New ATH Incoming? Gold (XAUUSD) Holds Bullish Structure!Hey Traders,

In today’s trading session, we are monitoring XAUUSD for a buying opportunity around the 4,380 zone. Gold remains in a well-defined uptrend and is currently in a corrective phase approaching the key trendline confluence and the 4,380 support & resistance area, which may act as a strong demand zone for continuation to the upside.

From a fundamental perspective, markets are keenly watching US labor data due Friday. Should the report come in soft, it would likely reinforce expectations of further Fed rate cuts in January, similar to December’s dovish messaging, which tends to weaken the US Dollar and support bullish flows into Gold.

In addition, escalating geopolitical tensions between the US and Venezuela have boosted safe-haven demand, as investors seek protection amid heightened uncertainty, pressuring traditional assets and strengthening gold’s appeal.

With these technical and macro drivers aligned, Gold may continue its bullish trajectory and challenge fresh all-time highs this year.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

Technical Analysis

$SPY & $SPX Scenarios — Thursday, Jan 8, 2026🔮 AMEX:SPY & SP:SPX Scenarios — Thursday, Jan 8, 2026 🔮

🌍 Market-Moving Headlines

• Labor check ahead of payrolls: Jobless claims act as the final labor signal before Friday’s jobs report.

• Growth efficiency read: Productivity data feeds directly into margin and inflation narratives.

• Macro breadth day: Trade deficit and consumer credit round out the growth and demand picture.

📊 Key Data & Events (ET)

8 30 AM

• Initial Jobless Claims Jan 3: 210,000

• U.S. Trade Deficit Oct: -58.4 billion

• U.S. Productivity Q3: 4.9 percent

3 00 PM

• Consumer Credit Nov: 9.2 billion

⚠️ Disclaimer: For informational use only — not financial advice.

📌 #SPY #SPX #JoblessClaims #Productivity #macro #markets #trading #stocks

GBP/JPY – Uptrend Weakens, Correction Risk RisesAfter a strong and decisive rally , GBP/JPY is clearly entering a cooling phase as the market begins to reassess risk. Cautious sentiment is returning , while a recovery in the Japanese yen is reducing the pair’s previous upside momentum.

On the macro side, the JPY is finding support from expectations that the Bank of Japan will continue its tightening path , whereas recent UK data have not been strong enough to provide fresh momentum for GBP. As global risk appetite softens, yen crosses typically come under early corrective pressure.

From a technical perspective, GBP/JPY has clearly reacted at the upper resistance zone and is showing signs of exhaustion after multiple failed breakout attempts. Price is now hovering around a balance area, while the short-term structure favors a pullback toward lower support. This suggests that buying pressure is gradually losing control, giving way to profit-taking activity.

In the preferred scenario , unless price can reclaim and hold above the current resistance, GBP/JPY is likely to extend its correction to seek a lower equilibrium level. This move can be seen as a necessary cooldown after a strong advance, before the market commits to its next directional move.

AUD/USD – Corrective pressure emerges after inflation coolsIt can be observed that AUD/USD is starting to show signs of slowing down after a relatively smooth advance. While the medium-term trend has not been fully broken , the latest macroeconomic factors from Australia are making the market more cautious toward the AUD.

From a fundamental perspective, Australia’s November CPI fell more than expected (3.4% vs. a 3.6% forecast and down from 3.8% previously). This indicates that headline inflation pressures are easing rapidly, particularly due to lower electricity prices. For the market, this development reduces expectations that the RBA will maintain a hawkish stance, thereby adding short-term downside pressure on the AUD — despite core inflation remaining sticky.

On the chart, AUD/USD has moved close to the resistance zone around 0.6780 within its ascending channel and is starting to show signs of exhaustion. Price is pulling away from the upper boundary of the channel, while 0.6730 stands out as the nearest support level. The current structure leans more toward a technical correction rather than a renewed bullish breakout.

In the base scenario, if selling pressure persists , AUD/USD may pull back to retest 0.6730, or even extend lower toward the lower support area of the ascending channel. Only if core CPI unexpectedly shifts RBA policy expectations would the AUD have a chance to regain immediate upside momentum.

Overall, AUD/USD is entering a necessary “cool-off” phase . With inflation easing and technical resistance overhead, the current pullback is more likely a rebalancing move before the market commits to a clearer directional bias.

SOL / USDT – Weekly OutlookPrice is currently reacting around a key horizontal level (~135–140) that previously acted as both support and resistance.

On the weekly timeframe, this level is critical:

A weekly close above this zone → confirms a R/S flip, opening room toward 160 – 180.

Failure to hold → increases chances of a pullback toward 120 – 110 support.

Market structure is still range-bound, so patience is key.

Let the level confirm before committing — weekly closes matter here.

Bias: Neutral → Bullish only after confirmation.

What do you think — will SOL flip this level or reject again?

👍 Like & 💬 comment if this helps — follow @mrctradinglab for more clean level-based setups.

MrC

LINKUSDT: long setup from daily resistance at 13.355Regarding BINANCE:LINKUSDT.P the level of 13.355 (formed on Dec 5) has been identified. Look at how precisely the price hit it today.

However, the asset has already covered nearly twice its average daily range compared to the last two weeks. Due to this, the probability of a breakout drops slightly — the asset might simply lack the energy to break through.

Nevertheless, the clear confirmation of this level means it is definitely worth watching. If a clean entry point forms, specifically with low volatility right in front of the level, that will be a signal for a Long.

The scenario I expect:

Volatility contraction on approach

Momentum stall at the level

Prolonged consolidation │ Довга консолідація

Closing near the level

Closing near the bar's extreme

The chart displays negative factors:

Yesterday's bar closed far from the level

Was this analysis helpful? Leave your thoughts in the comments and follow to see more.

Is GOLD retracing?📌 My Trade Entry — GOLD (CAPITALCOM) Explained

🔎 What I’m Looking At

This chart shows Gold price action (XAU/USD) where I decided to enter a trade. I chose this particular moment because the price behavior and structure fit my entry criteria — the conditions I watch before putting on a position.

TradingView

💡 Why I Entered Here

Before I pressed enter, I considered key technical points:

Trend observation — I looked at how price was moving leading up to this candle, checking whether it was showing strength or weakness in the direction I wanted to trade.

Price signal alignment — I was waiting for a confirmation pattern (such as a retest, breakout, or supporting candle) that matched my strategy. A good entry isn’t random; it’s based on a clear chart clue that the market might move in my favor.

📏 Risk Defined From the Start

Even as I entered, I already knew where my stop-loss and take-profit levels would be — this is how I protect myself if the market turns against me and how I plan my reward if it goes my way. Including these levels is essential because it keeps my risk controlled according to my trading rules.

📋 What This Entry Means to Me

Rather than guessing or entering too soon, I waited for the chart structure to confirm my idea. That’s how I improve consistency in my trading — entry triggers based on probability and confluence, not emotion.

Recent Movers – Pullback ExamplesRecent session showed several short-term momentum opportunities. The watchlist was created based on a normalized condition: stocks that made a 52-week high within the last three months. From this scan multiple names were selected with focus on viable pullback trades.

A pullback is a short-term counter-move in response to an impulse move. It represents a controlled reversion toward the mean and provides a structured way to participate if momentum resumes.

There is a pullback indicator is shown on the charts as a visual reference. It shows when price moves outside recent behavior and marks the subsequent reversion. The indicator was not made for entries, but for standardization and consistent evaluation.

Example Charts:

ADI

CPRI

CTRI

SOLV

RF

PFG

NTRS

More than 35 percent of the current watchlist is concentrated in the financial sector. This was also visible through sector relative strength over the past month, led by XLB (Materials) and XLF (Financials). This view can support a top-down perspective but is not required.

CRUDE OIL (WTI): Bullish Movement Confirmed

WTI Crude Oil will likely continue rising

after a liquidity grab below the underlined horizontal support.

A consequent cup & handle pattern formation provides a strong

bullish confirmation.

Goal will be 57.41

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPUSD is Nearing a Decent Support Area!Hey Traders, in today's trading session we are monitoring GBPUSD for a buying opportunity around 1.33600 zone, GBPUSD is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 1.33600 support and resistance area.

Trade safe, Joe.

AUDUSD Potential Bullish Bias | 0.66500 Support + USD Weakness!Hey Traders,

In today’s trading session, we are closely monitoring AUDUSD for a potential buying opportunity around the 0.66500 zone. AUDUSD remains in a well-established uptrend and is currently experiencing a healthy corrective pullback, approaching a key trendline confluence and the 0.66500 support & resistance zone, which may act as a strong demand area for bullish continuation.

From a fundamental perspective, increasing expectations of a potential interest rate cut at the upcoming FOMC meeting continue to weigh on the US Dollar. Ongoing USD weakness typically supports risk-sensitive currencies such as the Australian Dollar, further strengthening the bullish bias on AUDUSD.

As always, wait for confirmation before entry and manage risk responsibly.

Trade safe,

Joe.

Gold in NFP week — When the chart out-plays the traderNFP week (Non-Farm Payrolls) is known for wide ranges, frequent SL sweeps, and sharp reversals that make retail traders believe the trend has broken, while the market is actually just collecting liquidity before the real move.

1. Gold is “calm” early week, “crazy” late week

Mon – Tue: Price usually compresses and moves sideways to build positions and stack liquidity

Wed – Thu: Spikes, fake breakouts, and Stop Hunts happen more often

Friday (NFP release): Volatility explodes, spreads widen, and price can hit both directions within minutes

During NFP week, gold isn’t hard to analyze — it’s hard because it won’t let you be right too early.

2. NFP news doesn’t just create a trend, it creates noise before the trend

Before running the main direction, gold often:

Breaks a level quickly to trigger retail SL

Wicks back into the original zone (liquidity sweep)

Then launches the real move

That’s why traders get “stopped at the top or bottom” — not because they’re wrong, but because their SL is sitting at the most obvious liquidity spot.

3. Where does gold react the hardest during NFP week?

Typically at:

Recent highs and lows

Round numbers

Zones where structure looks too clean and everyone draws the same

These areas are liquidity magnets, not true breakout guarantees.

4. What should traders do this week?

Reduce position size, avoid all-in

Don’t place SL too tight near early-week levels

Wait for liquidity to be swept before entering

Avoid FOMO when spikes appear too soon

Prioritize setups that revalidate structure after the noise

5. The classic gold storyline every NFP week

Retail traders hunt perfect entries.

Institutions hunt perfect SL.

Gold hunts SL first, then delivers trend later.

NZDUSD Breakout and Potential Retrace!Hey Traders,

In today’s trading session, we are closely monitoring NZDUSD for a potential buying opportunity around the 0.57600 zone. NZDUSD has successfully broken out of its previous downtrend, signaling a shift in market structure. The pair is now in a corrective pullback, approaching a key retracement level and the 0.57600 support-turned-resistance zone, which may act as a strong demand area for bullish continuation.

From a fundamental perspective, ongoing weakness in the US Dollar, driven by growing expectations of a potential interest rate cut at the upcoming FOMC meeting, continues to support USD-based downside moves. This macro backdrop favors risk-sensitive currencies such as the New Zealand Dollar, reinforcing the bullish bias on NZDUSD.

As always, wait for confirmation and manage risk accordingly.

Trade safe,

Joe.

SAP Approaches a Key Weekly Support Area Worth WatchingSAP remains a core European enterprise software name, with its AI-driven cloud transition back in focus.

Technically, price has arrived at a level I’ve been waiting for for quite some time.

The strongest area on the current chart for a mid- to long-term investor to keep an eye on sits roughly between €180 and €206.

Why is this zone so important?

Because multiple technical criteria align in this area in a clean and compact way.

Criteria inside the highlighted box:

1. Channel projections — both larger and smaller structures.

2. Equal waves.

3. Fibonacci retracement (38.2%) — in strong long-term trends, these levels often act as key reaction zones.

4. Round number €200 — psychological levels matter, especially for long-term positioning.

5. Previous highs — the pause in early 2024 now starts to offer liquidity that can act as support.

6. Weekly EMA 200 — last, but definitely not least.

From a purely technical perspective, initiating a mid- to long-term position from this zone would not be a mistake. This clears the first filter — technical structure.

From here, fundamentals and your own thesis should take over.

My role is to make sure you don’t make technical mistakes , and at current levels,you don't.

If this was helpful, feel free to hit the LIKE / Boost button.

See you soon.

Cheers,

Vaido

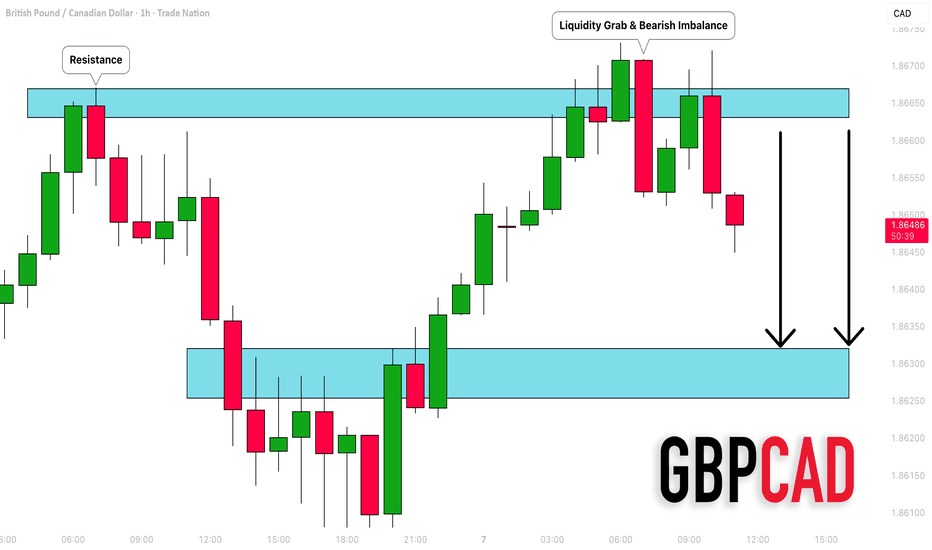

GBPCAD: Bearish Move After a Trap 🇬🇧🇨🇦

I took a short position on GBPCAD this morning

after the price made a false violation of the underlined resistance

and dropped, forming a selling imbalance candle.

I expect that the pair will drop more and reach 1.86323 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GE40 (DAX): Structural Breakout — Bulls Targeting 25,000

Macro Environment: Investors are currently digesting a "Santa Rally" while eyeing the upcoming Fed Minutes for clues on 2026 monetary policy. Despite thin year-end liquidity, the technical structure remains exceptionally bullish as fiscal reform optimism offsets manufacturing weakness.

Technical Analysis

The H4 chart reveals a decisive shift in market regime:

The Breakout: Price has cleared a multi-month descending trendline and a major horizontal ceiling at 24,400.

Base Formation: A clean accumulation zone (grey box) acted as a launchpad, confirming strong institutional demand at lower levels.

Momentum: The successful flip of previous resistance into support suggests a "Buy the Dip" environment.

Order Swing Set-up: LONG

Entry: 24,476 (Ideally on a retest of the breakout level)

Take Profit: 25,006 (Key psychological level & measured move target)

Stop Loss: 24,195 (Protected below the recent consolidation base)

Risk/Reward Ratio: ~ 1:1.8

⚠️ DISCLAIMER: This post is for educational purposes and personal opinion only; it is not financial advice. Trading indices involves significant risk, especially during low-liquidity holiday periods. Please Do Your Own Research (DYOR) and manage your risk strictly.

The Honest Company (HNST): decision zone, not imaginationPrice is testing a strong support area where diagonal support, volume profile and the 0.618 Fibonacci zone converge. This level previously acted as a launchpad for impulsive moves, and price is reacting again. Selling pressure is fading, downside volume is drying up, and the structure remains intact. No breakdown so far - this is a technical test, not weakness.

The first objective is a recovery back toward the 3.90–4.00 area. Holding above support opens the path to 5.50 and later toward the 6.00+ zone, where heavy volume is located. The scenario is invalidated only by a clean breakdown below support with no recovery.

Fundamentally, the picture is stabilizing. The company printed positive EPS in 2025, quarterly revenue remains in the 90–100M USD range, and forward estimates show no deterioration.

The market is asking one question: does this base hold?

The answer is being written right now.

Japanese Yen Forecast: USD/JPY Falls on Japan PMI Price Pressure- The US fueled geopolitical tensions over the weekend, capturing Venezuelan President Nicolas Maduro, influencing demand for safe-haven assets, and USD/JPY trends.

- Traders had the opportunity to react to the weekend events on Monday, January 5. US control of Venezuela is likely to have ramifications on supply-demand dynamics for crude oil and Bitcoin (BTC). The news sent USD/JPY higher in early trading.

- While market reaction to President Maduro’s capture was key, finalized manufacturing sector -PMI data supported a tighter monetary policy environment, affirming the bearish medium-term outlook for USD/JPY.

- Below, I’ll discuss the macro backdrop, the near-term price catalysts, and technical levels traders should closely watch.

Technical Outlook: USD/JPY on a Downward Trajectory

- For USD/JPY price trends, technicals, and fundamentals will continue to require close monitoring.

- Looking at the daily chart, USD/JPY traded above its 50-day and 200-day Exponential Moving Averages (EMAs), signaling a bullish bias. While technicals remained bullish, bearish fundamentals are developing, outweighing the technical structure.

- A break below the 155 support level and the 50-day EMA would indicate a bearish near-term trend reversal. A sustained fall through the 50-day EMA would expose the 200-day EMA. If breached, 150 would be the next key support level.

- Crucially, a sustained fall through the 50-day and 200-day EMAs would reinforce the bearish price outlooks for USD/JPY.

US ISM Manufacturing PMI and Fed Speakers in Focus

- Later on Monday, US private sector PMI figures are likely to influence demand for the US dollar and the USD/JPY pair. Economists forecast the ISM Manufacturing PMI to increase from 48.2 in November to 48.3 in December.

- Typically, a less pronounced contraction, rising employment, and higher prices support a less dovish Fed policy stance, which would lift demand for the US dollar. While the sector accounts for around 10% of the US GDP, the underlying PMI data provide insights into the effect of tariffs and the higher interest rate backdrop on prices.

- Last week, the less influential S&P Global US Manufacturing PMI revealed that tariffs continued to drive prices higher, suggesting a more hawkish Fed policy stance. However, the ISM Services PMI, due out on January 7, will be key, given that the sector accounts for roughly 80% of US GDP and is the key inflation contributor.

- While the PMI data will influence US dollar demand, Fed commentary remains key for USD/JPY trends. Increased calls to cut rates to bolster the labor market would dampen demand for the US dollar, pushing USD/JPY lower.

- According to the CME FedWatch Tool, the probability of a March Fed rate cut increased from 51.1% on January 2 to 54.0% on January 3.

- Looking ahead, expectations of further BoJ rate hikes, a new Fed Chair, potentially favoring lower rates, and a cooling US labor market remain key drivers. These scenarios continue to support a bearish short- to medium-term outlook for USD/JPY.

Position and Upside Risk

- In my view, expectations of narrower US-Japan rate differentials and threats of yen intervention signal a negative price outlook. However, the BoJ neutral interest rate and incoming US economic data will be key.

- A higher neutral interest rate level would indicate multiple BoJ rate hikes and a narrower US-Japan interest rate differential. A narrower rate differential would reverse yen carry trades into US assets, pushing USD/JPY toward 140 over the longer term.

However, upside risks to the bearish outlook include:

- Dovish BoJ chatter and neutral interest rate in the range of 1% and 1.25%.

- Strong US economic indicators.

- Hawkish Fed rhetoric.

- These scenarios would send USD/JPY higher. However, the ever-present threat of yen interventions is likely to cap the upside at around the 158 level, based on the latest communication.

Conclusion: Focus on the BoJ Neutral Rate

- In summary, the USD/JPY trends reflect expectations of narrowing rate differentials. Market focus will remain on the BoJ’s neutral rate, economic data, and the Fed’s forward guidance on rate cuts.

- A neutral rate in the range of 1.5% to 2.5% would indicate a more aggressive BoJ rate path. Expectations of multiple BoJ rate hikes reaffirm the cautiously bearish short- and bearish medium-term bias for USD/JPY. Additionally, dovish Fed chatter and a potential unwinding of yen carry trades. A yen carry trade unwind would likely send USD/JPY toward 140 over the longer 6-12 month time horizon.

Decision Point — Bounce or Breakdown?EURUSD is trading at a key decision area after a sustained decline from the upper range. Price is now approaching the mid-range support, with momentum slowing, suggesting the market is preparing for either a reaction bounce or continuation lower.

The broader structure remains range-bound, with price capped below the 1.1800–1.1810 resistance zone and buyers historically stepping in near the lower boundary.

Resistance: 1.1800 – 1.1810

Support: 1.1700 – 1.1710

Decision zone: 1.1730 – 1.1740

➡️ Primary: hold above 1.1700 → corrective bounce → rotation back toward 1.1760–1.1780.

⚠️ Risk: clean break below 1.1700 → continuation toward the lower support zone before stabilization.

XAU/USD – The bullish trend continues to strengthenAs we move into the early sessions of 2026, gold continues to reinforce its role as a safe-haven asse t amid escalating geopolitical tensions following U.S. military actions in Venezuela . The sharp 2.7% surge in the previous session signals a clear return of defensive capital flows, especially as global markets face rising uncertainty. At the same time, expectations of further Fed rate cuts this year are creating a favorable environment for non-yielding assets such as gold.

From a technical perspective, the H4 chart confirms that XAU/USD’s bullish structure remains firmly intact . After a brief corrective phase, price quickly rebounded from the 4,440 zone, validating it as a key instant support where buying pressure consistently emerges. The recovery legs are decisive and well-supported, indicating that buyers remain firmly in control of the broader trend .

As long as price continues to hold above this support area, the high-probability scenario points toward a renewed advance toward 4,520, followed by a potential extension to the 4,600 resistance zone. With safe-haven demand still active, any near-term pullbacks are likely to remain technical in nature, serving as a base for further upside continuation in XAU/USD.

USD/JPY – Buyers Return, the Uptrend Remains in ControlEntering the early sessions of 2026, USD/JPY is showing notable stability after a brief corrective move. Although the yen found temporary support from hawkish remarks by BoJ Governor Kazuo Ueda and ongoing speculation about possible intervention from Tokyo , the market largely views these factors as constraints on upside momentum rather than forces strong enough to reverse the primary trend.

From a macro perspective, the interest-rate differential between the U.S. and Japan remains wide. The BoJ’s 25 bps rate hike to the highest level in 30 years carries more symbolic weight than practical impact, while global capital continues to favor carry trades. As a result, USD/JPY continues to hold above key support levels, despite short-term volatility.

On the H4 chart, the bullish structure remains clearly intact. Price is advancing within a well-defined ascending channel , forming higher lows. The 156.00–156.10 zone serves as critical support, where price has repeatedly reacted and bounced decisively. As long as this area holds, the current pullback should be viewed as technical consolidation, laying the groundwork for further upside.

Under the base scenario, USD/JPY is likely to rebound toward 157.30 , and potentially extend to the upper resistance of the channel. While intervention risks or tighter BoJ signals may keep traders cautious, the uptrend remains the dominant narrative as long as the technical structure stays intact.

$SPY & $SPX Scenarios — Wednesday, Jan 7, 2026🔮 AMEX:SPY & SP:SPX Scenarios — Wednesday, Jan 7, 2026 🔮

🌍 Market-Moving Headlines

• Services and labor cross-check: ADP, ISM Services, and Job Openings together shape the near-term labor and growth narrative.

• Rates sensitivity: Markets will gauge whether services strength offsets soft manufacturing momentum from earlier in the week.

• Setup into Friday jobs: Today’s data can influence positioning ahead of the official employment report.

📊 Key Data & Events (ET)

8 15 AM

• ADP Employment Change Dec: 48,000

10 00 AM

• ISM Services Index Dec: 52.2 percent

• Job Openings Nov: 7.6 million

• Factory Orders Oct: -1.2 percent

⚠️ Disclaimer: For informational use only — not financial advice.

📌 #SPY #SPX #ISM #ADP #JOLTS #macro #markets #trading

LIGHT| Pump & Dump Pattern | HIGH RISK WARNINGExecutive Summary

Bitlight (LIGHT) trading at $0.43 within a descending channel on the 4H timeframe. Classic pump and dump pattern: consolidate → pump → dump → repeat. Token crashed 74-80% after team wallets dumped $11M+ on exchanges. Only 10% of supply circulating with 90% locked until 2026 unlocks. Extreme caution advised.

BIAS: BEARISH - Pump & Dump Structure

⚠️ HIGH RISK WARNING ⚠️

Team wallets dumped $11.2M worth of LIGHT pre-crash

80% price crash in 24 hours after insider sell-offs

Only 10% of 420M supply circulating

90% supply locked - massive dilution risk in 2026

Official X account potentially compromised (Jan 4, 2026)

FDV $275M vs Market Cap $27M = 10x dilution risk

Price History - Pump & Dump Cycles

Pump 1: Rally to ~$4.50-$5.00 → Dump

Pump 2: Rally to ~$3.50 → Dump

Pump 3: Rally to ~$1.50 → Dump

Current: ~$0.43 (consolidating before next move)

Pattern: Lower highs, lower lows throughout

Red Flags

5 wallets dumped $8.2M in 24 hours during Jan 1 crash

Team-linked wallets moved 4.64M LIGHT ($11.2M) to exchanges

Thin liquidity amplifies volatility

0.81 turnover ratio = high trader churn

"Controlled dump" accusations from community

Technical Structure - 4H

Descending Channel:

Clear downtrend with lower highs and lower lows

Yellow dashed trendlines defining channel

Each pump rejected at descending resistance

Pattern suggests continuation lower

Key Levels:

Resistance:

$0.80 - $1.00 - Immediate resistance

$1.50 - Previous pump high

Descending trendline resistance

Support:

$0.40 - Current support

$0.00 - Potential target if pattern continues

SCENARIO ANALYSIS

BEARISH (Primary): Continuation Lower

Consolidation at current levels

Possible small pump to trap buyers

Then dump to new lows

Pattern repeats until liquidity dries up

BULLISH (Low Probability):

Break above descending channel

Would require major catalyst

RGB protocol adoption could help long-term

But tokenomics remain problematic

My Assessment

Classic pump and dump structure. Team wallets dumping on retail. 90% supply still locked = massive future dilution. Each rally gets sold into. Descending channel intact. Avoid or trade with extreme caution. Not worth the risk.

Strategy:

AVOID - High risk of further dumps

If trading: Short rallies to descending resistance

Never hold through consolidation phases

Take profits quickly on any pump

This is not financial advice. Be Careful! EXTREME CAUTION ADVISED.