Trend Analysis

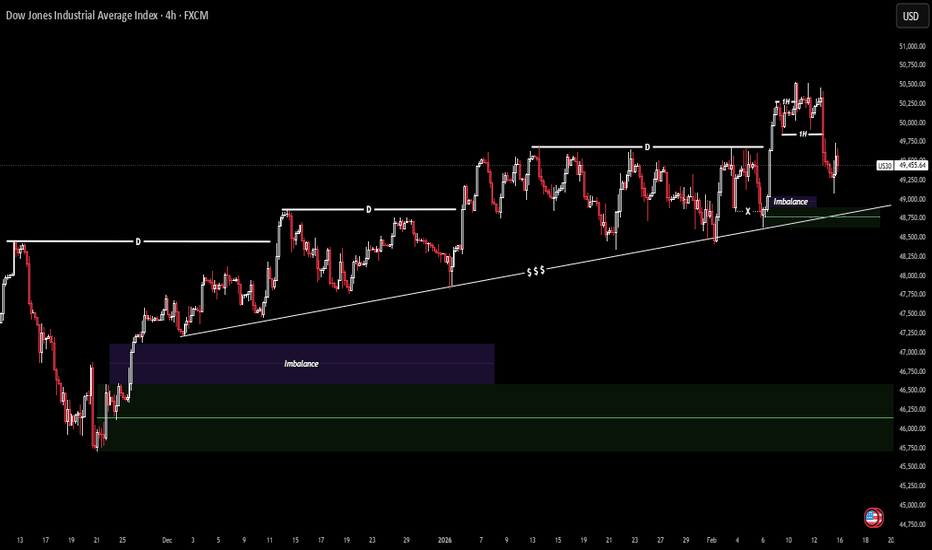

US30: Personal OutlookOn the daily timeframe, price is trading within an upward channel, maintaining an overall bullish structure. However, price has left behind a clearly defined demand zone and an imbalance (FVG), which may act as potential targets if momentum shifts.

On the 4H timeframe, the liquidity generated during the uptrend becomes more evident. Price is also approaching a key 4H demand zone.

If this 4H demand holds, we could see a continuation of the bullish move and further upside expansion.

If the demand fails, price may begin a deeper pullback, likely targeting the daily imbalance and demand zone below.

This analysis reflects my personal view of the market and is not financial advice.

#ADA/USDT Spot LONG#ADA

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 0.2490, and the price has bounced from this level several times. Another bounce is expected.

The RSI is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 0.2645

Target 1: 0.2700

Target 2: 0.2758

Target 3: 0.2825

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

#ARB/USDT | Testing Wedge Breakout Amid Key Support#ARB

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 0.1066, and the price has bounced from this level several times and is expected to bounce again.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 0.1099

First Target: 0.1139

Second Target: 0.1188

Third Target: 0.1238

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

#DASH/USDT – Bullish Breakout Setup | 1H Chart Analys#DASH

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 34.50, and the price has bounced from this level several times. Another bounce is expected.

The RSI is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 35.38

First Target: 36.44

Second Target: 37.73

Third Target: 39.40

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

DeGRAM | XRPUSD will move to $1.5📊 Technical Analysis

● 6H symmetrical triangle breakout confirmed. Price consolidated between descending resistance and support. Current compression near apex signals imminent volatility expansion.

● Higher lows structure.

💡 Fundamental Analysis

● SEC lawsuit dismissed Feb 1, 2026. Legal overhang removed, paving way for institutional adoption .

● Spot XRP ETFs saw $1.3B+ inflows (43 consecutive days). Institutions accumulating during consolidation .

✨ Summary

Long entry $1.30. Objective: $1.60 (triangle target).

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

Gold, Wave 3 expansion ahead! We are positioning for a potential wave 3 expansion in Gold.

From a structural Elliott Wave perspective, wave 2 appears complete and the market is transitioning into the early phase of wave 3. As always, we do not assume continuation, we wait for confirmation.

The confirmation level and entry are aligned.

Entry: 5118.69

Stop loss: 4881.61

A break above the entry level would confirm bullish continuation and support the wave 3 expansion scenario. The stop is placed at the structural invalidation level, maintaining clear risk parameters.

Make sure to not enter too many trades and stick to good risk management!

Risk management always remains the priority. Structure defines the idea, confirmation defines the execution.

Reading Price Control Using the Reference CandleCRT – Candle Range Theory

Advanced Professional Guide with Key Levels

Candle Range Theory (CRT) is an advanced price-action framework that analyzes market behavior through price control within a defined candle range, rather than relying on classical candlestick patterns.

Before any meaningful move, the market builds a Decision Range.

CRT is the skill of reading and trading that range.

1️⃣ Reference Candle | What Is It?

A Reference Candle is a candle that:

Has a clear and meaningful range (High–Low)

Forms before or after a liquidity event

Appears at a significant Key Level

Is often accompanied by volume expansion or momentum shift

📌 This candle defines the decision framework for near-future price behavior.

2️⃣ Candle Range Structure | Internal CRT Levels

Each Reference Candle contains three critical levels:

Level Function

High Seller control ceiling

Low Buyer control floor

Midpoint (50%) Balance of power

🎯 The Midpoint (50%) is the most important CRT level

Price acceptance above or below it defines market bias.

3️⃣ Bias Determination | Market Direction

Price above 50% → Bullish Control

Price below 50% → Bearish Control

Price inside the range → Indecision / Liquidity Hunt

❌ Trading inside the range without a break and confirmation is a structural mistake.

4️⃣ Key Levels | The Backbone of CRT

CRT without Key Levels is incomplete.

Major Key Levels include:

Previous High / Low

Liquidity Highs & Lows

Daily / Weekly Open

Session High / Low (London / New York)

Higher-Timeframe Support & Resistance

📌 The highest-quality CRT setups form when the Reference Candle is created directly at a Key Level.

5️⃣ Liquidity & Manipulation | The Hidden Dimension

In many cases:

Initial breaks of the Reference Candle’s High or Low

are liquidity grabs (stop hunts), not real breakouts.

CRT helps you:

Identify false breakouts

Enter after manipulation, not before it

6️⃣ Professional Long Setup (Buy Model)

Conditions:

Price reaches HTF Support or a Liquidity Low

Liquidity sweep occurs

A Reference Candle forms

Price holds above the Midpoint

Break & Close above the candle High

Execution:

Entry: High retest or LTF confirmation

Stop Loss: Below the candle Low

Targets:

TP1: Internal range high

TP2: External liquidity

🎯 Risk–Reward: Minimum 1:3, optimal 1:5

7️⃣ Professional Short Setup (Sell Model)

Exact inverse logic:

HTF Resistance or Liquidity High

Reference Candle formation

Price acceptance below Midpoint

Break & Close below the candle Low

Entry with confirmation

8️⃣ Multi-Timeframe Alignment

A professional CRT trader uses:

Higher Timeframe (H1–H4):

Market bias

Key Levels

Reference Candle

Lower Timeframe (M1–M15):

Entry execution

Risk refinement

Precision confirmation

9️⃣ Risk Management (Institutional Style)

Stop Loss always outside the range

Risk per trade: 0.5%–1%

Partial profits allowed, core position maintained

No trade if:

The range is too small

Market is ranging with no liquidity presence

🔟 Common Advanced Mistakes

❌ Choosing a Reference Candle without context

❌ Ignoring liquidity behavior

❌ Trading mid-range

❌ Entering without break & close

❌ Trading against HTF bias

🎯 Professional Summary

CRT is the art of reading price control, not chasing candles.

When combined with Liquidity, Key Levels, and Multi-Timeframe alignment,

it becomes a repeatable, low-risk, institutional-grade trading framework.

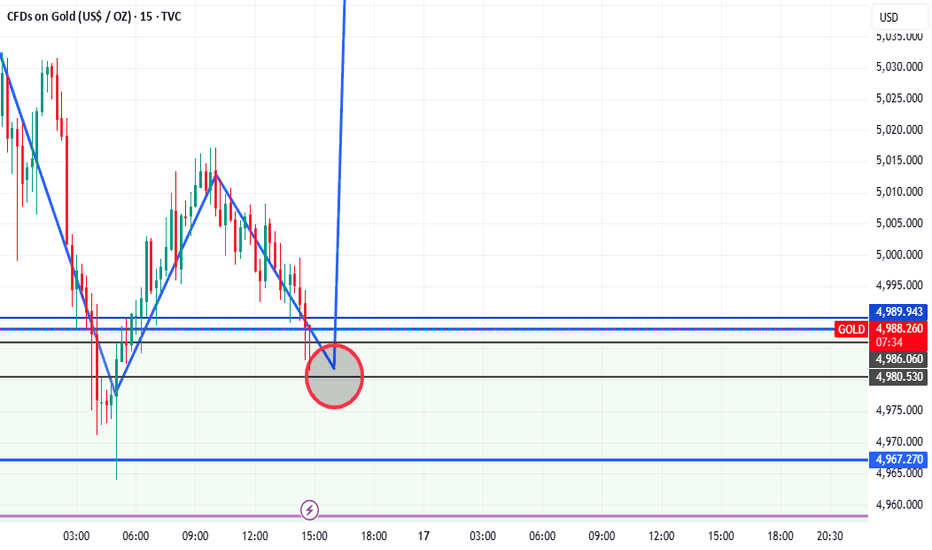

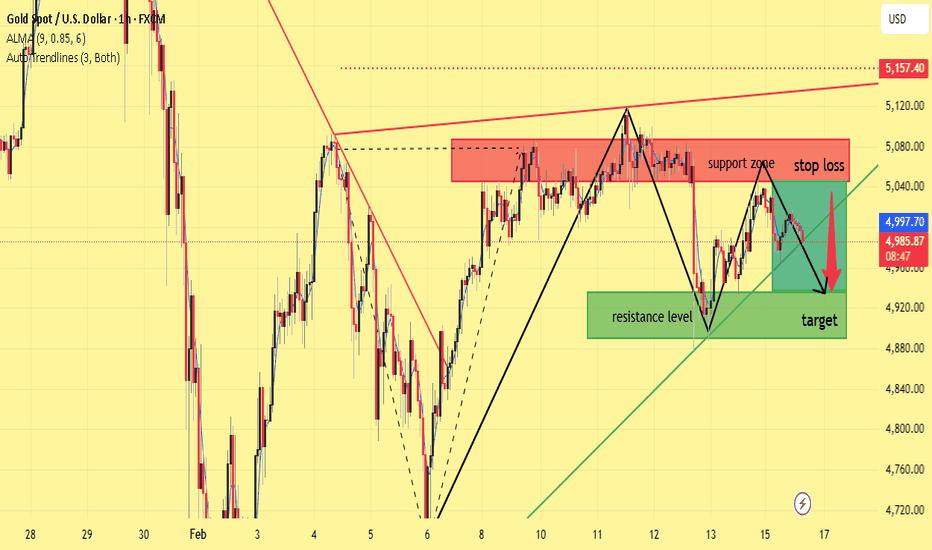

XAUUSD 1H – Bearish Rejection from Supply Zone, Downside TargetOn the 1-hour timeframe, Gold (XAUUSD) shows a clear rejection from a well-defined supply/resistance zone around 5,070–5,120. Price previously formed a corrective structure after a strong recovery from the 4,720 lows, but bullish momentum weakened as price approached the upper resistance band.

Technical Structure

Supply / Resistance Zone:

The red highlighted area marks a strong distribution zone where sellers previously entered aggressively. Multiple rejections confirm institutional selling interest.

Trendline Confluence:

Price respected the ascending green trendline from the recent swing low near 4,880. However, the recent breakdown below short-term structure suggests weakening bullish control.

Lower High Formation:

The latest push upward failed to break the previous swing high, creating a lower high within the resistance zone — a classic bearish continuation signal.

Support to Resistance Flip:

The marked resistance level (around 4,880–4,920) previously acted as support. After the breakdown, it now serves as a downside magnet (target area).

Trade Idea

Entry Zone: Rejection within 5,040–5,080 supply region

Stop Loss: Above 5,120 (above supply and structure high)

Target: 4,900–4,880 support zone

Bias

Short-term bearish while price remains below the 5,120 resistance. A confirmed breakdown below 4,980 strengthens the probability of continuation toward the green target zone.

Invalidation

A strong 1H close above 5,120 would invalidate the bearish setup and open the path toward 5,150+.

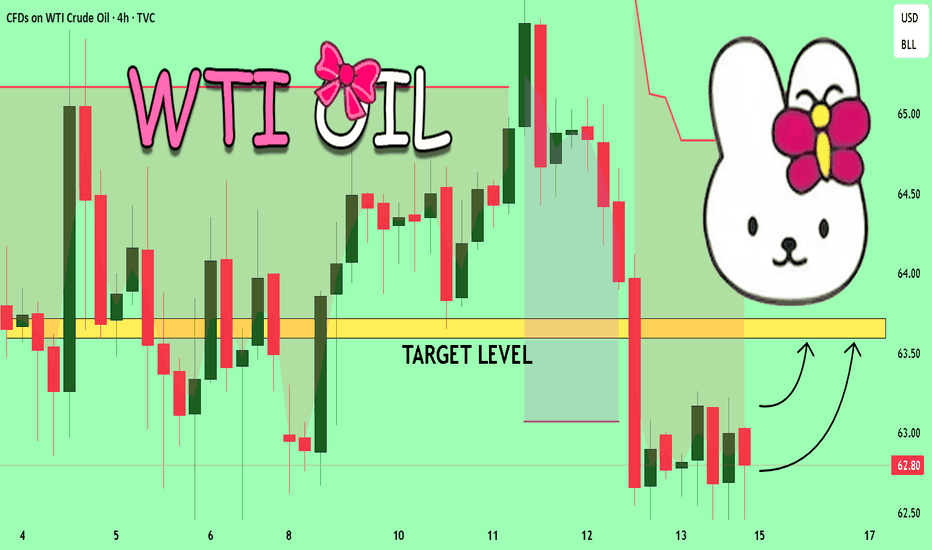

USOIL Trading Opportunity! BUY!

My dear followers,

I analysed this chart on USOIL and concluded the following:

The market is trading on 62.80 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 63.60

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

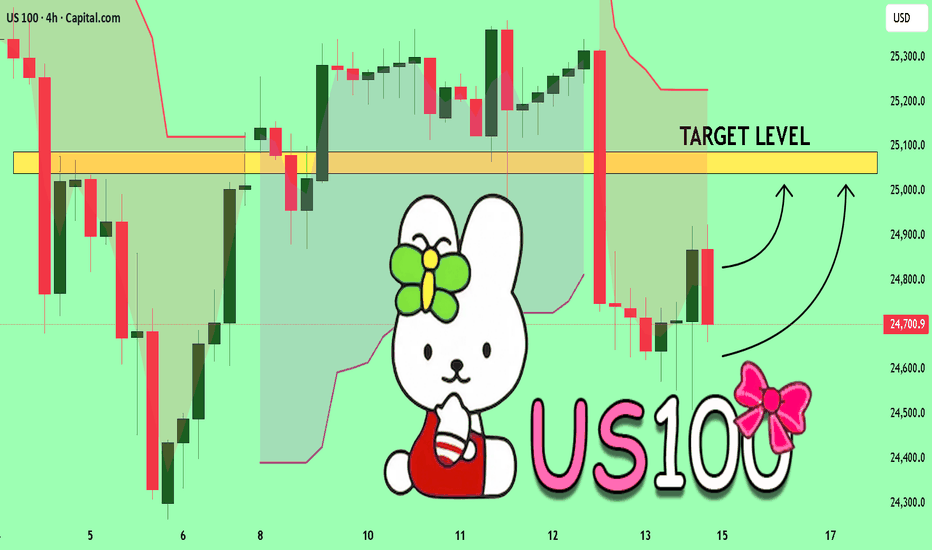

US100 Expected Growth! BUY!

My dear subscribers,

My technical analysis for US100 is below:

The price is coiling around a solid key level - 24700

Bias - Bullish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 25038

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBPCAD | Long Idealooking for GBPCAD to make a retest here of the Asia Low.

Looking for a test and a close above the Asia Low before entering.

Weekly chart show really long wicks and a lot of them. Will go breakeven as fast as possible here to limit risk.

That's it, short and easy.

Let me know what you think!

This is not investment advice!

CRM ORDERS FEB 2026PLTR (1D) Institutional Read

Price is trading below the key distribution band at 150–162 (repeated rejection/offer absorption overhead). As long as price remains below that shelf, rallies are likely to be sold into. 120 is the near-term line in the sand; if it holds, that’s where bids are showing up and you can expect mean-reversion attempts back into the supply band.

Institutional flow zones

Distribution / supply: 150–162 (overhead inventory; expect sellers to defend and trap late longs).

Demand / absorption: 100–110 (area where downside liquidity tends to get absorbed; buyers likely reload there if 120 fails).

Targets

Target up: 160 first, then 180 (clear next upside magnet if 162 is reclaimed/held).

Target down: 120 first; below that 100 (extended flush risk toward ~75 if 100 breaks).

AUDUSD Will Move Lower! Short!

Take a look at our analysis for AUDUSD.

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 0.707.

Taking into consideration the structure & trend analysis, I believe that the market will reach 0.703 level soon.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

Support-Based Long Toward Major Resistance Overview

This is a 1-hour chart of Gold (XAU/USD) showing price consolidating above a well-defined support zone after rejecting a major resistance area.

🔵 Key Levels Identified

Support Zone:

4,965 – 4,980

Previously acted as resistance

Now flipped into support

Multiple reactions confirm buyer interest

Resistance Zone:

5,080 – 5,100

Strong supply area

Prior highs rejected from this zone

Clear liquidity resting above highs

Current Price: ~4,993

🧠 Market Structure Insight

Strong impulsive move down → sharp recovery

Price now forming higher lows near support

Compression below resistance suggests potential breakout attempt

Liquidity likely resting above 5,090–5,100

This looks like a classic support retest in an overall bullish structure.

📈 Trade Idea (Based on Chart Markup)

Entry: Near 4,970–4,980 (support zone)

Target: 5,090–5,100 (resistance sweep)

Invalidation: Clean break below 4,960

Risk-to-reward looks favorable if entry is taken near support.

⚠️ What to Watch

Strong bullish reaction candle from support

Volume expansion on breakout

Rejection wicks near 5,100

If price breaks below 4,960 with momentum, bullish bias weakens.

🎯 Conclusion

Bias: Short-term bullish toward 5,100 resistance

Structure supports a bounce play as long as support holds.

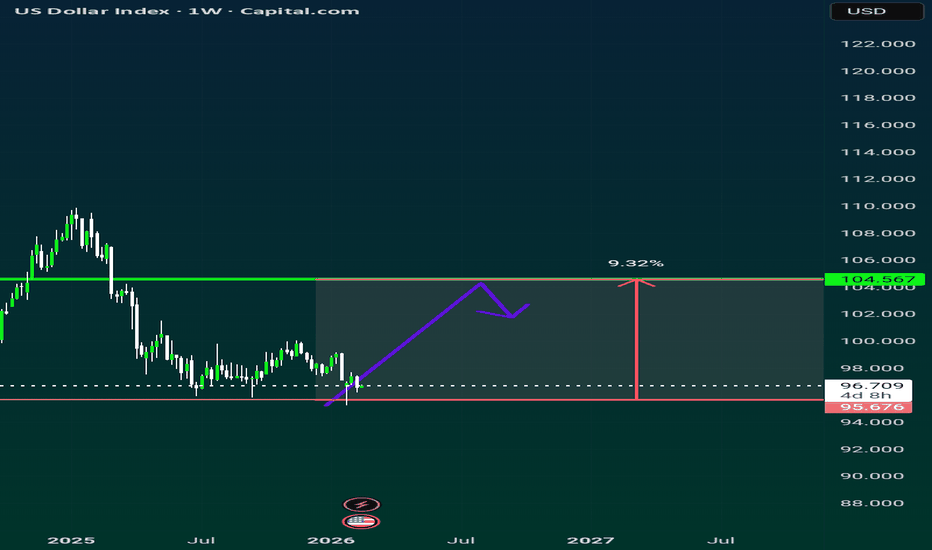

MY DXY LONG FORECAST Q1 FY26Don't mind the title been a while since I was posting like a mad man coming up with silly titles like this

Anyway the fund managers "Are super short and bearish" quote on quote 😮💨😑 we've seen this before if they advertise their bearishness we fully loaded bullishness

Price has rejected this point multiple times on the weekly and is failing to close lower than the past rejections but did wick lower recently the doji 2 candles before this was the buy signal this big bearish candle mere pullback which is why it didnt close lower creating new lows on close wick aside

Couple that with the reversal showing on almost every dxy vs pair im long brothers

LIKE COMMENT FOLLOW

EURGBP: Bullish Forecast & Outlook

The recent price action on the EURGBP pair was keeping me on the fence, however, my bias is slowly but surely changing into the bullish one and I think we will see the price go up.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GOLD Is Bearish! Sell!

Please, check our technical outlook for GOLD.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 4,993.27.

Considering the today's price action, probabilities will be high to see a movement to 4,995.52.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Like and subscribe and comment my ideas if you enjoy them!