Gold Recovers From Key Support - Bulls Target $5,100Hello traders! Here’s my technical outlook on XAUUSD (2H) based on the current chart structure. Gold previously traded within a clearly defined ascending channel, where price respected both the rising support and resistance lines, signaling a controlled bullish trend and steady buyer dominance. This structure eventually led to a clean breakout above the channel and above the key Buyer Zone, triggering an impulsive bullish expansion. The rally accelerated sharply and culminated at a local top, where price showed signs of exhaustion and strong selling pressure emerged. From this peak, XAUUSD experienced a sharp drop, confirming a short-term structural shift and initiating a corrective phase. After the sell-off, price found support near the lower levels and formed a clear reversal from the lows, indicating that buyers stepped back in aggressively. This reaction marked a “turned around” point and initiated a recovery move. Currently, XAUUSD is consolidating above the Buyer Zone, which now acts as a key support area around 4,880–4,900. Multiple reactions and breakouts from this zone suggest acceptance above support and reinforce its importance. From a market structure perspective, this behavior points to a corrective bullish recovery rather than a continuation of the prior sharp sell-off. Above current price, the Seller Zone / Resistance Level around 5,100 stands out as the next major area of interest. This zone previously acted as strong resistance and rejected price during the last bullish attempt, making it a logical upside target and potential decision point. My primary scenario favors a continuation higher as long as price holds above the Buyer Zone and continues to respect the rising support line drawn from the recent swing low. In this case, a gradual push toward the 5,100 resistance area (TP1) is likely, representing a measured recovery within the broader structure. However, a strong rejection from the Seller Zone could trigger another pullback toward support, while a decisive breakdown and acceptance below the Buyer Zone would invalidate the bullish recovery scenario and signal renewed downside pressure. For now, structure suggests buyers are attempting to regain control after the sharp drop, with price stabilizing above key support and targeting the next resistance. Please share this idea with your friends and click Boost 🚀

Parallel Channel

BITCOIN - From the DISTRIBUTION phase to the CONSOLIDATION phaseBINANCE:BTCUSDT.P tested 60K during the current cycle and formed a fairly significant pullback to 70K. However, it is too early to talk about a bullish trend; this is just a reaction to liquidation. The cycle continues...

At the moment, the decline is 52%, which is historically within acceptable limits and is a relatively average indicator.

Fundamentally, there is no support for the crypto market, and Friday's pullback was supported by the recovery of the US stock market.

Global and local trends are bearish, and local spikes in volume and bullish impulses are possible in the hunt for liquidity, which should be viewed conservatively.

The price has entered the key trading channel of 53K - 73K and is likely to stop within the current cycle and form another trading range, which may subsequently reinforce the reversal momentum. Key liquidity zones have not yet been tested: 59650 - 53330.

Resistance levels: 71,900, 73,800, 82,200

Support levels: 65,000, 59,650, 53,330

How can we tell that the market is ready to reverse? Technically, the reversal phase does not come immediately after distribution, the cycle of which is still ongoing. The market must enter a consolidation phase with the gradual formation of sequentially rising lows/highs. The breakdown of local structures + the market holding above key resistance levels will hint at a positive market sentiment.

Thus, we are waiting for the formation of an intermediate bottom and a change in the market phase from distributive to consolidation...

Best regards, R. Linda!

XAUUSD: Liquidity Grab Below Support, Expansion Ahead To $5,110Hello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

Gold has been trading within a well-defined bullish environment, previously respecting a clean ascending channel, where price consistently formed higher highs and higher lows. This structure reflected strong buyer dominance and healthy trend continuation rather than impulsive exhaustion. During this phase, XAUUSD also went through a consolidation range, signaling accumulation before the next impulsive move. The breakout from the range triggered a strong bullish impulse, pushing price aggressively toward the 5,110 Resistance Zone, where sellers became active. This area acted as a major supply zone, leading to a sharp rejection and a deep corrective move. Price dropped impulsively, breaking below the rising channel and testing lower liquidity, which marked a short-term shift in market structure.

Currently, XAUUSD is stabilizing above the reclaimed support zone, with multiple breakout attempts confirming acceptance above demand. This price behavior indicates that buyers are gradually regaining control, while sellers are unable to push price back below key support.

My Scenario & Strategy

My primary scenario favors a bullish continuation, as long as XAUUSD holds above the 4,970 Support Zone and continues to respect the rising triangle support line. The recent reclaim and consolidation above support suggest that the prior drop was a fake breakdown, not the start of a sustained bearish trend. From a structural perspective, pullbacks toward the support zone are considered corrective, offering potential continuation opportunities rather than reversal signals. The next key upside objective lies at the 5,110 Resistance / Supply Zone (TP1), which aligns with previous supply and remains the main barrier for further upside. A clean breakout and acceptance above the 5,110 resistance would confirm bullish continuation and open the door for a renewed expansion toward higher levels.

However, a decisive breakdown and acceptance below the support zone and triangle support line would invalidate the bullish scenario and signal a return of bearish pressure. For now, structure favors buyers, with Gold holding above key demand and building strength for the next directional move.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

GOLD (XAUUSD): Strong Intraday Bullish Signal

Gold turned very bullish on Friday.

The price violated a resistance line of a bullish flag pattern

on a 4H time frame.

With a high probability, it is heading toward 5070 level now.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

BTCUSDT Lower Highs, Lower Lows - Bears in Full ControlHello traders! Here’s my technical outlook on BTCUSDT (3H) based on the current chart structure.BTCUSDT previously traded within a well-defined ascending channel, where price consistently respected both the rising support and resistance lines. This structure reflected a controlled bullish trend with higher highs and higher lows, supported by steady buyer demand. After reaching the upper boundary of the channel, price failed to sustain bullish momentum and formed a clear turning point near the channel resistance. This loss of momentum marked the beginning of a structural shift, as buyers were no longer able to defend higher levels. After the range breakdown, BTC entered a sharp descending channel, characterized by strong impulsive bearish candles and brief, shallow pullbacks. Price respected the descending resistance line well, confirming that sellers remained in control and that each rebound was being sold into. This structure highlights aggressive distribution rather than healthy consolidation. As price accelerated lower, it approached a key Resistance / Seller Zone around the 67,000 area, where previous reactions occurred. Currently, BTC has broken below this Seller Zone and is pushing into the Buyer Zone around the 62,300–63,800 region, which aligns with a major horizontal support level. This area represents the first significant demand zone where buyers may attempt to slow or temporarily halt the decline. The sharp move into this zone suggests strong bearish momentum, but also increases the probability of a short-term reaction or consolidation. My primary scenario favors bearish continuation as long as BTC remains below the broken Seller Zone and continues to respect the descending channel structure. Any pullback toward the 67,000 resistance area is viewed as a potential short opportunity rather than a sign of trend reversal. The first downside objective lies near the 62,300 Support Level (TP1), where partial profits can be considered due to expected demand reaction. However, if BTC shows strong acceptance and sustained buying strength above the Seller Zone, this would weaken the bearish bias and signal a possible deeper corrective phase. Until that happens, structure, trend, and momentum all favor sellers, with the market firmly positioned in a bearish continuation phase. Please share this idea with your friends and click Boost 🚀

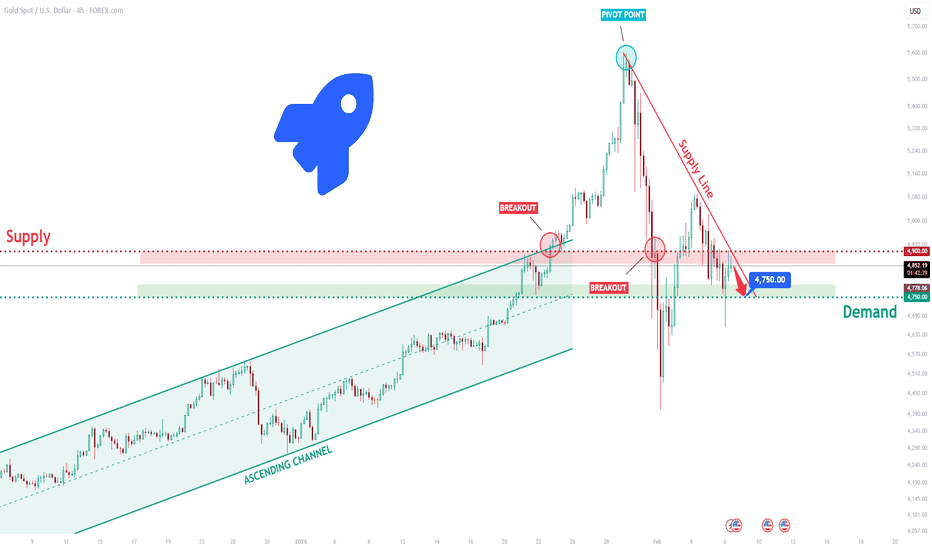

XAUUSD Short: Supply Holding, $4,750 Demand as TargetHello traders! Here’s a clear technical breakdown of XAUUSD (4H) based on the current chart structure. Gold previously traded within a well-defined ascending channel, where price respected both the rising support and resistance lines, forming a series of higher highs and higher lows. This structure confirmed sustained bullish momentum and healthy trend continuation. During this phase, pullbacks remained corrective, and buyers consistently defended the lower boundary of the channel, allowing price to gradually grind higher. The bullish move ultimately accelerated into a strong impulsive rally, which culminated at a clear pivot high, marking a temporary exhaustion of buying pressure. Following this pivot point, market structure shifted. Price broke below the ascending channel support and transitioned into a bearish corrective phase, signaling that bullish control was weakening.

Currently, XAUUSD is trading below the descending Supply Line, with price structure showing lower highs and failed recovery attempts. This suggests that the recent upward moves are corrective pullbacks rather than the start of a new bullish trend. Below current price, the Demand Zone around 4,750 stands out as the next major area of interest. This zone represents a strong historical demand level and aligns with prior consolidation, making it a logical downside target where buyers may attempt to step in.

My primary scenario favors further downside continuation as long as price remains below the descending supply line and below the 4,900 Supply Zone. Any rallies into this resistance area are viewed as potential selling opportunities rather than trend reversals. The main downside objective is the 4,750 Demand Zone (TP1), where partial profits can be considered and where a market reaction is likely. If price reaches this zone, the response will be key in determining whether gold forms a base for a corrective bounce or continues lower into deeper demand. However, a strong bullish reclaim and acceptance back above the supply zone and the descending supply line would invalidate the bearish scenario and signal a possible trend shift. Until that happens, structure, trend, and price behavior continue to favor sellers. Manage your risk!

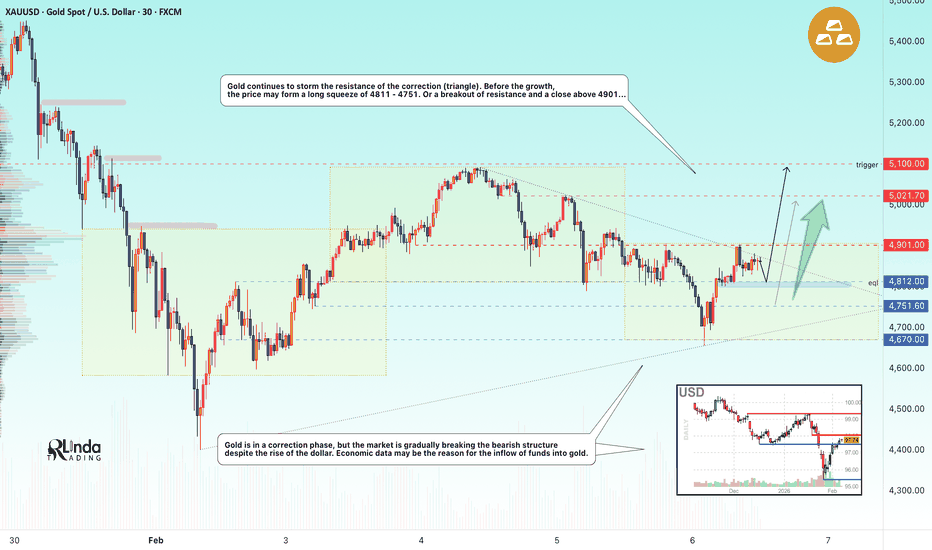

GOLD - Consolidation above 5000. Awaiting NFP...CAPITALCOM:GOLD consolidates above $5,000 in anticipation of key data from the US. Economic data may set the medium-term tone for the market. A long squeeze before the move cannot be ruled out...

Central banks continue to buy metal, expectations of a more dovish Fed policy weaken the dollar. Easing tensions in the Middle East and growing risk appetite in global markets support the gold trend.

Ahead of us are the Employment Report (NFP) on Wednesday and

Inflation Data (CPI) on Friday .

These data will determine further expectations for Fed rates and the direction of the dollar.

Gold is in a state of equilibrium ahead of the release of critical data. A sustained breakout from the current range ($5000-5100) is likely only after the release of US employment and inflation reports, which will clarify the trajectory of the Fed's monetary policy.

Resistance levels: 5047, 5098, 5100

Support levels: 4946, 4902, 4811

The zone of interest and liquidity within the current movement is the 4950-4940 area. There is a possibility that during the transition from the European to the US session, the market will test this area before growing. However, a premature breakout of 5047 and a close above 5050 could trigger a rally to 5150-5250.

Best regards, R. Linda!

BTCUSDT Long: Descending Channel Breakout - Demand HoldingHello traders! Here’s a clear technical breakdown of BTCUSDT (2H) based on the current chart structure. Bitcoin previously traded within a well-defined consolidation range, where price moved sideways for an extended period. This ranging phase reflected a temporary balance between buyers and sellers and allowed liquidity to build above and below the range boundaries. Eventually, this equilibrium resolved to the downside, triggering a strong bearish impulse. After the range breakdown, BTC entered a clean descending channel, characterized by consistent lower highs and lower lows. Price respected both the upper and lower channel boundaries well, confirming controlled bearish pressure rather than emotional selling. This structured decline indicates that sellers remained in control while buyers were only able to generate short-lived pullbacks. The bearish move culminated at a clear pivot low, where selling momentum exhausted and aggressive buyers stepped in. From this pivot point, Bitcoin produced a sharp bullish reaction, breaking decisively above the descending channel, which marked a meaningful structural shift from bearish continuation to recovery. Following the breakout, price impulsively rallied and reclaimed key levels before reaching the Supply Zone around 71,700, where bullish momentum temporarily stalled. This level acted as a logical resistance, leading to a pullback.

Currently, BTC is consolidating above the Demand Zone and along the rising demand line, suggesting that the retracement is corrective rather than the start of a new bearish trend. Multiple reactions from this demand area indicate active buyer interest and defense of the level, reinforcing the idea of a developing higher-low structure. As long as price holds above the Demand Zone and respects the rising demand line, the broader bias remains cautiously bullish.

My primary scenario favors upside continuation after consolidation. A sustained hold from demand opens the door for a renewed push toward the 71,700 supply level (TP1), which represents the first major upside target and a logical area for partial profit-taking. A clean breakout and acceptance above this supply zone would confirm bullish continuation and signal potential expansion toward higher highs. Conversely, a decisive breakdown below the Demand Zone and loss of the rising demand line would invalidate the bullish recovery scenario and suggest a deeper corrective move. Until such confirmation appears, the current market structure points to balance with a bullish continuation bias from demand. Manage your risk!

Gold Spot (XAU/USD) – 2H Technical AnalysisGold Spot (XAU/USD) – 2H Technical Analysis

Gold experienced a strong and extended uptrend, moving cleanly inside a rising channel. This phase showed strong bullish control and momentum buying. However, that structure has now failed, which is the most important change on the chart.

The break of the rising channel signals that the bullish trend is over for now. What we are seeing is not a healthy pullback, but a transition from trend to consolidation, often seen before a deeper correction.

Current Market Phase

Price is now moving sideways in a range, showing indecision and balance between buyers and sellers.

Buyers defend the lower area

Sellers cap price near resistance

Momentum is compressed, not expanding

This behavior typically appears before a strong move, not during one.

Key Levels That Matter

Resistance (Sell Zone)

5,100 – 5,120

Price has been rejected here multiple times

As long as price stays below this zone, upside is limited

Support (Decision Level)

4,850 – 4,900

This level is holding the market together

A clean break below it changes everything

Direction Scenarios

1. Bearish Continuation (Higher Probability)

Breakdown below 4,850

Confirms sellers in control

Likely move toward 4,600 → 4,550

Momentum expected to increase quickly

2. Bullish Recovery (Lower Probability)

Strong break and hold above 5,120

Would invalidate the bearish structure

Opens room for trend continuation, but needs strong volume

What Traders Should Focus On

Do not chase price inside the range

Wait for a confirmed breakout

Bias stays bearish below resistance

Risk management is critical during consolidation

Final Take

Gold is no longer trending upward. It is in a distribution and consolidation phase after trend exhaustion. Until proven otherwise, downside risk is higher than upside, and the next decisive move will come from a break of the current range.

ADOBE [ADBE] EWP TC FIB ANALYSIS MONTHLY TFADOBE (ADBE) – Monthly Elliott Wave Count

ADBE continues to trade inside its multi-decade bullish channel and is now approaching the lower boundary near $242, which we consider our primary Wave IV buy zone. From an Elliott Wave Principle perspective, the 2021 high completed Supercycle Wave III, with the current decline unfolding as Supercycle Wave IV (Cycle A–B–C). Wave C appears mature on higher timeframes: momentum is deeply reset on the monthly RSI, price action remains corrective (not impulsive), and we’re seeing classic late-stage Wave C behaviour near structural support.

Key confluence at $230–$250:

– lower secular channel support

– ~0.382 retrace of Supercycle III

– historical RSI cycle lows

> This strongly favours Wave IV termination in this region.

Invalidation:

A decisive monthly close below ~$200, followed by loss of channel support, would invalidate this count and open risk toward the 0.5–0.618 retracement zone (~$125–$160). Until then, $242 remains support, not hope.

NASDAQ confirmation:

The Nasdaq Composite remains in a corrective structure rather than an impulsive bear leg, supporting the interpretation that this is a broader Cycle/Supercycle Wave IV correction across tech — not the start of a secular bear market.

Assuming Wave IV completes near $242, projected Wave V targets align with the upper channel and Fib extensions in the $1,300–$1,350 region (≈ +456% from the Wave IV low), consistent with a final Supercycle Wave V advance.

Bottom line:

We’re positioned in the late stages of Wave IV, watching the $242 area as our buy zone. If this level holds, ADBE sets up for a multi-year Wave V move toward ~$1,346. Patience here matters.

Like and follow for more charts like this.

EURUSD - Breakthrough of consolidation resistance. Growth?FX:EURUSD is ending its correction. A breakout of resistance and bullish momentum are forming. If the market maintains its current direction, the price could reach 1.197-1.210 in the medium term.

The dollar is falling due to the rise of the Japanese yen after early parliamentary elections, the impact of which may be medium-term.

After the dump, the currency pair formed a consolidation that stopped the local downtrend. The weakening of the dollar triggered a breakout of resistance. The exit from consolidation and the bearish wedge is a fairly strong bullish signal. The market may form a retest of 1.1829 before breaking through 1.1875. If the bulls break through resistance, the medium-term bullish trend may continue.

Resistance levels: 1.1875, 1.1972

Support levels: 171829, 1.1778, 1.1769

After consolidation, the market has entered a distribution phase. Given the current trend, the weak dollar, and the current market phase, there is potential for continued growth.

Best regards, R. Linda!

This Is Not a Reversal: #XMR’s Structure Signals downside

Yello Paradisers! Are you aware that #XMRUSDT is currently in one of the most deceptive Elliott Wave phases, where the price looks stable, but the structure strongly suggests another sharp downside move is still ahead?

💎#XMR after the sharp decline from the all-time high, has been unfolding a textbook structure inside a dominant descending channel. From a higher-timeframe Elliott Wave perspective, the market is clearly positioned within wave 4 of the larger impulsive decline. This is a critical phase, as wave 4 corrections are designed to exhaust late participants before the final continuation leg unfolds.

💎The current price action is forming an ascending corrective channel, but it is important to understand that this move is not impulsive. Structurally, this advance fits perfectly as an ABC/WXYXZ complex correction, developing entirely within the boundaries of the broader bearish descending channel. This tells us that the market is correcting in time and structure, not reversing the trend. In professional Elliott Wave terms, this is a classic setup before wave 5 continuation to the downside.

💎Market participation further validates this count. Volume has been consistently decreasing throughout the ascending channel, indicating a lack of real buying interest. This contrasts sharply with the previous sell-offs, which were accompanied by expanding volume, confirming that sellers remain in control of the primary trend. Corrective advances with declining volume are a strong hallmark of wave 4 behavior.

💎Momentum also aligns perfectly with this interpretation. RSI is showing a hidden bearish divergence between the last two swing highs, a signal that momentum is resetting in favor of the prevailing downtrend rather than building strength for a reversal. Hidden divergence in wave 4 environments typically precedes strong trend continuation moves.

💎From a structural level perspective, $420 remains the key resistance zone and aligns with the upper boundary of the corrective formation. On the downside, $277 acts as an important interim support, while $230 is the major support area and a logical downside objective once wave 5 begins. A decisive breakdown of the ascending corrective channel would confirm the completion of wave 4 and activate a high-probability wave 5 continuation scenario.

If you want to be consistently profitable, you need to be extremely patient and always wait only for the best, highest-probability trading opportunities. Strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler. This is the only way you can get inside the winner circle of Paradisers.

MyCryptoParadise

iFeel the success🌴

FET/USD [FETCH.AI] EWP FIB TC ANALYSIS WEEKLY TFElliott Wave Overview for Artificial Superintelligence Alliance (FET / USD):

After the initial decline following the 2019 IEO, FET established a long-term base and advanced in a five-wave impulsive structure from the March 2020 low into the September 2021 high, marking Primary Wave 1 / A.

Since that peak, price action is best interpreted as Primary Wave 2 / B, unfolding as an expanded flat correction. Within Intermediate Wave C of Primary Wave 2 / B, the market is currently trading in Minor Wave 5, likely subwave 5 of 5, which typically represents the final phase of downside momentum.

Completion of this structure is expected near the $0.08 area, where Primary Wave 2 / B should terminate. From there, a trend reversal is anticipated, opening the door for a strong impulsive advance toward the $15 region as the next major bullish phase begins.

A decisive break below the GZ - golden zone - would invalidate this scenario and imply a deeper decline toward $0.01 and below.

Like and follow for more charts like this.

AVAX / USD [AVALANCHE] EWP TC FIB ANALYSIS WEEKLY TFAVAX remains inside a long-term descending channel, keeping the macro bias bearish. The 2024 rally topped near the 0.618 Fib + channel resistance, consistent with a Wave B in an ABC correction. Price has since broken support and appears to be unfolding Wave C, likely as a 5-wave impulse. Current structure suggests further downside toward the $6 region (possibly lower) before any meaningful macro bottom can form. Only a reclaim of $20 and a channel breakout would invalidate this bearish count. Until then, rallies remain corrective.

Like and follow for more charts like this.

Silver (XAGUSD) Pullback After Strong Uptrend, Now ConsolidatingSilver (XAGUSD) – Pullback After Strong Uptrend, Now Consolidating

Simple Analysis:

Big Picture Trend:

Silver was in a strong uptrend, moving cleanly inside an upward channel (green zone). Buyers were firmly in control for most of the move.

Trend Break & Drop:

Price broke down from the rising channel (highlighted circle) and sold off sharply. This signals that bullish momentum weakened and traders started taking profits.

Current Phase – Consolidation:

After the drop, price is now moving sideways in a consolidation box between roughly 71 (support) and 90 (resistance). This shows indecision: buyers and sellers are battling for control.

Key Levels to Watch:

Support: ~71

Resistance: ~90

Major Upside Target: ~101 (previous resistance / breakdown level)

What This Means:

If price breaks above the consolidation range, it could make a strong move back toward 100–101 (blue arrow).

If price fails and breaks below support, further downside is possible.

Summary:

Silver paused after a strong rally. It’s currently resting and building energy. The next breakout from consolidation will likely decide the next big move

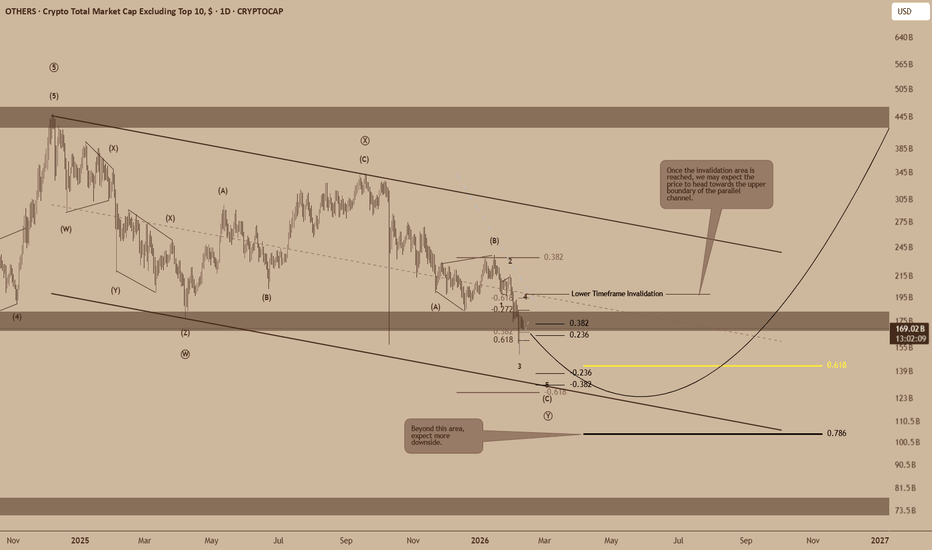

OTHERS: Structural Weakness Remains Despite Short-Term Relief The broader cryptocurrency market (excluding the top 10) continues to display structural weakness, with price action favoring additional downside before any sustainable recovery can be considered. While short-term relief remains possible, the dominant Elliott Wave structure and Fibonacci confluence suggest that bearish targets are still active at the macro level.

This analysis focuses on structure, alignment, and proportionality, rather than short-term price noise.

Price remains confined within a descending channel, respecting both its upper and lower boundaries with notable precision. The recent rejection from the channel’s upper half reinforces the idea that the prevailing trend is corrective rather than impulsive.

The broader pattern can be interpreted as a complex corrective structure, where price is currently developing the latter stages of a zigzag-style move. Despite intermittent bounces, market behavior continues to favor trend continuation to the downside.

ELLIOTT WAVE BREAKDOWN

At the macro level, the structure is unfolding as a corrective sequence, rather than the start of a new impulsive advance.

The larger move can be interpreted as a zigzag (A)–(B)–(C).

- Wave (A) completed with clear internal subdivision.

- Wave (B) retraced into Fibonacci resistance, failing to reclaim the prior structure decisively.

- Price is now progressing within wave (C), which itself subdivides cleanly into a five-wave structure.

Internal Structure

Within wave (C), the chart highlights:

- A clearly defined 1–2–3–4–5 sequence on the lower timeframe.

- The smaller, darker Fibonacci measurements correspond to this micro impulsive count, used to confirm momentum and internal symmetry.

- These internal waves align with the broader corrective expectation, reinforcing the bearish scenario rather than contradicting it.

Downside Expectation and Macro Targets

As long as price remains below the descending channel resistance, the expectation is for continuation toward the macro 0.618–0.786 retracement zone. These levels align with:

- Channel support

- Completion of wave (C)

- Fibonacci extensions of the broader corrective structure

A sustained move beyond the 0.786 region would signal further structural weakness and likely imply that the correction is not yet complete.

Lower Timeframe Invalidation: A Conditional Note

While the macro outlook remains bearish, the chart clearly highlights a lower timeframe invalidation level.

- A break above this level would suggest the possibility of a short-term uptrend or relief rally.

- Such a move would likely target the upper boundary of the parallel channel, rather than signal a full trend reversal.

- Importantly, this does not invalidate the macro bearish structure unless followed by impulsive continuation and structural confirmation.

In other words, any upside above the lower timeframe invalidation should be viewed as corrective unless proven otherwise.

CONCLUSION

The broader crypto market continues to trade within a corrective framework, with downside risk still dominant despite the possibility of temporary relief moves. Elliott Wave structure, Fibonacci symmetry, and channel dynamics all point toward lower levels being required before a meaningful macro reversal can occur.

What makes this analysis particularly compelling is the alignment across degrees, from micro wave counts to macro Fibonacci targets, where multiple measurements converge at similar bearish levels. This type of structural agreement strengthens confidence in the roadmap, even as short-term volatility persists.

As always, structure leads, and price confirms.

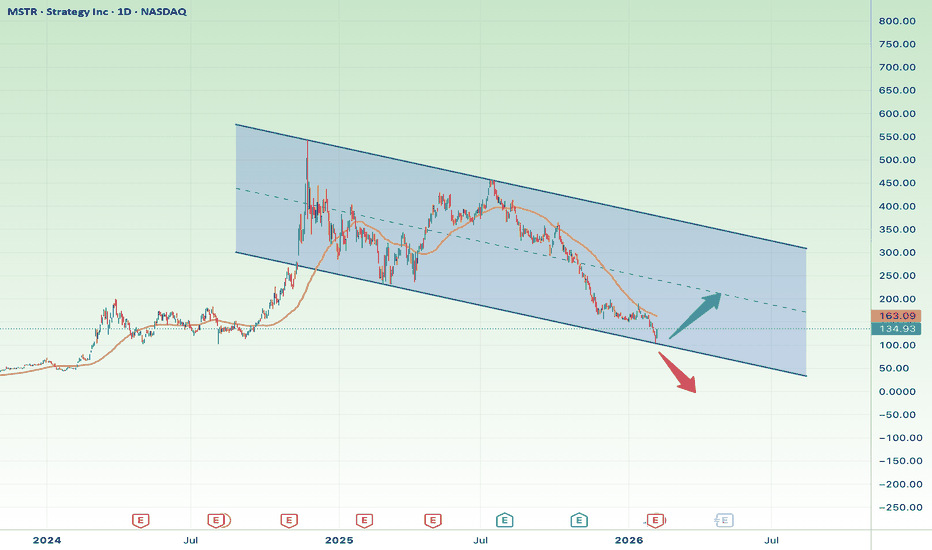

MSTR at Key Support: Bounce Opportunity or Breakdown Risk?Market Structure

MSTR is trading inside a long-term descending channel, indicating that the broader trend remains bearish / corrective.

Price has recently reacted right at the lower boundary of the channel, which is a critical support zone.

The moving average is still above price, suggesting that bullish momentum has not yet been confirmed.

Bullish Scenario (Support Bounce)

• Current zone: Major support at the channel low

• If this level holds:

• Target 1: 160 – 165

• Target 2: 190 – 200 (midline of the channel)

• This move would be considered a technical bounce or corrective rally, not a full trend reversal.

Bullish Stop Loss:

❌ Daily close below 130 – 125

Bearish Scenario (Channel Breakdown)

• If price breaks and closes below the channel support:

• Target 1: 110

• Target 2: 90 – 80

• A breakdown would likely accelerate downside momentum.

Bearish Stop Loss (for shorts):

❌ Daily close back above 145 – 150

Final Thoughts

• Risk-to-reward favors a cautious long at support, but confirmation is still needed.

• MSTR remains highly correlated with Bitcoin, so BTC volatility can quickly trigger either scenario.

• Best approach:

• Wait for clear bullish confirmation, or

• Trade short-term with strict risk management.

USDCAD: Bullish Outlook Explained 🇺🇸🇨🇦

USDCAD will likely continue rising on Monday, following

a confirmed breakout of a resistance line of a falling channel.

The violation occurred after a test of a strong intraday support.

Expect a rise at least to 1.704 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Weekly Down-Channel: Support Rebound Play ?ENA/USDT is trading at the lower boundary of a well-respected weekly descending channel. This area acts as dynamic support, so the primary idea is a controlled rebound toward the channel midline first, and potentially the upper boundary if momentum follows. Confirmation comes from strong rejection wicks and a weekly close holding the channel support (plus a break of minor bearish structure on lower TFs). A clean weekly close below the lower band invalidates the bounce and favors bearish continuation.

UJ. Bulls Building Momentum, Weekly Analysis and PlanThe Week:

In the past couple of week the bulls manage to stop what was looking like a bearish momentum and make it their momentum. Two weeks ago we get a very sharp Hammer on solid volume confirming strong bullish presence, this week this was further confirmed by pushing the price back to 157 again on supporting volume, and this level was mentioned to be re-tested in our previous Idea on UJ. On Sunday Japan is having a General Election which will have a significant impact on the pair, so be ready for the gaps on Monday.

Daily Chart:

What is most interesting at this TF is volume, which has been overall falling in the past 4 days, but another interesting fact is the ultra high volume on some very narrow candles , which is a sign of warning and being very careful as the MM's are moving lots of money either one direction or the other. The current trading range is L152 H159.454, and if the bulls are to continue what they have started we will see a re-test of the high and possibly a breakout, other wise we are going back to 152.

4h Chart:

For about a week the price was moving smoothly up in a fairly tight channel, only at the end of this week the PA breakout of it to enter in a even smaller side channel, which we have to be very thankful to see, because offers us an absolutely amazing trading entries at breakout.

The current 4h range is quite wide L152.707 H157.331, there is also a strong mid level to be careful, where the 4h,Daily and Weekly mid-ranges are meeting forming a possible support.

1h Chart:

When we zooming further in, the side channel that the PA entered on Friday, becomes clearer at what it has to offer. The plan will be to trade the breakouts of the channel.

Now, on the upside the path is much clearer with a possible stop at 158.349, whether on the down side there might be some challenges like the Fangorn Forest, but that shouldn't scary us as we have the possibility to trade on rallies or up-scaling.

One Trade to rule them all, One Trade to find them, One Trade the win them all and then re-invest them.

"sorry I shouldn't watch LOtR before I write the ideas"

The Plan

Side Channel Breakout either upper or lower band: Targets

Up 158.349 and 159.218

Down 155.500, 155.000 and 152.700

Thank you for dedicating some of your precious time reading this idea.

I hope you have a profitable week

GU, Trading Heaven, Weekly Analysis and PlanThe Week:

Last week shooting star didn't fail to deliver as mentioned in last week report, but it fail to form the evening star, which is a bit disappointing. On Friday the bulls took the matter in their hands and managed to absorb some of the losses incurred during the week. Volume stays high above average, and with the narrow candle, it seems to me we that we are getting early signs of accumulation phase.

Daily Chart:

Here the trend is mostly bullish the high low hasn't been approached yet. Next possible targets for the bears is the demand zone around 1.34, at this level we also have the Daily low band and Weekly mid range. Volume wise, we have the first three candles of the week, very narrow, but on very high volume, positions are being marked there, probably accumulating for the next move.

4h Chart:

New range formed L1.35074 H1.37334. This is where the pair currently trades we are right in the middle of Daily range, pretty uncomfortable place to trade, being patient and waiting for the PA to reach a more solid level could be a good choice. The bullish pullback on Friday has reached the 4h and Daily mid-range levels, and a rejection from here is highly probable. Ideally we want to see the price entering the demand zone before engaging in trades(lower risk). But there is also a good trading opportunities on the breakout of the channel or within the channel. We will get a closer look at the entries at the 1h TF.

1h Chart:

As you can see on the chart the current 4h range is about 220 pips wide and has about 150 pips from each side to support or resistance, looks like a trading heaven. There are so many trading possibilities for both rejections or breakouts. I will try to summarise them as best as I can in the "Plan" section.

The Plan

Resistance Rejections

current 1.36215

4h upper band 1.37334

D upper band 1.38738

Support Rejections

4h lower band 1.35087

D lower band 1.33436

Breakouts

Short 1.35087

Long 1.37334

This are just a few possibilities, but honestly the current set up offers so much.

Targets I leave to you to decide which level you want to attack.

Thank you for dedicating some of your precious time reading this idea.

I hope you have a profitable week

Gold, Holding Ground. Weekly Analysis The Week:

The bulls managed to sustain most of the bearish pressure and actually closed the week in green. The last two weekly candles (shooting star and hanging man) suggest some kind of consolidation or pausing point, Bulls and Bears in full war mode. In the incoming week I don't expect the PA to exit the current range L4274.25 H5592.65, which is great for rejection strategies within the range.

Daily Chart:

On daily chart, things are slightly different. First comes the hammer on Monday which stopped the price from falling and pushing it all the way up to 5091.95 which is just above the Daily and Weekly Mid-Range. Another interesting observation is the volume on Thursday and Friday, the candles are just marginally different but the volume on the down candle on Friday much healthier (although still below average). This information give us a warning about the current level which might be hard to break and open the possibility to short from here.

4h Chart:

This TF has created a new trading range L4402.39 H5091.95 and also currently we have two mini-trends, which might be an early sign of pause and consolidation which was already noted on the weekly chart.

Downtrend High 5597.72 Low 4402.39 LH 5091.95

Uptrend Low 4402.39 High 5091.95 HL 4659.10

Of course we don't mind at all if it's trading up, down or sideways (especially in a large range like this one) because there trading possibilities regardless of the trend.

1h Chart:

At this timeframe first thing we note is the breakout of the down channel which started on Wednesday and ended on Friday.

The price then entered into a supply zone, which will give us the chance to early trades on Monday.

The Plan:

The metal remains highly volatile, so there is more risk involved but also greater profits.

Short Rejection current level 4950 or 5091.95 Target 4h mid-range 4750 or lower.

Long Breakout 5091.95 Target 5445

Thank you for dedicating some of your precious time reading this idea.

I hope you have a profitable week

GOLD - Consolidation in a symmetrical triangle. Up or down? FX:XAUUSD showed signs of recovery on Friday, but the price is stuck within the boundaries of a symmetrical triangle, which generally indicates market uncertainty.

Key fundamental factors

The ADP, JOLTS, and unemployment claims reports pointed to weakness in the labor market, supporting expectations of two Fed rate cuts this year, which is positive for gold. Upcoming US-Iran talks are supporting demand for safe-haven assets, despite the conclusion of the Ukraine talks. Other central banks (the ECB and the Bank of England) easing policy has strengthened the dollar, putting pressure on gold.

Gold's attempt at recovery looks vulnerable. Although weak employment data and geopolitical risks provide support, the main counterforce remains the global rotation of capital in favor of the US dollar.

Technically, the market may have a chance to break through the correction resistance, but will there be support from traders?

Resistance levels: 4901, 5021, 5100

Support levels: 4811, 4751, 4670

I expect that before attempting a breakout, the market may try to test liquidity in the 4812 zone. However, if the market breaks through the resistance conglomerate and manages to close above 4901, then the market will be able to continue its growth towards 5000.

Otherwise, if 4812 does not hold the price, the market will close within the boundaries of a symmetrical triangle (flat).

Best regards, R. Linda!