Silver: Major Surge Following Triangle Breakout.Hello there,

I am a professional trader and investor. I have traded for several years and could realize thousands of successful trades. Likewise, I use several indicators to spot the best assets and trading opportunities in the market. My focus lies on pivot-based momentum analysis to spot the best timing to enter the trade for a maximum of profit through a total-return trading approach.

Today, taking a close look at silver, we saw a massive surge in bullish volatility within the previous weeks and month. After a strong consolidation, silver broke out of this huge triangle. Considering this, fundamental indicators also supported this breakout and the bullish build-up. We see a lot of supply chain shortages making industry-specific precious metals like silver massive.

Silver is now printing several highs after the other, and with this momentum it is likely that the main target will be reached. The main target of this huge triangle is within the 140 to 150 zone. It is not unlikely that with such bullish momentum established, further targets above this initial zone will be reached.

Thank you very much for watching.

Silver

Silver Trading IdeaBased on Simple Technical Analysis ( Trendline + Support & Resistance )

Risk Disclaimer:

Please be advised that I am not telling anyone how to spend or invest their money. Take all of my analysis as my own opinion, as entertainment, and at your own risk. I assume no responsibility or liability for any errors or omissions in the content of this page, and they are for educational purposes only. Any action you take on the information in this analysis is strictly at your own risk. There is a very high degree of risk involved in trading. Past results are not indicative of future returns. Good luck :-)

Technicals dont matter hereI had some idiot with a similar last name to my first name they to call me an idiot because he said to short silver at $70ish. Then he saw my other 2 post and claimed he's a trader for 5 yrs and I'm an idiot because I didn't include any technicals. I'd be mad to I'm sure he cleaned out his daddy's money gambling on options for 5 yrs.

Enough of that idiot. To everyone looking at the charts and basing things off of rsi, over extension, yadayadayada etc. The price of silver is not going to follow those indicators how other stocks might. The silver price is based on the actual metal in physical form...short at your own risk. Buy physical because it looks like non of the deliveries are going to be fulfilled! The paper price and the actual price will part ways soon!

SILVER - Record High $72.70Executive Summary

Silver just hit an ALL-TIME HIGH of $72.70 on December 24, 2025, capping off a historic year that has seen the precious metal surge +148.54% YTD - outperforming gold's impressive +70% gain. Currently trading at $71.80, silver is riding a powerful ascending channel on the 4H timeframe with no signs of slowing down. Safe-haven demand, Fed rate cut expectations, inclusion on the U.S. critical minerals list, and rising industrial use have created a perfect storm for silver bulls.

BIAS: BULLISH - Strong Uptrend Intact

This is one of the most bullish setups I've seen. +148% YTD, record highs, ascending channel intact, and technicals screaming "BUY." The trend is your friend.

Current Market Context - December 24, 2025

Silver is having a historic year:

Current Price: $71.8050 (+0.50% on the day)

Day's Range: $70.2124 - $72.693

52-Week Range: $28.3390 - $72.693

ALL-TIME HIGH: $72.70 (hit today)

Technical Rating: BUY

Performance Metrics - ALL GREEN (HISTORIC):

1 Week: +12.68%

1 Month: +43.50%

3 Months: +63.61%

6 Months: +96.26%

YTD: +148.54%

1 Year: +142.28%

This is the best performing major asset of 2025. Silver has more than doubled from its 52-week low of $28.34.

THE BIG STORY - Silver Outshines Gold in Historic Rally

Record-Breaking Performance

Silver has surged more than 150% year-to-date, significantly outpacing gold's impressive 70%+ gain. This is gold's biggest annual gain since 1979, and silver is beating it handily.

Key milestones:

ALL-TIME HIGH: $72.70 (December 24, 2025)

Previous record broken multiple times this month

Up 143.56% from 52-week low of $28.94

Up 142.08% from 2025 low of $29.116 (April 4)

Month-to-date: +24.87%

Three consecutive winning sessions

Largest 3-day gain: +9.12% ($5.893)

Why Silver Is Outperforming Gold

Strong investment demand

Inclusion on U.S. critical minerals list

Rising industrial use (solar panels, electronics, EVs)

Tighter supply dynamics

Rotation from gold investment demand

Safe-haven appeal in uncertain times

FUNDAMENTAL DRIVERS - The Perfect Storm

1. Safe-Haven Demand

Geopolitical tensions driving investors to precious metals

U.S. President Trump calling for regime change in Venezuela

Global uncertainty supporting haven assets

Investors flocking to tangible assets

2. Fed Rate Cut Expectations

Markets pricing in two rate cuts for 2026

Non-yielding assets like silver thrive in low-rate environments

Trump wants next Fed chairman to lower rates

Falling U.S. dollar supporting precious metals

Interest rates ticking lower

3. Industrial Demand Surge

Silver added to U.S. critical minerals list

Solar panel production driving demand

Electric vehicle growth increasing silver usage

Electronics and technology applications expanding

Industrial use creating structural demand

4. Supply Constraints

Tight mine supply globally

Limited new production coming online

Inventory drawdowns

Supply unable to keep pace with demand

5. Broader Precious Metals Rally

Gold broke above $4,500 for first time

Platinum up ~160% YTD

Palladium up ~100% YTD

Copper and base metals climbing

Entire commodities complex in bull mode

Expert Analysis

Fawad Razaqzada (City Index/FOREX.com):

"The lack of any bearish factors and strong momentum, all backed by solid fundamentals, which include continued central bank buying, a falling U.S. dollar and some level of haven demand" is supporting precious metals.

Societe Generale Analysts:

"The risk of a major drop in the gold price would seem largely linked to a slowing of outright gold buying, such as by emerging market central banks. Barring such an event, investor positions suggest that the extraordinary surge in gold prices is likely to continue."

Gold target: $5,000/oz by end-2026 (Societe Generale)

ADM Investor Services:

"With the dollar weakening, interest rates ticking lower, and the U.S. President calling for regime change in Venezuela the bull camp has a plethora of bullish themes."

Technical Structure Analysis

Price Action Overview - 4 Hour Timeframe

The chart shows a textbook bullish structure:

Ascending Channel Pattern:

Clear ascending channel established

Lower trendline (support) rising from ~$58 area

Upper trendline (resistance) at ~$73-74 area

Price respecting channel boundaries well

Midline (dashed) providing dynamic support/resistance

Higher highs and higher lows throughout

Recent Price Action:

Strong rally from channel bottom

Price currently near upper channel (~$71.80)

Recent pullback found support at midline

Recovery to new highs

Momentum remains strong

No signs of channel breakdown

Key Observations:

Price at all-time high territory

Channel intact and well-defined

Trend structure extremely bullish

Pullbacks being bought aggressively

Volume supporting the move

Key Support and Resistance Levels

Resistance Levels:

$72.693 - Day's high / immediate resistance

$72.70 - ALL-TIME HIGH

$73.00 - Psychological level

$74.00-$75.00 - Upper channel resistance

$80.00 - Extended bullish target

$100.00 - Major psychological target (analyst projections)

Support Levels:

$71.00 - Immediate support

$70.00 - Psychological support / recent breakout level

$68.00-$69.00 - Channel midline support

$65.00-$66.00 - Secondary support

$62.00-$63.00 - Channel bottom support

$58.00-$60.00 - Major support zone

Channel Analysis

Channel width: approximately $10-12

Channel slope: strongly bullish (steep angle)

Current position: Near upper channel

Midline: ~$68-69 area (dynamic support)

Channel bottom: ~$62-63 area (strong support)

Channel top: ~$73-74 area (resistance)

Moving Average Analysis

Price trading well above all major moving averages

All MAs sloping sharply upward

Golden cross patterns on multiple timeframes

MAs providing dynamic support on pullbacks

Trend structure extremely bullish

Technical Rating

The TradingView technical gauge shows "BUY" - confirming the bullish bias across multiple indicators.

SCENARIO ANALYSIS

BULLISH SCENARIO - Continuation to New Highs

Trigger Conditions:

Price breaks above $73.00 with volume

Channel breakout to upside

Gold continues rally toward $5,000

Fed signals more rate cuts

Dollar weakness continues

Price Targets if Bullish:

Target 1: $73.00-$74.00 - Upper channel

Target 2: $75.00-$76.00 - Channel breakout target

Target 3: $80.00 - Extended target

Moon Target: $100.00 (analyst projections for 2026)

Bullish Catalysts:

Record highs attracting momentum buyers

Gold rally continuing ($4,500+, targeting $5,000)

Fed rate cut expectations

Dollar weakness

Safe-haven demand (Venezuela, geopolitics)

Industrial demand (solar, EVs, electronics)

Critical minerals list inclusion

Supply constraints

Entire precious metals complex in bull mode

BEARISH SCENARIO - Pullback Within Channel

Trigger Conditions:

Rejection at upper channel ($73-74)

Profit-taking after massive rally

Dollar strength

Fed hawkish surprise

Risk-on rotation out of safe havens

Price Targets if Bearish:

Target 1: $70.00 - Psychological support

Target 2: $68.00-$69.00 - Channel midline

Target 3: $65.00-$66.00 - Secondary support

Extended: $62.00-$63.00 - Channel bottom

Bearish Risks:

Overbought conditions after +148% YTD

Near upper channel (potential rejection)

Profit-taking at record highs

Holiday thin volumes

Potential dollar bounce

Fed policy uncertainty

NEUTRAL SCENARIO - Consolidation Near Highs

Most likely short-term outcome:

Price consolidates between $70-$73

Digests recent gains

Builds base for next leg higher

Healthy consolidation after massive rally

Channel midline provides support

MY ASSESSMENT - BULLISH

The weight of evidence overwhelmingly favors bulls:

Bullish Factors (Dominant):

+148.54% YTD - Best performing major asset

ALL-TIME HIGH just hit ($72.70)

Ascending channel intact and well-defined

Technical rating: BUY

Outperforming gold significantly

Multiple fundamental drivers aligned

Safe-haven demand strong

Fed rate cuts expected

Industrial demand surging

Supply constraints

Entire precious metals complex bullish

No bearish factors visible (per analysts)

Bearish Factors (Minor):

Near upper channel (potential short-term resistance)

Overbought after massive rally

Holiday thin volumes

Profit-taking risk at record highs

My Stance: BULLISH - Buy Dips

This is one of the strongest trends in any market right now. +148% YTD with no signs of slowing. The fundamentals are aligned, the technicals are bullish, and the channel is intact. Don't fight this trend.

Strategy:

Buy dips to channel midline ($68-69)

Buy dips to $70 psychological support

Target upper channel ($73-74) and beyond

Tight stops below channel support

Don't short this market

Respect the trend - it's massively bullish

Trade Framework

Scenario 1: Breakout Trade Above $73

Entry Conditions:

4H candle closes above $73.00

Volume confirmation

Gold holding above $4,500

Trade Parameters:

Entry: $73.00-$73.50 on confirmed breakout

Stop Loss: $71.00 below recent support

Target 1: $75.00 (Risk-Reward ~1:1)

Target 2: $78.00-$80.00 (Risk-Reward ~1:2.5)

Target 3: $85.00+ (Extended)

Scenario 2: Buy the Dip at Channel Midline

Entry Conditions:

Price pulls back to $68-69 zone

Bullish rejection candle

Channel midline holds

Trade Parameters:

Entry: $68.00-$69.00 at channel midline

Stop Loss: $65.00 below secondary support

Target 1: $71.00-$72.00 (Risk-Reward ~1:1)

Target 2: $73.00-$74.00 (Risk-Reward ~1:1.5)

Target 3: $75.00+ (Extended)

Scenario 3: Buy at $70 Psychological Support

Entry Conditions:

Price tests $70.00 level

Bullish bounce

Volume spike on recovery

Trade Parameters:

Entry: $70.00-$70.50 at psychological support

Stop Loss: $68.00 below midline

Target 1: $72.00-$72.70 (ATH retest)

Target 2: $73.00-$74.00 (upper channel)

Target 3: $75.00+ (Extended)

Risk Management Guidelines

Position sizing: 2-3% max risk per trade

Respect the channel - it's your guide

Don't short this market

Buy dips, don't chase highs

Use channel levels for entries/exits

Scale out at targets

Move stop to breakeven after first target

Holiday volumes may be thin - use appropriate size

Invalidation Levels

Bullish thesis invalidated if:

Price closes below $62 (channel bottom)

Ascending channel breaks down

Gold crashes below $4,000

Dollar surges significantly

Fed signals no more rate cuts

Bearish thesis invalidated if:

Price closes above $75 (channel breakout)

New all-time highs with momentum

Gold breaks $5,000

Industrial demand accelerates further

Conclusion

Silver is having a historic year. With +148.54% YTD gains, it's the best performing major asset of 2025, significantly outpacing gold's impressive +70% rally. The precious metal just hit an ALL-TIME HIGH of $72.70 and shows no signs of slowing down.

The Numbers:

Current Price: $71.8050

ALL-TIME HIGH: $72.70

YTD Performance: +148.54%

1-Year Performance: +142.28%

52-Week Low: $28.34

Technical Rating: BUY

Key Levels:

$72.70 - ALL-TIME HIGH

$73.00-$74.00 - Upper channel resistance

$71.80 - Current price

$70.00 - Psychological support

$68.00-$69.00 - Channel midline

$62.00-$63.00 - Channel bottom (major support)

The Setup:

Silver is in a powerful ascending channel with all fundamentals aligned. Safe-haven demand, Fed rate cuts, industrial demand, and supply constraints have created the perfect storm. The technical rating is "BUY" and the trend is undeniably bullish.

Strategy:

Buy dips to $68-70 support zone

Target $73-74 (upper channel) and $75+

Stops below channel support

Don't fight this trend

Respect the channel

Analysts are targeting gold at $5,000 by end-2026. If silver continues to outperform, $100 silver is not out of the question.

XAGUSD (Silver) – Bullish Continuation Setup | 4HSilver remains in a strong uptrend, printing higher highs and higher lows on the 4H timeframe. Price is holding above key moving averages, showing sustained bullish momentum.

After the recent breakout, I’m looking for continuation toward the next resistance zone.

🟢 Trade Plan:

Buy: 76.425

🔴 Stop Loss: 68.134

🎯 Take Profit: 84.730

📊 Technical Outlook:

Trend structure: Bullish (HH/HL)

Price above dynamic MA support

RSI remains strong, supporting upside momentum

Any pullback toward the MA zone could offer continuation entries

As long as price holds above the trend support, bulls remain in control. A clean break and hold above recent highs should open the path toward the 84.7 target.

⚠️ Not financial advice. Manage risk and wait for confirmation.

SLV | Next Leg Higher Is Here | LONGiShares Silver Trust seeks to reflect generally the performance of the price of silver. The Trust seeks to reflect such performance before payment of the Trust's expenses and liabilities. It is not actively managed. The Trust does not engage in any activities designed to obtain a profit from, or to ameliorate losses caused by, changes in the price of silver.

Silver- Monthly TFLook at how far we are extended above the 21 SMA on the monthly TF, the same is the case for any TF- weekly included. Usually such huge divergences even out, the last time we were at $50 peak in 2011, it was similar and we know what happened. It may not play out the same over the next 14 years, but we have to be wary especially if holding bags and in gains or if trying to enter now, which has more risk v reward imho

XAUUSD ATH Sell Analysis 4530 - 4130This sell from 4,530 down toward ~4,130 is a straightforward “extension then correction” setup. Price pushed into a fresh high at 4,530 right at the upper boundary of the rising channel, but instead of building acceptance above that level it looks like an exhaustion print. In my framework, this is also exactly where my 5-wave model count completes. The impulse ends at 4,530 so I’m not treating the next move as a trend failure, but as the expected corrective phase that typically follows a completed count. The logical magnet for that correction is the heavy volume cluster / prior consolidation near 4130 where price previously spent time and transacted heavily. That zone is where I expect the market to rebalance, fill the thin area left by the late stage expansion, and potentially stabilize before the next directional decision.

Invalidation for the correction idea would be sustained price acceptance as we are in discovery and continuation above 4530

For now I expect price rejections and potential ABC top formations

Silver XAG to $47 soonBreaking Out - silver is second most used commodity after oil and reserves are running low. It’s not difficult to work out that soon large companies, like apple , Samsung, Microsoft etc will be HODL silver like a baby on breast milk. Not to mention when the vampires come out to bite you will need your silver bullets so don’t sell your silver .

XAUUSD: potential year-end correction🛠 Technical Analysis: On the 4-hour (H4) timeframe, Gold (XAUUSD) continues its aggressive bullish cycle, supported by a "Global bullish signal" that originated earlier in December. The price is currently trading at historic highs, oscillating around the 4,500.00 psychological handle.

While the long-term moving averages (SMA 100 and 200) are far below the current market price—indicating a strong underlying trend—the immediate price action is testing a steep "Resistance line". A failure to break decisively above this diagonal resistance suggests a high-probability mean-reversion move toward the nearest liquidity pool and horizontal support zone at 4,347.07.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: Potential short position after a slight update of the current high (approximately 4499.96).

🎯 Take Profit: 4,347.07 (Support).

🔴 Stop Loss: 4,602.73 (Above the recent peak).

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

Silver Price Hits a Record High Near $72Silver Price Hits a Record High Near $72

On 12 December, we noted that silver had climbed above $60. It took the market less than two weeks to advance further and clear the next psychological milestone at $70.

Today, XAG/USD reached $72, extending the sharp rally that began in the autumn. Gold prices have also been showing strong momentum.

The surge in precious metals has been driven by:

→ robust ETF buying from retail investors;

→ rising geopolitical tensions (media reports suggest the US has deployed additional military forces close to Venezuela);

→ reduced liquidity during the holiday period. Thin trading conditions often leave markets exposed to abrupt price swings.

Technical Analysis of XAG/USD

When reviewing the XAG/USD chart two weeks ago, we:

→ identified an ascending channel (marked in blue);

→ outlined the possibility of a pullback from the channel’s upper boundary.

Since then (as indicated by the arrows):

→ the price retreated twice from the upper boundary on 12 and 16 December;

→ on 17 December it broke above the channel;

→ on 19 December the former resistance acted as support, allowing buyers to consolidate above the blue ascending channel.

The current move is characterised by a steep upward trajectory (shown in orange), with the breakout above the $70 psychological level appearing decisive.

With silver trading this morning close to the upper edge of the orange channel and the RSI in overbought territory, the market looks vulnerable to a corrective pullback. Indeed, long holders may be tempted to lock in profits after a gain of nearly 30% since the start of the month.

That said, the unique dynamics of holiday trading could still fuel an attempt to push towards the $80 level.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stop!Loss|Market View: GOLD🙌 Stop!Loss team welcomes you❗️

In this post, we're going to talk about the near-term outlook for GOLD ☝️

Potential trade setup:

🔔Entry level: 4471.202

💰TP: 4334.376

⛔️SL: 4539.615

"Market View" - a brief analysis of trading instruments, covering the most important aspects of the FOREX market.

👇 In the comments 👇 you can type the trading instrument you'd like to analyze, and we'll talk about it in our next posts.

💬 Description: Gold is fulfilling the previously outlined scenario, and given the current market situation for this metal, a potential reversal is likely. Specifically, a false breakout has formed, and if it is confirmed (with the price not moving above 4493), we can expect a decline toward key supports near 4380. Trend support and the latest price accumulation can also be targeted. All of this is located near the 4300 area.

Thanks for your support 🚀

Profits for all ✅

XAUUSD Daily – Five-Wave Impulse Toward 4,530On the XAUUSD daily chart I’m tracking a potential five-wave advance within the existing uptrend.

Wave (1)** marks the initial impulsive leg higher from trendline support

Wave (2)** is the corrective pullback that holds above the origin of wave (1) and respects the rising trendline

Wave (3)** extends beyond the wave

(1) high, confirming continuation of the bullish structure and establishing a new swing high.

* Price is now correcting as **wave (4)** back into the area of:

* the rising trendline drawn from prior lows, and

* the former consolidation / breakout zone around the previous highs.

While price holds above the wave (4) low and the trendline, I’m anticipating a continuation leg to the upside as **wave (5)**.

The projected wave (5) objective is around 4,527, where I have a confluence of measured extension and overhead resistance.

A decisive daily close below the wave (4) low and trendline support would invalidate this wave count and delay the bullish scenario.

GOLD: The Silent Takeover (Why Smart Money is Moving)The charts are speaking loud and clear. While the retail crowd is glued to the daily drama of Big Tech, Gold ( TVC:GOLD ) has entered a "pure trend" phase that is impossible to ignore.

Today we are breaking down why the yellow metal is currently the heavy hitter in the room.

1️⃣ THE DOMINANCE: Gold vs. The Giants 🥊

We always look for Relative Strength—assets that are moving UP when the rest of the market is struggling or moving sideways.

My latest scan shows TVC:GOLD is currently outperforming the market heavyweights. We are seeing Gold winning against:

The Tech Titans: Gaining ground against NASDAQ:AAPL , NASDAQ:MSFT , and $AMZN.

The Benchmarks: Showing stronger momentum than both the AMEX:SPY (S&P 500) and NASDAQ:QQQ (Nasdaq).

The Chip Leaders: While names like NASDAQ:NVDA are consolidating, the metals sector is expanding.

This isn't just a hedge anymore; it's an alpha generator.

2️⃣ THE TECHNICAL SETUP 📈

(Weekly Chart View) The price action on TVC:GOLD is textbook bullish.

The Breakout: We have smashed through the $4,300 level.

Trend Alignment: The Moving Averages are fanned out perfectly. There is no resistance overhead—just "Blue Sky" potential.

Momentum: The buying pressure is consistent. This isn't a spike; it's a ladder.

3️⃣ HOW TO TRADE THE RALLY? (The Watchlist) 📋

If you are looking to ride this wave, you need to know the vehicles available. Based on the current momentum, here are the tickers seeing the most action:

🔥 The "High Octane" (Leveraged Miners):

AMEX:GDXU : MicroSectors Gold Miners 3X – For those who want maximum aggressive exposure.

AMEX:JNUG : Direxion Daily Junior Gold Miners 2X – Junior miners often move faster (in both directions) than the majors.

AMEX:NUGT : Direxion Daily Gold Miners 2X – The standard for leveraged large-cap miner exposure.

🥈 The "Silver Sibling":

AMEX:AGQ : ProShares Ultra Silver – Silver often lags Gold, then catches up violently. Keep this on your radar.

🛡️ The "Steady" Hand:

AMEX:UGL : ProShares Ultra Gold – A 2x leveraged play on the metal spot price itself, avoiding miner-specific risks.

4️⃣ THE MACRO TAILWINDS 🌍

Why is this happening now?

The Fear Trade: Global uncertainty is funneling liquidity back into hard assets.

Fiat Hedges: With central banks worldwide continuing to print, Smart Money is treating Gold as the ultimate insurance policy.

Rate Expectations: As we look toward future rate cuts, non-yielding assets like Gold become mathematically more attractive.

💡 THE VERDICT

The trend is up, the momentum is real, and the relative strength is undeniable. Whether you are trading the spot price or the leveraged miners, the wind is at your back.

⚠️ RISK MANAGEMENT:

Leveraged ETFs like AMEX:GDXU and AMEX:JNUG are volatile instruments designed strictly for intraday or short-term trading.

CRITICAL WARNING: These are NOT for buy-and-hold strategies. Professional traders typically only use these for short swings and exit quickly.

If you are inexperienced, DO NOT TOUCH THESE. Leverage magnifies losses significantly. Most beginners lose money here. Educate yourself fully before trading.

👇 THE QUESTION:

Is this the run to $5,000? Or do you think Tech will reclaim the throne next week? Let me know in the comments!

🔥 Follow me AlgoatTV for more setups and professional analysis!

Disclaimer: This is not financial advice. Trading involves significant risk. Always do your own research.

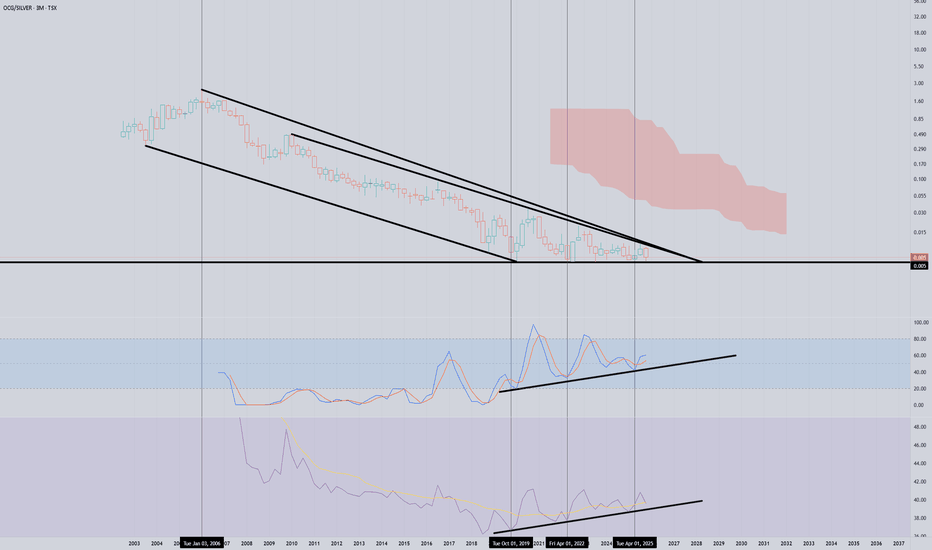

A massive move for Outcrop may be imminent!This is Outcrop Silver vs spot silver.

As you can see, the breakout has not even come close to starting. This base has been building for more than six years.

The positive divergence on the quarterly RSI charts tell me that IF this breaks out, it will be an EPIC move.

Fundamental Update - Eric Sprott has been buying a lot of shares AND this just graduated from TSX.V to TSX a few weeks ago.

Silver - Strength Speaks Loudest!!🏆Silver has been one of the strongest performers across almost the entire market, consistently outperforming most assets and leading the momentum higher.

📈Structurally, price remains firmly bullish , respecting the rising blue channel with clean impulsive moves followed by shallow corrections. This behavior is exactly what strong trends look like.

🏹As long as this rising blue channel holds , the plan remains straightforward:

I’ll be looking for trend-following longs on every correction, not chasing highs, but waiting patiently for pullbacks into structure.

Only a clear and decisive break below the channel would invalidate this bullish thesis. Until then, Silver remains a buy-the-dip market, favoring continuation rather than reversal.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Silver Market Once in a Lifetime Breakout: 120/140 USD PT📌 Base case unchanged: I’m still targeting $125–$150 within 12–24 months. The next leg of the bull run should accelerate after the all-time-high (~$49–$50) breaks and sticks. Spot is circling the mid-$40s (recent highs ~$46–$47), so the setup is in place. 💎✨

🎯 Bottom line

Silver’s structural deficit + gold leadership + policy-driven cost inflation meet a fresh technical regime. The ATH break is the ignition; $65–$75 is the first destination, and the $125–$150 12–24M target stays live if real yields drift down and PV/electronics demand stays elevated despite thrifting. Manage the whipsaws; respect $38 as the cycle guardrail. BUY/HOLD bias remains warranted. 🚀💎🔥

________________________________________

📊 Technical Outlook (2-week candles)

• Structure: Multi-year Cup & Handle from 2011 → 2020 base → 2024/25 handle. The $40 neckline break is done; a weekly/monthly close > $49.50 flips the market into price discovery.

• Levels that matter:

— Resistance: $49–$50 (ATH), then $65–$75 (measured move / vacuum), interim supply near $57–$60.

— Support: $44.5–$45 (breakout retest), $41–$42 (former cap), deeper $38 and $34 (trend break if lost).

• Momentum breadth: Higher highs on price with constructive consolidation while gold prints records → classic GSR mean-reversion tailwind. 📈⚡

________________________________________

🧭 12–24 Month Path Outlook

Base (55%) – Break & run: Close above $50 triggers trend systems and discretionary chase → extension to $65–$75 by mid-’26, stair-step into $100–$125 by late ’26/early ’27; overshoot to $150 on macro squeeze. 🚀

Alt up (15%) – Blow-off: Parabolic sprint to $85–$100 immediately post-break, sharp retrace to high-$60s, then grind to $125–$150.

Pullback (25%) – Fakeout & reload: Failure at $49–$50, mean reversion to $41–$42 or even $38, rebuild positioning; timeline slips ~1–2 quarters.

Bear tail (5%) – Macro shock: USD spike + real-yield jump + PV air-pocket; lose $34 → cycle delay (target deferred, not canceled). ⚠️

________________________________________

🚦 Catalyst Scorecard — Visible & Hidden Drivers (0–10)

1. Fed path & real yields — 9.0/10 (Bullish)

The Fed cut 25 bps on Sept 17 (now 4.00–4.25%) and signaled scope for more easing this year; several officials reinforced that bias. Lower real yields are the single strongest tailwind for non-yielding metals. 🏦

2. U.S. Dollar trend — 6.0/10 (Net-Bullish for silver)

DXY has been firm the last two weeks, a minor headwind; but with the Fed easing bias, dollar upswings look tactical, not structural. Any USD rollover clears the runway. 💵

3. Gold leadership & GSR mean-reversion — 8.5/10 (Bullish)

Gold at/near record highs ~$3.75–$3.80k keeps silver in tow. GSR ~80–84 is elevated vs. bull-market medians → skew favors silver outperformance on a gold grind. 🪙⚖️

4. Structural deficit — 8.5/10 (Bullish)

Fourth straight sizable deficit; ~678 Moz cumulative drawdown since 2021. 2025 still projected to run a ~115–120 Moz deficit despite softer bar/coin demand. 📉📦

5. Industrial demand (PV/Electronics) — 7.5/10 (Bullish with nuance)

PV/electrical demand at record highs; PV up again in 2024 (+3% y/y) and installations broadened across 38 “>1GW” countries. Offsetting force: silver thrifting (0BB, copper plating) → another 10–12% loading cut likely in 2025. Net: total ounces still robust as capacity growth outpaces thrifting… for now. ☀️🔋

6. ETP/ETF flows — 7.5/10 (Bullish)

Global silver ETPs flipped to net inflows in 2024 (+62 Moz) and kept adding into 2025. SLV shows ~15,362 tonnes in trust as of Sept 26—a sizable base of “sticky” investment metal. 📊📈

7. LBMA & COMEX stocks / liquidity premia — 7.0/10 (Bullish)

LBMA silver in London: 24,646 t (Aug) — up m/m but well below pre-2020 peaks; COMEX registered ~196 Moz. Tight-ish float + delivery frictions can widen location premia during spikes. 🏭📦

8. Tariff & logistics regime — 7.0/10 (Bullish via inflation/frictions)

U.S. 50% copper tariff (Aug 1) lifts domestic copper premia and can indirectly affect by-product silver flows and refining economics. Recent gold bar tariff confusion also showed how policy can snarl bullion logistics; LBMA welcomed clarifications, and noted silver discussions continue—headline risk persists. 🚢⚙️

9. Base-metal supply shocks (by-product linkage) — 6.5/10 (Bullish)

Grasberg disruptions and Peru protest-related shutdowns point to emerging fragility in copper output; since much silver comes as a by-product, copper hiccups can tighten silver supply at the margin. ⛏️🌍

10. Mexico policy/permitting — 6.0/10 (Bullish later, volatile now)

World’s top silver producer remains mired in regulatory overhang; exploration still depressed post-2023 reforms. Any genuine permitting thaw would be years from ounces—near-term effect is restraint. 🇲🇽📜

11. India retail/investment demand — 6.5/10 (Bullish)

Silver hitting record rupee highs; local ETFs up ~50%+ YTD; retail investment +7% y/y in H1’25. Seasonal tailwinds into festivals. 🎉🇮🇳

12. China macro & manufacturing — 5.5/10 (Mixed)

Electronics appetite is steady, PV leadership intact; property stress caps jewelry, but investment demand remains opportunistic. Net: supportive on dips, headline-sensitive. 🏗️🇨🇳

13. Systematic/CTA & options positioning — 6.0/10 (Volatility amplifier)

Trend models chased the $40 break; dealer gamma turns negative above $45–$47 at times, inviting intraday whipsaws. 🎯📉📈

14. Geopolitics (Ukraine/Mideast/Taiwan) — 5.5/10 (Event-Bullish)

Safe-haven jolts remain episodic; they matter more after the ATH triggers chase behavior. 🌍🔥

________________________________________

🧨 Hidden (under-traded) catalysts

• GSR compression trade: Once $50 breaks, programmatic rebalancing from gold to silver can accelerate relative gains. (GSR in the 60s pulls silver deeper into triple digits fast.) ⚖️💥

• By-product elasticity: Copper policy & outages (tariffs, mine incidents) can reduce silver by-product feed even as PV demand hums—this is not fully priced. 🔧⛏️

• Vault/warehouse microstructure: LBMA/COMEX stock changes vs. delivery notices can suddenly widen time/location spreads → sparks short-term basis fireworks that lift spot. 📦⏳

________________________________________

🛠️ Positioning & Execution

• Core: BUY/HOLD core metal exposure; add on $44–$45 retests; reload heavier on $41–$42.

• Breakout tactics: On a weekly close > $50, ride call spreads (e.g., $60/$90 9–15M out on SI or SLV) or risk-reversals (sell $35 puts to fund $80–$100 calls).

• Risk controls: Invalidate momentum if weekly close < $38; cut leverage.

________________________________________

🧩 Fundamental NOTES

• Spot context: XAG/USD ~$46, 52-week range ~$28–$46.7. ATH ~$49–$50 (1980/2011).

• Deficit math: Metals Focus/Silver Institute show fourth straight deficit; 2025 deficit ~117 Moz amid record industrial demand and only modest supply growth.

• Supply: 2024 mined = 819.7 Moz; 2025e ≈ 835.0 Moz (+1.9% y/y). Primary mine share keeps slipping; AISC fell in 2024 (by-product credits).

• PV nuance: Silver loadings ↓ ~10–12% in 2025e, but global PV installations broadened; total silver ounces into PV remain lofty even as intensity falls.

• Vaults/ETFs: LBMA London holdings 24,646 t (Aug). SLV metal in trust 15,361.84 t (Sep 26). COMEX registered ~196 Moz.

• Macro winds: Fed cut and may cut more in 2025 → lower real yields + easier USD path.

• Policy kicker: U.S. copper tariffs live; gold bar tariffs clarified after August confusion; silver remains under policy watch—any mis-classification can jolt premia.

________________________________________