Silver previous resistance - new support at 8080The Silver remains in a bullish trend, with recent price action showing signs of a breakout within the broader uptrend.

Support Zone: 8080 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 8080 would confirm ongoing upside momentum, with potential targets at:

8836 – initial resistance

9106 – psychological and structural level

9400 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 8080 would weaken the bullish outlook and suggest deeper downside risk toward:

7845 – minor support

7423 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the Silver holds above 8080. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Silver

SILVER M30 Prior High Test and Momentum Exhaustion Setup📝 Description

TVC:SILVER has pushed back into the previous swing high, completing a full recovery from the prior corrective leg. While price has successfully reached this key resistance area, the move is increasingly corrective rather than impulsive. Momentum conditions suggest exhaustion near the highs rather than strong continuation.

________________________________________

📈 Signal / Analysis

Primary Bias: Bearish

Preferred Setup:

• Entry: 84.3

• Stop Loss: 85.15 (Invalidation on RSI(14) acceptance above the 70 level)

• TP1: 82.91

• TP2: 81.93

• TP3: 80.96 (HTF draw / lower liquidity)

The displayed targets represent the primary downside objectives. However, if RSI(14) breaks and holds above the 70 region, this setup becomes invalid, signaling renewed bullish strength instead of exhaustion.

________________________________________

🎯 ICT & SMC Notes

• Price has tagged prior high liquidity (BSL)

• Current leg shows signs of momentum loss near resistance

• No strong impulsive continuation after the high test

________________________________________

🧩 Summary

TVC:SILVER is trading at a critical inflection point. While price has reached the previous high, momentum conditions do not currently support strong continuation. As long as RSI remains below overbought acceptance, the expectation favors a corrective pullback toward lower PD arrays.

________________________________________

🌍 Fundamental Notes / Sentiment

Broader sentiment remains balanced, with no immediate macro catalyst forcing aggressive upside continuation. In such conditions, rallies into prior highs are more likely to resolve through consolidation or corrective pullbacks unless momentum and risk appetite expand decisively.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

USDCHF: post-NFP setup🛠 Technical Analysis: On the H4 chart, USDCHF is rebounding into a key resistance cluster around 0.7990–0.8000, where price meets the prior supply zone and the MA area (SMA200 ~0.7976). The structure still carries a broader bearish tone (global bearish signal), and the current rally looks like a retest rather than a clean trend reversal. It expected that a potential liquidity sweep (renewal of the local high) followed by a reversal — a confirmed close back below 0.79900 would be the trigger for continuation lower. If the rejection is validated, the downside path opens toward the marked support at 0.78787.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: Sell after a sweep higher and a confirmed H4 close back below 0.79900 (approx. 0.79809 – 0.79900)

🎯 Take Profit: 0.78787

🔴 Stop Loss: 0.80488

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

SILVER (XAGUSD): Waiting for Breakout

I see a bullish accumulation pattern on Silver on a daily time frame.

The price is currently testing a significant horizontal resistance

based on a current ATH.

Its breakout and a daily candle close above 84.0 level

will provide a strong signal to buy.

I will expect another wave up then at least to 90.0 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SILVER - Ascending Channel Breakout! | Liquidity Sweep Complete

Hey TradingView community! 👋

Silver is EXPLODING right now! Let me break down what I'm seeing on the 45-minute chart.

The Setup

XAGUSD is trading at $81.72 (+2.28%) inside a beautiful ascending channel, and it just swept liquidity from the 4HR FVG zone before launching higher. This is textbook bullish price action - sweep the lows, grab liquidity, then rip to the upside.

We're now pushing toward the 52-week high at $83.75. The momentum is STRONG.

Why I'm Bullish

Ascending channel intact - higher highs, higher lows

Liquidity sweep complete - 4HR FVG zone filled and bounced

Up 11.80% this week alone - second highest close in HISTORY

Up 171% in the past year - absolute monster performance

HSBC targeting $100/oz silver - analysts extremely bullish

Soft US payrolls data = Fed rate cuts = bullish for metals

The News is INSANE

Silver is on a historic run:

Up 11.80% this week - ended at $78.88 (second highest close EVER)

Up 8 of the past 10 weeks - relentless buying

171.36% gain over the past year - outperforming almost everything

HSBC sees gold at $5,000 and silver at $100 in H1 2026

Soft US jobs data (50K vs 60K expected) = more Fed cuts coming

Geopolitical tensions (Venezuela, Ukraine, Greenland) = safe-haven demand

Index rebalancing pressure is OVER - bulls back in control

Key Levels I'm Watching

Resistance:

$82.80 - Immediate resistance

$83.75 - 52-WEEK HIGH / All-time high area

$85.00+ - Breakout target

$100.00 - HSBC analyst target

Support:

$79.85 - Immediate support (previous resistance)

$76.50-78.00 - 4HR FVG zone (already swept)

$73.50-74.00 - 2HR FVG zone (deeper support)

$70.00 - Major support / channel bottom

My Game Plan

Bullish scenario (PRIMARY): Silver just swept the 4HR FVG and is now pushing toward the 52-week high at $83.75. If we break above that level with volume, next stop is $85+, then potentially $100 as HSBC predicts. The ascending channel is intact, momentum is strong, and fundamentals are bullish (Fed cuts, geopolitics, safe-haven demand).

Bearish scenario: If we get rejected at $83.75 and lose $79.85 support, we could retrace to the 4HR FVG zone at $76.50-78.00. But given the strength of this move, I'd view any pullback as a buying opportunity.

The Bottom Line

I'm BULLISH. This is one of the cleanest setups I've seen. Ascending channel, liquidity sweep complete, FVG filled, and now exploding higher. Silver is up 171% in a year and analysts are calling for $100.

The trend is your friend here. Buy dips, target new highs.

Let's see if we can break that $83.75 ATH! 🎯

What do you think? New all-time highs incoming? Let me know in the comments! 👇

XAG Analysis

15 min analysis shows consolidation area. Any side breaks with strong close of candle out of the box, I will open position. Blue line is 70% of the previous bearish move passing is another confirmation for another bullish leg.

Target can be top of the channel but there might be another bottom touch before hitting top, so manage your positions and close some portion to save your profit.

Weekly candle close was above all other weeks.

Stay tuned for our next updates.

Silver: Stronger Story, Higher VolatilitySilver, both safe-haven demand and industrial demand are working together.

From a technical perspective, 78.70 – 79.00 is the short-term balance area. To the upside, the 81.00 – 84.00 zone stands out as the main resistance that needs to be cleared. On pullbacks, 77.00 (0.5) and 75.40 (0.382) should be closely monitored.

👉 Comment: Silver is more volatile than gold, but its underlying narrative is stronger.

BRIEFING Week #2 / Happy New Year !Here's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

MAJOR VOLATILITY EVENT ON JAN 14 : GET READYI've created this message to alert all of you to a massive volatility event that should take place on January 14, 2026.

My predictive modeling system suggests the SPY/QQQ/DIA will react to some type of massive volatility event on Jan 14. I don't know what will cause the event, but it looks like the SPY/QQQ/DIA may move 3-5% or more and remain in an elevated-volatility period for more than 5-10 days (through the end of January).

I suggest traders take Monday/Tuesday (Jan 12-13) to balance their portfolios/trades and try to position ahead of this massive volatility event.

If you have trades that could be wiped out over the next 5-10 days because of an event like this, make efforts to preserve your capital ASAP.

If you have longer-term trades, expiring after Feb 15 or so, you may be OK holding them if they are LONGS/CALLS. But I believe this volatility event could be something HUGE. So, all of you need to make efforts to protect your account/capital - even if I'm wrong.

I've created this video to explain WHY it is so important for traders to understand what may happen on Jan 14. And the only reason I know this event is likely to happen is because of my predictive modeling tools.

Either way, this is a warning for all of you. The markets will likely move into a massive volatility event on or near Jan 14.. Get ready.

This could be HUGE.

Get some

SILVER: Trading Signal From Our Team

SILVER

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short SILVER

Entry Point - 79.951

Stop Loss - 81.180

Take Profit - 77.803

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

XAGUSD | SILVER - Ascending Triangle. Road to $100 or $30??XAGUSD 1 Hour Timeframe

Possible bullish move here in the following weeks, may decide another large movement for Silver.

This may be true given the circulating news that Silvers "Paper" price is being undervalued due to Banks Shorting silver (CCN, 2025) and prices are being suppressed.

what do you think? let's hear your opinions

Silver LiningSilver is sitting at a key decision area right now. After a clean push higher, a pullback, and then another leg up, structure still looks bullish. Price has been holding above the rising moving average and continues to make higher lows, which is usually a good sign for continuation.

That said, we are now pushing directly into a major resistance zone. This lines up with the prior high and the 0.0 fib level from the last move. Areas like this are where price often pauses, chops around, or rejects before making its next real move. This is not a spot where I want to guess direction. This is a spot where I want to wait for confirmation.

If this move is going to continue higher, I want to see price hold above the moving average, keep pullbacks shallow around the 23.6 to 38.2 fib zone, and then break and hold above current highs with expanding volume. If that happens, it would suggest another leg higher is likely.

On the other hand, if price can’t get through this area, I’ll be watching for rejection wicks, failed breakout attempts, and a loss of the moving average. That would open the door for a deeper pullback into the fib retracement zone, potentially toward the 38.2, 50, or even 61.8 levels. I’ll also be watching RSI for signs of momentum fading rather than focusing on the absolute reading itself.

RSI is elevated but not extreme. In strong trends, it can stay high longer than most people expect, so I care more about divergence, structure, and failure signals than the raw number. Volume has been expanding on pushes and contracting during consolidation, which is healthy. The next real expansion out of this range should give us direction.

Bottom line, this is not a place to predict. Price is compressing at resistance, and the next real move should come from either a breakout or a clear rejection. Until that happens, this is range behavior, and patience is key. Let price show its hand.

Argenta Silver Corp Daily OutlookI have taken an initial position on TSXV:AGAG

I'm looking for price to continue higher following a small retracement in wave (ii) in orange. It's quite possible the retracement could develop further in time and price but irrespective based on this count, I consider this a worthwhile initial entry.

A potential target zone for this next leg higher is the green zone. After which we could see some consolidation in red 2. although it would be a little frustrating to hold the position, assuming red 2 retraces towards my entry, i think it will be short term pain for longer term upside as red wave 3 unfolds.

More comments on the chart

SILVER Will Collapse! SELL!

My dear subscribers,

This is my opinion on the SILVER next move:

The instrument tests an important psychological level 7995.1

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 7807.8

My Stop Loss - 8100.3

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Gold and Silver Breakout After Jobs ShockFriday’s US jobs report acted as a macro trigger

Not noise

A regime signal

Payrolls printed well below expectations

Labor momentum is cooling faster than policy expected

Markets reacted immediately

✓ Gold pushed into the $4,490 zone

✓ Silver surged toward $79

✓ Weekly momentum confirmed across both metals

Why This Matters

Weak employment data accelerates the path toward rate cuts

That shifts the balance

✓ Real yields fall

✓ Dollar pressure increases

✓ Non yielding assets gain relative strength

This environment historically favors precious metals

Why This Move Has Follow Through

✓ The rate hiking cycle is already over

✓ Inflation has stabilized enough to allow easing

✓ Geopolitical risk remains elevated

✓ Central bank gold accumulation continues

This is structural demand meeting cyclical tailwinds

Silver Is Leading

Silver out performance signals risk appetite within the metals complex

✓ Dual demand from industry and capital flows

✓ Elevated gold silver ratio compressing

✓ Smaller market size amplifies momentum

Historically silver leads during expansionary phases of metals bull cycles

Technical Structure

Gold

✓ Holding breakout above recent consolidation

✓ Prior resistance now acting as support

Silver

✓ Clean expansion from multi week base

✓ Strong acceptance above breakout zone

This is trend continuation behavior not exhaustion

Positioning Insight

Pullbacks into prior breakout zones remain constructive

Invalidation only occurs on sustained acceptance back below support

RB Trading

Educational content only

Risk management required

Silver Pulls Back After Double Top TestSilver futures bounced off resistance at $82.67 on Tuesday. According to our primary scenario, the next key move will be for price to break through this level, which would open the way toward the red Target Zone between $92.25 and $111.28. In that area, we expect the prominent top of the green-labeled wave to form, followed by a larger corrective move. Based on this outlook, traders could consider entering short positions within the $92.25 to $111.28 range, using a stop set 1% above the upper boundary of the zone. Alternatively, it’s possible that the green wave alt. already peaked at $82.67 and price is now correcting directly below support at $69.26. If this scenario plays out—which we assign a 35% probability—a direct pullback into the alternative green long Target Zone between $53.26 and $47.16 would be expected.

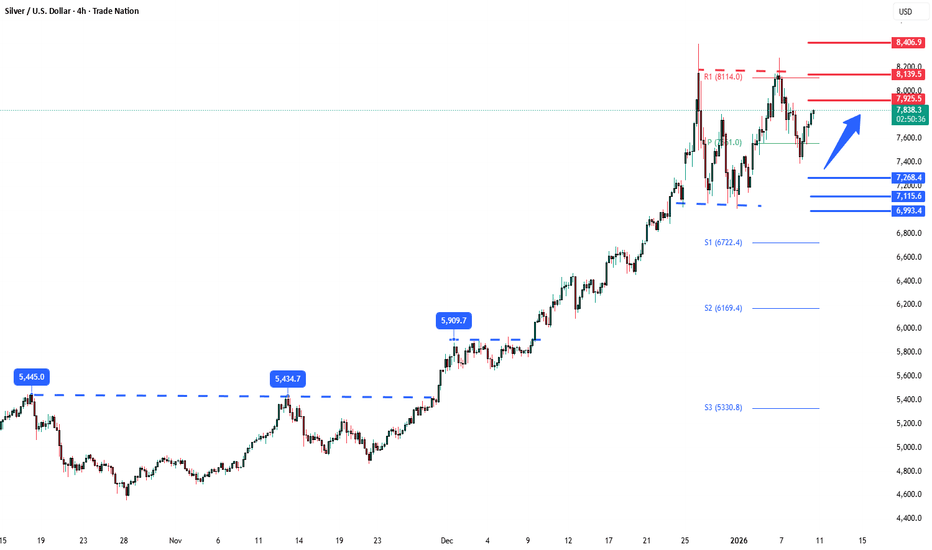

Silver bullish sideways consolidation supported at 7230The Silver remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 7230 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 7230 would confirm ongoing upside momentum, with potential targets at:

7926 – initial resistance

7154 – psychological and structural level

7397 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 7230 would weaken the bullish outlook and suggest deeper downside risk toward:

7126 – minor support

6984 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the Silver holds above 7230. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

From Silver Shine to Zinc Strength: Hindustan Zinc’s Rally AheadBreakout: Stock has broken out of a descending triangle (bullish signal).

Current Price: ₹498.10

Target Zone: ₹572.10 (upside potential)

Stop-Loss: ₹444.95 (risk level)

Volume: Strong at 36.55M, confirming momentum.

Market Drivers

Silver Rally: Recent gains supported by rising silver prices.

Sector Strength: Outperformed metals sector and Sensex in early December.

Fundamentals

India’s only integrated zinc producer.

Strong reserves with >25 years mine life.

⚠️ Disclaimer

This is educational analysis only, not investment advice. Please consult a SEBI-registered advisor before trading.

SILVER Will Keep Growing! Buy!

Hello,Traders!

SILVER reacts from a well-defined horizontal demand zone after a corrective sell-off. Sell-side liquidity has been swept and smart money mitigation is visible, suggesting a bullish reaction toward higher internal liquidity and upside targets. Time Frame 2H.

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XAGUSD Double-Top Breakdown?Silver (XAGUSD) is still structurally bullish on the bigger picture, but the tape has shifted in the short term. After a powerful 2025 uptrend, price topped out near 83.00 and has since sold off aggressively, with expanding daily volatility (ATR rising). That kind of impulse pullback often signals exhaustion, especially when momentum flips.

Technically, a Double Top is forming at the peak, and momentum confirms the pressure: MACD has crossed bearish and the histogram is widening to the downside. The key level to watch is the neckline around 72.00—this is the line that turns a pullback into a true reversal attempt. As long as price is chopping above it, the base case is consolidation and stabilization.

If we get a sustained daily close below 72.00, that would validate the breakdown path, opening room toward 66.00 as the next meaningful support objective. Invalidation is clean: a push back above 75.00 would argue for a failed breakdown and a return to the broader bull structure. Keep 69.50 (SuperTrend support) on the radar—losing it would likely accelerate downside momentum. This is a study, not financial advice. Manage risk and invalidations.

Thought of the Day 💡

The best trades often come from clarity: know your trigger, and respect your invalidation.

-------------------------

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts!