GBPJPY is showing clear strong bullish trend bullish viewGBPJPY – 4H Timeframe | Bullish Trend 📈

GBPJPY is showing a clear bullish trend, with price approaching a key support zone, offering a potential buying opportunity 🔍

🔹 Buy Zone:

• 211.700 – Key support area & bullish reaction zone ✅

🎯 Technical Target:

• 214.200 – Supply zone

Bullish bias remains valid as long as price holds above support. Wait for confirmation before entry and stay disciplined.

⚠️ Use proper risk management

This is not financial advice. Always protect your capital.

👍 Like | 💬 Comment | 🔁 Share | ➕ Follow for more trading insights

Community ideas

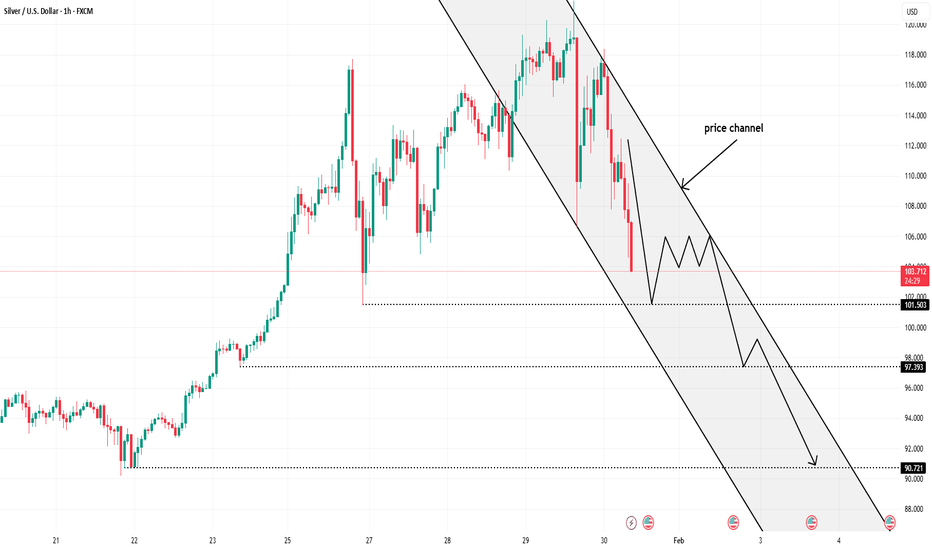

Silver Has Broken Structure — The Channel Now Defines DownsideSilver has clearly transitioned from an impulsive uptrend into a bearish price channel, and the latest sell-off confirms that this is no longer a healthy pullback. After failing to hold the previous highs, price broke structure decisively and began printing lower highs and lower lows, signaling a shift in short-term market control from buyers to sellers. The descending channel now acts as the primary framework. Every rebound inside this structure has been corrective and capped by channel resistance, which is classic sell-the-rally behavior. The sharp bearish candles show initiative selling, not just profit-taking, suggesting that supply is active and confident. As long as price remains below the channel midline and upper boundary, upside attempts are likely to be faded. From a supplydemand perspective, the failed rebound zones above are acting as overhead supply, while price is gravitating toward lower liquidity pools. The next key downside magnets sit around the 102.00 area first, followed by the deeper support near 97.30, and ultimately the larger liquidity pocket closer to 90.70 if momentum accelerates.

Macro:

Silver is highly sensitive to USD strength, real yields, and risk sentiment. Any stabilization in the U.S. dollar or easing of safe-haven demand typically pressures silver more aggressively than gold. This macro backdrop aligns with the current technical picture of distribution turning into markdown rather than a pause before continuation higher.

Silver is no longer in accumulation or trend continuation mode. It is now respecting a bearish channel, and until price reclaims the channel and breaks structure back to the upside, the path of least resistance remains down, with rallies serving as opportunities for sellers, not confirmation for longs.

Sell CHF/JPY at right shoulder of H&S patternI believe all the JPY crosses could be at an important reflection point and therefore I am looking to buy the JPY. There is a possible Head & Shoulders pattern forming on this pair with profit at the neckline incase the pattern doesn't complete.

Sell Limit : 200.30 right shoulder

Stop : 201.59 above head of H&S

Profit : 196.75 before neck line of H&S

Risk 1 : 2.75 / stop is 129 pips

Is Bitcoin Going to $65K?, Why Bearish Structure is Strong Bitcoin price action remains in a corrective phase, with price now trading below several key support levels on the lower time frames. As price approaches major decision zones, the focus shifts to the weekly timeframe, where higher-time-frame structure provides clearer context for direction.

On the weekly chart, Bitcoin has shown a clear rejection from the midpoint of the larger trading range. This midpoint has acted as a strong pivot historically, and failure to reclaim it suggests that recent upside moves were corrective rather than trend-defining. As long as price continues to trade below this level, downside risk remains elevated.

From a market structure perspective, Bitcoin is still operating within a macro lower-low environment, keeping the broader trend bearish. This structural weakness increases the probability that the current correction has further to run rather than resolving into immediate continuation higher.

If bearish conditions persist, the next major area of interest sits below $70,000, with the $65,000 region standing out as a key high-time-frame support zone. This level represents a potential tracking pivot where price may attempt to stabilize or form a longer-term base.

Until Bitcoin can reclaim the weekly range midpoint and invalidate the lower-low structure, the path of least resistance continues to point lower, keeping $65,000 in focus.

Silver Is Rolling Over Inside a Descending ChannelSilver has completed a clean trend transition. After a strong, well-respected ascending channel (green), price failed to sustain upside momentum and printed multiple rejection wicks at the channel top, signaling buyer exhaustion. That failure marked the start of a trend rotation, not just a pullback.

Technically, price has now broken down into a descending channel (gray), with structure flipping from higher highs to lower highs and lower lows. The orange and green moving averages have rolled over, and price is trading below dynamic resistance, confirming bearish control in the short term. Each bounce has been corrective and capped near the mid-channel — classic sell-the-rally behavior, not accumulation.

From a supply–demand perspective, the circled highs represent a distribution zone where smart money sold into late buyers. The sharp impulsive drops that followed show initiative selling, not profit-taking. As long as price remains below the descending channel resistance, rallies are likely to be faded, with downside continuation toward the lower channel boundary.

Precious metals are sensitive to real yields and USD strength. Any stabilization or rebound in the U.S. dollar, or easing of safe-haven urgency, typically pressures silver harder than gold due to its higher volatility and industrial exposure. This macro backdrop supports the current corrective-to-bearish phase rather than a fresh bullish expansion.

Silver is no longer trending up it is rotating lower inside a bearish channel. Until price reclaims the channel and holds above moving averages, the path of least resistance remains down, with bounces serving as liquidity for sellers, not signals of a new uptrend.

AUD/JPY :: Market Structure & Momentum ReviewAUD/JPY (Australian Dollar vs Japanese Yen) — Bullish Technical Setup + Macro Context + Correlation Watchlist 💹

📌 TRADE IDEA — PLAN

✔️ Market bias: Bullish trend confirmed — price respect on HULL MA pullbacks + strong RSI support, momentum still favoring upside continuation. (Technical momentum structure visible on daily/4H chart)

✔️ Entry strategy: Thief layering style (multiple limit buys):

💎 Buy Limits: 106.500 — 107.000 — 107.500 — 108.000 (you can add more layers based on your risk.)

➡️ Big picture: Layers capture pullbacks into value while keeping jungle-style risk control.

📌 Stop Loss (Thief SL): 109.500

– Adjust to your risk tolerance but keep it logical above recent swing highs.

📌 Target Zone: 🎯 106.000 first target

🔥 Police-force resistance + overbought zone likely to trap late sellers — escape profits early! (manage profit levels dynamically)

📌 Note (Respect the Market):

Dear Traders (Thief OG’s), this TP/SL is a guide — your profit is your choice. Trade smart, lock gains, manage risk. 🙌

📊 REAL-TIME FUNDAMENTAL CONTEXT (London Time)

🧠 Economic Drivers Impacting AUD/JPY:

🔹 AUD Strength Factors:

• AUD rally on improved risk appetite & Aussie CPI anticipation — strong commodity flows buoy AUD.

• AUD/JPY often tracks global risk sentiment (bullish in rally phases).

🔹 JPY Dynamics:

• Japanese inflation/currency dynamics shifting — Tokyo CPI slowdown tempers BoJ tightening expectations.

• Fresh reports suggest potential yen intervention signals from Japan’s PM & policymakers.

📆 Upcoming Key Releases (Watchlist):

• AUD CPI / RBA rate commentary — big volatility trigger.

• Japan GDP / BoJ policy updates — can bend JPY strength.

• Global risk news (equity, bond routs) — impact carry crosses like AUD/JPY.

🔗 RELATED PAIRS + CORRELATION WATCHLIST

• OANDA:AUDUSD – Shows overall Australian dollar strength. If AUD/USD holds bullish momentum, it supports AUD/JPY upside.

• FX:USDJPY – Direct Yen strength indicator. Strong USD/JPY = weak JPY → bullish pressure for AUD/JPY.

• OANDA:NZDJPY – Similar risk-on carry trade behavior; often moves in the same direction as AUD/JPY.

• OANDA:EURJPY – Confirms broader JPY sentiment during risk-on / risk-off market conditions.

🔁 Correlation Insight:

AUD/JPY performs best in risk-on environments (strong equities, rising yields) and weakens when safe-haven Yen demand increases.

🛠️ TECHNICAL & STRUCTURAL NOTES

📍 Minor cross pair — subject to volatility swings but tradable with layered entry strength and defined risk.

📍 Daily/4H HULL & RSI show supportive pullbacks into key levels.

📍 Price above 100-EMA indicates medium-term bullish structure with reasonable support.

🧠 THIEF TRADER MOTIVATION & WISHES 💎🔥

💬 “Trade like a smart thief — take only what the market gives you, exit before resistance hits. Patience + precision = profit.”

💬 “Layers stack profits, discipline stacks equity.”

💬 “Be a strategist, not a spectator.”

Wishing every Thief OG 📈 smart entries, shark-level exits, and snowballing profits! 🦈💰

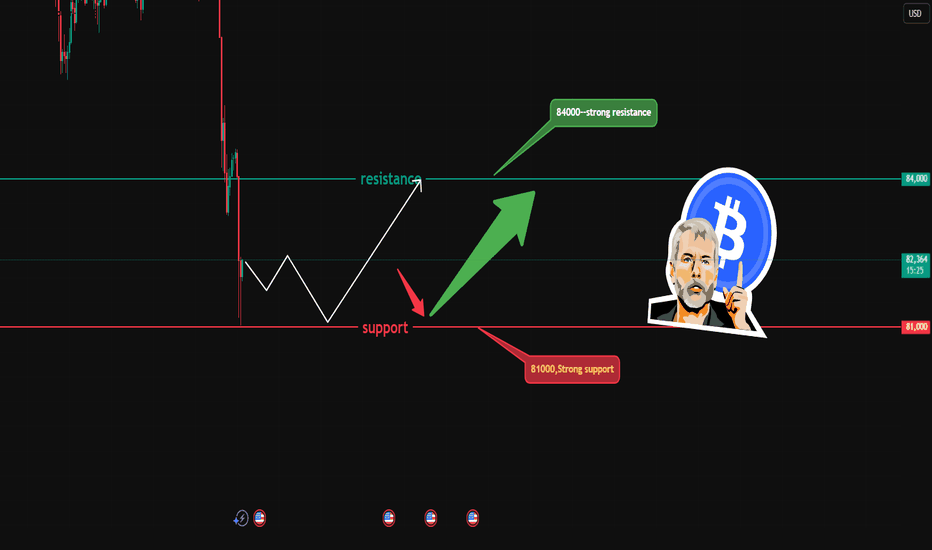

Bitcoin trading strategy

and the current Bitcoin market has entered a critical stage of high-level correction and intensified bullish-bearish struggle. After the previous surge, the price quickly declined due to three pressures: ETF fund outflows, concentrated selling pressure from those trapped at previous highs, and profit-taking on-chain. Short-term bullish momentum has significantly weakened, and market sentiment has turned cautious.

Structurally, the price has broken below a key psychological level, and the technical indicators show a weak consolidation and correction cycle. Multiple rebound attempts have been met with resistance, and trading volume remains weak, lacking the sustained funding support for a continued upward move. However, the underlying logic of the long-term bull market has not completely collapsed; whale buying and institutional long-term allocation demand still exist, providing temporary support.

In terms of trading strategy, we maintain the core principle of primarily focusing on long positions at low levels and being cautious with short positions at high levels. Avoid chasing highs, and instead, build positions in batches around strong support levels, strictly controlling leverage and stop losses. Do not try to predict the bottom or trade against the trend. Wait for volume to recover and for clear directional signals before the market returns to an upward trend.

Bitcoin trading strategy

buy:81000-82000

tp:83000-94000

SPX500 and NAS100: Market Context Analysis📊 SPX500 Analysis

━━━━━━━━━━━━━━━━━━━━━━

Price is interacting with liquidity within the inefficiency zone, which suggests that large players are accumulating long positions in these areas (blue rectangles). However, price struggles to hold above.

Note how price engages with buy-side liquidity at the highs (marked with purple lines) without any strong acceptance. In essence, the objective of these local bullish moves is liquidity itself: price sweeps liquidity and then immediately retraces to test the inefficiencies or to take sell-side liquidity resting near the lows.

This is how large players generate profit — accumulating at the lows and distributing at the highs.

━━━━━━━━━━━━━━━━━━━━━━

After the most recent liquidity sweep into the TFVG, price formed an IFVG, confirming a shift in the local order flow. However, it is important to understand that such a shift in order flow must have an objective, and the ultimate objective is revealed through price reaction.

Yesterday, price tapped the 7000 level but once again failed to achieve acceptance in that area. This signals uncertainty.

For confidence in a continuation of the bullish move, we need further confirmation in the form of acceptance with imbalance formation around 7016 or higher.

If that does not occur, price is likely to revisit the Fair Value Gap (marked in purple).

In that scenario, the reaction from that zone will be key.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📉 NAS100 Analysis

━━━━━━━━━━━━━━━━━━━━━━

The situation on Nasdaq is similar, except for the relative weakness compared to SPX. This is evident in the fact that SPX has already printed a new ATH, while Nasdaq has only approached that area.

In other words, if U.S. indices start to move lower, Nasdaq will most likely decline more aggressively — in terms of pure range, it tends to deliver a larger move.

━━━━━━━━━━━━━━━━━━━━━━

Price has achieved acceptance above the last high, meaning external liquidity has been taken.

I will be waiting for price to return into the internal area of interest for position rebalancing.

The key confirmation for confidence in the continuation of the bullish move, in this case, will be SPX.

Feel free to ask your questions in the comments.

Enjoy!

NAS100 QQQ CRACKING! AGAIN!NASDAQ has been CRACKING everywhere, structure after structure. Now it's forming a major double top.

What we need to see now is lower lows and highs in a commanding way. If it continues this back-filling, then I would call this a High base for more upside.

This is a simple, low-risk, short setup. Trading it against previous highs. (even if it breaks a bit above it) with a lot of downside potential!

This is the cost of doing business the right way. Be willing to take the small hits until you get PAID! WELL!

So I would forget about this trade if I were planning to jump in and out. I would hold it, giving time to PAY ME!

If you enjoy the work:

👉 Drop a solid comment

Let’s push it to 6,000 and keep building a community grounded in raw truth, not hype.

Bitcoin Down to 60's, 50's in 2026October should be the bottom based on cycles.

ATL 2015 to ATH 2017 = 1064d

ATH 2017 to ATL 2018 = 364d

ATL 2018 to ATH 2021 = 1064d

ATH 2021 to ATL 2022 = 364d

The pattern would print this cycle's ATH on the 6th of October 2025.

We indeed saw the top on October 2025. 364 days takes us to early October low.

ETH Sell/Short Setup (4H)Based on the price reaction at the FLIP zone, the loss of the ascending trendline, and the formation of a bearish CH (Change of Character), it seems that bearish momentum is starting to take control of the market. These factors together suggest a potential shift in market structure in favor of the sellers.

We have marked two red dashed lines on the chart, which represent our planned entry zones. These areas are selected based on structure and price behavior, not emotions or anticipation.

The targets are clearly defined and labeled on the chart in advance. Risk management is a priority in this setup. Once Target 1 is reached, the position should be moved to break-even in order to protect capital and eliminate downside risk.

If the stop loss is triggered, it simply means we are out of the trade—no revenge trading, no overthinking. This is part of the plan and must be respected.

Now we wait and let the market decide. Patience and execution matter more than prediction.

Normally, we do not share such clean and straightforward setups here. This example is posted purely for educational purposes, to demonstrate how we approach structure-based trading and risk management.

Let’s see how price reacts and what the market delivers.

If you have a coin or altcoin you want analyzed, first hit the like button and then comment its name so I can review it for you.

This is not a trade setup, as it has no precise stop-loss, stop, or target. I do not publish my trade setups here.

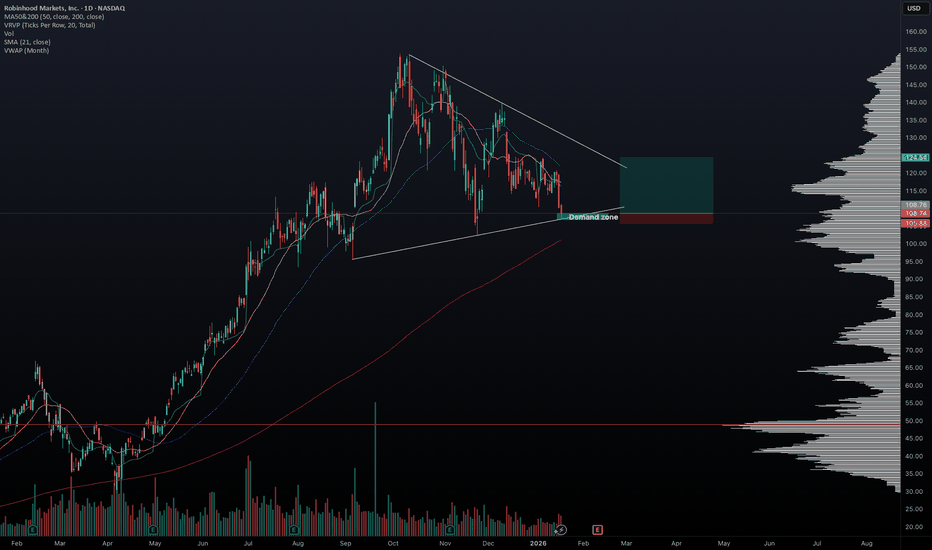

01/18/2026 HOOD longHello traders,

I’m seeing many S&P stocks forming wedge patterns (QQQ is also forming a wedge), and HOOD is one of them. While the exact catalyst for the next market move is unclear, it appears something is cooking, and a directional move may be approaching. HOOD is currently sitting near the lower boundary of its wedge and could bounce toward the upper range. Let’s stay disciplined and trade cautiously in this choppy market.

May the trend be with you.

AP

Order Block Theory: Trading Institutional FootprintsStop drawing random trendlines. Banks do not look at your diagonal lines. Banks trade based on Liquidity and Equilibrium.

If you want to trade like a relentless machine in 2026, you must learn to spot the "Footprints" that institutions leave on the chart. These footprints are called Order Blocks (OB).

Today, we are moving beyond "Support and Resistance" and entering the world of Smart Money Concepts (SMC).

1. What is an Order Block?

When a massive institution (like BlackRock or a central bank) wants to buy $100 Million of Bitcoin, they cannot just click "Buy." It would spike the price instantly, giving them a terrible entry.

Instead, they manipulate the price.

They Sell heavily to drive the price down into a liquidity zone (inducing panic sellers).

They absorb all that panic selling with their massive Buy orders.

The price explodes upward.

The Footprint: That final "Sell Candle" before the explosion is the Bullish Order Block. It represents the institutional point of interest.

2. How to Identify a Valid OB

Not every candle is an Order Block. A valid OB must meet three criteria:

Violence: The move away from the candle must be explosive. It should leave behind a "Fair Value Gap" (FVG) or Imbalance (a gap where price moved too fast).

Break of Structure (BOS): The move must break a previous High (for bullish) or Low (for bearish). This proves the institutions are in control.

Unmitigated: The price has not returned to this level yet.

How to Spot Valid and Invalid Order Blocks

Not every order block is worth trading. Some levels look good on the chart but fail quickly when price comes back. Common signs of a weak or fake order block include:

*Price didn’t move away clearly after the block formed

*No push beyond a nearby high or low before the move

*The zone has already been tested or traded through (mitigation block)

*Price returns and moves straight through with little or no reaction

*The move looks slow or messy instead of clean and decisive

Bullish Order Block

A bullish order block is a price area where buying showed up just before a strong move up. It often appears near the end of a downward move, close to the last bearish candle before price starts rising.

When price comes back to this area, it may slow down or bounce, which is why traders often see it as a potential support zone.

Bullish OB: The last Red Candle (Down) before a violent Green Move (Up).

Bearish Order Block

A bearish order block is a price area where selling showed up just before a strong move down. It usually forms near the end of an upward move, close to the last bullish candle before price starts falling.

Bearish OB: The last Green Candle (Up) before a violent Red Move (Down).

3. The "Cheat Code": How to Spot Them Automatically

If you are new to SMC, your eyes might trick you. It can be difficult to distinguish between a "random candle" and a "valid institutional footprint."

To solve this, I personally use a specialized tool to filter out the noise:

Tool: Tuffy SMC OB Indicator (by TuffyCalls).

Why it works: It automatically highlights only the Order Blocks that have caused a Break of Structure (BOS), saving you hours of chart time. You can find it in the public library or check my profile for the setup.

4. The "Mitigation" Strategy (Why Price Comes Back)

This is the secret sauce. Why does Bitcoin often crash, touch a specific line to the dollar, and then skyrocket?

The Logic: Remember step 1? The Bank Sold to drive the price down before they Bought. This means they still have Short Positions open that are technically in a loss as the price rockets up.

They must bring the price back down to their Order Block to close those Short positions at Breakeven before they let the price fly to the moon. This process is called Mitigation.

Your Trade:

Entry: You place your Limit Buy Order at the Top (Open) of the Bullish Order Block.

Stop Loss: Just below the Bottom (Wick) of the Order Block.

Target: The next major liquidity pool (previous high).

Conclusion

Trading Order Blocks requires patience. You are no longer chasing green candles; you are acting like a sniper, waiting for the price to come to you.

Retail traders chase the pump.

Smart Money waits for the retest.

Draw the block (or let the Tuffy SMC indicator draw it for you), set the alert, and wait for the footprint.

GBP/USD | Moving forward (READ THE CAPTION)As you can see in the hourly chart of GBPUSD, it is now being traded in the highest price ever since October 2021! currently being traded at 1.38130, showing no indication of a bearish turn.

It has gone through today's NDOG several times but it returned to it every time.

Should it touch the NDOG again, if it fails to hold above it, it may fall down further to 1.37640 again.

Bullish Targets: 1.38340, 1.38490, 1.38640 and 1.38750.

Bearish Targets: 1.38100, 1.37950 and 1.37800.

Gold Intraday Trading Plan 1/30/2026Gold was very crazy yesterday. It went up to near 5600 and dropped almost 5000 pips to 5098 and closed above 5300. Nowadays, it can easily went up and down by 1000 pips. As it has re-entered the previous channel, I am expecting it to continue to fall at least to channel bottom again and go up from there.

Therefore, I will sell at 5407 and buy from around 5250.

Three Trades to Watch: 30 January 2026The final week of January has delivered the volatility traders were promised. We are witnessing a historic decoupling in precious metals and a rise in META and TSLA following better than expected earnings reports.

Here is the technical and fundamental alpha you need to capture the momentum.

1. Gold ( CRYPTOCAP:XAUT ): The Unstoppable Breakout

While Bitcoin consolidates, Gold has chosen violence. The asset has shattered multi-year resistance levels to enter true price discovery mode. The "Digital Gold" narrative may be pausing, but the original safe haven is breaking out, driven by renewed central bank accumulation and persistent inflation fears for the 2026 fiscal year.

The Central Bank Put:

The breakout isn't just retail speculation; it is structural. Global central banks, particularly in the East, have accelerated gold accumulation to diversify reserves away from fiat treasuries. This creates a "price floor" that didn't exist in previous cycles. Furthermore, real rates have decoupled from gold prices—historically, high rates crushed gold. In 2026, gold is rallying despite rates, signalling a total loss of faith in sovereign debt sustainability. It is also significantly outperforming Bitcoin (BTC) during its current phase of consolidation, cementing its role as the preferred safe-haven asset for this cycle.

Trader’s Takeaway : Do not short a parabolic breakout in price discovery. Watch for a retest of the breakout level to build long exposure. The trend is your friend until the daily structure breaks.

2. Meta ( NASDAQ:META ): The Efficiency Engine Roars

Meta’s Q4 earnings release on Wednesday silenced the bears. Defying fears of a "Capex Trap", Meta reported better-than-expected revenue growth and demonstrated that its massive AI spend is finally converting to ad-revenue efficiency.

AI Monetisation

The bear case was that Zuckerberg was burning cash on AI with no return. The Q4 report dismantled this. The "Family of Apps" operating income surged, driven by AI-powered ad targeting that has restored conversion rates to pre-IOS14 levels. Crucially, the Reality Labs loss narrowed slightly, showing that the "Year of Efficiency" wasn't a one-off gimmick—it's the new operating standard.

Technical Analysis: The Gap and Go

Pattern : The post-earnings action formed a classic "Runaway Gap." Unlike exhaustion gaps, this occurs midway through a trend, signalling a continuation of the move.

Volume Profile : We saw a massive volume node at the earnings open. This suggests institutions stepped in to defend the price, creating a "line in the sand" for bulls.

Moving Averages : The price has reclaimed the 50-day EMA with conviction. As long as the price stays above the gap fill, the momentum remains bullish.

The Funding Edge : The difference in holding costs is staggering. Analysis of funding rates over the last 32 hours shows that while Hyperliquid’s annualized rate spiked as high as 18%—averaging nearly 8%—BitMEX funding rates remained flat at 0.00%.

3. Tesla ( NASDAQ:TSLA ): The Growth Story Resets

Tesla delivered a surprise earnings beat in Q4 2025, reporting adjusted EPS of $0.50 (vs. ~$0.45 expected), which helped steady the stock despite a 3% year-over-year revenue decline.

Margin Stabilisation

The fear was a race to the bottom on EV pricing. However, Tesla revealed that auto gross margins (ex-credits) have bottomed and are ticking up. This "margin trough" is the signal institutional allocators were waiting for. Additionally, Energy Storage revenue grew triple-digits YoY, finally becoming a material contributor to the bottom line, diversifying the risk away from pure auto sales.

The Funding Rate Arbitrage Opportunity on BitMEX:

The rush into Tesla longs caused financing costs to explode on retail-heavy exchanges. Data from earnings day reveals that Hyperliquid funding rates for TSLA skyrocketed to over 100% APR at peak volatility. In stark contrast, BitMEX funding held firm at 0.00%.

Lingrid | AUDNZD Rally Expected Following Trendline BreakoutFX:AUDNZD perfectly played out my previous trading idea . Price is testing the descending trendline and now stabilizing above former resistance, suggesting a shift in control back to buyers. The recent pullback held above the rising channel base, forming a higher low and confirming that downside pressure is being absorbed rather than expanded. Price action inside the consolidation looks constructive, with momentum gradually rebuilding.

If buyers continue to defend the 1.1610 demand area, it could attempt another leg higher toward the 1.1734 resistance zone. A successful continuation would align with the broader channel structure and favor trend extension.

➡️ Primary scenario: hold above 1.1610 → push toward 1.1734.

⚠️ Risk scenario: a sustained break back below 1.158 may weaken bullish structure and delay upside continuation.

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

#6,000.80 benchmark ahead / excellent ProfitsAs discussed throughout my yesterday's session commentary: 'My position: I have been waiting for Gold to invalidate #5,200.80 benchmark all session long as I was well aware if Gold establishes #5,200.80 benchmark as an Support, Medium-term stays Bullish and new #6,000.80 psychological benchmark Target can be pursued with my set of key re-Buy orders (both Short and Medium-term). As soon as #5,200.80 is tested first time, I spotted that Gold delivered firm Support zone within #5,178.80 - #5,184.80 last night, I Bought Gold there aggressively with set of Buying orders waiting for final #5,200.80 break-out which was delivered on Asian session market opening where I closed my set of Buying orders on #5,223.80 and closed all of my orders. Needless to mention besides all Fundamentally (critically) Bullish / Gold-friendly pointers, most important one is DX taking strong hits with every Hourly candle which is adding enormous Buying pressure on Gold. I will continue Buying Gold from my key entry points maintaining my next Medium-term Target seen Trading at #6,000.80 benchmark.'

I have engaged new set of Buying orders on #5,272.80 as Gold established QM Support there and as I spotted that Gold always delivers distinguished Support level (in form of Buying accumulation) and only then deliver major move to the upside. I have closed my orders on #5,352.80 benchmark with excellent Profit. As Gold extended the rise, I have waiting (now already traditional) market closing which in most cases opens with a Gap and engage two time #100 lot's Buying orders on #5,416.80 / and as Gold opened with a Gap, I closed my both orders on #5,452.80 extension with spectacular Profit.

My position: Once more Gold is being utilized as a safe-haven as crypto market and DX in particular are suffering significant losses. However as before, I am making use of the DX as my key indicators to suggest the underlying trend for Gold, which remains critically Bullish, as the DX made a solid Technical Low's throughout yesterday's session and dipped strongly, assisted also by fluid Fundamentals which are not DX-friendly. As I determined the trend, every dip on Gold for me is distinguished re-Buy opportunity and I will stick to this strategy for full Profit maximization. My ideas are posted a bit late from usual time I post however I am Trading into late night almost every evening. I will continue Buying Gold from my key entry points and just finished #5,506.80 - #5,524.80 few moments ago. #6,000.80 mark represents my next Medium-term Target and keep #5,432.80, #5,452.80, #5,462.80 as key re-Buy points.

4 Key Bullish Reversal Patterns And a Quick Guide4 Key Bullish Reversal Patterns And a Quick Guide

When you see a chart it is like looking at a map.

If nobody tells you what everything means it would be impossible to know what you are looking at. But if you know the meaning of those lines colors or letters you will know how to get from one place to another safely.

In the stock market it is the same.

You have a map of price and volume made by the orders we all executed. The chart does not lie. It is transparent about what happened.

And sometimes, just sometimes, it is easy to read and know that the odds are in your favor.

Today I share 4 bullish reversal patterns that I find very interesting. I use them every day and they are easy to detect and trade.

1️⃣ Double Bottom

This pattern has two identical lows and a line called the neckline formed by the highest peak between both lows.

If this line breaks to the upside it is a good time to buy and go long. If it does not break do not do anything!

As an example:

And how do you know where to sell? You should always look at previous points of reference like support or resistance but using Fibo levels in these cases works very well. The most typical way is to use the 61.8% or 100% extension of the size of the Double Bottom . This is measured from the minimum to the maximum that forms the neckline. The bigger the Double Bottom the higher the expectation for the rise.

The white circles show how the Double Bottom reaches 61.8% and later 100% of the pattern.

2️⃣ Inverted head and shoulders

This pattern gets its name from its shape but in this case we flip the H and S. We must see 3 peaks where the two side peaks do not go past the central peak. Their highs create a resistance line.

When this happens it means the price reached those levels with strength but stopped. After several tests it is l osing more and more strength leaving that central peak further away.

Let us see an example that doubled the price in one year.

3️⃣ Bullish Engulfing

This pattern has a bearish candle followed by a day with a candle that starts at an even lower price but ends clearly above the highs.

This pattern by itself is not very interesting to me but seeing it in a support zone is a great signal for me.

In this case NYSE:A was falling hard and it is never a good idea to buy then .

But look at how the yellow zone was previous lows and it started to look interesting even though that last candle was an 8% drop in one day! That is crazy.

The next day the price starts even lower than the day before but achieves an 11% move up. Without knowing anything else about fundamentals or news this is just great news for buying. Bullish engulfing in a support zone with huge daily moves. Something big is happening.

In the following months the stock returned 18% after the bounce from this bullish engulfing.

4️⃣ MORNING STAR

This pattern could fill several articles. It has many variations and possible traps. This is perhaps the most complex one to understand but the idea is that after a relevant drop there is a day of calm like a doji or a small candle to go back up the next day.

This is a very common pattern and it is vital to see it in support zones like the previous one. This gives it more credibility and more chances of being a real trend change and not just another bounce.

In this case in NASDAQ:MU we saw a huge rally in a few days of more than 60%. It is a small bullish engulfing but in a zone where the price had already shown strength. Buyers were appearing and the morning star confirmed it.

In NYSE:S something similar happens. First support levels and then the morning star arrives in a strategic zone.

SentinelOne ended up rising 45% after the Bullish engulfing .

If you look closely some of these patterns can be confused with others. But it is not a mistake. Patterns can coexist and even overlap when you study them. In the end people have seen that certain patterns move the price in one direction and everyone focuses on a different shape. For example the inverse H and S can be understood as a triangle.

It is okay. The break is the same.

The important thing is not which pattern it is but that you start being able to see these patterns and how they work. Over time you will improve your technique to find them.

👇 WANT MORE?

🚀 Hit the rocket, read my profile and follow so we can find each other again.

GOLD: Rally Hits Our Key Target ZoneGold futures gained fresh upward momentum today, climbing to yet another new high. The price is now trading well inside our red Short Target Zone, which ranges from $5,416 to $6,362.

We will take Profits here on ALL Gold longs and maybe even open a short.

We do have a bit of room left inside the target zone, but as soon as the upwards momentum comes to a halt, we anticipate the completion of the larger green wave , which should trigger a significant reversal to the downside. Accordingly, we are preparing for a major decline phase—starting with a break below the support levels at $4,197 and $3,901.

Traders looking to capitalize on this move can consider short entries within our red Target Zone. For risk management, a stop can be placed 1% above the upper edge of the zone.