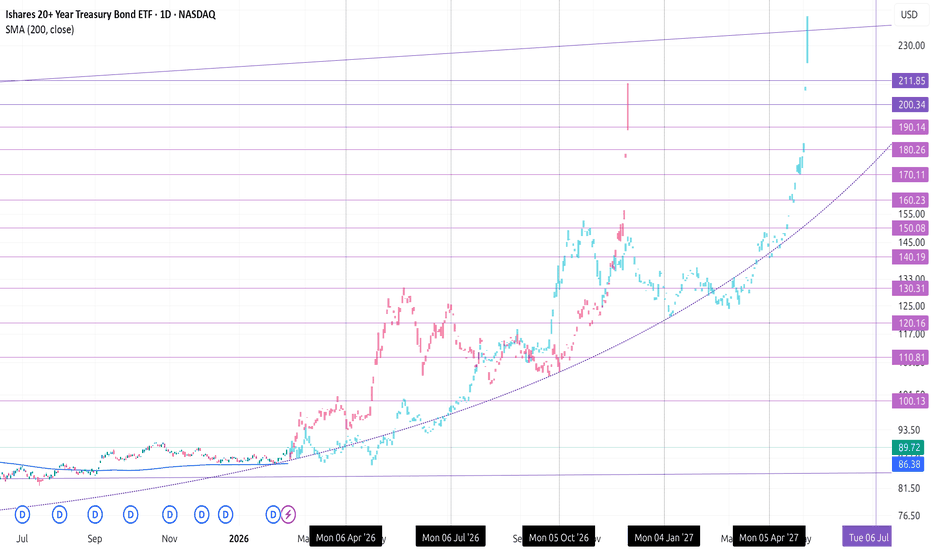

NPL buying opertunity 🚀 NPL READY FOR BIG MOVE?

🎯 100 → 110 → 118 INCOMING?

🟢 BUYING ZONE: 85 – 89

🛑 STOP LOSS: 79 (Daily Close)

🎯 TARGET 1: 100

🎯 TARGET 2: 110

🚀 LONG TARGET: 118

stop loss daily close below 79.

Manage risk accordingly.

📊 Risk–Reward Analysis (Approx)

Agar entry 88 pe lein:

Risk = 88 → 79 = 9 rupees

Reward T1 = 88 → 100 = 15 rupees → RR ≈ 1:2.5

Reward T2 = 88 → 110 = 25 rupees → RR ≈ 1:4.1

Reward LT = 88 → 118 = 33 rupees → RR ≈ 1:5.5

Trend Analysis

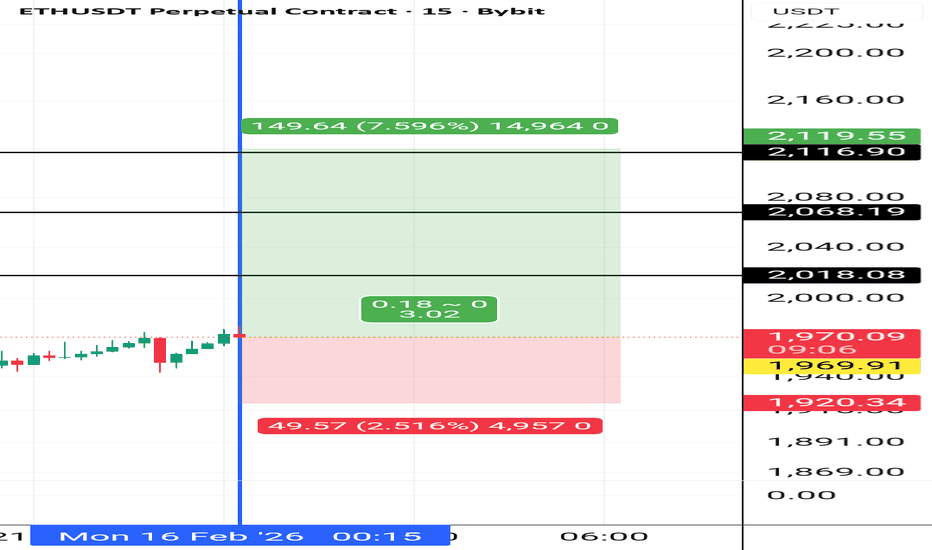

ETH PERPETUAL TRADE SELL SETUP Short from $2060ETH PERPETUAL TRADE

SELL SETUP

Short from $2060

Currently $2060

Targeting $1975 or Down

(Trading plan IF ETH

go up to $2130 will add more shorts)

Follow the notes for updates

In the event of an early exit,

this analysis will be updated.

Not a Financial advice

USOIL: Bulls Will Push

The analysis of the USOIL chart clearly shows us that the pair is finally about to go up due to the rising pressure from the buyers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Confusion Is Costing You MoneyMost traders do not lose money because they lack information. They lose because they are drowning in it. When you layer five different oscillators on a single chart, you are not increasing your accuracy. You are increasing your anxiety. A cluttered screen forces your brain to process conflicting data points, leading to a state of ""analysis paralysis.""

The High Price of Hesitation

In the fast-moving crypto markets, hesitation is the most expensive mistake you can make. When your RSI says ""sell"" but your MACD says ""buy,"" you freeze. By the time you make a decision, the opportunity is gone.

Symptoms of indicator fatigue include:

- Late Entries: You wait for too many confirmations and buy the top.

- Early Exits: A minor fluctuation in one indicator scares you out of a winning trade.

- Revenge Trading: Frustration from missed moves leads to impulsive, high-risk bets.

- Confluence Over Quantity

Professional trading is not about stacking random tools. It is about finding confluence. You need a single, unified logic that synthesizes data rather than displaying raw noise. A valid signal only exists when price action, volume, and market structure agree with each other.

Instead of looking at five separate lines, effective analysis requires a system that instantly identifies:

1.Trend Exhaustion: Knowing when the buyer is out of ammo.

2.Whale Activity: Seeing where the smart money is trapping the retail crowd.

3.Market Structure: Understanding if you are in a range or a breakout.

4. Stop Trading History Lessons

Most classic indicators were designed for the stock market of the 1980s. They are mathematical averages of past prices. In crypto, where volatility is extreme and manipulation is common, these lagging tools are obsolete. You cannot drive a car by looking only at the rearview mirror.

Modern markets require adaptive algorithms that:

- React to volatility spikes in real-time.

- Filter out ""fake-outs"" designed to trigger stop-losses.

- Provide binary ""Yes/No"" decision points.

- Preserve Your Mental Capital

Your attention is a finite resource. If you spend 90% of your energy trying to interpret a messy chart, you have zero energy left for risk management and discipline. A clean, systematic approach does the heavy lifting for you. It turns trading from a stressful guessing game into a calm execution of rules.

Clarity is the only edge that matters.

EURUSD BULLISH FX:EURUSD On the daily chart, EURUSD is in a bullish trend. Three days ago, we saw a candle with a long lower shadow, and the next two days failed to fill that shadow. This indicates buying pressure to the upside, which is also visible on the 4H chart.

In the daily trend, we can see that the price retested the level (as shown in the first circle). In the second circle, the price retested the level again with clear upside pressure.

I believe this week we may see the bullish trend continue toward the upside, with a target at 1.20391.

If the price gives me a valid buy signal, I will enter a long position on EURUSD with a target at 1.20391.

AUDCAD Will Fall! Short!

Here is our detailed technical review for AUDCAD.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 0.963.

The above observations make me that the market will inevitably achieve 0.942 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Like and subscribe and comment my ideas if you enjoy them!

Dollar Index (DXY) Stabilises After CPI ReleaseDollar Index (DXY) Stabilises After CPI Release

Late January proved exceptionally volatile in the currency markets, as reflected by the ATR indicator. However, following the rebound from the four-year low (B), price swings on the DXY chart have narrowed, suggesting a degree of market stabilisation.

Friday’s CPI release had the potential to trigger sharp moves in the US dollar index, yet no major surprises emerged. According to Forex Factory data, the actual figures were broadly in line with analysts’ forecasts (inflation eased slightly as expected), and market participants headed into the long weekend, with US financial markets closed on Monday for Presidents’ Day.

Technical Analysis of the DXY Chart

On 27 January, when analysing the Dollar Index (DXY) chart, we:

→ updated the descending channel (marked in red);

→ noted that DXY was trading near a long-term support zone from which price had rebounded twice in the second half of 2025;

→ suggested that the downward momentum could be losing strength.

However, the market had other plans. Although the rally towards peak C (the former support level) is a clear sign that bearish pressure is fading, it was preceded by a false downside breakout of the aforementioned support area.

Swing analysis also points to stabilisation, based on the proportional structure:

→ peak C formed within the 50%–61.8% retracement of the A→B impulse;

→ trough D developed within the 50%–61.8% retracement of the B→C move;

→ peak E emerged within the 50%–61.8% retracement of the C→D impulse.

The previously highlighted support zone is now acting as a range where supply and demand appear balanced.

While the descending channel remains technically valid, the confident trajectory (indicated by the arrow) from the B low suggests that bears may struggle to maintain the prevailing trend of recent months.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Gold Outlook: Holiday Low Volume, Range & Smart Money ZonesGold Market Overview for February 16, 2026

Gold traded quietly in a narrow, range-bound session amid very thin liquidity. US markets were closed for Presidents' Day (Feb 16), and China was shut for Lunar New Year (Feb 15–23 start), limiting fresh flows and catalysts.

Price Action: Spot XAU/USD closed near $5,020 (sources vary: ~$5,019–$5,044), with intraday range roughly $5,010–$5,035–$5,070. It saw mild downside pressure, down ~0.3–0.45% from Feb 13/14 levels (~$5,035–$5,043). Futures settled similarly, with minor losses (e.g., -0.14% in some reports).

Key Factors:

Profit-taking after Feb 13's strong ~2.5% rebound (post-cooler US CPI boosting rate-cut bets).

No major data or news over the weekend → subdued, choppy trading.

Broader bull trend intact (earlier 2026 highs >$5,500), supported by safe-haven flows, CB buying, and Fed easing hopes, but holiday low volume added chop and minor pullbacks.

Technical View (chart-aligned): Price consolidated near/above $5,000 psych level, failing big upside push. Fits low-volume holiday "range + manipulation" theme, with possible tests of supports (~$4,989–$5,000) or resistances (~$5,080+). Your smart money zones relevant: price well above buy area (4,888–4,917) but below sell zone (5,098–5,125).

Consolidation day with slight downside bias in thin conditions, prepping for volatility on market reopen. Watch upcoming US data (GDP, PCE) for cues. Uptrend holds overall. 🚀

XAUUSD SHORT SET UPI Identified the Key Resistance Zone

The grey shaded zone around 5,010 5,030 marks a previous area where price reacted strongly before.

Price previously struggled to break above this area.

Wait for Price to Return to the Zone 5,014-5024

Trend Confirmation

On the right side of the chart:

Price is trading below the moving average.

The moving average is sloping slightly down.

Lower highs are forming after the big drop.

This suggests short-term bearish pressure.

Entry Logic (Why Sell Here?)

The sell position is taken:

Inside the resistance zone

After rejection signs (small candles, wicks, hesitation)

With overall bearish structure

This gives:

Better risk-to-reward

Logical stop placement

Trade aligned with structure

Stop Loss Placement

Stop loss is placed:

Above the resistance zone (around 5,062 area)

Above recent swing high

Why?

If price breaks strongly above resistance, the bearish idea is invalid.

Target (Take Profit)

Target is placed near:

Previous support area around 4,880

Prior swing lows

Why?

Markets often revisit previous reaction zones.

Simple Strategy Summary

Mark strong resistance

Wait for pullback into resistance

Confirm bearish structure

Enter short inside the zone

Place stop above structure

Target previous support

Keep it simple Good Luck!!

Gold – Consolidation Potential - Volatility Remains ChallengingGold volatility may have eased in the last week when judged by the levels of movement at the start of February, however prices are still relatively wild and can catch out those traders who haven’t prepared carefully in advance. For example, Monday February 9th saw Gold open at 4990 and steadily climb up to a high of 5119 on Wednesday, then prices collapsed 3.2% on Thursday down to a low of 4879, before spiking 2.46% on Friday to close at 5042, which was an eventual weekly gain of 1%. It’s a challenging environment for sure!

The current backdrop may remain constructive for Gold, with Asian central bank demand remaining on dips, as well as market expectations for a minimum of 2 Federal Reserve interest rate cuts across 2026 reinforced by Friday’s weaker than expect US CPI release, a move which typically provides support for non-yielding precious metal.

However, it also seems traders may be reluctant to attempt buying at higher levels for the time being after being scared by the drop from all-time highs at 5598 seen on January 29th down to the lows at 4403 on February 2nd. This could mean a period of consolidation may be due, especially with Chinese markets closed all week for the Lunar New Year. Chinese investors have been extremely active across all precious metals markets to start 2026.

That said, Gold traders may want to stay on alert this week, with several potential volatility catalysts on the horizon. Geopolitical tensions between the US and Iran remain a key wildcard, particularly with Washington maintaining a significant military presence in the region and diplomatic talks between the two nations set to resume on Tuesday. At the same time, macro risks could intensify with the release of the Fed’s January policy meeting minutes (Wednesday 19:00 GMT), followed by the Fed’s preferred inflation measure, the PCE Index (Friday 13:30 GMT). Together, these developments could prove pivotal in shaping near-term direction and volatility for Gold prices across the week.

Technical Update: Steady Recovery From 4425 Support Positive?

Gold has stabilised after its 21% liquidation from the January 29th all‑time high at 5598, with the 50% Fibonacci retracement at 4425 holding to form a steady recovery. The key question now is whether this is merely a reactive bounce before the resumption of a broader move back to the downside, the early stages of renewed positive momentum capable of resuming the long‑term uptrend, or a period of price consolidation between the key support and resistance levels.

While it’s impossible to know the next directional themes with absolute certainty, mapping key support and resistance levels can help to frame the current Gold recovery. These reference points could offer a clearer read on whether price action is leading to a more sustained rebound, a temporary reaction within the broader late‑January decline, or a more extended consolidation in price.

Potential Support Focus:

Bearish Gold traders might be viewing the latest recovery as merely a reactive bounce within the broader late-January weakness. Their focus during the upcoming sessions may be on identifying resistance levels capable of capping this strength and possibly turning price action lower again.

Using the chart above, Gold bears could now be watching 5142, which is the 61.8% Fibonacci retracement of the latest decline, as a key focal point. If this level continues to cap the current advance and weakness re‑emerges, breaks below potential support at 4762, a level which is equal to half the latest recovery, could trigger further downside. While not a guarantee of renewed declines, closing breaks below 4762 may well shift focus back to critical support at 4425 that held so effectively at the start of February. A break below 4425 could exposure risks of even deeper declines.

Potential Resistance Focus:

For those looking at the potential for upside continuation, 5142, the 61.8% retracement of the latest decline, may be the first key resistance focus. Traders expecting a broader recovery could be watching for sustained closes above this level, as a break could signal scope for a more extended phase of price strength.

A close above 5142 this week could keep upside momentum in play, shifting focus toward the 5346 upper Bollinger band. A break of that level may reopen scope toward the 5598 January all‑time high, though that may still provide strong resistance.

Potential Price Consolidation Focus:

Of course, while both the support at 4762 and resistance at 5142 continue to contain price action, Gold may simply settle into a broader consolidation phase. This would align with easing volatility and a natural period of re‑balancing after the recent dramatic price swings.

The material provided here has not been prepared accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

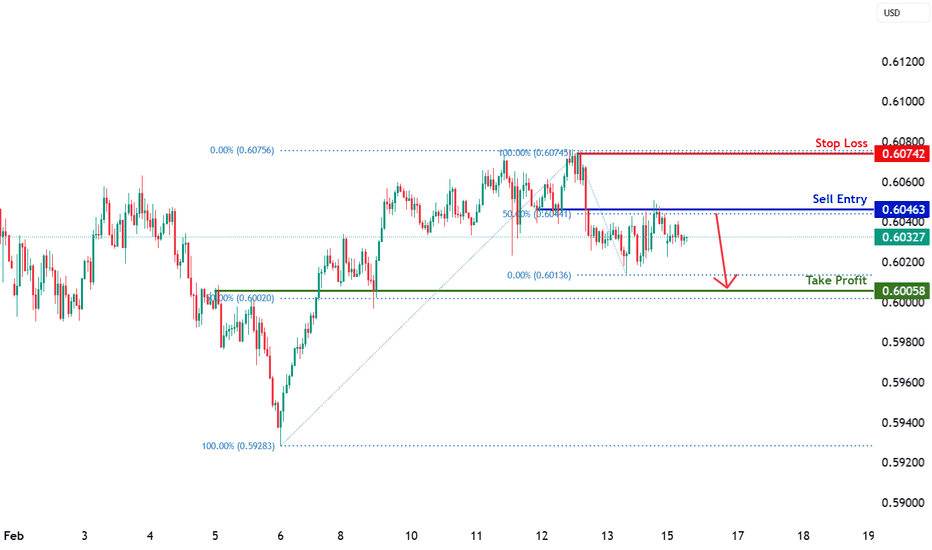

NZDUSD H1 | Potential Bearish DropBased on the H1 chart analysis, we can see that the price has rejected off our sell entry, which is a pullback resistance that aligns with the 50% Fibonacci retracement.

Our stop loss is set at 0.6074, which acts as a swing high resistance.

Our take profit is set at 0.6005, which acts as an overlap support that is slightly above the 50% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

GOOGL – Will the Downtrend Continue This Week? (Feb 16–20 )GOOGL is coming into this week still respecting a bearish structure on the 1H timeframe. We’ve seen a clear BOS to the downside, followed by a controlled pullback and compression inside a descending channel. Price is currently hovering around the 305–307 area, which is acting as a decision zone.

Market Structure

The higher timeframe intraday trend remains bearish. Lower highs are intact, and price continues to trade in the discount portion of the recent range. EMA/VWAP are still acting as dynamic resistance rather than support. There has not yet been a confirmed higher high to shift short-term bias.

As long as the descending trendline holds, rallies should be treated as potential short opportunities rather than breakout confirmations.

Key Levels to Watch

Immediate resistance sits around 306.20–307.90. This area has already produced rejections and aligns with short-term supply.

Above that, 309.00–310.50 becomes a stronger premium zone. A clean reclaim and hold above 310 would be the first sign that momentum is shifting.

On the downside, 303.70–304.50 is the first support area. If that fails, 302–300 becomes the key psychological and options-based support zone. Below 300, the next downside magnet sits near 297.50.

GEX Context

Options positioning shows strong call resistance above 312–315 and solid put support around 300. Net positioning is slightly negative, suggesting the stock may remain in a transition phase early in the week.

This setup supports a range-to-bearish bias unless buyers reclaim and hold above 310 with strength. Dealers are likely to defend the 300 level early in the week unless heavy downside momentum develops.

Bullish Scenario

For bulls to regain control, GOOGL needs to break the descending channel and hold above 310 on a retest. If that happens, 312.50 becomes the first upside magnet, followed by a potential move toward 315 if gamma shifts more positive.

Without that structure break, upside attempts may continue to fade.

Bearish Scenario

If 306–308 continues to reject and price breaks cleanly below 303.70, then 302 and 300 are likely to be tested. A loss of 300 opens the door for a flush toward 297.50.

At this stage, the primary strategy remains sell-the-rip until proven otherwise.

Weekly Bias

Slightly bearish with compression. A breakout from the current range (roughly 300–310) will likely lead to expansion. Until that break happens, expect controlled movement inside this zone.

Disclaimer

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research, manage your risk carefully, and trade responsibly.

Elliott Wave Analysis XAUUSD – February 16, 2026

Momentum

D1

Daily momentum remains bearish. With the current downside pressure, we continue to expect that wave B has already completed and the market is transitioning into wave C.

H4

H4 momentum is also declining. Therefore, today price is likely to continue trending lower or move sideways within a narrow range while maintaining selling pressure.

H1

H1 momentum is preparing to turn upward. This suggests a short-term corrective bounce may occur within the next few hours before the main trend resumes.

Wave Structure

D1

On the daily timeframe, the ABC corrective structure is becoming clearer. As long as daily momentum continues to decline, I expect a strong bearish move within the next 1–2 days to confirm that wave B has formed and wave C is underway.

H4

H4 momentum remains bearish, reinforcing the scenario that wave B has completed.

A further confirmation of black wave B formation will be a break below the red wave B low at 4778.

H1

As discussed yesterday, the rebound toward 5062 invalidated the scenario of a completed 5-wave bullish structure.

Instead, the current movement is more likely:

– An ABC corrective structure

– A 1–2 structure within the larger black wave C downtrend

Possible Scenarios

Scenario 1: Triangle ABCDE for black wave B

If wave B forms a triangle, price may rebound toward the upper boundary of the triangle.

In this case:

– The H4 decline will not be aggressive

– Price will likely move sideways

– The 4955 area will act as strong support

Scenario 2: ABC within a complex correction of black wave C

In this scenario, price may continue declining toward:

– 4827

– 4658

– Potentially deeper toward 4406

Scenario 3: 1–2 structure of black wave C

If this is a 1–2 setup, we could see a sharp and extended decline below 4406 to fully develop wave C.

Key Observation

Focus on H4 momentum:

– If H4 becomes oversold but price does not drop significantly and instead moves sideways → Scenario 1 or 2 becomes more likely

– If price breaks down aggressively through key support levels → Scenario 3 becomes more probable

Trading Plan

Price has closed below the liquidity zone at 5007. I expect this area to act as strong resistance.

If price retests this zone, we will look for a Sell opportunity aligned with the H4 bearish momentum.

– Sell zone: 5006 – 5008

– SL: 5036

– TP1: 4955

– TP2: 4927

– TP3: 4778

Priority remains trading in alignment with the H4 trend, applying strict risk management and closely monitoring price reaction at target levels.

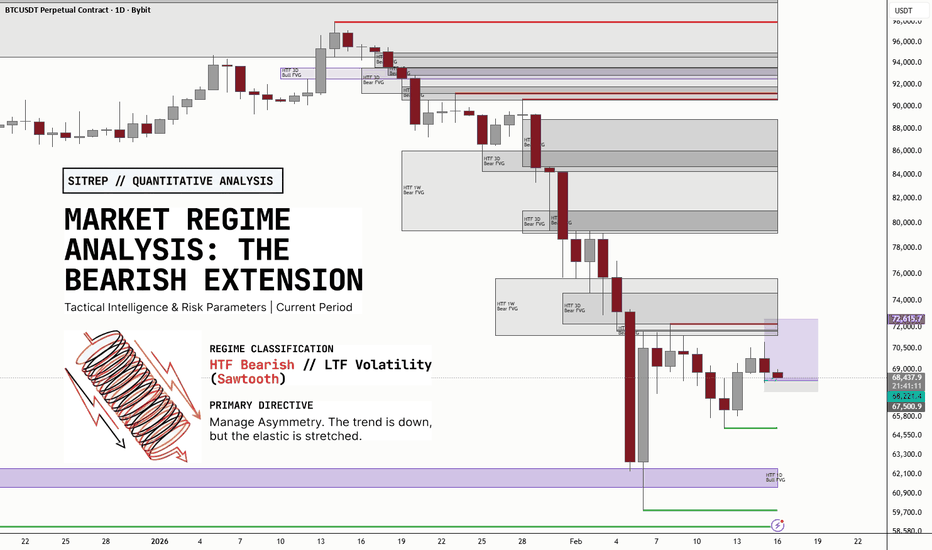

CRYPTO MARKET ANALYSIS: Tactic & Risk & ScenarioThe Sawtooth Regime

HTF structure is bearish. 1H broken. 4H neutral. Shorts look obvious — and that's the problem.

1W deviation at 2.48x. The trade is crowded. Everyone's a genius bear right now.

This is the Sawtooth: sharp risk-on impulses → immediate rejection. Rinse, repeat. The market wants to trap both sides.

The play? Stay light. Gross 25-35%, net slightly short. Prioritize mean reversion longs over chasing the trend into stretched levels.

MARKET BREADTH ANALYSIS

1H: sub-15% above. Structure is broken — this is flush territory. Almost nothing is holding its short-term levels.

4H: ~50%. The market is stuck in no-man's land. Chop zone. Neither side has conviction.

1D/1W: <26% / <20%. The macro skeleton is bearish.

Most crypto is underwater on trend timeframes. Risk-off is the regime, not the exception.

Notice the pattern on the chart — every breadth spike since late December gets sold immediately. That's the Sawtooth in action.

Until 1D breadth reclaims, bounces are rentals, not purchases.

DEVIATION & OVERHEAT

Deviation & Overheat — The Rubber Band Is Stretched

This is the slide that should make bears uncomfortable.

1W deviation at 2.48x. 3D at 1.86x. Over half the market is already extended to the downside. The rubber band doesn't stretch forever.

Series overheat confirms it: 66.7% of assets are overheated short on 1H. 59.4% on 1D. That's not a setup — that's a crowded exit.

The math is simple. When everyone is already short and deviation is this extreme, the asymmetry flips. The next violent move isn't another leg down — it's the squeeze that liquidates the latecomers.

Trend is your friend. Until the rubber band snaps back in your face.

Market Physics — Where the Bounce Dies

Price action signals are dead neutral. 71 bull vs 72 bear. Net balance: -1. The market is telling you nothing — and that IS the signal.

But structure isn't neutral. 32 HTF bearish FVGs formed. That's a ceiling made of concrete.

Here's the playbook: mean reversion bounces get pulled toward these gaps like gravity. FVGs are the magnet. Then they become the wall.

Bounce into the gap → rejection → continuation lower. That's the Sawtooth mechanic visualized.

If you're playing longs here, the FVG overhead is your exit — not your target. Take the R/R the market gives you, don't fight the structure for more.

Secondary Vitals — What's Happening Under the Hood

Three signals. Two say bounce. One says "not so fast."

RSI: 5.8% of assets firing signals, skew oversold.

Textbook bounce setup. The market is technically coiled for relief.

Spreads: 24.6% signal activity, long dominance at 29 vs 7. The spread structure is already hunting liquidity to the upside. Smart money is positioning before the crowd.

But liquidation skew is still short at 7.2%. Impulse flushes remain on the table. The market can still wick you out before the bounce prints.

Translation: the bounce is loading, but the path there might hurt first. Size accordingly — or get liquidated accordingly.

System Dynamics — Why Just Short the Trend Doesn't Work Right Now

Left side: what bears think they're trading. A clean, smooth distribution lower. Set it and forget it.

Right side: what's actually happening. Oversold → violent risk-on impulse → failure at resistance → rotation back down. Repeat until both sides are wrecked.

This is not a trend. It's a meat grinder.

Large outliers at the tail of the data series confirm it — the market is producing outsized moves in both directions. One-way positioning gets punished every time.

The edge isn't in direction. It's in timing the rotation. Buy the oversold flush, sell the resistance rejection, keep size tight.

If your PnL looks like a staircase in this regime, you're doing it wrong. It should look like a series of scalps — in and out before the saw catches you.

Probability Forecast — Three Paths, One Base Case

No predictions. Just probabilities.

Base case (55-65%): Relief bounce → rejection at FVG → Sawtooth continues. The 1W deviation at 2.48x forces a technical snapback. Then the bears reload at resistance. Chop continues. This is the highest-probability path and exactly why sizing matters more than direction.

Negative case (20-30%): 4H breadth breaks below 40% while deviation stays elevated. That's the liquidation cascade trigger. No bounce — just a flush that takes everyone's stops and keeps going.

Positive case (10-20%): 4H breadth reclaims 60%+ and deviation cools through time, not price. The sustainable bottom. Lowest probability for now — but watch the breadth numbers.

If base case → trade the rotation. If negative → cash is a position. If positive → flip the playbook.

Know which path you're on before the market tells you the hard way.

Risk Management — Capital Preservation Mode

Gross: 25-35%. No exceptions. This isn't the regime to be a hero.

Net: -5% to -15%. Slight short bias, fully hedged. You're renting exposure, not owning it.

Long/Short ratio 1:1.4 — for every $1 long, $1.40 short. The hedge is the trade.

1D/1W breadth says bear market. Respect it. Survive first, profit second.

Tactical Execution — The Anti-Pattern

Shorts: Do NOT initiate here. 1W deviation 2.48x = garbage R/R. Fix profits, trail stops, keep your hedge.

Longs: Mean reversion only. Cherry-pick high Long Score names. Exit at the FVG — no exceptions.

Golden rule: if 1H breadth is above-65%, you're holding for minutes, not days. This is a scalper's regime, not a swing trader's.

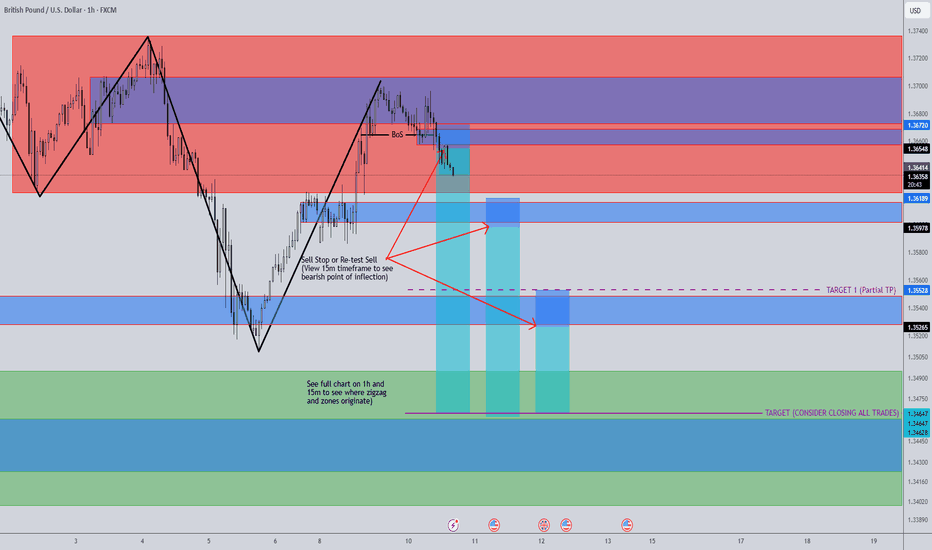

GBP/USD ForecastCopy entire chart and zoom out to see price action points. Zig zag and points of inflection.

Price is in a bearish flow on the higher timeframe (refer to zig-zag). Price came up to bearish point of inflection within the supply zone shown, then had an internal BoS to confirm the reversal. The blue/red zones shown are bearish points of inflection that i grabbed from prior price action.

I plan to take sell stops once price exceeds these zones. If you would like to take a zoomed entry, wait for price to break points of inflection and then observe re-test on lower timeframe and make entry based on lower timeframe price action/reversal signals. Partial TP and full TP are shown by purple lines.

I will post updates for anyone looking to move with me on this forecast (entries and/or cancelation). If you find this forecast helpful please hit the boost button! If this forecast helps you take a profit, please leave some feedback in the comments section!

MNQ Market Open strategy (Patient is Key)MNQ Analysis: 1-Hour Time Frame

Following the market open, we will monitor price action on the 1-hour timeframe to gauge the impact of recent weekend news. Our primary thesis anticipates a secondary retest of the Fibonacci 61.80% to 78.60% retracement levels. A successful hold here suggests a move toward the AOI (Area of Interest) at 25,183.75, with the potential for a breakout.

This bullish scenario is contingent upon a 75% or greater positive market sentiment following the news release.

Alternative Scenario

If the market fails to sustain these levels, we will remain sidelined until price clears the 100% Fibonacci extension (24,240.50). A break and subsequent retest of this lower low would shift our bias toward short positions targeting previous lows.

Strategy: Exercise patience and avoid chasing the move. Allow the market to confirm its direction before executing

MNQ Morning Briefing: Key Levels & Sentiment Analysis

Market Outlook: We are monitoring the 1H Timeframe to assess the impact of weekend news. Volatility is expected; patience is the priority.

Bullish Scenario (75%+ Positive News Impact)

* Key Action: Watch for a secondary retest of the Fibonacci 61.80% – 78.60% zone.

* Target: A move toward the AOI (25,183.75) for a potential breakout.

Bearish Scenario (Negative News Impact)

* Key Action: Wait for a confirmed break below the 100% Fibonacci level (24,240.50).

* Strategy: Look for a retest of this breakdown point before considering short positions toward previous lows.

> Trading Note: Do not chase the open. Let price action validate the direction before committing capital. Stay disciplined.

Can BTC hit $100k or will Sellers break $60 support? While the current Market is holding to the $66k, can the BTC Bulls get reinforcement to kick the $100k to $104 resistance area before further downside?

The current support area is one to watch out for, the bulls have strong chances of gathering Longs here as there is most likely going to be a sideways for a while followed by a bounce. This bounce will likely attack the $84k resistance and if the bulls persist we hit the $94k but this is expected to be an area of more resistance as they climb up, the resistance will persist and it's likely if they break the $98k resistance it gets tougher as they hit the 100k area.

What if they failed at holding the $66k to $68k current support then expect the dump to continue to the $58k to $54k support area.

I am still waiting to buy $44k BTC if they gods permit.

EURJPY 2DThe price has recently lost its bullish structure, breaking both the trendline and the 50-day moving average on the Daily timeframe, signaling a weakening of bullish momentum.

The current likely scenario is a corrective move to the upside, forming a pullback toward the breakout zone and the Fibonacci area, which may now act as new resistance. If price shows a bearish reaction in this zone and confirms the setup, short positions can be considered in line with the new prevailing market direction.