Tilray Brands' (NASDAQ: TLRY) record-breaking fiscal Q2 2026Based on a comprehensive analysis of Tilray Brands' (NASDAQ: TLRY) record-breaking fiscal Q2 2026 earnings report and its broader financial trajectory, several key technical price levels have emerged as critical support and risk zones. These levels provide a structured framework for assessing the stock's stability following its positive fundamental news and for managing downside risk in a volatile sector.

Detailed Technical Support Zones:

The stock's reaction to its strengthened balance sheet and reaffirmed guidance establishes a baseline from which to gauge future pullbacks. Three primary tiers of technical support are identified, each representing a potential area where buyer interest could resurge if broader market or sector-specific pressures cause a retracement from current levels.

Primary Near-Term Support ($7.70):

This represents the first and most immediate level of defense following the post-earnings price action. Holding above $7.70 would indicate that the bullish sentiment derived from the company's record revenue, improved net loss, and transition to a net cash position of $27.4 million remains intact. A successful test of this zone would suggest a healthy consolidation, allowing the stock to build a foundation for its next move higher.

Secondary Core Support ($7.00):

The $7.00 level is a significant psychological and technical threshold. A decline to this zone would indicate a deeper correction, potentially triggered by sector-wide volatility or profit-taking after the earnings rally. However, it would also likely be viewed as a strategic entry point for investors who believe in the long-term thesis centered on Tilray's diversified portfolio and its poised entry into the U.S. medical market pending federal rescheduling. Holding this support is crucial for maintaining the intermediate-term uptrend structure.

Tertiary & Critical Long-Term Support ($6.00):

The $6.00 level represents a major line in the sand for the bullish narrative. A retracement to this depth would signal a severe loss of momentum and likely reflect broader pessimism about the cannabis sector or specific execution concerns. While a test here would be concerning, a definitive reversal and bounce from $6.00 would demonstrate exceptional resilience and could mark a significant long-term bottom. A sustained break below, however, would invalidate the current recovery thesis and necessitate a fundamental re-evaluation.

The Danger Zone: Ultimate Risk Level ($3.50):

Beyond the established support tiers lies the critical danger zone at $3.50. A breach of the $6.00 support and a decline toward $3.50 would represent a catastrophic technical breakdown, implying a market judgment that Tilray's operational progress—including its record $218 million revenue, $292 million in cash, and path to $62-$72 million in adjusted EBITDA—is fundamentally insufficient or that the company faces an insurmountable threat. This level is far below the current trading range and would only come into play in a scenario of extreme sector distress, a major company-specific failure, or a complete collapse of the U.S. regulatory catalyst thesis.

Fundamental Context and Confluence:

These technical levels must be interpreted alongside Tilray's solidifying fundamentals. The company is no longer a speculative pure-play but a diversified CPG company with market leadership in cannabis and growing distribution/pharma businesses. The 36% growth in international medical cannabis and the potential U.S. medical expansion provide tangible growth catalysts. The improved balance sheet significantly de-risks the equity, making deep declines less probable unless the core thesis fractures.

Conclusion:

In summary, while Tilray's stock exhibits positive momentum driven by strong financial execution, the identified support levels at $7.70, $7.00, and $6.00 provide a clear roadmap for assessing strength and potential accumulation opportunities. The $7.00 level is particularly pivotal as a bellwether for medium-term sentiment. The fundamental improvements act as a buffer against severe declines, making a test of the $3.50 danger zone an unlikely tail-risk scenario unless the company's operational or regulatory outlook deteriorates dramatically. Investors should monitor reactions at these defined levels, where the interplay between technical price action and Tilray's evolving commercial story will be most clearly evident.

TLRY

Buy above $9If price drops back below $9, I'm going to be having a word with the charting gods. The technical setup here is very textbook.

White boxes on the chart may be fractals.

(Essentially, waves of momentum that ripple through like little mirror signatures after the initial wave.)

Tilray has a crazy awesome bullish setup over the next month or two, but oddly other markets I am seeing bearish signs. The only explanation I can think of is maybe Tilray is partly seen as a recessionary play due to their alcohol business and capital is switching sectors. One positive sign for Tilray is even though it is listed in the Nasdaq, even while the Nasdaq was red today (01/02/26), Tilray was UP +7%. Unexpected bullish divergence.

The other option is that this is all liquidity based and it's just the fact that rescheduling cannabis should lead to greater liquidity in the sector.

Who knows.

But!

IF the gods aren't completely screwing with us, Tilray should revisit $15 in the next few months. If Trump comes out and says, "Actually, I lied, and weed is bad." THEN the rally could end and we reverse the whole thing.

I love this stock long-term no matter what.

I think when the U.S. Treasury goes tits up, obviously everything will enter crisis, but they'll love cannabis once we peasants really get pissed and start banging on the doors. They'll legalize weed while we enter a lost decade and reshuffle the monetary system.

One day, cannabis will be a commodity again, like wheat, cotton, etc., but that's just my opinion and a bit of a historical cycle thing.

Tilray Soars on Trump Policy Shift: Buy or Sell?Tilray (TLRY) shares jumped 30% following major political news. President Donald Trump announced plans to reclassify cannabis as a Schedule III drug. Additionally, a new pilot program may allow seniors to buy cannabis through Medicare. The stock has now doubled since its December lows. This analysis breaks down why this matters for your portfolio across key sectors.

Geopolitics and Strategy: The Policy Pivot

The U.S. government is changing its strategic stance on cannabis. President Trump’s potential executive order signals a massive shift in federal law. Moving cannabis to "Schedule III" lowers its legal severity. This aligns the U.S. with other progressive nations. For Tilray, this removes the constant fear of federal prosecution. It creates a safer environment for institutional investors to enter the market.

Economics: Tax and Banking Freedom

Reclassification solves two major economic problems for Tilray. Currently, cannabis companies pay extremely high taxes because of "Section 280E." This rule prevents them from deducting normal business expenses. Schedule III status removes this burden. It instantly improves cash flow and profitability. Furthermore, it opens access to traditional banking services, reducing the cost of doing business.

Business Models: The Senior Market

The proposed Medicare pilot program is a game-changer. It allows the government to subsidize cannabis for seniors. This creates a stable, guaranteed revenue stream for Tilray. Seniors often use these products for pain relief and health. This shifts the business model from recreational use to "medical necessity." A government-backed customer base is highly reliable and lucrative.

Science and Innovation: Research Growth

Strict laws previously blocked scientific research. Reclassification makes Research and Development (R&D) much easier. Tilray can now study cannabis compounds more freely. This accelerates the creation of new medical products. Patent analysis suggests this will lead to proprietary formulas. Owning exclusive medical patents creates a "moat" that protects Tilray from competitors.

Market Data: What Traders Are Betting

Options traders expect huge volatility. Data shows traders are pricing in a 50% move by March 2026. The target price in this bullish scenario is $21.22. This means investors are willing to bet money that the stock will rise significantly. Sentiment is aggressive and optimistic.

Technical Analysis: The Trend is Up

The stock chart confirms the positive news. Tilray is trading above its 50-day, 100-day, and 200-day moving averages. These are key lines that determine the trend direction. When the price is above them, the trend is "Bullish" (upward). The Relative Strength Index (RSI) is at 53, showing the rally has room to grow.

Conclusion: Wall Street’s Verdict

Analysts rate Tilray as a "Moderate Buy." Price targets reach as high as $25, suggesting a potential 75% gain. The combination of tax relief, new senior customers, and technical momentum makes a strong case. However, the move depends on the Executive Order becoming law. Investors should watch for official confirmation from the White House.

TLRY📌 TLRY: Why did the stock soar 65% and what's next?

Last week saw the biggest weekly gain in the company's history.

We won't go into too much detail on the fundamentals, but here's a quick overview:

Revenue breakdown by product for the quarter:

Canadian recreational cannabis: ~$59.1 million — the core of the Canadian business

Canadian medical cannabis: ~$6.7 million

International medical cannabis: ~$14.9 million — the key growth rate (+71% in the last quarter of 2025!)

At the same time, cash flows, and earnings are in negative territory on a TTM basis.

Net debt ~59 M

P/B ~0.9

Now to the most interesting part:

This share price increase is related to the likelihood of cannabis being reclassified in the US from Schedule I to Schedule III of controlled substances.

What does this mean:

1. Repeal of Section 280E of the US Internal Revenue Code

Currently, companies operating with cannabis in the US cannot deduct regular business expenses (rent, salaries, marketing) when calculating their income taxes. This severely compresses margins.

Reclassification will automatically remove this limitation.

2. Access to Capital and Banks

Breaking; Tilray Brands, Inc. (NASDAQ: TLRY) Spike 41% Today Shares of Tilray Brands, Inc. (NASDAQ: TLRY) saw a noteworthy uptick of 41% today defying market sentiment. For the past 2 days the stock has bounced from the $7 support zone eyeing the $15 resistant point.

Ascertaining the bullish thesis is the RSI at 56, giving room for further price uptick since the asset is not overbought.

In another news, Trump expected to sign executive order to reclassify marijuana as soon as Monday, source tells CNBC.

President Donald Trump is expected to issue an executive order as soon as Monday that would allow for reclassification of weed, a source familiar with the matter told CNBC. Such a move would allow cannabis companies to fall under different tax regulations and encourage investment.

Cannabis stocks took a leg up in Friday’s midday trading following CNBC’s report.

Tilray shares were recently trading at a little more than $10 after peaking at more than $2,140, adjusted for splits, in September 2018. The Amplify Cannabis ETF is still on track to lose more than 8% in 2025, its fifth straight down year.

Analyst Summary

According to 3 analysts, the average rating for TLRY stock is "Buy." The 12-month stock price target is $150.0, which is an increase of 1,259.93% from the latest price.

Tilray Brands, Inc., a lifestyle consumer products company, engages in the research, cultivation, processing, and distribution of medical cannabis products in Canada, the United States, Europe, the Middle East, Africa, and internationally.

Patience is KEYVery clear impulsive bullish price action from July-October.

We have pulled back currently 50%.

We're at a potentially good swing trade price, but I want to stack this stock for the long-term so I'm not buying yet. Before I buy, I want to see a shorter-term uptrend begin again and buy a pullback. Not looking to catch this falling knife.

***(Note: Since the bullish price action occurred around a news event where Trump talked about de-regulating cannabis, the bullish move may not last. This is why patience is key. This happened during Biden as well. Tilray 3-4x in weeks then bled back down to lower lows once people realized it was just talk.)

I am long-term bullish on this stock however.

I would love to buy sub-$1 on a little uptrend and hold for 5-10 years even.

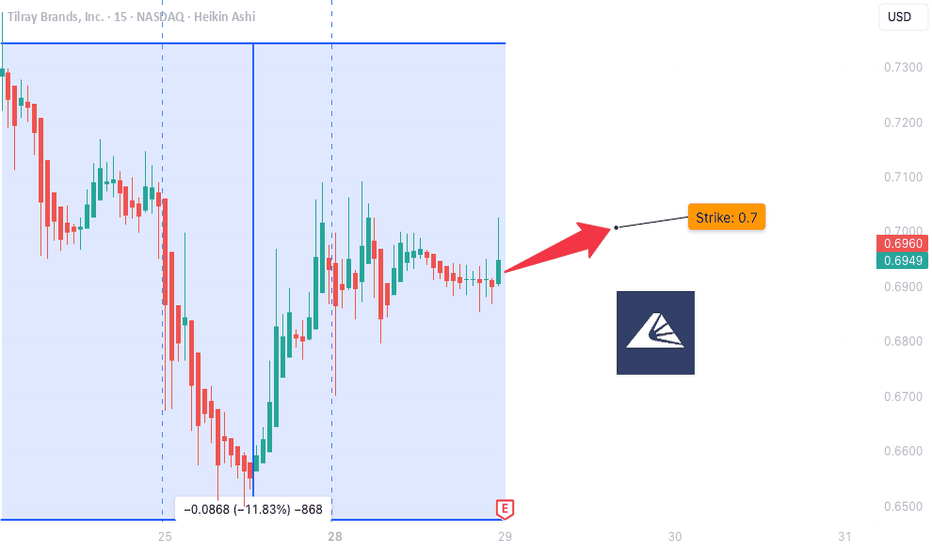

TLRY Earnings Play: Lotto-Style PUT Setup

📉 **TLRY Earnings Play: Lotto-Style PUT Setup**

*Tilray Brands (TLRY) - Earnings Due July 30 (AMC)*

🔻High risk. High reward. Possibly… nothing. But here's the setup:

---

### 🔬 Fundamental Breakdown:

* 💸 **TTM Revenue Growth**: -1.4% (🚩 declining)

* 📉 **Profit Margin**: -114.4%

* 🧾 **Operating Margin**: -16.8%

* 🧠 **EPS Surprise (avg 8Q)**: **-89.4%**, with only **12% beat rate**

* 🧯 **Sector Risk**: Cannabis = Over-regulated + Overcrowded

🧮 **Fundamental Score**: 2/10 → Broken business model.

---

### 📊 Technicals:

* 🔺 Above 20D MA (\$0.61) and 50D MA (\$0.49)

* 🔻 Well below 200D MA (\$0.91)

* 📉 Volume 0.72x = Weak institutional interest

* 📏 RSI: 57.69 (neutral drift)

**Technical Score**: 4/10 → Weak drift, low conviction.

---

### ⚠️ No Options Flow. No Big Bets Seen.

(But that’s exactly what makes this a clean lotto...)

---

## 🎯 Lotto Trade Idea:

```json

{

"Type": "PUT",

"Strike": "$0.70",

"Expiry": "Aug 1, 2025",

"Entry": "$0.10",

"Profit Target": "$0.50",

"Stop Loss": "$0.035",

"Confidence": "30%",

"Size": "2% portfolio max",

"Timing": "Pre-earnings close"

}

```

---

### 🧠 Strategy:

This is not a trade based on strength. It’s based on **TLRY’s consistent failure to deliver** — and if it disappoints again, we ride the downside. If not? Risk tightly capped.

---

⚖️ **Conviction**: 35%

💀 **Risk**: Total loss possible

🚀 **Reward**: 400%+ possible

---

📝 *Not financial advice — just one degenerate’s earnings notebook.*

💬 Drop your TLRY lotto plans below👇

TLRY Tilray Brands Options Ahead of EarningsAnalyzing the options chain and the chart patterns of TLRY Tilray Brands prior to the earnings report this week,

I would consider purchasing the 2usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $0.32.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

TLRY cannabis stocksHexo turned out to be a bummer pick

but TLRY is still remaining

Which leads me to believe that the only thing that could cause a price to drop this much and then project this high upwards, has got to be due to federal legalization THC drinks and possibly more.

Lots of legal hoops to jump through for states and cannabis and more, but there is good that comes from legalization, meaning research money, meaning jobs, meaning genetics, meaning new ways of grow cannabis and using it that could ultimately be safer to consume vs now, maybe leads to dosages being figured out and effects to be specifically altered per user or use or effect or whatever you want to imagine.

Maybe not every state is ready to allow it but it seems across the board, it's a favorable issue for a lot of members of both parties. I've heard trump say, he doesn't need or want to use it but he has seen it do amazing things to help other, I've heard Kamala can help undo damage done during the course of a long a difficult career, and allow people who were simply selling to get by vs selling to commit crime and harm others, which ultimately means, she could probably do some good with the current fentanyl issue. As clearly she is now thinking about it from some views other than her own and how it can be used as a net good.

On top of that, it's clear the big companies or execs maybe even pharma companies need a look and a whole lot of questions asked about why cannabis caused the inability to fund through loans, borrow money, pay with credit and more.

So TLRY has overseas connections, favorable politics swinging their way through years of work, and drinks infused with THC, which as more research comes out, there might be ways to safely allow bars to serve drinks without someone being unable to get home within a reasonable amount of time. Would this ever occur, maybe, but the important key to take away is open research and money into science and then obviously trying to work with Mexico to literally end cartels (I have deep core ties to Columbia) and Escobar from stories I've heard personally and have no idea if they are true, really took care of the area he controlled, but yeah, he also probably was doing some awful stuff to others.

Lesson to learn here is that maybe some evil can be treated with a new direction, but some evil needs two major governments and police/technology and security that both keeps each place within their areas trying to solve a common goal and allowing each other to assist when a task is too difficult to handle on their own or ours. And clearly show the world that Mexico won't allow groups of evil to thrive and America can secure the border by doing it all in Mexico which could then theoretically lead to a an open border discussion, but say what you want. There is a major issue with cocaine usage and literally and knowingly killing other humans to profit, which is maybe evil, and something we could easily do which defense stocks getting obviously so much money pretty much all the time.

Again, why can't we help our vets to the point where it's not a issue? And they can seek help without losing status, rank, pay, benefits and more.

again, political views aside, America has a bad ass military that runs one hell of task, why aren't we using them to flush out corruption and evil and still find a way to maintain being an ideal view of how the military used to stand up to bad, and maybe we should have listened better should a former president suggest that money can cause an issue where oversight is gone, paraphrasing of course, as it's quite obvious this president have some serious foresight and tried to express that concern.

finally, cut anything out of this that you want to make it make sense in your world, but to make short a sweet, legalization allows the states more power, gives institutions power to direct lots of money towards meaningful research, gives avenues where we can actually start to work on the drugs that are laced with awful stuff coming into the country so frequently. And then you figure out who funds it and destroy whatever is left of that system, maybe dismantle is a better term, and start to setup some form of life that means someone in south america shouldn't feel the need to risk their life to leave their home, or why so many innocent people die for "drugs" which is probably a way better start a securing the border. A big wall can still have value in metal, and value can lead to an even better wall for cyber crimes, especially as we head to space. The space force is no joke, It was some well done prep work from former presidents and a realization of how much valuable stuff will be in a space making it targets for "evil"

Why do I say all of this, probably because a big first step is exactly the one I mention, legalization, and then locking up or whatever the leader decides is needed at that time. Ideally with a new lens of money being used to manipulate others at will. but my view is just one, I can't say my way is best, right or even possible, but again, legal leads to open freedom in safe environments. In fact, maybe the best person to handle an issue like that is someone who is potentially willing to legalize something that her decisions in the past have led to jail or worse.

TLRY Tilray Brands Options Ahead of EarningsAnalyzing the options chain and the chart patterns of TLRY Tilray Brands prior to the earnings report this week,

I would consider purchasing the 1usd strike price in the money Calls with

an expiration date of 2024-10-11,

for a premium of approximately $0.70.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Tilray Brands (TLRY) to Report Q1 FY2025 Results October 10thTilray Brands Inc. (NASDAQ: NASDAQ:TLRY ), a global lifestyle and consumer packaged goods giant, is set to announce its Q1 Fiscal Year 2025 financial results on October 10, 2024. As the market eagerly anticipates the latest earnings report, let's dive into the company's recent performance, its strategic acquisition moves, and the stock's technical outlook, which offer both opportunities and potential risks for investors.

Overview

Tilray (NASDAQ: NASDAQ:TLRY ) has been making waves in both the cannabis and beverage industries, diversifying its portfolio and expanding its reach globally. Most notably, Tilray has completed the acquisition of Atwater Brewery from Molson Coors Beverage Company, further cementing its position in the craft beer industry. The acquisition adds Atwater Brewery, a historic Michigan-based craft brewery, to Tilray's growing list of premium brands, which includes SweetWater Brewing Company, Montauk Brewing Company, and more.

According to Tilray’s CEO, Irwin D. Simon, this acquisition enhances the company's presence in the Great Lakes region and strengthens its distribution channels. Tilray aims to leverage its resources to grow Atwater’s brand and introduce its signature brews to more beer enthusiasts across the U.S.

Financially, Tilray has shown strong revenue growth, reporting a 25.80% increase in revenue for FY2024, bringing in $788.94 million compared to $627.12 million the previous year. However, challenges persist on the profitability front, as the company posted losses of -$244.98 million, which, while substantial, are an 83.14% improvement compared to its previous year’s loss. This signals Tilray is making efforts to reduce its financial burden, though it has not yet reached profitability.

Analyst Sentiment and Stock Price Forecast

The average analyst sentiment for Tilray Brands’ stock is “Hold,” with a 12-month price target of $2.00. Currently trading at $1.70, this represents an expected 17.65% upside, a modest gain but potentially compelling for those seeking short- to medium-term investment opportunities.

It’s worth noting that Tilray (NASDAQ: NASDAQ:TLRY ) operates in an industry marked by volatility, as it juggles both the cannabis and consumer packaged goods markets. This makes its future growth trajectory dependent on various regulatory developments and the company’s ability to continue expanding into new markets and sectors.

Technical Analysis: Key Levels to Watch

From a technical perspective, NASDAQ:TLRY has seen a modest recovery, trading up 1.18% in premarket trading on Friday. The stock had previously been in a downward trend, but recent price action signals a potential shift.

Relative Strength Index (RSI) Currently sits at 45.58, the RSI indicates that the stock is neither overbought nor oversold. This suggests that while there’s some weakness, it also provides an opportunity for investors to capitalize on potential upside if a breakout occurs.

Support and Resistance Levels: Tilray's stock finds support at $1.50. Should the stock dip below this level, we may see a return to bearish momentum. Conversely, resistance at $2.00 serves as the next key level to break. If the stock can break through this resistance, it may attract new momentum traders and long-term investors, pushing it higher.

While the stock has recently bounced off support, the overall trend remains weak. Investors should closely monitor the stock’s movement approaching its Q1 results, as a move above or below the critical $1.50 support could signal further action.

Upcoming Earnings & Potential Catalysts

With the Q1 FY2025 earnings release scheduled for October 10, 2024, investors will be watching for several key metrics:

Revenue growth, particularly how the Atwater Brewery acquisition has impacted the top line.

Cost reduction efforts, as Tilray continues to narrow its losses.

Any updates on expansion plans, particularly in the cannabis market, which could provide a catalyst for stock price appreciation.

Additionally, Tilray’s diverse portfolio in cannabis, beverages, and consumer packaged goods offers multiple streams of revenue, which provides a level of insulation against market-specific headwinds. However, its success in achieving profitability and growing margins will remain critical for future stock price appreciation.

Conclusion: Opportunity With Caution

Tilray Brands (NASDAQ: NASDAQ:TLRY ) presents an interesting investment case with its significant growth potential driven by acquisitions and a diversified product line. However, the company is still facing financial hurdles, and its stock reflects ongoing volatility in the broader cannabis and consumer goods sectors.

For short-term traders, the current technical setup offers an opportunity to capitalize on a breakout above $2.00 or a potential pullback to the $1.50 support level. Long-term investors should focus on the company’s Q1 earnings and any signals that point toward sustained revenue growth and eventual profitability.

While Tilray’s stock is currently rated a Hold by analysts, its acquisition strategy and diversified portfolio position it as a potential turnaround candidate, making it a stock worth watching closely as Q1 results are unveiled.

TLRY Tilray Brands Options Ahead of EarningsAnalyzing the options chain and the chart patterns of TLRY Tilray Brands prior to the earnings report this week,

I would consider purchasing the 2.50usd strike price Calls with

an expiration date of 2025-1-17,

for a premium of approximately $0.29.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

SNDL a MJ penny stock in reversal from trend down LONGSNDL is shown on a weekly chart with a volume profile and VWAP band lines anchored back

three years. Perhaps due to recent news of potential federal legalization or other catalysts

SNDL is now above its pivot low. The EMA cloud ( periods 7, 21 and 42) is now green as

lines converged into a zero slope and are now rising. Price is now approaching the first lower

band line and will thus enter the fair value zone above the undervalued zone. A reasonable

target is 7.0 where the POC line of the volume profile is confluent with the black mean VWAP

line. The is more than 100% upside and will not occur quickly. Price may get spikes with

marijuana-related news along the way. A sign the trade is going bad is if both the faster green

RSI line and the slower black RSI line both go below the 50 level. The stop loss will be

at 1.86 below the EMA cloud. Accordingly. the risk is $0.50 per risk. If only $100 is to be risked

the trade can be 200 shares. Risk is off when price rises to $2.85 and the stop-loss is adjusted

to the entry price. Beyond $3.00, the stop loss can be adjusted to a trailing 10-15% or the

ATR. I see the last weekly candle as a Doji and so consolidation and price consensus making for

a best entry.

OGI - a MJ penny stock upgraded LONGOGI got an upgrade from hold to buy and with it a target of 5.25 or more than double current

valuation. The ballot iniative in Florida and legalization in Gremany are recent news. VP Harris

seeks to make legalization an lection issue this fall while pushing for a DEA reboot on the whole

cleassification of MJ. Prospects for growth seem more clear for OGI . I will take a long trade

here with the National MJ Day upcoming this weekend. I will target the horizontal levels

of recent pivots as drawn in black on the 60 minute chart.

OGI Swing Trades Continue More Volatlity from Fed News SHORTOGI has completed another trend up from the federal news about a push for legalization

of marijuana as a handout from incumbents seeking another term. My recent idea on OGI

as to demonstrate its suitability for high return short duration swing trades to add compounding

into the profit and returns. The increased volatility due to the federal news only adds to

the overall picture. I will short OGI here looking for price to fall to the area of the mean VWAP

where I will reverse my position and begin to take a long position in increments at optimal

entries.

FLGC rides MJ rallying from being beatdown long term LONGFLGC here on a 30 minue chart reflects the new agenda in the swamp as incumbents try to

fortify their re-election agenda. Same is happening in Germany !. My trade started 10 days

ago. I am looking for 300% got 200% so far. Momentum continues. Hot is hot until it is not.

(See also ideas on OGI, ACB and TLRY.) Adding on any pullback or consolidation.

TLRY and its peers jump on high federal news catalyst LONGTLRY on the 2H sharge shows a draamatic trading response to the DOJ recommending the

reclassification of marijuana. No much to the analysis = these will have momentum until it

fades. I suspect good continuation plays here until mid -day on Friday when profit taking

and sell-offs will dominate. Short sellers will take positions at the tops as well. In the

meanwhile long trades are the low lying fruit.. The risk is a bit lessens by the surge from

the news. Others include SNDL, OGI , ACB and the ETF MJ for those who like to spread risk

across a basket of stocks. For the time being these stocks will be truly buzzed but do not be

late. Stay home if you are.

TLRY - 420 to the MOON or is CANNABIS FINISHED?This chart is pretty explanatory, and probably doesn't require much explanation.

I'm bullish on this stock.

I'm 90% sure Dems push cannabis legislation through as it's a bipartisan issue for the most part, and will look good for both parties pre election. Starts with credit cards and banks, imo.

Don't follow green line path as gospel, it is often incorrect, but helps me plan a preliminary "ideal" path based on indicators. It helps with backtracking predictions, and keeping emotions in check, as you know what "past you" saw.

I like 1.89 as a big time buy target, but it could easily go lower.

Relevant trends and targets marked.

Watch out, current trends are showing the run-up into earnings, which would allow for a drop.

Does this mean anything? Not always, but it's good to note.

current bullish price movement doesn't have to end if rejection trends and targets start to break and confirm.

Good luck!

CGC trade from bounce at fib level LONGCGC fell in a standard Fibonacci retracement of 3 week trend up from Mid-March. News of

an application to issue a new class of shares may as well be considered a dilution of current

shareholders. CGC is 5 days away from National MJ Day of the 20th. I expect a further

pullback into the 0.618 level given the fundamental news but CGC could rally on trader interest

regarding the notable day. My trade plan is to buy a pullback if and whne it finds support at

6.15 and then enter long seeking the target of 7.95 which would be a Fib 0.5 retracement of

the trend down. I will look at other MJ stocks as well.

ACB a MJ small cap set up LONG Aurora Cannabis on a 15 minute chart is sitting on the dynamic support of the second lower

VWAP band in deep undervalued territory also below the high volume area of the immediate

volume profile anchored back to April 11th. The Trend indicator shows bearish momentum has

bottomed. The dual time fram RSI indicator shows RS values in the low 40s. ACB did have some

bullish volume spikes throughout the previous session. Next weekend, is National MJ Day and

a bit celebratory for stocks in this subsector. The backdrop of legalization in Germany and the

ballot initiative in Florida both have relevance and importance. Vice President Harris is pushing

the legalization as an incumbent seeking to be re-elected. All of this helps in ACB's

fundamentals and projects for future growth.

I see an upside of 15% to the recent high pivot and potentially beyond that.

ACB a Cannabis Penny Stock LONGACB is moving of late due to the legalization of marijuana in Germany as well as the election

referendum in Florida in November. It is the best capitalized of the peer penny stocks in

this sector. Today from the low at the opening bell to the high before the NY lunch hour, ACB

moved about 30%. There was both a long and short trade here. The options moved

multiples. National MJ Day is April 20th. I expect these stocks to keep moving at least

until then. ACB is getting support from the mean anchored VWAP line and is able to run

with its bullish momentum to the second upper VWAP line before the shorts take positions

and longs realize profits. Since ACB is now situated at the mean VWAP, it is set up for

a long entry now.

Tilray ($TLRY) 4.20 and beyondLooks like a massive ZigZag has finished on Tilray. C-Wave is pretty much exactly .786 the length of the A-Wave (in log).

If the impulse from the low is completed, it's a bit too early to call for a completed correction, though not entirely impossible, if this finishes as a Zigzag down (meaning we're currently in the C-wave). Timewise it would seem too short though, so this might need a bit more time to offer the next long.

i.ibb.co