Bullish bounce setup?Fiber (EUR/USD) could make a short-term pullback to the pivot and could bounce to the swing high resistance.

Pivot: 1.1694

1st Support: 1.15504

1st Resistance: 1.1918

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

USD

Bullish rise?USO/USD could fall towards the support level, which is an overlap support and could bounce from this level to our take profit.

Entry: 60.64

Why we like it:

There is an overlap support level.

Stop loss: 59.57

Why we like it:

There is an overlap support level.

Take profit: 62.37

Why we like it:

There is a swing high resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Weekly analysis 26th-30th January 2026In this video, we present a weekly market outlook for USD, EUR, and Ethereum (ETH) covering the period 26th–30th January 2026.

The analysis focuses on key technical levels, market structure, and momentum across major currency pairs and the crypto market. We break down recent price action, identify critical support and resistance zones, and discuss potential scenarios that may shape market movements during the week ahead.

Ethereum, USD, EUR, SPX500, FTSE100, CAC40, DAX40.

EURUSD Rejection From Resistance, 1.1630 Support in FocusHello traders! Here’s my technical outlook on EURUSD (4H) based on the current chart structure. EURUSD previously traded within a well-defined bullish channel, supported by a rising trend line and a sequence of higher highs and higher lows. This structure confirmed strong buyer control after price reversed from the broader base and pushed higher with momentum. During this bullish phase, price broke above a key Seller Zone around 1.1680–1.1700, confirming bullish continuation and acceptance above former resistance. The market then extended higher before momentum started to fade near the upper boundary of the channel, where price clearly turned around, signaling exhaustion from buyers. Following the top, EURUSD transitioned into a corrective phase, breaking below the ascending structure and forming a descending channel. This shift marked a short-term change in market control, with sellers gaining strength. Price respected the descending resistance line, producing lower highs and confirming bearish pressure. Several corrective pullbacks occurred, but each rally failed below the Resistance Level near 1.1700, reinforcing this area as a strong supply zone. Fake breakouts and quick rejections from this zone further highlight active selling interest. Currently, EURUSD has broken below the descending resistance line and is trading beneath the Seller Zone, suggesting that recent upside moves are corrective rather than impulsive. Price is now moving toward the Buyer Zone / Support Level around 1.1630–1.1600, which previously acted as a key demand area and structural reaction zone. This level is marked as TP1, where buyers may attempt to slow or pause the decline. My scenario: as long as EURUSD remains below the 1.1680–1.1700 Resistance Level and continues to respect the broader bearish structure, the downside bias remains valid. I expect price to continue lower toward the 1.1630–1.1600 Support Level (TP1). A clean breakdown and acceptance below this zone would open the door for a deeper bearish continuation. However, a strong bullish reaction and acceptance back above resistance would invalidate the bearish scenario and suggest a possible return to consolidation or trend recovery. For now, market structure favors sellers while price trades below resistance. Please share this idea with your friends and click Boost 🚀

EUR/USD - H4 Weekly Outlook - Breakout Loading ?📝 Description 🔍 Market Structure

EUR/USD remains in a strong H4 uptrend, supported by a rising trend OANDA:EURUSD line and higher-high / higher-low structure. Price is currently compressing below a key resistance zone, suggesting a breakout or pullback scenario is loading.

🔴Trendline support respected multiple times

🔴Price holding above key moving averages

🔴Momentum slowing near resistance → decision zone

📍 Key Support & Resistance

🟢 Resistance Zone: 1.1760 – 1.1800

(June & September highs in focus)

🔴 1st Support: 1.1600 – 1.1580

🔴 2nd Support: 1.1540 – 1.1520

#EURUSD #ForexTrading #WeeklyOutlook #BreakoutSetup #PriceAction #SupportResistance #TradingView #Kabhi_TA_Trading

⚠️ Disclaimer

This analysis is for educational purposes only.

Forex trading involves risk — always manage position size and use a stop-loss.

💬 Support & Engagement👍 Like if you’re waiting for the breakout

💬 Comment: Breakout or Pullback first?

🔁 Share with traders watching EUR/USD

EURUSD Outlook | Bullish Structure + Key Demand Zone!Hey Traders,

In today’s trading session, we are closely monitoring EURUSD for a potential buying opportunity around the 1.17000 zone. EURUSD remains in a well-defined uptrend and is currently undergoing a healthy corrective pullback, approaching a key trendline confluence and the 1.17000 support-turned-resistance area, which may act as a strong demand zone for bullish continuation.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

GBPUSD | Breakout Watch from the ChannelCable’s tone has improved as UK inflation has stopped falling cleanly. December CPI ticked up to 3.4% y/y (from 3.2%), with services inflation still sticky (CPIH services 4.5% y/y), which can keep the market cautious about pricing aggressive BoE easing.

Technical lens: Price has been compressing inside a downward sloping channel after the prior leg higher, and we’re now pressing the upper channel line around the mid-1.36s. RSI is also pushing into the high-60s, which fits with “pressure building” rather than a clean mean-reversion setup. A sustained push through the channel top would put the next obvious magnet at the 1.41–1.42 supply zone marked on the chart.

Catalysts: The next FOMC meeting is 27–28 January (press conference on the 28th), which is the near-term volatility trigger for USD legs. On the UK side, the latest CPI print firming up keeps the “higher-for-longer vs slower cuts” debate alive into the BoE’s 5 February decision.

GBPUSD Final rally before a 2026 collapse.The GBPUSD pair has been trading within a giant Bullish Megaphone pattern for the past 3 years. This week will most likely be the first to close green after three straight bearish 1W candles. It is likely however to be the last one as having broken below its 1W MA50 (blue trend-line) in November 2025, the pair has confirmed the start of a new Bear Cycle.

So far, that is similar to the 2019 - 2021 Bullish Megaphone, which after making a 1W MA100/ 200 Bearish Cross and breaking below its 1W MA50, it confirmed a massive Bear Cycle that first hit its bottom on the 0.836 Fibonacci level and then broke the pattern to the downside making a new market Low.

As a result, we expect this week's bullish sentiment to reverse on the Lower Highs Resistance (2021 also displayed one) and towards the end of 2026 test the 0.836 Fib at 1.2400. Notice also the striking similarities among the 1W RSI sequences of those two fractals.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDJPY FLYINGUSDJPY is maintaining a strong bullish continuation after a clean break and hold above the prior supply turned support zone, confirming bullish market structure with higher highs and higher lows on the daily timeframe. The recent consolidation acted as a healthy pause before continuation, absorbing supply and building liquidity for the next upside expansion, which aligns with the impulsive breakout now in play. Fundamentally, the pair remains supported by the persistent policy divergence between the Federal Reserve and the Bank of Japan, where US yields stay elevated and risk sentiment continues to favor the dollar, while the yen remains structurally weak despite periodic intervention concerns. As long as price holds above the key demand zone and trend support, bullish momentum, breakout continuation, liquidity sweep, and trend-following strategies remain favored, targeting higher resistance levels with the trend firmly in control for profit-focused execution.

AUDUSD Outlook | Uptrend Holds as Gold Supports AUD!Hey Traders,

In today’s trading session, we are closely monitoring AUDUSD for a potential buying opportunity around the 0.67600 zone. AUDUSD remains in a well-established uptrend and is currently undergoing a healthy corrective pullback, approaching a key trendline confluence and the 0.67600 support-turned-resistance area, which may act as a strong demand zone for bullish continuation.

From a fundamental perspective, the Australian Dollar often benefits from its positive correlation with Gold. With Gold maintaining a strong bullish bias, this relationship could provide additional upside support for AUDUSD, reinforcing the bullish technical outlook.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

DXY Breakout and Potential Retrace!Hey Traders, in today's trading session we are monitoring DXY for a selling opportunity around 99.100 zone, DXY was trading in an uptrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 99.100 support and resistance area.

Trade safe, Joe.

NZDUSD H4 | Bullish Continuation To Extend?The price is falling towards the pivot, which is a pullback support that aligns with the 38.2% Fibonacci retracement.

Our stop loss is set at 0.5817, which is a pullback support that aligns with the 50% Fibonacci retracement.

Our take profit is set at 0.5924, which is a pullback resistance.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

Bearish reversal for the Bitcoin?The price has rejected off the pivot and could fall to the 1st support, which is a pullback support.

Pivot: 90,345.62

1st Support: 86,783.95

1st Resistance: 92,360.63

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

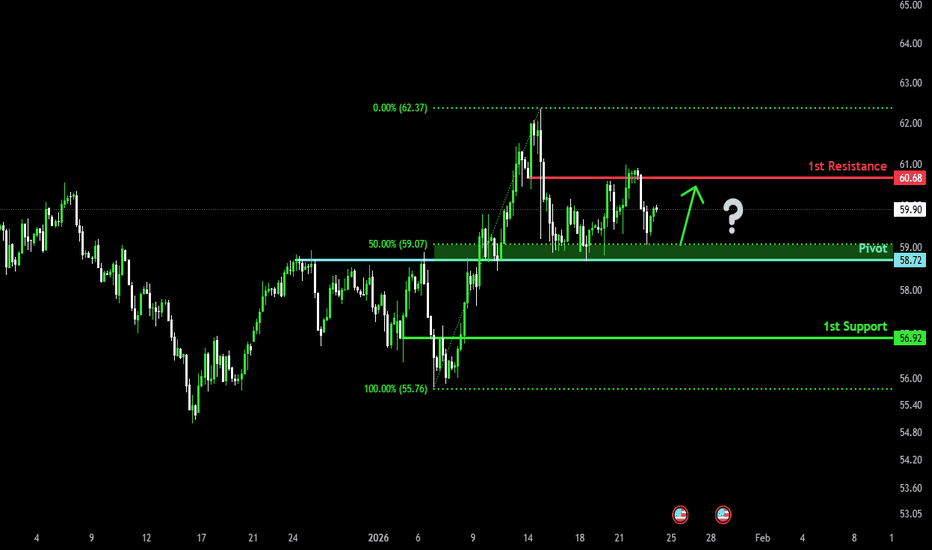

Bullish bounce off?WTI Oil (XTI/USD) could fall towards the pivot and could bounce to the 1st resistance.

Pivot: 58.72

1st Support: 56.92

1st Resistance: 60.68

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish continuation?Kiwi (NZD/USD) is falling towards the pivot which is a pullback support and could bounce to the 1st resistancenatnthe 161.8$% Fibonacci extension.

Pivot: 0.5853

1st Support: 0.5799

1st Resistance: 0.5940

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Heading towards 50% Fib resisstance?Swissie (USD/CHF) could rise towards the pviot which has been identified as a pullback resistance that aligns with the 50% Fibonacci retracement.

Pivot: 0.7930

1st Support: 0.7878

1st Resistance: 0.7965

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Potential bearish drop?Loonie (USD/CAD) has rejected off the pivot and could stop at the 1st support, which is a pullback support that aligns with the 145% Fibonacci extension.

Pivot: 1.3794

1st Support: 1.3756

1st Resistance: 1.3821

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Silver Strength (XAG/USD) – Safe-Haven Demand Fuels Upside📝 Description 🔍 Setup (Market Structure) FX:XAGUSD

XAG/USD continues to show strong bullish structure on the H1 timeframe.

Price has respected a well-defined demand zone with multiple retests and rejections, confirming strong buyer interest. Silver is trading above EMA and Ichimoku cloud support, signaling trend continuation rather than exhaustion.

The broader backdrop supports metals as safe-haven assets, keeping the upside bias intact.

📍 Support & Resistance

🟡 Key Demand / Support Zone: 85.00 – 87.00

🟢 1st Resistance: 98.00

🟢 2nd Resistance / Extension Target: 101.00

Trend strength remains valid above demand with higher-high structure intact

🌍 Fundamental Context

1.Rising geopolitical tensions and trade-related uncertainty

2.Investors rotating into safe-haven assets like Silver

3.Risk-off sentiment continues to support precious metals

#XAGUSD #Silver #PreciousMetals #SafeHaven #ForexTrading #TechnicalAnalysis #PriceAction #TradingView #Kabhi_TA_Trading

⚠️ Disclaimer

This analysis is for educational purposes only.

Markets are volatile — always manage risk properly and use a stop-loss.

💬 Support the Idea 👍 Like if you’re bullish on Silver

💬 Comment: Breakout continuation or pullback first? 🔁 Share with traders watching metals

USDJPY starting a new short-term Bullish Leg.Almost 3 weeks ago (January 02, see chart below), we gave a strong Buy Signal on the USDJPY pair, which eventually hit our 159.000 short-term Target:

That was while it unfolded the Bullish Leg of its 6-week Channel Up. Right now we have another buy opportunity emerging as the pattern has just started its new Bullish Leg.

If it follows at least the minimum +2.21% rise that the one before had, we expect the current Bullish Leg to target at least 160.800. If however the 4H RSI turns overbought (above 70.00) and gets rejected, we will take the profit regardless, as this is exactly what took place on the previous 4 Highs in the last 2 months.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDCHF - Let the Market Come to YouUSDCHF remains overall bullish, and price is now doing exactly what we want to see in a healthy trend.

We’re currently retesting a key intersection:

– the lower blue trendline

– and the green structure support

As long as this intersection holds, my focus stays on trend-following long setups. I want to see buyers step in again from here and defend structure before considering any entries.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

USDCAD - Back Into Supply, Sellers Watching CloselyUSDCAD is now hovering around a clear resistance and supply zone.

This area has already proven itself in the past, and price is once again reacting to it.

As long as this zone holds, the bias remains to the downside, and we’ll be looking for short setups, ideally confirmed on lower timeframes.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Bullish continuation?Gold (XAU/USD) is falling towards the pivot, which aligns witht he 38.2%Fibonacci retracement and could bounce to the 1st resistance.

Pivot: 4,634.76

1st Support: 4,542.50

1st Resistance: 4,867.17

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish bounce off key support?Loonie (USD/CAD) has bounced off the pivot, which acts as an overlap support and could rise to the 61.8% Fibonacci resistance.

Pivot: 1.3797

1st Support: 1.3749

1st Resistance: 1.3869

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party