AUDNZD Setup: Symmetrical Triangle + Bullish FundamentalsToday, I want to share a long idea on AUDNZD ( OANDA:AUDNZD ) with you.

Let’s walk through the fundamental and technical picture step by step.

From a fundamental perspective, AUDNZD maintains a mild bullish bias.

Australia’s monetary policy remains slightly more restrictive compared to New Zealand’s.

Persistent inflation pressures keep the RBA cautious about rate cuts, while recent inflation data in New Zealand has largely been priced in and has not provided a fresh advantage for the NZD.

Additionally, Australia continues to benefit from relatively stronger growth support driven by the commodity sector, which adds to AUD resilience.

Overall, the fundamental balance currently favors AUD over NZD, making a long AUDNZD position reasonable — though, as always, not without risk.

AUDNZD is currently trading near key support lines.

From a classic technical analysis perspective, the pair is consolidating inside a symmetrical triangle, signaling compression and a potential expansion phase ahead.

From an Elliott Wave perspective, AUDNZD appears to have completed the main wave 4, suggesting the market may be preparing for the next impulsive move.

If price breaks above the upper line of the symmetrical triangle, I expect AUDNZD to push at least toward the 1.16370 NZD as an initial upside target.

First Target: 1.16370 NZD

Second Target: 1.1668 NZD

Stop Loss(SL): 1.1547 NZD

Points may shift as the market evolves

Do you think AUDNZD can resume its upward trend?

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Australian Dollar/New Zealand Dollar Analysis (AUDNZD), 4-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

Symmetrical Triangle

ASL , Triangular BreakoutAisha Steel Mills Ltd. (ASL) is consolidating in a descending / symmetrical triangle after a pullback. Price compression indicates selling pressure is easing. A breakout above 14 would confirm strength, while a sustained move above 14.80 could accelerate upside momentum.

Stop-loss: 12.89 on a close below structure.

🎯 Target 1: 15.85 (R:R ~1:1.25)

🎯 Target 2: 16.89 (R:R ~1:2.05)

Structure favors upside continuation on a decisive breakout.

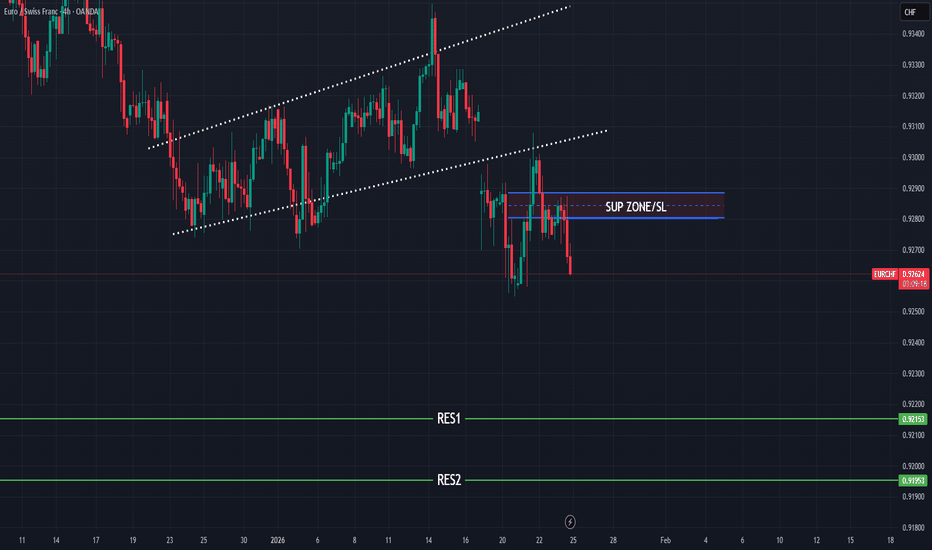

AUDCAD is Breaking Triangle — Bullish Breakout Ahead of CPI?Today, I want to share a long trading opportunity on the AUDCAD pair ( FX:AUDCAD ), so stay tuned!

Currently, AUDCAD has successfully broken through its resistance line and is now situated within a heavy resistance zone(0.9585 CAD-0.9247 CAD).

From a classic technical analysis perspective, if we look at the AUDCAD chart on the 4-hour timeframe, we can see a symmetrical triangle pattern, which suggests a continuation of the recent bullish trend of AUDCAD.

From an Elliott Wave perspective, it appears that AUDCAD has completed microwave 4 of the main wave 5, and we can expect the start of microwave 5 of the main wave 5. The breakout above the upper line of the symmetrical triangle could confirm the end of the microwave 4.

Additionally, today’s Canadian CPI data could act as a key catalyst for AUDCAD.

Based on recent macro trends, I expect inflation pressures in Canada to remain soft.

If CPI comes at or below expectations, it should weaken CAD and support a bullish continuation on AUDCAD.

As long as the structure holds, I remain biased to the long side.

As a result, I expect that after breaking the upper line of the symmetrical triangle, AUDCAD could rise at least to 0.9357 CAD.

First Target: 0.9357 CAD

Second Target: 0.9397 CAD

Stop Loss(SL): 0.9241 CAD

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Australian Dollar/Canadian Dollar Analysis (AUDCAD), 4-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

Bitcoin Cash BCH Breaking Out Of A Sym Triangle With A Bull FlagHello Traders,

Here is my chart for Bitcoin Cash BCH. As you can see it looks like the price has broken out of a symmetrical triangle and has bounced on top of the top trendline of the symmetrical triangle which is a bullish sign.

Also the price looks to have formed a bull flag as the price has broken the top trendline of the symmetrical triangle and the price looks to be pushing up from the bull flag. Momentum looks good on the RSI as well with the monthly reading 61.5 (middle ground) , weekly 55.5 (middle) and the daily RSI at 47 (below middle). The 4hr RSI is at 44. The reason I am saying this is when I have watched the price break out of something before and the RSI is already into overbought territory so +70 on any timeframe its likely the price has topped and its a false breakout.

Anyway, it looks like the price wants to go up from here. If the price goes up and breaks the previous LH with conviction then my target is the other LH at $1642.

Lets see what happens.

APLD: Momentum Confirms Triangle BreakoutAPLD - CURRENT PRICE : 37.68

APLD Breaks Symmetrical Triangle – Momentum Confirms Trend Continuation

Applied Digital Corporation (APLD) continues to trade within a strong long-term uptrend, with price holding well above the rising EMA 200 , signaling sustained institutional support and a structurally bullish market environment.

From a price-structure perspective, APLD has broken out of a bullish symmetrical triangle , supported by clear volume expansion, confirming genuine buying interest rather than a false breakout. This pattern reflects a period of healthy consolidation before trend continuation, with price now attempting to resume its prior upside trajectory.

Momentum further reinforces the bullish setup. The three highlighted green vertical lines mark previous instances where RSI crossed above 70, and in each case, price continued to rise afterward, demonstrating that overbought readings in this stock have historically acted as trend-confirmation signals rather than reversal warnings. RSI has once again moved above 70, aligning with the current breakout and strengthening the case for continued upside.

Based on the technical structure, the first upside target is $47, while the second target at $58 represents the x-to-x measured move of the symmetrical triangle . On the downside, $28 remains the key support and invalidation level. As long as price holds above this level and the EMA 200, the technical bias remains firmly bullish, with pullbacks viewed as opportunities within an ongoing uptrend.

ENTRY PRICE : 35.00 - 37.68

FIRST TARGET : 47.00

SECOND TARGET : 58.00

SUPPORT : 28.00

Notes : On 09 Jan 2026, major Wall Street analysts update their ratings for Applied Digital Corporation (APLD), with price targets ranging from $40 to $58. (Source: moomoo)

ETH: Symmetrical Triangle ScenarioETH is trading inside a daily symmetrical triangle: lower highs from $3,300–$3,350 and higher lows from $2,850–$2,900.

Liquidation heatmaps show over 1B USD in liquidations stacked both above and below price, so a break of structure can move fast.

📈 Long Idea – Trade the Upside Break

- Trigger: Daily close above 3,300 (triangle resistance and recent supply).

- Entry: Breakout close or retest of $3,300 as support with bullish reaction.

- Invalidation: Close back inside the triangle / below ~$3,150

- Targets:

- T1: $3,500–$3,600

- T2: $3,900–$4,000 on a full triangle measured move and short squeeze.

📉 Short Idea – Trade the Downside Break

- Trigger: Daily close below $2,900 (triangle support).

- Entry: Breakdown close or bearish retest of $2,900 from below.

- Invalidation: Reclaim and close back above $3,000 (bear trap).

- Targets:

- T1: $2,700–$2,600

- T2: $2,200–$2,300 if long liquidations cascade.

🧠 Key Trading Principles

- React, don’t predict: Let a daily close outside the triangle pick direction; this avoids guessing inside the chop.

- Expect volatility: With leverage heavy on both sides, post‑break moves can be unusually sharp, so size positions and stops accordingly.

Breaking: Antelope Enterprise Holdings Limited (AEHL) Surge 90%The shares of Antelope Enterprise Holdings Limited (NASDAQ: NASDAQ:AEHL ) surge over 90%. The asset is set to breakout of a bullish symmetrical triangle. With the RSI at 50, this gives more room for NASDAQ:AEHL to capitalize on the bullish spike.

In recent news, Antelope Enterprise Holdings Limited (NASDAQ: AEHL), today announced that its board of directors has approved a change of the Company’s fiscal year end from December 31 to September 30.

The Company plans to file a transition report on Form 20-F for the transition period of January 1, 2025 through September 30, 2025. The Company’s 2026 fiscal year will begin on October 1, 2025 and end on September 30, 2026.

CEO Ms. Tingting Zhang, stated: “This fiscal year change is intended to better align our reporting cycle with the Company’s operational and financial planning needs. We remain committed to high standards of financial reporting, transparency, and compliance.”

About AEHL

Antelope Enterprise Holdings Limited, through its subsidiaries, provides livestream e-commerce, and business management and information systems consulting services in the People's Republic of China and the United States. The company operates social media and various e-commerce platforms. It also provides business management consulting; information system technology consulting services, including the sales of software use rights for digital data deposit platforms and asset management systems.

Oberoi Realty | Consolidation Within Symmetrical TriangleThis is the daily timeframe chart of Oberoi Realty.

The stock is trading near a strong support zone placed around ₹1550–1600, which has been acting as a key demand area.

The stock is currently trading within a symmetrical triangle formation.

The immediate resistance zone is placed near ₹1780–1800.

A decisive breakout above this level may open the path for the next resistance zone around ₹2000–2030.

if this support zone sustain then we may see higher prices in Oberoi Realty.

thank you ...

XAUUSD 51st Record High of 2025 | Symmetrical Triangle BreakoutHistoric Context - A Record-Breaking Year

According to the Wall Street Journal and Dow Jones Market Data released December 19, 2025:

Gold futures have closed at record highs 51 times in 2025

Price has surged 66 percent year-to-date to 4387.30 USD per troy ounce

This is gold's best annual performance since 1979

Silver has soared 131 percent in 2025, hitting 14 record highs

Both metals are on pace for their biggest gains since 1979, the last year they hit this many records

This historic context is critical for understanding current price action. We are not in a normal market environment. Gold is experiencing a generational bull run driven by central bank accumulation, geopolitical uncertainty, and monetary policy expectations.

Current Market Context - December 20, 2025

Gold experienced volatility following the Federal Reserve December 18, 2025 policy decision. The central bank maintained its hawkish stance, projecting fewer rate cuts for 2026 than markets anticipated. Despite this headwind, gold recovered and hit another record high on December 19.

The resilience above 4300 USD despite hawkish Fed rhetoric demonstrates the strength of underlying demand from central banks and institutional investors.

Key Events This Week:

December 18: Federal Reserve held rates steady, projected only two rate cuts for 2026 versus market expectations of three to four

December 18: US Dollar Index surged following hawkish Fed commentary, initially pressuring gold

December 19: Gold recovered to close at 51st record high of 2025 at 4387.30 USD according to WSJ

December 19: CFTC COT report released showing strong speculative long positioning

December 20: Price consolidating near 4338 USD within symmetrical triangle pattern

Ongoing: PBOC and Chinese ETF buying continues despite record high prices

Ongoing: Physical demand weakness in India and China as discounts widen to multi-year highs

Technical Structure Analysis

Pattern Identification - Symmetrical Triangle

The 45-minute chart displays a textbook symmetrical triangle formation characterized by:

Converging trendlines with lower highs and higher lows

Decreasing volatility as price compresses toward the apex

Volume declining during the consolidation phase

Pattern duration of approximately 10-12 days

Apex convergence point approaching within the next 24-48 hours

Symmetrical triangles are continuation patterns approximately 55-60 percent of the time, but given the preceding choppy price action, this formation could break in either direction.

Triangle Boundaries

Upper Trendline (Descending Resistance):

Connects the highs from December 12-13 around 4380-4390 USD

Currently intersecting near 4355-4360 USD

A decisive close above this trendline signals bullish breakout

Lower Trendline (Ascending Support):

Connects the lows from December 9-10 and December 18-19

Currently providing support near 4300-4310 USD

A decisive close below this trendline signals bearish breakdown

Key Price Levels

Resistance Levels:

4355-4360 USD - Descending trendline resistance immediate

4380-4390 USD - Recent swing high and horizontal resistance

4400-4410 USD - Psychological resistance and previous rejection zone

4450-4475 USD - Major resistance from November 2025 highs

4500 USD - Psychological round number and measured move target

Support Levels:

4310-4320 USD - Ascending trendline support immediate

4280-4290 USD - Horizontal support from December lows

4250-4260 USD - Previous consolidation zone

4200-4220 USD - Major support and psychological level

4150-4175 USD - Secondary support if breakdown accelerates

Moving Average Analysis

Price is oscillating around the 20-period moving average indicating indecision

The 50-period moving average is relatively flat confirming the consolidation phase

The 200-period moving average on higher timeframes remains in uptrend supporting long-term bullish bias

A sustained move above the 20 and 50 MAs would confirm bullish momentum

A breakdown below both MAs would signal bearish continuation

RSI Analysis

RSI on the 45-minute timeframe is currently neutral oscillating between 45-55

No overbought or oversold conditions present

RSI is forming a similar compression pattern to price suggesting energy building for directional move

Watch for RSI to break above 60 for bullish confirmation or below 40 for bearish confirmation

Volume Analysis

Volume has been declining during the triangle formation typical behavior before breakout

Expect volume surge on the breakout candle to confirm validity

Low volume breakouts often result in false moves and should be treated with caution

Watch for volume at least 150 percent of average on breakout candle

Fibonacci Analysis

Measuring from the December low near 4200 USD to the December high near 4390 USD:

0.236 retracement: 4345 USD - Currently testing this level

0.382 retracement: 4317 USD - Aligns with triangle support

0.5 retracement: 4295 USD - Key level if support breaks

0.618 retracement: 4273 USD - Strong support zone

Current price action around 4338 USD is testing the 0.236 Fibonacci level, a relatively shallow retracement suggesting buyers remain interested.

CFTC Commitments of Traders Analysis - December 19, 2025

The latest COT report released December 19, 2025 provides critical insight into market positioning:

Gold Futures Only Positions as of December 9, 2025:

Open Interest: 432,569 contracts

Non-Commercial Long: 268,485 contracts ( 62.1 percent of open interest)

Non-Commercial Short: 44,599 contracts (10.3 percent of open interest)

Commercial Long: 63,707 contracts (14.7 percent)

Commercial Short: 326,286 contracts ( 75.4 percent )

Changes from December 2, 2025:

Open Interest increased by 14,079 contracts

Non-Commercial Longs added 7,154 contracts

Non-Commercial Shorts added only 828 contracts

Commercial Shorts added 10,791 contracts

COT Interpretation:

The positioning data reveals several important dynamics:

Speculators (Non-Commercial) are heavily net long with 62.1 percent long versus only 10.3 percent short

This represents a 6:1 long to short ratio among speculators - extreme bullish positioning

Commercial hedgers (producers and merchants) are heavily short at 75.4 percent, which is normal hedging behavior in a bull market

Open interest is increasing alongside price, confirming the uptrend has participation

The continued addition of speculative longs suggests momentum traders remain committed to the bull case

Warning Signal: Extreme speculative long positioning can precede corrections when longs begin to take profits. However, in strong trending markets, positioning can remain extreme for extended periods. The key is watching for a shift in the weekly changes - if longs start liquidating while price stalls, that would be a bearish signal.

Physical Demand Analysis - Asia Market Weakness

Reuters reported on December 19, 2025 that physical gold demand in Asia has weakened significantly due to record high prices:

India Market:

Dealers offering discounts of up to 37 USD per ounce to official domestic prices, up from 34 USD last week

Domestic gold prices hit fresh record of 135,590 rupees per 10 grams

Demand is roughly one quarter of normal levels according to PN Gadgil and Sons CEO

Wedding season jewelry purchases dampened despite being peak demand period

Demand expected to remain subdued as prices continue rising

China Market:

Bullion trading at discounts of up to 64 USD to global benchmark - highest in over five years

This is the widest discount since August 2020 during COVID-19 pandemic

Wholesale and retail demand described as incredibly weak by analyst Ross Norman

However, ETF buying and PBOC purchases continue despite weak physical demand

Other Asian Markets:

Singapore: Trading from 0.5 USD discount to 2.2 USD premium

Hong Kong: Trading from par to 1.8 USD premium

Japan: Discounts up to 6.0 USD, though retail shops out of gold bar stocks

Physical Demand Interpretation:

The divergence between weak physical demand and strong prices is significant:

Traditional price-sensitive buyers in India and China are stepping back at these levels

However, institutional demand (ETFs, central banks) is offsetting physical weakness

PBOC continues accumulating gold as part of reserve diversification strategy

This suggests the rally is being driven by institutional and speculative flows rather than traditional jewelry demand

A correction could occur if institutional buying slows, as physical demand is unlikely to provide support at current prices

Fundamental Analysis

Federal Reserve Policy Impact

The December 18, 2025 FOMC meeting delivered several key takeaways affecting gold:

Interest rates held steady as expected but forward guidance was more hawkish than anticipated

Dot plot projections showed median expectation of only two rate cuts in 2026

Fed Chair emphasized data dependency and willingness to maintain restrictive policy longer if needed

Inflation concerns remain despite progress with services inflation proving sticky

Labor market remains resilient reducing urgency for rate cuts

Implications for Gold:

Higher-for-longer interest rates are traditionally bearish for gold as they increase the opportunity cost of holding non-yielding assets. However, gold has shown remarkable resilience to rate expectations in 2024-2025, suggesting other factors are driving demand.

US Dollar Dynamics

The US Dollar Index strengthened following the hawkish Fed reaching multi-week highs

Dollar strength typically pressures gold prices due to inverse correlation

However the correlation has weakened in recent months as both assets attract safe-haven flows

Watch DXY price action for confirmation of gold direction

A reversal in dollar strength would provide tailwind for gold

Central Bank Demand

Central bank gold purchases remain a crucial support factor despite weak retail demand:

Global central banks have been net buyers of gold for consecutive years

PBOC (People's Bank of China) continues accumulating gold alongside Chinese ETF buying according to analyst Ross Norman

India central bank has increased gold reserves significantly

Emerging market central banks continue accumulating gold as reserve diversification from USD

This institutional and central bank demand is offsetting weak physical retail demand in Asia

Central bank buying provides structural floor under prices even when retail demand weakens

Geopolitical Factors

Safe-haven demand remains elevated due to:

Russia-Ukraine conflict continues with no resolution in sight

Middle East tensions remain elevated with ongoing regional instability

US-China relations remain strained with trade and technology disputes

Global election cycle creating policy uncertainty

Debt ceiling and fiscal concerns in major economies

These factors support gold safe-haven bid and help explain its resilience despite hawkish Fed policy.

Directional Bias Assessment

Arguments for Bullish Breakout:

Gold has hit 51 record highs in 2025 - momentum clearly favors bulls

Best annual performance since 1979 with 66 percent YTD gains

Long-term uptrend remains intact on daily and weekly timeframes

COT data shows speculators adding to long positions with 62.1 percent long exposure

Central bank and ETF demand continues despite weak physical demand

PBOC accumulation ongoing according to analyst reports

Geopolitical tensions maintaining safe-haven bid

Technical measured move target of 4480-4500 USD if triangle breaks higher

Arguments for Bearish Breakdown:

Extreme speculative long positioning (6:1 ratio) creates correction risk

Physical demand in India at one quarter of normal levels

China discounts at 64 USD - widest since August 2020

Hawkish Fed policy supporting stronger dollar and higher yields

Price has risen 66 percent in one year - mean reversion risk elevated

Holiday liquidity reduction could exacerbate any profit-taking

Technical measured move target of 4200-4220 USD if triangle breaks lower

My Assessment - Cautiously Bullish with Correction Risk:

The weight of evidence supports the bull case given the historic momentum and institutional demand. However, several warning signs warrant caution:

Extreme speculative positioning creates vulnerability to profit-taking

Physical demand weakness in Asia suggests price-sensitive buyers are exhausted

The rally is increasingly dependent on institutional flows rather than broad-based demand

Short-term (next 1-2 weeks): Neutral to slightly bearish. The combination of extreme positioning, weak physical demand, and holiday liquidity conditions creates correction risk. A pullback to 4280-4320 USD would be healthy and provide better entry for longs.

Long-term (1-3 months): Bullish. The structural drivers (central bank buying, geopolitical uncertainty, monetary policy expectations) remain intact. Any correction should be viewed as buying opportunity. Targets of 4500-4600 USD remain valid for Q1 2026.

Trade Framework

Scenario 1: Bullish Breakout Trade

Entry Conditions:

45-minute candle closes decisively above 4360 USD upper trendline

Volume on breakout candle exceeds 150 percent of 20-period average

RSI breaks above 60 confirming momentum

Ideally accompanied by dollar weakness DXY declining

Trade Parameters:

Entry: 4365-4370 USD on confirmed breakout

Stop Loss: 4330 USD below triangle midpoint

Target 1: 4400-4410 USD previous resistance

Target 2: 4450-4460 USD November highs

Target 3: 4500-4520 USD measured move target

Risk-Reward: Approximately 1:2.5 to first target

Scenario 2: Bearish Breakdown Trade

Entry Conditions:

45-minute candle closes decisively below 4300 USD lower trendline

Volume on breakdown candle exceeds 150 percent of 20-period average

RSI breaks below 40 confirming bearish momentum

Ideally accompanied by dollar strength DXY rising

Trade Parameters:

Entry: 4295-4300 USD on confirmed breakdown

Stop Loss: 4340 USD above triangle midpoint

Target 1: 4250-4260 USD horizontal support

Target 2: 4200-4220 USD major support

Target 3: 4150-4175 USD measured move target

Risk-Reward: Approximately 1:2 to first target

Risk Management Guidelines

Position sizing should not exceed 1-2 percent risk per trade given current volatility

Reduce position size during holiday period due to lower liquidity

Use hard stop losses do not move stops further from entry

Scale out of positions at each target level 33 percent at each target

Move stop to breakeven after first target achieved

Avoid holding large positions over weekend given geopolitical risks

Monitor DXY and Treasury yields for confirmation of gold direction

Be prepared for false breakouts wait for candle close confirmation

Invalidation Levels

Bullish thesis invalidated if:

Price closes below 4250 USD on daily timeframe

Triangle breaks down with volume confirmation

DXY breaks to new highs above 110

Bearish thesis invalidated if:

Price closes above 4410 USD on daily timeframe

Triangle breaks up with volume confirmation

DXY reverses sharply below 106

Conclusion

OANDA:XAUUSD has delivered a historic performance in 2025 with 51 record highs and 66 percent gains - the best year since 1979. The precious metal is currently consolidating within a symmetrical triangle near 4338 USD, setting up for the next directional move.

Key Data Points:

51 record highs in 2025 according to Dow Jones Market Data

66 percent YTD gains - best since 1979

COT shows 62.1 percent speculative long positioning (6:1 long/short ratio)

India physical demand at 25 percent of normal levels

China discounts at 64 USD - widest since August 2020

PBOC and ETF buying continues despite weak retail demand

Key Takeaways:

The symmetrical triangle is approaching its apex suggesting a breakout is imminent within the next 24-72 hours

Historic momentum (51 records) supports bullish bias but extreme positioning creates correction risk

Physical demand weakness in Asia is a warning sign that price-sensitive buyers are exhausted

Institutional demand (central banks, ETFs) is currently offsetting retail weakness

Short-term bias is neutral with correction risk; long-term bias remains bullish

Bullish breakout targets 4450-4500 USD; bearish breakdown targets 4250-4280 USD

Risk management is critical given extreme positioning and holiday liquidity conditions

The optimal approach is to wait for confirmed breakout with volume rather than anticipating direction. Given the extreme speculative positioning, any breakdown could trigger rapid profit-taking. Conversely, a breakout to new highs could accelerate as shorts cover.

Trade the breakout, not the anticipation. Let price confirm direction before committing capital.

This is not financial advice. Always conduct independent research and manage risk appropriately.

Gold Near Triangle Top — Correction Phase IncomingBased on yesterday’s U.S. economic data, Gold( OANDA:XAUUSD ) failed to post a significant bullish move.

At the moment, Gold appears to be trading within a Symmetrical Triangle pattern and is currently moving near the upper lines of this pattern.

From an Elliott Wave perspective, it seems that Gold has completed a Double Three corrective structure near the upper lines of the symmetrical triangle.

In addition, a Regular Bearish Divergence (RD−) can be observed between the two most recent highs, which weakens the bullish momentum.

I expect that Gold will at least decline toward the lower lines of the symmetrical triangle. If these lower lines are broken, we could even anticipate a breakdown below the Support zone($4,265-$4,240).

First Target: Lower lines of symmetrical triangle

Second Target: Support zone($4,265-$4,240)

Stop Loss(SL): $4,357

Points may shift as the market evolves

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌 Gold Analyze (XAUUSD), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

USDT Dominance% Breakout: Crypto Correction Not Over?Today, I’m going to analyze Market Cap USDT Dominance%( CRYPTOCAP:USDT.D ) on the weekly timeframe for you. The reason I want to analyze USDT.D% is that the crypto market conditions have become a bit complex lately, and many factors are influencing it. Therefore, it’s better to take a look at the weekly chart of USDT.D%.

Currently, it seems that USDT.D% is in the vicinity of a Heavy Resistance zone(6.78%-5.25%), but at the same time, there’s also a Support zone(6.24%-5.57%) that could potentially lead to an increase in USDT.D%.

From a classical technical analysis perspective, we can clearly see on the weekly chart that the upper lines of the symmetrical triangle have been broken, and it seems that USDT.D% is currently pulling back to those upper lines. As long as it doesn’t move below those lines again, we can still expect that the market correction is ongoing and hasn’t ended yet. This is a sign that helps us gauge whether the crypto market correction is complete or still ongoing.

From an Elliott Wave perspective, with the breakout of the symmetrical triangle, it seems that USDT.D% might be starting a new impulsive wave.

Since we’re not seeing Regular Divergence(RD-) at the highs, it indicates that the recent upward movement in the crypto market, especially Bitcoin’s( BINANCE:BTCUSDT ) recent gains, is still part of the correction phase.

In conclusion, based on the above analysis, I expect USDT.D% to rise again. If USDT.D% breaks through the resistance lines, we can hope that it will also break through the Heavy Resistance zone(6.78%-5.25%), and that would be a negative sign for the crypto market, potentially leading to deeper corrections in the coming weeks.

So, what do you think? Do you believe the crypto market correction is over, or do you think it will continue? That’s a nice question to leave our analysis with.

Stop Loss(SL): 5.49%

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Market Cap USDT Dominance% Analyze (USDT.D%), Weekly time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

USDJPY - Triangle (consolidation before news) FX:USDJPY formed a false breakout of the symmetrical triangle consolidation support. An ideal maneuver ahead of the news and expectations of a positive outcome for the JPY.

“The Bank of Japan may raise interest rates for the first time in 11 months at its meeting on December 19.” Against this backdrop, the currency pair may test the 156.00 area before a possible decline if the Bank of Japan takes this step. The Japanese national currency may strengthen, putting pressure on the dollar, which has been rising since yesterday's US session...

Technically, the zone of interest for a decline is 156.0. A false breakout is possible before a decline to support.

Resistance levels: 156.10

Support levels: 155.0, 154. 5

The strengthening of the yen may put pressure on the dollar. But again, it is worth paying attention to the context regarding the policy of the Japanese regulator. Further movement depends on the news.

Best regards, R. Linda!

XRP Breakdown Risk: Triangle + Resistance = DropXRP( BINANCE:XRPUSDT ) is moving within a resistance zone($2.32-$2.19) and has shown notable reactions to the resistance line and the Potential Reversal Zone(PRZ) .

From a technical analysis perspective, it seems that XRP has formed a Symmetrical Triangle Pattern. If the lower line of this pattern is broken, it would align with our analysis.

Additionally, from an Elliott Wave theory standpoint, we expect the next corrective wave for XRP, and a break of that lower triangle line would confirm this expectation.

I expect that in the upcoming hours, XRP will begin a downward trend and test the support zone($2.16-$2.11). If it breaks through that support, we can expect further declines toward the next support zone($2.04-$2.00) and Cumulative Long Liquidation Leverage($2.04-$2.02).

First Target: $2.133

Second Target: $2.069

Third Target: $2.043

Stop Loss(SL): $2.330

Cumulative Short Liquidation Leverage: $2.30-$2.25

Cumulative Long Liquidation Leverage: $2.16-$2.13

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌 XRP Analyze (XRPUSDT), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

Biocon Under Heavy Selling Pressure — Momentum Turning WeakBiocon – Daily Timeframe Update

This is the daily timeframe chart of Biocon.

The stock is showing a sharp decline and may take a pause near its first LOP support at 370–380.

If this support breaks, the next strong support zone lies at 330–345, from where a potential reversal can be expected.

Thank you !!

GOLD → Mixed data forms a symmetrical triangle FX:XAUUSD is bouncing off support at 4030, with bulls trying to maintain the current trend. The fundamental backdrop is currently weak for gold, which is why there are bears in the market. The PMI report is coming up...

Mixed US employment data (NFP growth to 119K, but unemployment rose to 4.4%) has created uncertainty. The probability of a Fed rate cut in December remains at 40%. Fed officials remain cautious, warning of the risks of premature easing.

Focus on the 4070-4082 area and local trend resistance...

Gold is awaiting new signals from PMI data. A breakout of the range is likely if there are significant deviations from forecasts (Manufacturing PMI: 52, Services PMI: 54.8)

Technically, a symmetrical triangle is forming on the chart, which could keep the market within its boundaries if the fundamental background remains unchanged. However, a breakout of either boundary could trigger a distribution in the direction of the break

Resistance levels: 4080, 4110

Support levels: 4040, 4030, 4006

In the medium term, gold currently looks weak. The reaction to support is weakening, a cascade of levels and a downward resistance line are forming. The market may test the 4080 area, but if the PMI is weak, gold will return to attack the trend support. However, a break above 4082 and a close above this zone could give us a chance for growth.

Best regards, R. Linda!

USDT Dominance at Key Resistance – Crypto Reversal Ahead?One of the key indices we can use to gauge the direction of the cryptocurrency market is USDT Dominance ( CRYPTOCAP:USDT.D ) .

In this analysis, let's look at USDT.D% on the weekly timeframe .

Currently, USDT.D% is moving in a Resistance zone(6.77%-5.25%) , Time Reversal Zone(TRZ) , and is near a Potential Reversal Zone (PRZ) .

From a classic technical analysis perspective, it seems that USDT.D% is inside a Symmetrical Triangle and is currently near the upper lines of this triangle.

In terms of Elliott Wave theory, USDT.D% looks like the corrective wave B of the main wave Y is completing.

So we might expect USDT.D% to move downwards again, at least towards the lower lines of the symmetrical triangle .

Note: This is purely a technical analysis. USDT.D% is at a sensitive area, and if it breaks above the upper lines of the triangle, we should anticipate a decline in Bitcoin and other tokens.

What do you think? Can USDT.D% break the upper lines of the symmetrical triangle and push the crypto market down again, or will the market bounce back? Let me know your thoughts!

Please respect each other's ideas and express them politely if you agree or disagree.

Market Cap USDT Dominance% Analyze (USDT.D%), Weekly frame.

Be sure to follow the updated ideas .

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

ICICIGI: Weekly Triangle Squeeze | Explosive Move Expected Soon BUY Setup 🛡️

Entry: ₹2,040-2,050 (Current Level)

Target 1: ₹2,080-2,100

Target 2: ₹2,150-2,180

Target 3: ₹2,250+ (Extended - Post Breakout)

Stop Loss: ₹1,975

Technical Rationale:

MAJOR PATTERN: Symmetrical Triangle forming on Weekly chart - apex approaching

Trading at upper boundary of triangle - breakout imminent (marked "2d 6h")

Strong +2.32% gain today showing bullish momentum

Volume at 11M - showing increased participation

Price testing critical resistance at 2,000-2,050 zone

Multiple convergence of trendlines creating decision point

RSI around 60 - neutral to bullish zone with room for upside

Trading above EMA on higher timeframes

Insurance sector showing relative strength

Triangle pattern spanning 6+ months - significant breakout potential

Support at ascending trendline around 1,975

Risk-Reward: Excellent 1:3+ ratio (much higher if triangle breaks out)

Pattern: Symmetrical Triangle on Weekly Chart - one of the most powerful continuation patterns. Breakout from 6-month consolidation could trigger massive move.

Strategy:

Conservative: Wait for weekly close above 2,060 with volume for confirmation

Aggressive: Enter now with SL below triangle support at 1,975

Book 25% at T1 (2,090), 25% at T2 (2,165), hold 50% for major breakout target 2,250-2,300

Key Levels:

CRITICAL Breakout Zone: 2,050-2,060 (triangle apex)

Strong Resistance: 2,000-2,050 (current battle zone)

Extended Targets: 2,250, 2,300+ (measured move from triangle)

Major Support: 1,975 (triangle support), 1,900

Timeframe: Weekly chart - suitable for positional/swing trading (weeks to months)

Triangle Measured Move: If breaks above 2,060, target = 2,300+ (height of triangle added to breakout point)

Volume Watch: Need strong volume on breakout for confirmation

Disclaimer: For educational purposes only. Not SEBI registered.

ACPLACPL PSX 1D

💰 Fundamentals

✅ EPS YoY: 6.07 vs 0.45 → Massive Growth!

✅ EPS (Q1 2026 / Sep 2025): 6.07 ↑ from 3.07 → +1248% Growth

✅ EPS (TTM): 18.22 ↑ from 12.6 → +219% Growth

📰 News Catalyst:

📢 Fauji Foundation & KAPCO are set to acquire 84% stake in ACPL — strong institutional backing and long-term growth confidence.

📈 Technicals

🔹 Price has retested the bottom of a parallel channel.

🔹 Currently consolidating below trendline resistance – expecting potential breakout of the symmetrical channel.

🔹 Volume confirmation will be key for momentum continuation.

🎯 Targets: First test previous swing high → then aim for channel top.

⚠️ Note: Book partial profits on strength — timing is everything.

💎 Summary:

Strong quarterly & annual EPS growth + acquisition news = solid fundamentals.

Technicals aligning with potential breakout zone — watch for volume surge!

TWLO - Downtrend line BROKEN!TWLO - CURRENT PRICE : 134.88

The chart shared here is the weekly chart, where TWLO broke above its downtrend line with strong volume — a signal of growing bullish momentum. On the daily chart, TWLO formed a rising window (gap-up) last Friday — a bullish signal that often indicates strong buying momentum and potential continuation of the uptrend.

From a pattern analysis perspective, some traders may interpret the current setup as a bullish symmetrical triangle, indicating potential continuation to the upside. Next target will be 154.00 and 174.00. Support level is 114.73 (the low of window area based on daily chart).

ENTRY PRICE : 132.00 - 135.00

FIRST TARGET : 154.00

SECOND TARGET : 174.00

SUPPORT : 114.73 (CUTLOSS below this level on closing basis)

Thomas Scott Ltd - Symmetrical Triangle Breakout - Weekly📊 Thomas Scott (India) Ltd – Symmetrical Triangle Breakout on Weekly Chart 🔺

📅 Chart Date: October 26, 2025 | Timeframe: Weekly

📈 CMP: ₹364.05 (+16.93%)

📍 Symbol: NSE:THOMASCOTT

🔍 Technical Overview

📉 Pattern: Symmetrical Triangle

Price has been consolidating within a contracting triangle pattern since February 2024, showing a gradual squeeze in volatility.

This week’s strong bullish candle with +16.9% move and above-average volume indicates a potential breakout attempt from the upper trendline.

💥 Volume Confirmation (🔊)

Volume rose sharply to 277.4K, much higher than the recent average of 189.8K, supporting the breakout strength.

📈 Next Resistance Zone: ₹415–₹430 (previous supply area).

📉 Immediate Support: ₹330 (triangle breakout zone).

🎯 Trading Plan (for Educational Purpose)

Entry (on Retest): ₹335–₹345 zone

Stoploss: ₹295 (Weekly Close Basis)

Targets: ₹415 / ₹475 / ₹525

Risk–Reward: ~1:2.5

⚠️ Disclaimer

This analysis is for educational and charting purposes only, not financial advice. Always do your own research before investing or trading.

Nifty Key Levels on Radar — Crucial Zones to Watch This WeekNifty 50 – 1 Hour Timeframe Analysis

Nifty is currently showing strong support near the 25,800 zone.

If this level breaks, the next support can be seen around 25,550–25,600.

As per the current market structure, Nifty may first move in a range-bound phase, achieving initial targets around 26,150–26,180.

If the upward momentum continues, the next potential targets will be around 26,300–26,400 levels.

If the pattern support zone holds, then the pattern targets are likely to be achieved.

Thank you!

NIFTY | Twin Bullish Patterns Signaling Market ConfidenceNIFTY | Dual Bullish Pattern on 15-Minute Timeframe

This is the 15-minute timeframe chart of NIFTY.

NIFTY is currently forming two bullish patterns — a triangle pattern and a falling flag pattern.

If the triangle pattern support breaks, the next strong support lies near the ₹25,550–₹25,600 zone, aligned with the lower boundary of the falling flag.

As long as this support zone holds, NIFTY is likely to resume its upward momentum, potentially heading toward a new high in the ₹26,250–₹26,300 range.

Thank You !!