MNQ Friday Outlook | Consolidation & Liquidity Build📊 MNQ Weekly Close Setup — Jan 30, 2026

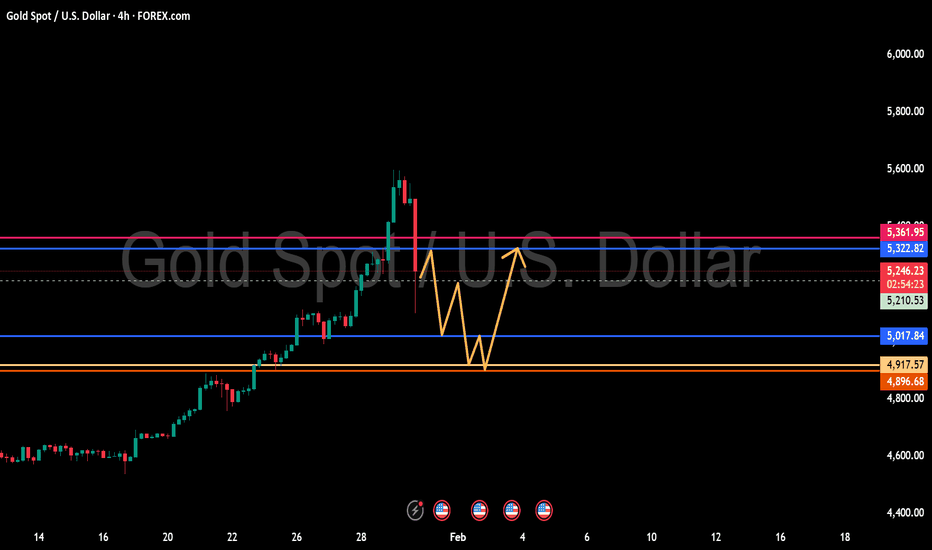

Thursday's session swept the IPDA 20 Day High and delivered an 800+ point selloff into discount arrays. After a move like that, Friday typically consolidates.

✅ Documented this move on Twitter before it happened.

🎯 EXPECTATION: Equilibrium Consolidation

Price will likely hover around equilibrium, building:

• Sell Side Liquidity (SSL) below

• Buy Side Liquidity (BSL) above

This creates a trap — shorts get enticed by the "continuation" narrative.

📍 LEVELS TO WATCH:

• HTF Breaker + Order Block (formed before the run down)

• Equilibrium of the current range

• Discount arrays as support

⚠️ TWO SCENARIOS:

1️⃣ Consolidation → Push into HTF Breaker/OB

Shorts pile in, get squeezed into the breaker zone

2️⃣ Sideways Chop → Wait for Next Week

Low volume Friday grind, real move comes Monday

Either way — no need to force it. Let liquidity form, then strike.

📝 Will update Friday AM before market open if anything changes.

Community ideas

NZDJPY Wave Analysis – 29 January 2026- NZDJPY reversed from support area

- Likely to rise to resistance level 93.80

NZDJPY currency pair recently reversed from the support area between the key support level 91.75 (former top of wave i from the start of January), 20-day moving average and the 38.2% Fibonacci correction of the upward impulse from November.

The upward reversal from this support area continues the active impulse waves iii, 3 and (5).

Given the strong daily uptrend and continuation of the widespread yen sales, NZDJPY currency pair can be expected to rise further to the next resistance level 93.80 (which reversed the price earlier this month).

Long Consolidation. 2110 - Saudi Cable

Closed at 169 (29-01-2026)

Getting Momentum. Took Support from 124 - 125.

Long Consolidation.

Currently there is a resistance zone from 170 - 177

Breaking Out from 178 - 180 with Good Volumes

may result in an upside move towards 314 - 315.

However, this is on a bigger tf.

UNH - C Wave Nearing it's endIf you look at this stock from a price-to-book ratio perspective, it hasn't been on sale like this since 2013. Warren Buffet bought a decent sized stake in this company mid last year, fundamentals here are solid, just waiting for the rest of the market to catch up. This is essentially free long-term money at the bid here. Expecting $500 a share within the next few months.

Wave-Count Confidence: Strong

The BTC "Fakeout" Play: My Exact Plan for $94,000The plan remains exactly as discussed. We need to see price reclaim support to confirm a 'fakeout' of the recent lows, which would open the door for an upward continuation toward $94,000 – $95,000.

⚠️ The Bear Case: However, if we see strong red candles on the daily close over the next few days, it’s a warning sign. This potential weakness could drive price further down toward the lower support zones at $84,800 – $83,500.

GBPCAD breakout retest?The GBPCAD remains in a bullish trend, with recent price action showing signs of a breakout within the broader uptrend.

Support Zone: 1.8545 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 1.8545 would confirm ongoing upside momentum, with potential targets at:

1.8690 – initial resistance

1.8750 – psychological and structural level

1.8810 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 1.8545 would weaken the bullish outlook and suggest deeper downside risk toward:

1.8500 – minor support

1.8465 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the GBPCAD holds above 1.8545. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

+ 6% USDCAD.Q1 | W4 | D29 | Y26. FRGNT DAILY CHART FORECAST

📅 Q1 | W4 | D29 | Y26

📊 USDCAD— FRGNT DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:USDCAD

EURUSD – FX Markets Starting to Get InterestingWe talked in our USDJPY piece on Tuesday, about how political events in the US and Japan had collided to make FX markets more volatile, with traders forced to cut weak long USDJPY positions as the threat of joint intervention increased.

Move forward 48 hours and we are now talking about how EURUSD has just pulled back from hitting its highest level in 4.5 years at 1.2082. Wow! It seems FX markets could be about to move back to a more prominent spot on trader’s screens again after an extended period on the sidelines.

At the start of the week, the willingness of the US administration to support attempts by Japanese authorities to weaken USDJPY initiated a debate amongst traders regarding whether they may also tolerate an overall weaker US dollar. This view gained momentum when President Trump suggested he was comfortable with recent dollar declines as it was good news for US exporters, comments which helped push EURUSD up to its multi-year highs late on Tuesday.

Sadly, for EURUSD bulls, the speed of the move prompted US Treasury Secretary Scott Bessant to step in yesterday reiterating the US administration’s commitment to a strong dollar, comments which sent the world’s biggest currency pair hurtling back down towards 1.1900.

However, despite these comments and with the potential risks from the Federal Reserve interest rate decision and press conference last night safely negotiated, EURUSD prices are currently already back trading at 1.1990 again at the time of writing (0700 GMT). This leaves EURUSD at a potential crossroads and traders could be looking at the technical update to try and determine whether this speedy advance has more upside momentum or if a reversal could be due.

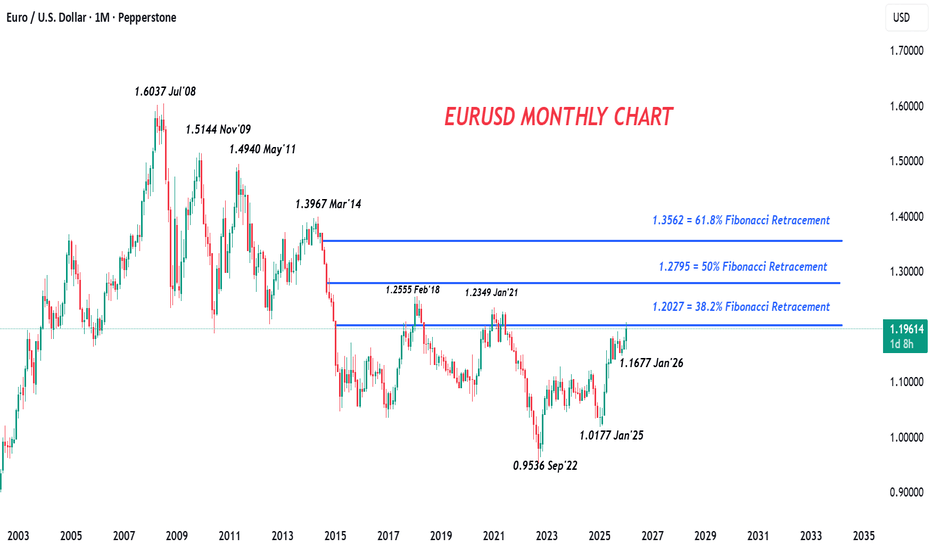

Technical Update: 4 ½ Year Highs But is EURUSD Back to Long Term Resistance?

EURUSD has drawn plenty of attention recently, with fresh upside acceleration driven in part by heavy selling pressure on the US Dollar. However, to properly frame this move within a broader context, it’s worth stepping back to the monthly EURUSD chart below, which captures price behaviour all the way back to July 2008. This longer‑term view helps clarify where the latest strength sits within the wider structural picture.

A couple of points stand out on this chart. First, the latest EURUSD strength is an extension of an already well‑established advance since the January 2025 lows. Second, the move is now pressing into what could be considered a key resistance at 1.2027, a level which corresponds to the 38.2% Fibonacci retracement of the July 2008 to September 2022 decline.

It could be argued that a monthly close above this resistance level may lead to further attempts at the upside, however, that can’t be determined until Friday’s close. What may be suggested at this stage is that 1.2027 could be a pivotal reference point for shaping the next longer‑term directional themes. With month‑end approaching, it’s worth monitoring how well this level is defended on a closing basis.

Potential Resistance Levels:

Having identified 1.2027 as a key resistance level on a monthly closing basis, the January close could be important in determining how EURUSD price action reacts moving forward. While a monthly close above 1.2027 wouldn’t guarantee continued upside, it could increase the likelihood of further attempts to push higher and test additional retracement levels.

Looking again at the monthly chart, if 1.2027 were to give way on a monthly closing basis, the focus for traders may shift toward 1.2349, which is the January 2021 failure high. A break above that level could open scope toward 1.2555, which is the February 2018 extreme.

Potential Support Levels:

Of course, it’s possible that the 1.2027 retracement resistance holds on a monthly closing basis. If so, risks could shift back toward lower levels. In that scenario, traders may look to 1.1890 as the first notable support, a level which corresponds to the 38.2% retracement of the latest phase of price strength.

As the daily chart above illustrates, a closing break below 1.1890 may shift the focus toward the lower Fibonacci retracement levels as the next potential supports. The 50% retracement at 1.1831 is the next area that could slow or limit selling pressure. However, a close below this level could point to further downside risks and open the way for a deeper decline toward 1.1772, the 61.8% retracement support.

The material provided here has not been prepared accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

GBPUSD: breakout setup toward 1.3940🛠 Technical Analysis: On the H1 chart, GBPUSD remains in a strong bullish structure after the “global bullish signal,” with price continuing to print higher highs and higher lows. The pair is now consolidating just below the key resistance band around 1.3843–1.3850, suggesting a potential squeeze before the next directional move. An ascending support trendline is holding the pullbacks, keeping the short-term momentum constructive. Price is trading above the SMA 50, while SMA 100 and SMA 200 stay well below, confirming trend strength. A clean breakout and hold above the resistance zone would likely trigger continuation toward the next upside objective near 1.3939. If the breakout fails, a retest of the trendline and the nearest support zone around 1.3680 becomes the first level to watch for buyers to defend.

———————————————

❗️ Trade Parameters (BUY)

———————————————

➡️ Entry Point: Buy on a confirmed breakout and hold above 1.38431–1.38500

🎯 Take Profit: 1.39391

🔴 Stop Loss: 1.37788

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

Couple of good candles in last 2 days.We saw 2 good candles in last 2 days indicating bottom formation and the candle today signifies a trend breakout. Now if Nifty can close the week above today's candle it will lay a path for good budget on Sunday to take us forward.

Supports for Nifty at this juncture remain at: 25167 (Father line support of Daily chart), 24919 and 24610. Closing below 25167 will be very negative for the market and can signal further down trend to continue.

Resistances for Nifty remain at: 25458 (The high that we reached today), 25589 and 25712 (Mother line resistnace). Bulls can breath a sigh of relief only above this level. A good closing above 25712 in the next week will signal a start of another round of Bull rally. We wiat and watch till then.

EU deal has tried to create a bottom and a good budget in favour of Industry, in favour of consumption and in favour of increased spending from government will significantly take things towards positive run ahead. A big bonus will be the US deal if GOI can make it happen some how within next one or 2 months can potentially unlock new limits and new levels. 1 good thing has fallen in favour of investors that is EU deal all eyes on budget now. In the meantime good positive closing tomorrow will be very helpful. Friday and Sunday (Markets are open on Sunday) are 2 key days to watch.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We are not a SEBI registered Research analyst. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

The Day Ahead data-heavy session aheadMarkets head into a data-heavy session with the focus on US activity and trade, Eurozone confidence, and a Riksbank rate decision, all landing alongside a blockbuster earnings slate.

Macro & Data

In the US, initial jobless claims will be the key real-time read on labour market momentum, while factory orders, wholesale sales, and the November trade balance help shape Q4 growth tracking.

Europe sees a confidence check via Eurozone January economic sentiment and December M3, with Italy’s industrial sales and wages adding colour on domestic demand.

Japan’s consumer confidence offers a read on household sentiment, while Canada’s trade data and Sweden’s Q4 GDP indicator round out the global picture.

Central Banks

Riksbank decision is the headline risk in Europe, with markets watching tone and guidance as closely as the rate call itself.

ECB’s Cipollone speaking may add nuance on the policy outlook, especially around financial conditions and transmission.

Earnings

A mega-cap and cyclicals-heavy lineup: Apple will dominate sentiment, while Visa and Mastercard give a pulse on global spending.

Semis are in focus with Samsung Electronics, SK hynix, KLA, and Keyence.

Industrials and defensives feature strongly (Caterpillar, Honeywell, ABB, Lockheed Martin, Parker-Hannifin), alongside healthcare (Roche, Thermo Fisher, Stryker, Sanofi).

Financials include Blackstone, ING, Lloyds, with consumer/media names like Comcast and Altria also reporting.

Rates & Supply

US 7-year Treasury auction will test demand amid ongoing volatility in the belly of the curve.

Bottom line: Expect earnings-driven equity moves, with rates and FX sensitive to US jobs data and the Riksbank. Volatility could pick up into the US close as Apple reports.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Report 29/1/26Macro–Geopolitical Report

Event focus: Renewed USD selloff (“Sell America” undertone) after Trump waved off dollar weakness, speculation around USDJPY policy signaling, and a Fed that held rates steady while offering little urgency to restart cuts.

What happened, in plain terms

A sharp leg lower in the U.S. dollar has become the macro headline because it’s no longer being treated as a simple “rate-differential” move; markets are increasingly framing it as a confidence and policy-risk move. In the WSJ framing, shocks and signs of a slowing economy triggered a “Sell America” impulse—U.S. equities and bonds stabilized, but the currency stayed heavy, reflecting anxiety that a debt-burdened U.S. is undermining the global order that supports its own growth.

The catalyst was political signaling: Trump said he wasn’t concerned by a weakening dollar (“No, I think it’s great”), reinforcing a market narrative that the administration is tolerant of depreciation as a competitiveness tool.

This coincided with renewed tariff threats toward Europe and unusual Treasury-related steps that fueled speculation Washington might want a stronger yen versus the dollar—an idea Treasury Secretary Scott Bessent publicly rejected (“absolutely not”), while reiterating a “strong dollar policy.”

What the tape says

The WSJ Dollar Index is sitting around 94.02 (about -1.98% YTD), underscoring that the move is large enough to reprice hedging costs, global asset returns, and inflation expectations at the margin.

In the same market snapshot, EURUSD ~1.1956 and USDJPY ~153.42 illustrate the two key channels: (1) broad USD softness, and (2) heightened sensitivity of USDJPY to policy rumors.

Crucially, the dollar weakness is not happening in a classic “risk-off” way where Treasuries rally hard and equities dump. Around the Fed decision, major stock indexes were “little changed,” and the 10-year Treasury yield edged up to ~4.25%.

That combination—currency down while rates don’t collapse—keeps the market’s attention on risk premium (policy uncertainty, fiscal trajectory, and foreign demand for U.S. assets), not just growth.

Central bank layer: Fed on hold, but not a clean dovish pivot

The Fed held the policy rate in a 3.5%–3.75% range on a 10–2 vote and signaled limited urgency to cut again after the prior contentious reductions. Powell’s messaging emphasized being “well positioned,” implying the bar for immediate easing is not low unless labor-market weakness re-emerges or inflation progress becomes convincing.

For FX, this matters because the near-term USD path is being pulled by two opposing forces: a still-restrictive (or at least not-eager-to-ease) Fed that would normally support USD, versus a political/fiscal/policy uncertainty premium that is now pushing in the opposite direction.

A key tell in the WSJ coverage is that many on Wall Street still expect easing to resume in 2026—meaning the market is increasingly comfortable selling USD rallies if the policy narrative stays noisy.

Strategic interpretation: why this is not “just” a dollar move

A weaker dollar can be benign when it reflects synchronized global growth and improving conditions abroad. The more destabilizing version is when it reflects foreign investors demanding a higher premium to hold U.S. assets—especially if both the currency and bonds wobble together during stress, which challenges the “haven” assumption. WSJ’s commentary explicitly raises the risk that attacks on Fed independence, tariff volatility, and unpredictable foreign policy are testing the “exorbitant privilege” dynamic.

This is where geopolitics bleeds into macro. Trade-war threats with Europe amplify the probability of retaliation, investment delays, and supply-chain re-routing.

Meanwhile, domestic political volatility (including shutdown risk around major funding packages) adds a governance-risk premium that global allocators do price—especially when deficits are already large and refinancing needs are structural.

Fiscal and political implications

If the administration is perceived as tolerant of USD weakness, the fiscal channel becomes more complicated. A cheaper currency can help tradables and manufacturing optics, but it also raises the imported inflation impulse and can increase the “political cost” of living expenses (energy, consumer goods, travel). WSJ notes that overseas exporters are already feeling it: a Polish furniture producer cited a ~12% USD drop versus PLN (combined with tariffs) making price points harder to hit for U.S. buyers.

On the capital-account side, any narrative that foreign reserve managers or large pensions are less comfortable holding Treasuries (even at the margin) forces the U.S. to pay in some mix of: higher yields, weaker currency, or weaker risk assets. That’s the “triangle” markets are probing right now, and it’s why the dollar move is being interpreted as a prestige/policy signal rather than a routine fluctuation.

Forward-looking scenarios

The base case is orderly depreciation: USD remains under pressure but not in free fall, because U.S. markets are still the deepest pool of liquidity and global risk appetite hasn’t collapsed. This is consistent with the view that it’s more “investing less in America” than outright selling.

In that world, the dollar trend persists, hedging costs for foreign investors drift, and equity leadership rotates toward firms with foreign revenues and real-asset sensitivity.

The risk case is disorderly repricing: if tariff escalation with Europe becomes concrete, or if policy steps are interpreted as FX management-by-rumor (especially around USDJPY), the market can quickly shift from “lower USD helps earnings” to “higher U.S. risk premium hurts multiples.” The stress signature would be: USD down and long-end yields up and equities failing to rally on weaker currency—i.e., a classic confidence shock.

Asset-by-asset implications

XAUUSD (Gold). A structurally weaker USD is a direct tailwind for gold, but the more powerful driver here is confidence/credibility. If markets interpret policy volatility as erosion of reserve-currency “buoyancy,” gold benefits as a non-sovereign hedge.

The main offset is if real yields rise because investors demand more term premium; that can cap upside. Net: bias constructive on dips while USD trend is negative and policy uncertainty remains elevated.

S&P 500. Near-term, USD weakness can mechanically lift reported earnings for multinationals and support risk appetite, which is why equity indexes can stay resilient even as FX slips.

But the medium-term signal matters more: if the dollar decline is read as a risk premium move, multiples become vulnerable even if EPS translation improves. The market staying “little changed” around the Fed while USD narratives dominate tells you equities are waiting for confirmation—either a benign “soft landing + global catch-up” story or a harsher “policy shock” story.

USDJPY. This pair is the policy-rumor pressure valve. Speculation that Treasury actions could be interpreted as favoring yen strength, plus explicit denials from Bessent, creates a setup where USDJPY can gap on headlines even without a big rates move. With USDJPY around 153, the balance is: structural USD softness versus episodic risk-on rebounds.

Tactically, headline-driven volatility risk is high; strategically, sustained USD weakness increases the probability of a grind lower in USDJPY unless U.S. yields reassert dominance.

DXY / broad USD. With the WSJ Dollar Index near 94 and framed as the lowest since 2022 in the coverage, the market is telling you it’s comfortable challenging the old “America exceptionalism” premium. The key inflection is whether overseas growth and policy stimulus keep surprising to the upside (supporting non-USD assets) while U.S. politics inject uncertainty. If yes, rallies get sold. If no—if U.S. growth re-accelerates and tariff threats fade—USD can stabilize quickly because positioning can unwind.

Crude Oil. A weaker dollar is typically supportive for commodities on pricing mechanics, but oil is dominated by demand expectations and geopolitics. Trade-war escalation is a clear demand-side risk; an orderly USD decline with stable growth is supportive. Net: oil’s reaction function becomes two-factor: USD down helps, but global growth fears (and risk-off) can overpower.

Dow Jones. Compared with the S&P 500, the Dow’s heavier industrial/old-economy composition makes it more sensitive to trade policy and input costs. If USD weakness is paired with higher tariffs, margins can get squeezed even as exporters gain competitiveness. The fact the Dow was essentially flat (~49,015, +0.02%) in the snapshot is consistent with a market that hasn’t decided whether this is “good weak USD” (earnings tailwind) or “bad weak USD” (confidence premium).

How to Identify Market Highs & Lows - The Foundation of TradingHow to Identify a High and a Low - Trading Foundation

Educational video covering one of the most critical skills in trading: the ability to correctly identify market highs and lows. Master this, and market structure becomes clear.

📚 Why This Matters:

Price = Trader Perception

Understanding highs and lows isn't just technical—it's psychological:

At a High:

Traders perceive price is expensive → Take profits → Ask for discount (pullback)

At a Low:

Traders perceive price is cheap → Take profits on shorts → Ask for discount (rally)

The Opportunity:

If we can clearly identify true highs and lows, we can anticipate these turning points and position ourselves advantageously.

This is the foundation of all market structure analysis.

📊 The Simple Rules:

How a HIGH is Formed:

Rule: A high is formed when a Higher High (HH) creates a minimum of 2 Lower Lows (LL)

What This Means:

Price makes a new high (HH)

Then creates at least 2 consecutive lower lows

This confirms the high is established and price is moving away

Visual Pattern: HH (High formed)

/ \

/ \

/ LL1

/\

/ LL2

How a LOW is Formed:

Rule: A low is formed when a Lower Low (LL) creates a minimum of 2 Higher Highs (HH)

What This Means:

Price makes a new low (LL)

Then creates at least 2 consecutive higher highs

This confirms the low is established and price is moving away

Visual Pattern:

HH2

/\

/ HH1

/

LL (Low formed)

When a High is Broken:

Scenario:

High is formed (HH + 2 LLs) ✓

Price rallies back and breaks ABOVE that high

Then shifts to creating a Momentum Low

What This Tells Us:

Sellers have stepped in at the high. Despite breaking higher, price couldn't sustain and reversed to make a momentum low = bears in control.

Trading Implication: Potential reversal or distribution zone

When a Low is Broken:

Scenario:

Low is formed (LL + 2 HHs) ✓

Price drops back and breaks BELOW that low

Then shifts to creating a Momentum High

What This Tells Us:

Buyers have stepped in at the low. Despite breaking lower, price couldn't sustain and reversed to make a momentum high = bulls in control.

Trading Implication: Potential reversal or accumulation zone

📚 Key Takeaways:

✅ HIGH: HH followed by minimum 2 LLs

✅ LOW: LL followed by minimum 2 HHs

✅ Minimum 2 swings required for confirmation (not 1)

✅ Break + momentum shift = highest probability signals

✅ This is objective - no guessing, just structure

✅ Foundation skill - master this before complex strategies

This is the foundation. Everything else in trading builds on this simple but powerful concept.

👍 Boost if you found this educational

👤 Follow for more trading fundamentals

💬 Can you identify highs and lows now? Practice and share!

EURUSD — Possible BUY Setup 💶💶💶🔥 EURUSD — Possible BUY Setup🔤🔤

Expert Market Analysis

Powered by FXWMarkets

📌 Investment Thesis & Key Drivers

The EURUSD pair remains in a strong multi‑month uptrend, powered mainly by broad USD weakness and shifting expectations around global central bank policy.

Although the pair is extremely overbought, the macro pressure against the USD continues to support the bullish direction.

➡️ BUY Bias — but only on a pullback OR a confirmed breakout above 1.2000.

📊 Rating Summary

Metric Rating

Action ⭐ BUY (Pullback or Breakout Confirmation)

Confidence 65%

Timeframe Short‑Term (Days–Weeks)

Risk Level 🔥 High

Setup Quality 70/100

🔑 Why EURUSD Still Looks Bullish

💵 1. Macro USD Weakness

DXY slipping lower

“Fed uncertainty” dominating sentiment

USD weakness remains the main fuel for EURUSD strength

📈 2. Technical Dominance

Price well above all major MAs

SMA‑5: 1.196

SMA‑200: 1.166

Trend remains parabolic and powerful

🎯 3. Critical Resistance Test

Price consolidating just below 1.2000

A clean break → next leg toward 1.2083

⚠️ 4. Overbought Risk

Daily RSI = 76.052 → extremely overbought

High probability of a sharp pullback

📊 Technical Analysis

Score: 75/100

Verdict: 🔥 Bullish (but extended)

📈 Trend Structure

Strong uptrend on Daily & Weekly

Current price: 1.19536

Above SMA‑5 (1.196) and SMA‑10 (1.184)

🔥 Key Levels

Support 1: 1.1910

Support 2: 1.1800

Resistance: 1.2000 (major barrier)

📉 Momentum Indicators

Indicator Daily 4H Interpretation

RSI 76.05 59.72 Daily overbought; 4H cooling

MACD +0.004 -0.001 Daily accelerating; 4H slowing

ADX 53.10 46.59 Very strong trend

🧭 Technical Verdict

Short‑term cooling + strong long‑term trend =

➡️ Better entry on a dip

➡️ Breakout above 1.2000 = continuation

🌍 Fundamental / Macro Analysis

Score: 80/100

Verdict: ⭐ Strongly Positive

🔹 USD Weakness = Main Driver

DXY sliding toward 96

Market doubts Fed tightening

Anti‑USD sentiment dominating

🔹 ECB Context

Market “testing upside” ahead of ECB

USD weakness outweighs ECB concerns

🔹 Risk Context

EURUSD holding near 4‑year highs despite policy pushback → strong conviction.

🧭 Fundamental Verdict

Macro environment heavily favors EURUSD upside until the Fed shifts tone.

📰 Market Sentiment & Flow

Score: 65/100

Verdict: 👍 Bullish (but cautious)

🔥 Sentiment Highlights

Market watching 1.2000 closely

Fresh buyers stepping in above 1.1950

Some USD profit‑taking, but bullish conviction remains

🧭 Sentiment Verdict

Bullish, but hesitation is normal near a major psychological level.

⚠️ Risk Factors (FXWMarkets)

🏦 1. Overbought Condition

RSI 76 → risk of 100–200 pip correction

Possible dip toward 1.1850

🏛️ 2. Central Bank Jawboning

ECB could push back against EUR strength

Fed could sound more hawkish

➡️ Both can trigger sharp reversals

📉 3. Leverage Risk

High leverage + sharp pullbacks = dangerous

➡️ Use minimal leverage

🧩 Dimensional Integration — Final Verdict

Dimension Score Verdict

Technical 75 🔥 Bullish (Extended)

Fundamental 80 ⭐ Strongly Positive

Sentiment 65 👍 Bullish (Testing Resistance)

⭐ Overall Score: 74/100 → Conditional BUY

Direction is up — but entry must be strategic due to overbought conditions.

🎯 FXWMarkets Action Plan — Conditional BUY

🟡 Scenario 1: Buy the Dip (Preferred)

Wait for retracement into support:

Entry Zone: 1.1910 – 1.1930

Cleans out weak hands

Resets RSI for next leg up

🔥 Scenario 2: Buy the Breakout (Confirmation)

Enter only if price clears 1.2000 decisively:

Entry Trigger: Above 1.2005

Requires strong daily close

🛡️ Risk Management Example (Entry at 1.1920)

Stop Loss: 1.1890 (‑30 pips)

TP1: 1.2000 (R/R ≈ 2.6:1)

TP2: 1.2080 (R/R ≈ 5.3:1)

⚠️ Key Reminders for Retail Traders (FXWMarkets)

Leverage kills — use minimal leverage

Stops are non‑negotiable

Watch DXY — EURUSD strength depends on continued USD weakness

GBPUSD H1 Outlook: Weak High AboveGBPUSD H1 Outlook: Weak High Above, Range Distribution Under Supply, Key Drop Zone at 1.3670 (Fibonacci + EMA + RSI)

GBPUSD on H1 (FXCM) is still in a broader bullish sequence from the late-Jan rally, but the current price action is signaling distribution under a major supply box. Price is trading around 1.3804, sitting inside a consolidation zone just below the marked Weak High near 1.3860–1.3870. This structure often leads to a liquidity sweep above the range, then a controlled rotation lower into the nearest demand.

Today’s plan is simple: sell rallies inside/near supply, and only buy after price reaches demand with confirmation.

Market Structure Read (H1)

The move into the top box was a strong bullish impulse.

Since then, the candles have printed sideways compression with repeated rejections near the upper boundary.

A Weak High overhead suggests liquidity is still available above, which increases the probability of a stop-sweep before the next leg.

Key idea: While price remains capped below the supply ceiling, the risk favors a pullback toward the nearest demand zone.

Key Resistance (Sell Zones)

R1: 1.3835–1.3855

Upper range band. Expect wick rejections and failed breakouts.

R2: 1.3860–1.3870 (Weak High liquidity)

Main sweep zone. If price spikes here and closes back below, it becomes the best short trigger.

Key Support (Buy Zones)

S1: 1.3800–1.3780

Intraday support. If it breaks cleanly with H1 closes, downside opens quickly.

S2: 1.3685–1.3665 (Primary demand zone)

This is the most important level on your chart (blue band). Best area to look for a trend pullback buy.

S3: 1.3520–1.3500

Deeper support if the pullback expands beyond the first demand.

Fibonacci Levels (Practical Map)

Apply Fibonacci to the latest impulse leg into the top box (from the breakout base near the mid-1.36s up to the 1.386 area). The most useful retracement reactions typically sit at:

38.2%: first shallow pullback area (often aligns near the 1.378 region)

50%: fair value retrace (often around the 1.375–1.374 area)

61.8%: deeper discount zone, frequently aligning with 1.3685–1.3665 demand

This is why the 1.3685–1.3665 band is the “high-confluence” level: demand + 61.8% behavior.

EMA + RSI Filters (Avoid Low-Quality Entries)

EMA (suggested: EMA20/EMA50 on H1)

If price stays below EMA20 during rebounds, rallies tend to be sellable.

EMA50 is the trend health line: holding above it supports the “pullback then continue” thesis; losing it increases risk of deeper drop.

RSI (14)

Watch for bearish divergence if price retests 1.3855–1.3870 with weaker RSI.

For buys, RSI holding the 40–50 area and turning up at demand is a strong continuation cue.

Trade Setups (Entry, Stop Loss, Targets)

Setup A: Short From Supply (Preferred While Under Weak High)

Trigger

Price retests 1.3835–1.3855 and prints rejection (H1/M15 bearish engulfing, long upper wick), or a sweep into 1.3860–1.3870 then closes back below.

Stop Loss

Above 1.3875–1.3890 (above the sweep high to avoid being wicked out).

Targets

TP1: 1.3800–1.3780

TP2: 1.3720–1.3700

TP3: 1.3685–1.3665 (main objective)

Setup B: Buy The Dip at Demand (Best Risk-Reward Long)

Trigger

Price reaches 1.3685–1.3665 and shows bullish confirmation: strong rejection wick, bullish engulfing, or break of a minor swing high on M15.

Stop Loss

Below 1.3650 (beneath the demand base).

Targets

TP1: 1.3720–1.3740

TP2: 1.3780–1.3800

TP3: 1.3835–1.3855

Setup C: Breakout Long (Only With Confirmation)

Trigger

H1 closes above 1.3870 and then retests 1.3855–1.3870 as support.

Stop Loss

Below the retest low.

Targets

Trail by EMA20 or new higher-high structure.

Summary

GBPUSD H1 is consolidating under a clear supply box with a Weak High above. The highest-probability flow is:

Sell rallies into 1.3835–1.3870

Look for buys only at 1.3685–1.3665 with confirmation (Fibonacci + demand alignment)

BankNifty levels - Jan 30, 2026Utilizing the support and resistance levels of BankNifty, along with the 5-minute timeframe candlesticks and VWAP, can enhance the precision of trade entries and exits on or near these levels. It is crucial to recognize that these levels are not static, and they undergo alterations as market dynamics evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We trust that this information proves valuable to you.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you successful trading endeavors!

CHFJPY Is Bullish! Buy!

Please, check our technical outlook for CHFJPY.

Time Frame: 4h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 197.884.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 199.265 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Like and subscribe and comment my ideas if you enjoy them!