XAGUSD Bearish Confirmation: Trendline Breakdown and Supply RejeMarket Overview: Silver (XAGUSD) has shown a decisive shift in market structure on the 15-minute timeframe. After testing the primary supply zone, the price has failed to maintain its bullish momentum, leading to a clear technical breakdown.

Technical Observations:

Supply Zone Rejection: The price faced heavy selling pressure at the 92.50 - 95.00 resistance area (purple box). This rejection confirms the presence of strong institutional supply at these levels.

Trendline Breach: The ascending support trendline (blue line) has been broken to the downside. This breakdown is a significant bearish signal, indicating that the recent recovery phase has concluded.

Price Path Projection: Based on the current momentum (indicated by the black zig-zag path), I am expecting a series of lower highs. The immediate bearish target is the previous structural support, with a deeper move toward the major demand zone near 72.50.

Key Levels:

Resistance: 88.00 - 90.00 (Broken trendline retest zone).

Primary Support: 82.50.

Major Target: 72.50 - 75.00.

Trading Strategy: The bias remains bearish as long as the price stays below the broken trendline. I am looking for a potential retest of the 88.00 level to confirm a "break and retest" setup for a short entry. Always wait for price action confirmation (like a bearish engulfing candle) before executing.

Silver

Silver, Hope you like the game Ping Pong.Silver… welp, we all knew this day would come.

Silver is sentimental for a lot of investors—it’s the gateway metal. The first shiny thing people buy before wandering into the jungle of equities, options, and futures. But the story isn’t nearly as black‑and‑white as the r/Silver crowd likes to paint it.

Back in the 1890s, countries had to pick their monetary “starter Pokémon”: gold or silver. Most of Europe and the U.S. went gold. Meanwhile, countries like Spain, China, India, Iran, and much of South America ran on silver. And then you had a third group—countries that didn’t back their currency with any metal at all, instead pegging themselves to other nations’ currencies. That was common across Africa and parts of Asia.

And here’s the pattern:

- Gold‑backed countries became the “first world.”

- Silver‑backed countries became “developing” or “second world.”

- Countries pegged to others’ currencies became “third world.”

This isn’t a coincidence. It’s the foundation for why U.S. banks and firms (we won’t name names, but you know the usual suspects) spent decades suppressing silver’s price.

Why suppress silver? Three reasons:

1. Stunting silver‑rich nations.

Many second‑world countries hold massive silver reserves. Keep silver cheap, and you keep their development throttled. That forces them to rely on U.S. markets, the World Bank, and the regulatory/sanctions machinery that comes with it.

2. Masking inflation at home.

If silver were allowed to appreciate naturally, Americans would have a much clearer view of what inflation has done to the dollar’s purchasing power. Can’t have that.

3. Profit. Obviously.

Paper silver, futures contracts, leveraged plays—Wall Street has made a fortune gaming the spread between physical and paper markets.

So where are we now?

We’re spectators. Peasants in the cheap seats watching global superpowers volley the price of silver like a geopolitical ping‑pong ball.

China is the heavyweight at these price levels. Some of the U.S. banks that historically pushed silver around simply don’t have the capital to dominate the game anymore. China, however, *does*—and they absolutely do not want silver dropping below \$35, because that’s where Wall Street regains control.

China’s also carrying a mountain of new debt. Their real estate sector imploded, they took on Venezuela’s debt in exchange for oil access, and then the U.S. stepped in and said, “Cute deal you’ve got there—shame if someone… took it.” Now China’s holding liabilities that weren’t even theirs to begin with.

This isn’t just about metal. It’s about **superpower status**.

Measured by nominal GDP, China is roughly \$10 trillion behind the U.S. If that gap closes, history tells us something uncomfortable: when two nations reach similar economic size while competing for global dominance, the probability of conflict approaches 100%. Not my opinion—just historical pattern.

So yes, the world stage is now fighting over silver’s price. The U.S. doesn’t want China’s silver stockpile appreciating too much. China needs it to appreciate to service debt—or face default and humiliation.

Where does that leave silver?

It’ll likely rise, but in a slow, controlled, heavily‑managed fashion. Not the explosive catch‑up move we just saw after decades of suppression. More like a supervised climb with both superpowers tugging on the rope.

And for us?

We’re just the spectators. The peasants. Watching the ball go back and forth.

Hope you enjoy ping‑pong.

Silver Under Pressure: Is $71.30 Next📊 Silver (XAGUSD) Technical Analysis

📅 Date: February 5, 2026

💵 Current Price: $78.35

🔍 Market Overview

After a significant drop from the $95.25 peak down to the $74.00 support level, Silver is currently consolidating and trading around $78.35.

📉 Bearish Scenario (Main Outlook)

The bearish momentum remains dominant as long as the price trades below the Pivot Point of 83.50:

Immediate Target: A retest of the 74.00 support level.

Extended Targets: If the price breaks and stabilizes below 74.00 with a 1-hour candle close, we expect further decline toward 71.30 and 69.50.

📈 Bullish Scenario (Correction/Reversal)

If Silver gains strength and breaks above the pivot:

Key Condition: A decisive break and stability above 83.50.

Upside Targets: This would shift the momentum toward 87.70 and 90.20.

📍 Summary of Key Levels

Pivot Point: 83.50

Resistance / Targets: 87.70 | 90.20

Support / Targets: 74.00 | 71.30 | 69.50

Silver (XAGUSD) Structure Shift Near Key Supply ZoneSilver price has recovered from the lower demand area and is now approaching a higher-timeframe supply zone around the 92–96 region.

The recent upward move appears corrective within a broader bearish structure, as price remains below the descending trend line and previous high-volume area.

The highlighted upper zone marks an important reaction area where momentum may slow or reverse if selling pressure returns.

As long as price stays below this zone, attention remains on the lower structural levels for continuation of the prevailing downside bias.

This chart focuses on market structure, zone interaction, and directional behavior around key levels, without providing execution instructions.

Silver (XAGUSD) – Price Approaching Upper Reaction ZoneSilver is currently moving within a corrective recovery after a prior downward move. Price is now approaching a previously active upper zone that has acted as a reaction area in the past.

The marked structure highlights how price may respond around this area. If the zone continues to hold, the market could show another shift in momentum, while a sustained move beyond it would signal a change in short-term structure.

This chart is shared for educational and market-structure observation purposes only.

SILVER Will Go Down From Resistance! Sell!

Please, check our technical outlook for SILVER.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 9,147.7.

Considering the today's price action, probabilities will be high to see a movement to 8,217.3.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Like and subscribe and comment my ideas if you enjoy them!

XAUUSD: rejection at 5,100🛠 Technical Analysis: On the H4 timeframe, Gold remains in a broader bullish trend, but the latest move shows a sharp reversal from the major 5,600 resistance zone, followed by a heavy bearish impulse. Price has rebounded back into the 5,050–5,100 area, where the chart marks a key resistance/supply zone that is now acting as a selling pivot. This looks like a classic retest after a breakdown: if buyers fail to reclaim and hold above the zone, the correction is likely to resume. The moving averages are still stacked bullishly (SMA50 above SMA100 above SMA200), but price is currently below the SMA50, signaling a corrective phase within the larger uptrend. The projected scenario expects reverse near 5,000–5,100 and then continuation lower toward the next structural support at 4,573.95. If bearish pressure accelerates, the lower support zone around 4,300 becomes the extended downside objective. A clean recovery and sustained hold back above the 5,100 resistance would weaken the sell idea and favor stabilization.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: Sell on rejection from the 5,050–5,100 (more conservative ~4981.32)

🎯 Take Profit: 4,573.95 (extended target: 4,300)

🔴 Stop Loss: 5,252.90

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

Silver — Bullish Correction Into a Bearish WallSilver just printed a fresh bullish ABC on the 1H.

C-target sits around $96 .

Here’s the part that matters:

That $96 level is also a bearish WCL from higher timeframe structure.

So no, this isn’t a “new bull market” victory lap.

HTF is still bearish .

But this pullback? It’s doing exactly what a healthy correction should do — walking straight into HTF resistance.

That’s ideal.

What I’m watching:

Bullish sequence stays valid → price can tag the $96 C-target

That level = decision point, not a blind buy zone

If HTF sellers show up there, continuation lower stays on the table

If $96 gets accepted, HTF bias is in trouble

This is context , not prediction.

Correction into resistance first. Reaction second. Ego last.

Let price speak.

Not financial advice.

Stop!Loss|Market View: EURUSD🙌 Stop!Loss team welcomes you❗️

In this post, we're going to talk about the near-term outlook for the EURUSD currency pair☝️

Potential trade setup:

🔔Entry level: 1.17711

💰TP: 1.15916

⛔️SL: 1.18450

"Market View" - a brief analysis of trading instruments, covering the most important aspects of the FOREX market.

👇 In the comments 👇 you can type the trading instrument you'd like to analyze, and we'll talk about it in our next posts.

💬 Description: Support at 1.17960 continues to attract the euro price, creating a basis for continued downward movement toward 1.16000. It should be noted that a short-term rebound in the dollar is likely today, so selling, according to the scenario above, should only be considered in the event of a confirmed breakout of 1.17960. Level 1.16500 should also be noted as an interim target.

Thanks for your support 🚀

Profits for all ✅

They lied to you about Bitcoin to take your money !You Invested your life savings into Bitcoin because they told you its the supercycle !

At the first few weeks ..you gained a small profit and everytime you turn on the news or social media you saw everyone cheering and posting new ATH targets for Bitcoin..some of them said 200k and others said its going to a million Dollars !

These people had thousands of followers and everyone was grateful and positive in their replies but guess what ! It was all FAKE lol...that's right each and everyone of them is a scammer and 99% of their followers are fake bots !

If you look closely to their accounts you'd see that all of their posts were bullish at the top and bearish at the bottom, their whole accounts are dedicated to give false hopes and deceiving charts in order to trap their followers in a dead trade that provides the real trading whales with exit liquidity !

Look at Jim Cramer .. he's the text book example of a trading scammer and investors actually gained money by inversing his financial advices lol..and he's not alone, most of the social media influencers are exactly like him and the more followers they have the more evil they are.

Now Bitcoin crashed to 70k in a matter of days ... 50% of your wallet is gone ! so are you going to sell now ? But market might recover soon and 70k might be the bottom !

If you check the social media right now everyone is saying a different story and you are confused and lost between the moon boys and the realistic investors.. what are you going to do now ? Are you gonna accept your losses and save the rest of your money or are you going to hold to Zero and fullsend it ?

Come let me help you my friend .. your first mistake was that you believed and trusted other people with your money .. people who gain profit only if you lose your money !

Second mistake was that you didn't do your own research ... You had no idea where the market is going and you risked everything with zero knowledge or experiance.

So how to fix this ? The answer is damage control !

Market has been going down for a while now and the chart seems to be forming a Head & shoulders so as soon as the price goes up to form the right shoulder you need to get the hell out and save yourself from the real crash!

Second step which is a very important step for now and the future is that you unfollow and block everyone who told you its the supercycle ! Once you get those parasites out of your social media feed then you should start looking for real investors who were calling the top at 100k + and were telling their followers to take profit and get out.

Third step is that you need to learn how to read charts .. read about candles patters and find your own buy & sell signals, DO NOT LISTEN TO ANYONE AT ALL including myself !

You can use paper trading in Trading view app to learn how to trade with fake money and once you master a technique stick to it and implement it to real trading.

Above is my expectation for Bitcoin so 2026 should be very interesting and I would be honored if you check my other posts for more ideas and please like and follow my account to support me.

Stay safe out there friends ! Thank you and best regards,

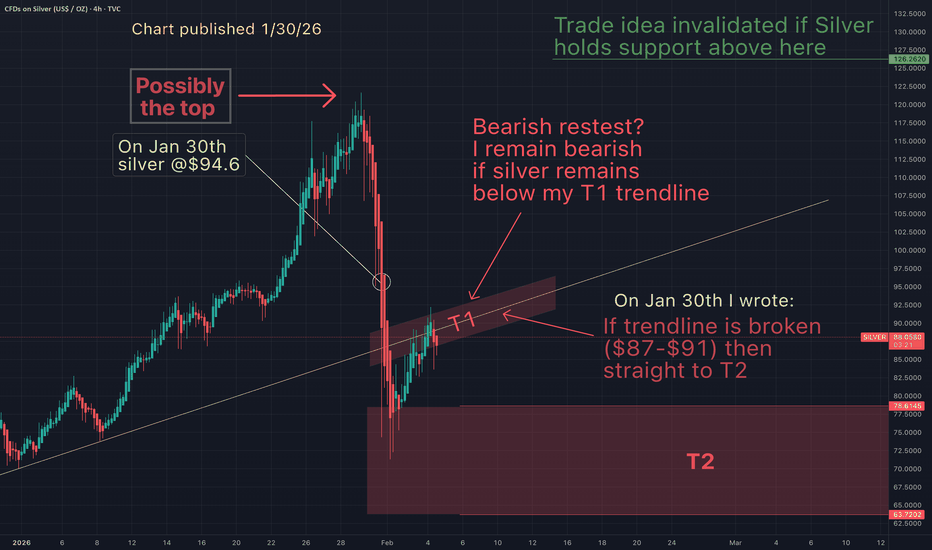

You will ask yourself, "how did he know silver would do that"?On Fri Jan 30th, I suggested that the top was in for silver and it was soon about to dump further into my bearish target (T2). Silver was $94.6 at that time, and there were no news narratives suggesting a crash. By Monday it dumped to $71 and now the news platforms and influencers have "reasons" why it did. "Show me the chart and I'll tell you the news"

TA works!

May the trends be with you.

SILVER FREE SIGNAL|LONG|

✅SILVER taps into a key demand PD array after a sharp sell-off, followed by bullish displacement. Structure shift suggests smart money defending discounted levels, targeting buy-side liquidity above recent highs.

—————————

Entry: 86.00$

Stop Loss: 82.67$

Take Profit: 90.30$

Time Frame: 1H

—————————

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Silvers easy path back to triple digitsSilver recently experienced a massive bearish move, plunging nearly 25% in just two days and catching many traders off guard. After an extended bull run that built up heavy speculation and overleveraged positions, the market finally snapped, triggering aggressive sell-offs and forced liquidations. This sharp correction wiped out weak hands and reset sentiment almost overnight. During this volatility, Corp capitalized on the move by methodically liquidating short positions accumulated throughout the prior rally, turning the extreme price action into an opportunity rather than a setback. The move highlights how quickly momentum can shift in commodity markets and how disciplined positioning can pay off when volatility spikes. The chart provided shows a clear and easy path for silver to reclaim $100. The liquidation points are easy swing highs that should be achievable within the next month.

Silver doing a dead cat bounceSilver and the Liquidity Trap

Financial markets often operate on the principle of memory, where price action leaves behind a digital footprint of human emotion and institutional intent.

Most traders look at a single indicator, but the real power lies in confluence. We are currently witnessing a rare alignment where historical resistance, mathematical Fibonacci ratios, and high-volume accumulation intersect at the exact same price coordinate.

It is a statistical bottleneck that often precedes a violent expansion.

The psychology here is fascinating.

After an aggressive rally that defied standard expectations, Silver experienced a sharp correction that flushed out late buyers.

The current bounce has carried price back to the 50% Fibonacci retracement level , which sits precisely at the site of previous resistance . When an old resistance becomes a new resistance again, it suggests that the supply overhang has not been fully absorbed.

Adding weight to this scenario is the Volume Profile visible on the right.

The large volume accumulation at this level indicates a massive exchange of hands. This zone acts as a magnet for profit-taking and fresh selling interest. We also see a rising wedge pattern forming on the 1h timeframe. This price squeeze suggests that the momentum of the bounce is exhausting, as buyers struggle to push higher against a wall of institutional sell orders.

It is worth noting that Gold has already led the way by breaking down from a similar structure.

In the world of precious metals, Silver often acts as the high-beta sibling, trailing behind before making an even more volatile move. The nuance here is that patterns are probabilistic maps, not certainties. A rising wedge is a bearish leaning structure, but it remains a "potential" until the lower support line is decisively breached.

The scenario for invalidation is clear. If Silver manages to close above this high-volume cluster and reclaims the 0.618 Fibonacci level , the bearish thesis loses steam. However, given the current exhaustion, the probability favors a retest of the recent floor. We wait for a confirmed break of the wedge support (around $85,5) to validate the next leg of the correction.

👇 WANT MORE?

🚀 Hit the rocket, read my profile and follow so we can find each other again.

Silver Outlook as Hawkish Stances EmergesOne of the key reasons for the sell-off in precious metals on 30 January was the US president’s nomination of Kevin Warsh as the next Fed chairman.

We then saw headlines such as: ‘Silver dropped 26% in under 20 hours; gold saw its worst day since the 1980s — driven by Warsh’s hawkish image.’

How might Warsh’s hawkish stance impact precious metals and their outlook in the coming months? Are precious metals still bullish – 30 Jan sell off as retracement for mor upside,

or are they turning bearish, now is a retracement for more selling ahead?

100-Ounce Silver Futures

Ticker: SIC

Minimum fluctuation:

0.01 per troy ounce = $1.00

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

#Microfutures

www.cmegroup.com

SILVER | Rebounds After Dramatic Two-Day SelloffSILVER | Rebounds After Sharp Two-Day Selloff

Silver prices rebounded above $89 per ounce, recovering part of the losses after a dramatic two-day selloff that erased nearly 40% from recent record highs. The rebound comes as markets reassess positioning after an extreme unwind.

The broader rally in precious metals earlier this year was supported by geopolitical and economic uncertainty, currency debasement concerns, and rising tension around Federal Reserve independence. In silver, a structural supply deficit and strong investment inflows, particularly from Chinese speculators, further amplified volatility.

Technical Outlook

Silver maintains a bullish structure while trading above the 85.40 pivot.

As long as price holds above 85.40, upside momentum is expected toward 91.00, followed by 95.44 and 99.11.

A 1H candle close below 85.40 would invalidate the bullish bias and shift momentum bearish, opening downside targets at 80.13, followed by 76.90 and 71.40.

Key Levels

• Pivot: 85.40

• Support: 80.13 – 76.90 – 71.40

• Resistance: 91.00 – 95.44 – 99.11

USDCHF: retest 0.76000🛠 Technical Analysis: On the H4 timeframe, USDCHF remains in a clear bearish structure after the “global bearish signal,” with price continuing to trade below the key moving-average cluster. The rebound into the highlighted resistance area (around 0.7755–0.7790) looks like a classic retest after the breakdown, where sellers may defend and resume the downtrend. Price is currently below the SMA 50 and well below the SMA 100/200, confirming that rallies are still corrective. The upper resistance zone near 0.7890 remains the larger supply ceiling and aligns with the higher MA resistance. If price gets rejected from the current resistance band, the next bearish leg is projected toward the marked support at 0.7594. A sustained break and hold above 0.7830–0.7850 would weaken the bearish setup and shift focus to the higher resistance zone.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: Sell on rejection from 0.7755–0.7790 (around 0.77355)

🎯 Take Profit: 0.75942

🔴 Stop Loss: 0.78299

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

Near Important Support Zones! Wait for Confirmation!Gold Analysis

Closed at 4890.29 (30-01-2026)

The blue shaded area is a Very Strong Support Zone.

Multiple Strong Green Candles may confirm HL in this

zone & Gold may print new highs after crossing 5600.

Breaking 4500 may drag the price towards 4300 - 4400.

Wait for HL to print!SILVER Analysis

Closed at 85.169 (30-06-2026)

74 - 76 is an important Support zone.

if this level is sustained, we may witness Higher Low

printed around this level & the uptrend may continue.

Crossing 121 - 122 may expose new Highs.

However, Breaking 70 may bring the price towards 62 - 63 which

is the next Important Support level.

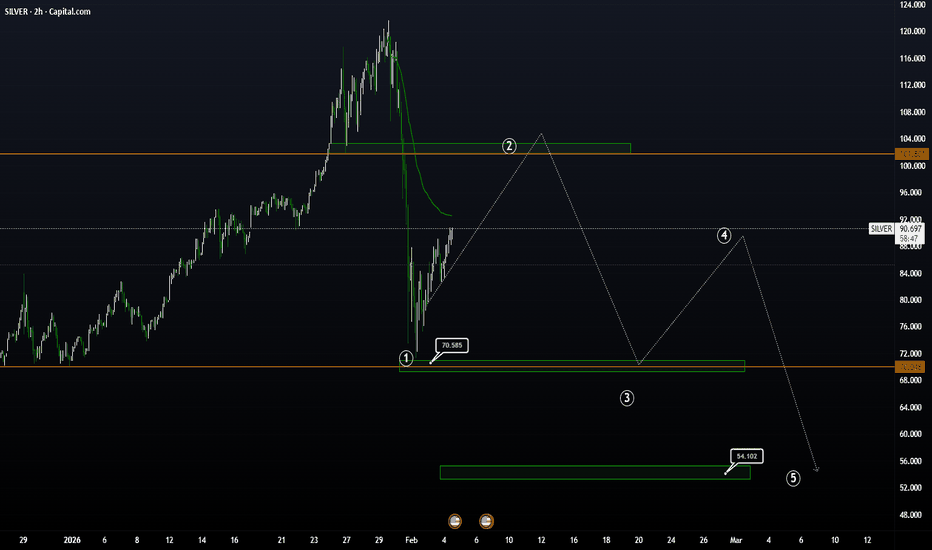

SILVER Potential MoveXAG Update: Riding the Elliott Wave 🌊

let's talk about #XAG. As I mentioned, Silver is continuing its downward move exactly as predicted. It's tough to see, but with everything happening in the background right now, the market sentiment is struggling to stay afloat.

I’m currently tracking an Elliott Wave theory (as shown in the chart) that suggests this correction could play out over a longer timeframe.

We are following the wave structure to the downside as liquidity dries up.

This theory is only invalidated if we see a strong reclaim of the $100 level.

Stay patient and don't fight the trend. The market doesn't care about feelings it cares about levels.

Silver’s Historic Rebound: Is the $100 Target Next ?Silver (XAGUSD)

📅 Date: February 4, 2026

📰 Fundamental News (Today’s Highlights)

Massive Rebound: After a historic 40% sell-off last week, Silver has jumped over 5% today. Dip-buyers and institutional investors are returning to the market, viewing current prices as a major value opportunity.

Geopolitical Safe-Haven: Tensions have spiked following reports that the US Navy intercepted an Iranian drone in the Arabian Sea. This has reignited the "safe-haven" bid for Silver.

Industrial Anchor: Demand from the solar energy sector remains a structural support. With global solar capacity projected to hit record highs in 2026, silver’s industrial deficit continues to prevent a total price collapse.

📈 Bullish Scenario

As long as the price holds above the Pivot Point of 79.00, the recovery trend is intact:

Target 1: 92.50

Target 2: 95.90

Long-term Target: 101.20

📉 Bearish Scenario

A break and close below 79.00 would signal a return to the downward correction:

Downside Targets: 74.70 and 71.30.

Bullish reversal for the Silver?The price has bounced off the support level, which is a pullback support, and could potentially rise from this level to our take profit.

Entry: 83.81

Why we like it:

There is a pullback support level.

Stop loss: 74.24

Why we like it:

There is a multi-swing low support level.

Take profit: 103.53

Why we like it:

There is a pullback resistance level that aligns with the 61.8% Fibonacc retracment.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Stop!Loss|Market View: NZDUSD🙌 Stop!Loss team welcomes you❗️

In this post, we're going to talk about the near-term outlook for the NZDUSD currency pair☝️

Potential trade setup:

🔔Entry level: 0.60799

💰TP: 0.59906

⛔️SL: 0.61334

"Market View" - a brief analysis of trading instruments, covering the most important aspects of the FOREX market.

👇 In the comments 👇 you can type the trading instrument you'd like to analyze, and we'll talk about it in our next posts.

💬 Description: Short-term weakening of the US dollar is still expected in the coming days, but medium-term buyers' of the USD is quite confident. Therefore, NZDUSD can expect a strengthening to 0.61 today/tomorrow, from where, if the same false breakout or bearish divergence forms, a reversal to 0.6 and 0.59 is expected.

Thanks for your support 🚀

Profits for all ✅