SOFI at a Critical Breakout Zone | Bull Flag in PlaySOFI has completed a strong impulsive rally (from ~9 to above 30) and is now consolidating in a bullish continuation pattern.

The current structure is a clear bull flag / falling wedge, formed after a strong impulse.

Key bullish signs:

• Price is holding above the moving average

• Consolidation is mostly time-based, not price-destructive

Key Price Levels

• Dynamic Support:

26.0 – 26.5 (lower wedge boundary + MA)

• Major Support:

24.5 – 25.0

• Immediate Resistance:

29.5 – 30.0

• Post-Breakout Resistance:

33.5 → 36.0

Bullish Scenario (Primary)

If price:

• Breaks above the upper wedge boundary

• Holds above $30 with daily closes

➡️ Bullish continuation is confirmed.

Upside Targets:

33.5 → 36.0 → 38.0

Invalidation / Stop:

Daily close below 26.0

Bearish / Deeper Pullback Scenario

If price:

• Fails to break the pattern

• Loses the 26.0 support

➡️ A deeper correction toward demand zones becomes likely.

Downside Targets:

25.0 → 23.5

Bearish Invalidation:

Clean breakout and acceptance above 30.0

Final Takeaway

SOFI is consolidating after strength — not weakness.

As long as price holds above $26, bullish continuation remains the higher-probability scenario.

Triangle

JBL - 5 months INVERTED TRIANGLE══════════════════════════════

Since 2014, my markets approach is to spot

trading opportunities based solely on the

development of

CLASSICAL CHART PATTERNS

🤝Let’s learn and grow together 🤝

══════════════════════════════

Hello Traders ✌

After a careful consideration I came to the conclusion that:

- it is crucial to be quick in alerting you with all the opportunities I spot and often I don't post a good pattern because I don't have the opportunity to write down a proper didactical comment;

- since my parameters to identify a Classical Pattern and its scenario are very well defined, many of my comments were and would be redundant;

- the information that I think is important is very simple and can easily be understood just by looking at charts;

For these reasons and hoping to give you a better help, I decided to write comments only when something very specific or interesting shows up, otherwise all the information is shown on the chart.

Thank you all for your support

🔎🔎🔎 ALWAYS REMEMBER

"A pattern IS NOT a Pattern until the breakout is completed. Before that moment it is just a bunch of colorful candlesticks on a chart of your watchlist"

═════════════════════════════

⚠ DISCLAIMER ⚠

The content is The Art Of Charting's personal opinion and it is posted purely for educational purpose and therefore it must not be taken as a direct or indirect investing recommendations or advices. Any action taken upon these information is at your own risk.

GOLD (XAU/USD): Bullish Trend ContinuesGOLD appears poised for continued upward movement, potentially reaching new highs.

A bullish breakout from the neckline of an ascending triangle pattern on a 4-hour timeframe suggests a strong trend-following bullish signal.

It is highly probable that the price will soon reach the 67.00 level.

GOLD - The battle for 4400. Will the growth continue?FX:XAUUSD starts the week of 2026 with a rise of more than 1.5%, staying above $4,400 amid escalating geopolitical tensions in Latin America

Geopolitical crisis: US-Venezuela, Donald Trump threatened new military intervention if the interim government does not comply with Washington's demands.

Expanding risks: Trump hinted at Colombia and Mexico. The situation between Russia and Ukraine remains tense. Against this backdrop, investors are actively shifting funds into defensive instruments, including gold and the US dollar

Important US labor market data is expected this week, which could add to volatility. Venezuela has set up a commission to free Maduro, indicating a further escalation of the conflict.

Gold remains a priority for investors amid unprecedented geopolitical uncertainty. Short-term corrections are possible, but the overall uptrend is likely to continue, especially if the conflict in Latin America escalates

Resistance levels: 4440, 4470, 4519

Support levels: 4400, 4373

If the bulls keep gold above 4410-4400, then in the short and medium term, gold will be able to continue to grow despite the fact that the daily ATR has already been exhausted. Local and global trends are bullish...

Best regards, R. Linda!

EURJPY - Correction (hunting for liquidity) before growthFX:EURJPY is entering a correction amid an uptrend that has been ongoing since March last year. Zone of interest: 183.0

Amid the growth of the dollar, the euro is entering a correction, but the main trend of the index is bearish.

The key area of interest and liquidity for the currency pair is 183.43 - 183.15. A false breakout/long squeeze and holding the price above this level could trigger further growth. Locally, we have a correction against the backdrop of a global bullish trend

Resistance levels: 184.26, 184.82

Support levels: 183.43, 183.15

A pullback on a bullish trend is an additional opportunity to enter the market at a favorable price. Focus on support at 183.43 - 183.15 (additionally 183.0)

Best regards, R. Linda!

ETHEREUM - Consolidation near 3150 ahead of rallyBINANCE:ETHUSDT.P is rising after breaking through trend resistance and consolidating. The main trend remains bearish, but there are local indications of bullish support. The 3150 trigger is ahead.

Bitcoin is strengthening amid geopolitical nuances, acting as a hedging factor (locally). A rise in the leading cryptocurrency could support Ethereum, which, in turn, could trigger a breakout of 3150 and a subsequent rally.

Ethereum is consolidating near 3150, forming resistance (a trigger). Technically, consolidation continues, and the coin may test local lows at 3120-3100 before retesting 3150 and continuing the rally.

Resistance levels: 3150, 3200, 3270

Support levels: 3120, 3100, 3077

If the pullback is not deep and the price quickly returns to retest 3150, then we can continue to monitor the coin, waiting for a signal to long...

If the bulls hold the price above resistance after breaking through 3150, this move could trigger continued growth toward 3200-3270.

Sincerely, R. Linda!

Wock Pharma - Price is sitting right below long-term resistance🚨 NSE:WOCKPHARMA is testing a 12-year breakout zone 🚨

Price is sitting right below long-term resistance after a powerful multi-year base. This is exactly how big trends start.

🔹 Technicals:

• 12-year descending trendline being tested

• Higher lows on the monthly chart = structural uptrend

• Break + hold above resistance can open a fresh long-term leg

🔹 Fundamentals tailwind:

• Strong presence in complex generics & injectables

• Growing focus on US/EU regulated markets

• Improving operating leverage as scale kicks in

• Balance sheet steadily strengthening post restructuring

Setup: If it breaks and sustains above this zone, it could mark a multi-year re-rating phase.

I’m super bullish for the long term based on the technical + fundamental alignment.

⚠️ Disclosure: I’m invested.

#Wockhardt #PharmaStocks #IndianStocks #Breakout #TechnicalAnalysis #LongTermInvesting #StockMarketIndia #Investing #ChartBreakout

ETHUSDT – Compression Inside a Triangle, Patience RequiredOn the 4H timeframe, ETHUSDT is forming a clear triangle structure, indicating compression and reduced directional clarity. In these conditions, price reaction at key zones becomes more important than anticipation.

On the 1H timeframe, price has reached the first supply area, where selling orders are present and buyer–seller interaction has already started. From here, a retest of the 3,250 level remains a reasonable expectation before the next decision unfolds.

At this stage, two short-term scenarios are worth monitoring:

If buyers maintain control and price manages to engulf the 4H supply zone at 3,278 – 3,210 with a confirmed close above 3,280, continuation becomes more likely. In that case, after a brief pause or retracement, price could push toward the major supply zone around 3,350.

Alternatively, if the ascending trendline on the 1H timeframe guides price one more time and then breaks, the market may shift into a corrective phase. Under this scenario, a pullback toward the 3,090 – 3,060 area becomes a realistic short-term expectation, as this level aligns with a 1H FL.

For now, ETH remains inside the triangle, and the market has not made its decision yet.

This is a structure that favors confirmation over prediction — updates will follow as price reveals its next move.

`Pouryabdi

UK 100 Index – Is The Break Above 10000 Important?The UK 100 cracked 10000 for the first time ever on Friday as it participated in a wider surge in global indices on the first full trading day of 2026. The UK’s blue-chip index initially rose over 1% from opening levels at 9938 to register a new record high of 10054 before drifting back to eventually close +0.5% at 10000, right on the psychological break out level.

Looking forward, this potentially awkward close, may leave traders with the initial uncertainty of deciding whether the upside momentum continues to even higher levels in the week ahead, or if events in Venezuela over the weekend, where the US launched an assault that captured the country’s President Maduro and his wife to stand trial for drug charges, may lead to a bout of risk aversion.

Initial moves in early trading on Monday have currently shrugged off concerns regarding events in Venezuela with the UK 100 trading +0.2% higher at 10022 at time of writing (0700 GMT), however things can change quickly.

On a more macro basis, the UK 100, which is packed full of multi-national corporates that generate over 70% of their revenue outside of the UK, may be more impacted across the week by economic data from the US that could directly influence market expectations for when the next Federal Reserve interest rate cut may realistically take place.

The ISM Services PMI survey (Wednesday, 1500 GMT), will provide an important update on the health of the US economy. Service activity is the main driver of growth, so the focus may be on whether it continues to hold above 50, in economic expansion territory, or if consumer concerns regarding job security and higher prices have led to a drop off in activity.

Then on Friday, it’s the release of Non-farm payrolls at 1330 GMT, providing traders with an early update on the strength of the US labour market. The outcome of this release, including the headline and unemployment rate (currently 4.6%) could have volatility implications for the UK 100 into the weekend, depending on how far the readings deviate from market expectations.

Technical Update: Breaking Higher From Triangle Pattern?

Traders often view round numbers as psychological resistance, so last week’s break above 10000 in the UK 100 naturally raises the question of whether the index is attempting to break higher again. This latest move also carries added significance, as it coincided with a new all‑time high at 10054 posted on Friday.

While not a guarantee of upside momentum, traders may be watching to see whether this move above 10000 can generate further strength.

With that in mind, it remains prudent to monitor key support and resistance levels closely in the coming week. This could help determine whether the recent price action reflects a continuation of upside momentum capable of producing new highs, or whether the break above the October/December resistance proves to be a false move, from which a price correction could emerge.

Potential Resistance Levels:

Having established a new all‑time high of 10054 last week from which fresh selling pressure emerged, this level may form the first resistance focus, and it could be useful to observe how price behaves around this level in the week ahead. Closing breaks above 10054 may be required to maintain upside momentum toward higher levels.

If confirmed, closing breaks above 10054 could signal a resumption of price strength, opening the way for a move toward 10128, which is the 38.2% Fibonacci extension. Closing breaks above 10128 could then open the way for further gains toward 10248, which is the 61.8% extension.

Potential Support Levels:

By running Fibonacci retracements on the latest advance from December 9th to the January 2nd all‑time high, the 38.2% retracement level is identified at 9881. This could act as the first support zone should a price correction in the UK 100 develop.

As the chart above highlights, closing breaks below 9881 could expose further downside risks for moves toward 9775, which is the 61.8% retracement. Should that level also give way, weakness may extend toward 9610, the December 9th low.

The material provided here has not been prepared accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

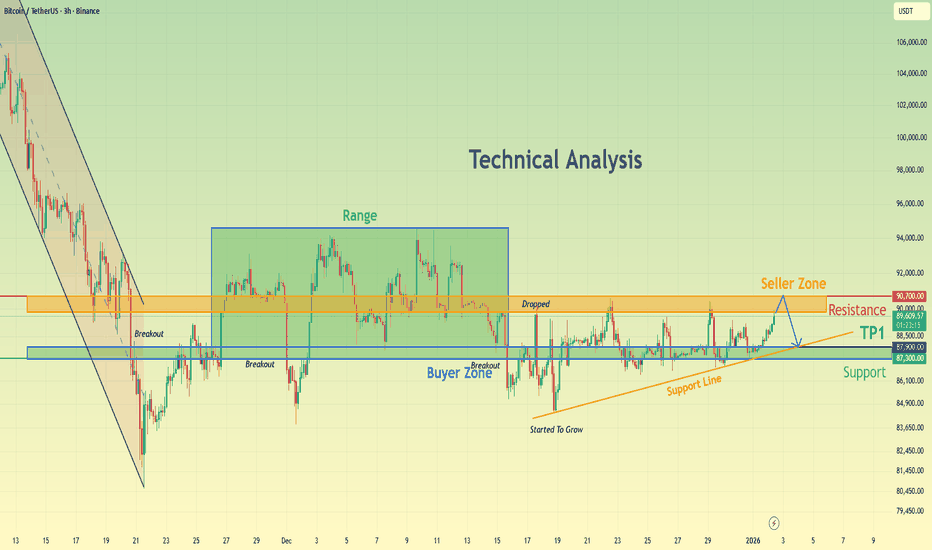

BTCUSDT Pullback to Buyer Zone $87,900 Before Next ExpansionHello traders! Here’s my technical outlook on BTCUSDT (3H) based on the current chart structure. Bitcoin is trading within a broader consolidation phase following a strong bearish impulse earlier in the chart. After the sell-off, price found a clear pivot low, from which buyers stepped in and initiated a recovery. This recovery led to a breakout above a key structure level, confirming a shift from bearish pressure into stabilization. Following the breakout, BTC moved into a well-defined range, highlighting balance between buyers and sellers. The lower boundary of this range aligns with the Buyer Zone around 87,300, which has acted as a strong support area with multiple successful defenses. Each dip into this zone has been met with buying interest, confirming it as a key demand area. On the upside, price remains capped by the Seller Zone / Resistance around 89,800–90,700, where selling pressure has repeatedly limited further advances. More recently, BTC has started to form a rising support line, indicating gradually strengthening bullish pressure. Price is currently trading above this support line and holding above the Buyer Zone, suggesting that the latest pullbacks are corrective rather than impulsive. The overall structure shows compression between rising support and horizontal resistance, often a precursor to an expansion move. My scenario: Bitcoin may first attempt a corrective pullback toward the Buyer Zone (TP1) around 87,900, which aligns with a key horizontal support level and the lower boundary of the recent consolidation structure. This area has already shown strong demand in the past, making it a high-probability reaction zone. As long as price approaches this zone without strong impulsive bearish momentum, the move can be viewed as a healthy retracement within the broader consolidation / emerging bullish structure. A clear bullish reaction from the Buyer Zone—such as long lower wicks, bullish engulfing candles, or strong impulsive candles—would signal that buyers are still in control. Please share this idea with your friends and click Boost 🚀

Goldman Sachs at a Decision PointGS price is currently moving inside a Rising Wedge pattern — a structure that is inherently risky and often associated with corrective moves, especially near the upper boundary.

At the moment:

• Price has made a strong push into the upper trendline

• The moving average (orange line) has been reclaimed as support

• However, there is no confirmed and sustained breakout above resistance yet

This places the market at a critical smart-money decision zone.

Trading Scenarios

Bullish Scenario (Valid Breakout)

If price:

• Holds and closes above the 915–920 zone

• Shows acceptance above the wedge (no deep pullback)

Then a confirmed breakout is in play.

Upside Targets:

930 → 950

Invalidation / Stop-loss:

Hourly close below 905

Bearish Scenario (Fake Breakout / Rejection)

If price:

• Fails to hold above the upper trendline

• Falls back inside the wedge structure

This would activate a classic fake breakout scenario.

Downside Targets:

895 → 880 (wedge support)

Short invalidation:

Hourly close above 920

Structural / Behavioral View

• The sharp upside move may represent a liquidity grab

• Rising wedges near highs often resolve to the downside

• Still, the breakout candle strength suggests sellers are currently weak

Key takeaway:

Confirmation matters more than prediction

Fundamental Context (Brief)

Goldman Sachs continues to benefit from:

• Strong trading and investment banking revenue

• Increased market volatility

• A dominant position in capital markets

That said, the stock is trading at elevated valuation levels, making short-term pullbacks completely normal.

Final Summary

GS is sitting right at a major resistance zone:

• Acceptance above 920 → bullish continuation

• Rejection → controlled correction

Best strategy:

• Trade after confirmation, not inside the pattern

GOLD - Trading range 4300 - 4400. Interest in hedge assetsLet's consider FX:XAUUSD before the opening of the trading session. The main nuance is how the market will react at the opening after the increase in geopolitical risks due to the actions of the US...

Starting January 5, liquidity will begin to grow in the market after the Christmas and New Year holidays. However, the year is starting with an increase in geopolitical risks due to US actions in Venezuela... The Russian-Ukrainian conflict is still not progressing in negotiations, which also creates additional risks. The Pacific and Asian sessions may be reactive...

The dollar is forming a correction within a downward trend, but it will be necessary to monitor the index's reaction to the US geopolitical actions that took place on Saturday. The growth of the index may put pressure on the metal...

Gold is forming a trading range of 4300-4400. Globally, we have a bullish trend, but locally, gold is forming a correction. BUT! It is necessary to monitor the price reaction relative to 4315-4300 from the opening of the Pacific, Asian, and European sessions....

Resistance levels: 4355, 4400, 4440

Support levels: 4315, 4302, 4275

Accordingly, based on the available technical and fundamental data, we can assume that there may be a bullish run from the 4300 zone. I do not rule out an attempt to retest 4300 - 4275 (long squeeze) before growth...

Best regards, R. Linda!

XRP makes big moves -LONG-DAILY-VIEW-Hello all 🌍😀🙋♂️🙋♀️

Thank you so much for coming today 🌞

Let's dive right in 🏄♂️🏄🌊⏬👇🐼

I am and have been extremely bullish on XRP

🐮🙋♀️🙋♂️WHY?☮️💡🤯

FUNDAMENTALLY:

💠Deflationary in nature🍃 the more XRP that is burned (every transaction, results in a very small fraction of burned token) the more it pushes price of XRP up naturally -supply and demand-

💠XRP is ranked top 5 fastest transaction times of all cryptocurrencies (3-5 seconds)

💠The SEC tried to sue XRP's creator Ripple in 2020 for selling XRP to institutional investors, the lawsuit ended in a 'permanent' injunction against XRP selling to institutions. This could be considered good and bad

💠August 2025 SEC dropped the case and both parties dismissed their appeals

💠 The lawsuit of 2020 didn't stop XRP from outperforming, XRP is currently top 5 cryptocurrencies market cap rating, sitting at 💲130 Billion total (not circulating)

Let's dive in, to the next look 🔍🤸🤸♂️💭⏬🐼

TECHNICALLY:

NOVEMBER 3rd 2023 , XRP price went from .48 cents to 2.9 on DECEMBER 3rd

a 490 percent 💲price increase in just 1 month 🤯 That's a bullish and QUICK🏃♀️🏃♂️💨 jump ⏬⏬🔽👇

⭐👀📍

We have currently made a break from a bearish🐻 descending triangle📐 and it is a strong break at that 💥

If we can continue to gain support 💪 and turn these resistances into fuel ⛽ without getting rejected, XRP price could see some of our bullish 🐂🎯 targets, listed above 📈📉

Let's see!

⌚⌛👀🐶📌😀

Thank you for stopping by and always remember 👇👇

🫡🐴🐲🐸🤖👻👽🙍♂️🙍♀️🫡

🛑🛑🛑This is not financial advice🛑🛑🛑 Above are approximate targets based on fibs and major trend lines etc. I always recommend looking at multiple charts when making a big investment. Always have a stop loss ✋🛑💲 set🆗

Any thoughts 💭💡, questions 🙋♀️🙋♂️❓, good 👍, bad👎, happy 😄 or sad 😥, in the comments always welcome.

Jazerbay 🌠

EURUSD Holding Buyer Zone - Rebound Toward 1.1780 in FocusHello traders! Here’s my technical outlook on EURUSD (2H) based on the current chart structure. EURUSD is trading within a broader bullish structure after a strong upside move from the lower levels. Earlier, price advanced inside an ascending channel, confirming sustained buyer control and a sequence of higher highs and higher lows. Following this impulsive rally, EURUSD broke above a key structure level and transitioned into a consolidation phase near the highs. Currently, price is reacting around the Buyer Zone near 1.1740, which aligns with a key Support Level and a previous breakout area. This zone has already shown multiple reactions, indicating active demand. Above, the market remains capped by a descending Resistance Line and the Seller Zone around 1.1780, where selling pressure previously caused a rejection. The recent move into support appears corrective rather than impulsive, suggesting a pause within the broader bullish trend. My scenario: as long as EURUSD holds above the 1.1740 Buyer Zone, the bullish structure remains intact. A strong reaction from this area could lead to another push toward the 1.1780 Resistance Level (TP1). A confirmed breakout and acceptance above resistance would open the door for further upside continuation. However, a decisive breakdown below the buyer zone would weaken the bullish setup and signal a deeper corrective move toward lower support levels. For now, price remains at a key decision area, with buyers defending structure while consolidation continues. Please share this idea with your friends and click Boost 🚀

BCH BreakoutI'm seeing a beautiful triangle, almost an ascending triangle, on the BCH weekly chart. It's breaking out of two upper trend lines with two candles come tomorrow Sunday. I'm hoping for a weekly close above $650. I really like the way BCH has been trading since it's predictable and follows rules. There are two trades inside the triangle using the 200MA combined with MACD that executed perfectly so I think that future patterns and behaviors can be relied upon to act in a more predictable fashion than BTC.

Anyway I've written my price goals on the chart for you to look at though I don't plan to take profit on any except for the final goal but I will be adjusting my stop loss as time goes on. Please feel free to comment, I enjoy other perspectives and repartee!

BREAKOUT ABOVE 52 WEEK HIGH IN SANSERA - EDUCATIONAL PURPOSE

Breakout above 52 week high is seen in Sansera, Also triangle pattern breakout is seen

can initiate long position on slight correction (retest) near 1750-1755

STOPLOSS - below 1200 on weekly closing basis (-32%)

TARGET - Fibo suggest 3270 (85%) in 4-5 years (Till December 2030)

RISK REAWARD RATIO : 1:2.7

ONLY INVESTMENT VIEW, NOT FOR SHORT TERM TRADING

BITCOIN - Flat holding back the market. Focus on 90K...BINANCE:BTCUSDT.P is forming a local uptrend, based on cascading support generated by the market during low (holiday) liquidity.

Fundamental support for Bitcoin and the cryptocurrency market is still absent, or not felt. Accordingly, it's too early to talk about a bullish reversal, rally, or pump. The daily chart shows a downtrend and consolidation in a flat/symmetrical triangle pattern. The zone of interest (liquidity area) is 89950 - 90600. A false breakout/short squeeze could shift the imbalance toward bears and trigger a reversal and decline within the current trading range, which in turn could trigger a decline in the altcoin market.

Resistance levels: 89950, 90600, 91900

Support levels: 88000, 86800, 85000

A localized upward movement amid a global downtrend, as long as this zone is not broken, can be considered a counter-trend correction. A short squeeze through the liquidity zone could trigger a bluer price move toward lower zones of interest, such as 88K - 85K.

Sincerely, R. Linda!

BTC - Ascending Triangle | Liquidity Sweep Before Breakout?

Executive Summary

Bitcoin is trading at $90,529 on the first trading day of 2026, testing the upper resistance of an ascending triangle on the 4H timeframe. Price has rallied +2% today as dip buyers stepped in aggressively. The structure suggests a short-term pullback to sweep liquidity below $88K before breaking the ascending pattern and bursting higher.

BIAS: BULLISH - Short-Term Dip, Then Breakout

Current Market Data

Current: $90,529 (+1.98%)

Day's Range: $88,309 - $90,927

October Peak: $126,000

Key Support: $86,000-$88,000

Fear & Greed Index: 36 (Fear → improving)

What's Driving the Rally

"January Effect" - Tax-loss selling ended, capital redeploying

Whale accumulation visible on-chain

Open interest up 2% to $130B - leveraged bulls entering

$217.82M in shorts liquidated in 24 hours

Meme coins rallying (PEPE +32%) - risk-on returning

Fed rate cuts expected by March

Key News Context

Bitcoin's four-year cycle officially broken - first red post-halving year

ETF effect pulled liquidity forward into 2024

BlackRock deposited 1,134 BTC ($101.4M) to Binance - bearish signal

But whales reducing exchange deposits - bullish signal

Zero Bitcoin obituaries in 2025 - first time since Satoshi era

Technical Structure - 4H

Ascending Triangle Pattern:

Rising support trendline (yellow dashed) - higher lows

Horizontal resistance at $90,000-$90,500 (pink zone)

Price compressing toward apex

Typically bullish breakout pattern (70%+)

Key Levels:

Resistance:

$90,000 - $90,500 - Horizontal resistance (pink zone)

$93,000 - $93,200 - Upper target zone

$100,000 - Psychological level

Support:

$88,000 - CME gap zone ($87,800-$88,000)

$86,000 - $86,500 - Major support zone (pink)

$84,000 - $84,500 - Deep support / liquidity pool

Liquidity Analysis

Heavy liquidation clusters below $88,000

More intense bands near $86,000 and $84,500

CME gap at $87,800-$88,000 - likely to be filled

Thin resistance between $91,000-$94,000 if breakout occurs

SCENARIO ANALYSIS

PRIMARY: Liquidity Sweep Then Breakout

Short-term dip to $86,000-$88,000 to sweep liquidity

Fill CME gap at $87,800-$88,000

Bounce off ascending trendline support

Break above $90,500 resistance

Target $93,000-$94,000, then $100,000

BULLISH: Direct Breakout

Trigger: 4H close above $90,500 with volume

Targets: $93,000 → $94,000 → $100,000

BEARISH: Triangle Breakdown

Trigger: Break below $86,000 and ascending trendline

Targets: $84,500 → $83,000 → $80,000

My Assessment

Ascending triangle at resistance with liquidity pools below. Expect short-term dip to sweep $86K-$88K liquidity, fill CME gap, then break ascending pattern and burst higher. Risk-on sentiment returning, whale accumulation, and January Effect support bullish thesis.

Strategy:

Wait for dip to $86,000-$88,000 zone

Long on bounce with stop below $84,500

Target $93,000-$94,000, then $100,000

Or long on confirmed breakout above $90,500

Drop your comments below on what you think is the NEXT MOVE!

BTCUSDT Long: Demand Support Intact, Next Test at $89,000Hello traders! Here’s a clear technical breakdown of BTCUSDT (4H) based on the current chart structure. After a strong bearish impulse, Bitcoin was trading inside a well-defined descending channel, reflecting sustained seller control. This bearish phase ended with a clear breakdown and a sharp reaction from a key pivot low, where buyers stepped in aggressively, marking an important structural shift. From this pivot point, BTC transitioned into a consolidation phase, forming a broad range, which signals balance between buyers and sellers after the impulsive move. Price respected both the upper and lower boundaries of this range multiple times, confirming it as a valid accumulation zone. Eventually, Bitcoin broke below the range briefly, but this move was quickly absorbed by buyers near the Demand Zone around 86,800, leading to a strong recovery and reclaim of structure.

Currently, BTCUSDT is trading above the rising Demand Line, having confirmed a breakout and subsequent retest. Price is gradually moving higher toward the Supply Zone near 89,000, where multiple tests and rejections have already occurred. This area represents a key resistance, with sellers actively defending it, as shown by repeated reactions and failed continuation attempts.

My scenario: as long as BTCUSDT holds above the 86,800 Demand Zone and respects the rising demand line, the bias remains bullish and corrective pullbacks are likely to attract buyers. A clean breakout and acceptance above the 89,000 Supply Zone would confirm bullish continuation and open the door for further upside. However, failure to hold demand and a breakdown below the demand line would invalidate the bullish scenario and shift focus back toward range lows. For now, price is compressing between demand and supply, and a decisive move is likely ahead. Manage your risk!