USD Bear is here: Important Analysis on FX Pairs, Stock MarketIn this video I got over some important outlooks on the EUR/USD, GBP/USD and USD/JPY along with outlook on the stock market.

The U.S. Dollar has been getting absolutely crushed along with the stock market which usually has the opposite effect. Considering we may be into a stagflation scenario, this is not surprising.

Tariffs have spiked volatility and puts the Federal Reserve in a very tight spot of Interest Rate Policy. Interesting times ahead to say the least.

From a pure technical analysis point of view, the USD may be set for much further losses as monthly patterns suggest a big move may be on the horizon. Will be keeping a very close eye on these as we move forward in these stormy waters of the U.S. economy.

As always, Good Luck & Trade Safe.

Usdjpyforecast

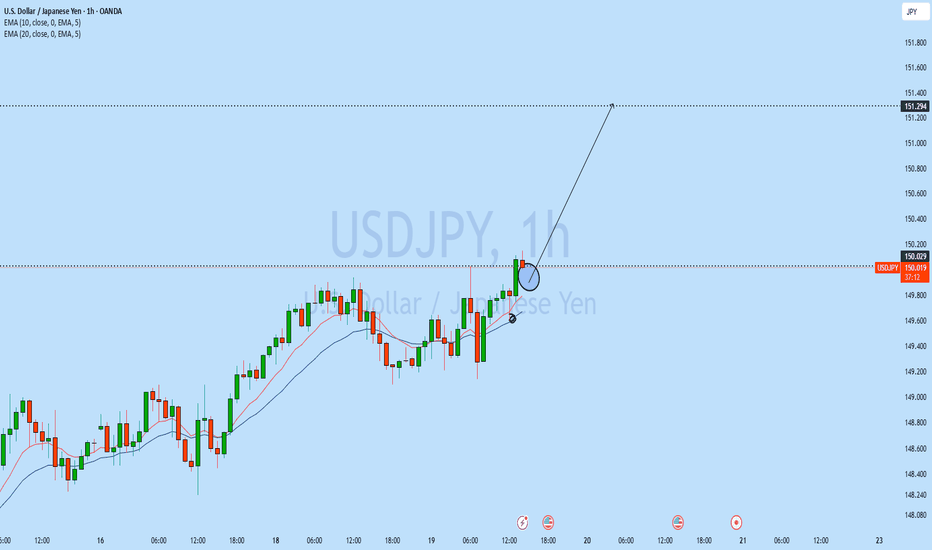

USDJPY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USDJPY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USDJPY Daily Analysis: Slight Bearish Bias Expected Amid Safe-HaUSDJPY Daily Analysis: Slight Bearish Bias Expected Amid Safe-Haven Demand and Fed's Dovish Tone 21/11/2024

Introduction

USDJPY is projected to hold a slight bearish bias today, driven by the strength of the Japanese yen as a safe-haven asset and the persistent dovish stance from the U.S. Federal Reserve. Weakening U.S. economic indicators and geopolitical concerns further fuel bearish sentiment, providing downward pressure on the currency pair. This article explores the fundamental and technical factors shaping USDJPY’s performance and offers insights for forex traders.

---

Key Drivers Influencing USDJPY Today

1. Increased Safe-Haven Demand for the Japanese Yen

The Japanese yen (JPY) remains supported by ongoing safe-haven demand amid global uncertainties. Heightened geopolitical tensions and concerns about slowing global growth have led investors to flock to the yen, exerting downward pressure on USDJPY.

2. Dovish Federal Reserve and Weak U.S. Dollar

The U.S. dollar (USD) continues to struggle as the Federal Reserve signals a cautious stance on monetary tightening. Recent U.S. data, including softer retail sales and cooling inflation, reinforce expectations that the Fed will maintain a pause in interest rate hikes. This dovish sentiment weakens the USD, further contributing to the bearish outlook for USDJPY.

3. Japan’s Stable Monetary Policy

The Bank of Japan’s (BoJ) commitment to its ultra-loose monetary policy remains unchanged. However, speculation about potential tweaks to its yield curve control strategy has bolstered the yen’s strength, adding to the bearish tone for USDJPY.

4. Technical Weakness in USDJPY

From a technical perspective, USDJPY has broken below key support levels, with momentum indicators suggesting further downside potential.

---

Technical Analysis Indicators

Moving Averages and RSI

USDJPY is trading below its 50-day moving average, signaling sustained bearish momentum. The Relative Strength Index (RSI) is trending lower but remains above oversold levels, indicating room for further declines without a reversal.

MACD and Support Levels

The MACD shows a bearish crossover, underscoring the pair’s downward momentum. The next significant support level lies at 147.00, which, if breached, could open the door for additional declines.

---

Conclusion

With strong safe-haven demand for the yen, dovish Federal Reserve signals, and bearish technical indicators, USDJPY is likely to maintain a slight bearish bias today. Traders should monitor U.S. economic releases and geopolitical developments, as they could introduce volatility and influence sentiment.

---

SEO Tags:

- #USDJPYforecast

- #USDJPYanalysis

- #USDJPYtechnicalanalysis

- #ForexTradingUSDJPY

- #JapaneseYenStrength

- #USDWeakness

- #USDJPYtoday

- #ForexMarketOutlook

- #USDJPYprediction

USDJPY analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USDJPY and GBPJPY AnalysisHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

XAUUSD and USDJPY Top-down analysisHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USDJPY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USDJPY Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USDJPY top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USDJPY and GBPJPY Top-down analysisHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis

USDJPY Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USDJPY and GBPJPY Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GBPJPY and USDJPY Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USDJPY Daily Analysis: Slight Bearish Bias as Economic DataUSDJPY Daily Analysis: Slight Bearish Bias as Economic Data and Market Sentiment Weigh on the Pair 03/12/2024

Introduction

USDJPY is expected to show a slight bearish bias today as a combination of weaker U.S. economic data, dovish Federal Reserve expectations, and strengthening risk sentiment exert downward pressure on the pair. This article breaks down the key factors influencing USDJPY’s potential move today, highlighting the fundamental drivers behind the bearish outlook.

---

Key Drivers Influencing USDJPY

1. Dovish Fed Outlook and U.S. Economic Data

The U.S. Federal Reserve's recent stance has remained cautious, signaling that further interest rate hikes are less likely in the near term. This dovish bias, coupled with disappointing economic data from the U.S., including weaker-than-expected manufacturing PMI and labor market figures, is reducing the appeal of the U.S. dollar (USD) relative to other currencies. As market expectations for a pause in U.S. monetary tightening grow, the USD faces pressure, contributing to the bearish outlook for USDJPY.

2. Improved Global Risk Sentiment

There has been a shift towards a risk-on sentiment in global markets, with stock markets showing positive momentum. As investors turn to riskier assets, the Japanese yen (JPY) tends to benefit due to its status as a safe-haven currency. A strong yen in a risk-on environment can weigh on USDJPY, especially as the Japanese economy shows resilience in key sectors like exports and manufacturing.

3. Declining U.S. Bond Yields

U.S. Treasury yields have softened recently, which has reduced the appeal of holding U.S. assets. Lower yields on U.S. government bonds make the dollar less attractive, particularly against currencies like the JPY, which has relatively higher yield expectations. This decline in U.S. bond yields contributes to the negative sentiment around USDJPY.

4. Positive Data from Japan

Japan's economic fundamentals are showing strength, particularly in the export sector. Data indicating stable economic growth and a positive outlook for Japan’s trade balance further supports the Japanese yen. As Japan benefits from stronger export performance, the JPY is gaining in value, adding pressure to USDJPY's upward momentum.

---

Technical Analysis

Moving Averages and RSI

USDJPY is trading just below its 50-day moving average, suggesting a potential for bearish continuation. The Relative Strength Index (RSI) is approaching the overbought territory, indicating that the pair may be nearing a correction. If the RSI continues to fall, it could signal a deeper pullback in the pair.

MACD and Key Levels

The Moving Average Convergence Divergence (MACD) shows a slight bearish crossover, reinforcing the downtrend in USDJPY. Immediate resistance is at 148.00, while support is seen around 147.00. A break below 147.00 could lead to further downside, with the next key support level at 146.50.

---

Conclusion

USDJPY is likely to experience a slight bearish bias today due to a combination of dovish Federal Reserve expectations, soft U.S. economic data, and a risk-on market sentiment that favors the Japanese yen. Traders should monitor key support levels and watch for any changes in U.S. economic conditions or global risk sentiment, as these factors will play a crucial role in determining the pair’s movement in the short term.

---

SEO Tags:

- #USDJPYforecast

- #USDJPYanalysis

- #USDJPYtechnicalanalysis

- #ForexTradingUSDJPY

- #USDBearishOutlook

- #JPYstrength

- #USDJPYtoday

- #ForexMarketAnalysis

- #USDJPYprediction

USDJPY Daily Analysis: Slight Bearish Bias Amid Dollar Weakness USDJPY Daily Analysis: Slight Bearish Bias Amid Dollar Weakness and Yen Resilience 02/12/2024

Introduction

The USDJPY pair is projected to lean slightly bearish today, driven by continued U.S. dollar (USD) weakness and the Japanese yen’s (JPY) resilience as a safe-haven asset. With risk sentiment in flux and U.S. Treasury yields declining, the pair faces downward pressure. This article provides an in-depth analysis of the fundamental and technical factors shaping USDJPY’s outlook for the day.

---

Key Drivers Influencing USDJPY

1. Weak U.S. Dollar Sentiment

The USD remains under pressure following last week’s dovish remarks from Federal Reserve officials, which signaled a pause in interest rate hikes. With market expectations of monetary easing in 2025 growing, the dollar’s attractiveness continues to decline, weighing on USDJPY.

2. Japanese Yen's Safe-Haven Demand

The JPY is benefiting from its status as a safe-haven currency amid lingering global uncertainties. Concerns about geopolitical tensions and slower global growth are keeping investors cautious, favoring the yen over the dollar.

3. Declining U.S. Treasury Yields

Lower U.S. Treasury yields are eroding the yield advantage of the USD against the JPY. The 10-year Treasury yield has fallen below key levels, diminishing the carry trade appeal that often supports USDJPY.

4. Economic Divergence

While Japan’s economic recovery remains modest, the stability in inflation and a cautious Bank of Japan (BoJ) monetary policy provide support for the yen. In contrast, slowing U.S. economic data, including weaker consumer spending and manufacturing activity, adds to bearish sentiment for USDJPY.

---

Technical Analysis

Moving Averages and RSI

USDJPY is trading below its 50-day moving average, reinforcing bearish momentum. The Relative Strength Index (RSI) is hovering near oversold territory, suggesting limited downside but no immediate reversal signals.

MACD and Key Levels

The MACD indicator shows a continuation of bearish momentum. Immediate support lies at 147.80, and a break below could target 147.00. Resistance is capped at 148.50, which may limit any corrective movements.

---

Conclusion

USDJPY is likely to exhibit a slight bearish bias today as fundamental factors such as dollar weakness, safe-haven demand for the yen, and declining U.S. Treasury yields align against the pair. Traders should remain cautious of intraday volatility driven by economic data releases or sudden risk sentiment shifts.

---

SEO Tags:

- #USDJPYforecast

- #USDJPYanalysis

- #USDJPYtechnicalanalysis

- #ForexTradingUSDJPY

- #JapaneseYenOutlook

- #USDWeakness

- #USDJPYtoday

- #ForexMarketAnalysis

- #USDJPYprediction

USDJPY Daily Analysis: Slight Bearish Bias Amid Dollar Weakness USDJPY Daily Analysis: Slight Bearish Bias Amid Dollar Weakness and Yen Resilience 29/11/2024

Introduction

The USDJPY pair is expected to exhibit a slight bearish bias today, driven by persistent U.S. dollar weakness and the Japanese yen's resilience as a safe-haven asset. Market participants remain cautious ahead of key economic events, while falling U.S. Treasury yields and geopolitical uncertainties provide additional support for the yen. In this article, we will delve into the fundamental and technical drivers shaping the USDJPY outlook for the day.

---

Key Drivers Influencing USDJPY

1. Weak U.S. Dollar

The U.S. dollar remains under pressure as investors continue to price in dovish Federal Reserve policies. Recent economic data pointing to slowing consumer activity and declining durable goods orders further weakens the greenback’s appeal, supporting a bearish outlook for USDJPY.

2. Japanese Yen Safe-Haven Appeal

The Japanese yen (JPY) continues to attract demand as a safe-haven currency amid global economic uncertainties. Persistent geopolitical risks and concerns about slowing global growth have led investors to favor the yen, exerting downward pressure on USDJPY.

3. Falling U.S. Treasury Yields

Declining U.S. Treasury yields, particularly on the 10-year note, reduce the dollar’s attractiveness in yield-sensitive pairs like USDJPY. Lower yields diminish the carry trade advantage, making the yen more appealing.

4. Bank of Japan's Stability

While the Bank of Japan (BoJ) maintains its accommodative monetary policy, steady inflation and economic stability support the yen. BoJ policymakers’ cautious approach to monetary tightening continues to provide implicit strength to the currency.

---

Technical Analysis

Moving Averages and RSI

USDJPY is trading below its 50-day moving average, indicating a bearish trend. The Relative Strength Index (RSI) remains neutral but leans toward oversold conditions, hinting at potential further downside.

MACD and Key Levels

The MACD indicator signals continued bearish momentum. Key support lies at 147.00, with a break below this level potentially targeting 146.50. Immediate resistance is seen at 148.20, which may cap any intraday recoveries.

---

Conclusion

USDJPY is likely to maintain a slight bearish bias today as weak U.S. dollar dynamics and strong demand for the yen weigh on the pair. Traders should keep an eye on any unexpected shifts in risk sentiment or economic data releases that could influence intraday volatility.

---

SEO Tags:

- #USDJPYforecast

- #USDJPYanalysis

- #USDJPYtechnicalanalysis

- #ForexTradingUSDJPY

- #JapaneseYenOutlook

- #USDWeakness

- #USDJPYtoday

- #ForexMarketAnalysis

- #USDJPYprediction

USDJPY Daily Analysis: Slight Bearish Bias Expected Amid Dollar USDJPY Daily Analysis: Slight Bearish Bias Expected Amid Dollar Weakness and Yen Strength 28/11/2024

Introduction

The USDJPY pair is poised for a slight bearish bias today, driven by continued weakness in the U.S. dollar and growing demand for the Japanese yen (JPY). Factors such as falling U.S. Treasury yields, dovish Federal Reserve expectations, and geopolitical uncertainties favor the yen’s appreciation against the greenback. This analysis outlines the fundamental and technical factors shaping the USDJPY outlook for the day.

---

Key Drivers Influencing USDJPY

1. Weak U.S. Dollar

The U.S. dollar is under pressure as market participants price in a prolonged pause in Federal Reserve rate hikes. Recent U.S. economic data, including a decline in durable goods orders and consumer sentiment, reinforces the dovish tone, limiting the dollar’s strength against the yen.

2. Japanese Yen Safe-Haven Appeal

The Japanese yen benefits from its status as a safe-haven currency amid lingering global economic uncertainties. Investors seeking stability are increasing their exposure to the yen, further driving USDJPY lower.

3. Declining U.S. Treasury Yields

U.S. Treasury yields continue to trend lower, reflecting reduced market expectations for future rate hikes. The 10-year yield, in particular, has fallen to multi-week lows, diminishing the attractiveness of the dollar in yield-sensitive currency pairs like USDJPY.

4. Japan’s Stable Monetary Policy Outlook

While the Bank of Japan (BoJ) maintains its ultra-loose monetary policy, steady domestic inflation data and a resilient labor market lend implicit support to the yen, providing a counterbalance to the dollar’s weakness.

---

Technical Analysis

Moving Averages and RSI

USDJPY is trading below its 50-day moving average, indicating a bearish trend. The Relative Strength Index (RSI) is near neutral levels but trending downward, suggesting potential for further downside.

MACD and Key Levels

The MACD indicator remains in bearish territory, pointing to sustained selling pressure. Immediate support is seen at 147.20, with a break below potentially opening the door to the 146.50 level. Resistance is located at 148.50, which could cap any short-term rebounds.

---

Conclusion

The USDJPY pair is expected to exhibit a slight bearish bias today, influenced by a weaker U.S. dollar, stronger demand for the Japanese yen, and falling Treasury yields. Traders should monitor key economic releases and shifts in risk sentiment, which could impact intraday movements.

---

SEO Tags:

- #USDJPYforecast

- #USDJPYanalysis

- #USDJPYtechnicalanalysis

- #ForexTradingUSDJPY

- #JapaneseYenOutlook

- #USDWeakness

- #USDJPYtoday

- #ForexMarketAnalysis

- #USDJPYprediction

USDJPY Daily Analysis: Slight Bearish Bias Expected Amid WeakUSDJPY Daily Analysis: Slight Bearish Bias Expected Amid Weak U.S. Dollar and Safe-Haven Yen Demand 27/11/2024

Introduction

The USDJPY pair is anticipated to hold a slight bearish bias today as macroeconomic and geopolitical factors weigh on the U.S. dollar while favoring the Japanese yen. With falling U.S. Treasury yields, dovish Federal Reserve expectations, and steady demand for safe-haven assets, the yen gains a tactical advantage over the greenback. Let’s delve into the fundamental and technical factors shaping the USDJPY outlook for today.

---

Key Drivers Influencing USDJPY

1. Weaker U.S. Dollar

The U.S. dollar remains under pressure as markets digest weak economic data, including slowing consumer confidence and subdued retail sales. These reports reinforce expectations that the Federal Reserve will maintain a dovish stance on monetary policy, limiting the dollar’s upside potential.

2. Strengthening Japanese Yen

The Japanese yen (JPY), often seen as a safe-haven currency, is benefiting from subdued risk sentiment in global markets. Investors seeking refuge amid lingering uncertainties in economic recovery and geopolitical tensions are turning to the yen, bolstering its value against the dollar.

3. Falling U.S. Treasury Yields

Declining yields on U.S. Treasuries continue to exert downward pressure on USDJPY. The 10-year yield has dipped as markets price in lower growth prospects and anticipate potential Federal Reserve rate cuts in 2025. This reduces the appeal of the dollar in yield-sensitive pairs like USDJPY.

4. Japan’s Steady Economic Data

Japan’s economy shows resilience, supported by consistent industrial output and improving labor market conditions. These factors strengthen the yen’s position against the dollar.

---

Technical Analysis

Moving Averages and RSI

USDJPY is trading below its 50-day moving average, signaling a bearish trend. The Relative Strength Index (RSI) is neutral but trending toward the oversold region, suggesting potential for further downside.

MACD and Key Levels

The MACD indicator remains in bearish territory, highlighting sustained downward momentum. Key support is observed at 147.00, while resistance lies at 148.30. A breach below 147.00 could accelerate bearish momentum toward the next major level at 145.80.

---

Conclusion

USDJPY is poised for a slight bearish bias today, driven by the weakening U.S. dollar, safe-haven yen demand, and falling U.S. Treasury yields. Traders should keep an eye on upcoming economic releases from the U.S. and Japan, as well as any shifts in global risk sentiment, which could influence intraday movements.

---

SEO Tags:

- #USDJPYforecast

- #USDJPYanalysis

- #USDJPYtechnicalanalysis

- #ForexTradingUSDJPY

- #JapaneseYenStrength

- #USDWeakness

- #USDJPYtoday

- #ForexMarketOutlook

- #USDJPYprediction

USDJPY Daily Analysis: Slight Bearish Bias Anticipated Amid Yen USDJPY Daily Analysis: Slight Bearish Bias Anticipated Amid Yen Strength and U.S. Dollar Weakness 26/11/2024

Introduction

USDJPY is expected to exhibit a slight bearish bias today as market dynamics favor the Japanese yen over the U.S. dollar. The yen's safe-haven status, coupled with declining U.S. Treasury yields and dovish Federal Reserve expectations, continues to apply downward pressure on the pair. This article explores the key fundamental and technical factors shaping the USDJPY outlook.

---

Key Drivers Influencing USDJPY

1. Japanese Yen’s Safe-Haven Appeal

The Japanese yen (JPY) remains supported by its safe-haven status, attracting investors amid persistent global economic uncertainties. Despite a modest improvement in risk sentiment, the yen continues to draw strength from its traditional role as a hedge against volatility, particularly as market participants look for stability.

2. Weaker U.S. Dollar

The U.S. dollar (USD) is under significant pressure due to dovish Federal Reserve policy expectations. Recent economic data, including subdued inflation and slowing retail sales, have reinforced market beliefs that the Fed will refrain from tightening monetary policy further, reducing the dollar’s appeal against the yen.

3. Falling U.S. Treasury Yields

U.S. Treasury yields are declining as markets price in stable interest rates and potential economic slowing in the U.S. Lower yields make the dollar less attractive to investors, further contributing to the bearish bias in USDJPY.

4. Improved Japanese Economic Data

Recent economic reports from Japan have painted a picture of gradual recovery, with improvements in industrial production and consumer sentiment. This strengthens the yen and adds additional downward pressure on USDJPY.

---

Technical Analysis

Moving Averages and RSI

USDJPY is trading below its 50-day moving average, signaling sustained bearish momentum. The Relative Strength Index (RSI) remains neutral but is trending lower, leaving room for further downside.

MACD and Key Levels

The MACD indicator continues to show a bearish crossover, indicating strong downward momentum. Immediate support lies at 146.50, while resistance is seen at 148.50. A break below the support level could lead to further declines toward the 145.00 level.

---

Conclusion

With the Japanese yen’s safe-haven appeal, weakening U.S. dollar, and falling Treasury yields, USDJPY is expected to maintain a slight bearish bias today. Traders should monitor global economic developments and any potential surprises in U.S. or Japanese economic data that could impact market sentiment.

---

SEO Tags:

- #USDJPYforecast

- #USDJPYanalysis

- #USDJPYtechnicalanalysis

- #ForexTradingUSDJPY

- #JapaneseYenStrength

- #USDWeakness

- #USDJPYtoday

- #ForexMarketOutlook

- #USDJPYprediction

USDJPY Daily Analysis: Slight Bearish Bias Expected Amid Yen USDJPY Daily Analysis: Slight Bearish Bias Expected Amid Yen Strength and U.S. Dollar Weakness 25/11/2024

Introduction

USDJPY is anticipated to exhibit a slight bearish bias today, influenced by the Japanese yen's safe-haven appeal, falling U.S. Treasury yields, and ongoing weakness in the U.S. dollar. With risk sentiment stabilizing globally and dovish Federal Reserve expectations weighing on the greenback, this pair's downside bias becomes increasingly apparent. In this analysis, we explore the fundamental and technical drivers shaping USDJPY’s market outlook.

---

Key Drivers Influencing USDJPY

1. Japanese Yen’s Safe-Haven Strength

The Japanese yen (JPY) remains supported by its safe-haven status, attracting investors amid persistent uncertainties in global economic growth. Despite a mild improvement in risk sentiment, the yen continues to benefit from its status as a reliable hedge, especially as market participants reduce exposure to riskier assets.

2. Weakening U.S. Dollar

The U.S. dollar (USD) is under pressure as expectations of further Federal Reserve rate hikes diminish. Recent U.S. economic data, including subdued inflation figures and slower retail sales growth, have reinforced the view that the Fed will maintain a dovish policy stance. This reduces the dollar's appeal against the yen.

3. Falling U.S. Treasury Yields

U.S. Treasury yields have declined in recent sessions as markets adjust to expectations of stable interest rates. Lower yields reduce the attractiveness of the USD, further supporting the bearish bias for USDJPY.

4. Geopolitical and Global Risk Sentiment

While geopolitical tensions have eased somewhat, the Japanese yen remains favored due to its consistent historical performance during periods of economic uncertainty. Stabilization in global markets hasn’t eroded the yen’s demand, particularly against the weaker dollar.

---

Technical Analysis

Moving Averages and RSI

USDJPY is trading below its 50-day moving average, a key signal of bearish momentum. The Relative Strength Index (RSI) is trending lower but has yet to reach oversold levels, suggesting room for additional downside moves.

MACD and Key Levels

The MACD indicator shows a bearish crossover, signaling downward momentum. Key support is at 147.00, while immediate resistance lies at 149.00. A sustained break below the 147.00 level could open the door for further declines.

---

Conclusion

Given the yen’s safe-haven appeal, ongoing dollar weakness, and declining U.S. Treasury yields, USDJPY is poised for a slight bearish bias today. Traders should monitor upcoming U.S. economic releases and global risk developments for potential volatility triggers.

---

SEO Tags:

- #USDJPYforecast

- #USDJPYanalysis

- #USDJPYtechnicalanalysis

- #ForexTradingUSDJPY

- #JapaneseYenStrength

- #USDWeakness

- #USDJPYtoday

- #ForexMarketOutlook

- #USDJPYprediction

USDJPY Daily Analysis: Slight Bearish Bias Expected Amid !!USDJPY Daily Analysis: Slight Bearish Bias Expected Amid Safe-Haven Yen Strength and Weak U.S. Dollar 22/11/2024

Introduction

USDJPY is anticipated to hold a slight bearish bias today as the Japanese yen benefits from its safe-haven appeal and the U.S. dollar remains under pressure due to dovish Federal Reserve expectations. Mixed global economic signals and declining U.S. Treasury yields are further weighing on the pair, while technical indicators suggest a continuation of the bearish momentum. This article highlights the key drivers shaping USDJPY and provides actionable insights for forex traders.

---

Key Drivers Influencing USDJPY Today

1. Safe-Haven Demand for the Japanese Yen

The Japanese yen (JPY) continues to attract demand as market participants navigate persistent geopolitical uncertainties and mixed global growth signals. Investors are gravitating toward safer assets like the yen, particularly amid concerns surrounding slowing U.S. economic momentum and fragile global risk sentiment.

2. Weak U.S. Dollar Amid Fed Dovishness

The U.S. dollar (USD) remains pressured following dovish comments from Federal Reserve officials. The market is increasingly pricing in a prolonged pause in rate hikes due to recent soft economic data, including lower retail sales and subdued inflation. This weakens the greenback’s appeal, contributing to USDJPY’s bearish outlook.

3. Declining U.S. Treasury Yields

U.S. Treasury yields have edged lower as markets adjust expectations for Fed monetary policy. Falling yields reduce the attractiveness of dollar-denominated assets, adding to the bearish bias for USDJPY.

4. Technical Indicators Align with Bearish Momentum

Technically, USDJPY has broken below key support levels, with indicators like the MACD and RSI signaling further downside potential.

---

Technical Analysis Indicators

Moving Averages and RSI

USDJPY is trading below its 50-day moving average, a clear sign of sustained bearish momentum. The Relative Strength Index (RSI) is edging closer to oversold territory, indicating that while further declines are possible, a consolidation phase might emerge.

MACD and Key Levels

The MACD indicator reflects a bearish crossover, confirming downward momentum. Immediate support for USDJPY is at 147.50, with resistance seen near 149.00.

---

Conclusion

With the Japanese yen gaining from safe-haven flows, a weaker U.S. dollar driven by dovish Fed expectations, and falling Treasury yields, USDJPY is expected to maintain a slight bearish bias today. Traders should monitor upcoming U.S. economic releases and shifts in global risk sentiment for potential volatility.

---

SEO Tags:

- #USDJPYforecast

- #USDJPYanalysis

- #USDJPYtechnicalanalysis

- #ForexTradingUSDJPY

- #JapaneseYenStrength

- #USDWeakness

- #USDJPYtoday

- #ForexMarketOutlook

- #USDJPYprediction