BTC bearish divergence negated, 200EMA not yet testedCRYPTOCAP:BTC

🎯The bottom appears to be in as Bitcoin climbs the wall of worry once more. BTC showed strength this week, rejecting just below the daily 200EMA. This isn’t a great sign, I would like to have seen it tested to show strength. Still a possibility from here as price tests resistance, flipped support. Wave (3) appears to be underway; we should expect a strong move in the coming days/weeks. The first resistance will be the daily 200EMA; overcoming this will be bullish. Price is above the daily pivot, showing a bullish trend emerging.

📈 Daily RSI is creeping to overbought, bearish divergence was negated.

👉 Analysis is invalidated below wave (2), bringing up the downside target $76600

Safe trading

Pivot Points

AAVE Hidden bearish divergence on the daily playing outEURONEXT:AAVE

🎯 The path from last week’s analysis is being followed, so far. Price printed a bullish engulfing candle breaking above the daily pivot, but was ultimately rejected at the R1 pivot, now testing the daily pivot and High Volume Node as support. The downtrend is intact. The first target for continued upside is the daily 200EMA and High Volume Node resistance at $210. Overcoming the daily 200EMA will add confluence to a major bottom being in. Wave (C) of triangle wave (D) appears to be underway.

📈 Daily RSI printed hidden bearish divergence which is playing out.

👉 Analysis is invalidated if we drop below $148, keeping wave (B) alive.

Safe trading

Elite | XAUUSD · 15M – Range Hold → Bullish Recovery SetupOANDA:XAUUSD PEPPERSTONE:XAUUSD

After a strong impulsive move, price entered consolidation and corrective structure. The latest rejection from the lower range boundary shows buyers defending the level. As long as price holds above the marked demand zone, bullish recovery toward range highs remains valid.

Key Scenarios

✅ Bullish Case 🚀

Holding above 4595–4600 support:

🎯 Target 1: 4629

🎯 Target 2: 4641

🎯 Extended Target: 4660+

❌ Bearish Case 📉

Failure to hold demand and a breakdown below 4566 may open downside continuation toward:

🎯 4513 (range expansion support)

Current Levels to Watch

Resistance 🔴: 4629 – 4641

Support 🟢: 4600 – 4566 – 4513

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice.

XAUUSD | Weekly outloook | Jan 19th - 25th — 2026 Market Structure:

Gold remains bullish but is consolidating below recent ATH.

Key Levels:

Resistance: 4620 / 4640 / 4670

Support: 4560 / 4520 / 4500

Liquidity:

Sell-side liquidity rests below 4560 & 4510.

Buy-side liquidity remains above 4640 targeting 4700.

POI / Breaker:

Demand zone between 4520–4560.

Intraday reaction zone at 4585–4600.

Plan:

Looking for continuation on a clean break above 4625.

Failure below 4510 would neutralize bullish bias.

Disclaimer ⚠️: This is purely for educational purposes trade at your own risk

AUDCAD- Daily Bird's- Eye View | Tracking PhaseFrom the daily bird’s-eye perspective, I’m waiting for distribution back into mid-term accumulation. The focus is on how price behaves once it reaches those levels — specifically whether they hold and produce a clear change in character.

Until that confirmation appears, there’s no urgency to engage. This is a tracking phase, not an execution phase.

➡️ HTF context: Daily overview

➡️ Area of interest: Mid-term accumulation

➡️ Confirmation: Change in character

➡️ Edge: Patience and tracking

Patience is key. Tracking is the edge.

USDCAD- HTF Continuation | Tracking PhaseSeeking continuation on the higher-timeframe leg as price expands. On the minor framework, price is collecting sell-side liquidity (SSL) and rotating into a minor accumulation zone.

Once mitigation is complete, I’ll be looking for a lower-timeframe structure shift back into HTF alignment before considering execution. Until that confirmation shows, there’s no rush — the focus is on tracking behavior, not forcing entries.

➡️ HTF bias: Continuation

➡️ Minor context: SSL draw → accumulation

➡️ Execution: After mitigation + LTF shift

➡️ Edge: Tracking, not anticipation

Patience is key. Tracking is the edge. Let’s go.

USDCHF - Post Mid- Term Shift | Advanced Bullish ModelFollowing the flow after a mid-term structure shift. The lower high was breached, confirming a change in intent, and an advanced bullish model is now in play.

This is a high-difficulty environment (5⭐), so execution is secondary to alignment. I’m focused on how price reacts around key levels as we continue through the delivery cycle.

No forcing, no chasing — just letting structure and behavior guide the next decision.

➡️ Context: Mid-term shift confirmed

➡️ Trigger: LH breach

➡️ Model: Advanced bullish framework

➡️ Focus: Reaction at key levels

➡️ Edge: Tracking the flow, not prediction

Patience is key. Tracking is the edge. Let’s go.

EURUSD- Post --Sweep Monitoring | Accumulation PhasePrice has completed a liquidity sweep, and I’m now monitoring volume reactions as the market collects courtyard liquidity and rotates back into full accumulation.

At this stage, I’m expecting a potential shift toward delivery, but there’s no stress and no chasing. The only job here is to watch the tape and let smart money reveal intent through structure and displacement.

Until that confirmation shows, I remain patient.

➡️ Context: Sweep → Accumulation

➡️ Focus: Volume response & tape behavior

➡️ Execution: Only after confirmation

➡️ Edge: Tracking, not forcing

Patience is key. Tracking is the edge. Let’s go.

EURGBP - 7H Bird's-Eye View | Patience Before SizeFrom the 7H bird’s-eye perspective, price has already distributed into a strong higher-timeframe accumulation territory. Within that environment, I participated with point buys during the minor bullish legs, targeting internal highs as part of the ongoing delivery.

That said, the full mid-term structure shift has not yet completed. Until we see a clear mid-term shift followed by controlled pullbacks, I’ll remain selective and patient. Full position size only comes after structure confirms, not before.

Until then, the job is simple:

track price, study behavior, and let the cycle complete.

➡️ HTF context: Accumulation

➡️ Current participation: Minor bullish legs only

➡️ Full exposure: After mid-term shift + pullback

➡️ Edge: Tracking, not forcing

Patience is key. Tracking is the edge. Let’s go.

CADJPY - Bullish Framework | Patience Before DeliveryPrice remains bullish on the higher-timeframe scale, with the mid-term and minor structure aligned within the same cycle.

We’ve seen price mitigate the mid-term order block (orange), followed by an initial expansion, leaving clear footprints of where distribution is likely to occur. Current bearish momentum is contextual, occurring as price rotates back into a higher-timeframe accumulation area, not as a trend reversal.

From this zone, I’ll be tracking internal structure and displacement for confirmation of renewed buy-side intent. Buy executions are only valid once price confirms delivery from accumulation — until then, patience is the edge.

➡️ Bias remains bullish

➡️ Focus is on tracking, not forcing entries

➡️ Execution comes after confirmation, not anticipation

XRP has been BEARISH since JULY 24th 2025! IT STILL IS!

Back in July 2025, when XRP was at all time highs, nobody could see that XRP was in a Veraxis zone to the downside.

Price was screaming bearish whilst price was allegedly bullish. To back up my call, i added a note on Tradingview notes, dated 24th July 2025 to make an embedded receipt of this prediction. My note said:

"XRP must go down to AT LEAST $1.50 and potentially to 0.50c, as we are now in a HEAVY sell."

Roll on October 10th 2025, the so called "Crypto Crash" zoomed price to 0.77c, which shocked the crypto space. To me, this was just the beginning.

The black arrows on my chart annotate on the days i wrote the notes.

THIS MOVE IS NOT OVER.

As price progressed, many Veraxis zones to the downside were created and were respected, however the most recent one printed 10th November 2025 , and on 17th December 2025 i embedded another receipt/note to say:

"XRP will now continue its journey down to AT LEAST 0.50c, with potential to go down to 0.38c. Resistance may have to be hit first at $2.36 - $2.60 before it happens."

And as you can see from the annotated arrows, price retraced EXACTLY to that price 19 days later. The journey is now continuing down.

For context. When a Veraxis zone prints, price 9 times out of 10 MUST return back to it. I call the price of 0.50c - 0.38c as this is an untouched Veraxis zone.

One caveat as it's price over everything: Price is currently in a Veraxis zone to the upside which is contradictory to my prediction of lower prices, and price 'could' move up from here.

However, my back testing has trumped this move up in my opinion, as the Veraxis zone at 0.50c below current price, must be touched FIRST. If price does indeed spike up from this current Veraxis zone of $2.05, then i will temporarily adapt to price, but with always the expectation that 0.50c MUST be then touched in future.

SAFE MY PEOPLE!

(This analysis is built on the Veraxis framework — a methodology shaped from first principles and refined through extensive independent research. Veraxis, derived from Latin for “The True Pivot Point,” reflects a unique approach to market structure that isn’t sourced from external strategies or conventional teachings. It represents my own interpretation of how price truly pivots, reacts, and reveals intent.

As always, this is not financial advice. Trade safely, stay disciplined, and let the data speak.

)

Dogecoin could have another rally (4H)The chart shows a clear bullish Change of Character (CHoCH), formed by strong and aggressive buying pressure. This shift in market structure suggests that buyers are currently in control and that bullish momentum is building.

At the moment, price is holding and trading around an important key level, an area that has historically acted as a major decision zone. The ability of price to remain supported here strengthens the bullish outlook.

Above the current price action, a large liquidity pool has formed near the highs. This liquidity remains untapped and may be taken soon, which often acts as fuel for continuation toward higher levels rather than a reversal.

Two potential entry zones have been clearly marked on the chart. Instead of entering all at once, it is recommended to scale into positions using a DCA (Dollar-Cost Averaging) approach, allowing for better risk control during pullbacks.

All targets are marked on the chart.

Once price reaches the first target, it is advised to secure partial profits and then move the stop loss to break-even, ensuring a risk-free trade while allowing the remaining position to aim for higher targets.

If you would like us to analyze a coin or altcoin for you, first like this post, then comment the name of your altcoin below.

BITCOIN is about to take off (4H)Bitcoin has formed a clear bullish Change of Character (CHoCH) on the chart, signaling a potential shift in market structure from bearish or ranging conditions into a bullish phase. This structural change suggests that buyers are gaining control and that the market sentiment is gradually turning positive.

At the moment, price is trading around key higher-timeframe levels, where we have observed significant trading activity and time spent in this zone. This type of price behavior indicates strong acceptance of value in this area, which often acts as a solid base for continuation moves.

One of the most important observations is the liquidity pool located above the recent highs. This liquidity has already been swept, yet the price failed to drop afterward. This is a critical sign of strength. If the primary intention of the move had been only to grab liquidity, we would typically expect a sharp rejection or bearish follow-through. Instead, price has held its structure, suggesting that smart money is positioning for higher targets, not distribution.

For execution, two buy entry zones have been clearly marked on the chart. We are not chasing the price. Instead, we will patiently wait for pullbacks into these zones and enter long positions using a DCA (Dollar-Cost Averaging) strategy. This approach allows better risk management and reduces the impact of short-term volatility.

Target : 95127$ _ 106000$

When price reaches Target 1, it is recommended to secure partial profits. After that, the stop loss should be moved to break-even, allowing the trade to continue risk-free while aiming for higher targets.

As always, proper risk management is essential. A strong daily close below the key structure levels would weaken this bullish scenario and require a reassessment of the setup.

Overall, as long as Bitcoin holds above these key levels and maintains its bullish structure, the path of least resistance remains to the upside.

If you would like us to analyze a coin or altcoin for you, first like this post, then comment the name of your altcoin below.

Sideways No More?Waypoint REIT (WPR) has been range bound for nearly six years, but the current structure hints at a potential breakout. Price has retraced to the top of the long-term range and is now finding support at two key 50% levels projected from major swing highs and lows.

Trade Scenario 1: Aggressive Entry

Entry: Current levels

Stop Loss: Just below the bullish engulfing candle from the week ending 19 Oct

Target: Initial TP just under the yearly R2 pivot. Beyond that, trail your stop below new swing lows to manage risk.

Minimum Range Target: $3.70

This setup favors traders looking to front run the breakout with tight risk control.

Trade Scenario 2: Conservative Confirmation

Entry: Wait for a clean breakout and hold above the $2.82 high

Stop Loss & Targets: Same as above initial TP near R2, then trail stops with structure

This approach suits those prioritizing confirmation over early positioning.

Long Trade Setup – Oil India Ltd Bias: Long from confluence zone

Price is retracing into a strong demand zone that aligns with both the 21 EMA and 50 EMA, creating a confluence setup ideal for a long entry. The pivot level at 431.38 acts as a structural magnet, and a clean break above it could accelerate momentum toward higher targets.

Trade Thesis:

- Confluence Zone: EMA 21 + EMA 50 + prior demand

- Structure: Higher low forming above 410

- Momentum: Bullish continuation expected on reclaim of pivot

- Risk:Reward : Favorable setup with clear invalidation below zone

Waiting for price action confirmation within the zone—preferably a bullish engulfing or volume spike—to initiate the trade. Targets are layered to trail profits as price unfolds

Kalyan Jewellers- Short Trade Setup Short Trade Setup – Kalyan Jewellers

Timeframe: 125-minute chart

Stop Loss: Above ₹499

Price recently broke a prior pivot with momentum, confirming bearish intent. The current retracement is approaching a stacked supply zones, which aligns with the D EMA 50 and 21. This confluence marks a high-probability reversal area.

Trade thesis:

- Supply Zone: "Level on top of level" + HTF supply

- Structure: Lower high forming after pivot break

- Bias: Short on retracement into supply, targeting demand imbalance

Execution will depend on price action confirmation near the entry zone. Monitoring for rejection candles or volume divergence before initiating the position.

GOLD (XAUUSD): Support & Resistance Analysis for Next Week

Here is my latest structure analysis for Gold .

Support 1: 4540 - 4552 area

Support 2: 4595 - 4501 area

Support 3: 4342 - 4451 area

Support 4: 4232 - 4280 area

Resistance 1: 4640 - 4655 area

Resistance 2: 4690 - 4705 area

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD Long Term Selling Trading IdeaHello Traders

In This Chart GOLD HOURLY Forex Forecast By FOREX PLANET

today Gold analysis 👆

🟢This Chart includes_ (GOLD market update)

🟢What is The Next Opportunity on GOLD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

BTCUSD | 1H ICT Bullish Continuation SetupMarket Structure

BTCUSD remains bullish on the 1H timeframe following a clear Break of Structure (BOS) to the upside. Price entered a corrective phase forming a descending channel and has now retraced into a bullish order block, where early signs of a lower-timeframe Market Structure Shift (MSS) are appearing. This suggests potential continuation toward higher liquidity.

Key Levels

Buy-Side Liquidity (Primary Objective): $97,957.54

Internal Range Liquidity (Intermediate): $97,160.80

MSS Reference Level: $95,815.73

Bullish Order Block: $94,159.74 – $94,961.77

Trade Idea

BTCUSD | 1H — Bullish Zone: $95,147.46

Invalidation / SL: $94,159.74

(A sustained candle close below this level invalidates the bullish idea and signals failure of the order block.)

Target: $97,957.54

(Buy-side liquidity objective)

Confluence

• Order Block Mitigation: Price has retraced into a validated bullish OB that previously generated upside displacement and BOS.

• Liquidity Context: Sell-side liquidity was swept prior to the current reaction, aligning with ICT accumulation logic.

• Corrective Structure Completion: Price is breaking out of the descending corrective channel, indicating the pullback phase may be complete.

Invalidation Criteria (Very Important)

This bullish idea is invalid if price delivers a clean close below $94,159.74, as this would negate the bullish order block and imply further downside or range expansion.

This analysis is for educational purposes only and is not financial advice.

Weekly suggests top is in for nowTouched upper channel edge on weekly but ultimately got rejected. Major correction in the next couple of weeks. RSI 95 on weekly which I think is the highest ever. Big RSI DIVERGENCE on all time high of around 8%. There is huge Leverage on the long side polymarket, leveraged etf, CFDs that when they go - we will be looking at 30% downside with a lot of hopeful bulls trapped. The bullishness, the leverage, the moves remind me of 1929 and during the fall of 1929 there were lots of mini corrections as people got jittery in their longs but the belief that you buy the dip. This is that time again. Market is trying to tell us something.

Bullishness among traders is off the scale with so many posters saying "it's different this time" even though fundamentals are basically the same as they were for the last year.

My trade of 2026 is SHORT METALS (incl COPPER, SILVER, GOLD) , LONG CRYPTO, TREASURIES, STOCKS

DISCLAIMER Not investment advice. Do own research and trade accordingly.

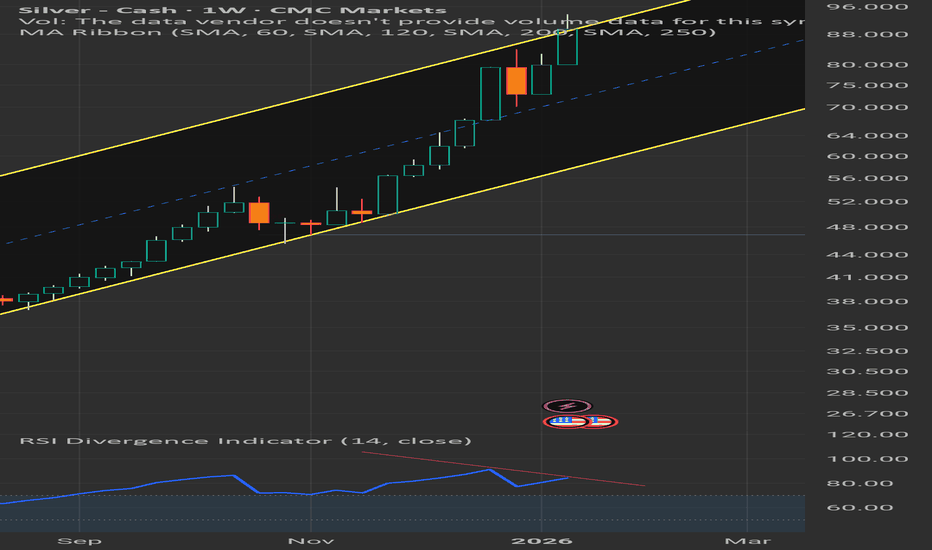

This must be relevant - Silver ⚠️ Silver hits top of weekly channel that's been in place for the last year's bull run - since Jan 2025. RSI at 94 - last time it was this high was 2011. Major RSI divergence on the highs that I calculated at 8%. I think the weekly is flashing major warning signs.

DISCLAIMER

Not trading advice. Please do your own research and trade accordingly.

XRP: 180° Time Cycle Hit Today (Square of 9)We are approaching a critical window of time for XRP.

I have been tracking a Square of Nine time cycle anchored to the significant high formed on July 18, 2025. By plotting the geometric progression of time from that peak, we can identify potential pivot points where trend changes or accelerations are statistically more likely.

The Math (Time Analysis):

Anchor: July 18, 2025

90° Square: Oct 17, 2025 (Local High)

120° Trine: Nov 16, 2025 (Consolidation)

180° Opposition: Jan 16, 2026 (TODAY)

Today marks the 180-degree Opposition date. In Gann theory, the 180-degree point is one of the strongest "Hard Aspects" in a cycle—often marking a definitive reversal or a violent continuation of the prevailing trend.

The Execution (Price Analysis): While "Time" tells us when to look, "Price" tells us what to do.

As you can see on the chart, the trend remains structurally bearish. Price is currently holding below the key dynamic resistance (EMA), and recent price action shows that selling pressure has remained dominant throughout this cycle.

The Setup: I am watching this 180° Time Pivot closely.

Bearish Continuation: If price fails to reclaim higher levels here, the time cycle suggests an acceleration of the downtrend.

Bullish Reversal: For a valid long, I need to see Price synchronize with Time. I am waiting for a confirmed break of structure or a strong reversal candle to validate that the time pivot is active.

Until then, Time says "Pay Attention," but Price says "Caution."

Let me know in the comments if you track Time Cycles or just Price Action!