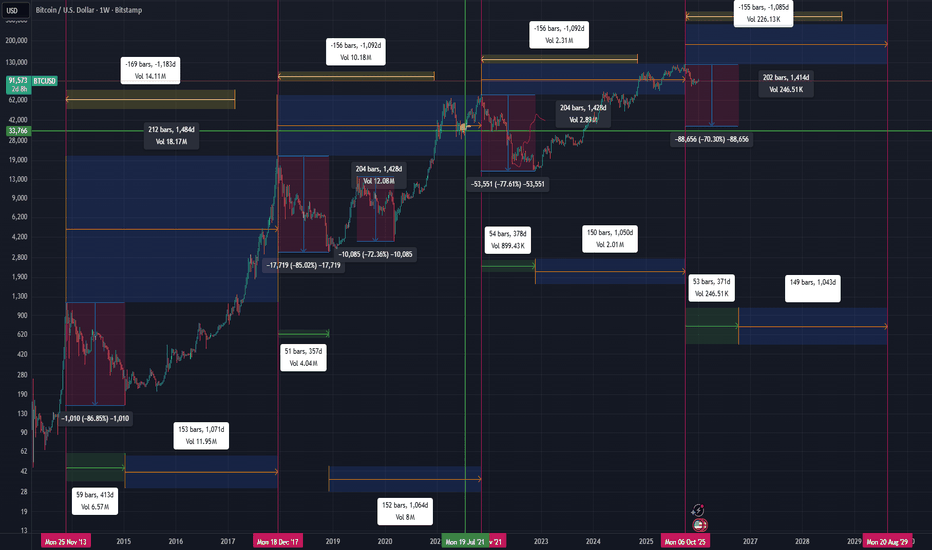

Update on my previous analysis (published on Feb 23, 2023):

As of now, Bitcoin appears to have formed a cycle top at the end of the projected period from my previous post.

Based on the same cyclical structure and historical behavior, I believe a new corrective / bearish cycle is starting.

My expectation is that this declining cycle will continue, and the next major cycle top could form roughly 1,400 days from here.

This analysis is based on long-term cycle timing and structural repetition rather than short-term price action.

Not financial advice. Just my personal market view.

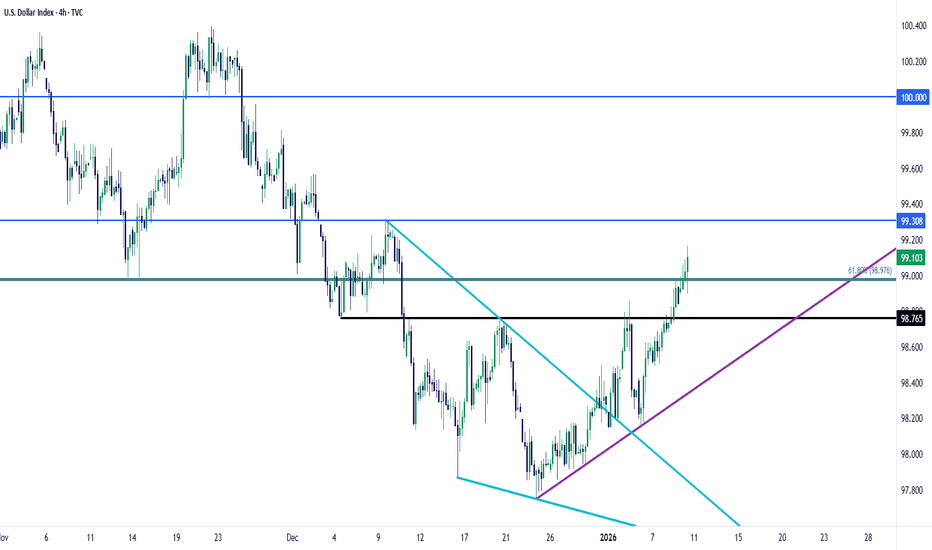

USD

USD Triangle Break - What's NextThe NFP report from this morning is one of those items that could be construed either way. The headline number was below expected but the unemployment rate was a touch better at 4.4% v/s 4.5% expected.

Initially there was a bit of chaos in DXY, which is to be expected, but so far a big level has held and bulls are pushing up to fresh highs.

The support in question is the 98.98 level, which is the 61.8% Fibonacci retracement of the 2021-2022 major move. That price has so far been defended and now for the past couple weeks, USD bulls have been making a strong push. Next resistance is near at 99.30 and the 100-100.22 level was a brick wall in Q4, after having shown as support in late-2024 trade.

On the driver side of the matter, USD/JPY is at a fresh high and this is a point of concern if chasing either market, as getting closer to that 160.00 handle could bring threats of intervention from the MoF. This doesn't necessarily mean a top is in place or nearby, but it does highlight caution if chasing USD/JPY breakouts as bull traps after fresh highs have been a more regular type of thing in the pair. - js

Gold Outlook: Key Break at 4475 Ahead of U.S. Jobs DataGOLD | Market OVERVIEW

Gold edges higher as traders await key U.S. economic data later today for clues on the rate path. Focus is on December NFP, expected to show solid hiring with steady unemployment—potentially reducing urgency for near-term Fed cuts. Markets are also watching the Fed leadership transition, after Treasury Secretary Scott Bessent said Donald Trump may name a successor to Jerome Powell later this month.

📉 MARKET BIAS

Short-term bearish below 4475; direction confirmed by intraday closes.

🔼 BEARISH SCENARIO (PRIMARY BELOW RESISTANCE)

• While below 4475, price may pull back toward 4458

• A 15M close below 4458 supports continuation toward:

🎯 4436 🎯 4407

🔼 BULLISH SCENARIO (INVALIDATION)

• A 1H close above 4475 flips momentum bullish

• Upside targets:

🎯 4500 🎯 4520

📌 KEY LEVELS

• Pivot: 4475

• Support: 4458 – 4436 – 4407

• Resistance: 4500 – 4520

GBPUSD Could Push Higher? | Rate-Cut Risk Pressures the Dollar!Hey Traders,

In today’s trading session, we are closely monitoring GBPUSD for a potential buying opportunity around the 1.33800 zone. GBPUSD remains in a well-established uptrend and is currently undergoing a healthy corrective pullback, approaching a key trendline confluence and the 1.33800 support-turned-resistance area, which may act as a strong demand zone for bullish continuation.

From a fundamental perspective, growing expectations of a potential interest rate cut by the Federal Reserve in the coming months continue to weigh on the US Dollar. A softer USD environment typically supports upside momentum in GBPUSD, reinforcing the bullish technical outlook.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

NZDUSD - Bears Brewing at a Critical Intersection!!!📉NZDUSD has been moving inside a clear bearish structure , with lower highs forming along the orange descending trendline.

⚔️Price is now approaching a major confluence area where the upper orange trendline meets the green resistance zone, a level that has repeatedly acted as a ceiling.

As price retests this intersection, we will be looking for trend-following short setups, expecting sellers to defend this area and potentially drive price back downward within the bearish cycle.

A strong breakout above the trendline would invalidate the short bias, but unless that happens, the bears remain in control.

Are you seeing the same reaction zone on your charts? Let me know 👇

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

SILVER H4 | Bullish Momentum To Extend?Based on the H4 chart analysis, we can see that the price has bounced off our buy entry level at 74.35, which is a pullback support.

Our stop loss is set at 70.75, which is a pullback support.

Our take profit is set at 81.10, which is a swing high resistance.

High Risk Investment Warning

Stratos Markets Limited (

NZDUSD H4 | Bearish BreakoutBased on the H4 chart analysis, we can see that the price is breaking out of our sell entry level at 0.5743, which is an overlap support.

Our stop loss is set at 0.5771, which is a pullback resistance.

Our take profit is set at 0.5690, which is a pullback support slightly below the 100% Fibonacci projection.

High Risk Investment Warning

Stratos Markets Limited (

AUD/USD H1 | Bullish Reversal SetupBased on the H1 chart analysis, we can see that the price has bounced off our buy entry level at 0.6683, which aligns with the 78.6% Fibonacci retracement.

Our stop loss is set at 0.6660, which is a pullback support.

Our take profit is set at 0.6717, which is an overlap resistance that is slightly above the 38.2% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited (

USDCAD H4 | Bearish Reversal Off 50% Fib ResistanceBased on the H4 chart analysis, we can see that the price has rejected off our sell entry level at 1.3887, which is a pullback resistance that aligns with the 50% Fibonacci retracement and the 78.6% Fibonacci projection.

Our stop loss is set at 1.3933, which is a pullback resistance that aligns with the 61.8% Fibonacci retracement.

Our take profit is set at 1.3809, which is a pullback support.

High Risk Investment Warning

Stratos Markets Limited (

Potential bullish bounce off?Silver (XAG/USD) has bounced off the pivot and could rise to the 1st resistance.

Pivot: 74.41

1st Support: 72.02

1st Resistance: 78.94

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Falling towards 50% Fib support?Ethereum (ETH/USD) is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 3,029.50

1st Support: 2,914.63

1st Resistance: 3,204.48

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

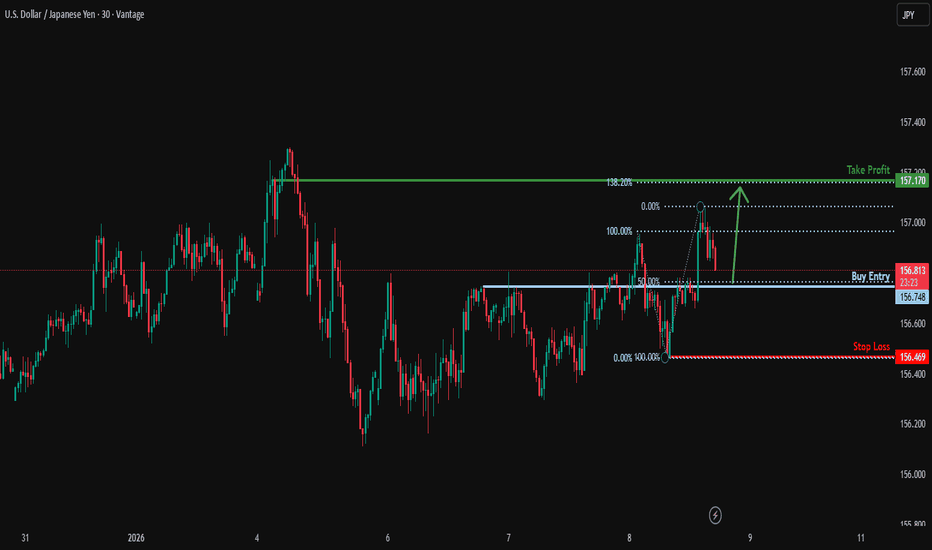

USD/JPY - Triangle Breakout (07.01.2026)📝 Description🔍 Setup (Price Action) FX:USDJPY

USD/JPY is forming a well-defined triangle pattern on the M30 timeframe.

Price is compressing between lower highs and higher lows, signaling a volatility squeeze.

The market is approaching the apex, where a strong directional move is likely.

📌 Trade Plan

Bullish Breakout Bias 📈

Wait for a clean breakout and candle close above triangle resistance

Ideal entry on breakout retest or strong continuation candle

Momentum confirmation is key (no chasing)

📍 Support & Resistance Levels

🟢 1st Resistance: 157.28

🟢 2nd Resistance: 157.57

🔴 Support Zone: 156.23 – 156.41

#USDJPY #ForexTrading #TriangleBreakout #PriceAction #SupportResistance #JPY #TradingView #Kabhi_TA_Trading

⚠️ Disclaimer

This analysis is for educational purposes only.

Forex trading involves risk — always manage position size and use stop-loss.

💬 Support the Work 👍 Like if you trade USD/JPY 💬 Comment: Breakout or Fakeout?

🔁 Share with your trading circle

USD/JPY(20260109)Today's AnalysisMarket News:

On Tuesday, both the Dow Jones Industrial Average and the Dow Jones Transportation Average hit record closing highs, marking the first buy signal from Dow Theory in over a year.

Technical strategists believe this confirms the bull market that began in late 2022 remains firmly established, even as some previously high-performing AI-related stocks have recently faced pressure.

The Dow Jones Industrial Average's last record closing high was on January 5th, while the Dow Jones Transportation Average's record high was even further back. Dow Jones market data shows that the index's last record closing high was on November 25th, 2024.

Technical Analysis:

Today's Buy/Sell Threshold:

156.79

Support and Resistance Levels:

157.40

157.17

157.02

156.55

156.41

156.18

Trading Strategy:

If the price breaks above 157.02, consider buying with a first target price of 157.1.

If the price breaks below 156.79, consider selling with a first target price of 156.55.

USDCHF H4 | Could We See A ReversalThe price is reacting off our sell entry level at 0.7992, which is an overlap resistance that lines up with the 61.8% Fibonacci retracement and the 78.6% Fibonacci projection.

Our stop loss is set at 0.8025, which is a pullback resistance that is slightly below the 78.6% Fibonacci retracement.

Our take profit is set at 0.7942, which is a pullback support that aligns with the 38.2% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited (

GBPUSD H4 | Bullish Reversal SetupThe price is reacting off our buy entry at 1.3420, which is an overlap support.

Our stop loss is set at 1.3371, which is a pullback support that aligns with the 127.2% Fibonacci extension.

Our take profit is set at 1.3485, which is a pullback resistance that lines up with the 50% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited (

EURUSD H4 | Falling Towards Key SupportThe price is falling towards our buy entry level at 1.1612, which is an overlap support that aligns with 61.8% Fibonacci retracement and slightly below the 78.6% Fibonacci projection.

Our stop loss is set at 1.1612, which acts as an overlap support that aligns with 61.8% Fibonacci retracement and slightly below the 78.6% Fibonacci projection.

Our take profit is set at 1.1674, which is a pullback resistance.

High Risk Investment Warning

Stratos Markets Limited (

DXY 1Y Chart - Concerns AheadToday you can review the technical analysis idea on a 1Y linear scale chart for US Dollar Index (DXY).

The RSI being below the trend line seems concerning for the DXY however let's see how the global economy works out this year.

If you enjoy my ideas, feel free to like it and drop in a comment. I love reading your comments below.

Disclosure: This is just my opinion and not any type of financial advice. I enjoy charting and discussing technical analysis. Don't trade based on my advice. Do your own research! #millionaireeconomics #DXY

GOLD H4 | Bullish Bounce OffThe price has bounced off our buy entry level at 4,403.41, which is a pullback support that is slightly above the 50% Fibonacci retracement.

Our stop loss is set at 4,316.54, whic is a pullback support.

Our take profit is set at 4,534.93, which is a swing high resistance.

High Risk Investment Warning

Stratos Markets Limited (

Bullish bounce off?AUD/USD has bounced off the support level, which is a pullback support that aligns with the 78.6% Fibonacci retracement, and could bounce from this level to our take profit.

Entry: 0.6685

Why we like it:

There is a pullback support that aligns with the 78.6% Fibonacci retracement.

Stop loss: 0.6665

Why we like it:

There is a multi-swing low support.

Take profit: 0.6712

Why we like it:

There is a pullback resistance that aligns with the 38.2% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Could we see a bounce from here?USD/JPY is falling towards the support level, which is a pullback support that aligns with the 50% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 156.74

Why we like it:

There is a pullback support level which is a pullback support that aligns with the 50% Fibonacci retracement.

Stop loss: 156.46

Why we like it:

There is a pullback support level.

Take profit: 157.17

Why we like it:

There is a pullback resistance that aligns with the 138.2% Fibonacci extension.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bearish reversal off 50% Fib resistance?USD/CAD is rising towards the resistance level, which is a pullback resistance that aligns with the 50% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 1.3896

Why we like it:

There is a pullback resistance level that aligns with the 50% Fibonacci retracement.

Stop loss: 1.3977

Why we like it:

There is a pullback resistance level.

Take profit: 1.3799

Why we like it:

There is a pullback support that aligns with the 38.2% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Potential bearish drop?GBP/USD is rising towards the resistance level, which is a pullback resistance and could reverse from this level to our take profit.

Entry: 1.3484

Why we like it:

There is a pullback resistance.

Stop loss: 1.3567

Why we like it:

There is a swing high resistance level.

Take profit: 1.3355

Why we like it:

There is an overlap support level that aligns with the 38.2% Fibonacci retracement

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.