LINK Daily: Short-Term Rejection, Long-Term StrengthLINK Daily – Watching the Retrace

LINK on the daily just got rejected from the 50MA, confirming it as short-term resistance.

The next key support sits around the 0.618 Fibonacci level, which also marks the origin of the last bounce that was rejected at the 50MA.

From a system perspective, the current structure reads:

Price < BB Center (orange) < SMA < MLR10 — indicating a short-term downtrend.

However, on the long-term view, price remains above the 200MA, meaning the broader uptrend is still intact.

At this stage, LINK needs a daily close above the BB Center to regain short-term momentum and open the path for recovery.

With Q4 underway and the narrative in the US shifting in favor of crypto, LINK could soon find conditions for continuation once the local structure stabilizes.

Bias:

Neutral-bullish: short-term pressure within a long-term bullish structure.

Always take profits and manage risk.

Interaction is welcome.

Oracle

LINK 1H – Sitting on a Cluster of SupportLINK 1H – Sitting on a Cluster of Support

LINK on the 1H looks quite similar to ETH, but with one key difference: the 200MA is much closer.

Price is now testing a tight cluster of support, where multiple technical factors align. If this area holds, LINK could rebound with strength.

However, if it breaks down, the 0.618 Fib sits below as the next potential shelter for price.

The next few candles will likely decide if bulls can defend this zone or if another leg lower is needed.

Key notes:

200MA nearby, acting as dynamic support

Local cluster of support being tested

0.618 Fib as next confluence level

Short-term structure mirrors ETH

Bias:

Neutral-bullish — holding this zone keeps the uptrend intact, but losing it could invite deeper retracement.

Always take profits and manage risk.

Interaction is welcome.

Oracle's surge is a bull market warningOracle has become the latest torch bearer of this market’s fever. A sharp, double-digit jump in days. Not because of numbers on a balance sheet, but because of mood. Sentiment is running wild, and traders are piling in.

These are the signs of caution experienced traders take during bull markets.

This market doesn’t need fundamentals. It needs stories. Oracle provided one, AI, cloud infrastructure, and firming whispers of a TikTok tie-up. That’s all it takes in a market already priced for perfection. The hotter the tape, the more dramatic the reactions.

The narrative is seductive. Media and enterprise tech converging. Old-guard software reborn as a cloud giant. These are big, glossy ideas. But when valuations are stretched, stories become more dangerous than compelling.

We’ve seen this play out before. In hot markets, price runs ahead of reality. Crowds cheer the breakout, analysts upgrade, and traders convince themselves this time is different. Then something shifts. Sentiment cracks. The same names that soared, collapse first.

Oracle is not the problem. It’s the signal. A sign that markets are running on fumes of optimism. The Nasdaq is back to trading at extreme multiples. Liquidity is abundant, and money is chasing flash. When that music stops, the hangover will be sharp.

Caution is the trade here. Oracle’s rally is not a testament to strength. It’s evidence of a market too eager to believe its own stories.

The forecasts provided herein are intended for informational purposes only and should not be construed as guarantees of future performance. This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry Markets providing personal advice.

Tech giants ignite the market: NVIDIA — $4.3T, Oracle +40%...As of September 2025, #NVIDIA’s market capitalization is estimated at about $4.313 trillion, making #NVIDIA the most valuable publicly traded company in the world by market cap.

Across big tech, the backdrop has turned decisively positive: #Oracle shares have surged 40% on accelerating cloud revenue and AI contracts; #Apple unveiled a new device lineup led by iPhone 17; and #Google continues to climb on progress in AI tools, ad tech, and cloud services. Together, these catalysts are lifting demand for AI infrastructure and ecosystem services, reinforcing network effects between hardware vendors, platforms, and developers.

Key growth drivers for IT giants in 2025:

#Oracle — faster cloud revenue, major AI contracts, and expanded data-center infrastructure sparked a sharp 40% jump in the stock.

#Apple — the launch of iPhone 17 and an updated device lineup strengthens ecosystem cash flows, driving upgrade cycles and service monetization and supporting a positive re-rating of the shares.

#Google — gains in advertising and cloud alongside the rollout of generative AI, improvements in search and commerce products, and cost optimization for inference.

#NVIDIA — new chips and architectures (including Blackwell) cement leadership in AI compute, while data-center expansion and the MLOps stack support a robust order backlog.

Institutional demand — inflows into AI-themed funds and ETFs, plus strategic partnerships by corporations and governments, are sustaining premium sector valuations and fueling a broadening cycle of spend on AI infrastructure, devices, and platform services.

According to FreshForex, a prolonged AI demand cycle and scaling potential create conditions for further share-price appreciation. The parallel surge in #Oracle , product updates from #Apple , and #Google’s rally keep the spotlight on the sector and bolster expectations for AI-driven earnings — from chips to devices and cloud — while #NVIDIA’s lead in next-gen architectures secures its role as a key beneficiary of the trend.

Oracle (ORCL) Stock Price Pulls Back After Historic SurgeOracle (ORCL) Stock Price Pulls Back After Historic Surge

On 10 September 2025, ORCL shares soared by 36% in a single trading session:

→ the price reached an all-time high above $340;

→ Oracle’s co-founder and chairman, Larry Ellison, briefly became the world’s richest individual.

Why Did ORCL Shares Surge?

The rally was triggered by announcements of several multibillion-dollar deals in cloud infrastructure for artificial intelligence. Oracle revealed contracts worth a total of $300 billion, with clients including OpenAI, Nvidia, SoftBank, Meta, and Elon Musk’s xAI.

According to media reports:

→ CEO Safra Catz stated that the company’s Remaining Performance Obligations (RPO) could soon exceed $500 billion;

→ analysts and investors began drawing comparisons between Oracle and Nvidia, positioning Oracle as a key player in the AI ecosystem by providing essential cloud infrastructure.

However, by the end of the week, ORCL shares had retreated by roughly 15% from their peak.

Technical Analysis of ORCL

After such a steep rally, many holders likely took profits, contributing to the pullback. In addition, strong overbought signals emerged following last week’s bullish gap, indicated by:

→ the RSI indicator;

→ a price breakout above the upper boundary of the long-term channel (shown in blue);

→ the advance beyond the psychological $300 level.

Although Oracle’s long-term outlook remains highly promising, the company still holds a smaller share of the cloud services market compared with Amazon Web Services, Microsoft Azure, and Google Cloud.

At present, we could assume that the market has entered a corrective phase, with ORCL potentially retracing to the $270–280 area, where a cluster of support levels is located:

→ the median line of the medium-term (orange) channel;

→ the 50% Fibonacci retracement of the A→B impulse;

→ the upper boundary of the blue channel, which may switch its role to act as support.

Additional support could be found at $260 and at the lower edge of the gap near $240 if the correction deepens. Overall, however, given the long-term impact of the recently secured contracts, Oracle’s prospects in cloud computing and AI remain robust.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Oracle Corporation | ORCL & Ai If there is one person that you can compare it with Tony Stark aka IRON MAN is Larry Ellison

the ruthless entrepreneur who is born to win and be the number 1. Since the close of trading Friday, Ellison’s net worth has pumped 8 billion dollar to reach $ 206 billion

Oracle’s stock has reached new highs following its earnings report last week, which exceeded expectations and raised its revenue forecast for fiscal 2026.

Orcl have risen 20% this month and If this upward trend holds, it would mark their best performance since October 2022, when the stock jumped 28%, and the second best month since October 2002, nearly two decades ago.

The company’s stock success is partly driven by its involvement in the booming artificial intelligence sector. Ellison, Oracle’s founder since 1977, mentioned in last week’s earnings call that the company is building data centers to meet the growing demand for generative AI.

“We are literally building the smallest, most portable, most affordable cloud data centers all the way up to 200 megawatt data centers, ideal for training very large language models and keeping them up to date,” Larry said during the call

also he recently mentioned that Elon Musk and I ‘begged’ Jensen Huang for GPUs over dinner!We need you to take more of our money please!! It went ok. I mean, it worked!

Oracle also announced last week a partnership with Amazon’s cloud computing division to run its database services on dedicated hardware. Over the past year, it has formed similar alliances with Microsoft and Google, two other major cloud infrastructure providers

Oracle's cloud services are a key driver of their success, with revenue from this division growing 21% year over year, reaching $5.6 billion in quarterly earnings

Oracle is becoming a crucial provider, acting like a foundational layer for AI-focused companies. Their database systems are now critical to supporting businesses like OpenAI, AWS, and Google Cloud in building the infrastructure for future AI advancements. Despite AWS and Google Cloud being direct competitors, Oracle’s software remains essential to AI’s future.

Oracle's technology plays a foundational role, much like GPUs have in AI development. As companies seek efficient cloud-database solutions for AI workloads, Oracle is well-positioned to fulfill this demand.

Considering their strong Q1 performance and the central role of their database software in this field, I now view Oracle as a strong buy. The company's AI-powered cloud solutions, strategic partnerships, and growing database market make their technology indispensable for the future of AI

Oracle’s fiscal Q1 for FY 2025 exceeded expectations, with non GAAP earnings per share (EPS) of $1.39, surpassing estimates by $0.06, and revenue hitting $13.3 billion, outperforming projections by $60 million. The cloud segment, which includes their AI database software, remains a significant growth driver, generating $5.6 billion in revenue.

Most of Oracle’s revenue came from the Americas, contributing $8.3 billion, a 6.9% year-over-year increase. The AI revolution, gaining momentum in the US, aligns with their strong revenue growth in this region.

During the Q1 earnings call, management emphasized their expanded partnerships with major tech companies like Google Cloud (Alphabet Inc) and AWS (Amazon), which are notable given that they are also competitors. Oracle highlighted its success in the AI training space, pointing to the construction of large data centers equipped with ultra-high-performance RDMA networks and 32,000-node NVIDIA GPU clusters.

In the EMEA region, crucial to Oracle’s growth due to rising demand for cloud infrastructure and AI solutions among European enterprises and governments (sovereign AI), the company reported $3.3 billion in revenue.

Oracle’s earnings per share aka EPS is projected to grow at a compound annual rate of 13.5% for FY 2025, increasing to 14.41% in FY 2026, and continuing to compound at a modest double-digit rate in the coming years.

While these projections show strong potential for Oracle to be a compounder, I believe they may be somewhat conservative. The company’s remaining performance obligations (RPO) jumped 53% year-over-year to $99 billion by the end of the first fiscal quarter, indicating that their pipeline of signed work is growing faster than revenue. Once Oracle scales its solutions and workforce to match this RPO growth, we could see both revenue and EPS accelerate further.

In fact, while Oracle’s forward revenue growth is projected at just 8.86% for the next 12 months, their backlog is growing by over 50%. This suggests a notable gap between revenue expectations and actual demand.

I believe the current revenue growth projections are too low, and once revised upward, they could become a key growth catalyst for the company.

As for Oracle’s valuation, its forward price-to-earnings (P/E) ratio stands at 24.74, which is just 6.76% above the sector median of 23.17. However, given Oracle’s growth potential, I think it warrants a P/E ratio closer to 30.12, which is roughly 30% above the sector median. This would imply an additional 21.75% upside for the stock, excluding dividends.

With a forward P/E ratio only slightly above the sector median, despite Oracle’s impressive growth, the company’s performance suggests the stock should be trading at a higher valuation.

Larry Ellison is the man that I always can trust his vision and always bullish on his spirit and his ambitious. Oracle expanding influence in AI, coupled with robust revenue growth, positions the stock for significant upside. AI is like a modern day Gold Rush, and Oracle, much like GPU makers, is providing the essential tools the "pickaxe" for AI companies so That’s a space I’m eager to invest in

the chart looks insane and if there will be pullback I consider it as a buy opportunity

ORACLE Can you foresee it at $2000??Oracle (ORCL) is having perhaps the most dominant recovery from Trump's Tariff lows out of the high cap stocks, trading comfortable on new All Time Highs.

This is no surprise to us, as like we've mentioned countless times on our channel, we are currently at the start of the A.I. Bubble and heavy tech giants are expected to see massive gains until 2032, where we've calculated the end of this Bull Cycle and the start of a strong Bear.

As mentioned, this situation is extremely similar to the Dotcom Bubble of the 1990s. Of course Oracle is nearly impossible to repeat the +38637% gains of that Golden Decade after the 1990 Oil Crisis but in Fibonacci price and time terms, it can technically complete a +3411% rise and hit $2000 in the next 7 years.

If you have a long-term investor mindset like us, this is a must stock to buy and hold.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Link long - zoom in on weekly closeWe are approaching a breakout.

Maybe this week's close is the trigger that all the bulls (and altcoins) have been waiting for.

Generally speaking, I don't like trading Chainlink. Although if we see a weekly close just above 14.2, above the 20 MA, I think it could be a good investment entry.

I think Chainlink will be one of the utility coins that completely explodes before retail has time to react. A good weekly close is something that smart money probably would appreciate. If you think long-term, I think Chainlink is in a good position with good upside without any immediate big risk.

ofss rsi breakout cmp : 9030

stoploss : weekly closing below 8780

target :10400

Disclaimer:

This publication is strictly for educational and informational purposes only and should not be construed as investment advice, a trading recommendation, or a solicitation to buy or sell any securities. The analysis and views expressed are solely my personal opinions and may contain inherent biases. I may or may not have a position in the securities discussed at the time of writing. Please do your own research and consult with a qualified financial advisor before making any trading or investment decisions. Trading and investing in financial markets involves substantial risk, and you are solely responsible for your own decisions and outcomes.

Oracle (ORCL) shares surge 24% in a week, hitting all-time highOracle (ORCL) shares surge 24% in a week, hitting an all-time high

Last week, Oracle (ORCL) shares:

→ rose by approximately 24% — marking the strongest weekly gain since 2001;

→ broke through the psychological level of $200 per share;

→ reached an all-time high, with Friday’s session closing above $215. It is possible that a new record may be set this week.

What’s driving Oracle (ORCL) shares higher?

The main catalyst was the quarterly earnings report released last week:

→ Earnings per share ($1.70) exceeded analysts’ expectations ($1.64);

→ CEO Safra Catz projected revenue growth of 12–14% in upcoming quarters;

→ Company founder Larry Ellison highlighted “astronomical” demand for data centres, as well as Oracle’s competitive edge in building and servicing them.

Notably, Oracle provides infrastructure services for both OpenAI and Meta Platforms.

Technical analysis of ORCL shares

ORCL shares have shown high volatility throughout 2025, largely influenced by news surrounding Donald Trump. His promises to strengthen the US position in AI served as a bullish signal, while plans to impose international trade tariffs had a bearish impact.

As a result, a broad upward channel has formed on the chart, with the following key observations:

→ the price has repeatedly bounced sharply from the lower boundary (1), indicating strong demand;

→ by early June, the price had risen and stabilised near the channel’s median line (2).

Currently, the ORCL chart shows that the earnings-driven rally has pushed the price into the upper quartile (3) of the channel.

With the RSI indicator at extreme highs, it is reasonable to assume that ORCL may be vulnerable to a pullback. However, if a correction does occur, it is unlikely to be deep — perhaps testing the psychological $200 level — given the company’s strong fundamentals.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

ORCL Earnings Play – Riding AI Momentum (2025-06-11)📈 ORCL Earnings Play – Riding AI Momentum (2025-06-11)

Ticker: NYSE:ORCL (Oracle Corp)

Event: Earnings Report — 📆 June 11, After Market Close (AMC)

Bias: ✅ Moderately Bullish | Confidence: 70%

Strategy: Call Option | Expiry: June 13, 2025

🔍 Market Snapshot

📍 Price: Trading near recent highs

📈 RSI (Daily): 87.66 — Extremely overbought

📊 IV Rank: 0.75 → Implied volatility is high

📦 Options Market: Bullish skew; max pain at $170 suggests risk, but not dominant

🧠 Narrative Drivers: AI/cloud strength, institutional accumulation, strong uptrend

🧠 AI Model Consensus Summary

✅ Bullish (3/4 Models):

• Grok/xAI, Llama/Meta, Gemini/Google → all recommend a long call

• Favor upside potential due to strong trend + favorable sentiment

• Strike debate: $195 vs. $200 → $200 favored for cost/leverage

⚠️ Bearish (1/4 Models – DeepSeek):

• Flags overbought RSI + $170 max pain

• Recommends buying puts (contrarian sell-the-news play)

✅ Recommended Trade Setup

🎯 Direction: CALL

📍 Strike: $200

📅 Expiry: 2025-06-13

💵 Entry Price: $0.86

🎯 Profit Target: $1.00 (+16%)

🛑 Stop Loss: $0.25 (–71%)

📈 Confidence: 70%

⏰ Entry Timing: Before earnings close

📏 Size: 1 contract (limit to ~1% of capital)

⚠️ Risk Factors

• ❗ Binary Event: IV crush or weak results can kill premium

• 🧊 RSI > 87 → potential for short-term correction

• 🔁 If no move materializes, you may lose full premium

📣 Will NYSE:ORCL deliver an AI-fueled beat or flop on IV crush?

💬 Share your take ⬇ | Follow for daily earnings plays and AI-backed trade alerts.

GME COLLAPSE - NET SELLOFF - MARKET ANALYSISGameStop (GME) is dropping in after-hours trading following its $1.3 billion convertible senior notes offering, which investors see as potential dilution. Similarly, Cloudflare (NET) is also falling due to concerns over its $1.75 billion convertible debt offering, which could impact shareholder value.

On the flip side, Oracle (ORCL) surged after reporting strong Q4 earnings, with cloud infrastructure revenue expected to grow over 70% in fiscal 2026. This could provide a tailwind for the broader cloud sector.

The market’s pullback today was much needed, with many stocks retesting key breakout zones

ALTCOIN BOOM FOR CHAINLINK 2025-2026 PROPOSALWhy This Asset?

Core Info: Chainlink is the decentralized oracle network that bridges blockchains with real-world data (price feeds, weather, sports scores), enabling smart contracts to operate autonomously. It’s the critical infrastructure for DeFi, gaming, insurance, and beyond.

Recent News:

Cross-Chain Interoperability Protocol (CCIP) launched on Base (Coinbase’s L2) and other chains, streamlining cross-chain token transfers.

Partnership with DTCC (the $2 quadrillion securities settlement giant) to pilot real-world asset (RWA) tokenization.

Deep Dive:

Chainlink is capitalizing on two seismic shifts:

Institutional Adoption: DTCC’s collaboration signals TradFi’s growing reliance on blockchain infrastructure.

Multichain Dominance: CCIP’s expansion solves crypto’s fragmentation issue, making LINK indispensable for cross-chain interoperability.

Latest Tech/Utility Update

Update: CCIP mainnet launch + upgraded staking v0.2 (supports more node operators, boosts rewards).

Implications:

For Users: Cross-chain swaps become cheaper and faster, rivaling LayerZero and Wormhole.

For Investors: Only 8% of LINK is staked. If adoption accelerates, reduced supply + rising demand could trigger deflationary pressure.

Biggest Partner & Investment

Partner Spotlight: SWIFT, the global banking messaging network, tested CCIP with 10+ major banks for cross-border transactions.

Deal Size: Undisclosed, but SWIFT’s network spans 11,000+ banks. Integration could funnel trillions into blockchain.

Impact: SWIFT’s involvement isn’t just a partnership… it’s a gateway for TradFi liquidity. Chainlink is now the backbone for both DeFi and legacy finance.

Most Recent Added Partner

New Collab: Avalanche integrated Chainlink Data Streams for high-speed DeFi pricing.

Why It Matters: Avalanche’s institutional subnets (e.g., JPMorgan’s Onyx) now rely on Chainlink for hyper-accurate data. LINK solidifies its role as the oracle for performance-focused chains.

Tokenomics Update

Changes:

Staking v0.2 offers 5-8% APY but requires longer lockup periods.

Total supply remains fixed at 1B tokens (no inflation).

Analysis:

Staking upgrades reduce sell pressure, but 40% of tokens are still held by early investors. Gradual unlocks could cause short-term volatility, though institutional demand (e.g., SWIFT/DTCC) might absorb it long-term.

Overall Sentiment Analysis

Market Behavior: Accumulation phase. LINK surged 40% since June (13 or 13−15 range), with whale wallets growing steadily.

Driving Forces:

Bullish: CCIP adoption + SWIFT/DTCC hype.

Bearish: Rising competition (Pyth Network, API3) in the oracle space.

Insight: Sentiment is cautiously bullish. Chainlink’s first-mover advantage is strong, but it must keep innovating to fend off rivals.

Recent Popular Holders & Their Influence

Key Investors:

Wintermute (crypto’s top market maker) boosted LINK holdings by 12% this month.

Cobie, a crypto influencer, tweeted: “LINK is the oracle blue-chip.”

Why Follow Them: Wintermute’s moves often signal institutional positioning. Cobie’s endorsement fuels retail momentum.

Summary & Final Verdict

Recap: Chainlink is the glue connecting DeFi, TradFi, and multichain ecosystems. CCIP, SWIFT/DTCC deals, and staking upgrades create a perfect storm of utility and demand.

Verdict: LINK is a long-term hold with asymmetric upside. It’s not a meme coin, but its dominance in oracles (60%+ market share) makes it a cornerstone of crypto’s future. Risks include token unlocks and Pyth Network’s growth.

Final Thought: If you’re betting on blockchain infrastructure becoming mainstream, LINK is essential. If you want hype-driven pumps, look elsewhere.

$LINK Chainlink-An Indispensable Part of the Digital EconomyChainlink: A Cornerstone in Blockchain and DeFi

Chainlink ( BIST:LINK ) stands as a cornerstone in the blockchain and decentralized finance (DeFi) sectors, thanks to its decentralized oracle network that bridges smart contracts with real-world data. This article delves into Chainlink's current integration strategies and technological advancements, assesses its position in the competitive oracle market, and anticipates the challenges and opportunities awaiting in the near future. By understanding these facets, stakeholders can better appreciate Chainlink's pivotal role in the rapidly evolving blockchain landscape.

Understanding Chainlink's Integration and Interoperability

Chainlink's integration strategies, particularly through the Cross-Chain Interoperability Protocol (CCIP), have positioned it as a pivotal player in enabling seamless interactions across diverse blockchain environments. This protocol allows for secure and efficient multi-chain communication, facilitating the development of decentralized applications that require interaction with multiple blockchain networks. Among its various applications, CCIP has been instrumental in extending Chainlink’s influence across major blockchain platforms such as Hedera and Ronin .

Hedera's adoption of CCIP highlights its significance, with the protocol being deployed on its mainnet, enabling cross-chain applications over 46+ blockchain networks. This supports the tokenization of real-world assets (RWA) and advances decentralized finance (DeFi) operations, leveraging CCIP's robust security framework and the Cross-Chain Token (CCT) standard for efficient token management . Similarly, Ronin's migration to CCIP underscores the protocol's importance in gaming ecosystems, providing seamless and secure token transfers between Ronin and Ethereum

Beyond technical infrastructure, CCIP’s integration efforts are crucial in the realm of DeFi and RWA adoption. Notably, collaborations with entities like Coinbase and Paxos for the USDO stablecoin incorporate Chainlink's Proof of Reserve mechanism alongside CCIP for enhanced transparency and cross-chain capabilities. This level of interoperability and security is further extended into traditional financial markets through partnerships with Swift and Euroclear, facilitating seamless blockchain connectivity using existing standards.

One of the standout examples of Chainlink’s strategic partnerships is its collaboration with Shiba Inu’s Shibarium. Announced in March 2025, this integration incorporates CCIP, facilitating cross-chain transactions for tokens like SHIB, BONE, and LEASH across 12 blockchains. This not only strengthens Shibarium's ecosystem but also introduces advanced data solutions through Chainlink’s market data feeds, promising a significant expansion in functional capabilities for decentralized finance applications .

Technological Foundations of Chainlink

Chainlink's success in the DeFi ecosystem is anchored in its robust technological infrastructure. Three core components—data feeds, Proof of Reserve (PoR) mechanism, and smart contract automation functions—underscore its technical prowess and reliability.

Chainlink's data feeds are crucial for bringing off-chain information to on-chain environments, providing real-time and decentralized data essential for blockchain operations. These feeds pull from multiple sources to ensure data integrity and reliability, catering to fields like market data, weather information, and more. For instance, Chainlink's BTC/USD feed on the Ethereum Mainnet exemplifies the system's capability in handling critical financial data with accuracy . Through a network of independent nodes that are motivated to deliver precise information, Chainlink guarantees the high security and tamper-resistance of these feeds, supporting substantial transaction values across diverse blockchains .

The Proof of Reserve mechanism stands out as a transformative feature, allowing real-time verification of reserve assets. Chainlink's PoR significantly improves transparency in fiscal environments by enabling institutions like 21Shares and Ark Invest to verify their reserve holdings continuously . This real-time verification negates the need for traditional audits, providing a more fluid and ongoing assurance of reserve backing, essential for applications in stablecoins and tokenized funds .

Smart contract automation, leveraging Chainlink Automation and Functions, is another critical facet that enhances Chainlink's offerings. Automation services, previously known as Keepers, enable contracts to execute autonomously based on pre-set criteria like time schedules or external events . By integrating external API data into smart contracts, Chainlink Functions empowers applications to react dynamically to real-world changes, facilitating complex operations such as automatic fee conversions and stablecoin redemptions .

Competitive Landscape and Market Dynamics

Chainlink stands as a formidable leader in the decentralized oracle market, holding over 80% market share, serving a significant volume of the blockchain ecosystem's contract needs and maintaining partnerships exceeding 1,500, including those with prominent projects like Aave, Uniswap, and Google Cloud . This robust network offers high-value services, ensuring accurate data via technologies such as the Cross-Chain Interoperability Protocol (CCIP) .

However, as the decentralized oracle arena evolves, competitors like Band Protocol , API3 , and smaller emergent players such as RedStone Crypto and Pyth Network strive to capture niche segments of the market. Band Protocol , for instance, provides cross-chain compatibility and provides data feeds across 60 partnerships, although still significantly trailing in comparison to Chainlink's vast ecosystem . Band focuses on specific use cases, offering competitive services for niches like sports data and random number generation .

API3 stands out by employing direct first-party data feeds, eliminating the need for intermediaries which is a major contrast to Chainlink's node-operated model. Although its current market impact is less prominent than Chainlink , API3 's Oracle Extractable Value (OEV) rewards system has incentivized dApps use, successfully distributing substantial rewards to various projects such as Compound .

While these competitors chip at specific market needs, Chainlink strengthens its position by embracing AI integration and maintaining a seamless cross-chain application framework. Its innovative steps into data streaming for sub-second updates and comprehensive AI enhancements further solidify its position as the oracle of choice, capable of handling a wide variety of blockchain needs effectively .

Emerging technologies, such as AI-driven analytics and real-time data services by competitors, suggest intense competitive pressures on Chainlink's foundational strengths. Therefore, Chainlink's continued dominance relies on strategic adaptation, robust technological advances, and maintaining its extensive partner network to combat niche encroachment by these alternative services .

Challenges and Strategic Responses

Chainlink is currently navigating a complex landscape of challenges, from market volatility and regulatory scrutiny to scaling its technical operations. To sustain its growth and maintain its market position, Chainlink must implement strategic responses that address these concerns dynamically.

Market volatility remains a formidable challenge for Chainlink, as the cryptocurrency market is known for its rapid fluctuations. High volatility can lead to unpredictable price swings that affect investors' confidence and market positioning. To mitigate these risks, Chainlink should focus on strengthening its ties within the DeFi ecosystem, ensuring robust integrations with major blockchains like Ethereum, and leveraging its expansive network of 1,500+ partnerships to stabilize its influence and market relevance .

Governmental scrutiny and regulatory compliance are additional hurdles. The regulatory landscape for cryptocurrencies constantly evolves, with heightened focus on transparency, anti-money laundering (AML), and know-your-customer (KYC) standards. Chainlink’s proactive engagement with regulatory bodies, as evidenced by co-founder Sergey Nazarov's advocacy for regulatory clarity around real-world asset (RWA) tokenization, positions the company to influence favorable policy outcomes that support its operational goals . Establishing partnerships that enhance compliance will ensure that Chainlink remains adaptable in a rapidly changing legal environment.

Prospects for Chainlink’s Future Growth

Chainlink is poised to significantly influence the blockchain landscape by leveraging technological innovations and strategic positioning. As the blockchain ecosystem matures, Chainlink’s proactive adoption of advanced technologies like the Cross-Chain Interoperability Protocol (CCIP) will be pivotal. This protocol facilitates secure cross-chain asset transfers and interactions, which are essential for enhancing decentralized finance (DeFi) and enabling enterprise-level tokenization—a key avenue for future growth .

In the ever-evolving blockchain environment, maintaining robust interoperability through CCIP can position Chainlink as a leader in cross-chain solutions. They continue to expand their reach with significant integrations across multiple blockchains, such as Arbitrum, Avalanche, and Ethereum. These integrations underscore Chainlink's growing footprint in decentralized applications, further solidifying their influence in the industry .

Market trend analyses for Chainlink vary broadly, reflecting investor sentiment and anticipated market developments. While some forecasts suggest conservative price estimates for 2025, ranging from $14.17 to $19.74, others project moderate optimism, predicting values between $25 and $39.2 driven by continued DeFi influence and technical innovations . Long-term outlooks are more bullish, with anticipated values reaching up to $181.79 by 2031, highlighting potential substantial growth as Chainlink capitalizes on macroeconomic crypto trends.

My prediction is the same

Chainlink’s decentralized oracle network remains crucial for bridging smart contracts and real-world data, playing a foundational role in supporting not only DeFi but also broader enterprise solutions. The expansion of Chainlink’s integrations and services enhances its capability to harness cross-chain functionality, vital in driving its future success .

Preemptively positioning itself within emerging enterprise dynamics and leveraging cross-chain solutions effectively can ensure that Chainlink maintains a competitive edge. As blockchain technology integrates deeper into various industry sectors, Chainlink's forward-looking strategies, particularly in enhancing interoperability and service expansion, will be key to sustaining its growth trajectory and tapping into new market opportunities over the next decade.

Conclusions

Chainlink solidifies its position as a leader in decentralized oracle services, with strategic integrations and technological advancements fortifying its market presence. While it faces competition and regulatory challenges, its potential for growth remains significant. By maintaining innovation and strategic alliances, Chainlink is poised to navigate future challenges effectively, offering considerable opportunities for investors and stakeholders. The insights discussed underscore Chainlink’s resilience and its continuous influence in shaping the future of blockchain and DeFi ecosystems.

Best regards EXCAVO

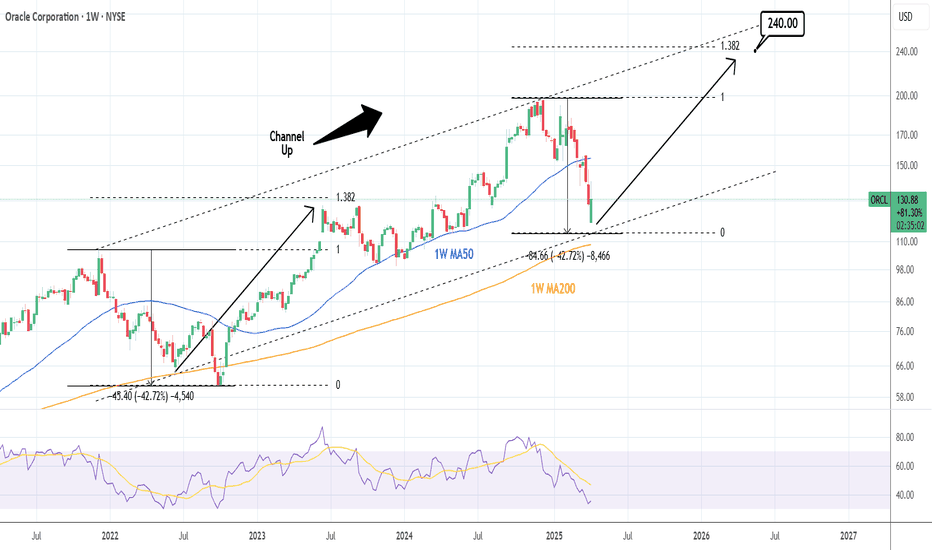

ORACLE: On a 3 year bottom. Buy opportunity for 240 long termOracle is bearish on its 1W technical outlook (RSI = 35.862, MACD = -4.360, ADX = 42.565) as this week it reached almost the same levels of correction as the 2022 Bear Market (-42.72%). This is also nearly a HL bottom for the 3 year Channel Up and as the 1W MA200 is right below, a great long term buy opportunity. The bullish wave after the 2022 bottom almost reached the 1.382 Fibonacci, so we have a technical level to target this time also (TP = 240).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Chainlink ($LINK) The Road to $100Chainlink holds a leading position in oracle technology and continues to expand its influence. The project actively cooperates with major companies and blockchain ecosystems, which strengthens its position in the market. For example, partnerships with Google Cloud, SWIFT and other tech industry giants confirm Chainlink's relevance to traditional businesses.

One of the key factors behind Chainlink's success is its decentralized architecture, which provides high security and fault tolerance. This is especially important in the face of growing demand for reliable smart contract solutions.

Recently, Chainlink CEO Sergey Nazarov participated in a crypto summit organized at the White House. This event was an important step in the legalization and regulation of the crypto industry in the United States. Sergey Nazarov's participation emphasizes the importance of Chainlink as one of the key players in the blockchain ecosystem. His presentation focused on the role of oracle networks in ensuring data transparency and security, which is particularly important for regulators and governments. This attention to the project from the authorities may contribute to further development of Chainlink and its integration into traditional financial systems.

According to my analysis, the price of LINK has the potential for significant growth in the coming months. Considering the current market trends as well as technical analysis based on Fibonacci levels, we can assume that the price of LINK will reach the range of $80-100 by September 2025.

Alex Kostenich,

Horban Brothers.

Oracle: Tilting Downward…After a sharp rebound from the $152.02 support following the steep drop from the peak of the beige wave II, Oracle is once again tilting downward as expected. The next step should see the price fall below $152.02 to reach the projected low of the beige wave III. After a countermovement of wave IV, the broader downward movement as part of the beige five-wave decline should extend further, ultimately driving the stock to the low of the overarching blue wave (A). If Oracle instead breaks above the $198.31 resistance in the short term, the macro-level light green wave alt. will rise to a new high. However, this alternative scenario holds only a 34% probability. Primarily, we assume that wave was completed with the December peak.

Chainlink goes for the title of top-1 blockchain in the worldChainlink is going mainstream! The project is being implemented in a number of major European banks and has also reached an agreement on partnership with SWIFT! This is an incredible result for cryptocurrencies. Chainlink also has multiple applications in other areas: DeFi, Gaming, NFT, DePin and RWA. Take note, don't miss out on an Apple-level project in its infancy!

7% PUMP OR DUMP INCOMING FOR CHAINLINKCurrently trading at resistance. we need to flip this $24.75 level into support to then aim for a 7% pump to the upside.

If we reject here, I would expect a 7% dump to the value area low.

#Chainlink #Crypto #Oracle

Calculate Your Risk/Reward so you don't lose more than 1% of your account per trade.

Every day the charts provide new information. You have to adjust or get REKT.

Love it or hate it, hit that thumbs up and share your thoughts below!

This is not financial advice. This is for educational purposes only.

Oracle Soars on USA AI Deal – Is $238 Next?Good morning, trading family!

Here’s what I’m seeing for Oracle (ORCL) right now:

If it can break above $191, we might see it push up to $199–$200. If it clears that, $230–$238 could be the next big move, especially with all the excitement around its role in the $100B U.S. AI project.

But let’s stay cautious—if it drops, $179 could be the next level to watch, and if that doesn’t hold, $166 might be in play.

If this analysis helped you, drop a comment below! A like, boost, or share would mean the world and help others join the conversation. Let’s crush it this week!

Kris/Mindbloome Exchange

Trade What You See

What Lies Beyond Stargate's Gates?In a bold move that redefines the intersection of technology and national policy, President Donald Trump has unveiled "Stargate," a colossal project aimed at advancing the United States' capabilities in artificial intelligence. This initiative, backed by tech titans Oracle, OpenAI, and SoftBank, is not merely an investment in infrastructure but a strategic leap towards securing America's future in the global AI race. With commitments reaching up to $500 billion, Stargate is set to transform not only how AI is developed but also how it integrates into the fabric of American society and economy.

The project's immediate impact is palpable; it involves constructing state-of-the-art data centers in Texas, with plans to scale significantly across the nation. This undertaking promises to generate around 100,000 jobs, showcasing the potential of AI to be a major economic driver. Beyond the economic implications, Stargate aims at a broader horizon — fostering innovations in fields like medical research, where AI could revolutionize treatments for diseases like cancer. The involvement of key players like NVIDIA, Microsoft, and Arm underscores a unified push towards not just business efficiency but also societal benefits, challenging us to envision a future where technology and humanity advance hand in hand.

However, the vision of Stargate also brings to mind the complexities of global tech dependencies, especially concerning AI chip manufacturing, which largely relies on foreign production. This initiative invites a deeper contemplation on how national security, economic growth, and technological advancement can be balanced in an era where AI's influence is ubiquitous. As we stand on the brink of this new chapter, Stargate challenges us to think critically about the future we are building — one where AI not only serves our immediate needs but also shapes our long-term destiny.