Natural Gas at Critical Support – Reversal Setup or Breakdown AhPrice is currently trading near a strong demand/support zone around 280–285. This level has acted as a base previously, and we’re seeing minor consolidation here, which suggests selling pressure is slowing down.

The broader structure is still weak on the higher side after the recent rejection near 350–360, but if price holds above the current support and forms a strong bullish candle with volume, a pullback toward 320–360 levels is possible.

However, a clean breakdown below 280 could trigger fresh downside momentum.

Key Levels:

Support: 280

Resistance: 320–360

Right now, it’s a wait-for-confirmation zone. Reaction from this base will decide the next directional move.

Disclaimer:

This analysis is for educational purposes only and not financial advice. Please manage your risk properly and trade according to your own strategy.

Natural Gas

Natural Gas Holding On For Dear Life!Natural Gas is trying to defend the weekly high volume surge candle from the cold snap forecast.

This commodity looks very vulnerable if it gets another lower weekly candle close.

Right now the asset class is showing sell side pressure as we progress into building season.

I don't like the long setup....nor do i like the short setup.

The price action in Nat gas seems broken and needs to settle.

Natural Gas Stock Forecast | Oil | Dollar | Silver | Gold0:00 Weekly Commodities Market Outlook

0:18 Natural Gas Technical Analysis (Support, Resistance, Trend)

4:47 Oil Price Analysis (Range Trade Levels & Targets)

7:21 US Dollar Index DXY Analysis (Bear Flag or Reversal?)

10:23 Gold Price Analysis (Blow-Off Top, Support & Next Move)

16:58 Silver Price Analysis (Weaker Than Gold? Trend Breakdown)

20:26 Commodities Outlook & Trading Scenarios

In this weekly commodities forecast, we break down the technical analysis for Natural Gas NYMEX:NG1! , Crude Oil NYMEX:CL1! , the US Dollar (DXY), Gold COMEX:GC1! , and Silver COMEX:SI1! . Are we seeing a bottom in Natural Gas or is there more downside ahead? I cover the key support and resistance levels you need to watch for profitable trades this week.

📉 Assets Covered in This Video:

Natural Gas (NG): Detailed price prediction and trend analysis.

Crude Oil (CL): Bullish and bearish scenarios for oil traders.

Precious Metals: Gold (XAUUSD) and Silver (XAGUSD) technical breakdown.

US Dollar Index (DXY): How the dollar's strength is impacting commodity prices.

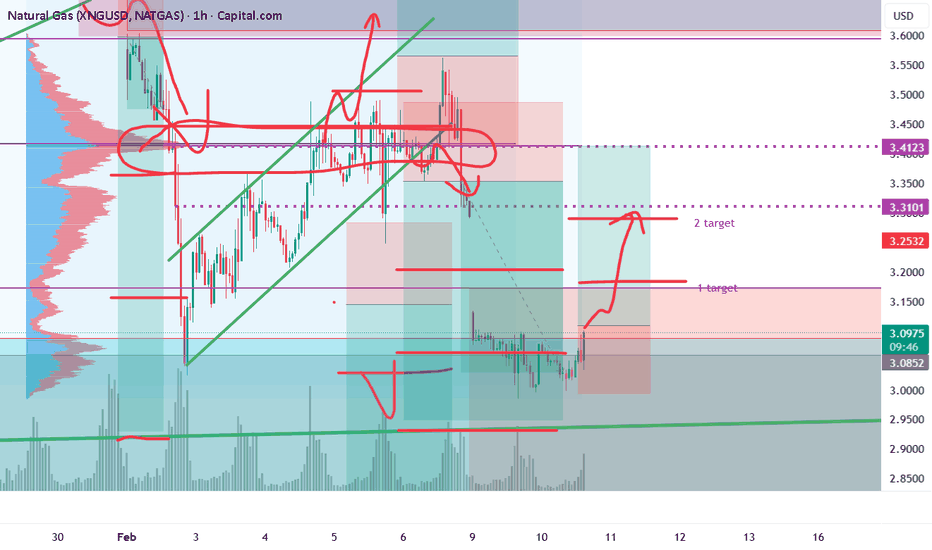

NatGas NatGas is mid term bullish for me... But there is liquidity around 3,30 and more under 3,20 $. We need to see short dump to start closing a big gap from Monday. Now it´s boring game of retail. Today is EIA report I hope some bear news, but I looking toward for wether after 14.-17. febuary. We will see.

Will Natural Gas Keep Rallying? Nat Gas continues to flex it muscles through this cold front.

Demand has certainly increased and is likely going to stay firm into the Feb 8 week, as we get updated forecasts that are expected to warm up.

Resource stocks remain strong which should support Nat gas pushing a bit higher.

If Nat Gas pushes up another 10% we will be trading into an extreme 3 standard deviation move. This open up the probabilities of a sharp pullback.

UNG volume has been excessively high on recent weeks.

We have trimmed some of our resource stock longs... selling into strength but letting runners run.

Natural Gas Holds Bullish Price on InventoriesNatural has inventories showed that the cold snap were experiencing is real>

There was a larger drawdown than expected -242b vs -237b

The demand likely will keep pushing price higher especially since forecast remain on the colder side.

I remain long Nat Gas resource stock specifically EQT & RRC which were deep in profit.

Nat gas looks like it want to test and fill the UNG gap from December 2025.

Will Gas Prices Collapse or Skyrocket in 2026?The natural gas market stands at a critical inflection point in 2026, transforming from a simple commodity into a geopolitical weapon and economic force. A massive surge in global LNG capacity, dubbed the "third wave," is reshaping the entire energy landscape. The United States has achieved record production levels of 108.5 billion cubic feet per day, while new liquefaction facilities from Qatar to the Gulf Coast prepare to flood markets with an additional 300 billion cubic meters by 2030. This abundance has driven domestic prices down, saving American consumers $1.6 trillion over 17 years and pushing gasoline to 4-year lows.

However, this supply glut creates a paradox. While North American producers maintain unprecedented output, global volatility intensifies as regional markets become interconnected. A production disruption in Qatar now affects prices in Houston; a cold snap in Tokyo impacts manufacturing costs in Berlin. Geopolitical risks have escalated dramatically, pipelines have become legitimate military targets, cyberattacks on infrastructure are industrialized, and traditional alliances fracture under sanctions. Russia's gas flows through Azerbaijan to Europe exemplify how energy security has become a theater for strategic manipulation.

Technology accelerates both opportunity and risk. Artificial Intelligence now drives exploration decisions and trading algorithms, while satellites patrol for methane leaks. Yet the industry faces existential threats: state-sponsored hackers target control systems, carbon regulations tighten globally, and the economics of stranded assets loom large. Capital discipline has replaced the boom-bust mentality of previous cycles, with producers prioritizing margins over volume. The convergence of massive supply, geopolitical tension, and technological transformation creates a market where the only certainty is radical uncertainty, making natural gas simultaneously more abundant and more volatile than ever before.

Why Did Natural Gas Fall by 50 % in One Day ? - AnalysisWhat you’re seeing is not a real 50% collapse in natural gas prices, but a futures contract rollover effect. Natural gas trades in monthly contracts, and each month has its own price based on expected supply, demand, and especially weather risk. The February contract often carries a big premium in winter because of heating demand and cold-weather risks, while the March contract can trade much lower if those risks are expected to ease. When trading platforms switch from showing the expiring February contract to the March one, it can look like a massive price drop, but in reality, it’s just a shift from one contract to another with different fundamentals.

If you had an open position, you would not automatically lose 50% just because of this chart change. Your profit or loss is calculated based on the specific contract you traded (e.g., February gas), not the new one displayed. A large loss would only occur if your position was actually closed and reopened in the new contract at the lower price, which is a rollover transaction, not a market crash. So the dramatic percentage drop you see is mostly a visual effect of switching contracts, not natural gas suddenly becoming half as valuable.

Disclaimer:

This analysis is for informational and educational purposes only and does not constitute financial advice, investment recommendation, or an offer to buy or sell any securities. Asset prices, valuations, and performance metrics are subject to change and may be outdated. Always conduct your own due diligence and consult with a licensed financial advisor before making investment decisions. The information presented may contain inaccuracies and should not be solely relied upon for financial decisions. I am not a licensed financial advisor or professional trader. I am not personally liable for your own losses; this is not financial advice.

NG1! - Correction NeededFrom January 15 to January 26 of this year, a five-wave impulse was completed. We now expect a correction.

Potential targets:

6.360

5.741

5.204

4.677

The most probable range appears to be between 5.204 - 4.677 or lower, given that this is a commodity.

The exact correction structure will become clear as the move develops.

Estimated movement potential from current levels:

Approximately 4-30%

---

Please subscribe and leave a comment!

You’ll get new information faster than anyone else.

---

Natural Gas → XNG/USD Bullish Trading Framework⚡ XNGUSD NATURAL GAS 🔥 Energy Market Capital Flow Blueprint 📊 DAY TRADE

🎯 TRADING PREMISE

Bullish Setup: Triangular Moving Average Breakout with Support Retest Confirmation

Current Market Status (January 26, 2026) 📍

Current Price Range: $6.00 - $6.30 USD/MMBtu (Historic Winter Storm Rally 🌪️)

Market Movement: +20% surge this week | +90% gain since last week

Largest Weekly Advance: Since records began in 1990 📈

Henry Hub Spot Price: $4.98/MMBtu (Up from $3.12 last week)

💡 TECHNICAL BREAKDOWN

Pattern Recognition 🔍

✅ Contracting Triangle Formation - 5-leg consolidation structure complete

✅ Moving Average Support Holds - Dynamic support level providing retest opportunities

✅ Bullish Bias Confirmed - Price action shows sustained strength above key MAs

✅ Resistance Zones Identified - Multiple profit-taking levels established

Key Technical Levels 📍

Support Zone: $5.00 - $5.100 (Primary dynamic support)

Consolidation Range: $5.200 - $5.400 (Thief Entry Layers)

Breakout Target Zone: $5.900 - $6.200 (Aggressive profit capture)

Extended Target: $6.500 - $7.000+ (If production disruptions persist)

🕵️ THIEF STRATEGY - LAYERED ENTRY BLUEPRINT

Entry Strategy: Multi-Layer Limit Order Approach 🎪

The "THIEF" Method uses strategic layering to accumulate positions at optimal price levels, minimizing emotional trading and maximizing efficiency:

Recommended Limit Order Layers:

🥇 Layer 1 @ $5.100 - Initial dip retest entry (First position)

🥈 Layer 2 @ $5.200 - Continued support averaging down (Add position)

🥉 Layer 3 @ $5.300 - Zone confirmation accumulation (Build size)

💎 Layer 4 @ $5.400 - Consolidation break final entry (Complete setup)

Entry Flexibility: You can adjust these layers based on your individual risk tolerance 💰, account capital allocation 💵, market volatility conditions ⚡, and personal trading rules 📋

✅ Pro Tip: Use 15-30 minute timeframe chart for precise layer execution & optimal entry confirmation

🎯 PROFIT TARGET STRATEGY

Primary Target: $5.900 - $6.100 USD/MMBtu

Reasoning:

Strong resistance confluence zone

Overbought warning signals emerging

Technical trap potential at extreme levels

Profit-taking anticipated from institutional players

Secondary Targets (Optional - Aggressive Traders Only) 🚀

Target 2: $6.300 - $6.500 (If momentum sustains)

Target 3: $6.800+ (Only if extreme cold continues)

🛑 STOP LOSS MANAGEMENT

Thief Strategy SL: $5.000 USD/MMBtu

Placement: Just below primary support consolidation

Reasoning: Clean break confirmation of bullish premise failure

📊 FUNDAMENTAL DRIVERS - REAL MARKET DATA 🔥

🌡️ WEATHER IMPACT (PRIMARY CATALYST)

Historic Winter Storm: Arctic blast across USA disrupting supply & boosting heating demand

Production Disruption: ~10% of US natural gas production knocked offline due to freezing

Texas & Louisiana: Production dropped >17 billion cubic feet/day from mid-January peaks

Grid Impact: US power demand expected to reach winter record levels

Temperature Forecast: Frigid conditions continuing through January 26-28, 2026

💨 SUPPLY-DEMAND IMBALANCE

Supply-Side Pressures:

↓ Production fell to 106.9 Bcf/d (down from 109.7 Bcf/d in December)

↓ Daily production hit 2-year low near 92.6 Bcf/d due to weather

↓ LNG export flows fell to lowest level in 1 year (equipment frozen)

↓ 37 LNG vessels departed US ports (139 Bcf carrying capacity stranded)

↓ Freeport terminal nominations cut 41% | Cove Point halved

Demand-Side Surge:

↑ Electric power generation demand surging for heating & cooling

↑ Residential heating demand at seasonal peaks

↑ Industrial fuel switching to gas from displaced alternatives

🏭 STRUCTURAL LONG-TERM FACTORS

LNG Expansion: New capacity additions (Golden Pass, Plaquemines, Corpus Christi Stage 3)

Data Center Boom: AI infrastructure explosion creating sustained power demand

2027 Outlook: EIA forecasts 33% price increase to $4.60/MMBtu average

Storage Status: Working inventory at 3,065 Bcf (+177 Bcf vs 5-year average)

📈 ECONOMIC CALENDAR - KEY UPCOMING FACTORS

This Week (Late January 2026) 🔴

⛈️ Winter Storm Monitoring: Cold snap continues affecting production

📊 EIA Storage Report: Thursday release (expected further draws)

🏛️ NYMEX Funding Flows: COT report showing speculative positioning

💨 Production Rate Tracking: Daily output watching for recovery

Next Month (February 2026) 📅

🌡️ Temperature Normalization: Potential warm-up easing heating demand

🛢️ LNG Terminal Recovery: Equipment repairs bringing export capacity back online

📊 EIA Q1 Forecast Update: February 10 release with fresh projections

📈 Q1 Storage Withdrawal Season End: March signals transition to injection phase

Strategic Considerations 🎯

Geopolitical: Watch Middle East tensions (impacts global LNG flow)

Production Recovery Timeline: Key risk factor for downside

Weather Pattern Shifts: La Niña vs El Niño transition possible

Data Center Power Demand: Sustained long-term upside driver

📍 CORRELATED PAIRS TO MONITOR 👀

Direct Correlation Watches:

1. 🛢️ ICMARKETS:XTIUSD - WTI Crude Oil

Correlation: +0.65 positive (alternative energy pricing)

Why Watch: Oil prices influence natural gas demand & substitute competition

Current Action: Oil weakness could support gas as substitute

Technical Link: Both energy markets tracking geopolitical risk

2. 🌍 ICMARKETS:XBRUSD - Brent Crude Oil

Correlation: +0.60 positive (global energy marker)

Why Watch: International energy benchmark influencing global LNG pricing

Current Action: Brent decline may increase relative gas attractiveness

Technical Link: European gas prices tied to Brent dynamics

3. 💵 THINKMARKETS:USDINDEX - US Dollar Strength

Correlation: -0.45 inverse (commodity pricing relationship)

Why Watch: Stronger USD = lower commodity export values

Key Level: Watch DXY weakness supporting commodity upside

Trading Insight: Weakening dollar = tailwind for XNGUSD rally

4. ⚡ OANDA:XAUUSD - Gold Prices

Correlation: +0.35 positive (risk-on sentiment)

Why Watch: Risk appetite indicator for commodity markets

Current Setup: Gold strength confirms inflation hedge positioning

Broader Signal: Both rallying = risk-on energy environment

5. 📊 AMEX:SPY - S&P 500 Index

Correlation: +0.40 positive (economic health)

Why Watch: Stock market rallies increase overall economic energy demand

Tech Impact: Data center power surge linked to tech stock valuations

Risk Signal: Equity market weakness could signal recession/lower demand

Secondary Watch Pairs:

UKOIL (UK Brent Comparison) - European gas market barometer

TTF European Gas Futures - Global LNG competitor pricing

Asian LNG Spot Prices - International demand signals

Henry Hub Futures Strips - Forward market pricing expectations

🚨 RISK WARNINGS & TRADING NOTES

CRITICAL TRADING RULES ⚠️

✅ DO:

Set YOUR OWN stop losses based on YOUR risk tolerance

Adjust profit targets according to YOUR strategy

Use position sizing appropriate for YOUR account

Trail stops as price moves favorably in your direction

Follow YOUR personal capital management rules

Respect technical support/resistance zones

Wait for confirmation before aggressive entries

❌ DON'T:

Blindly follow ANY trader's targets (including this analysis)

Risk more capital than you can afford to lose

Ignore news events & volatility spikes

Trade against the current trend without confirmation

Use leverage beyond YOUR comfort level

Skip your stop loss to "hope" for recovery

Make emotional decisions based on FOMO

Market Volatility Notice 📢

Natural gas is HIGHLY VOLATILE - expect sharp intraday moves

Winter weather can create GAPS - gaps exceeding 10-15% possible

News events cause LIQUIDITY SHIFTS - spreads may widen

LNG terminal updates are UNPREDICTABLE - monitor hourly for changes

Production data releases DRIVE SPIKES - be cautious around EIA reports

Trading Timeframe Recommendations ⏰

Scalpers: 5-15 minute charts (quick entries/exits)

Day Traders: 15-60 minute charts (intraday momentum)

Swing Traders: 4H-Daily charts (position holds 2-5 days)

Position Traders: Weekly charts (longer-term thesis)

📊 MARKET SENTIMENT & TECHNICALS

Overall Bias: 🟢 BULLISH (Short-term strength | Caution on extremes)

✅ Trend: Strong uptrend continuing

✅ Momentum: Bullish momentum confirmed

⚠️ Overbought: RSI entering extreme levels

⚠️ Volatility: Historic elevation = risk factor

⚠️ Trap Potential: Institutional profit-taking likely at $5.900+

🎓 FINAL THOUGHTS

This is a TECHNICAL + FUNDAMENTAL TRADE blending real economic data with proven price action patterns. The historic winter storm provides legitimate fundamental support, but markets overshoot in both directions.

Your Success Depends On:

Your own technical & fundamental analysis

Proper risk management execution

Emotional discipline during volatile moves

Adherence to YOUR personal trading plan

Continuous market monitoring & adaptability

Remember: Profits come from execution of YOUR strategy, not following someone else's targets blindly.

TRADE SMART 🧠 | TRADE SAFE 🛡️ | TRADE YOUR OWN PLAN 📋

Analysis Date: January 26, 2026 | Real-Time Market Data Verified ✅

👍 If This Analysis Helped You:

FOLLOW for daily market insights

COMMENT with your trade setup & ideas

SHARE with your trading community

Let's build profitable trading decisions together! 🚀💰

Nat Gas: At The Moon - $6.. Now Next Stop $7?! NYMEX:NG1! NYMEX:NGG2026 Well it's been 4 days since my last post,

In my previous post I put forward a target of $6 for the prompt month NG contract . Now that we've blown through that target with a strong weekend open, the next question is where do we go from these historic Winter 2026 highs?? Many NG bears, would argue everything is already priced in, and there's no more gas left in the tank. However, if you look back a year from now, you'll realize we're finally at the bullish levels that were the BASE CASE for what we thought the supply & demand picture would like for 2026. This means we are finally at the expected value that markets had anticipated, 12 months ago, not that we are OVERVALUED.

Now BEARS are supposed be hibernating during the winter, but for some the recent historic rally has caused them to come out of hibernation. Well... there's a reason bears try to sleep through the winter.... it's because you don't chase penny's... when there's dollars to be made!! Right now you should only be taking tactical & quick shorts. This rally still has room to run, and you don't want to step in front of this Bull Train!!

From my charts & fundamental insights, I believe our next target for a session close will be $6.55 then $6.99, and that the February 2026 contract will expire above $6.

Looking at the charts for the front month, you can clearly see an upward directional channel that's now been established. The 30 minute ichi cloud has been providing upward support for NG. The 30min ichi wave targets are lower than the 1hour ichi cloud, and at first if you're looking at the lower time frame, it might seem that the near term movement is to the downside, below the lower upward channel support line & the next wave targets take us lower.

Howeverrrrrrr, if you look at the 1hour ichi, you can clearly see a support cloud above the upward channels bottom support. The next wave targets on the hourly seem to imply, that we can reach $6.55 to $6.65, and if those targets are smashed through next resistance is at $6.99 at the top of the upward channel.

The one hope for Bears, that may lead to consolidation & accumulation at or below the $6 level, before another move higher past $6.30 : "..analysts said potential reductions in LNG exports and pipeline deliveries to Mexico could help offset some of the tightening.

“Another potential wrinkle is how much LNG exports may decline as a result of Fern,” said Pat Rau, NGI’s senior vice president of research and analysis. “Back during Winter Storm Uri, LNG exports fell as well. That meant the overall supply/demand picture wasn’t just lost supply, there was some curtailed demand to help balance things a bit.””-NGI

Now, taking the above quote into consideration... I know you must be skeptical of a continuation of this breakout, but please refer to my previous post of why this rally had legs to begin with to take out the $6 level. But to reach the $7 level, I'll provide a few more quotes below, of why this historic Winter Freeze will keep the bull train going strong down the tracks.

A few fundamental insights on why the cold weather in the U.S. has been an ignition switch for NG prices for the weekend open, quotes provided from industry news source Natural Gas Intelligence:

“I think this storm has all the elements to make it a major risk on the level of Elliott and Uri,” said NGI’s Dan Spangler, senior director of analytics. “There’s going to be widespread cold in nearly all major producing areas, so there will definitely be a freeze-off impact.”

"Wood Mackenzie said Friday that average U.S. natural gas production month-to-date is down to 109.2 Bcf/d, “reflecting the impact of supply-related outages.” The consultancy’s freeze-off projections for the final two weeks of January jumped 9.5 Bcf on Thursday to 138.8 Bcf. That would be an all-time high if realized, breaking the 118.7 Bcf record set in February 2021 when Uri hit.”

"When Uri struck in mid-February 2021, LNG feed gas flows slowed to a trickle. Deliveries fell 87% to 1.3 Bcf/d from above 10 Bcf/d at the start of the month, Wood Mackenzie data show."

“Prices still took off back then, of course,” Rau said, “but the impact may have been even worse if LNG hadn’t served as a demand destruction vehicle to help counter some of the lost production.”

"Even so, Fern may not stress the Texas power grid to the same degree as Uri, according to RBN Energy LLC analyst John Abeln.

The expected zone of extreme cold during Fern “does not extend as far south across Texas” as it did during Uri, Abeln said, and the storm is forecast to move through the state much more quickly. Temperatures in Dallas are expected to rise above freezing by Tuesday, compared with a much longer stretch below freezing during Uri.

“The sustained deep freeze that exhausted storage and led to equipment failures is likely to be much less severe this time around,” Abeln said.

If deep snow materializes, frigid temperatures linger and production freeze-offs mount, February natural gas “could rally to the $7.500 area” in a highly bullish scenario, Yawger added.

Exceptional storage withdrawals are in the cards as well, with most analysts now looking for a pull far north of 300 Bcf for the last week of the month.

“The chatter around the natural gas space is a storage draw of over 350 Bcf or greater,” Yawger said. “There have only ever been four draws of 300 Bcf or greater in the history” of federal storage data.

NG: Natural Gas Surge as the Polar Vortex Tests the Upper Range Market Overview and Key Drivers

Natural gas futures are among the most seasonally sensitive products in the commodity markets, with prices largely driven by predictable demand cycles and unpredictable weather shocks. Demand typically begins to build in late summer, with prices often finding seasonal lows between July and August before rallying into September and October as the market prices in winter heating demand. Volatility generally accelerates from November through February, when cold weather events, storage draws, and forecast revisions can rapidly shift sentiment. As winter demand fades, prices often soften into March and April, followed by a weaker period in May and June as heating demand subsides and storage injections resume.

Beyond seasonality, traders closely monitor weekly EIA storage reports, temperature forecasts measured through heating degree days, production trends, and LNG export flows. Short term price discovery is frequently driven by changes in weather models, while medium term direction is shaped by whether storage levels and production trends confirm or contradict seasonal expectations.

Natural gas does not maintain a consistent correlation with other energy products, as pricing is driven more by regional supply and demand than global macro flows. That said, broader risk sentiment and energy sector positioning can still influence short term price behavior. Volatility remains elevated, especially during winter, when forecast changes can reprice the market quickly.

Over the past week, natural gas prices reacted sharply to weather driven headlines. A polar vortex warning across large parts of the United States triggered a surge in short term demand expectations, leading to an aggressive upside move. This rally pushed price into the upper portion of the broader multi-year range.

What the market has done

• The market remains within a larger multi-year range, with clearly defined weekly resistance in the 5.8 to 6.0 area and weekly support near the 3.2 area.

• Since the end of winter in 2025, price has respected a block step trend down, consistently rotating lower after each failed rally attempt.

• The market began its seasonal rally in September, driven by expectations of increased winter heating demand and tightening balances.

• Sellers responded aggressively at the start of December at offer block 2, auctioning price lower and pushing the market back toward the 3.2 weekly support area.

• In the past week, a polar vortex weather warning across the United States triggered a sharp upside spike, driving price toward the 5.6 area, aligning with offer block 1 near the top of the multi-year range and directly into the March 2025 mVAH.

What to expect in the coming weeks

The key level to monitor remains the 5.0 area, which aligns with daily level 1, the March mVAL, and the April mVAH. This zone is likely to act as the primary decision point for both buyers and sellers as the winter season progresses.

Bullish scenario

• If the market holds above the previous week’s close at 5.278, continued momentum could carry price higher toward the 6.0 area.

• The 6.0 level aligns with weekly resistance and the upper boundary of the multi year range.

• Sellers are expected to respond aggressively in this area, potentially leading to rotational or rejection based price action rather than sustained breakout behavior.

Neutral scenario

• Price may balance between the 5.0 area and the 5.75 zone for the remainder of the winter season.

• This range represents a region of prior acceptance, with 5.75 aligning with weekly resistance and the March 2025 mVAH.

• In this scenario, traders should expect two sided trade and rotational behavior rather than directional continuation.

Bearish scenario

• If buyers fail to hold price above the 5.0 area, long liquidation could accelerate.

• A downside move could target the SOC, repairing single prints left behind during the recent weather driven rally.

• Buyers are expected to respond near the 4.47 and 4.25 area, which aligns with the December 2025 VPOC and daily level 2.

Conclusion

Natural gas remains a headline driven market where technical structure and macro fundamentals must be evaluated together. While seasonal demand and extreme weather events continue to support volatility, the broader market remains constrained within a well defined multi year range. From a technical perspective, acceptance or rejection around the 5.0 area will likely dictate whether price continues higher toward weekly resistance or rotates lower to repair unfinished auctions. Fundamentally, traders should remain alert to shifts in weather forecasts, storage trends, and production data, as these factors can quickly invalidate technical setups. As winter unfolds, traders will need to respect the speed of rotations and the market’s tendency to punish late positioning near range extremes.

If you found this analysis helpful, consider sharing your own levels or scenarios and join the discussion.

Disclaimer: This is not financial advice. Analysis is for educational purposes only; trade your own plan and manage risk.

Acronyms:

C - Composite

w - Weekly

m - Monthly

VAH - Value Area High

VAL - Value Area Low

VPOC - Volume Point of Control

LVN - Low Value Node

HVN - High Value Node

LVA - Low Value Area

SP - Single print

Natural gas 50% rally eyes $5.25! Arctic blast, Trump $83b shiftWhile everyone is focused on gold hitting $5,100 and silver approaching $110, natural gas has staged one of the most vertical rallies we've seen in years, surging nearly 50% from the mid-January low of $2.65 to near $4.00 in just 10 days. Is this the start of a sustained bull market?

We analyse the powerful combination of weather-driven demand and structural policy shifts driving natural gas prices higher. We break down the technical setup across multiple timeframes, identifying key resistance zones and two potential scenarios for the next move.

Key topics :

Dual fundamental catalysts :

Arctic blast : The polar vortex hit the US harder than forecasted, spiking heating demand and freezing production in key basins.

Trump's $83 billion shift : The administration cancelled green energy loans and redirected funds specifically to Natural Gas and Nuclear infrastructure, adding a structural tailwind to long-term demand.

Daily analysis :

Golden Cross confirmation : Price broke above the 200MA and is now testing the 50MA, confirming the bullish cross from November.

50% Fibonacci resistance : Currently testing the $3.95 level (50% retracement from $5.24 to $2.65) with RSI at 60—room for another 10 points of upside momentum.

Cluster resistance : The confluence of the 50MA and 50% Fib creates strong resistance, but a break could turn this into powerful support.

4-hour chart :

Scenario 1 (Cup & Handle complete) : If the pattern is finished at the 23.6% Fib, the measured move targets $4.70 (78.6% extension).

Scenario 2 (Double Top at $4.00) : RSI divergence suggests resistance could hold. A pullback to $3.45-$3.65 would form the handle, with the neckline projection targeting $5.25. Trade setup

Entry : Current levels or on pullback to $3.45-$3.65.

Stop Loss : Below the 61.8% Fibonacci (unlikely to break if this is a true impulse).

Target : $5.25 (previous December 2025 peak), with potential extension if $4.25 breaks decisively.

Risk Management : Secure partial profits along the way and trail stops to protect gains.

Are you buying the dip or waiting for confirmation above $4? Let us know in the comments!

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

$NATGAS - Ready for Winter Storms ahead ?PEPPERSTONE:NATGAS

January/2026

Weekly Chart

- East Coast and North-East of United States are about to face a harsh winter ahead

Short-Term Strong Bullish Momentum Fundamentally driven for PEPPERSTONE:NATGAS

High Probability Set-up

Semi-Correction is expected as a Bullish pull-back and profit taking ,

leaving so, some breathing room for new participants to jump on-board,

as well decreasing the risk-reward ratio if not yet entered.

www.youtube.com

TRADE SAFE

*** NOTE THAT THIS IS NOT FINANCIAL ADVICE !

PLEASE DO YOUR OWN RESEARCH BEFORE PARTAKING ON ANY TRADING ACTIVITY BASED SOLY UPON THIS IDEA

Natural Gas Stock Forecast | Oil | Dollar | Silver | GoldNatural Gas Stock Forecast | Oil | Dollar | Silver | Gold

Catch the latest commodities trading insights! This week's market analysis includes a look at both sides of the coin for oil, gold and silver. Plus, get some helpful technical analysis and trading tips to guide your decisions.

0:00 Intro & Commodities Overview

0:38 Natural Gas AMEX:UNG

8:23 Oil NYMEX:CL1!

9:51 US Dollar (DXY)

11:55 Gold & Silver COMEX:GC1! COMEX:SI1!

19:15 Outro

Natural Gas stock Bulls PEPPERSTONE:NATGAS Support & Resistance Guide

AMEX:USO Oil Stock price Forecast

TVC:DXY US dollar Stock analysis

Gold OANDA:XAUUSD Stock price Forecast

Silver OANDA:XAGUSD stock analysis

And that’s all she wrote folks. That was an amazing month everyone. Beautiful short squeeze and unwind. Hope we all made money on all sides. Coming up on contract switch. I think March contract will retrace to at least $3 zone but may go even to $2.8, then continue trend back up to $4. Going to be an interesting contract switch, massive backwardation in effect. Good luck all.

Why Did Natural Gas Explode by 88% ? - AnalysisWhy it spiked so hard

1) Forecasts flipped colder → demand repriced immediately. The biggest mechanical driver was a rapid shift to much colder weather forecasts across key consuming regions, which instantly implies:

-higher residential/commercial heating demand, and higher power-sector gas burn (especially when wind/renewables are weak).

2) Short covering / squeeze dynamics amplified the move

When a market is positioned short and fundamentals suddenly tighten, price doesn’t just rise, it jumps as shorts rush to buy back contracts. Multiple market writeups for that week explicitly point to short covering as fuel for the outsized daily gains.

3) “Freeze-offs” risk (supply disruption from extreme cold)

Extreme cold can reduce production and disrupt operations (“freeze-offs”), especially if it pushes into producing regions and infrastructure bottlenecks. That risk premium is exactly the kind that gets priced fast because it can change balances overnight.

4) Europe: low storage + cold + geopolitics added an extra premium

In Europe, TTF/UK hubs were also reacting to: colder forecasts and storage draw concerns, and added supply-security/geopolitical anxiety (some coverage linked this to fears around U.S.–EU tensions and LNG leverage). Those helped push European benchmarks to their highest levels in months during the same window.

Disclaimer:

This analysis is for informational and educational purposes only and does not constitute financial advice, investment recommendation, or an offer to buy or sell any securities. Asset prices, valuations, and performance metrics are subject to change and may be outdated. Always conduct your own due diligence and consult with a licensed financial advisor before making investment decisions. The information presented may contain inaccuracies and should not be solely relied upon for financial decisions. I am not a licensed financial advisor or professional trader. I am not personally liable for your own losses; this is not financial advice.

Nat Gas: To The Moon - Next Stop $6?! NYMEX:NG1! NYMEX:NGG2026 Few of us thought this day would come... there were dark spots for bulls after one of the earliest & coldest starts to winter on record. But we were quickly disappointed when a blow torch got taken to the weather models in December 2025.

However, those of us who held onto the bleak speck of hope for winters return... have been deeply rewarded, and we can say with the reclaiming of $5. Gentleman... WINTER 2026 Has Arrived!

In the face of a structural downtrend...Old Man Winter... is back, thanks to the POLAR VORTEX!

Here's a few quotes from Industry News Source Natural Gas Intelligence, if you aren't convinced yet that this rally has legs to stand on:

“(LNG Feedgas) Flows were off record levels around 20 Bcf/d, though, as the severe cold limited some activity at midweek.

Production, meanwhile, tracked at about 107 Bcf on Wednesday, per Wood Mackenzie. That was down nearly 3 Bcf from the monthly rate and reflected in part slowing production activity amid freezing conditions. Risk of further reductions loomed, NatGasWeather said, noting “the likely loss of numerous Bcf in production due to freeze-offs.

" Multiple pipeline operators issued weather alerts and operation flow orders as frigid conditions grew entrenched.

“Extreme cold-related outages are most likely to occur in the Permian Basin, the Haynesville Shale, Oklahoma, and the Northeast,” Wood Mackenzie analysts said. “ -NGI

“GasFundies principal analyst Bart Roy Burk is even more aggressive, telling NGI his current withdrawal estimate for next week stands at 414 Bcf. Projected heating degree days (HDD) for the period rank among the top five in nearly 80 years, he noted.

Weather models show the cold settling in for most of the week rather than as a brief cold shot.

“Fundamentals for the week, before the full effect of freeze-offs and some offsetting demand curtailments, point to a Lower 48 draw of more than 400 Bcf,” Burk said. “The way I see it, the week ending Jan. 30 will be a new record large draw.”

Besides the 359 Bcf record pull in January 2018, only three reporting weeks in EIA history have seen withdrawals exceed 300 Bcf, two of them in the past two years. Winter Storm Uri in February 2021 drove a 338 Bcf pull, while the past two Januarys saw pulls of 326 Bcf in 2024 and 321 Bcf in 2025.“-NGI

Natural Gas - Supply Fears? Natural Gas had one of the largest moves i have ever seen in one day.

Fear has spread into the nat gas market on supply fears since tensions have been rising around NATO / USA / EU....

With tarrifs being threatened one area that the EU remains vulnerable is their energy consumption.

We closed our AMEX:UNG calls today for over 900% locking in extraordinary gains...

We sold our AMEX:BOIL for 31% gain...

Nat Gas equities remain interesting and still a buy if this price holds / consolidates.

The 2026 Gas Crisis: Texas Freezes and Europe Runs Dry

Going long on March Natural Gas futures at 2.95.

1) Weather Current models (ECMWF and GFS) show the formation of a blocking anticyclone. This is not just a short-term frost, but a prolonged cold that will linger in key consumption regions (Midwest, Northeast) at least until February 5–8.

2) Production Current models show the formation of a blocking anticyclone. This is not just a short-term frost, but a prolonged cold that will linger in key consumption regions at least until February 5–8. If the frost lasts for another 48–72 hours (as confirmed by the AO index), production could fall to 105 Bcf/d. Every lost unit (Bcf) under conditions of record demand is a direct driver of growth.

3) Export Corpus Christi (Train 5): Commissioning work began on the 5th line on January 14. This adds a constant demand of ~0.7 Bcf/d to the system (with potential up to 1.5 Bcf/d at full load). Exports will reach record levels in March.

4) Current Status of European UGS (Underground Gas Storage) Fill level: EU average is ~50.4% – 52% (according to GIE AGSI data). For comparison: at the same time in 2025, the level was above 65%. Due to prolonged cold weather and periods of low wind (Dunkelflaute), storage withdrawals in January are proceeding at rates 1.5–2 times higher than the norm. If Europe ends the winter with 20-25% in UGS, it will have to inject 35–40 billion m³ more gas in the summer than last year. This will create massive demand as early as March-April.

Blocking anticyclones (High-pressure blocking) over Greenland and Scandinavia look stable. This means that the cold pattern in Europe will last at least until February 5–10.

A negative AO "locks" heat over the Atlantic and "pushes" Arctic air masses onto the European continent. This leads to temperature anomalies 5–8°C below normal in Germany, France, and the Benelux countries.

The second cold wave (February) may turn out to be drier and frostier, which is critical for wind generation (Dunkelflaute), forcing power engineers to burn more gas.

We are moving along the lower bound of the historical range. At the current withdrawal rate (~607 million cubic meters per day), Europe risks reaching the 30% level as early as mid-February, which is a month earlier than usual. If current withdrawal rates persist, Europe will reach the 22-24% level by March 31 with a probability of 51%.

SUMMARY European UGS (Germany, France) have dropped to ~42%, the lowest figure in 5 years, and withdrawals are occurring at double speed. Total US demand (January 20–21) hit a historical high of 184 Bcf/d. With current production at 107 Bcf/d, the gap is being covered by massive withdrawals from UGS. The surplus of +106 Bcf (relative to the 5-year norm) that existed on Friday will be completely liquidated by the end of this week. The market is shifting from a state of "surplus" to a state of "massive deficit."

March is currently pricing in the risks that gas might not be sufficient for normal UGS filling in the summer of 2026.

NATURAL GAS Epic Short Squeeze? Natural gas on Friday closed near the lows of the session but hitting extreme support.

Over the weekend news hit the tape about colder weather reports and increased snow.

This has sent Nat gas roaring up over double digits.

In our group we swung UNG 10.50 calls which should be up over 1000%

There is a strong thesis that this week the shorts will be caught off guard and forced to cover which could add more fuel to the fire.

The inventory report on Thursday will be interesting to see and price may stay firm into the report.