EURUSD: 1.19 breakout setup toward 1.2050🛠 Technical Analysis: On the H4 chart, EURUSD is consolidating right under the 1.1933 resistance after a strong rebound from the mid-1.16/1.17 support base. The structure still favors buyers as price continues to print higher lows and holds above the key 1.1800 support zone. Both the “local” and “global” bullish signals remain valid, while the 50/100/200 SMAs are acting as dynamic support beneath price. A confirmed close above 1.1933 would signal a clean breakout and open the way toward 1.1979 first, with an extended continuation objective toward the 1.2050 resistance area. If the breakout fails and price gets rejected from 1.19–1.1933, a pullback back into the 1.1800 zone is likely, with the next demand area near 1.1730. Volatility may increase around key US data releases, so confirmation is critical before committing.

———————————————

❗️ Trade Parameters (BUY)

———————————————

➡️ Entry Point: 1.19327 (buy on confirmation above resistance)

🎯 Take Profit: 1.19795 (extended target: 1.2050)

🔴 Stop Loss: 1.18858

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

Nonfarmpayroll

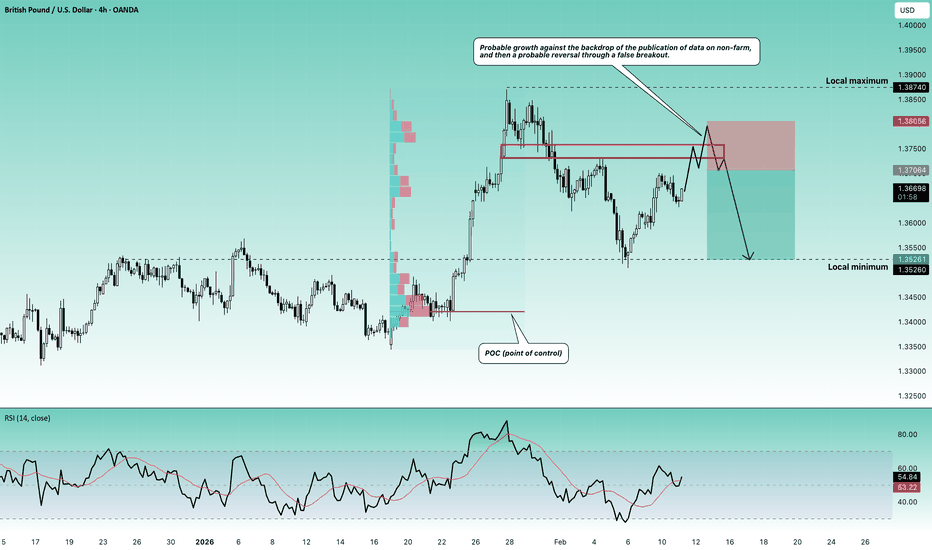

Stop!Loss|Market View: GBPUSD🙌 Stop!Loss team welcomes you❗️

In this post, we're going to talk about the near-term outlook for the GBPUSD currency pair☝️

Potential trade setup:

🔔Entry level: 1.37064

💰TP: 1.35261

⛔️SL: 1.38056

"Market View" - a brief analysis of trading instruments, covering the most important aspects of the FOREX market.

👇 In the comments 👇 you can type the trading instrument you'd like to analyze, and we'll talk about it in our next posts.

💬 Description: Most major currency pairs are currently looking strong against the US dollar, with a resolution likely to occur during today's non-farm trading session. However, the medium-term trend is still favorable for the US dollar, so a momentary rally is expected, followed by a likely reversal in favor of the American currency. For the pound, a potential sell-off is considered near 1.37500, where the mirror resistance area is located. A false breakout near this area would be a strong entry point, opening the door to targets at 1.35000 and below.

Thanks for your support 🚀

Profits for all ✅

USDCHF: post-NFP setup🛠 Technical Analysis: On the H4 chart, USDCHF is rebounding into a key resistance cluster around 0.7990–0.8000, where price meets the prior supply zone and the MA area (SMA200 ~0.7976). The structure still carries a broader bearish tone (global bearish signal), and the current rally looks like a retest rather than a clean trend reversal. It expected that a potential liquidity sweep (renewal of the local high) followed by a reversal — a confirmed close back below 0.79900 would be the trigger for continuation lower. If the rejection is validated, the downside path opens toward the marked support at 0.78787.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: Sell after a sweep higher and a confirmed H4 close back below 0.79900 (approx. 0.79809 – 0.79900)

🎯 Take Profit: 0.78787

🔴 Stop Loss: 0.80488

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

Gold breaks 4500 as confidence in US data gets testedUS jobs data for December delivered a messy, two-way market reaction.

According to the Bureau of Labor Statistics, total nonfarm payrolls rose by 50,000 in December. On its own, that headline looks like an economy that is still adding jobs, but at a very slow pace.

Although, prior months were also revised down, including November to 56,000 from 64,000, and October to -105,000 from -173,000.

Gold pushing through the 4,500 level has added to the sense that markets are struggling to settle on a clean interpretation of the data.

Beyond the payrolls report, reporting in Japan has pointed to a possible snap election in February 2026, which can matter for yen pricing.

$USNFP -U.S Non-Farm Payrolls(December/2025)ECONOMICS:USNFP

(December/2025)

source: U.S Bureau of Labor Statistics

- The US economy added 50K payrolls in December 2025,

less than a downwardly revised 56K in November and below forecasts of 60K.

Employment continued to trend up in food services and drinking places (27K), health care (21K) and social assistance (17K) while retail trade lost 25K jobs.

Also, federal government employment was little changed in December and employment showed little or no change in mining, quarrying, and oil and gas extraction; construction; manufacturing; wholesale trade; transportation and warehousing; information; financial activities; professional and business services.

The change in total nonfarm payroll employment for October was revised down by 68K to -173K and the change for November was revised down by 8K to +56K.

With these revisions, employment in October and November combined is 76K lower than previously reported.

Considering full 2025, payroll employment rose by 584K, corresponding to an average monthly gain of 49K, less than the increase of 2.0 million in 2024.

US500 Long Setup – Inverse H&S + Key Support📈 US500 Long Setup – Inverse H&S + Key Support

The US500 4H chart is shaping up for a bullish continuation, with multiple technical signals aligning. Price has recently formed a potential inverse head and shoulders pattern, suggesting a reversal from the recent downtrend. With Break of Structure (BOS) confirmed and price holding above the Support Level at 6914.4, bulls are gaining control.

🟢 Trade Setup Details

- Support Level: 6914.4

- Key Levels to Watch: 6895.4 and 6824.8

- Maximum Stop Loss: 6868.2

- Take Profit Targets:

- 🎯 TP1: 6962.1

- 🎯 TP2: 6971.7

The current price action around 6925.9 shows strength, with volume supporting the bullish breakout.

🔍 Technical Highlights

- Two Break of Structure (BOS) points confirm bullish momentum.

- The inverse head and shoulders pattern adds confluence to the long bias.

- Price is holding above key support and reclaiming higher ground.

- Volume shows increasing interest on bullish candles, suggesting accumulation.

📈 Bullish Scenario

If price continues to hold above 6914.4, we could see a push toward TP1 and TP2. Watch for:

- Retest of neckline with bullish confirmation

- Momentum indicators crossing into bullish territory

- Volume spike on breakout above 6930–6940

⚠️ Risk Management

- SL below 6868.2 protects against invalidation of the inverse H&S pattern.

- Consider scaling out at TP1 and TP2 to lock in gains.

- Avoid chasing if price moves too far—wait for pullbacks or confirmation candles.

💡 Summary: US500 is showing a textbook bullish reversal setup, with inverse head and shoulders, Break of Structure, and strong support at 6914.4. With layered TP targets and a tight SL, this trade offers a clean structure and solid risk/reward.

🚀 Whether you're trading the breakout or riding the momentum toward 6970+, this setup deserves your attention.

Silver Long Setup – Support Zone in Play The Silver 4H chart🪙 Silver Long Setup – Support Zone in Play

The Silver 4H chart (XAGUSD) is flashing a compelling long opportunity as price rebounds from a well-defined Support Zone. After a corrective dip, bulls are stepping in near the 74.55–73.73 region, which aligns with structural support and prior accumulation. With volume stabilizing and price reclaiming momentum, this setup offers a clean risk/reward profile for upside continuation.

🟢 Trade Setup Details

- Buy Zone: 74.5592 to 73.7359

- Max. Stop Loss: 73.7359 (conservative SL at 73.8163 also valid)

- Take Profit Targets:

- 🎯 TP1: 79.4363

- 🎯 TP2: 80.5171

- 🎯 TP3: 81.3697

The current price action around 77.98 suggests bullish intent, with a breakout above the descending trendline adding fuel to the move.

🔍 Technical Highlights

- Price has respected the Support Zone, forming a base for potential reversal.

- A descending trendline has been breached, signaling a shift in short-term sentiment.

- Volume shows accumulation behavior, supporting the bullish thesis.

- The profit zone offers a risk/reward ratio near 2:1, ideal for swing entries.

📈 Bullish Scenario

If Silver holds above the support base, we could see a steady climb toward TP1 and TP2, with TP3 as an extended target. Watch for:

- Bullish candles with strong body and volume confirmation

- Retest of broken trendline as support

- Momentum indicators crossing into bullish territory

⚠️ Risk Management

- SL placement below 73.73 protects against deeper pullbacks.

- Consider partial exits at TP1 and TP2 to secure gains.

- Avoid chasing if price runs too far—wait for pullbacks or consolidation near breakout zones.

💡 Summary: Silver is bouncing off a key Support Zone, with bullish structure forming and upside targets clearly mapped. With TP1–TP3 offering layered exits and a tight SL, this setup blends precision with potential.

📊 Whether you're trading the breakout or riding the wave toward 81+, this setup deserves your attention.

EURUSD: bearish view before NFP🛠 Technical Analysis: On the H4 chart, EURUSD has broken below the rising support line, turning the recent upswing into a local bearish setup. Price is now trading under the key moving-average cluster (SMA50/100 around 1.1714–1.1735) with the SMA200 near 1.1690 acting as additional overhead resistance. The current zone around 1.1646–1.1631 is an important support area, and a confirmed breakdown would validate continuation to the next demand level. The primary downside target is the marked support at 1.15491.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: Sell when the 1.16440 support zone is broken (approx. 1.16300)

🎯 Take Profit: 1.15491

🔴 Stop Loss: 1.16851

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

Fundamental Note: EURUSD 07 Jan 2026EURUSD is trading around the 1.17 area as markets position for the first Non-Farm Payrolls release of 2026 on Friday, 9 Jan (Employment Situation for Dec 2025). This print matters more than usual because it’s the year’s first “reality check” on whether the late-2025 slowdown in hiring is turning into a softer trend (supporting more Fed cuts) or stabilizing (supporting USD via higher yields). Right now, consensus expectations lean toward a modest jobs gain in the mid-50k to ~60k range, with unemployment seen near 4.5% and wage growth watched closely for a rebound risk. In the short term, a weaker NFP and/or softer earnings would likely push US yields and the USD lower, giving EURUSD room to squeeze back toward recent highs; a hot wages surprise or upside payroll miss could quickly flip the move into a USD rebound. On the Euro side, easing inflation keeps the ECB comfortable in its “hold” stance, which reduces near-term EUR policy volatility versus the US data-driven repricing this week.

Bottom line: the market is mostly looking for a “soft-but-not-breaking” NFP that validates expectations for further Fed easing in 2026—any big deviation should produce an outsized EURUSD reaction.

🟢 Bullish factors:

1. NFP downside surprise or softer wages → lower US yields/USD.

2. Market still broadly positioned for additional Fed cuts in 2026.

3. ECB “on hold” narrative reduces euro-side policy shock risk near-term.

🔴 Bearish factors:

1. Strong NFP and/or hot wage growth → higher US yields, USD bid.

2. Risk-off flows (or renewed geopolitical stress) typically favor USD liquidity.

3. Euro inflation cooling can revive future ECB cut discussions if growth fades.

🎯 Expected targets: Volatile range into/through NFP. Base case (soft NFP): upside toward 1.1750–1.1820. Hawkish surprise (strong jobs/wages): pullback toward 1.1600–1.1550, with 1.1500 as the next downside area if the USD rally extends.

EURUSD: Pre-NFP Analysis - Key Breakdown LevelsFocus on EURUSD ahead of today's Non-Farm Payroll and major US economic data releases (December 16th, 2025).

📰 Market Context:

Major News Events Today:

Non-Farm Payroll (NFP)

Additional major US economic releases

Market participants in wait-and-see mode

Current Price Action:

Following Monday's break above 1.17627, price has entered a sideways consolidation pattern. This pause indicates market participants are positioning ahead of the news before committing to the next directional move.

📊 Technical Analysis:

Recent Structure:

From last week's analysis, EURUSD has shown multiple bearish trend-changing patterns. These patterns suggest underlying weakness despite the recent rally.

Current Setup:

The extended rally has pushed price significantly higher. At current levels, it wouldn't take much to trigger profit-taking from buyers who entered earlier in the move. The NFP data could be the catalyst.

🎯 Key Levels to Watch:

Level 1 - Breakdown Point: 1.17379

Initial breakdown confirmation. Break below signals weakness.

Level 2 - Major Breakdown: 1.17193

Critical support. Break here confirms major bearish structure shift.

💼 Trade Setup:

Sell Entry: Close below 1.17734

Wait for candle close below this level for confirmation.

Stop Loss: 1.0780

Invalidation above this level.

Risk: 46 pips

Targets: Breakpoint Two

T1: 1.17379 (initial breakdown)

T2: 1.17193 (major breakdown)

⚠️ Risk Management:

Be cautious of NFP volatility:

Expect increased noise immediately after news release

Wider spreads possible

Potential whipsaws before directional move

Wait for candle close confirmation, not just spikes

Strategy: Let the news settle, then trade the confirmed direction rather than the initial spike.

Trading Principle:

News creates volatility, but structure determines direction. Multiple bearish patterns + profit-taking zone + news catalyst = high-probability setup IF structure confirms.

👍 Hit the boost button if this pre-NFP analysis helps

👤 Follow for post-NFP follow-up analysis

💬 Drop your questions in the comments

Chumtrades XAUUSD Trading Plan NF today🧠 Market Psychology

Expect price to range sideways before a clear breakdown.

Market is waiting for NFP, smart money stays cautious → focus on range trading (4330–4280).

🔴 Resistance (Key Resistance)

4335 – 4340

4318 – 4322

🟢 Support (Key Support)

4260 → Short-term lower range

424X → Swing BUY zone

4204 → Deep pullback, strong swing BUY area

🎯 Trading Expectation

Before news:

Trade the range

Sell high – Buy low

Avoid FOMO in the middle

After news / Breakdown:

Look for deep BUY entries

Focus on 424X – 4204

A Jobless Profit Boom!I think this chart is self-explanatory.

Corporate profits are ripping higher while payroll growth barely moved.

America just printed a profit boom without the jobs to match it.

This explains the massive multiple expansion in stocks and the topped-out economy that is now rolling over.

Unsustainable!

Print and play has consequences!

THANK YOU for getting me to 5,000 followers! 🙏🔥

Let’s keep climbing.

If you enjoy the work:

👉 Drop a solid comment

Let’s push it to 6,000 and keep building a community grounded in truth, not hype.

NVDA Earnings, FOMC Minutes, US Non-Farm OH MY!!!All eyes on NVDA and earnings - they matter (a lot)

More important than a beat or miss is the price action around NVDA earnings

-bulls have a long ways to go to reclaim all-time highs

-bears have pressured NVDA enough that it seems like major support could break

FOMC Minutes today

-CME Fed Watch Tool is literally 50/50 on the December rate cut outlook

-if the FED doesn't cut in December, they will likely be cutting in early 2026

US Employment Data

-Remember Non-Farm Payroll? Well it's back with a Thursday release

-58k forecasted, 4.3% unemployment forecasted

-let's see how the release is taken by the markets

Although it feels like "the brink" in many ways, my thoughts as expressed in the video

are I believe the market can win both ways and just provide wild volatility but no real direction or follow through. Negative sentiment is truly awful and it rarely rewards the bears with a sustainable down move. Seasonality is expected but perhaps bulls have grown too complacent. Therefore, the market is comfortable making everybody uncomfortable

More to come later this week when the smoke clears or the dust settles

Thanks for watching!!!

CP

Stop!Loss|Market View: EURUSD🙌 STOP!Loss team welcomes you❗️

In this post, we're going to talk about the near-term outlook for the EURUSD currency pair☝️

Potential trade setup:

🔔Entry level: 1.17085

💰TP: 1.15818

⛔️SL: 1.17720

"Market View" - a brief analysis of trading instruments, covering the most important aspects of the FOREX market.

👇 In the comments 👇 you can type the trading instrument you'd like to analyze, and we'll talk about it in our next posts.

💬 Description: A decline in the euro is seen as the main scenario for today, as part of a reversal from the area near 1.19000. Currently, the price is testing short-term resistance at 1.17445, where the POC (point of control) of the current downward movement is located. For a more conservative entry, it is better to use a pending order with an entry level below this resistance.

Thanks for your support 🚀

Profits for all ✅

❗️ Updates on this idea can be found below 👇

S&P 500: Rising Wedge signals movement before NFP📈 BLUEBERRY:SP500 | Rising Wedge + Non-Farm Payrolls: Which breakout scenario is more likely?

A Rising Wedge pattern is forming on the 30-minute chart of US SPX 500, with price approaching the convergence point of two trendlines. This pattern typically signals weakening bullish momentum but doesn’t rule out a breakout to the upside 🚀.

🔍 Technical Analysis:

• Price is consolidating within a narrowing channel, forming a Rising Wedge 🔺.

• Key support lies between 6717 - 6734 (lower blue zone) 🛡️.

• Target zone on a breakout to the upside is 6767 - 6775 (upper blue zone) 🎯.

• The pattern signals an imminent breakout, but confirmation with a candle close beyond the wedge is needed 🕒.

📊 Non-Farm Payrolls Impact:

• If NFP comes in below expectations, the market may react positively (break up) on hopes of Fed easing monetary policy 💵👍.

• Conversely, a higher-than-expected NFP could increase downside pressure (break down from the wedge) 📉⚠️.

💡 Trade Setup:

• Enter a BUY position once price breaks above 6733 with confirming high volume 🔥.

• Place stop loss below support at 6716 to manage risk 🚧.

• Target area between 6770 - 6775 🎯.

📝 Summary:

The Rising Wedge on SPX 500 points to a breakout soon, with the NFP report acting as a key catalyst. Wait for confirmation and manage your risk carefully ✅.

Please like and comment below to support our traders. Your reactions will motivate us to do more analysis in the future 🙏✨

Harry Andrew @ ZuperView

Non-Farm Payrolls: Do You Trade the Print or Let It Pass?NOTE – This is a post on Mindset and emotion. It is NOT a Trade idea or strategy designed to make you money. If anything, I’m posting this to help you preserve your capital, energy and will so you can execute your own trading system with calm, patience and confidence.

Every first Friday, the market braces for NFP.

For some, it’s a chance to catch a big move.

For others, it’s a day to protect capital and energy.

The real question isn’t just what’s the number?

It’s: What’s your process around events like this?

Here’s the work to do before Friday:

1. Define your approach

Are you trading the release, fading the first spike, or waiting until the dust settles? Write it down before the event - don’t decide in the heat of the moment.

2. Check what’s pulling you in

Is it part of your tested edge, or are you driven by FOMO, the rush of adrenaline, or the feeling that you “should” trade it?

3. Notice your body’s signals Faster breathing or shallow breaths

Shoulders tightening

Heart rate climbing

Narrowed focus on the screen

Fingers itching to click

These are not just “nerves” they are signals. Use them as feedback, not fuel.

4. Review the impact afterwards

Did trading the news leave you calm, in control and aligned with your plan?

Or did it drain your energy, push you into overtrading, or spark regret?

The point isn’t whether NFP is an opportunity or a trap . It can be either.

The edge comes from knowing yourself, deciding ahead of time and sticking to a process that matches both your system and your psychology.

So before the number drops, get clear:

- Do you have a defined playbook?

- Or are you letting the market and your body pull you into one?

If you’re contemplating trading at any point around the NFP number you might want to check out @JeffBoccaccio’s posts on ES range expectations around the release for some idea on how he frames the news event. Start here but check out the linked video post for a walk-through explanation:

Cable$FibreIn the past few days we've seen a bearish momentum on cable and fibre. This is my opinion will continue to be the case in he coming weeks. This week however, the market is retracing, to take out those who're currently profitable. The first week of the month is relatively unpredictable so I'd advice you to sit back and relax, unless you know what you're doing. From next week, I expect to see price resume its bearish stance.

Critical jobs data you need to watch this week Fresh labor market data will likely be the focus this week, with payrolls, unemployment, and wage growth all carrying weight for the Federal Reserve’s policy path. Stronger-than-expected job reports could revive dollar demand, while weaker figures may keep pressure on the greenback as markets price in further Fed easing.

Nonfarm payrolls for September are projected at 39K, a modest improvement from August’s 22K, but still far below the levels seen through most of 2023 and earlier years (chart, top left).

The unemployment rate is expected to hold at 4.3% (chart, top right).

Average hourly earnings are seen rising 0.3% month-on-month, matching August’s gain. That would keep annual wage growth steady, reflecting sticky wage pressures even as job creation softens.

The JOLTS job openings series remains elevated at 7.3 million (chart, bottom left), but still well below the peaks of 2022. This suggests firms are slower to post new jobs, but demand has not collapsed entirely.

Follow-Up: Non-Farm Moves from FridayHi All,

Following up on the range (size of the move) after non-farm on Friday to see how close our range expectation estimates were (see the earlier video post linked here for that).

The actual number came in pretty poor and worse than expected at 22k (vs 75k expected).

The move on the Non-farm release itself was actually quite muted with roughly a 20pt move on both sides of our VWAP starting point. But the real move came around 30 minutes into the US open where we saw a quick decline down to our lower boundary (50pts lower at 6470) and then briefly over-ran to 6450. But we settled and that 6470 became support for most of the session before reverting back to that declining VWAP to finish the day around 6490.

So, what's the lesson here: a bit of time pre-framing the possibilities for moves in either direction using a combination of stats (ATR, standard deviation of range), other technical analysis tools (support/resistance, VWAP, vol profile) along with experience can help frame the day and the important levels. Use this to start to decide what tools to pull out of the toolbox (trading strategies) and where to initiate trades.

If you find this helpful and would like to see more please let me know.

Happy Trading!

EURUSD after NFPEURUSD continued its bullish trend and tested the 1,1760 level.

On Friday, it failed to close above the previous highs, which makes it crucial now to see a fresh push higher and a daily close above 1,1760.

This week, the main focus is on Thursday, with U.S. inflation data and the ECB’s interest rate decision coming up.

Don’t rush into entries at the current levels – manage your risk and wait for the market’s reaction!

Its Non-Farm: How much will ES Move?Hi all - Happy Non-Farm Friday!

I haven't done this in a while and thought it might be helpful to share my process for estimating the size of the move that we may get on ES after the Non-Farm Payrolls data is released.

I'm not trying to make a prediction on direction here - but more understand where the boundaries could be so I can determine how to trade this (what trading tool I can pull out of my box) once the announcement comes out.

Hope it helps and please let me know if you find it useful and I'll create more posts .

Cheers,

Jeff

This week’s main event: Non-Farm Payrolls – Friday at 15:30!This Friday, September 5, 2025 at 15:30 EET , the U.S. Department of Labor will release one of the most anticipated macroeconomic reports — the Non-Farm Payrolls (NFP) . This release could confirm whether hopes for a near-term Fed policy shift are justified — the very hopes that helped U.S. equities climb to historic highs in late August. Markets see this report as a checkpoint for both the ongoing rally and rate expectations.

NFP and the markets: 3 possible scenarios

Strong report: If job creation exceeds expectations, unemployment falls, and wages accelerate — markets may believe the Fed will stay cautious on cutting rates. Typically, this boosts the dollar and bond yields, while growth stocks and tech underperform. More traditional sectors like banking, industry, and energy tend to hold up better. Gold and crypto often dip under pressure from a stronger USD and rising yields.

Weak report: If job gains disappoint, unemployment rises, and wage growth slows — this strengthens the case for a faster Fed pivot. In this case, the dollar usually softens, yields fall, and growth stocks, gold, and major crypto (BTC/ETH) gain on expectations of lower rates.

Neutral report: If numbers align closely with forecasts and there’s no big surprise, markets may remain range-bound. Initial reactions fade quickly, and focus shifts to the details — such as wage data and revisions to past reports. Price action often becomes choppy and short-lived until the next key catalyst.

The September 5 NFP release is a crossroads moment before the Fed’s September 16–17 meeting. Volatility is almost guaranteed, and the market’s reaction will depend on the combination of headline jobs number, unemployment rate, wage growth, and revisions. According to FreshForex , this setup offers tactical trade setups across forex, metals, and crypto pairs.