BTCUSD Consolidates Between Key Demand and Resistance ZonesBTCUSD is trading after a corrective phase following a strong bearish move. Earlier price action respected a downward structure, forming lower highs with consistent selling pressure. After recent lows, price stabilised and moved sideways, suggesting reduced selling momentum and a shift into consolidation rather than further sharp declines.

Key resistance is seen around 89,800–90,200, where price previously faced rejection. Acceptance above this level would weaken the bearish structure and improve recovery potential. On the downside, demand at 86,800–87,400 shows strong buying interest and base formation, acting as key support. Below this, bearish momentum may accelerate.

Price is currently range-bound between demand and resistance. Early higher lows suggest accumulation, though confirmation is required. Overall bias remains neutral to cautious, with volatility expected near these zones.

Community ideas

ETH Update📊 ETH Update

ETH remains in a bear market 🐻

and has formed a head and shoulders pattern

on the weekly timeframe 👀.

Price has broken below the black neckline support ❌,

confirming bearish structure.

What’s next? 👇

Key levels to watch:

🔹 First level: around $2,500

→ Previous POC

→ Price could stabilize or bounce here.

🔹 Second level: blue support zone around $2,100

→ Another area where price may stabilize.

🔹 Last major level: around $1,500

→ Strong long-term area for those looking to accumulate ETH.

These are the most important ETH levels right now.

⚠️ Important note:

There are no bullish reversal signals at the moment.

Bias remains bearish until structure changes.

Stay patient,

risk management first.

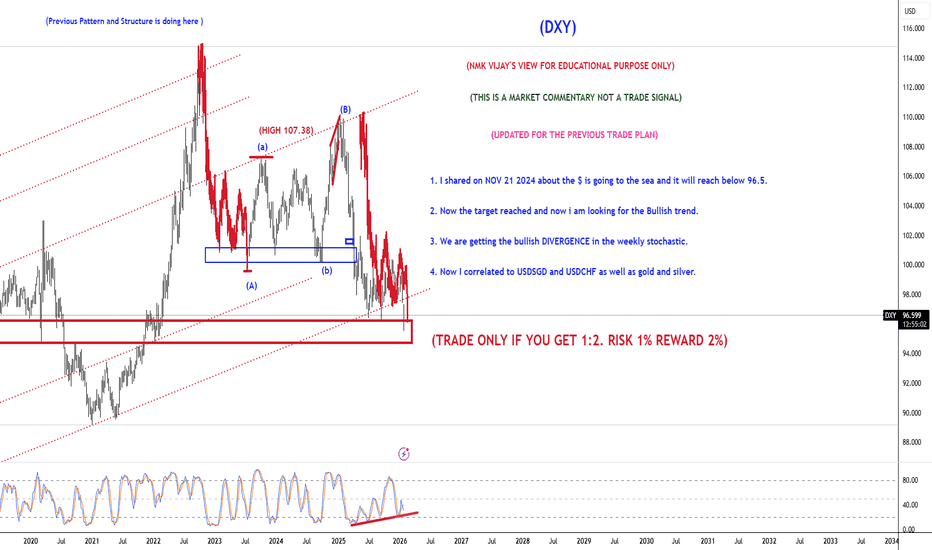

DXY: Bullish Trend Formation.DISCLAIMER : All labelling and wave counts done by me by manually and i will keep change according to the LIVE MARKET PRICE ACTION. So don't bias, hope on my trade plans...try to learn and make your own strategy...Following is not that much easy...I AM NOT RESPONSIBLE FOR ANY LOSSES IF U TOOK THE TRADE ACCORDING TO MY TRADE PLANS....THANKS LOT..CHEERS

XAGUSD Bullish Breakout: Trend Continuation Toward 124.00This is a 30-minute XAGUSD (Silver vs USD) chart showing a bullish breakout within a well-defined uptrend.

Overall trend: Price is moving inside a rising channel, respecting an ascending trendline that has acted as dynamic support.

Ichimoku Cloud:

Price is above the cloud, confirming bullish market structure.

The cloud is rising and expanding, signaling strong underlying momentum and trend stability.

Key resistance & breakout:

A horizontal resistance zone capped price multiple times.

Silver has now broken and held above this level, confirming a bullish breakout.

Price action: Post-breakout consolidation shows higher lows, indicating acceptance above resistance rather than a false break.

Support confluence: The breakout level aligns closely with the rising trendline and the top of the Ichimoku cloud, strengthening the bullish bias.

Target projection: An upside target is marked near 124.00, consistent with trend continuation and prior structure extension.

Overall, the chart favors trend continuation to the upside, as long as price remains above the breakout zone and ascending trendline.

GBPUSD - The hunt for liquidity before the trend continues FX:GBPUSD entered a local correction phase amid a pullback in the dollar after a strong rally. The main trend is bearish, and growth after the correction may continue.

A correction has been forming since the opening of the session. The dollar is recovering slightly, while the pound is correcting towards the daily level of 1.377 and the Fibonacci area of 0.5-0.6. If the bulls hold back the correction, the market may return to the trend.

The main/medium-term trend is bullish. The correction and false breakout of support may shift the imbalance of forces towards buyers, which could trigger growth from strong levels.

Resistance levels: 1.3831, 1.38688

Support levels: 1.377, 1.3748

A false breakdown of support and the upward trend line could trigger growth within the main trend

Best regards, R. Linda!

Eh' Manual For BernieBernie..... born Emmanuel, renamed by the mountains after he accidentally set his own boots on fire was the only creature in the high ridges who understood the Rocky Mountain Ginge’s obsession with glowing sap.

Mostly because Bernie loved fire the way poets love metaphors: recklessly, wholeheartedly, and with no regard for personal safety.

The Ginge trusted him.

Bernie trusted flames.

This was the problem.

One evening, after a long day of “goo hunting,” the Ginge proudly held out a fresh glob of Ember Sap, still pulsing with that warm, molten glow.

“Bernie like goo?” the Ginge asked, grinning.

Bernie’s eyes widened. “It’s… beautiful.”

He leaned in too close.

The sap flickered.

The glow brightened.

And then as if remembering what it once was it caught fire again.

A sudden WHOOMPH lit up the ridge.

Bernie staggered back, beard smoking, eyebrows gone, hands waving like a man trying to negotiate with physics.

“IT LIKES ME!” he shouted, thrilled and terrified.

The Ginge blinked. “Bernie spicy now.”

Snow melted in a perfect circle around them.

Bernie, still smoldering, nodded proudly. “Put that in the manual.”

“What manual?” the Ginge asked.

Bernie grinned through the soot.

“The one they’ll write about me someday.”

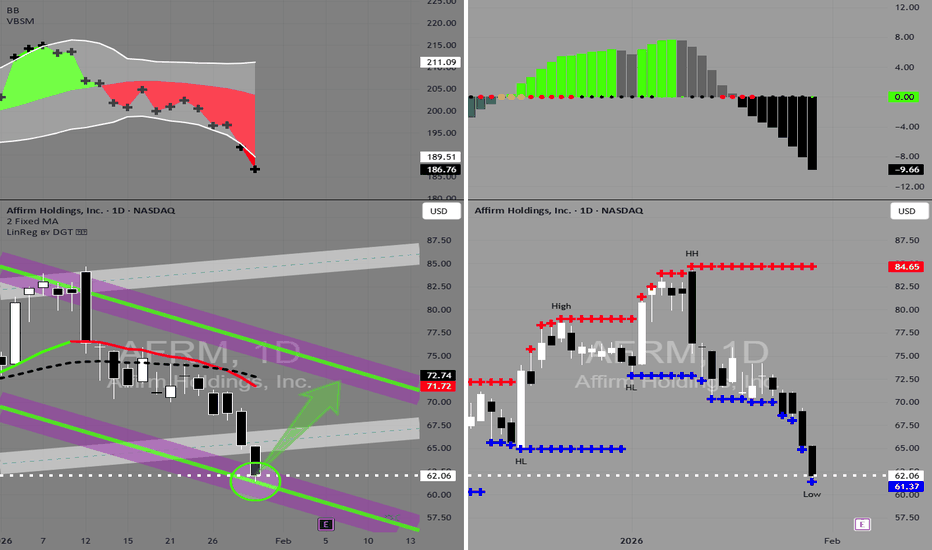

AFRM in BUY ZONEMy trading plan is very simple.

I buy or sell when at either of these events happen:

* Price tags the top or bottom of parallel channel zones

* Money flow volume spikes beyond it's Bollinger Bands

So...

Here's why I'm picking this symbol to do the thing.

Price in buying zone at bottom of channels

Money flow momentum is spiked negative and at bottom of Bollinger Band

Entry at $61.50

Target is upper channel around $70

Set your own stop.

Ripple (XRP): Sellers Are Pressuring | Getting Ready For -70%XRP seems to be getting ready for a solid short opportunity. Buyers got pushed back by the EMAs, and now we are seeing increasing pressure from sellers, which could very likely end in a breakdown.

Maybe this move plays out simply because XRP never really moves with the rest of the market, or maybe not — but from our perspective, this setup makes sense. Even if the broader market pushes higher, XRP historically tends to get sold into strength.

P.S: Red zone is DCA zone

Swallow Academy

USDJPY Under Pressure! SELL!

My dear followers,

I analysed this chart on USDJPY and concluded the following:

The market is trading on 154.22 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 153.74

Safe Stop Loss - 154.53

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Hellena | Oil (4H): SHORT to support area 62.295.Colleagues, earlier I described the upward movement as a full-fledged ABC correction, and the price justified expectations and completed the planned upward movement, but at the moment I think it is worth considering that wave A has been extended.

This fits well with both the old and new scenarios.

I expect wave “B” to begin its movement soon.

I will not set distant goals and will wait for the price to reach the first support area — the maximum of wave “3” of the middle order at 62.295.

I admit the possibility of updating the maximum of wave “A” approximately in the resistance area of 65.199.

In general, if correction “B” continues too far down, I will return to the old scenario.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

EUR/USD Daily AnalysisOn the daily timeframe, EUR/USD appears to be stabilizing after encountering resistance at the upper boundary of the price channel shown on the chart.

The pair is now attempting to break below its previous swing high — which has turned into current support — while bearish signals are emerging on lower timeframes.

Accordingly, further downside is expected, with potential targets at 1.1670, followed by 1.1300.

The bearish outlook remains valid as long as the pair continues to trade below 1.2156.

Nifty 50: Dual SMC Setups for Union Budget Special Session Market Analysis

The Nifty 50 ended January 30th at 25,315 after a volatile session that saw intraday lows of 25,213.65. We are currently coiling within a major Symmetrical Triangle. While the broad trend remains corrective, the 15-minute timeframe shows an internal ascending support (the "inner trend") near 25,350, indicating that buyers are attempting to defend higher levels ahead of the Union Budget 2026.

The Two-Scenario Strategy

Due to the high-impact nature of the Budget session on Sunday, Feb 1st, we are tracking two high-confluence zones to manage extreme volatility:

Setup 1: The FVG Fill (Primary Plan)

Logic: Price retraces to fill the 15m Fair Value Gap (FVG) and reacts off the 50% Fibonacci Discount zone, maintaining the internal ascending support.

Entry: 25,247

Stop Loss: 25,140 (Structural invalidation below the internal support and 200-DMA)

Target: 25,600 (Primary supply zone and triangle breakout target)

Risk/Reward: 1:4.6

Setup 2: The Liquidity Sweep (Contingency)

Logic: If primary support fails, we look for a "liquidity grab" or stop-hunt below the 25,140–25,150 horizontal demand zone to mitigate the Bullish Order Block (OB) near the 200-day EMA (approx. 25,184).

Entry: 25,040

Stop Loss: 24,993 (Below the major psychological floor)

Target: 25,600

Risk/Reward: 1:7.3

Conclusion

The internal structure remains bullish as long as the higher-low sequence holds. A decisive close above 25,450 will confirm the "inner trend" has won, likely leading to a fast move toward 25,600+ once policy clarity emerges post-Budget.

EURAUD February 2026 fundamental analysisFundamental Case:

AUD is tightening while EUR remains on hold. ECB at 2.0% with inflation at target, policy firmly neutral through 2026. If ECB cuts 25bp in 2026, rate differential expands even further against EUR.

The RBA's potential tightening to 3.85% creates a structural advantage for AUD that will persist through February and likely beyond. AUD's inflation above target through mid-2027 means RBA will remain hawkish relative to ECB's steady-as-she-goes approach.

Technical & Valuation:

EUR/AUD is inverse to AUD/USD strength. With AUD/USD breaking above 0.70 and AUD momentum clearly positive, EUR/AUD should depreciate correspondingly.

Risk: If global growth suddenly deteriorates, EUR's status as relative safe haven (vs commodity-linked AUD) could provide temporary support. ECB could accelerate easing if inflation falls below 2%.

VERDICT: SELL | RBA tightening advantage over ECB neutrality is clear. AUD carry increasingly attractive vs EUR's stagnation. Fundamental divergence supports EUR/AUD weakness

Coach Miranda Miner Thoughts - SPX 7,000 vs PSEI: Why the Philippine Market Is Pricing Confidence, Not Growth

Core Thesis

The performance gap between the S&P 500, now above 7,000, and the Philippine Stock Exchange Index is not primarily a story of technology dominance versus old economy exposure. The deeper driver is a persistent confidence and governance discount embedded in Philippine equities. This discount suppresses valuation multiples, discourages sustained capital inflows, and structurally caps upside regardless of headline GDP growth.

1. The Economy–Equity Market Disconnect

The Philippines has posted relatively strong GDP growth compared with many peers, yet the PSEI has delivered flat to negative real returns over the past decade. This divergence signals that equity prices are not tracking economic expansion, but rather investor skepticism about the durability and credibility of that growth.

While U.S. equities benefit from a clear translation of growth into earnings and reinvestment, Philippine equities are discounted due to uncertainty around execution, policy continuity, and institutional reliability. Growth exists, but the market does not trust its conversion into long-term shareholder value.

2. Structural Market Fragility Magnifies Risk

The Philippine equity market remains structurally thin relative to global and regional peers.

Liquidity is persistently low, making prices highly sensitive to foreign flows

Market breadth is narrow, dominated by banks, property, and conglomerates

IPO activity has been weak, limiting capital formation and future growth narratives

These conditions amplify volatility and reduce resilience during risk-off periods. In contrast, the U.S. market attracts capital not only because of innovation, but because of depth, scale, and constant reinvestment through listings and corporate activity.

3. Governance Risk as a First-Order Valuation Variable

This is the most underappreciated driver of PSEI underperformance.

Repeated corruption probes, infrastructure controversies, and regulatory uncertainty have directly influenced investor behavior. Analysts and market participants increasingly cite governance credibility rather than earnings weakness as the main reason Philippine equities trade at a persistent valuation discount.

In practice, political and institutional risk is being priced as a permanent earnings drag. This elevates required risk premiums, suppresses multiples, and discourages long-term foreign participation.

4. Confidence Has Become a Pricing Mechanism

Unlike U.S. markets, where earnings growth and productivity dominate price discovery, sentiment and institutional trust function as macro variables in Philippine equities.

This creates a self-reinforcing loop:

Weak confidence reduces participation

Low participation depresses prices

Depressed prices further deter capital

As a result, rallies fail to sustain even when fundamentals improve. The market’s underperformance is therefore structural rather than cyclical.

5. Why Correlation With SPX Breaks Down

The divergence between SPX and PSEI reflects capital allocation preference, not economic destiny.

Global investors allocate toward markets offering:

Liquidity

Transparency

Rule-of-law credibility

Policy predictability

Until these conditions improve, Philippine equities remain structurally underweighted in global portfolios. Sector rotation alone will not close the gap. Any meaningful re-rating requires restored institutional trust and market credibility.

Key Takeaway

The Philippine market is not underperforming because it lacks growth. It is underperforming because growth is being discounted by governance risk and structural fragility. Confidence is the true valuation multiplier, and until it improves, the PSEI will remain disconnected from global equity momentum even as the S&P 500 continues to make new highs.

Footnotes / Sources

Rampver Financials, Global Investing for Filipinos Is a Must

reads.rampver.com

Ginlix AI, World’s Worst Market Performance and Recovery Challenges

www.ginlix.ai

i3Investor CEO Morning Brief, Philippines Seeks Fix for World’s Worst Performing Stock Market

klse.i3investor.com

PhilStar, Have We Seen the Bottom in Philippine Stocks

www.philstar.com

XAU/USD: Bearish Correction from Premium Supply ZoneGold (XAU/USD) is currently undergoing a technical pullback on the 15-minute timeframe after reaching an extreme premium valuation. Following a massive bullish expansion, the price has encountered a high-interest institutional supply zone near the 5,650 - 5,693 range. The current price action indicates a "Mean Reversion" phase as the market seeks to rebalance the recent vertical surge.

Technical Deep-Dive:

Supply Zone Interaction: The upper purple box represents a significant resistance barrier where initial selling pressure has materialized. The failure to sustain momentum above 5,650 suggests that buyers are taking profits, allowing for a corrective structure to develop.

Correction Trajectory: As illustrated by the black forecast path, the market is expected to perform a series of lower highs. The projected move focuses on a retest of intermediate liquidity before continuing its descent toward established value areas.

Key Downside Objectives:

Primary Target: 5,450 – This minor demand zone serves as the first major area of interest for a potential bounce.

Major Target: 5,378 – A deeper retracement level that aligns with the green support block, where a significant pool of buy orders is anticipated.

Risk Management: The bearish outlook for this correction remains valid as long as the price holds below the 5,693 peak. A decisive close above this supply zone would invalidate the retracement thesis and signal a continuation into uncharted territory.

Trading Strategy: This setup favors a "Sell the Retest" approach within the distribution phase. Traders should monitor for bearish confirmation—such as a rejection wick or a shift in lower-timeframe structure—before targeting the expansion toward the identified support zones below.