure emerging after the buy-side objective was achieved.

🧠 Structural & Liquidity Read

Price delivered a strong bullish expansion from the sell-side drawdown low, efficiently rebalancing multiple FVGs. The rally fulfilled a buy-side objective, reaching into premium pricing relative to the prior dealing range.

Following the expansion, the price failed to hold above the London/NY highs, signalling buy-side liquidity exhaustion. The rejection from highs shows distribution behaviour, not continuation.

Narrative Summary

Price completed a bullish expansion phase, efficiently delivering into buy-side liquidity resting above prior session highs. Subsequent failure to hold premium pricing, combined with NY session rejection and volume acceptance below the high-volume node, signals distribution rather than continuation. Current sentiment favours a bearish corrective phase or consolidation until sell-side liquidity is sufficiently rebalanced.

XAU/USD 16 January 2026 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Analysis and bias remains the same as analysis dated 14 January 2026. It is worth noting how price failed to print above fractal high. Price seems to be in the process of printing bearish CHoCH to indicate bearish pullback phase initiation.

Price has printed according to my analysis dated 13 January 2026 where I mentioned, in alternative scenario, price to continue bullish.

As a result of continued bullish momentum CHoCH positioning has been brought closer to recent price action.

Price is currently trading within an internal low and fractal high.

Intraday expectation:

Price to print bearish CHoCH to indicate bullish pullback phase initiation. Thereafafter price to react at either discount of 50% internal EQ, or H4 supply zone before targeting weak internal high priced at 4,639.890

Alternative scenario: Price to again continue bullish.

Note:

The Federal Reserve’s renewed easing cycle, alongside a weaker U.S. dollar and persistent geopolitical tensions, continues to drive volatility in the gold market.

Traders should remain cautious and adjust risk management strategies to navigate sharp price swings.

Additionally, gold pricing is highly sensitive to U.S. policy under President Trump, where tariff measures, fiscal uncertainty, and shifting geopolitical strategy amplify market repricing risks and reinforce safe‑haven demand.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Analysis and bias remains the same as analysis dated 14 January 2026. Please note how weak internal low is holding with price unable to close above.

Price has printed according to my analysis dated 13 January 2026 where I mentioned, in alternative scenario, price to continue bullish.

Price continued bullish with very minimal pullback, therefore, I will not classify previous IBOS.

Price is currently trading within an established internal range, however, again, I will continue to monitor price with respect to depth of pullback.

Intraday expectation:

Price to trade down to either M15 or H4 demand zone, or discount of 50% internal EQ before targeting weak internal low, priced at 4,639.890.

Alternative scenario:

Price could potentially continue bullish.

Note:

Gold continues to exhibit elevated volatility as markets digest the Federal Reserve’s ongoing dovish tilt and persistent global geopolitical tensions.

With uncertainty remaining a dominant theme across global risk assets, traders should prioritise disciplined risk management, as abrupt price swings and liquidity pockets may become increasingly common.

Furthermore, recent tariff announcements from President Trump, particularly those directed at China, have added another layer of instability to the macro landscape. These policy developments have the potential to intensify market turbulence, heighten risk‑off flows, and trigger sharp intraday reversals or whipsaw‑like behaviour in gold.

M15 Chart:

Brent Oil M30 HTF Breakdown and Bearish Continuation Setup📝 Description

Brent Oil experienced a sharp impulsive sell from the HTF supply area, shifting momentum decisively bearish. The current price action is a corrective pullback into a lower-timeframe FVG, with no signs of structural recovery.

________________________________________

📈 Signal / Analysis

Primary Bias: Bearish while price remains below the M30 FVG and prior breakdown level

Preferred Setup:

• Entry: 63.38

• Stop Loss: Above 63.73

• TP1: 63.01

• TP2: 62.67

• TP3: 62.38 (HTF liquidity / FVG draw)

________________________________________

🎯 ICT & SMC Notes

• Strong impulsive sell confirms bearish order flow

• Current move classified as corrective retracement

• No bullish CHOCH or demand reaction confirmed

________________________________________

🧩 Summary

As long as price fails to reclaim the M30 FVG, the structure favors continuation toward lower liquidity targets.

________________________________________

🌍 Fundamental Notes / Sentiment

With easing geopolitical tensions, the risk premium priced into oil is likely to unwind. In the absence of supply disruption fears, Brent faces downside pressure, keeping lower prices favored as the market rebalances.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

USDJPY M15 HTF FVG Rejection and Bearish Continuation Setup📝 Description

FX:USDJPY after a sharp impulsive drop is showing a corrective pullback into a lower-timeframe FVG zone. Price remains capped below the descending structure, suggesting the move is corrective rather than a trend reversal.

________________________________________

📈 Signal / Analysis

Primary Bias: Bearish while price holds below the FVG and descending channel

Preferred Setup:

• Entry: 158.42 (FVG Rejection)

• Stop Loss: Above 158.53

• TP1: 158.29

• TP2: 158.19

• TP3: 158.10 (sell-side liquidity draw)

________________________________________

🎯 ICT & SMC Notes

• Pullback into LTF FVG after impulsive sell

• No bullish CHOCH confirmed

• Structure remains bearish below dynamic trendline

________________________________________

🧩 Summary

As long as price stays below the H1 FVG and descending structure, the expectation remains for continuation toward lower liquidity levels.

________________________________________

🌍 Fundamental Notes / Sentiment

With easing inflation pressures and softer USD momentum, USDJPY is vulnerable to downside correction. As long as dollar strength fails to extend, pullbacks may develop into a bearish move, favoring downside continuation over renewed highs.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

Chimera Investment Corporation, 10% - January 202610% Ww? Who gets out of bed for that? A 10% forecast is just as important as a 100% forecast. Active investors compound gains, that's how you win.

On the above daily chart price action has:

1. Printed multiple higher lows.

2. An RSI and price action resistance breakouts.

3. The last higher low print is followed with a confirmation of support on past resistance.

4. An inverse head and shoulder print confirms, with forecast to 14.50

Is it possible price action rolls over and breaks support? Sure.

Is it probable? No

Ww

==========================================================

Disclaimer

This is not financial advice. It’s a chart idea, it's me pointing at candles like they’re evidence in a court case. Nothing here is guaranteed, nothing here is a “signal,” and if you YOLO because a rectangle looked convincing, that’s between you and your bank.

I may hold a position at any time, and this idea can be invalidated without warning. If you lose money, don’t message me like I stole it. You clicked the buttons.

USDJPY — Regime Valid, Session Closed → No TradeThe higher-timeframe trend regime remains valid, but current participation conditions are not.

Despite structural continuation on the 4H, price is trading during a non-participatory session, resulting in compressed movement and low follow-through.

This is a good example of where:

Bias exists

Direction exists

Opportunity does not

No trade is intentional here.

My process requires both regime alignment and active session participation before considering any execution. When sessions are closed, patience is the position.

Waiting is not inactivity — it’s risk control.

Most losses don’t come from bad entries — they come from trading when nothing is required.

S&P 500 to 7300 over the next 60 days** Short term outlook **

On the above daily chart:

1. Price action prints multiple higher lows.

2. An RSI resistance breakout has printed.

3. The last higher low print is followed with a confirmation of support on past resistance.

4. An inverse head and shoulder print confirms, with forecast to 7300

1st resistance test @ 7300, which should print inside the next 60 days.

Conclusions

Alright, here’s the idea in plain English (because the market doesn’t care about your feelings, and neither does my chart). The daily structure is doing that annoying but encouraging thing: higher lows stacking up like a queue of people pretending they’re “just browsing.” That’s usually bullish. And now we see RSI finally breaks its downtrend resistance, which is basically momentum saying, “Fine. I’ll get up. Happy now?” Additionally the most recent higher low didn’t just happen, it got confirmed by support holding where resistance used to be. Classic role reversal. Like your ex suddenly being “nice” once you’ve moved on.

Finally, let’s throw the inverse head & shoulders into the mix, the measured expected move puts the first serious resistance test around 7300.

Base case: Price grinds higher and tags ~7300 within the next ~60 days, with 7300 acting as the first meaningful “prove it” level. If this fails: If price loses the reclaimed support zone, well that'll be interesting.. this whole bullish setup becomes a lovely piece of modern art interesting to look at, useless for making money. For the real money makers, keep the inbox open.

Ww

============================================

Disclaimer

This is not financial advice. It’s a chart-based opinion, which is a fancy way of saying: a guess with drawings. Markets can and will do whatever they want because they’re powered by:

algorithms,

panic,

euphoria,

and people who think “stonks” is a strategy.

Past performance, chart patterns, RSI breakouts, and confident arrows pointing upward do not guarantee future results. They barely guarantee a good mood. If you trade this idea, you’re doing it at your own risk. Use position sizing, stops, and common sense (or at least rent some). I’m not responsible for losses, missed gains, emotional damage, or you shouting at your phone like it owes you money.

UsdJpy SellThe trend is bullish, but the price always ends up making a pullback.

At this moment, confirmation of the pullback came with the Choch of the 4H fractal structure.

Price is using the 4H EMA as resistance, took liquidity in the 1H structure and reacted from a premium zone (50% Fibonacci).

The break of the 1H EMA shows alignment and increases the probability of bearish movements continuing - with the aim of taking internal liquidity from the 4H overall structure

Simplicity at its best Simply liquidated previous day's highs, inversed a Fair Value Gap and the first bearish candle to close below a 5min low was confirmation to take a sell order.

I'll admit i experienced a bit of turbulence but because my SL was placed 10 ticks above most recent high, i avoided manipulation and went on to close a few hours later at tp

US100 Short at Trendline🔍 Quick Summary

I’m looking for a short here on US100 as price reacts into a clear confluence of descending trendline resistance and a weak high. The rejection and compression under resistance suggest downside expansion back into demand ⚠️📉.

📊 Deep Analysis

On the 15-minute chart, price made a strong impulsive move up, breaking structure (BOS) and creating higher lows. However, that move has now stalled directly into a long-term descending trendline, which has capped price multiple times before.

Key observations:

Price tapped a Weak High / PWH zone and failed to hold above it

Clear rejection wicks at trendline resistance

Momentum slowing with choppy candles → signs of distribution

Price currently sitting below the trendline, not above it

This looks like a classic lower-high into resistance rather than continuation. Liquidity has been built above the highs, but price has failed to accept above resistance, increasing the probability of a downside sweep first.

The green demand zone below around 25,640 is the obvious magnet. If that level goes, the next downside push could accelerate quickly as late longs get trapped.

📰 News Supporting My Bias

The short bias is also supported by the macro backdrop:

Bond yields remain volatile, keeping pressure on tech valuations

Market participants are cautious ahead of key US data, leading to profit-taking near resistance

Nasdaq positioning remains crowded, increasing the risk of sharp pullbacks on rejection

This environment favours fade-the-rally setups rather than breakout chasing.

🎯 Trade Idea Scenario

Bearish Scenario (Primary)

Entry: Into trendline resistance / current consolidation zone

Confirmation: Rejection candles + failure to reclaim trendline

TP1: 25,640 (first demand / liquidity sweep)

TP2: 25,535 → 25,440 (next demand + imbalance)

SL / Invalidation: Clean break and acceptance above the trendline + weak high

Bullish Invalidation

If price breaks and holds above the trendline with strong volume, the short idea is invalid and I step aside — no fighting acceptance.

📌 What I’m Watching Next

I’m watching the next few candles at the trendline. Strong bearish closes or long upper wicks confirm the short. Acceptance above resistance cancels the idea.

⚠️ Disclaimer

This is my personal analysis and not financial advice. Always do your own research and manage risk carefully 📉📚.

EURAUD SHORTMarket structure bearing on HTFs 3

Entry at both Weekly and Daily AOi

Weekly Rejection at AOi

Previous Weekly Structure Point

Weekly EMA retest

Daily Rejection at AOi

Previous Daily Structure Point

Around Psychological Level 1.75000

H4 Candlestick rejection

Rejection from Previous structure

TP: WHO KNOWS!

Entry 120%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

CADCHF LONGTrade IDEA 1 for 2026:)

Market structure bullish on HTFs DW

Entry at both Weekly And Daily AOi

Weekly Rejection at AOi

Previous Weekly Structure Point

Daily Rejection at AOi

Previous Daily Structure Point

Around Psychological Level 0.57500

H4 Candlestick rejection

TP: WHO KNOWS!

Entry 95%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.