NASDAQ Will the 2-month Resistance hold and cause a correction?Nasdaq (NDX) opened lower today but quickly recovered as it hit its 1D MA50 (blue trend-line). With last week's Low being on the 1D MA100 (green trend-line), the level that has caused the last two major rebounds since November 21 2025, the market focus shifts again on Resistance 1 (almost 2 months intact), which has caused the last 4 top rejections.

With the Lower Highs trend-line also since its All Time High holding and a huge 1D RSI Lower Highs Bearish Divergence since September 22 2025, as long as the market doesn't close a 1D candle above Resistance 1, we expect a bearish reversal first to 24900 (just above Support 1) and if Support 2 breaks, bearish extension targeting the 1D MA200 (orange trend-line) around 24200.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

NASDAQ 100 CFD

NASDAQ Testing its short-term Resistance. Break or rejection?Nasdaq (NDX) rebounded aggressively after hitting its 1D MA100 yesterday and is already above its 1H MA200 (orange trend-line). The index now faces the short-term Resistance of the Lower Highs trend-line. This is where the last 3 rejections took place.

If rejected again, expect a new drop towards the lower Support, targeting 24900. If on the other hand it closes the day above the Lower Highs, expect a test of the upper Resistance Zone, targeting 25800.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

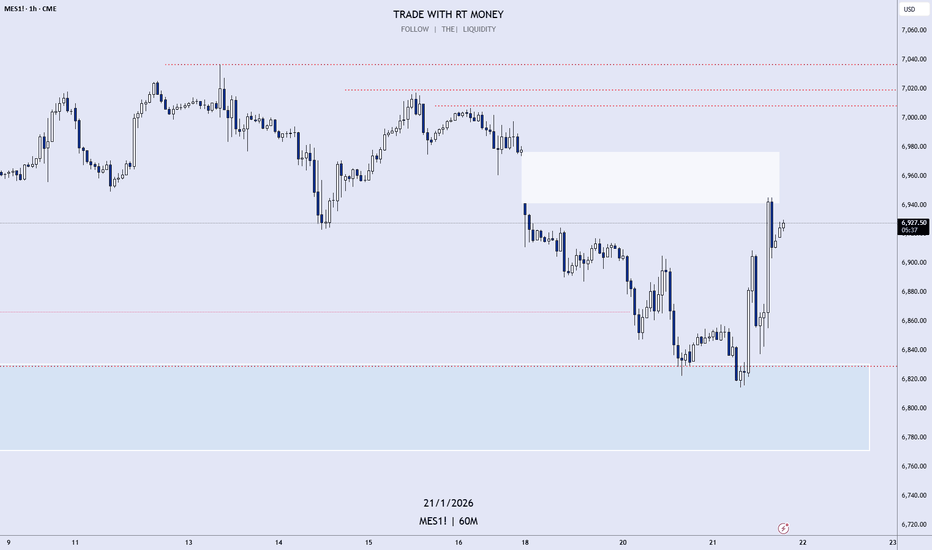

S&P500, NASDAQ Update: Found Support! Heading Higher?This is an mid-week UPDATE to the Weekly Forex Forecast for the week of Jan. 19-24th.

In this video, we will analyze the following FX market: ES and NQ

Both of the indices dumped upon the Open Tuesday with Trump tariff threats. Wednesday, the market found support and bounced for a full recovery from Tuesday's drop.

If price breaks through the Volume Imbalance, we could see the market rally to the buy side liquidity highs, as mentioned in the forecast .

We'll soon see...

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Wait for Liquidity. Then Execute.CAPITALCOM:US100 Overall structure remains bearish on both HTF and LTF.

Price is trading around 25,000, holding below key resistance zones. No structural shift confirmed yet.

VANTAGE:NAS100 In the short term, price may attempt a corrective

pullback toward 25,300–25,400, where prior imbalance and resistance sit.

As long as there is no acceptance above 25,400, this move is corrective only, not a trend reversal.

🎯 Key Levels & Scenarios

Upside (Corrective only)

• 25,300–25,400

→ Liquidity grab / short term pullback zone

→ Preferred area to look for short setups on rejection

Downside targets

• 24,800

→ Immediate intraday support (currently in play)

• 24,600

→ First clean downside objective

• 24,000

→ Major HTF liquidity pool / extended bearish target

⚡ Scalp Ideas (LTF)

Scalp Short

• Rejection from 25,250–25,400

• Weak bullish momentum or lower high on LTF

• Targets:

→ 25,000

→ 24,900

Scalp Long (counter trend, quick only)

• Strong reaction from 24,900–24,850

• Clear displacement and acceptance on LTF

• Targets:

→ 25,050–25,150

• Reaction trades only, not swing longs

⚠️ Invalidation

• Sustained acceptance above 25,400

→ Weakens immediate bearish continuation

→ Requires reassessment of short bias

Until invalidation occurs, rallies are sell side opportunities, not reversals.

Bias stays bearish. 📉🦈

🧠 Execution Reminder

Higher time frame first.

Lower time frame execution second.

Not investment advice. Always manage your own risk.

Nasdaq - Stocks are just heading higher!🚀Nasdaq ( TVC:NDQ ) is creating new all time highs:

🔎Analysis summary:

Tech stocks just finished an extremely strong year and we were offered quite a lot of buying opportunities during 2025. Looking at the higher timeframe, we could see a short term retracement going into 2026, but the underlying trend remains totally bullish.

📝Levels to watch:

$25,000

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

HTF Supply in ControlCAPITALCOM:US100 As seen on the daily chart, price continued to respect the OG supply zone at 25,900 – 26,000, a level marked and shared earlier.

The rejection from this area remained valid and downside continuation followed as expected.

VANTAGE:NAS100 On the 1H chart, structure stayed bearish while price remained below key resistance levels.

There was no acceptance back above resistance, keeping sellers in control.

📉 Daily Bias

Bearish below 25,900 – 26,000 (OG Supply Zone).

As long as price trades below this zone, downside scenarios remain valid.

🎯 1H Expectations

• Any move toward 25,300 – 25,350 is considered corrective

• While below 25,300, selling pressure remains active

• Acceptance below 25,150 confirms continuation toward lower levels

📌 Key Levels (HTF & 1H)

• 25,900 – 26,000 → Daily OG Supply / Invalidation

• 25,300 – 25,350 → 1H resistance

• 25,150 → Intraday decision level

• 25,000 – 24,950 → Lower liquidity / demand area

⚡ Intraday Execution Note (15M & 5M)

Bias is taken from Daily and 1H. Execution is refined on 15M and confirmed on 5M.

🔴 SHORT execution (primary direction)

• Entry zone: 25,250 – 25,300 (sell confirmation on 5M)

• Targets: 25,150 then 25,050 – 25,000

• Invalidation: acceptance above 25,350

🟢 LONG execution (reaction-based scalp)

• Entry zone: 25,000 – 25,050 (hold + confirmation on 5M)

• Targets: 25,150 then 25,230 – 25,250

• Invalidation: acceptance below 24,950

These are execution scenarios only and remain aligned with the higher time frame bearish structure.

🛑 Invalidation

Only a daily acceptance above 25,900 – 26,000 invalidates the bearish bias.

Until then, structure favors shorts.

🧠 Execution Reminder

Higher time frame first.

Lower time frame execution second.

Not investment advice. Always manage your own risk.

NASDAQ NAS100 Technical Analysis and Trade IdeaMy bias remains bullish on the NAS100 🐂, but patience is the name of the game today. Fundamentally, the index is struggling for oxygen as the market digests the "no rate cut" reality for January, causing a temporary decoupling from the broader risk-on flows 📉. Technically, we are trapped in a corrective flag, and the rejection at 25,600 confirms that the bears are still defending the highs.

If the setup triggers, aim for a 5R return to start 🎯. If the price action reclaims 25k within our optimal entry zone. Look to close partial profits (50%) at 25,400 (1R) 💰, then let the rest run and use a trailing SL. Patience pays on this one, let the setup come to us. ⏳ This trade is invalidated if we lose the 24,550 structural pivot 🛑.

NASDAQ testing again the ultimate Support: 1D MA100Nasdaq (NDX) futures opened today below the 1D MA50 (blue trend-line), following the latest U.S. - E.U. geopolitics over Greenland and almost hit the 1D MA100 (green trend-line).

That is the market's medium-term Support as it got tested twice in the past 2 months (November 20, December 17 2025) and produced two rallies to Resistance 1 (25830).

Even though Nov 20 broke it, the price closed the week above it and that's what kept the index bullish. As a result, if it closes a 1W candle below the 1D MA100, we will have the technical confirmation sell signal or further downtrend. In that case we will target Support 2 at 23850.

Until it closes below the 1D MA100 though, we have to keep treating it as a Support and expect another Resistance 1 test at 25800.

Note, however, that the 1D RSI has been under Lower Highs since September 22 2025, which constitutes a huge Bearish Divergence for the long-term.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

No Rush. No FOMO. Just Levels.CAPITALCOM:US100 As seen on the daily chart, price once again respected the OG supply zone around 25,900 – 26,000, a level marked and shared at the beginning of last week.

From this area, all short scenarios provided during the week played out cleanly, with price respecting structure step by step.

This move was further confirmed by the new week opening with a strong gap down, shifting price below the 25,300 area, fully aligning with the higher time frame bearish bias.

📉 Daily Bias VANTAGE:NAS100

Bearish below 25,900 – 26,000 (OG Supply Zone)

As long as price remains under this zone, downside scenarios remain valid.

🎯 1H Expectations

• Any retracement toward 25,600 – 25,900 is considered corrective

• While below 25,600, sellers remain in control

• Acceptance below 25,250 keeps downside pressure active

📌 Key Levels

• 25,900 – 26,000 → Daily OG Supply / Invalidation

• 25,600 → 1H resistance

• 25,250 → Key intraday support

• 24,900 – 24,800 → Lower demand / liquidity area

⚡ Intraday Scalp Scenarios (15M & 5M Execution)

Scalp bias is derived from 1H structure. Execution is refined on 15M and confirmed on 5M.

🔴 Short Scalp Scenario

• Sell zone: 25,580 – 25,650 (15M supply / HTF discount)

• Confirmation: 5M lower high + breakdown

• Targets:

→ 25,300 first reaction

→ 25,250 continuation level

🟢 Long Scalp Scenario (Counter-trend)

• Buy zone: 25,250 – 25,300 (intraday demand / reaction area)

• Confirmation: 5M rejection + hold above level

• Targets:

→ 25,380 – 25,420 quick reaction

→ 25,500 max scalp extension

⚠️ These are reaction based scalps, not trend reversals.

Main structure remains bearish unless daily invalidation occurs.

🛑 Invalidation

Only a daily acceptance above 25,900 – 26,000 invalidates the current bearish bias.

Until then, structure favors shorts.

🧠 Execution Reminder

No rush.

No FOMO.

Just your levels.

Not investment advice. Always manage your own risk.

Will NAS100 Sustain Its Bullish Momentum After the Pullback?NAS100 🚀 Bullish Swing Setup | SuperTrend Pullback & Layered Entry Strategy

🎯 TRADE IDEA: NAS100 (US100) BULLISH SWING

Capitalize on a structured pullback in the NASDAQ 100! This plan leverages a proven indicator confluence for a high-probability long opportunity.

📊 ANALYSIS & CONFIRMATION:

Trend: Primary Bullish Trend is intact. ✅

Trigger: Price is pulling back into a demand zone, offering a favorable risk-to-reward entry.

Indicator: The SuperTrend ATR Line is acting as dynamic support on the 4H/Daily timeframe. A bounce from this level confirms our bullish bias.

⚡ STRATEGY: "THE THIEF" LAYERED ENTRY

This method uses multiple limit orders to average into a position, perfect for volatile markets like the NASDAQ.

Entry Zone: Look for entries between 25,200 - 25,600

Layer Example:

🟢 Limit Order 1: 25,600

🟢 Limit Order 2: 25,400

🟢 Limit Order 3: 25,200

👉 You can adjust the number of layers and prices based on your capital and risk appetite.

❗ RISK MANAGEMENT:

Stop Loss (SL): A decisive break below 24,800 would invalidate the bullish structure.

⚠️ IMPORTANT NOTE: This is MY protective stop. Dear Thief OG's 👑, you MUST adjust your position size and SL based on your personal risk management strategy. Protect your capital first!

🎯 PROFIT TARGETS:

Primary Target: 25,600 (Initial resistance & profit-taking zone).

Key Reasoning: We anticipate a reaction here due to:

Moving Average resistance.

Potential overbought conditions on lower timeframes.

A "trap" for late buyers.

👉 Smart Move: Consider taking partial profits at 25,600 and trailing your stop for the remainder. Escape the trap with your profits! 💰

⚠️ REMINDER: Dear Thief OG's 👑, your Take Profit (TP) is your own decision. Secure gains based on your trading plan and market behavior.

🔍 RELATED ASSETS & MARKET CORRELATION:

Watching these related instruments can provide confirmation and a broader market view.

TVC:DXY (U.S. Dollar Index): 🟡 NEGATIVE CORRELATION

A weakening Dollar ( TVC:DXY DOWN) is generally bullish for Nasdaq. If the Dollar is falling, it adds confidence to this long thesis.

USTECH (CFD on Nasdaq 100): 🟢 DIRECT CORRELATION

Moves in sync with NAS100. Perfect for cross-verifying price action and volume.

NASDAQ:AAPL , NASDAQ:MSFT , NASDAQ:TSLA (Mega-Caps): 🟢 HIGH IMPACT

These heavily weighted Nasdaq components drive the index. Bullish momentum in these stocks supports a rising NAS100.

FOREXCOM:SPX500 (S&P 500): 🟢 POSITIVE CORRELATION

A strong S&P 500 often lifts the Nasdaq. Monitor for overall U.S. market strength.

💬 Let me know your thoughts in the comments!

What's your entry strategy for the NAS100 this week?

#NAS100 #US100 #TradingView #SwingTrading #Bullish #SuperTrend #TradingStrategy #IndexTrading #LayeredEntry #ThiefStrategy

Scalp the Flow. Respect the Trend.CAPITALCOM:US100 Price is showing a short-term bullish rebound, but it’s happening inside a higher-timeframe bearish environment. For me this is a classic setup: scalp longs in discount, then fade rallies into premium supply.

📌 Higher Timeframe Context VANTAGE:NAS100 (Daily)

• Price is still capped below the daily premium / supply zone

• Daily structure remains heavy unless we reclaim key resistance

• Buyers are reacting, but HTF control is still bearish below major supply

➡️ Daily Bias: Bearish below 26,000

📈 Intraday Structure (1H)

• Sharp selloff delivered, then price started rebounding

• Short term flow: bullish correction

• Key levels visible:

• Support: ~25,540 – 25,600

• Nearest resistance / sell area: ~25,720 – 25,780

• Higher resistance: 25,900+, then 26,000 zone

🔴 Short Scenario (Primary | With HTF Trend)

• Sell zone 1: 25,720 – 25,780 (first premium reaction area)

• Sell zone 2: 25,900 – 26,000 (major supply / higher premium)

• What I want to see:

• Weak push up + rejection

• Failure to hold above the zone (no clean acceptance)

• Targets:

• 25,600

• 25,540

• Extended: 25,480 → 25,400

This is the main play if price gives us a clean premium reaction.

🟢 Long Scenario (Secondary | Scalp Only)

• Valid while price holds above 25,600

• Best entries are pullbacks into support, not chasing highs

• Upside targets (scalp):

• 25,720 – 25,780 (first take profit zone)

• If acceptance happens: 25,850, then 25,900

⚠️ Longs are counter trend scalps until daily supply is reclaimed.

❌ Cancellation / Invalidation Levels

• Long scalp invalidated if: 1H closes below 25,520

• Short bias invalidated if: 1H accepts above 25,800

• HTF bearish invalidated if: 1H + daily acceptance above 26,000 (strongest flip)

🎯 Final Expectation

Short-term, price can keep pushing up from discount, but I expect rallies to get tested hard at 25,720–25,780 first. If that zone rejects, sell-side continuation remains the higher probability path.

Not financial advice. Risk management is mandatory.

NAS100 & Economy In Trouble!I have been warning for months now that people need to GTFO and STFO! I have done it with big names, Gold, Silver etc..

If you were smart, you would have looked at the evidence I presented and taken appropriate action. be honest with yourselves. If you haven't made your money by now, you won't make it at these euphoric levels chasing $4 trillion companies, EVs that are already a has-beens or expensive data centers that amount to real estate with low margins funded off the books by unprofitable companies with stock and SPV circle jerking the same $100 billion around.

Lastly, I have lived long enough to know that political-economic theories always face reality. Mosler’s #MMT and its “#Economists” learned that lesson in #Turkey. Their nonsense delivered 86% inflation, a collapsing LSE:TRY , and pain for 80 million people. I first posted the TRY collapse here on TradingView back in 2021. The results are now self-evident.

"END THE FED" nonsense pushed onto unsuspecting people by Austrian Libertarians and Monetarists are about to find out the hard way what it means NOT to have an independent FED if Trump gets his way. Many dictators have tried taking over their respective central banks with the same catastrophic results. Currency crisis, High Inflation, and economic collapse that turned into a humanitarian crisis.

Venezuela

Iran

Egypt

Argentina

Lebanon

Zimbabwe

Sri Lanka

Pakistan

Russia

Iraq on and on...

It's cool for every economic political hack masquerading as an economist to make the FED the vilan bc they know it would be too stupid for anyone to even think about trying it. So it gives them cover to continue to beat the "Hate The FED" drum. But believe me, the last thing they want to see is the end of the FED. Even as a world reserve currency and economic superpower, once the trust is gone its GAME OVER! It's like glass; it can never be repaired.

YOU HAVE BEEN WARNED!

This is not POLITICAL! This is COUNTING!

#FAFO

If you enjoy the work:

👉 Drop a solid comment

Let’s push it to 6,000 and keep building a community grounded in raw truth, not hype.

Sell-Side Liquidity Was the ObjectiveCAPITALCOM:US100 Yesterday’s analysis played out clean and technical, with price respecting higher timeframe supply and failing to hold premium levels.

As i have shared on monday this week, the short side idea remains valid as long as price stays capped below key resistance.

📌 Higher Timeframe Context VANTAGE:NAS100 (Daily)

• Price remains inside a daily premium supply zone

• No daily acceptance above resistance

• Overall structure still range to bearish

• Recent upside move shows weak continuation characteristics

➡️ Daily Bias: Bearish below 26,000

📉 Intraday Structure (1H)

• Clear failure at equal highs

• Distribution forming below resistance

• Price rejected from mid-range equilibrium (BB / balance area)

• Discount PD array below remains unfilled

Liquidity has been taken on the upside, and price is now rotating back into range.

🔴 Short Scenario (Primary)

• Sell zone: 25,750 – 25,900

• Conditions:

• Price remains below resistance

• No strong bullish displacement

• Targets:

• 25,650 (range low)

• 25,400 (discount / liquidity)

• Extended: 25,250

This aligns with the short idea shared earlier this week and remains the higher probability path.

🟢 Long Scenario (Secondary / Conditional)

• Valid only if price reclaims and accepts above 25,900

• Requires:

• Strong bullish displacement

• Holding above prior highs

• Upside targets:

• 26,000

• 26,050+

⚠️ No conviction longs while price trades below supply.

❌ Cancellation / Invalidation Levels

• Short bias invalidated if:

• 1H close above 26,050

• Acceptance above daily supply

• Long bias invalidated if:

• 1H close below 25,600

🎯 Final Expectation

Market continues to respect premium supply, confirming that patience at higher prices pays.

As long as price remains below daily resistance, Sell-Side reactions are favored , with liquidity resting lower.

Patience at premium. Execution at reaction.

Not financial advice.

Risk management is mandatory.

AMD Pullback Complete? Momentum Signals Say Watch Closely🚀 AMD – NASDAQ | Market Profit Playbook (Swing Trade)

🎯 Bullish Layered Entry Setup + Macro Factors

📌 Asset: Advanced Micro Devices, Inc. (Ticker: NASDAQ:AMD • NASDAQ Equity)

📈 Setup Type: Bullish Swing Play — Momentum + Pullback + Macro Support

📊 Timeframe: Swing / Multi-session

📍 Trade Plan — Bullish Thief Strategy (Layer Entries) 💰

Market Bias: Bullish continuation confirmed when price respects strong moving average pullback levels and accumulates buyers.

Strategy: Thief Style Layered Buy Limits 🧵

🔹 Buy Zones (Layered Limit Entries):

• 🛒 Layer 1: 205.00

• 🛒 Layer 2: 210.00

• 🛒 Layer 3: 215.00

• 🛒 Layer 4: 220.00

(You may extend layers above or below based on market context & risk tolerance)

💡 Layered limit orders help scale into the position during volatility and liquidity troughs for smoother basis.

🎯 Targets & Exits

📌 Primary Target: ~260.00 🚀

• Psychological resistance & overbought trap zone 👮♂️ — profit taking recommended as momentum stalls.

• Adjust partial exits as price approaches key levels.

⚠️ This is a range target — feel free to scale in/out based on price action, RSI divergence, trend strength.

🚨 Risk Management

🔻 Stop Loss: 195.00 — risk defined zone below major support.

📌 You choose your own SL — manage risk as per your trading plan.

🔍 Why This Setup Matters (Realtime Catalysts)

📊 Fundamental & Macro Drivers

🧠 AI and Data Center Demand: AMD’s data center business continues to expand with strong AI GPU & EPYC CPU adoption; record Q3 2025 revenue + partnerships with OpenAI & Oracle boost structural growth narrative.

💼 Strong Analyst Support: KeyBanc and other analysts reaffirm overweight views with robust targets, reflecting rising hyperscaler demand.

📈 Sector Momentum: Broader Nasdaq strength driven by tech & AI sentiment supports semiconductor plays like AMD.

🌍 Economic Factors to Watch

📊 Semiconductor Market Growth: Global market projected to expand significantly by 2025-26, fueled by AI, HPC & cloud infrastructure.

💡 Inflation / Cost Pressures: Ongoing inflation & supply chain costs continue to impact margins — track CPI & producer price data for risk gauges.

📉 Interest Rates: Any shifts in Fed policy or rate expectations can influence tech valuations quickly — watch upcoming FOMC dates.

🔗 Related Pairs / Correlations to Watch

🪙 Tech & Semiconductor Peers

• NASDAQ:NVDA (NVIDIA) — closely correlated AI / GPU leader

• NASDAQ:INTC (Intel) — fundamental demand indicator for chip cycle

• NASDAQ:AVGO (Broadcom) / NASDAQ:MU (Micron) — memory & connectivity cues

💡 Strength in peers often supports AMD momentum — divergence may signal rotation or sector rebalancing.

🛠 Technical Edge + Trader Sentiment

📌 Momentum Confluence:

• Pullbacks to key moving averages often trigger institutional buy pressure.

• Layered entries capture volatility while smoothing risk.

📌 Oscillators:

• Overbought RSI warns of profit zones near targets — taper positions accordingly.

📌 Market Structure:

• Watch for higher highs & higher lows formation for trend confirmation.

❗ Notes for Traders

• This is a plan template — adapt based on live price action.

• Always adjust layers, risk, and targets based on volatility & liquidity.

• Disclaimer: This is Thief style setup with fun rhythm — your execution + risk discipline matters.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

📌 Disclaimer: This is thief style trading strategy just for fun.

Are tech stocks about to surge? Nasdaq New Highs? The market is very close to making a big move.

We believe the market is still bullish and will likely trend higher.

Today crypto was strong when the market was weak. This could be signaling tech is about to capture some bullish liquidity.

Banks got decimated today, which allows lots of capital to rotate back into tech.

The Nasdaq is lagging and the only indices to not make new all time highs.

NASDAQ Testing 1 month Resistance. Break or rejection?Nasdaq (NDX) has been on a Higher Lows uptrend since the November 21 2025 bottom but following the December 05 high, it has failed to break above that 25830 Resistance (1) on 5 tests. Today it is attempting it for the 6th time.

A break and 1D candle closing above Resistance 1 then, will confirm the bullish break-out of that Ascending Triangle and transitioning into a Channel Up. If it maintains a high symmetry with the first one (+4.31%) then we expect to see 26150, falling just below Resistance 2 (26260) and the All Time High.

If however the price gets rejected again on Resistance 1 (close a candle below it), the minimum Target would be the 4H MA200 (orange trend-line) at 25450, falling just above the 0.618 Fibonacci retracement, which is the level that all Higher Lows since November 21 approached.

It has to be noted at this point that the 1D RSI is now hitting the Lower Highs trend-line that started on September 22 2025. If rejected here again, the market will confirm a huge Bearish Divergence that can shift the long-term trend to bearish.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Nasdaq - Tech is rallying during 2026!💰Nasdaq ( TVC:NDQ ) is remaining totally bullish:

🔎Analysis summary:

The Nasdaq and the entire tech sector is about to finish a very strong year of 2025. Going into 2026, market structure remains totally obvious and is clearly showing massive upside potential. Every major dip, especially going into 2026, leads to a massive buying setup.

📝Levels to watch:

$25,000 and $21,000

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

AAPL: The 30% Rule — Why Apple’s Next True Low Likely at 200 USD🍎 AAPL WEEKLY SNAPSHOT — EXECUTIVE SUMMARY

✨ Apple Inc. is entering the late phase of a multi-year corrective cycle

📉 Primary thesis: A ~30% correction is still unfolding, consistent with prior Apple macro drawdowns

🏛️ Macro backdrop: Dow Jones Industrial Average extended near psychological 50,000 → late-cycle risk elevated

⏳ Timing focus: 2025 distribution → 2026 corrective low

🎯 Projected downside target: $200 ±10 macro support + valuation reset

________________________________________

🔍 Why the 30% Correction Matters Historical Fractal Logic

Apple has repeatedly respected ~30% drawdowns during secular bull markets — not crashes, but controlled re-ratings:

• 📌 2021 → 2022:

• High → Low ≈ -30%

• Trigger: tightening cycle + growth multiple compression

• Outcome: strong multi-quarter recovery

• 📌 2024 → 2025:

• High → Low ≈ -30%

• Trigger: AI-led over-extension + index concentration risk

• Outcome: range repair, not trend resumption

• 📍 Current Cycle (2025 → 2026):

• Structure suggests another proportional leg

• Distribution at highs → rolling lower highs → trend exhaustion

• Measured move from 286 ⇒ ~200 aligns with historical symmetry

📐 Market logic: Apple doesn’t usually collapse — it compresses.

________________________________________

🧱 Key Technical Zones Weekly / Monthly

• 🔺 286–280: Macro ceiling / cycle high (distribution complete)

• ⚖️ 245–235: Mid-range congestion (temporary reactions possible)

• 🟨 215–200: High-probability terminal support zone

• 🚨 Invalidation (bear thesis): Sustained acceptance above 286

________________________________________

🧠 Macro Confluence Why 2026 Matters

• 📊 DJIA near historic extension → mean reversion risk rising

• 💰 Passive flows crowded into mega-caps (AAPL = core holding)

• 🧮 Valuation sensitivity at cycle peaks historically resolves via price, not time

• 🕰️ Apple corrections often lag index tops, bottoming after broader sentiment breaks

________________________________________

🎯 Strategic Trade Framework

• ❌ Avoid chasing long exposure at highs

• 🧘♂️ Expect volatility + range expansion before clarity

• 🛒 Best long-term accumulation: only near 200 zone, not earlier

• 🧭 Tactical traders may short rallies below 280 with tight risk

• 🏦 Post-2026: High-quality reset likely sets up next secular advance

________________________________________

🗳️ AAPL Weekly Scenarios — Levels Quiz

Which path do you see next?

🅰️ Hold above 245 → extended range before final breakdown

🅱️ Break 235 → acceleration toward 215–200 macro support

🅲 Flush to ~200 in 2026 → generational accumulation window

🅳 Your level: comment the one price that changes your bias