WAR

Gold a beginning of a crash? | Market outlookConfident support for the instrument is provided by the fact that investors flee from risk against the backdrop of a noticeable deterioration in the situation in Eastern Europe. Early in the morning, Russian President Vladimir Putin authorized a special military operation on the territory of Donbass. Today, a large block of macroeconomic statistics from the US is expected to be published, but it is possible that investors will leave it without due attention. An exception, perhaps, can only be annual data on GDP dynamics for Q4 2021. At the same time, these will be only updated data, and in case of minor changes, the market reaction will obviously be restrained.

Cup And HandleWhat do we have?

1) A pattern beloved by all boomers - Cup and Handle

2) Money printing because of covid and war

3) Mass draft and mobilisation of russian citizens who was serving in the army (90% of them did) happening since today

4) Potential North Korea and Russia Alliance to revenge for Korean War

5) Maximum panic and end of the world in the head of traders is possible, 69% chance

Something is going to break, DXY or SPX500 take your pick IIDecision time, eminent, could not stress it more, options:

1. The DXY topped, it will break down slowly but respecting a downwards path, like oil has done, in this case the SPX500 will break up.

2. Otherwise the SPX500 will break down and it will be in a massive recessionary 2008 move downwards, breaking the June lows and, a sign that something has gone sour in the street economy, but it has to be something big, it can also be another war, and trouble is coming in the next months/years

XAUUSD SHORT TO 1747A possible shorting opportunity on Gold down towards our buying zone. On the smaller timeframe, Gold has completed a 5 wave move, so I am now expecting a pullback down towards 1746 in order for market to fill the imbalance.

A nice 500 PIPS (2.85%) possible gain from this sell opportunity.

Drop a like and follow if you agree, or do let me know what you think!

BTC Relief Rally to 27k incoming?Here's just a quick look at the weekly BTC chart (Not a detailed analysis):

The market has held the 22.5k level very well and a relief rally to 27k is expected at this level before we see more downside! The downside concerns arise from the China - USA tensions, and if Taiwan gets attacked by China, we may see massive south-going price action. Trade safe!

-------------------------------------------

What Is a Wedge in the context of trading?:

"A wedge is a price pattern marked by converging trend lines on a price chart. The two trend lines are drawn to connect the respective highs and lows of a price series over the course of 10 to 50 periods. The lines show that the highs and the lows are either rising or falling and differing rates, giving the appearance of a wedge as the lines approach a convergence. Wedge-shaped trend lines are considered useful indicators of a potential reversal in price action by technical analysts.

Key Takeaways for Falling wedges:

1. Wedge patterns are usually characterized by converging trend lines over 10 to 50 trading periods.

2. The patterns may be considered rising or falling wedges depending on their direction.

3. These patterns have an unusually good track record for forecasting price reversals."

-------------------------------------------

If you like the content, then make sure to comment and like the post :D

Follow me for daily profitable trading setups

BTC dictates the market. If BTC falls, then Alts will fall as well. Trade safe!

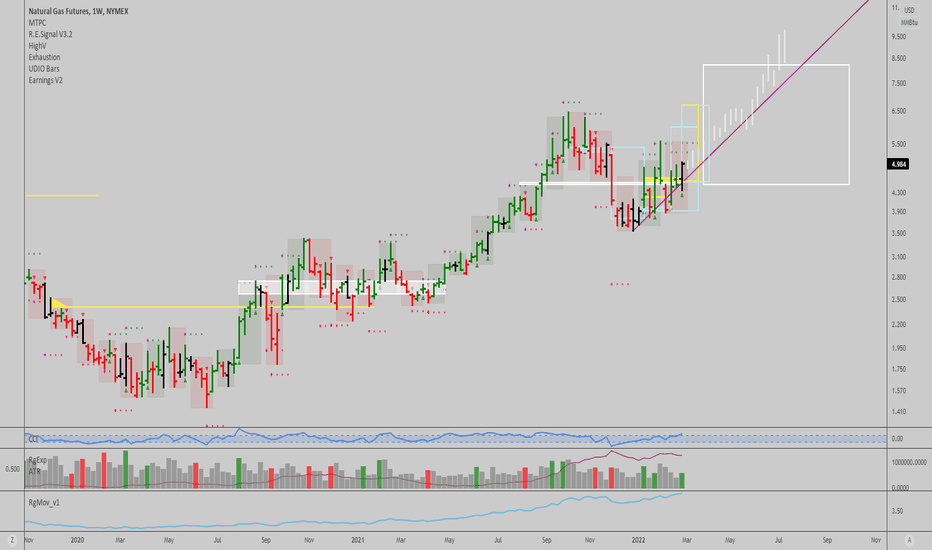

$NGAS: Natural gas can go 90% higher from hereIt's clear Nat Gas can gain traction fast here, I'm long since yesterday, via $UNG shares. Looking to add an options position here, since weekly charts are now bullish, I pre-emptively took a trade based on a daily signal, speculating on the weekly and eventually monthly kicking off. I commented about it in the Key Hidden Levels chatroom here and offered it to my clients as a signal as well.

With last night's shelling of a nuclear plant, escalation seemed likely, and the next step could be to enact sanctions on natural gas exports, which could deal a blow to supply and create a dramatic move to the upside as a side effect. Fundamentals aside, reward to risk and probability are on our side, so it's a good idea to get some decent exposure here.

Cheers,

Ivan Labrie.

Bearish market is not overWe are not at the bottom of a bearish trend because the bottom does not allow you to buy and trade.as i predicted btc is now dependent on fundamental news !If you want to predict BTC price you just have to follow war news and federal reserve! my advice is just trade in this area but make your own decision on every move

GOLD - Strong Rejection Ahead!Hello TradingView Family / Fellow Traders. This is Richard, as known as theSignalyst.

GOLD is overall bearish trading inside our orange channel, however , it is approaching a strong support area 1675 - 1700

Moreover, the lower orange trendline acts as non-horizontal support.

Thus, the highlighted purple circle is a strong area to look for buy setups as it is the intersection of the blue support zone and lower orange trendline.

As per my trading style:

As GOLD approaches the purple circle, I will be looking for reversal bullish setups (like a double bottom pattern, trendline break , and so on...)

Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

No Saving The EURO Against A Super Strong Greenback!Fundamentally & Technically there is likely NO HOPE of saving the EURO!

Fundamentally if you read the news, there is not even a glimmer of hope to save the EURO in the near term against a strong greenback! Here we focus on the technical side of the things. Currently the price is accelerating to the downside towards the support of 0.98000 region. Therefore once this level breaks the next support/ demand zone could be found near 0.86000 region!

Looking at the main chart, there are so many resistances that is capping the gains in the EURO especially the descending multi-month trendline!. Therefore as the price approaches this crucial support of 0.98000, it would be wise to await for this level to break. This would give us much confluence that the price is likely headed lower.

Have a look at the main chart and observe for full understanding. you can also view the weekly EURUSD and notice the descending trend where various resistances are present.

Bitcoin Bear Targets in case Ukraine x Russia tensions riseUntil the rising of the tensions between Ukraine and Russia, I was bullish about Bitcoin because of the fundamentals and on chain analysis. Now that my hopes on a diplomatic solution fades as war is in fact happening, my vision tends to change to a more bearish scenario. So I made a very simple analysis based on price levels and volume and the head and shoulders figure that was upsetting me and a lot of people on the market.

$CVX CHEVRON WYCKOFF plus INVERSE HEAD and SHOULDER Pattern$CVX Chevron Corp

This is one of my favorite charts because it had a clear UPTHRUST WYCKOFF DISTRIBUTION PATTERN and I was able to short the full measured move down without a sweat and share that with my friends, yay money!

Chevron has completed the full measured move down on the WYCKOFF distribution pattern and is showing signs of accumulation. A few things to note below:

1. Warren Buffet loaded on Chevron.

2. Supply on oil is still low and the demand is high. The government policy on oil refineries doesn't help the supply.

3. The Russia War on Ukraine is still in full effect. (prayers)

4. Their earnings lag, however, this stock will move significantly on news that directly effects these headlines.

5. It is a dividend paying stock, I believe the news will try hard to beat it down so hedge funds can load up.

Like I mentioned above, $cvx appears to be in accumulation, it has formed a decent consolidation pattern.

If you zoom into the 4 hour timeframe you will find a beautiful INVERSE HEAD & SHOULDER pattern developing (flip from bars to line chart for a different view).

The left shoulder shows the highest selling volume bar and checks the box of a textbook inverse H&S.

However, if this pattern fails, I have setup some support levels below.

This one will be on the top of my watchlist next week!