Nikkei 225 4H: Bullish Bias with Ending Diagonal in Play🇯🇵 Nikkei 225 (JP225) - 4H Chart - Jan 9, 2026

① Bias: Bullish ⤴️

As long as the price holds around 51,868, upside potential remains intact for now.

However, strong resistance is expected near 52,416, where the price could be rejected.

② Main Count:

Possible Ending Diagonal in progress from the Nov 21 low.

Currently viewing wave (v) as forming zigzag a-b-c, with wave a underway.

③ Key Levels:

Support: ~51,868

Resistance: ~52,416

④ Invalidation:

Count invalidated on a daily close below 51,048.

→ As long as this level holds, upside room remains.

⑤ Alternative:

Even if 51,048 is breached, an immediate bearish reversal is not highly likely (rebound potential remains).

On the other hand, if price approaches ~52,651 with minimal volatility, a top formation becomes more probable upon touch — stay cautious.

The key in the near term is defense of the 51,868 zone.

Stay calm and don't get shaken by short-term volatility.

THINK SIMPLE 📈

#Nikkei225 #Nikkei #JP225 #ElliottWave #TechnicalAnalysis #EndingDiagonal #TradingView

Wave Analysis

$SPY & $SPX Scenarios — Friday, Jan 9, 2026🔮 AMEX:SPY & SP:SPX Scenarios — Friday, Jan 9, 2026 🔮

🌍 Market-Moving Headlines

• 🚨 Jobs Day: Payrolls, unemployment, and wages hit together — the single most important macro catalyst of the week.

• Labor cooling vs resilience: Markets assess whether hiring strength holds without reigniting wage pressure.

• Rates and risk reset: Payrolls outcome will drive front-end yields, equity multiples, and January positioning.

• Housing check: Starts and permits add context on rate sensitivity in real economy demand.

📊 Key Data & Events (ET)

8 30 AM — Labor and Housing

• U.S. Employment Report Dec: 73,000

• Unemployment Rate Dec: 4.5 percent

• Hourly Wages Dec: 0.3 percent

• Hourly Wages Year over Year: 3.6 percent

• Housing Starts Oct: 1.33 million

• Building Permits Oct: 1.34 million

10 00 AM

• UMich Consumer Sentiment Jan: 53.4

⚠️ Disclaimer: For informational use only — not financial advice.

📌 #SPY #SPX #JobsReport #NFP #wages #labor #macro #markets #trading

S&P500(SPX500) 4H: Bullish | Ending Diagonal in Play【1/8 S&P500 (SPX500) 4H Chart】

① Bias: Bullish

If it holds around 6892.15, expect further upside

② Main Count:

Flat correction (A-B-C) in progress from the 10/30 decline

Currently, from the 11/21 low, a double zigzag (w-x-y) is unfolding

Likely forming wave 5 of an ending diagonal in (y)'s c-wave

③ Key Levels:

Support: Around 6892.15 Resistance: Around 6961.93

④ Invalidation:

Invalidated on a daily close below 6885.94

⑤ Alternative:

Shift to Bearish if breaks below 6885.94

THINK SIMPLE

#SPX500 #SP500 #ElliottWave #StockMarket #TechnicalAnalysis #CFDTrading #Investing #Trading

GBPUSD - Looking for the StopSince the correction went slightly deeper than expected, let’s define where price may stop.

It’s still too early to say with full confidence that a deep correction has already started. Price may push a bit higher first and only then transition into a broader corrective move.

Key levels to watch:

1.336 - local corrective area

1.329 / 1.324 - potential reversal zones

---

Please subscribe and leave a comment.

You’ll get new information faster than anyone else.

---

GBPJPY: Expecting Bearish Continuation! Here is Why

It is essential that we apply multitimeframe technical analysis and there is no better example of why that is the case than the current GBPJPY chart which, if analyzed properly, clearly points in the downward direction.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

COIN Short-term analysis | Trading and expectationsNASDAQ:COIN

🎯 Price appears to have completed wave C of 2, a corrective pattern to the downside, filling the gap left in May 2024. Coin recovered above the daily pivot, but below the daily 200EMA so direction is ambigous.

📈 Daily RSI has printed bullish divergence from oversold, a strong bottoming signal.

👉 Analysis is invalidated below wave C, $220, keeping the downtrend alive.

Safe trading

CHFJPY The Target Is DOWN! SELL!

My dear friends,

My technical analysis for CHFJPY is below:

The market is trading on 197.00 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 196.69

Recommended Stop Loss - 197.19

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

$PLTR — Bulls and bears still battling, but doesn't change anythNASDAQ:PLTR — Bulls and bears still battling. Traded it a few times, but currently still short.

Valuation remains stretched relative to fundamentals, with growth already well-telegraphed and expectations high. Intensifying competition this year is likely.

I still expect a move back to double digits this year.

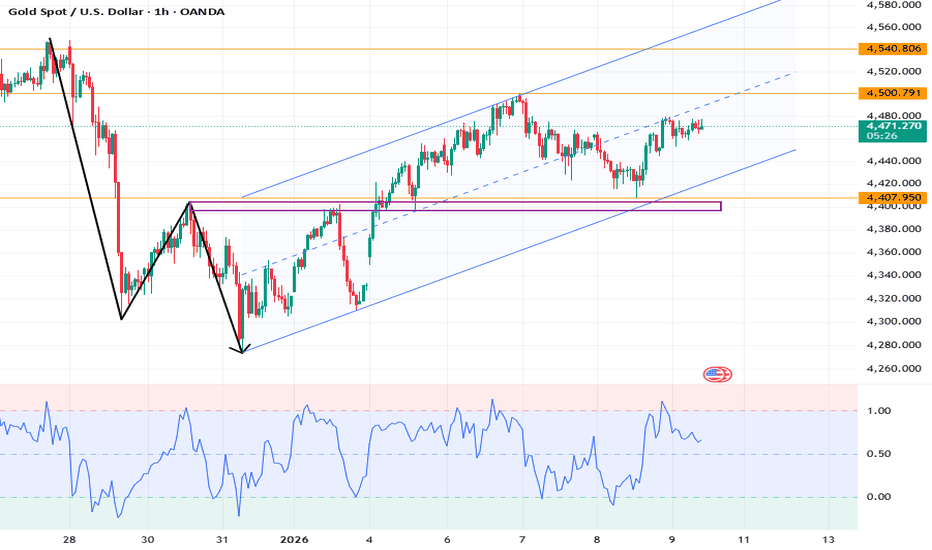

XAUUSD: Market Trends and News Analysis on January 9thRegarding tonight's US NFP employment report, the market generally expects an increase of approximately 60,000 jobs, a slight decrease in the unemployment rate to 4.5%, and a 0.3% month-over-month increase in hourly wages. This is the first NFP employment report released entirely on schedule since the US government shutdown last October disrupted the data release schedule. While current inflation is above the 2% target level, the Fed's next decision will still depend on whether the weakness in the labor market continues to justify easing policies, highlighting the importance of this data.

A weak labor market is generally positive for gold prices: If job growth slows and the unemployment rate rises, indicating weakening economic activity, it could strengthen market expectations for a Fed rate cut. Rate cuts typically reduce the opportunity cost of holding gold, driving up gold prices.

Short-term volatility is possible: If the actual data is lower than expected (e.g., non-farm payrolls significantly lower than 60,000 or the unemployment rate higher than 4.6%), gold prices may rise due to increased safe-haven demand and expectations of a rate cut. Conversely, if the data exceeds expectations, gold prices may face short-term pressure.

In summary, regardless of the data results, the interest rate cut and geopolitical uncertainty are expected to continue supporting gold prices. In the short term, gold prices are likely to remain on an upward trend, maintaining a high level (above 4400) and fluctuating within a narrow range.

Technically, the daily chart showed a bullish hammer candlestick pattern yesterday. Although prices slightly retraced during the Asian session, they still found support, indicating that short-term market expectations for further gains remain strong. However, cautious trading was observed during the Asian and European sessions. Traders are awaiting the data release, and technical analysis will be less relevant during the NY session, so further analysis will be omitted.

Considering the risks associated with the NFP data, a conservative strategy is to remain on the sidelines and avoid the uncertainty brought about by the shift in market focus. Support levels to watch in the NY market are around 4420/4395. Avoid trying to predict the top during an uptrend; be aware that new highs may be reached at any time.

More analysis →

BABA: Multi-Year Rounding Bottom Breakout — Wave 4 Support CheckThis chart for Alibaba (BABA) showcases a massive multi-year accumulation pattern, specifically a "Rounding Bottom" or "Cup" formation that began in late 2022. From an Elliott Wave perspective, the stock appears to have completed a primary Wave 3 impulse peak near the $190 level in late 2025 and is currently in the late stages of a Wave 4 corrective pullback.

The long-term outlook for BABA remains highly bullish as it successfully transitions from a multi-year basing phase into a structural uptrend. The recent pullback from the October 2025 highs represents a textbook Wave 4 correction, which has found precision support at the 0.382 Fibonacci retracement level ($143.58). This level aligns perfectly with the breakout point of the major rounding base, transforming old resistance into new support.

Key Technical Levels:

* Support Zone: The $143 - $150 area is critical; as long as the pivot at point 4 holds, the impulsive structure remains intact.

* Wave 5 Target 1: A 1.0 Fibonacci extension projects an initial target of $205.42, which would reclaim the 52-week highs.

* Wave 5 Target 2: The primary 1.618 extension sits at $242.59, aligning with major historical supply zones from early 2021.

* Invalidation: A sustained daily close below the Wave 2 low (approx. $70-$80) would invalidate this specific count, though the $143 level is the immediate "line in the sand" for bulls.

Projected Outlook:

The current price action at $150.96 is forming what looks like a bullish consolidation (handle) following the massive cup breakout. With cloud and AI demand accelerating revenue growth into 2026, the fundamental narrative supports a re-rating toward the $200+ consensus analyst targets. Traders should watch for a breakout above the Wave 3 peak to confirm the start of the final fifth-wave leg higher.

Nasdaq - Stocks are just heading higher!🚀Nasdaq ( TVC:NDQ ) is creating new all time highs:

🔎Analysis summary:

Tech stocks just finished an extremely strong year and we were offered quite a lot of buying opportunities during 2025. Looking at the higher timeframe, we could see a short term retracement going into 2026, but the underlying trend remains totally bullish.

📝Levels to watch:

$25,000

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

7000 Is the Target — Not the Top🔥 7000 Is the Target — Not the Top 🔥

Everyone is talking about fear, recession, and crashes…

While the market is still building one last expansion leg.

📌 My macro view is simple:

S&P 500 continues higher toward 7000

This move is driven by liquidity, optimism, and late-cycle euphoria

Headlines will stay bullish right until the very end

But here’s the part most traders miss 👇

🎯 7000 is not a buy zone.

It’s the transition zone.

GBPJPY Will Go Higher! Buy!

Please, check our technical outlook for GBPJPY.

Time Frame: 4h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 210.599.

Considering the today's price action, probabilities will be high to see a movement to 211.071.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

BRK.B: Healthy Correction in Wave 5 – Target 528 2026-Q1Berkshire Hathaway (BRK.B) is currently in a healthy correction within Wave 5 of the larger bullish impulse, following the 516 double-top resistance. The pullback respects the no-overlap rule and forms a contracting triangle in Wave 4, which does not invalidate the overall advance.

Primary Count remains intact:

we are in subwave 3 of Wave 5, with a short-term support zone at 480-496 and resistance at 528-542. If the price breaks above 542, the next target is 580-600 in Q1 2026 (60% probability).

Alternative Count (40%):

A break below 455 on high volume (>5M shares) would shift to a larger Wave (4) Flat, with C-wave targeting 430-440.

Cash reserves (~$190B) and low P/B provide strong support. Watch for a breakout above 510-516 as the key signal for resumption of the uptrend.

Disclaimer: This analysis is for educational purposes only and is not investment advice. Please do your own research (DYOR) before making any trading decisions.

XAUUSD – 30M Supply & Demand-Based Trade SetupGold is currently trading near a clearly defined demand zone on the 30-minute timeframe. Price has previously reacted from this area, confirming it as a key decision zone. The current structure suggests a potential short-term rejection from this upper demand/supply flip area, followed by a corrective move lower.

The projected path anticipates an initial decline toward the intermediate demand zone, where a temporary reaction or minor pullback may occur. If bearish momentum sustains and this level fails to hold, price is expected to continue lower toward the final target demand zone, which aligns with prior price imbalance and liquidity resting below.

Trade Plan Overview:

Bias: Bearish below the highlighted demand zone

Entry Concept: Rejection or bearish confirmation from the upper zone

Targets:

First reaction at the mid demand zone

Final target at the lower demand zone

Invalidation: A strong bullish close and acceptance above the upper zone would invalidate the setup

This idea is based purely on price action and supply–demand dynamics. Proper risk management is advised.

WULF Short-term analysis | Trading and expectationsNASDAQ:WULF

🎯 The triangle analysis appears to be playing out, currently printing wave d. Price lost the daily pivot but remains well above the daily 200EMA. Wave V target is the R2 pivot at $18.74. Triangles are a penultimate pattern.

📈 Daily RSI sits at the EQ

👉 Analysis is invalidated if price falls below wave a, $10.40

Safe trading

BTC | MonthlyCRYPTOCAP:BTC — Quantum Model Projection

Bullish Alternative Scenario 📈 | Primary Wave ⓹ Initiation

Since November, Bitcoin has been stabilized by the strong convergent support of the

Q-Structure λₛ , formed directly at the apex ➤ $80,619.71 , while also holding above the Primary Wave ⓷ trendline.

From this higher-timeframe perspective, the structure remains technically aligned with the view that BTC may be entering the early stages of a Primary-degree advance in Wave ⓹, representing a resumption of the broader Wave III uptrend within BTC’s second Cycle.

🔖 This outlook is derived from insights within my Quantum Models framework. Within this methodology, Q-Targets represent high-probability scenarios generated by the confluence of equivalence lines. These Quantum Structures also function as structural anchors, shaping the internal geometry of the model and guiding the evolution of alternative paths as price action unfolds.

XAUUSD 1H – Friday Trade IdeaPrice is showing higher lows after a strong rejection from demand, indicating short-term bullish momentum.

Current plan:

Buy on pullback / continuation

Risk is defined below the recent structure low

Target set at the prior resistance / liquidity zone

Expect minor pullbacks before continuation higher (normal price behavior)

This is a structure + price action setup, not indicator-based.

The goal is clean execution with controlled risk, not prediction.

📌 If price fails to hold above the demand, setup is invalid — no trade.

🤝 Trade With Me (Side-by-Side or Managed)

For traders who want real execution experience, I offer two options:

• Trade side-by-side with me

– Same bias

– Same structure

– Full explanation before execution

• Account trading / management

– Strict risk management

– No overtrading

– Capital protection comes first

This is for people who:

✔️ Want consistency, not signals

✔️ Value risk control

✔️ Want to learn by watching real trades, not hindsight

📌 This is not financial advice. Education & experience focused.

👍 Follow for structured Gold breakdowns

💬 Comment or message if you’re interested in trading together

Discipline > Emotion.

Structure > Indicators.

#MAGIC/USDT Bullish Reversal in MAGICUSDT Accumulation Zone#MAGIC

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

We are seeing a bearish trend in the Relative Strength Index (RSI), which has reached near the lower boundary, and an upward bounce is expected.

There is a key support zone in green at 0.1090, and the price has bounced from this level several times. Another bounce is expected.

We are seeing a trend towards stabilizing above the 100-period moving average, which we are approaching, supporting the upward trend.

Entry Price: 0.1122

First Target: 0.1149

Second Target: 0.1180

Third Target: 0.1216

Remember a simple principle: Money Management.

Place your stop-loss order below the green support zone.

For any questions, please leave a comment.

Thank you.