US Hiring At Critical LevelsTotal Nonfarm Hires (JTSHIL) is hovering around 5.29M — a level that has acted as a pivot zone in prior cycles.

In both 2001 and 2008, hiring rolled over before unemployment spiked. Businesses are slow hiring first. Layoffs come later. That’s how the labor cycle typically turns.

Right now, we’re not in collapse. We’re in compression.

The key question isn’t “Is this a recession?”

The question is: Does hiring stabilize here — or break below the 5.1M zone decisively?

If hiring rebounds above ~5.6M–5.8M, the slowdown narrative weakens.

If it cracks and accelerates lower, recession probability rises quickly.

Labor doesn’t usually fall off a cliff without warning. It erodes.

This level matters.

What Would Invalidate the Concern

Sustained rebound above ~5.6M–5.8M

Acceleration in private-sector payroll growth

Rising job openings alongside rising hires

Stable or rising temporary employment

If hiring expands meaningfully from here, the “critical level”

thesis weakens.

CAUTION!

THANK YOU for getting me to 5,000 followers! 🙏🔥

Let’s keep climbing.

If you enjoy the work:

👉 Drop a solid comment

Let’s push it to 6,000 and keep building a community grounded in truth, not hype.

Trend Analysis

BTC:Short-Term Bearish Confirmation After RejectionBTC:Short-Term Bearish Confirmation After Rejection

BTC fell from a strong correction zone that had been holding it strong all these days.

It looked like BTC was going to rise, but apparently the market is not too sure about this optimistic move.

Today BTC confirmed a short-term bearish setup and if this pattern continues, BTC could fall further as shown in the chart.

Main targets:

68k; 66k and 63k

Don't forget:

BlackRock Signaled More Selling as $291M in BTC, ETH Hit Coinbase Amid $2.5B Crypto Options Expiry - Coingape. This could push BTC down more.

You may find more details in the chart.

Thank you and good luck! 🍀

❤️ If this analysis helps your trading day, please support it with a like or comment ❤️

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

RED BOXES:

BREAK ABOVE 4970 for 4989✅, 4999✅, 5002✅, 5010✅ and 5016✅ in extension of the move

BREAK BELOW 4950 for 4038, 4933, 4920 and 4006 in extension of the move

We had another bullish open which was expected, but unfortunately, we didn't get that lower bounce we wanted to go long. Instead, we got the move we wanted into the defence region completing the red box targets and then giving us a RIP for a short trade.

Apart from that, we managed some long scalps on the indi's in Camelot, but a slow day on the markets.

We're still playing that 5020 pivotal region as mentioned in yesterdays report, and this 4H candle looks like it's going to break above the defence region. Support at the 5035-40 level can lead price to complete the move upside into the 5080's so lets see how we close.

As always, trade safe.

KOG

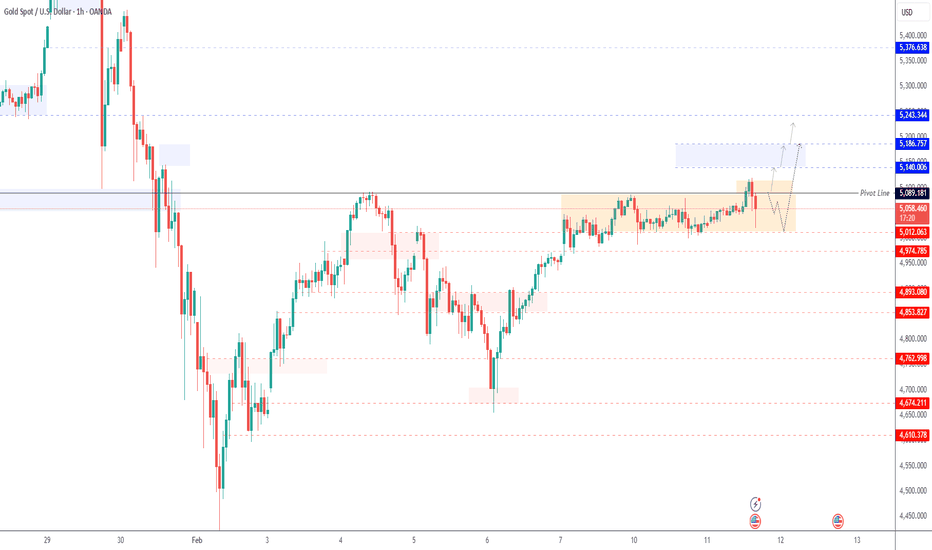

GOLD | Consolidation Ahead of BreakoutGOLD | Consolidation Range Ahead of Breakout

Gold is currently trading in a consolidation range between 5089 and 5012, with traders watching for the next directional breakout.

Technical Outlook

A 15-minute candle close above 5089 would confirm bullish continuation toward 5140, followed by 5186 and potentially 5243.

A move below 5012 would invalidate the bullish scenario and shift momentum bearish toward 4974 and 4893.

Key Levels

• Pivot: 5089

• Support: 5012 – 4975 – 4893

• Resistance: 5140 – 5186 – 5243

XAU/USD | Gold At a Critical Short-Term Decision Zone!By analyzing the #Gold chart on the 30-minute timeframe, we can see that right after our last analysis, gold moved higher again and delivered more than 1,500 pips of profit, pushing price up to $5,047. Gold is now trading around $5,012.

If price fails to hold above $5,050 within the next 4 hours, we can expect a deeper pullback. The downside targets for this correction are $4,999, $4,990, and $4,960. On the other hand, if gold manages to stabilize above $5,050 within the next 4 hours, we can expect further upside in the short term, with targets above $5,080.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

ETHUSDT — Mean Reversion Long SetupWe are initiating a BUY on ETHUSDT within the defined entry zone 1946.78–1982.12, following the Mean Reversion strategy. The setup is supported by high technical conviction, a deeply oversold RSI structure, and bullish order-flow absorption combined with very low volume during the recent pullback, indicating consolidation rather than active distribution.

Trend strength (ADX) remains elevated, suggesting that once direction stabilizes, moves may accelerate. While strong ADX environments can prolong downside swings, the confluence of oversold momentum, declining selling pressure, and improving sentiment — supported by institutional and fundamental catalysts — creates a good risk/reward configuration favoring upside mean reversion.

Trade Plan

Entry zone: 1946.78 – 1982.12

Stop-loss: 1713

Primary target: 2415.42

Extended resistance / conservative macro target: 2994.38

Expected duration: ~3–8 days

Risk/Reward: ~1:2

Risk Factors / Monitoring

Macro liquidity tightening or ETF flow reversals that weaken demand

Order-flow deterioration from Absorption → Churn/Supply

Sudden regulatory, macro, or security-driven negative catalysts

Unless order flow shifts decisively to supply or sentiment deteriorates materially, the operational plan is to enter within the specified zone and manage the position toward the stated targets using disciplined stop placement.

Bullish bounce off?Fiber (EUR/USD) has bounced off the pivot, which acts as a pullback support and could rise to the 1st resistance level.

Pivot: 1.1837

1st Support: 1.1778

1st Resistance: 1.1940

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party.

Solana price internal rotation from key support zone Solana price action is currently bouncing from daily support near the $71 level, an area that aligns closely with the value area low, adding technical significance to the zone. This region has acted as a short-term demand area, allowing price to stabilize after recent downside pressure. However, the rebound so far has lacked strong bullish influxes, suggesting that buyer conviction remains limited.

From a Fibonacci perspective, the lower 0.618 retracement has not yet been tested. In many corrective structures, price often sweeps nearby liquidity before establishing a sustainable bottom. This means Solana could briefly rotate lower to test the 0.618 Fibonacci level, potentially taking out early long positions, before attempting a more meaningful reversal.

Such a move would be consistent with a bottoming process rather than immediate continuation. If price finds acceptance and strong demand at the Fibonacci support, it would increase the probability of a rotational move higher. In that scenario, the next key upside target would be the higher-timeframe resistance near $87.50.

From a technical and price action perspective, Solana is currently trading in a key reversal zone. A successful bottoming structure, supported by improving volume, would be required to confirm a shift in momentum and open the door for upside continuation. Until then, traders should remain cautious and monitor liquidity behavior closely.

MCB – TECH INVESTMENT SET-UP | W | 11 FEB 2026 | By TCAMCB – TECH INVESTMENT SET-UP | W | 11 FEB 2026 | By The Chart Alchemist

• Buy 1: Rs. 422 (30%) (current price)

• Buy 2: Rs. 390 (30%)

• Buy 3: Rs. 376 (40%)

Target Prices:

• TP1: Rs. 440

• TP2: Rs. 470

• TP3: Rs. 500

• TP4: Rs. 530

SL (W closing): Below Rs. 364 | R:R: 1:4

📢 Disclaimer: All trade setups are shared for informational purpose.

Do your own research before taking any position - No claim, No blame

Bought Duolingo ($DUOL).Three reasons:Bought Duolingo ( NASDAQ:DUOL ).

Three reasons:👇

- A bear wedge / descending channel, which often behaves like a bull flag.

- The move is very stretched — selling never continues forever, and odds are starting to favor the bulls here.

- A small base break near the lower end of the channel, marking the first credible bottom attempt in this bear trend.

The entry was shared earlier today with members, and the exit will be shared there as well.

GBPUSD – 2H chart...GBPUSD – 2H chart 👇

Structure shows:

Descending trendline recently broken

Strong support zone around 1.3630–1.3640

Price bouncing from support

Next clear resistance above

🎯 Upside Targets (if support holds)

Target 1: 1.3735 – 1.3750

(previous horizontal resistance)

Target 2: 1.3820 – 1.3840

(major resistance zone marked on my chart)

🔑 Invalidation

If price closes back below 1.3600, upside structure weakens and could retest lower levels.

Right now bias = bullish while above support.

Potential bearish drop off?Cable (GBP/USD) has rejected off the pivot and could drop to the 1st support, which has been identified as an overlap support.

Pivot: 1.3717

1st Support: 1.3549

1st Resistance: 1.3782

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party.

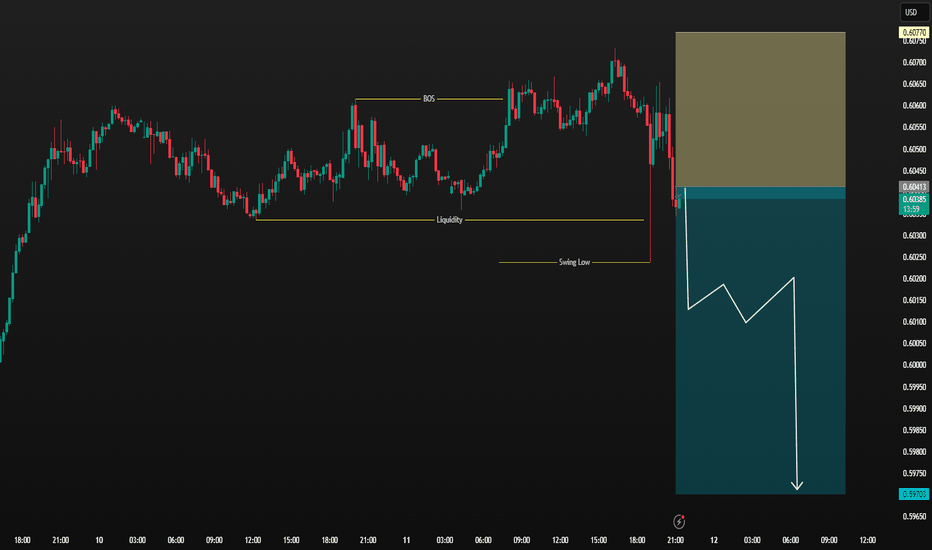

AUDUSD The Target Is DOWN! SELL!

My dear followers,

This is my opinion on the AUDUSD next move:

The asset is approaching an important pivot point 0.7138

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 0.7073

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

BTCUSD – 2H timeframe...BTCUSD – 2H timeframe.

🔍 Structure

Clear downtrend (descending trendline respected)

Price trading below Ichimoku cloud

Currently moving toward major demand zone 63,500 – 62,000

Equal lows liquidity sitting below 64K

📉 Bearish Scenario (More probable short term)

If price breaks 64,000 cleanly:

🎯 Sell Targets:

TP1: 63,500

TP2: 62,000 (strong demand zone)

Extended: 60,000 psychological level

❌ Invalidation: 2H close above 69,500

📈 Bullish Reversal Scenario

If price taps 62K–63K and shows strong rejection:

🎯 Buy Targets:

TP1: 70,000

TP2: 72,000 (my marked supply zone)

Extended: 78,000 – 80,000 major resistance

📌 My View

Short term → downside liquidity sweep toward 62K looks likely

After that → possible bounce to 70K+

USDJPY MARKET OUTLOOKUSDJPY is looking strongly bullish. A pullback that we spotted from the H4 timeframe is a good opportunity to go long. We’re buying this pair from the current market price ahead of the next market session (NEW YORK SESSION) we can also see that NFP repost is coming up and we believe it’s gonna be in favour of USD (stronger USD) so, a buy opportunity is envisaged.

EURUSD – 4H | Continuation Scenario After AccumulationThe pair appears to be completing its corrective phase following a strong impulsive move.

Price is currently stabilizing within a short-term consolidation structure on the 4H timeframe.

🔎 Technical Overview:

A higher low has formed after the recent pullback.

Price is holding above the previous supply breakout area.

Grey zone: short-term demand / mitigation zone.

Liquidity rests above, with relatively clean space toward the 1.20 psychological level.

📌 Scenario:

As long as price maintains acceptance above this zone, a continuation move toward the 1.2020 – 1.2050 range is anticipated.

Primary target: 1.20256

⚠️ Invalidation:

A confirmed 4H close below the demand zone.

Risk management remains the top priority.

NVDA Feb 11 Market Preview – Coiling Under Gamma PressureNVIDIA is stabilizing after a sharp selloff but has not reclaimed control yet. Price is compressing just beneath a heavy call resistance band while holding above defined put support. This is a balance area — not trend continuation.

Higher Timeframe Structure (1H)

NVDA rebounded from the 170–175 base and pushed into the 190–193 supply zone. That zone aligns with prior distribution and the highest positive NETGEX / call resistance area.

Price is now compressing between:

Support: 182–185

Mid Pivot: 187–188

Resistance: 192–193

Above 193, the path opens toward 195–197 and potentially 200 if momentum builds.

Below 182, downside liquidity increases toward 180 and then 175.

The larger structure is neutral with bearish memory still present. Buyers need acceptance above 193 to shift tone decisively.

15-Minute Execution View

Intraday price is coiling around 188–189. Volume is light and momentum signals are mixed, reflecting hesitation rather than conviction.

Key levels to monitor:193

– Major call wall / highest positive gamma

195–197

– Upside expansion zone

187–188

– Decision pivot

182

– Put support

180

– Breakdown acceleration trigger

GEX & Dealer Positioning

Gamma is concentrated around 192–193, acting as a volatility cap. Dealers are likely to suppress expansion while price remains beneath this zone.

If 193 is cleanly reclaimed and held, dealer positioning can flip and fuel upside momentum.

Below 182, negative gamma increases and breakdowns can accelerate quickly.

This is a level-to-level environment.

Trade Plan for Feb 11

Bullish Scenario

A break and hold above 193 with expanding volume opens continuation toward 195–197. That is where upside acceleration becomes more probable.

Bearish Scenario

Failure at 187–188 followed by a loss of 182 shifts control back to sellers. First target 180, then 175 if momentum expands.

Inside 182–193, expect chop and false breaks. Avoid mid-range trades without confirmation.

Overall:

Neutral inside 182–193 compression.

Bullish only above confirmed acceptance over 193.

Bearish below 182.

NVDA is coiling beneath resistance. Expansion will likely be decisive once gamma pressure is resolved.

This analysis is for educational purposes only and does not constitute financial advice. Always manage risk and trade responsibly.

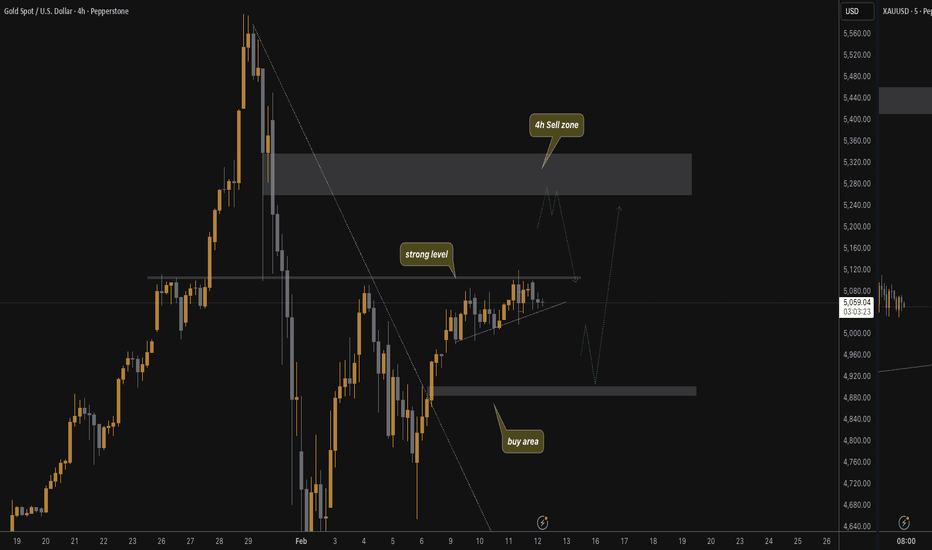

XAUUSD | Ranging price. Breakout today? whats up gold gang, no update from me yesterday as price was just ranging .. managed to scalp a few moves but no major movement

Price is trending upwards currently on the 4h bouncing from the strong level of resistance 5105

Can it break today?

Lots of liquidity to the downside also where i will be looking for buy positions at the buy area .. or if i can spot it in real time, a sell down.

Im still bullish as per price action closing above the previous high on the 4h but really needs to break the 5105 ... i expect it to do so explosively

catch you in the TG

tommy

BTC in a local downtrendBTC in a local downtrend

The breakout of channel 1 resulted in a decline close to the channel's high. The downward movement also took the price out of channel 2, but the price rebounded from the lower boundary of channel 3. The price bounced back to the lower boundary of channel 2, but there's currently a rejection here, which could lead to the price moving lower and reaching target 1.

USDJPY H4 | Bullish Reversal Off Key SupportMomentum: Bullish

Price is currently below the ichimoku cloud, however, price is forming potential bullish momentum towards the upside.

Buy entry: 153.552

- Pullback support

- 78.6% Fib retracement

- Fair value gap

Stop Loss: 152.660

- Swing low support

Take Profit: 155.628

- Overlap resistance

High Risk Investment Warning

Stratos Markets Limited (fxcm.com/uk), Stratos Europe Ltd (fxcm.com/eu):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (fxcm.com/en): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited (fxcm.com/au):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com/au

US 100 on bearish swing in my opinion fundamentally and technically US 100 struggling to take the highs again and manipulation in ranges giving an indication towards selling.

Last liq swept was good and below may important areas of liq to clear let see if more indications from the the technicals appear i ll add 1 or 2 percent more onto this...

Risking no more than 1 or 2 percent.

took partials while you are in profit.

never leave the money on the table.