SMC

What to do when you do not have any good POIsWatch this video to learn how to adjust your thought process when the market does not give you any valid POIs to work with. I struggled with this for a long time.

BULLISH ENTRY EXAMPLE 🔥🔥🔥Usually, liquidity is calculated by taking the volume of trades or the volume of pending trades currently on the market. Liquidity is considered “high” when there is a significant level of trading activity and when there is both high supply and demand for an asset, as it is easier to find a buyer or seller.

Hope this example can help some people understand when trading.

Imbalance, POI, and Confirmation entry back test/case studyThis video is longer than my usual however I explain what an Imbalance is and how it can be used to trade within the markets. I also go through a replay back to show it can be used to catch confirmation entries. Any feed back is greatly appreciated.

Discount/ premium pricing - SMC📉 We use the Fibonacci retracements for spotting discount and premium levels in a range.

📝 We draw the Fibonacci tool from the bottom to the top in an uptrend, and from the top to the bottom in a downtrend.

Terminologies:

EQL: equilibrium = a state of physical balance (50%).

Discount: we buy from

Premium: we sell from

To make it more approachable, we can compare using the fib tool as a scanner when you go to the supermarket. You won't buy the product when it's expensive, but only buy when it's cheap. Beside that - if we want to sell a product to a supermarket, we want to get the highest price as possible.

Combining it with order blocks

You can basically increase the probability of order blocks with the fib tool. Order blocks that are not in discount you won't buy from, and order blocks that are not in premium you won't sell from.

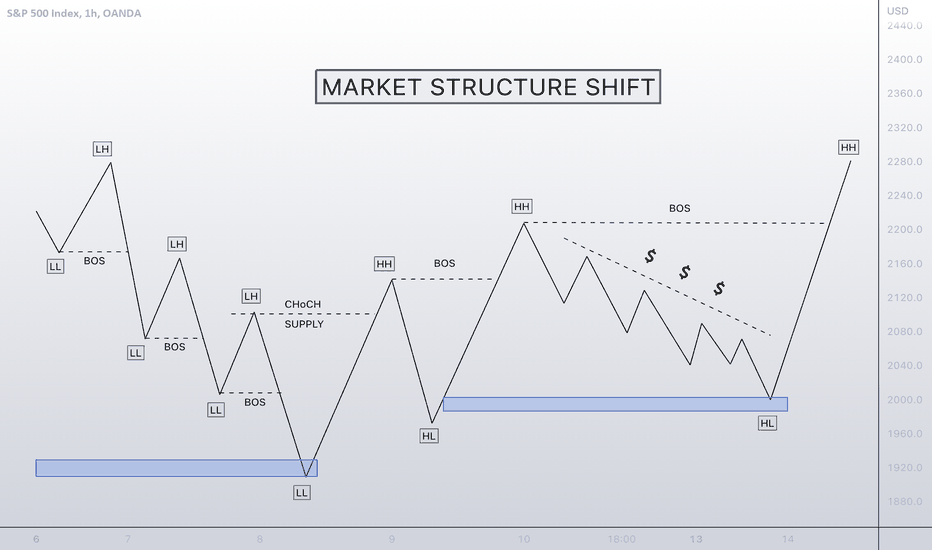

🤓 🤓 MARKET STRUCTURE SHIFT! SMCMarket structure in Forex trading or price action is how many people take advantage of the markets. No indicators, and no volume. Because the market does not have a centralised exchange. Forex traders often swing trade the market based on the structure to take advantage of the opportunity.

Structural market change is broadly defined as a shift or change in the way in which a market or economy functions or operates.

I have tried my best to show you in the easiest possible way to look out for. Save this to your notes for future reference.

🤓 🤓 DON'T TRADE FROM THIS ZONE!I have tried to make this example as simple as possible to understand for anyone that are not too familiar with liquidity hunts.

Always look for were the most liquidity is accumulating then place your trade above or below were there has been a liquidity swoop, as long as it lines up correctly with what strategy you are using.

If you add this to your trading tool belt this will improve your overall results.

LIQUIDITY MODELS🔹 Liquidity is like fuel to move the market in a specific price zone.

🔹 We can find liquidity in zones where a lot of people set their stop losses and buy/sell stops.

🔹 The market makers will manipulate the price to break these obvious zones and take the liquidity.

🔹 These are the most common liquidity patterns.

GBPUSD Using the Element of TimeThe element of time is a technical analysis tool that I've previously elaborated on -> Check links to related ideas.

The illustration is pretty self-explanatory.

First attempt failed, however price presented a better opportunity a couple hours later which ultimately yielded all our profits for the week.

I will provide my thought process, execution and exits for this trade in a subsequent recording :)

Stay tuned !

What is an Order Block? 🎯Why are order blocks formed?

Order blocks are created when a breakout move doesn't go to plan.

If banks get caught in a fake breakout move, they aren't going to sit and cry about it.

They are going to push the price back up/down so that they can close out of their negative positions to join the correct side of the market.

Stop using order blocks that have no logic, widen your chart perspective.

SMC Abbreviations & ExplanationsIOF: Institutional Order Flow

+OB: Bullish Order Block

-OB: Bearish Order Block

FVG: Fair Value Gap

SMT: Smart Money Tool/Technique

+BB: Bullish Breaker

-BB: Bearish Breaker

+MB: Bullish Mitigation Block

-MB: Bearish Mitigation Block

SSL: Sell Side Liquidity

BSL: Buy Side Liquidity

EQM: Equilibrium

CE: Consequent Encroachment

EQH: Equal Highs

EQL: Equal Lows

HTF: Higher Timeframe

MMM: Market Maker Model

MMSM: Market Maker Sell Model

MMBM: Market Maker Buy Model

LOKZ: London Open Kill Zone

LCKZ: London Close Kill Zone

NYOK: New York Open Kill Zone

SMT- Smart Money Tool

LP- Liquidity Pool

IOF-Institutional Order Flow

BISI - Buy Side Imbalance Sell side Inefficiency

SIBI- Sell Side Imbalance Buy Side Inefficiency

COT- Commitment of Traders

NFP-Non Farm Payroll

OTE - Optimal Trade Entry

BSL - Buyside Liquidity

SSL - Sellside Liquidity

OB - Order Block

+OB - Bullish Order block

-OB - Bearish Order block

PB - Propulsion Block

VB - Vacuum Block

MB - Mitigation Block

BRK - Breaker

+BRK - Bullish Breaker

-BRK - Bearish Breaker

FVG - Fair Value Gap

LP - Liquidity Pool

LV - Liquidity Void

RTO - Return to Order Block

RTB - Return to Breaker

RR - Risk to reward

MS - Market Structure

BMS - Break of Market Structure

SMS - Shift in Market Structure

IOF - Institutional Order Flow

PDH - Previous Daily High

PDL - Previous Daily Low

DH - Daily High

DL - Daily Low

CE - Consequent Encroachment

IPDA - Interbank Price Delivery Algorithm

MTH - Mean Threshold

LO - London Open

NYO - New York Open

NYKZ - New York Kill Zone

AMD - Accumulation, Manipulation, Distribution

WDYS - What Do You See?

TSBM - Turtle Soup Buy Model

TSSM - Turtle Soup Sell Model

SH - Stop Hunt

SL - Stop Loss

SP - Stops Purged

TP - Take Profit

HTF - High Timeframe

LTF - Low Timeframe

1D - Daily Timeframe

1W - Weekly timeframe

1M - Monthly timeframe

📚 Inducement: What Is It ⁉️Inducement is a trap before an area of supply or demand.

Price will usually lure impatient buyers/sellers into the market before the zone is met to create liquidity.

Once the impatient traders get trap [ped and stopped out, the true move begins.

This just goes to show the importance of sitting on your hands!

Traders, if you have your own opinion about this idea, write in the comments section, I always reply. 💬

🚨 RISK DISCLAIMER:

Trading Crypto, Futures, Forex, CFDs, and Stocks involves a risk of loss.

Please consider carefully if such trading is appropriate for you.

Past performance is not indicative of future results.

Always limit your leverage and use a tight stop loss.

--------------------------------------------------------------------------------------------------------

Please like, subscribe, and share this idea with others! ⬇️

--------------------------------------------------------------------------------------------------------

Conservative vs Aggressive Entries - Different ways to enter!There are different ways to enter trades - some opt for an aggressive approach while others opt for a conservative entry. Aggressive entries are taken at the first signs of reversal out of a supply/demand zone while conservative entries wait for more significant larger structure breaks in the trend.

I almost always opt for the conservative take as I want structure to be with me all the way. By getting in with an aggressive entry you can achieve higher risk reward but you will also inevitably run into more losses because you are relying on the short term trend to confirm your higher timeframe intensions.

It comes down to your risk tolerance: Conservative entries require patience and sometimes when they don't give an entry you'll need discipline to avoid getting burned - but they are the wiser option for risk averse traders. Aggressive trades will get you in on nearly every move you have planned but they'll also get you took out a fair amount more than conservative entries. How much pain can you take?

I recommend choosing an approach and sticking to it - being a master of one approach is better than a novice at many!

How to win your continuations and avoid bad tradesHi,

Those who follow me know that I only trade with pure price action and volume . If you are someone who also hates the subjectivity of indicators then you'd find this interesting.

This is what I look for before taking continuation trades, keep in mind that what's important when you trade like that is the concept of weak high/lows and strong highs/lows.

When you find those points all you have to do is trade with the trend then find the last point of supply/demand and take your entry.

Hope this helps.