Gold Short Trade - IntradayThis intraday trade should be quick and short, as soon as Bulls starts to give up.

1. Price reached the orange CL

2. Price left the L-MLH

3. Pullback to L-MLH expected and fullfilled.

4. Price weakens after Test/Retest of L-MLH

Short with no doubt, just following the rules.

Subscribe for my Newsletter §8-)

Community ideas

Gold Outlook (GC / COMEX, 1D)Gold just broke above a multi-month resistance line and followed through hard into the 5,300 area. The move is steep, but it’s coming after a long grind up and repeated higher lows, not a single one-off spike.

What I’m watching

Price is extended and momentum is elevated on the daily. That usually leads to one of two things: a sideways base to cool off, or a pullback into the breakout area.

Key levels

5,300 is the current high and obvious overhead reference.

5,000 is the first big psychological level below.

4,700 to 4,650 is the breakout zone from the prior resistance line. If this is a real trend continuation, this area is where buyers should show up on a pullback.

4,400 is the last major swing area below that. Losing that would change the structure.

Scenarios

1) Continuation (most likely while trend holds)

A brief consolidation under/around 5,300, then another push higher. This is typical after a clean breakout when dips stay shallow.

2) Pullback and retest (healthy)

A retrace back toward 5,000 and potentially into 4,700–4,650. If price holds there and bounces, that’s still a long trend, just with better entries.

3) Failed breakout (low probability but important)

Acceptance back below the breakout zone (4,650 area) and continued weakness. That’s the first sign this was exhaustion rather than trend continuation.

Invalidation for the long bias

Long bias stays intact as long as price holds above the breakout zone (roughly 4,650–4,700). A clean break and acceptance below it is where I stop treating this as a trending market.

This lines up with the “institutional hedge” angle too. The chart looks like steady accumulation that turned into an upside expansion, not a retail chase.

Dow/Gold flashes GFC warningTop: Dow / Gold ratio

Bottom: SP:SPX

The Dow/Gold ratio shows How many ounces of gold does it take to buy the Dow Jones Industrial Average.

It gives insight into the question “who’s winning: paper or metal?”

It moves often coincide with large inflection points.

The current level typical coincides with stock market tops:

1929

1972

1974

2008

XAUUSD: Continues Uptrend After Breakout, $5,170 in FocusHello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

XAUUSD is trading within a strong and well-established bullish trend, supported by a clearly defined upward channel that has guided price higher over an extended period. Throughout this move, Gold has consistently respected the channel structure, printing higher highs and higher lows, which confirms sustained buyer dominance and healthy trend conditions rather than an exhausted rally. In the middle of the trend, price paused and formed a consolidation range, signaling temporary balance and accumulation before continuation. This range acted as a base, after which XAUUSD broke out decisively to the upside, triggering a powerful bullish impulse. Following the breakout, price accelerated higher and began respecting a rising triangle support line, showing that pullbacks remain shallow and corrective in nature.

Currently, Gold broke above the marked Support Zone, confirming a clean structure flip where former resistance turned into support. This breakout was followed by acceptance above the level, indicating strong buyer commitment rather than a false move. Price is now trading above the support zone and continues to trend higher toward the upper boundary of the structure. Above the current price, a clearly defined Resistance Zone around the 5,160–5,170 area stands as the next major technical obstacle. This zone represents a higher-timeframe supply area where profit-taking or temporary selling pressure may emerge. However, so far, there are no strong signs of impulsive rejection, and price action suggests continuation strength rather than distribution.

My Scenario & Strategy

My primary scenario remains bullish as long as XAUUSD holds above the Support Zone around 5,050–5,070 and continues to respect the rising structure. A controlled pullback into support, followed by bullish continuation signals, would offer a favorable continuation setup. I expect buyers to maintain control and attempt a push toward the Resistance Zone near 5,170 (TP1). A clean breakout and acceptance above this resistance would confirm trend continuation and open the door for further upside expansion within the broader bullish channel.

However, if price reaches resistance and shows clear rejection, a short-term corrective pullback toward the support zone or the rising triangle support line would be a healthy and expected move within the trend. Only a decisive breakdown and acceptance below the support zone would weaken the bullish structure and signal a deeper corrective phase. For now, structure, momentum, and price action continue to favor buyers.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

SPX500 H4 | Bullish ContinuationMomentum: Bullish

Price is currently above the ichimoku cloud.

Buy entry: 6,976.08

- Pullback support

- 23.6% Fib retracement

Stop Loss: 2,946.65

- Swing low support

Take Profit: 7,017.09

- Swing high resistance

High Risk Investment Warning

Stratos Markets Limited (fxcm.com/uk), Stratos Europe Ltd (fxcm.com/eu):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (fxcm.com/en): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited (fxcm.com/au):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com/au

The Origin of Displacement never lies ;)Weekly structure is bullish

Daily is bullish

H4 is bullish

Institutional intent to confirm more buys occurred in H2

H2 FVG needs to get filled and properly balanced up so we can resume trading fairly

Bullish intent confirmed by the inefficiency

M30, H1 and H3 OB as our POI

POI in discount level

Apply proper risk management

Stop loss is 21 pips if you're using the entire M30 candle but it can be sharpened to 13 pips if you ignore the wick on top and use the body and bottom wick.

Use the daily high to set your TP

This is a swing setup :)

UiPath good R/R UiPath presents a potential long setup opportunity. There is a mitigation zone around the $15 range, with possible expansion toward the first macro target at $20. However, there is an open imbalance around the $13 range, which would serve as the stop-loss (SL) for this setup.

Not finacial advice.

AUDUSD BUY CallThe pair shows strong bullish conditions, with the highest positive reading of +3.83 on the weekly heatmap after divergence pairs. The 4H timeframe is in a clear bullish structure, and the 1H timeframe is aligned with the bullish trend, currently showing a minor pullback, which provides a favorable buy opportunity.

The trade is planned as a buy at CMP, with the stop loss placed at (Alligator Jaw price − 1 × ATR), where ATR is used as a volatility buffer.

The setup follows a 1:1 risk-to-reward ratio, with a recommended risk of 0.5% of account balance per trade.

Trade management involves moving the stop loss to breakeven once 80% of the take-profit target is achieved.

Coach Miranda Miner Thoughts - SPX 7,000 vs PSEI: Why the Philippine Market Is Pricing Confidence, Not Growth

Core Thesis

The performance gap between the S&P 500, now above 7,000, and the Philippine Stock Exchange Index is not primarily a story of technology dominance versus old economy exposure. The deeper driver is a persistent confidence and governance discount embedded in Philippine equities. This discount suppresses valuation multiples, discourages sustained capital inflows, and structurally caps upside regardless of headline GDP growth.

1. The Economy–Equity Market Disconnect

The Philippines has posted relatively strong GDP growth compared with many peers, yet the PSEI has delivered flat to negative real returns over the past decade. This divergence signals that equity prices are not tracking economic expansion, but rather investor skepticism about the durability and credibility of that growth.

While U.S. equities benefit from a clear translation of growth into earnings and reinvestment, Philippine equities are discounted due to uncertainty around execution, policy continuity, and institutional reliability. Growth exists, but the market does not trust its conversion into long-term shareholder value.

2. Structural Market Fragility Magnifies Risk

The Philippine equity market remains structurally thin relative to global and regional peers.

Liquidity is persistently low, making prices highly sensitive to foreign flows

Market breadth is narrow, dominated by banks, property, and conglomerates

IPO activity has been weak, limiting capital formation and future growth narratives

These conditions amplify volatility and reduce resilience during risk-off periods. In contrast, the U.S. market attracts capital not only because of innovation, but because of depth, scale, and constant reinvestment through listings and corporate activity.

3. Governance Risk as a First-Order Valuation Variable

This is the most underappreciated driver of PSEI underperformance.

Repeated corruption probes, infrastructure controversies, and regulatory uncertainty have directly influenced investor behavior. Analysts and market participants increasingly cite governance credibility rather than earnings weakness as the main reason Philippine equities trade at a persistent valuation discount.

In practice, political and institutional risk is being priced as a permanent earnings drag. This elevates required risk premiums, suppresses multiples, and discourages long-term foreign participation.

4. Confidence Has Become a Pricing Mechanism

Unlike U.S. markets, where earnings growth and productivity dominate price discovery, sentiment and institutional trust function as macro variables in Philippine equities.

This creates a self-reinforcing loop:

Weak confidence reduces participation

Low participation depresses prices

Depressed prices further deter capital

As a result, rallies fail to sustain even when fundamentals improve. The market’s underperformance is therefore structural rather than cyclical.

5. Why Correlation With SPX Breaks Down

The divergence between SPX and PSEI reflects capital allocation preference, not economic destiny.

Global investors allocate toward markets offering:

Liquidity

Transparency

Rule-of-law credibility

Policy predictability

Until these conditions improve, Philippine equities remain structurally underweighted in global portfolios. Sector rotation alone will not close the gap. Any meaningful re-rating requires restored institutional trust and market credibility.

Key Takeaway

The Philippine market is not underperforming because it lacks growth. It is underperforming because growth is being discounted by governance risk and structural fragility. Confidence is the true valuation multiplier, and until it improves, the PSEI will remain disconnected from global equity momentum even as the S&P 500 continues to make new highs.

Footnotes / Sources

Rampver Financials, Global Investing for Filipinos Is a Must

reads.rampver.com

Ginlix AI, World’s Worst Market Performance and Recovery Challenges

www.ginlix.ai

i3Investor CEO Morning Brief, Philippines Seeks Fix for World’s Worst Performing Stock Market

klse.i3investor.com

PhilStar, Have We Seen the Bottom in Philippine Stocks

www.philstar.com

SP500 Showing Rejection Pattern what should Next ?S&P 500 showing rejection from the 7,000 psychological resistance zone after a strong bullish rally. Price failed to hold above this level and formed a sharp bearish candle, signalling selling pressure and possible short-term trend exhaustion.

area marks a supply/resistance zone where sellers are active. As long as price stays below 7,000, further downside correction is likely. A minor pullback and consolidation may occur first, but continuation lower remains the stronger scenario.

Resistance Level ; 69,50 / 7,000

Support Levels ; 6,80 / 6,840

If 6,880 breaks, price could accelerate toward 6,840, which is the next strong demand area. Only a clean break and hold above 7,000 would invalidate the bearish outlook and open the path for continuation higher.

You may find more details in the chart,

Trade wisely best of Luck Buddies.

Ps; Support with like and comments for better analysis Thanks For Supporting.

TON Buy/Long Signal (12H)On the chart, we are currently observing a bullish Change of Character (CHoCH), and importantly, the low that initiated this structural shift has not been taken out. This level is acting as a key demand zone and a strong defensive line for buyers, indicating that bulls are still in control of the market structure.

From a price action perspective, TON appears to be attempting to form a double bottom at the lower range, which is often a classic bullish reversal or continuation pattern. This structure suggests that sellers are losing momentum while buyers are gradually stepping in to absorb supply and prepare for a potential upside expansion.

As long as no candle closes below the previous low, the bullish scenario remains valid. Holding above this critical support increases the probability that TON can complete this bullish setup and push price higher, potentially targeting higher liquidity zones and resistance levels.

Overall, market structure, price behavior, and buyer defense at the lows all support a bullish continuation bias, unless the key support is decisively broken with a strong close below it.

If you have a coin or altcoin you want analyzed, first hit the like button and then comment its name so I can review it for you.

This is not a trade setup, as it has no precise stop-loss, stop, or target. I do not publish my trade setups here.

TESLA: "The Future is Abundant" The single most important signal on this chart is the shallowness of the pullback.

Normal Behavior: A healthy trend usually pulls back to the 0.382 (Orange line) or 0.5 (Green line) to "refuel."

Tesla’s Behavior: It is refusing to even touch the 0.382 ($390). It is hovering right at the 0.236 Fib ($432.53).

The Verdict: This signals "Urgency." Buyers are so eager to get in that they are stepping in front of each other at shallow levels ($430) rather than waiting for a bargain at $390. This is the hallmark of a stock that wants to go to new All-Time Highs fast.

2. Technical Analysis: The Levels

A. The "Launchpad" Support ($432.53)

The Red Line (0.236 Fib).

Price Action: The recent wicks dipping below the red line and immediately snapping back up.. That is Algo Support. Every time the price touches $432, programmed buy orders are triggering.

Current Price ($438): As long as TSLA stays above $432, it is in a "Bull Flag" consolidation, preparing for the next leg up.

B. The "Gap" Below (The Risk)

Because the stock is so high up, there is an "Air Pocket" below.

If the $432 level fails, there is no structural support until the 0.382 Fib at $390.81. That is a $40 drop.

Note: Even a drop to $390 would be perfectly healthy and bullish (it would just be a standard pullback), but the current strength suggests the market doesn't even want to give us that discount.

C. The Target: $500 (Psychological Barrier)

The 0 Level ($499.95) is the magnet.

Round numbers like $500 act as gravity. The closer we get, the harder it pulls.

Tesla fits the "Tariff Beneficiary" narrative. If trade wars heat up in 2026, domestic manufacturing (Tesla's US Gigafactories) is premium. The market is pricing Tesla as a winner in a fragmented world.

4. Forecast & Strategy

Scenario A: The "High & Tight" Breakout (Most Likely)

The Setup: Price continues to chop sideways above $432, allowing the moving averages to catch up.

The Trigger: A high-volume push back toward $475.

Target: A retest of the $500 high. Breaking $500 puts it into "Blue Sky" discovery.

Scenario B: The "Healthy Flush"

The Trigger: A daily close below $432.

The Move: A quick flush down to the 0.382 Fib ($390).

The Play: If this happens, $390 is a "Back the Truck Up" buy zone. It aligns with previous consolidation highs and would be the first major opportunity for institutional money to reload.

Tesla is a leader. I am losing sleep over my Bitcoin chart, but this Tesla chart suggests I should sit on my hands and let the trend work. The line in the sand is $432.

_____________________________

The "Future is Abundant" narrative is Tesla’s clear pivot away from being evaluated strictly as an automotive manufacturer (where growth has slowed) toward being valued as a "physical AI" and energy utility ecosystem.

Based on the Q4 and FY 2025 investors deck and earnings call, here is an in-depth breakdown of the earnings, the 2025 reality versus the 2026 promise, and the roadmap for their autonomous future.

1. Executive Summary: The Pivot is Real

The headline financials show a company in transition. While the core automotive business shrank in 2025, the "Abundant Future" narrative is being funded by massive growth in Energy Generation and sustained by a war chest of $44B in cash. The story of this quarter is no longer about how many Model Ys were sold, but about how quickly Tesla can deploy training compute (Cortex clusters) and Robotaxis.

2. Financial Deep Dive (Q4 & FY 2025)

The "expected" value for a growth company is usually double-digit revenue expansion. Tesla missed that mark on the top line due to automotive headwinds but is protecting profitability through other segments.

Metric | Reported Q4 2025 | YoY Change | Context & Narrative

Total Revenue | $24.9B | -3% | "Automotive dragged this down, but Energy (+25%) and Services (+18%) prevented a steeper drop."

Auto Revenue | $17.7B | -11% | A significant contraction. Tesla attributes this to lower vehicle deliveries and lower ASPs (Average Selling Prices).

Energy Revenue | $3.8B | +25% | "The new growth engine. This is the highest quarterly deployment ever, driven by Megapack."

Non-GAAP EPS | $0.50 | -17% | "Profitability took a hit from the revenue drop, but they maintained a solid cash position."

Free Cash Flow | $1.4B | -30% | "Down significantly YoY, largely due to massive AI capital expenditures ($2.4B in Capex this quarter)."

Key Takeaway: The "car company" shrank (-11% revenue), but the "energy & services company" grew (+25% and +18%).

3. The "Future is Autonomous": 2026 & Beyond Outlook

Tesla effectively laid out a roadmap that bets the entire company on AI execution. Here is the forward-looking guidance derived from the deck:

A. The Robotaxi & FSD Rollout

This is the most aggressive timeline they have shared recently.

Unsupervised Operations: They have already begun removing safety monitors in Austin, TX (Jan 2026).

Expansion Timeline (1H 2026): They are targeting unsupervised commercial operations in Dallas, Houston, Phoenix, Miami, Orlando, Tampa, and Las Vegas within the first half of 2026.

The Cybercab: Cold weather testing is underway in Alaska (photos shown in deck), with volume production lines currently being installed for a 2026 launch.

B. The Compute War (AI Infrastructure)

Tesla is spending heavily to win the compute arms race.

Cortex Clusters: They are building "Cortex 2" in Texas. They plan to more than double their onsite compute capacity (H100 equivalents) in the first half of 2026.

Custom Silicon (A15 Chip): They teased the next-gen inference chip, the A15, targeting production in 2027.

The Spec: It boasts a 50x improvement over the current A14 chip, with 10x raw compute and 9x memory capacity. This is crucial for running larger, "end-to-end" foundation models in the car.

C. Optimus (Humanoid Robot)

Gen 3 Unveil: Expected in Q1 2026 (this quarter).

Production: The first production line is being installed now, with a goal to start production before the end of 2026.

Scale: They are planning for an eventual capacity of 1 million robots per year.

D. Heavy Industry (Semi & Energy)

Tesla Semi: Volume production begins in 2026 (Nevada factory).

Megapack: They are launching "Megapack 3" production at the Houston Megafactory in 2026.

4. Strategic Investments: The xAI Deal

A major highlight buried in "Other Updates" is the formalization of the relationship with Elon’s other company, xAI.

The Deal: Tesla invested $2 billion into xAI in Jan 2026.

The Rationale: This ties into the "Master Plan Part IV." Tesla provides the physical body (cars/robots), and xAI provides the digital brain (Grok/LLMs).

Integration: We are already seeing this with "Grok" acting as the AI companion inside Tesla vehicles for navigation and queries.

Summary Verdict

If you look strictly at 2025, Tesla looks like a shrinking automaker. But if you look at the 2026 guidance, they are a massive AI infrastructure play.

Bull Case: They successfully deploy unsupervised Robotaxis in 7 cities by mid-2026 and the Energy business continues its 25%+ growth trajectory.

Bear Case: The 11% drop in auto revenue is a warning sign. If the Robotaxi timeline slips (as it has in the past), they are left with a shrinking core business and massive capital expenditures.

The "Abundance" they pitched on the call is likely referring to the massive capacity they are bringing online from compute (doubling H100s) to battery refining (Lithium refinery ramping). They are building the machine that builds the machine, again.

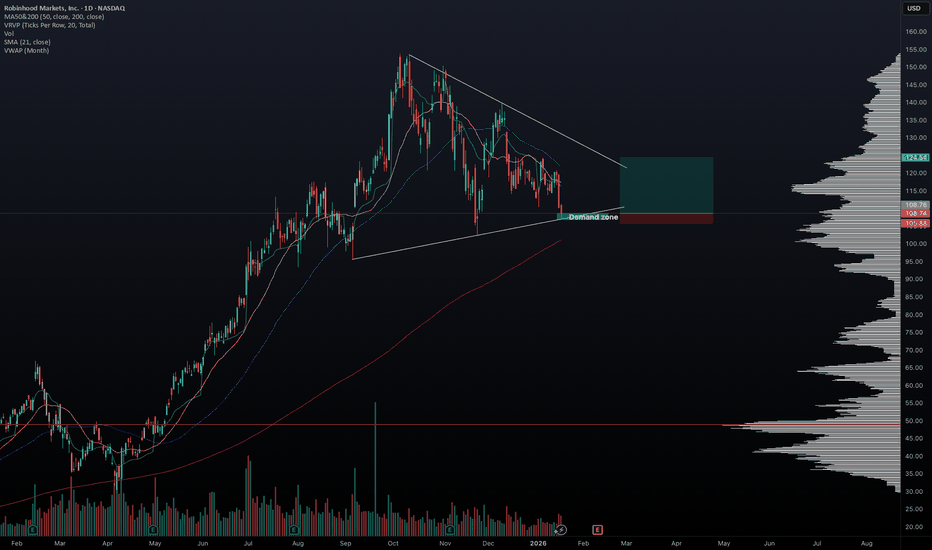

01/18/2026 HOOD longHello traders,

I’m seeing many S&P stocks forming wedge patterns (QQQ is also forming a wedge), and HOOD is one of them. While the exact catalyst for the next market move is unclear, it appears something is cooking, and a directional move may be approaching. HOOD is currently sitting near the lower boundary of its wedge and could bounce toward the upper range. Let’s stay disciplined and trade cautiously in this choppy market.

May the trend be with you.

AP

Lingrid | EURUSD Strong Weekly Close. Long OpportunityFX:EURUSD is maintaining bullish structure after a strong weekly close, with price holding above the rising trendline and forming a clear higher low. The recent pullback appears corrective rather than impulsive, suggesting the broader uptrend remains intact. Buyers have defended this level multiple times, keeping price supported within the upward channel.

If demand continues to hold above the trendline, price could gradually rotate higher toward the 1.1950 resistance area, where the upper channel boundary and prior rejection zone align. This region may act as the next upside magnet as long as pullbacks remain shallow and structure stays constructive.

➡️ Primary scenario: hold above 1.1800 → continuation toward 1.1950.

⚠️ Risk scenario: a sustained breakdown below 1.1780 could weaken bullish structure and expose 1.1570 support.

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

Bitcoin Down to 60's, 50's in 2026October should be the bottom based on cycles.

ATL 2015 to ATH 2017 = 1064d

ATH 2017 to ATL 2018 = 364d

ATL 2018 to ATH 2021 = 1064d

ATH 2021 to ATL 2022 = 364d

The pattern would print this cycle's ATH on the 6th of October 2025.

We indeed saw the top on October 2025. 364 days takes us to early October low.

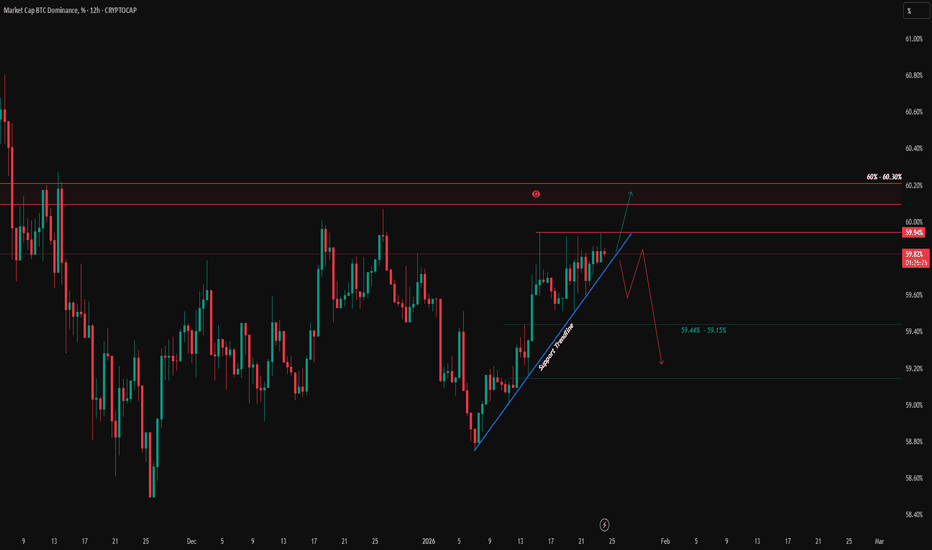

BTC.D What's Next? Key confirmation for Altcoin movement.BTC.D

BTC Dominance is now sitting right below a major resistance at 60% – 60.30%. This area has already rejected price multiple times, so this is a decision zone. As long as BTC.D stays below 60%, dominance is vulnerable to a pullback toward 59.44% – 59.15%, which would give more room for altcoins to breathe.

If BTC.D manages to break and hold above 60.30%, then dominance expansion continues and altcoins will likely stay under pressure. Until that breakout happens, this move is still just a test of resistance, not confirmation.

Bias stays neutral here. Let the level decide.

SUIUSD Chart Analysis 21-Jan-26Stop Loss: 1.4478

Buy Stop: 1.4993

Take Profit 1: 1.5541

Take Profit 2: 1.5964

Take Profit 3: 1.6490

A divergence has formed, indicating a potential bullish trend reversal. If price breaks above the buy stop, it is expected to move toward the projected take-profit targets.

⚠️ Always remember to protect your capital with proper stop-loss placement and disciplined risk management.