Crude to $75 Profit TargetYou all know I'm a 100% Chart driven trader.

But of course I also have my fundamental thoughts.

Here is my layman’s fundamental thesis:

I do not believe that Venezuelan oil will flood global markets, just because they grabed Maduro. On the contrary, the opposite is more likely. Venezuela’s production is dominated by heavy and extra-heavy crude, which is costly to extract and difficult to refine. As a result, an oversupplied market is unlikely from this point of view.

But with a U.S. military invasion of Iran could be very likely to drive oil prices higher, potentially sharply so. The effect would stem from supply risk, transportation chokepoints, and market psychology I think. Even if physical supply disruptions were initially limited. My experience is, that short-term crazy price moves are often driven by psychological factors.

So, in short:

1. Risk to the Strait of Hormuz (Primary Factor)

2. Potential loss or Threat of Iranian Oil Supply

3. Spillover Risk to Other Producers

4. Speculation and Financial Market Reaction

5. OPEC and Strategic Reserves Probably Very Limited

Sure, the magnitude would depend on duration, scope, and whether shipping through Hormuz remains uninterrupted, but upward price pressure would be immediate.

Timing is always the most difficult part. That’s why I would look at a trade with a horizon of at least three months, or longer (likely using ITM LEAP options).

The chart needs to confirm my thesis.

First, I want to see a break of the descending pressure line (red).

Next, the CIB line must be broken.

Finally, a sign of stabilization above the CIB line would serve as my entry signal.

That’s it. My stalker hat is on.

Crude Oil WTI

Oil Tries to Approach the $60 Level Once AgainOil prices have started the week with a notable bullish bias, posting gains of more than 1.5% in the short term. For now, buying pressure has remained firm, driven by rising geopolitical uncertainty stemming from growing tensions in Venezuela, which have begun to lift the risk premium for crude oil in the near term. Any scenario involving tighter U.S. sanctions, potential logistical disruptions, or direct frictions with the United States tends to immediately increase perceived risk in the oil market.

Venezuela remains a relevant global oil producer, so potential political disruptions could affect global crude supply in the short term. This dynamic appears to be influencing recent price action in the oil market. As long as uncertainty remains elevated, current buying pressure in WTI is likely to continue dominating price movements over the coming sessions.

The Bearish Trend Remains Relevant

Since June 20, 2025, average oil price movements have respected a well-defined bearish trendline, which continues to stand out as a key technical pattern on the chart. As long as buying pressure fails to clearly break above this structure, the bearish trend is likely to continue dominating market oscillations. However, a sustained breakout could pave the way for a more meaningful bullish bias, with prices holding above the 50-period simple moving average.

RSI

The RSI has managed to break above the neutral 50 level and maintains a consistent upward slope, indicating that average momentum over the past 14 sessions remains dominant. If the RSI continues to rise, it could reflect a renewed buying pressure in oil price action during the upcoming sessions.

MACD

Although the MACD remains relatively calm, its histogram has begun to hold above the zero line, suggesting that buying pressure is dominating short-term moving averages. As long as this behavior persists, it may continue to signal steady demand for oil in the short term.

Key Levels to Watch

$59 – Key resistance: A level where the bearish trendline converges with the 50-period simple moving average. Price action that manages to consolidate above this area could activate a dominant bullish bias, breaking the bearish structure that still attempts to prevail.

$57 – Nearby barrier: A recent neutrality zone. If price action once again consolidates around this level, it could signal the formation of a short-term sideways range.

$55 – Key support: The lowest level seen in recent weeks and the most relevant downside barrier to monitor. Selling pressure that pushes price back toward this area could revive a renewed bearish bias and extend the current bearish trendline.

Written by Julian Pineda, CFA, CMT – Market Analyst

WTI: Politics Just Entered the ChartLadies and gentlemen, if you're trading oil (WTI) right now, you're probably in one of the most sensitive periods of your trading life. Why? Trump just arrested Venezuela's leader a few days ago :) Odds of a strike on Iran are sky-high, Israel could jump in too + a ton of other factors that could spike massive volatility in the oil market over the next few weeks and make trading it brutal.

Let's break it down together.

Daily timeframe

We've got a super strong downward channel for ages, with most action hugging the upper side and midline—barely touching the channel floor in forever. Today's candle is straight-up engulfing the last three weak bearish ones to the upside, and with all the tension building, expect a sharp uptrend move soon.

Drop to 4H for real long/short triggers.

Short side: Killer trigger on break of support 56.463—it's held with strong reactions before. If it snaps, look for midline retest first, then channel floor test.

Long side: Riskier trigger at 58.731 break—could kick off the upside correction of this bearish channel. But since it'd be the first uptrend leg, keep risk low.

By the way, I’m Skeptic , founder of Skeptic Lab.

I focus on long-term performance through psychology, data-driven thinking, and tested processes.

Thanks for riding this idea—if it delivered value, hit that boost to keep the momentum rolling and follow to build the squad. Toss any symbol you want dissected in the comments, I'll handle it. 🩵

Now get outta here.

USOIL Sell Opportunity | Downtrend + Rising Venezuela Supply!Hey Traders,

In tomorrow’s trading session, we are closely monitoring USOIL for a potential selling opportunity around the 57.50 zone. USOIL remains in a well-defined downtrend and is currently in a corrective pullback, approaching a key trendline confluence and the 57.50 support-turned-resistance area, which could act as a strong rejection zone.

From a fundamental perspective, expectations that Trump’s takeover of Venezuela’s oil supply could increase global oil production may lead to higher supply in the market. According to basic supply and demand dynamics, an increase in supply—if not matched by demand—can put downward pressure on oil prices, reinforcing the bearish technical outlook.

As always, wait for confirmation and manage risk carefully.

Trade safe,

Joe.

$BRENT technicals in convegence between Fibonacci and TrendlineBLACKBULL:BRENT has been on a downtrend since last Summer...

Now the descending trend line is about to hit the bottom of the Fibonacci Retracement Levels.

This forms a triangle that we know can break either upward or downward - place your entry points and Stop-Loss points accordingly.

While I don't provide Fundamentals analysis, the latest turns of events with USA and Venezuela make me lean towards a break on the downside for more supply of Crude Oil available to the US.

(USOIL) 2H – Bullish Continuation After Trend ReversalThis 2-hour chart of WTI Crude Oil (USOIL) shows a clear transition from a prior downtrend into a structured bullish recovery. After forming a base near the mid-$55 area, price breaks structure (BOS) and establishes a steady uptrend, guided by an ascending channel.

The Ichimoku Cloud supports the bullish bias, with price trading above the cloud and the cloud turning positive. A clean pullback into a demand zone around 57.0–57.5 aligns with previous consolidation and cloud support, suggesting a potential buy-the-dip area.

Price is currently consolidating above a change in structure (CISD), indicating strength. Upside projections highlight two key resistance targets:

1st target: around 59.10

2nd target: near 60.45

As long as price holds above the demand zone and trend channel support, the bullish continuation scenario remains valid.

Could WTI could break $55 floor?Markets are gaining confidence in higher oil supply following the events in Venezuela at the weekend. Markets are pushing crude oil lower despite prices showing a bullish engulfing candle yesterday. Failure to rally on the back of yesterday's price action suggests crude prices could be heading lower instead. Let's see if that will be the case - it certainly looks that way so far in today's session. April's low near $55 was briefly broken in December, before prices bounced back. Now that area represent a pool of liquidity where traders who bought on the back of the double bottom pattern could be in trouble. A run on their stops - meaning a sharp drop below $55 - could be on the cards.

Fawad Razaqzada, market analyst with FOREX.com

OIL, 4 years in the making. a forceful break awaits. STRONG BUY!OIL is not for the faint hearted -- the constant abrupt shifting of prices made it almost untradeable.

Geopolitics, Economics, Dollar metrics -- and all fundamentally driven factors seem to have evaded any effect on OIL this past 4 years. Constantly headed south this past 4 years since January 2022.

Now, based on recent metrics that spans, 96 months.. we are seeing some major shift in structure hinting of an impending strong breakout. This ascending bend has only materialized after 2 years (referencing our diagram) -- with expanding upside pressure on its 4-year trend.

I Expect some expanding vertical momentum from here at 57 bargain area aiming for a 30-40% increase in price.

Factoring the geopolitics issues thats been arising lately -- the directional context of OIL finally waking up from its slumber is becoming clearer by the day.

Ideal seeding zone at the current price range. 57ish.

Target: 80.0

Long term. 100

WTI – This Trendline Keeps Price CappedPrice has reacted precisely from a descending trendline resistance, aligning with the broader bearish market structure. This level has consistently capped bullish attempts, making it a high-probability sell-side zone.

After the recent impulse up, price is showing signs of exhaustion below resistance, suggesting a potential lower high formation. As long as price remains below the trendline, bearish bias remains intact.

🔻 Sell Bias:

Rejection from trendline resistance favors continuation toward the downside.

🎯 Target:

A move lower is expected toward the marked sell-side target, with intermediate reactions possible before continuation.

📌 Invalidation:

A strong hourly close and acceptance above the descending trendline would invalidate this setup.

📌 Execution Plan:

Wait for bearish confirmation on the 1H timeframe (rejection candle, momentum slowdown, or lower high) before entering. Avoid chasing price into support.

CRUDE OIL REBOUND AHEAD|LONG|

✅WTI OIL reacts from a clean discount PD array after sell-side liquidity is swept. Strong bullish displacement suggests mitigation in progress, with price likely to retest demand briefly before expanding toward buy-side liquidity above. Time Frame 4H.

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Will Crude Oil Markets React to Maduro's Arrest: Trading Setup🚨 Crude oil could see a significant GAP with futures open! The impact of the "breaking news" regarding President Maduro's capture and extradition on "crude oil" prices, especially for the "market open" this Sunday.

The crude oil market is at a significant turning point as it tests the 57.32 level.

Technically, the price is squeezed between a firm resistance at 61.06 and a multi-month floor at 54.68.

While the recent arrest of Venezuela's president initially created a risk premium, analysts expect the long-term impact to be bearish if new investments eventually boost Venezuelan supply.

For now, the trend remains heavy, with rallies likely to find sellers near the 60.00 mark.

#CrudeOil #Trading #WTI #OPEC #EnergyMarket #Investing #MarketAnalysis

USOIL Outlook: Bearish Below 57.41 Despite Venezuela Supply RiskUSOIL (WTI) | Technical + Fundamental Snapshot

Fundamental driver to watch: Venezuela supply risk

Recent headlines are supply-supportive for crude:

Reuters reports Venezuela’s oil exports have come to a halt amid political turmoil and U.S. sanctions/embargo dynamics, with tankers stuck and storage nearing capacity—raising the risk of forced production cuts if exports remain blocked.

Reuters

Reuters also noted that Venezuelan oil facilities were operating normally and were not damaged in the reported U.S. operation—so the key risk is logistics/exports, not infrastructure destruction.

Reuters

For context, Reuters previously highlighted Venezuelan crude as roughly ~1% of global supply, which can still move prices at the margin when markets are thin or risk-sensitive.

Reuters

How this fits your chart: Venezuela tension can create spikes and whipsaws, but your structure still shows selling pressure below the pivot—so rallies may be corrective unless key levels break.

TECHNICAL VIEW

Timeframe: 6H

Current Price: ~57.32

Pivot Line: 57.41

Market Structure

Price is trading below the pivot (57.41) and making lower highs, which keeps the bias bearish.

Your projected path suggests a small corrective bounce, then continuation lower into the demand zone.

Scenarios

🔻 Bearish scenario (Primary)

Bias stays bearish while below 57.41

First target: 56.38

If price breaks/holds below 56.38, continuation toward the demand zone (~55.6–55.0 area) is likely (as you marked).

Next major support after that: 54.38

🔺 Bullish scenario (Invalidation)

A bullish shift needs a reclaim of the pivot and follow-through:

Hold above 57.41 first

Then a push above 58.69 increases the chance of a recovery toward:

60.16

61.83

Key Levels (Your Chart)

Pivot: 57.41

Resistance: 58.69 → 60.16 → 61.83

Support: 56.38 → 54.38 → 51.92

Conclusion

Even with Venezuela headlines supporting headline-driven spikes, your chart remains technically bearish below 57.41, favoring a move toward 56.38 and potentially the 55.xx demand zone, unless price reclaims the pivot and breaks higher.

Oil volatility: First short entry point at $60.23The job was done!

Trump kept his word — military action against Venezuela has begun.

Frankly, this was predictable.

Monday’s open will be extremely volatile — especially for oil and the U.S. dollar I suppose.

🔍 Now, let’s get more specific.

This military operation was expected, even pre-planned.

And It won’t reverse the existing downward trend in oil.

So here’s my plan:

I’ll short oil on rallies — but with reduced lot size and leverage, keeping room to add if price goes higher.

Why?

Because panic spikes happen — but they’re often short-lived.

📌 My entry zone starts at the ER level — $60.23 futures (marked on the chart).

That’s where I’ll place my first scaled-in short, carefully and calmly.

P.S. The ER formula is available on the CME exchange's website, and in just a few minutes, you can input the data to get incredible results. It’s truly amazing!

The Venezuelan EffectIn this video I going to exhibit the effect of the the profound economic crisis in Venezuela and its broader global implications. WTI, BRENT, BA, EXXON, LOCHKEADMARTIN

Overview of the Crisis

The video details Venezuela's transition from being the wealthiest nation in South America to a country grappling with extreme hyperinflation and economic collapse . It highlights how the nation's heavy reliance on oil exports—accounting for nearly 95% of its export earnings—made it uniquely vulnerable to fluctuations in global oil prices .

Key Economic Factors

The Resource Curse: The video explains how "Dutch Disease" occurred, where the focus on oil led to the neglect of other sectors like agriculture and manufacturing .

Hyperinflation: It discusses the catastrophic devaluation of the Bolívar, which led to a scenario where basic necessities became unaffordable for the average citizen .

Government Policy: The narrative touches upon the impact of price controls, nationalization of industries, and the role of political instability in exacerbating the financial downturn .

The Human and Global Impact

Mass Migration: A significant portion of the video is dedicated to the massive exodus of Venezuelans seeking better opportunities in neighboring countries, creating a regional humanitarian challenge .

Geopolitical Shifts: It explores how Venezuela’s situation has influenced regional politics and energy markets worldwide .

The video concludes by analyzing the current state of the Venezuelan economy and whether recent shifts in policy or international relations offer a path toward stabilization .

Oil Risk-Premium Phase, Geopolitical-Driven Upside Move📝 Description

Crude Oil on H4 is trading inside a bearish HTF structure, but recent price action shows a corrective recovery driven by rising geopolitical risk. The current move looks reactionary, not impulsive, with price responding to risk-premium flows rather than a confirmed structural shift. Market remains sensitive around key HTF PD Arrays.

________________________________________

📈 Analysis (Scenario-Based | Non-Signal)

Primary Scenario (Risk-Premium Driven):

• Rising US–Venezuela tensions are adding a clear risk premium to oil prices

• Initial upside moves are headline-driven spikes fueled by hedging and speculation

• Price is reacting to expectations, not confirmed supply disruptions

Short-Term Market Behavior:

• Short-term bias remains bullish with elevated volatility

• Pullbacks are likely liquidity-driven corrections, not reversals

• These moves help reset positioning before continuation

Structural Context:

• No confirmed HTF CHOCH + BOS so far

• Structure remains corrective within the broader range

________________________________________

🎯 ICT & SMC Notes

• Upside moves classified as risk-premium reactions, not structural breakouts

• Corrections viewed as liquidity accumulation phases

• HTF PD Arrays remain dominant reference points

________________________________________

🧩 Summary

Oil is trading in a risk-premium environment driven by US–Venezuela tensions. Short-term bias remains bullish, with upside spikes fueled by hedging and speculation. Pullbacks are likely liquidity resets, not trend reversals, keeping the structure tilted higher despite volatility.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

Say hello to oil prices at 40 to 50 dollars.Say hello to oil prices at 40 to 50 dollars.

Considering that the Venezuelan government has collapsed, and that major investments will flow into Venezuela in the near future, it can be said that oil prices will experience a sharp decline, and Iranian and Russian oil will become the cheapest oil in the world.

Oil Traders Watch This Breakdown Level Carefully🔻 XTI/USD (WTI / USOIL) — Bearish Breakout Trade Blueprint

Energies Market | Day / Swing Trade Opportunity

📌 Asset Overview

XTI/USD – WTI Crude Oil vs U.S. Dollar

Market Type: Energy Commodity (CFD / Futures correlated)

Trading Style: Day Trade / Swing Trade

🧭 Trade Plan

🔴 Primary Bias: BEARISH BREAKOUT CONTINUATION

Price has completed a structure breakdown, confirming seller dominance after failed bullish recovery. Momentum favors downside continuation as liquidity shifts below key levels.

🎯 Entry Strategy

📍 Sell AFTER confirmed breakout below → 56.80

• You may enter at any price level after breakout confirmation

• Aggressive traders: enter on breakdown momentum

• Conservative traders: wait for a pullback retest below 56.80

Execution depends on your risk model & position sizing.

🛑 Stop Loss (Risk Control)

🚨 Protective SL: 58.00

⚠️ This is a reference level, not a mandatory rule.

Adjust your stop placement based on:

Timeframe

Volatility

Account risk parameters

🎯 Profit Objective

🎯 Primary TP Zone: 55.80

Why this zone matters:

• Strong historical support

• Oversold reaction area

• High probability of short-covering

• Correction + liquidity trap zone

⚠️ Partial profits are advised as price approaches this region.

🔎 Key Technical Drivers

✔️ Breakdown below key structure

✔️ Lower highs + lower lows

✔️ Momentum shift favoring sellers

✔️ Failed bullish continuation

✔️ Liquidity sweep completed above range

🌍 Related Markets to Watch (Correlation Map)

💵 USD-Linked Instruments

DXY (U.S. Dollar Index) → Strong USD often pressures oil prices

USD/CAD → Inverse correlation (CAD = oil-linked currency)

📉 Risk & Macro Assets

US10Y Treasury Yields → Rising yields = pressure on commodities

S&P 500 / US Indices → Risk-off sentiment weighs on energy demand

🛢️ Energy Complex

Brent Crude (UKOIL) → Confirms directional bias

Energy Sector Stocks → Weakness confirms oil downside momentum

📰 Fundamental & Economic Factors Supporting This Trade

⚖️ Macro Environment

• Demand concerns from global growth slowdown

• Stronger USD reducing commodity attractiveness

• Tight financial conditions limiting speculative inflows

🛢️ Oil-Specific Factors

• Inventory sensitivity remains elevated

• Market reacts sharply to supply-demand imbalance

• Volatility increases near key economic releases

📅 Upcoming Market Sensitivities

• U.S. inflation data

• Federal Reserve policy expectations

• Energy inventory updates

• Global growth & demand outlook commentary

Expect volatility spikes around high-impact macro releases.

⚠️ Risk Disclaimer

This analysis is not financial advice.

Stop loss and take profit levels are guidelines only.

Every trader must manage risk according to their own strategy.

👍 If this analysis adds value

• Drop a LIKE 👍

• Share your view in comments 💬

• Follow for consistent energy market breakdowns 📈

Natural Gas Is Hibernating Ahead of an Upcoming SwingToday, we will discuss why natural gas is hibernating ahead of an upcoming swing. We will deep dive into:

1) the impact of inflation on commodity prices,

2) the technical outlook, covering both long-term and short-term perspectives, and

3) the fundamental confirmation of this view, based on the “Five Things to Watch in Energy Markets in 2026.”

Henry Hub Natural Gas Futures & Options

Ticker: NG

Minimum fluctuation:

0.001 per MMBtu = $10.00

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

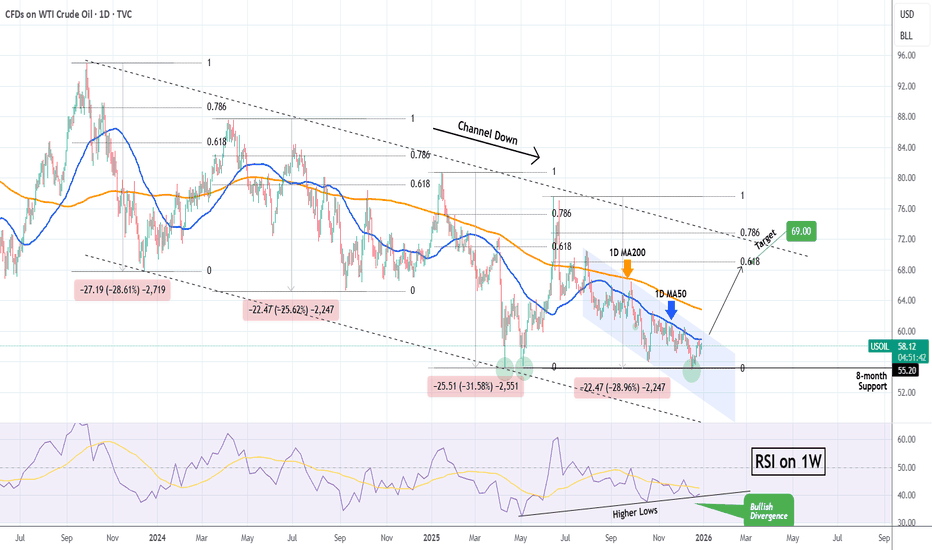

WTI OIL Strong case for a 2-month rally.WTI Oil (USOIL) has been trading within a Channel Down since the September 28 2023 High. Since then, it as had four Bearish Legs (including the current one), which declined on a range of -25.62% to -31.58%. All subsequent rebounds (Bullish Legs) that followed, hit at least their 0.681 Fibonacci retracement levels.

Given that the price rebounded 2 weeks ago on the 8-month Support (55.20) and the 1W RSI has been on Higher Lows (i.e. Bullish Divergence) since May, we may see a new Bullish Leg emerging now.

The one condition that will confirm that will be the price breaking above the blue Channel Down. If that takes place, we will turn bullish for the next two months, targeting $69.00 (Fib 0.618).

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USOIL WILL GO DOWN|SHORT|

✅WTI OIL trades into a clear premium supply zone after buy-side liquidity was taken. Weak bullish follow-through and rejection suggest smart money distribution, favoring a downside move toward resting sell-side liquidity below. Time Frame 6H.

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Hellena | Oil (4H): SHORT to support area of 55.74 (Wave 5).Colleagues, wave “4” of the minor order is ending or has already ended. As part of a major downward movement in wave ‘5’ of the major movement, I expect a downward movement in wave “5” of the minor order.

This wave should update the low of wave “3”, but I believe it is worth looking at the nearest target in the support area of 55.746.

I also allow for the possibility of reaching the 59.00 area before the price begins a downward movement.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!