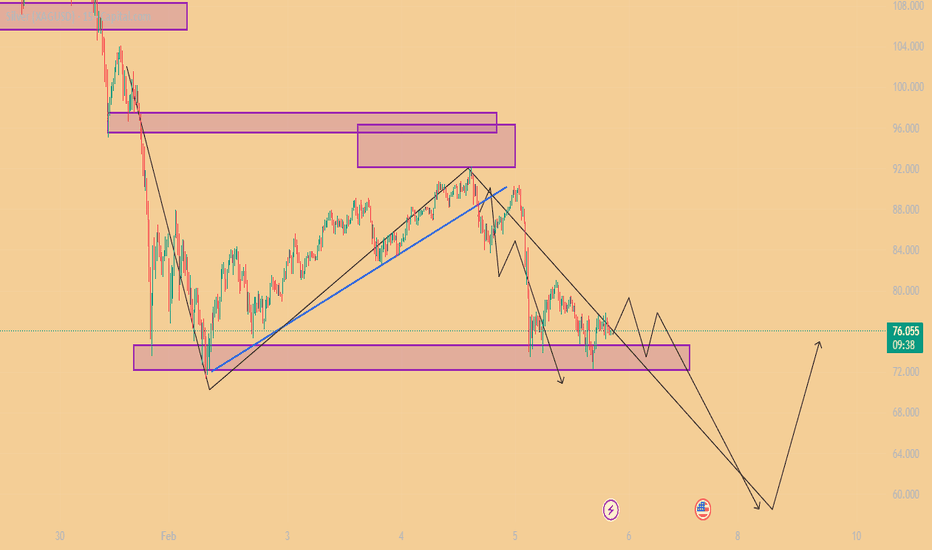

XAGUSD: Potential Bearish Continuation Following Trendline BreakMarket Overview: Silver (XAG/USD) is showing signs of a significant structural shift on the 15-minute timeframe. After a period of bullish recovery, the price has broken below a key ascending trendline (blue), indicating that the bears are regaining control.

Technical Observations:

Trendline Breach: The breakdown below the ascending support line suggests that the previous upward momentum has been exhausted.

Resistance Rejection: Price action failed to sustain above the higher supply zones near 92.000 - 96.000, leading to a sharp decline.

Current Structure: We are seeing a series of lower highs and lower lows. The price is currently testing a minor horizontal support zone around 72.000 - 74.000.

Projected Path: The analysis indicates a potential further drop toward the major demand level near 60.000, with a possible corrective bounce or consolidation before the final move lower.

Key Levels to Watch:

Immediate Resistance: 80.000 - 84.000

Major Supply Zone: 92.000 - 96.000

Current Support: 72.000

Primary Downside Target: 60.000

Silver

XAGUSD Bearish Breakdown: Rejection from Key Supply ZoneMarket Sentiment: Silver is currently exhibiting a strong bearish reversal after failing to sustain momentum within the overhead supply zone. The price action on the 15-minute chart indicates that the recent recovery phase has met significant selling pressure, leading to a breakdown of the immediate ascending support.

Technical Breakdown:

Resistance Rejection: The price faced a sharp rejection from the 92.50 - 95.00 liquidity area, confirming that this zone remains a heavy supply barrier.

Trendline Breach: A decisive break below the blue ascending trendline has occurred. This shift in market structure suggests that the bulls have lost control, and the path of least resistance is now to the downside.

Bearish Momentum: The large blue arrow indicates a strong directional shift. I am expecting a series of lower highs as the price moves toward the next major liquidity pools.

Target Levels: * Primary Support: 82.50 (Intermediate structural level).

Secondary Target: The major demand zone situated around the 72.50 - 75.00 range.

Trading Perspective: I am looking for a potential retest of the broken trendline or the immediate resistance level at 88.00 for a high-probability short entry. A sustained trade below the recent pivot low will further validate the bearish continuation toward the lower horizontal support boxes.

XAGUSD Bearish Trade Setup: Trendline Break with High R/R PotentMarket Context: Silver (XAGUSD) has confirmed a bearish structural shift on the 15-minute chart. After a prolonged struggle to break above the overhead supply zone, the price has finally breached the ascending support trendline, validating our bearish bias.

Technical Breakdown:

Supply Rejection: The price faced repeated rejections from the 92.50 - 95.00 resistance area. The inability to form a higher high indicates a depletion of bullish momentum.

Trendline Breakdown: The blue ascending trendline, which acted as a dynamic support, has been decisively broken. We are now seeing a "break and retest" pattern in play.

Bearish Continuation: The projected path (black line) shows a clear trajectory toward the lower demand zones as sellers take control of the market structure.

Trade Parameters:

Sell Entry: Initiated near the trendline retest zone around 88.10.

Stop Loss (SL): Placed safely above the recent swing high at 93.48 to protect against sudden spikes.

Take Profit (TP): Target is set at the major demand zone near 71.81.

Risk/Reward Ratio: This setup offers a highly favorable R/R ratio, targeting a significant move toward the lower horizontal liquidity levels.

XAGUSD Bearish Confirmation: Trendline Breakdown and Supply RejeMarket Overview: Silver (XAGUSD) has shown a decisive shift in market structure on the 15-minute timeframe. After testing the primary supply zone, the price has failed to maintain its bullish momentum, leading to a clear technical breakdown.

Technical Observations:

Supply Zone Rejection: The price faced heavy selling pressure at the 92.50 - 95.00 resistance area (purple box). This rejection confirms the presence of strong institutional supply at these levels.

Trendline Breach: The ascending support trendline (blue line) has been broken to the downside. This breakdown is a significant bearish signal, indicating that the recent recovery phase has concluded.

Price Path Projection: Based on the current momentum (indicated by the black zig-zag path), I am expecting a series of lower highs. The immediate bearish target is the previous structural support, with a deeper move toward the major demand zone near 72.50.

Key Levels:

Resistance: 88.00 - 90.00 (Broken trendline retest zone).

Primary Support: 82.50.

Major Target: 72.50 - 75.00.

Trading Strategy: The bias remains bearish as long as the price stays below the broken trendline. I am looking for a potential retest of the 88.00 level to confirm a "break and retest" setup for a short entry. Always wait for price action confirmation (like a bearish engulfing candle) before executing.

Silver, Hope you like the game Ping Pong.Silver… welp, we all knew this day would come.

Silver is sentimental for a lot of investors—it’s the gateway metal. The first shiny thing people buy before wandering into the jungle of equities, options, and futures. But the story isn’t nearly as black‑and‑white as the r/Silver crowd likes to paint it.

Back in the 1890s, countries had to pick their monetary “starter Pokémon”: gold or silver. Most of Europe and the U.S. went gold. Meanwhile, countries like Spain, China, India, Iran, and much of South America ran on silver. And then you had a third group—countries that didn’t back their currency with any metal at all, instead pegging themselves to other nations’ currencies. That was common across Africa and parts of Asia.

And here’s the pattern:

- Gold‑backed countries became the “first world.”

- Silver‑backed countries became “developing” or “second world.”

- Countries pegged to others’ currencies became “third world.”

This isn’t a coincidence. It’s the foundation for why U.S. banks and firms (we won’t name names, but you know the usual suspects) spent decades suppressing silver’s price.

Why suppress silver? Three reasons:

1. Stunting silver‑rich nations.

Many second‑world countries hold massive silver reserves. Keep silver cheap, and you keep their development throttled. That forces them to rely on U.S. markets, the World Bank, and the regulatory/sanctions machinery that comes with it.

2. Masking inflation at home.

If silver were allowed to appreciate naturally, Americans would have a much clearer view of what inflation has done to the dollar’s purchasing power. Can’t have that.

3. Profit. Obviously.

Paper silver, futures contracts, leveraged plays—Wall Street has made a fortune gaming the spread between physical and paper markets.

So where are we now?

We’re spectators. Peasants in the cheap seats watching global superpowers volley the price of silver like a geopolitical ping‑pong ball.

China is the heavyweight at these price levels. Some of the U.S. banks that historically pushed silver around simply don’t have the capital to dominate the game anymore. China, however, *does*—and they absolutely do not want silver dropping below \$35, because that’s where Wall Street regains control.

China’s also carrying a mountain of new debt. Their real estate sector imploded, they took on Venezuela’s debt in exchange for oil access, and then the U.S. stepped in and said, “Cute deal you’ve got there—shame if someone… took it.” Now China’s holding liabilities that weren’t even theirs to begin with.

This isn’t just about metal. It’s about **superpower status**.

Measured by nominal GDP, China is roughly \$10 trillion behind the U.S. If that gap closes, history tells us something uncomfortable: when two nations reach similar economic size while competing for global dominance, the probability of conflict approaches 100%. Not my opinion—just historical pattern.

So yes, the world stage is now fighting over silver’s price. The U.S. doesn’t want China’s silver stockpile appreciating too much. China needs it to appreciate to service debt—or face default and humiliation.

Where does that leave silver?

It’ll likely rise, but in a slow, controlled, heavily‑managed fashion. Not the explosive catch‑up move we just saw after decades of suppression. More like a supervised climb with both superpowers tugging on the rope.

And for us?

We’re just the spectators. The peasants. Watching the ball go back and forth.

Hope you enjoy ping‑pong.

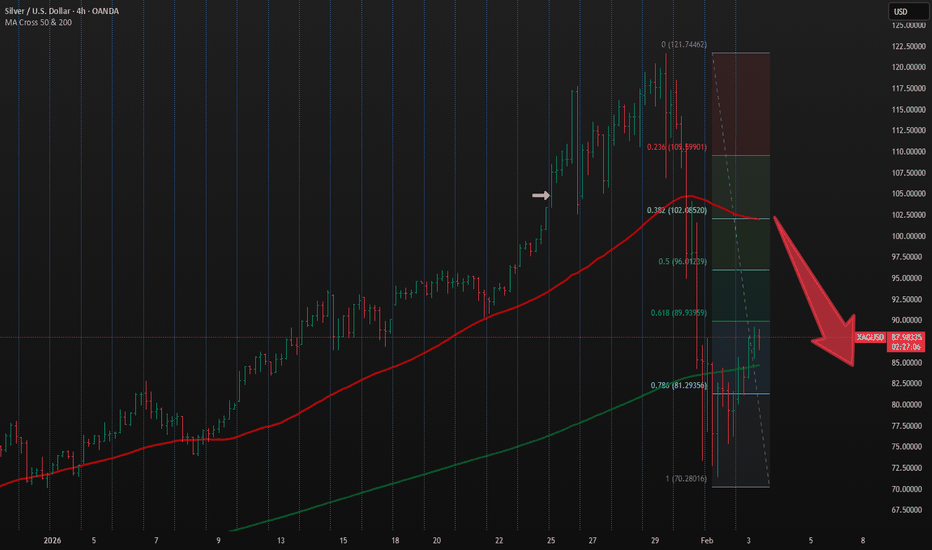

Silver (XAGUSD) Structure Shift Near Key Supply ZoneSilver price has recovered from the lower demand area and is now approaching a higher-timeframe supply zone around the 92–96 region.

The recent upward move appears corrective within a broader bearish structure, as price remains below the descending trend line and previous high-volume area.

The highlighted upper zone marks an important reaction area where momentum may slow or reverse if selling pressure returns.

As long as price stays below this zone, attention remains on the lower structural levels for continuation of the prevailing downside bias.

This chart focuses on market structure, zone interaction, and directional behavior around key levels, without providing execution instructions.

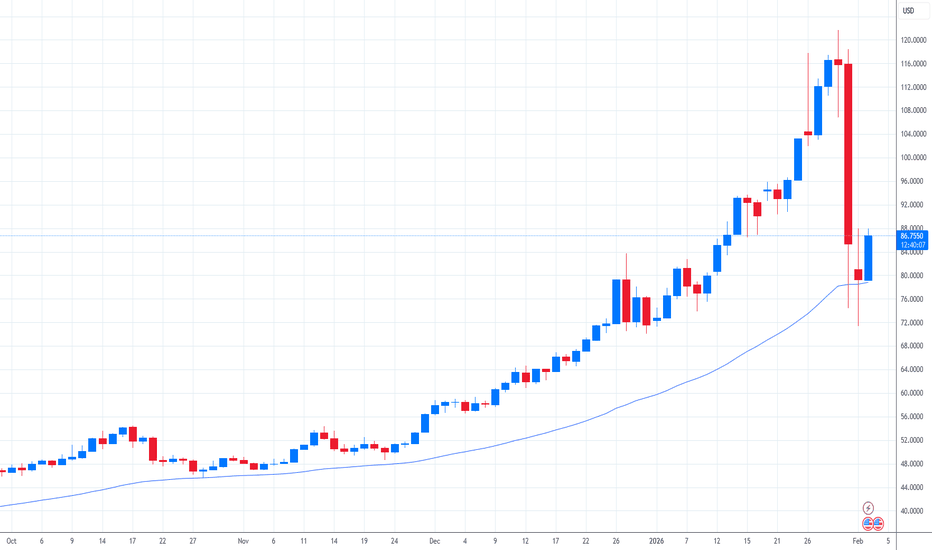

Bullish reversal for the Silver?The price has bounced off the support level, which is a pullback support, and could potentially rise from this level to our take profit.

Entry: 83.81

Why we like it:

There is a pullback support level.

Stop loss: 74.24

Why we like it:

There is a multi-swing low support level.

Take profit: 103.53

Why we like it:

There is a pullback resistance level that aligns with the 61.8% Fibonacc retracment.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Silver - Here comes the bullrun top!☠️Silver ( OANDA:XAGUSD ) creates its final top now:

🔎Analysis summary:

Silver still remains totally bullish. But Silver also remains totally overextended and the metal is also approaching the final resistance trendline. With all of this short term weakness, this might be the final top on Silver. Just please wait for bearish confirmation.

📝Levels to watch:

$100

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

SILVER (XAG/USD) | Market Update & Technical Outlook

Date: February 3, 2026

Current Price: 86.66

📰 Fundamental Market News (Today’s Highlights)

Industrial Demand Surge: Reports today indicate a significant rise in silver demand within the "Green Energy" sector, specifically for solar panel manufacturing. This industrial backing provides a solid floor for silver prices.

Inventory Depletion: Global silver inventories (notably COMEX) show a steady decline in available physical stocks. This supply-side tightness is a key driver for the current upward pressure.

Resilience Against USD: Despite the recent strength of the U.S. Dollar, silver has shown remarkable resilience. Investors are increasingly viewing it as a dual-purpose asset: an industrial essential and a hedge against inflation.

📈 Bullish Scenario (Primary Trend)

As long as the price remains above the Pivot Point of 79.00, the momentum is strongly bullish:

Target 1: 92.50

Target 2: 95.90

Long-term Target: 101.20

📉 Bearish Scenario (Alternative Case)

A break and stabilization below the 79.00 level would invalidate the bullish view Downside Targets: 74.70 followed by 71.30.

📝 Technical Comment

The RSI (Relative Strength Index) is losing its bearish momentum, suggesting that sellers are exhausted. This technical shift indicates that buyers are regaining control of the market trend.

Pure Halucinations Spaghetti Rainbow Vomit Silver chartComplete esoteric third eye guidance throwing all the fib tools that i like. the pattern clearly points to the 23rd of February 2026 as Pivotal Day. fall back to 50 Dollar silver we shrink into a microcosm again. overcome the amber goo rainbow stripe and we unlock a new dimension. whatever you do always check your risk. this is kinda recreational just want to keep it here as reference. thanks for reading.

Fundamental Note: XAUUSD (Gold) 02 Feb 2026Gold is extending a sharp metals selloff that started late last week, with forced liquidations and margin-driven deleveraging still spilling over across precious metals. The trigger was a sudden repricing in US rates and the USD after Kevin Warsh was named as the next Fed Chair, which pushed markets to reassess the medium-term policy path and term-premium risks. The move then accelerated as CME margin requirements were raised for metal futures, amplifying margin calls and “sell-what-you-can” behavior. Geopolitics remains a key swing factor: any easing in major flashpoints can quickly drain the safe-haven premium, while renewed escalation can stabilize bids even in a risk-off liquidation tape. This week’s main macro catalyst is US Non-Farm Payrolls on Friday (06 Feb), which matters because it can either validate a cooling labor market (USD-negative, gold-supportive) or revive “higher-for-longer” pricing (USD-positive, gold-negative). Markets will be laser-focused not just on headline payrolls, but also unemployment and wage growth, plus any revisions that could change the narrative. In the very short term, gold is trading more like a leveraged positioning unwind than a pure macro hedge—so volatility remains elevated and rebounds can be sharp but fragile.

Bottom line: fundamentals are mixed, but price action is dominated by deleveraging and USD/yields until NFP resets expectations.

🟢 Bullish factors:

Any NFP downside surprise or softer wages → lower US yields / weaker USD support gold.

Geopolitical escalation risk can quickly restore safe-haven demand.

Oversold conditions after liquidation waves can trigger sharp short-covering rallies.

🔴 Bearish factors:

Ongoing margin-call deleveraging across metals keeps downside pressure active.

Firmer USD / higher real yields after Fed repricing is a direct headwind for gold.

Any geopolitical de-escalation removes part of the risk-premium that supported the prior rally.

🎯 Expected targets: Bearish-to-volatile while below 4,800–4,900, with near-term downside risk toward 4,600–4,500 if liquidation persists. If gold stabilizes and NFP comes in soft, a rebound toward 4,850–4,950 is likely; a clean recovery above 5,000 would signal the unwind is largely done and opens 5,200–5,350 again.

Silver Frenzy Ending? Key Support at USD 75 in FocusSilver has come under pressure after an impressive rally, with the recent surge now showing clear signs of exhaustion. A stronger U.S. dollar has been the main driver behind the latest sell-off, reducing demand for precious metals and triggering broad profit taking as January draws to a close.

Adding to the weakness, exchanges in both the U.S. and China have raised margin requirements, forcing leveraged traders to reduce positions. This move has increased volatility and accelerated selling, contributing to the sharp pullback from recent highs.

Technically, the market has started to stabilize around the USD 75 level, which is now acting as an important support zone. This area previously served as resistance and is currently being tested as a potential floor. A successful defense of this level could allow silver to rebound and consolidate higher.

However, upside momentum may remain limited. Sentiment has shifted, and the recent squeeze dynamics appear to be fading. If USD 75 fails to hold, the market could enter a new washout phase, opening the door to a deeper correction.

For now, this technical zone is critical. If it lasts, silver may regain footing and attempt a recovery. If it breaks, further downside pressure is likely in the sessions ahead.

SILVER (XAG/USD) – BUYSILVER (XAG/USD) – BUY

The recent crash was a liquidity event, not a fundamental shift. Over-leveraged speculators were "washed out" by rising costs to hold positions.

The Trend: * Short-Term: Bearish/Neutral. The parabolic structure is broken. We are now in a "repair phase" where the market is looking for a new floor.

Long-Term: Strongly Bullish. Industrial demand from solar, EVs, and AI—combined with a structural supply deficit—remains the backbone of the 2026 silver thesis.

Key Support: $81.00 – $83.00 (Immediate "Must-Hold" zone). If this fails, the next stop is the Monday low of $71.20.

Key Resistance: $90.50 (0.382 Fibonacci level) and $96.20 (former support-turned-resistance).

Indicators: * RSI: Sitting at 29.3 (Extremely Oversold). Statistically, an RSI this low often precedes a sharp "mean reversion" bounce.

Volatility: Off the charts. Expect $5–$10 swings within minutes if the NFP or central bank news surprises.

Because the sell-off was so extreme, the "rubber band" is stretched too far. The high-probability play is a tactical Long for a recovery toward $90, while keeping a tight stop in case the "Warsh" dollar strength persists.

Direction: LONG (Buy)

Entry Price: $85.00 – $87.00 (Current market area).

Take Profit 1 (TP1): $90.40 (Heavy resistance/Fib level).

Take Profit 2 (TP2): $95.80 (Major psychological gap-fill).

Stop Loss (SL): $78.50 (Placed below the recent consolidation to avoid getting stopped out by "noise").

Probability of Success: 55% - 60%.

Why? While the technicals scream "Buy the Bounce," the fundamental environment (Fed Chair nomination) is currently pro-USD. If the Non-Farm Payrolls (NFP) on Friday are strong, this Long setup could be invalidated quickly.

Note: Please ensure proper risk management before entering any trade. We are not responsible for any profit or loss—trading involves risk and decisions are solely yours

SILVER at Resistance — Liquidity Trap or Breakout to 97.79?

Silver is approaching a key resistance zone after a steady bullish climb, but price is now entering a decision area where reactions matter more than predictions.

🔍 Market Structure:

• Rising move into resistance = potential liquidity sweep

• Trendline liquidity building below price

• Market sitting between breakout continuation and rejection

📉 Primary Scenario (Rejection):

If resistance holds (84.46 – 87.97), I expect a sell reaction targeting the liquidity pool below → potential move toward 74.00 support.

📈 Alternative Scenario (Breakout):

If price breaks and accepts above resistance, bearish bias becomes invalid and continuation toward the next resistance near 97.79 becomes likely.

No guessing tops.

No emotional bias.

Only reaction → confirmation → execution.

👉 Like if you trade liquidity, not hype

👉 Comment your bias on Silver here

👉 Follow for structured, clean metals analysis

BTC Moving Between Key Zones – Monitoring Reaction at Upper RangBitcoin is currently rotating between clearly defined supply and demand areas, with price recently bouncing from a lower demand zone and pushing back into mid-range resistance. The chart highlights how price has been respecting these zones, using them as turning points during intraday movement.

The latest move shows bullish momentum building off the lows, but price is now approaching an upper resistance area where reactions have occurred before. How price behaves here can help define whether the move continues higher through the range or if another pullback develops.

The projected path on the chart is simply a visual example of how price may travel between marked zones based on current structure. These areas are not guarantees — they are locations where market participants have previously shown strong interest.

Staying patient around these levels and waiting for clear price behavior can help avoid getting caught in the middle of range movement.

XAG/USD 15M Consolidation Below TrendlineThis chart shows XAG/USD on the 15-minute timeframe consolidating near a previously tested support zone while price remains below a descending trendline. The highlighted area represents a key reaction region where price has slowed after a strong decline. The drawn paths are for visual reference to show possible reactions based on historical structure and volatility, not a forecast.

XAG/USD 15M Price Reaction at Support ZoneThis chart shows XAG/USD on the 15-minute timeframe approaching a well-defined support area after a strong bearish move. Price is currently reacting near this zone while remaining below a descending trendline, which indicates overall selling pressure. The marked paths illustrate possible reactions based on previous structure and market behavior. All levels are shared for technical observation only.

Silver (XAG/USD) 15M Structure and Key Price ZonesThis chart highlights the recent price movement of XAG/USD on the 15-minute timeframe. Price is currently reacting near a previously tested support zone after a strong downward move. A descending trendline is visible, showing overall pressure, while the marked area represents a key reaction zone where price has shown consolidation. Future movement will depend on how price behaves around these highlighted levels. This view is based on technical structure only.

Asahi Holdings - Gold and Precious Metals Recycler Running.

Asahi Holdings Inc has been an absolute powerhouse over the last year, putting up a gain of nearly 100% . Based in Japan, this company isn't your household brand, but they are a massive player in recycling precious metals like gold, silver, and palladium from electronics and dental materials. When commodities run hot, companies that refine and sell them tend to follow suit, and this chart shows exactly that kind of steady, aggressive buying pressure.

Fundamentally, the story here is all about the underlying metal prices. Today’s earnings report confirms that high gold and palladium prices are boosting their margins, but the immediate reaction on the chart suggests the good news was already priced in and the dip in Silver and Gold caught them out as well as the rest of the industry. We saw a gap up at the open followed by a fade, which is a classic "sell the news" event. Traders are taking profits after a long run, even if the business itself and its revenues remains solid.

Technically, the trend is still very much intact despite today's red candle. The price has dipped under the 20-day SMA (the green line), which has acted as reliable support throughout this entire uptrend. The RSI is cooling off from overbought territory, dropping back into the mid-50s, which gives the stock some room to breathe and attract investors who might have felt they missed out. The MACD is flattening out, indicating that the immediate buying frenzy is pausing, but it hasn’t collapsed. Now that we are past earnings and got a green candle back on the board it will be interesting to see if it runs again.

Could be one to keep an eye on - especially if we see a recovery in Gold and Silver.

..................................................

PLEASE NOTE: Nothing I post is trading advice. All investing involves risk, and past performance doesn’t predict future results. Trends can and do end. For 2026 , my goal is to try and post one new asset each day. Something outside the usual gold, silver, BTC, or big tech names. I like to find stocks worldwide showing steady trends with some good gains, a recent pullback, and signs of renewed strength. I don’t necessarily hold positions in these. They are simply companies I find interesting at the time of posting. I’ll often revisit them within a week to see how they went and share any updates. If you enjoy these posts, please BOOST and FOLLOW ME to discover more under-the-radar stocks and businesses from around the world. ..................................................

XAGUSD Price Action: Liquidity Grab at Key LevelsSilver (XAGUSD) experienced a strong bullish phase, respecting multiple demand zones and higher-low structures. Price recently reached a major resistance area, where selling pressure increased aggressively, leading to a sharp bearish impulse and a clear shift in short-term market structure.

Key Technical Observations

🔴 Resistance Rejection & Distribution

Price reacted strongly from a higher-timeframe supply zone, signaling institutional distribution.

Multiple upper-wick rejections confirm sellers’ dominance at premium prices.

📉 Bearish Impulse & Market Structure Break

The steep bearish leg shows strong displacement, breaking previous demand zones.

This confirms a temporary bearish market structure, often seen before liquidity is fully collected.

🧱 Liquidity Sweep Scenario

Price is moving toward lower liquidity pools, targeting sell-side stops below previous lows.

Such moves are commonly used by smart money to rebalance positions before a trend continuation or reversal.

🟢 Potential Accumulation at Discount

The projected path suggests a possible final dip into deeper demand.

After liquidity absorption, price may stabilize and reverse, targeting higher inefficiency zones above.

Projected Price Path

📉 Short-Term

Continued downside or volatile sweeps toward lower support levels.

📈 Mid-Term

A bullish reaction from demand could initiate a corrective rally back toward the highlighted resistance / imbalance zone.

🎯 Upside Target Zone

Prior structure highs

Unmitigated supply

Fair value imbalance area

Trading Bias

Bias: Bearish short-term → Bullish corrective after confirmation

Confirmation to Watch:

Bullish engulfing candles

Break of minor structure

Strong bullish displacement from demand

⚠️ Disclaimer

This analysis is for educational purposes only. Always wait for confirmation and apply proper risk management.

Stop!Loss|Market View: GOLD🙌 Stop!Loss team welcomes you❗️

In this post, we're going to talk about the near-term outlook for GOLD ☝️

Potential trade setup:

🔔Entry level: 4769.128

💰TP: 3896.954

⛔️SL: 5034.135

"Market View" - a brief analysis of trading instruments, covering the most important aspects of the FOREX market.

👇 In the comments 👇 you can type the trading instrument you'd like to analyze, and we'll talk about it in our next posts.

💬 Description: Gold prices are stabilizing in the 4500-4800 range and will likely trade within this range, with a potential move toward 5000. However, for now, the main selling trend is seen as favorable, and for this to happen, the price must remain within this range. We'll likely receive more data during today's US session, and if all goes according to plan, selling could be considered today or tomorrow, with a target of 3800-4000.

Thanks for your support 🚀

Profits for all ✅

Gold/Silver Ratio: Gold To Outperform Silverthis setup never gets old, so i’m sharing the long-term chart of the gold vs silver ratio

focus on the 40-year range that started back in 1986, when the ratio hit the 80 oz level and reversed lower

most of the time, the 47–80 oz range managed to contain the ratio

last year, silver outperformed gold as the ratio dropped like a fallen knife

when it recently hit the lower boundary of the range, it stalled there

the idea is simple: when the ratio reaches the bottom, one can expect a move toward the opposite side near 80 oz from the current 58 oz

this implies gold appreciating significantly against silver

this can happen through less weakness versus the dollar, or more strength versus the dollar, compared to silver since this is a pure comparative relationship between the two metals