EURUSD - Analysis for the week ahead and potential tradesIn this video I show some good past setups on the EURUSD that would have been profitable as well as take a look at where the markets may be going over the next week or more. I focus primarily on the inside bar pattern and some potential ways to trade these setups.

Since early this year there have been a number of high quality price action setups including inside bars, engulfing bars, and pin bars. The majority were quality, trade-able setups that would have offered risk:rewards of 1:2 or better. Price is currently stuck in a strong bearish trend so we will be looking for small pullbacks into key resistance areas to get short with the trend. There is also a larger head-and-shoulder pattern that is currently forming. Prudent traders will want to watch closely to see if that pattern continues to form as well.

Pin Bar

ES - Bullish price action in the hourly'sPrice continues to consolidate on the daily chart so I take a look at any price action in the hourly charts. I see a potentially bullish hammer setup on the hourly chart off of a key price level. If the candle closes as a hammer and breaks above we may see that next strong bullish move up.

AUDUSD - Short term bearish signal confirmedWhile I have been and am still bullish on the weekly candle, there has been a fairly bearish signal in the 4 hours that has formed and also been confirmed. I was originally in the position from earlier this week and planned on holding until either the weekly pin bar broke to the upside or there was a significant enough bearish signal to cause me to close my position. I was still able to close for a profit since I had gotten at a lower price. Such a signal happened overnight. The setup was an inside bar/ pin bar fake-out. That is where you have an inside bar pattern followed by a breakout to the upside which quickly pulls back in and formed a pin bar. This is generally strong signals due to the fact that many market participants will get long on the breakout and when price pulls back in you have a squeeze setting up. In this particular case there were multiple inside bars which give the pattern even more strength.

If you are bullish and still want to get long there are a few options, you may simply want to wait until the price breaks above the weekly pin bar for the safest trade, but also the smaller risk-reward. If you are feeling more aggressive you could enter once price touches the important trend line at around 0.7475, or simply sit this one out.

S&P 500: This Retrace Can Lead To 2680a Before Reversal.S&P 500 update: After the bearish pin bar appeared and triggered within the predetermined resistance zone, price behaved as anticipated. Selling momentum asserted itself and this market is now in retrace mode. To avoid premature entries in a situation like this, it is important to evaluate potential support in light of the overall technical context.

In my recent S&P report, I wrote that price was vulnerable within the 2710 to 2751 resistance zone (.618 of recent bearish structure). The selling did not kick in right away, it took a couple of days, but the point was the risk of retrace was high. There was also a nice report written on S.C. yesterday about how to maneuver in a situation like this using options.

Now that bearish momentum is in effect, the question is: how low can it reasonably go and still maintain it's broader bullish bias? 2683 is the next support level (.382 of recent bullish swing) to watch for as far as a bullish reversal.

Remember, the bigger picture is bullish. Elliott Wave counts have pointed to the 3K area as a potential long term target (posted on S.C.). Considering this context, IF price is going to adhere to this path, then the 2680s are a convenient location for buying to resume. The price patterns that appear there will either confirm or reject this idea.

If price breaks below 2683, then it is obviously in for a deeper retrace, but it will still not change the bigger picture outlook by much. It will signal more of a range bound market on the short term.

In summary, when using the S&P as a gauge for portfolio management, or as an outright trading instrument, the technical picture can provide clarity where fundamentals will not. I wrote about the price vulnerability days before the bearish pin bar and short trigger. I cannot predict the news and catalysts that actually cause the reaction, all I know is that the probability of selling is high.

This market is very reactive to many factors such as earnings, political events, economic reports, etc. It is tough to do for most people, but tuning all this out and looking at the market purely from a technical standpoint will provide extra insight that the herd often misses because of these distractions. Short term price action favors selling, so be prepared for the 2683 level whether you are day trading or managing a stock portfolio. You can also follow along on S.C. and see how we utilize this information.

Potential Long oportunity for AudUsd??The Aussie has been bearish against the Dollar since 19th April (or Dollar has been strengthen).

0.7505 is the key level of support.

I am "betting" that Head & Shoulder pattern is likely to form **IF the coming 4hr candle closes with a long tailed bullish Pin.

Will update my Entry, SL and TP in an hour **IF it is a bullish Pin.

** Please do your own due diligence **

** This is not a Buy / Sell recommendation **

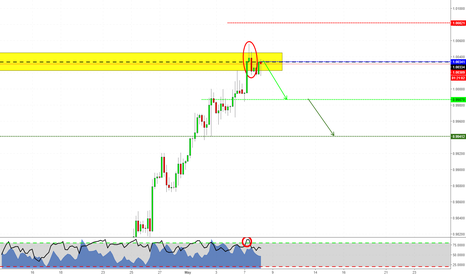

Reversal pattern on USDCHFHi guys,

i've been looking at this pair often lately, and i'm still looking to sell this because i think we need to see a relief rally before eventually continuing to the upward direction. At this moment, we're testing a very strong resistance level, both weekly and daily, and we're doing so in overbough condition (heavy overbought). On a lower timeframe, such as the 4H, you can see price is still overbought and has created a nice reversal pattern in the form of a pinbar + an engulfing to the downward side. I'm taking this short, with stops and targets as showed.

If you have any question/idea, feel free to share it below.

Otherwise, see you in the next chart!

ETHUSD: Relevant Support But Still Lacking For New Long.ETHUSD update: Price has retraced back to the 656 support which is a predetermined level. There is even a bullish pin bar present which can be tempting to enter a long, but just like BTC, this market is also lacking price structure.

The 656 level is the .382 of the recent bullish structure which is an attractive level to look for long setups. The question is, what does a long setup look like? Pin bars and other candle stick reversal patterns can serve as validation points, but what is missing here is a broader structure like a double bottom formation.

Just like the aggressive trade signal that we recently called in BTC (on S.C.), this market is showing a similar situation. Trend line support, a predetermined level (which BTC did not have at the time of the signal) and a bullish pin bar. This is the recipe for a long, but the problem is the probability, especially in light of a BTC market that has not proven any technical stability yet.

Keep in mind, price can fluctuate up to the 714 level (.382 resistance of current bearish swing), or even the 741 area (.618 of recent bearish structure) only to establish a lower high. Day trading up to these levels is one thing, but swing trading carries too much risk.

In summary, at S.C., we are now waiting for the more conservative criteria to appear before entering into the next swing trade long. Stability can be expressed in the form of chart patterns and until one of our setups appear, we will not issue any new signals. As long as momentum stays bearish, it is still within reason to expect price to push lower. How much lower? There is no way to determine that, especially with no particular structures in place. Patience is key. These markets will find stability, it is a matter of time. Instead of deciding for the market, at S.C., we will simply wait for it to provide clarity and then determine if there is an opportunity worth entering.

Questions and comments welcome.

ETHUSD: Higher Low Signals Strength But Inside Resistance Zone.ETHUSD update: Higher low forming inside resistance zone while momentum remains bullish. On top of that, there is a bullish pin bar that may signal further buying for a potential higher high.

While BTC has a somewhat similar formation, this market happens to be inside a resistance zone while BTC is not. As I write continuously, best practices say buy supports, sell resistances, but always remember to consider context. In the current situation, there is a bit of a conflict. There is a shallow higher low forming within the 741 to 845 resistance zone (.618 of recent bearish structure). Often higher lows lead to higher highs, and in this case, since momentum is clearly bullish, it is within reason to expect this resistance to break.

With that being said, I believe this market will follow BTC which is in a slightly better position to rally which can lead this market into the next reversal zone defined by the 876 boundary. Although a shallow higher low is a very aggressive trade, we are not issuing a buy signal for this market (especially since a signal was issued on BTC. See S.C.).

The more attractive location for a swing trade long is the 656 support (.382 of current bullish structure). Price may not retrace back to that level though, especially if BTC pushes its resistance zone. This is a tough call because as all the coins are poised to go higher, this particular market is less attractive because of the risk associated with such a location.

Best practices offer a general guide to positioning yourself alongside the intent of the market. Buying a strong market, one that makes higher lows and higher highs is appropriate, but context is an important consideration when it comes to assessing the risk. And when I mention risk, I am not just talking about the possible loss, but also the probability of the trade following through which is a different and tough to evaluate variable. If we are going to call an aggressive trade, we would rather choose BTC since it is in a more attractive position compared to this market. Remember, the purpose of these posts is to provide insight and perspective, because when it comes to taking risk, you have to be able to do that within the boundaries of your own tolerance and trading process. You must be able to make your own independent decisions, and know exactly why you make them and recognize when the market is not cooperating quickly. Check out S.C. for more.

AUD/USD [08.05.18] LONG 1W - here we can see obvious long trend. Do not rely on parallel channel, they are here to make clear the trend.

1D - little by little last wave turns into small triangle

4H - that's important the real detail, bear doesn't want to create new swing.

Target - 0.76278

Stop Loss - 0.74699

Entry Price - 0.75225

50% of pin-bar

S&P500: Higher Low Can Lead To Test Of 2710 Again Soon.S&P500 Update: This chart puts Friday's strong market close into perspective. There is a failed low and bullish pin bar off the 2615 to 2587 support zone. This bullish configuration can lead to a consolidation breakout and retest of the 2710 to 2751 resistance zone.

Earnings, economic data and political catalysts sway sentiment in this market constantly, but it is important not to lose sight of the levels. The 2615 to 2587 support zone is the .618 area relative to the recent bullish structure. This is an area to look for buying activity which appeared Thursday by the close. Friday was when a bullish trigger occurred along with dramatic follow though.

This information is valuable even if you are not trading the S&P outright. Since this market generally acts as a broader market gauge, you can use signals in this market to help time decisions in individual companies. For example, the current technical structure implies broader strength in the near term. If this market breaks out of its consolidation and pushes the 2751 resistance level, it may be well on its way toward the 3K level which sets the stage for a summer rally.

Keep in mind, this market is very sensitive to many economic and political variables. Don't be distracted by the reaction to this information, instead question how price is behaving at the predetermined levels. Now that momentum has shifted back to bullish, the next relevant area to consider is the 2710 to 2751 resistance zone (.618 of recent bearish structure). If price can close strong in this area, then it is more likely to push into the next zone which is the 2746 to 2804 area.

In summary, overall price is still within a broader consolidation but there are signs that imply a broader bullish breakout is more likely. Monitor fundamental catalysts but do not fall victim to exaggerated news or over dramatized hype. Instead, use the levels that this market faces as it moves forward as more of a measure of reality. If price breaks below the 2587 support, then more bearish sentiment should be expected, otherwise, this market is still following the bullish road map that has been outlined by the long term Elliott Wave count available on S.C. There is no guarantee that the market will stay on this path, but watch for fundamentals that reinforce this technical view along the way and plan ahead, do not react.

Questions and comments welcome.

Will DowJones30 rally from the Pin bar?23751 - 23267 is the key support area.

A long tailed bullish pin can be spotted on Daily chart rejecting from the key support area.

Main concern is that my Stop Loss size is very large (662 pips), will definitely trail my Stop Loss when price goes in my favour.

My position:

Entry : 23962

SL :23300

TP : 24955

** This is not a Buy/Sell recommendation **

** Please do your own due diligence **

AMAZON (AMZN) formed a pin barAMZN formed a pin bar yesterday.

Stock strenght is above 69.

Watch the stock and lets see if slowstochastic is going to reverse or check on lower timeframes if there is a entry signal.

Disclaimer:

This is just my tought: don't invest based on this idea.

Disclaimer:

This is just my tought: don't invest based on this idea.

Match Group MTCH formed a pin barMatch group MTCH slowstoch is oversold and yesterday the stock formed a pin bar .

Slowstochastic is below 20 so oversold: pin bar could be a good signal for reversing the trend.

Stock strenght is above 85!

Watch the stock and lets see on lower timeframes if there is a entry signal (for example at 4h TF).

Disclaimer:

This is just my tought: don't invest based on this idea.

Akamai technologies AKAM formed a pin barAkamai technologies AKAM: slowstoch is oversold and 2 days ago the stock formed a pin bar.

Slowstochastic is bounced on the oversold zone: pin bar is a good signal for reversing the trend.

Stock strenght is above 63.

Watch the stock and lets see on lower timeframes if there is a entry signal (for example at 4h TF).

Disclaimer:

This is just my tought: don't invest based on this idea.

EURUSD: different reasons to go longHi guys,

today i want to talk about why i'm going long on this pair. Starting from our daily analysis, you all can see that price is testing a former level of resistance that now can turn into support. In addition to that, we can also see the RSI is in oversold condition and the price has created an harmonic pattern called Gartley. Going down on lower timeframes, we find again an RSI oversold (4H) and also a pinbar formed right after the completion and an engulfing kicker coming few candles after it.

With all these things, i'm confident to go long with stops and targets as shown.

If you have questions/ideas, feel free to comment beneath.

Otherwise, see you in the next chart!

ETHUSD: Mixed Price Action Unfit For Long Signal.ETHUSD update: Pin bar forms in an attempt to break the primary bullish trend line. This candle stick pattern is usually a key requirement for a buy signal, but not the only requirement. This price action is tempting as a long signal, but the location makes it more risky than its worth.

At S.C. we apply rules based trading techniques to call our trades. The first rule is that price needs to be at a predetermined level (support or resistance). At the moment, price is fluctuating between the 575 support area (.382 of recent bullish swing) and the 741 to 845 resistance zone (.618 of recent bearish structure).

In order to go long, price needs to be gyrating around the 575 area and then establishing a bullish pin bar. The 575 area also happens to be where the secondary trend line is located as well which adds to the bullish argument. Or price needs to be testing the 493 to 434 support zone (.618 of current bullish swing) in order for a long signal to meet the criteria for taking risk.

Just like in BTC, there is nothing attractive or special about the current price area which means price action is more likely to behave randomly here. Situations like the one visible on the chart, are what lure traders who are driven by greed and focused on money into the market. They focus more on the potential profit rather than the probability of generating that profit consistently over time. Remember even when everything lines up perfectly, the trade can still fail. So imagine the performance over time of trades that are taken for no reason. The performance is completely random minus your costs.

In summary, either price pulls back further and retests the 575 level, or it pushes higher from here and retests a broad resistance zone. Momentum favors the push to resistance, but what kind of risk must you face at current levels? Would you be okay with taking a swing trade now, and then watch it pull back 100 points all while hoping it recovers? That is not the kind of trade that we would call whether it works out or not. Controlling risk is our primary concern, especially when sharing signals with the community. Forcing a trade is one of the more expensive bad habits that newer traders must shake as soon as possible. At S.C. we don't force trades, we wait until market variables line up so that we have a much better chance of coming out ahead consistently and avoiding low quality setups that randomly yield profits. The value is not in the profit, it is in the repetition.

Questions and comments welcome.

Nzd Cad Up Trend Technical brokenAs we see we have broken the Higher Highs to the downside with a SHS formation at the top and we have a break + follow through through the trendline .

Now we have a big pinbar right on the well respected s/r level which could lead to a nice pullback in direction of last lower high (right shoulder)

But as we have also break the upward trend from technical view we can also expect further downward movement.

i will look for a long in h4 after break above the small resistance and i look for a short on daily chart after break below the Pin.

GBPUSD: Attractive Location For Long, But No Setup. Yet.GBPUSD: Price is forming a pin bar on top of the bullish trend line which also happens to be in a minor support zone. This is an attractive place to look for long swing trade setups or to lock in profit on shorts.

The 1.4131 to 1.4065 zone (.618 of recent bullish swing) is a lower risk area to participate in this market which is somewhat bullish on the short term. The big picture is a different story (See Elliott Wave count on S.C.). Also the fact that price has rejected the 1.4325 level so dramatically begins to establish a very broad lower high (below 1.4500 level). This is in line with the general bearish outlook on the weekly time frame.

With that being said, taking a swing trade long is still possible, it is just that profit expectations need to be within reason since the long side is limited in terms of potential. At the moment, IF a swing trade setup develops, a target below the .14200 makes more sense compared to expecting a new high over 1.4300.

Also keep in mind, even though there is a sign of a bullish reversal on this chart, the market has about 12 hours before the candle closes. This means it can still close weak and the pin bar can disappear. I will be watching the Sunday night candle to determine if a long swing trade setup is present or not. Updates available on S.C. only.

BTCUSD: Lower High To Failed Low? Or New Low?BTCUSD update: Price establishes a pin bar at 6425 which emphasizes the relevance of the 6805 reversal zone boundary. Now is when things get tricky because this market is not in the clear yet when it comes to broader bullish momentum. The 7492 resistance level is still intact as well as the nearby bearish trend line. What does all this mean?

The broader bearish momentum is still intact and will be until the market proves otherwise. If you had the risk appetite to enter the market on the lows, then you got good prices in the face of total uncertainty. Buying now for that same reason presents increased risk because if the bearish momentum stays intact, you will be getting the worst prices AND having to take the pain or get shaken out if this market retests the low which is VERY POSSIBLE. This upward move, as welcome as it is, has not proven itself yet.

To prove that the bears are losing control. price needs to: close above the bearish trend line and close above 7492 which is the .382 of the most recent bearish swing. IF the market can meet these requirements, that is still not enough for me to get long as a swing trade, or even add to my position trade. After the break, I want to see a subsequent higher low or failed low formation. Whether it is shallow or goes into extreme low territory near 6K, that is the move that I prefer to buy into at this point.

Waiting for the higher low scenario will not give you the best prices, BUT it will help filter out buying too early. Timing this is not perfect, and it would be preferable to see that higher low initiated by another pin bar. Ultimately how you enter and what kind of risk you are willing to take is up to you. If you have no problem holding this market to zero, then buying anywhere near these lows is not a bad idea.

What about shorting? From a technical standpoint if I was able to short these markets, I would consider such a level for day trading purposes only. I must reiterate, holding longer time frame shorts at these levels is extremely risky, especially when some exchanges will not let you out of your position because of a liquidity shortage during a squeeze. Shorting on a day trade basis requires a ton of attention, and a very fast decision making process in order to decisively get out if you are wrong. Not a good idea for less experienced traders.

In summary, do not get sucked into the impulsiveness of these markets. From low to high, this market moved 1k points. People who do not know how to put this into perspective will look across all of the coins, see a lot of green, and proclaim, "The bottom is in!". In terms of structure, there is no evidence that suggests that the bearish momentum is losing its grip. According to the current structure in place, it is still within reason to expect a lower low or at least a retest of the low. The key to taking action is when the market does NOT do what it is setting up to do. It is setting up to establish a lower high which often leads to a lower low. If it can't make that lower low upon a retest, that is the evidence that reveals the bears are exhausted. Being that this market is in the middle of a major support zone, a failed low is a very welcome sign at such a location. I laid out the scenarios, now you must figure out your decisions in advance so that you are not reacting, you are instead following your plan.

Questions and comments welcome.