Tesla Short: Stop above $368, TP at $298In this video, I re-initiated the short idea for Tesla. Reason being that I observed that around $367-ish is an important price point (although I have no idea why). Also, the move up has been more corrective in nature (since I drew ABCDE). The move also resembles a rising wedge.

In any case, the most important point in this idea is the stop loss which should be set above $368. The ultimate Take Profit Target for me is $298 with a short-term target of $344.

Good Luck!

Wedge

Trading GOLD At All-Time Highs - 2 Methods for Profit TakingGold has broken out to all-time highs, leaving traders asking: “Where should I take profits when there’s no structure to target?”

In this video, I’ll walk you through two proven methods for setting profit targets when trading in uncharted territory:

🔹 Price Action & Technical Tools – measured moves, AB=CD patterns, Fibonacci extensions (127 & 1618), and wedge breakout projections.

🔹 Indicator-Based Exits – using RSI, stochastics, and volatility bands (Keltner Channels / Bollinger Bands) to identify exhaustion and exit signals.

You’ll learn:

✅ How to set profit targets without previous structure

✅ Why thinking like the “other trader” gives you an edge

✅ Why catching part of the move beats chasing the very top

If you have any questions or comments, please leave them below.

Akil

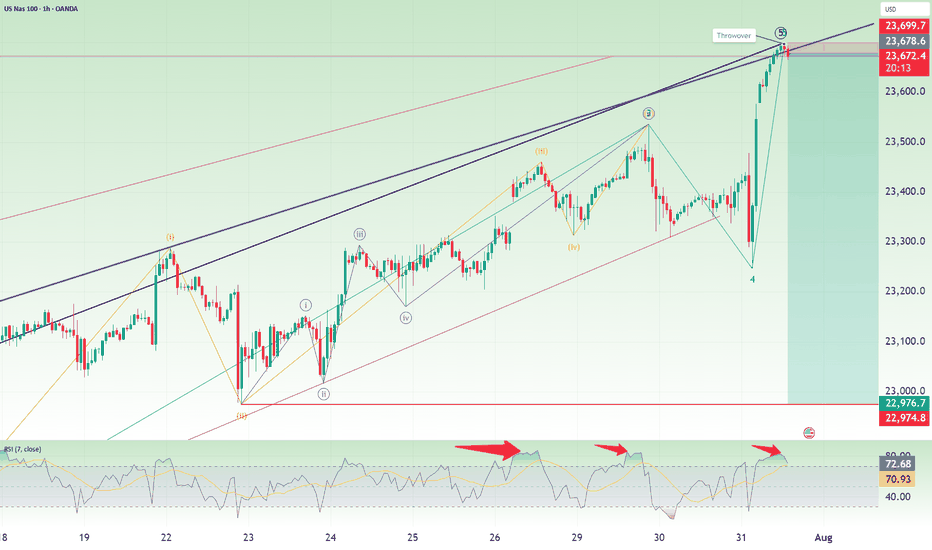

Nasdaq Short: multiple reasonsOver here, I present to you the Nasdaq short idea again. For my previous idea, it was stopped out at 23500. This time, I changed the wave counts again, mainly merging the previous wave 5 into wave 3, allowing for the new high to be a wave 5.

On top of that, here are the few other reasons for the short:

1. Fibonacci extension levels: Wave 5 is slightly more than Wave 1.

2. RSI overbought for the 3rd time on the hourly timeframe.

3. Rising wedge false breakout.

4. Head-and-shoulders on the 1-min timeframe.

As usual, the stop for this idea is slightly above the recent high, around 23700.

Thank you.

Understanding Wedge Patterns - A Real Bitcoin Case Study🎓📊 Understanding Wedge Patterns - A Real Bitcoin Case Study 🧠📈

Hi everyone, FXPROFESSOR here 👨🏫

From this moment forward, I will no longer be posting targets or trade setups here on TradingView. Instead, I’ll be focusing 100% on education only for here in Tradinfview.

Why? Because over time I’ve learned that even when traders receive the right charts, most still struggle to trade them effectively. So, from now on, FX Professor Crypto content here will be strictly educational — designed to teach you how to read and react to the markets like a professional. Unfortunately I cannot be posting on Tradingview frequent updates like I do all day. Education is always better for you guys. And i am very happy to share here with you what matters the most.

🧩 In today’s post, we dive into one of the most misunderstood formations: the wedge pattern.

Most resources show wedges breaking cleanly up or down — but real price action is messier.

🎥 I recorded a video a few days ago showing exactly how BTC respected a wedge formation.

⚠️ Note: Unfortunately, TradingView doesn’t play the audio of that clip — apologies that you can’t hear the live commentary — but the visuals are clear enough to follow the logic. (there is no advertising of any kind on the video so i hope i don't get banned again - i did make a mistake the last time and will avoid it-the community here is awesome and needs to stay clean and within the rules of TV).

Here’s what happened:

🔸 A clean wedge formed over several days

🔸 We anticipated a fake move to the downside, grabbing liquidity

🔸 BTC rebounded off support around a level marked in advance

🔸 Then price re-entered the wedge, flipping support into resistance

The lesson?

📉 Often price will exit the wedge in the wrong direction first — trapping retail traders — before making the real move. This is a classic liquidity trap strategy, exercised by the 'market'.

💡 Remember:

Wedges often compress price until it "runs out of space"

The initial breakout is often a trap

The true move tends to come after liquidity is taken

The timing of the 'exit' has a lot to do with the direction. In the future we will cover more examples so pay attention.

I stayed long throughout this move because the overall market context remained bullish — and patience paid off.

Let this be a reminder: it’s not about guessing the direction — it’s about understanding the mechanics.

More educational breakdowns to come — keep learning, keep growing.

One Love,

The FX PROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

Top-Down Analysis in Action – Live Trade: Where I Enter and WhyIn this video, I walk you through my full trading process – starting with a clean top-down analysis.

I begin on the daily chart to spot key market structure and levels, then zoom in to the 1-hour chart for confirmation, and finally execute my trade on the 5-minute chart.

You’ll see:

✔️ How I define my zones and structure

✔️ Why I wait for confluence across timeframes

✔️ Exactly where and why I enter the trade

Just real analysis and real trades.

If you’re looking to improve your entries and learn how to align multiple timeframes, this one’s for you.

🔔 Don’t forget to like, comment & subscribe for more real-time trading content!

NASDAQ:AMZN

NYSE:ANET

NASDAQ:CSCO

NASDAQ:CZR

NASDAQ:GOOG

NYSE:IONQ

NASDAQ:MRVL

NASDAQ:MSFT

NASDAQ:MU

NYSE:NKE

NASDAQ:NVDA

NASDAQ:ON

NASDAQ:SBUX

NASDAQ:SHOP

NASDAQ:SMCI

NYSE:TSM

NYSE:XOM

A Contrarian View On the US DollarI don't recall the last bullish headline I saw for the US dollar, bearish sentiment may be stretched, and I'm seeing plenty of clues across the US dollar index and all FX majors that we could at least be looking at a minor bounce. Whether it can turn into a larger short-covering rally is likely down to Trump's trade deals. Either way, I'm, on guard for an inflection point for the dollar.

Matt Simpson, Market Analyst at City Index and Forex.com

The What vs. The Where - A 2nd Breakout Pattern After A Nice WinA few days ago we looked at a bullish breakout opportunity on Silver and it played out perfectly. After a lovely move to the upside, price has started to consolidate again providing us with a very similar setup.

HOWEVER, just as in the case of the first, we need to be aware that once again the WHAT doesn't necessarily align with the WHERE stopping this from being a Grade A trading opportunity.

Please leave any questions or comments below and remember to hit that LIKE button before you go!

Akil

What is a Bearish Breakaway and How To Spot One!This Educational Idea consists of:

- What a Bearish Breakaway Candlestick Pattern is

- How its Formed

- Added Confirmations

The example comes to us from EURGBP over the evening hours!

Since I was late to turn it into a Trade Idea, perfect opportunity for a Learning Curve!

Hope you enjoy and find value!

Small Clues In A Big Breakout PatternSilver has been consolidating as of late and if there's one thing we no about contraction is that it eventually leads to expansion aka a breakout.

The issue with this particular setup is that based on location of the pattern, there's no predetermined directional bias for the breakout.

Therefor, what we're doing today is looking for small clues that the market has provided to give us any type of edge in predicting a breakout one way or another and guess what. WE FOUND SOME!

If you have any questions or comments, please leave them below!

Akil

A Different Way To Use the RSI To Trade Deceleration Patterns A deceleration pattern is a pattern that forms at the end of a directional move as it starts to lose steam. 2 good ones to learn are the rising/falling wedge & channel.

The problem wit these patterns however, is that it can sometimes be difficult to tell when that final reversal may come backing it hard to place stops.

Lately, and by that I mean for the past year or so, I've been tracking a very specific pattern on the RSI (Relative Strength Index) indicator to help me with these situations.

Please LIKE & SHARE and if you have any questions or comments, leave them below

Akil

Brent Crude Breaks Lower: Iran Deal Could Add 800K BarrelsBrent crude has dropped over 2% following news that the US and Iran may strike a deal, potentially adding 800,000 barrels per day to global supply. We explore the technical setup, including a wedge pattern and the risk of a deeper fall.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

USDCHF set for big move? Fed meeting could trigger breakoutUSDCHF is stuck in a tight range ahead of today’s Fed meeting, with technical patterns pointing to a possible breakout. A dovish Fed could trigger a move toward 0.8872 or lower, with risk-reward setups as high as 11:1.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Oil Short: Ending Diagonal and Rising WedgeI propose that Oil is a good short candidate because of what I am seeing:

1. Rising Wedge

2. Ending Diagonal within the Rising Wedge

I propose 3 entry points for shorting but mention that if you are shorting at the top of the trendline, to cater for false breakout, meaning more allowance in your stop.

Good luck!

USD Bear is here: Important Analysis on FX Pairs, Stock MarketIn this video I got over some important outlooks on the EUR/USD, GBP/USD and USD/JPY along with outlook on the stock market.

The U.S. Dollar has been getting absolutely crushed along with the stock market which usually has the opposite effect. Considering we may be into a stagflation scenario, this is not surprising.

Tariffs have spiked volatility and puts the Federal Reserve in a very tight spot of Interest Rate Policy. Interesting times ahead to say the least.

From a pure technical analysis point of view, the USD may be set for much further losses as monthly patterns suggest a big move may be on the horizon. Will be keeping a very close eye on these as we move forward in these stormy waters of the U.S. economy.

As always, Good Luck & Trade Safe.

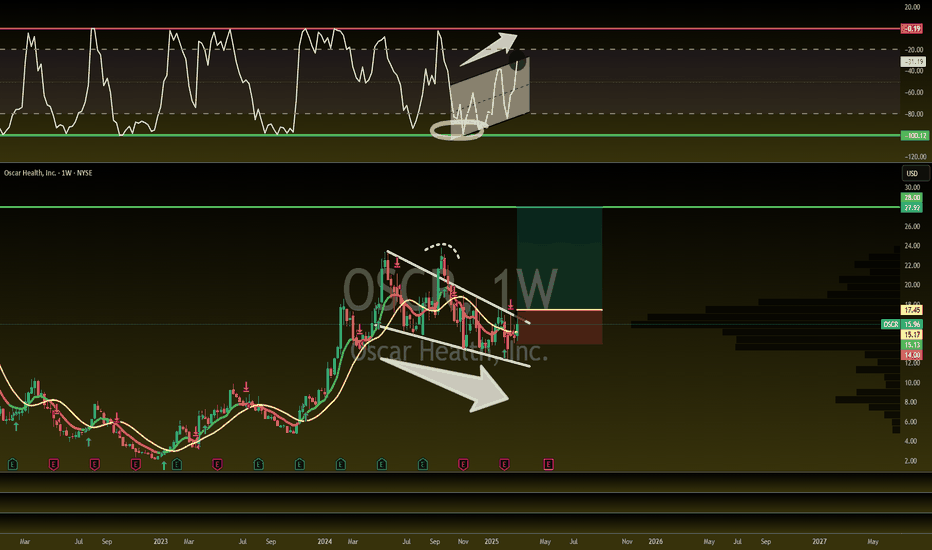

60% Upside - H5 Trade of the Week!H5 Trade of the Week!

In this video, we are talking about a phenomenal potential trade that allows us to take action if we get some key items.

Everything is lining up for this one. We just need a few more items, and it will be time to enter!

NYSE:OSCR Breakout = $24/ $28

Not financial advice

Is the Dollar's Rally Over? Key Levels to WatchIs the dollar trend doomed? Many say the trend is over, but the charts tell a different story. The Dollar Index remains at key support levels, with technicals pointing to a potential upside. A breakout retest around 105 could determine the next move. Will inflation, wage growth, and the Fed's stance push the dollar higher? Or will weak economic data trigger a breakdown? Watch now and decide—long or short?

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information

Silver's Next Big Move? Dont Miss This High Probability Short!In this analysis, I break down my short trade setup on Silver (XAG/USD) using a multi-timeframe approach to identify key levels, structure shifts, and liquidity targets.

• Monthly Outlook: Strong bullish close in January, but price is trading within a range between 32.67 - 28.77.

• Weekly Structure: Consecutive bullish candles since December with no real retracement, signaling potential liquidity grab to the downside.

• H4 Breakdown: Clear market structure shift with a lower high at 32.65, rejecting key resistance and breaking prior lows.

• Entry & Target: Shorting from 32.07, with stops above 32.67, targeting a 1:2 risk-reward down to 30.68 initially, with a possible extension toward 29.69.

Looking for liquidity sweeps and a healthy pullback before further continuation. Already in profit—let’s see how it plays out!

If you find this useful, make sure to like, share, and drop your thoughts in the comments!

NKN Analysis: Breakout Brewing – Buy Zone IdentifiedA technical breakdown of NKN’s descending wedge pattern, buy-in levels, and key targets for traders.

COINBASE:NKNUSDC CRYPTO:NKNUSD

🔥 Key Takeaways from the Analysis:

Descending Wedge Breakout Setup: The chart shows a descending wedge pattern, a bullish indicator that often leads to upward price movement.

Accumulation Phase Identified: Prolonged sideways movement and volume patterns suggest significant accumulation, setting the stage for a potential breakout.

Double (or Similar) Bottom Confirmation: Key support levels around $0.076 have been tested and confirmed, solidifying the bottom.

Anticipated Pullback Zone: Expect a retracement to $0.79–$0.82 before the breakout. This zone offers a strong buying opportunity.

Breakout Target: Initial breakout target is $0.1075 (~20% gain). Further moves could extend higher if momentum sustains.

Volume & Bollinger Bands Analysis: A breakout will likely come with high volume. Watch for pullbacks to the Bollinger Bands' midline for re-entry opportunities.

Long-Term Perspective: Weekly chart suggests a larger trend reversal, signaling potential for sustained bullish movement.

📝 Video Summary:

Chart Overview:

NKN/USD daily chart shows a descending wedge pattern, often associated with bullish reversals.

Clear signs of accumulation over a prolonged range with high volatility.

Support Levels & Patterns:

Key support confirmed at $0.076 with consistent wicks rejecting that level.

Pattern resembles a double or "similar bottom," reinforcing the breakout potential.

Buy Zone & Strategy:

Anticipate a pullback to $0.79–$0.82.

Monitor behavior around this zone, including volume and Bollinger Band interaction, for entry.

Volume Insights:

High-volume spikes are expected at the breakout, but excessive volume may cause short-term pullbacks.

Use Bollinger Bands to gauge retracement levels before re-entering.

Breakout Targets:

Initial resistance at $0.1075 for a conservative 20% gain.

Potential for further gains depending on market momentum.

Weekly Chart Perspective:

Signals suggest a larger trend reversal with opportunities for significant upside.

Bollinger Band analysis highlights the importance of sideways consolidation before a major move.

Pro Tips:

Sell during high-volume spikes to avoid overextensions.

Watch mid-channel levels (Bollinger Bands) for support during retracements.

💡 Extra Notes for the Audience:

Patience Pays Off: Wait for the pullback to $0.79–$0.82 for an optimal entry.

Risk Management: Monitor $0.795 support. Closing below it could indicate a failure of the setup.

Be Ready for Profit-Taking: The $0.1075 target is a key resistance zone where traders might offload positions.

A rising Wedge Formation In the 4H - Short for Short Period.So even though Bitcoin is in the middle of a huge upward move markets always gave us the opportunity to make money in the middle of every strong trending moves. For now we got a rising wedge formation with a heavy pull back based on the news from the FED and the zone which is acting as a magnet support level got more confluence points including the strong demand zone, the horizontal support line of the 2 formed triangles and the 1.27 extension fib level on the higher timeframe. All this points and some other additional insights are included in this short video and enjoy watching it. Please do consider to do your own research before making any type of investments in any type of markets and I urge you to notice that this is not a financial advice at all rather a personal view point.

Nathnael B.

Uptrend & Downtrend Bullish Falling Wedge Pattern TutorialA bullish falling wedge is a charting pattern that signals a potential reversal from a downtrend to an uptrend. Here's a breakdown of its key characteristics:

Shape: The pattern forms a wedge that slopes downward, with the upper trendline connecting the highs and the lower trendline connecting the lows. The key is that the highs and lows get closer together as the pattern develops.

Trend: It typically forms during a downtrend, indicating that selling pressure is decreasing.

Breakout: The pattern is bullish when the price breaks above the upper trendline. This breakout suggests that the downward trend is losing momentum, and an upward trend may follow.

Volume: During the falling wedge formation, volume tends to decrease, which supports the idea that selling pressure is diminishing.

Retest: After the breakout, it's common for the price to retest the upper trendline, and if it holds, it provides further confirmation of the bullish reversal.

Example

Imagine a stock that has been falling for several months. The price forms lower highs and lower lows, creating a narrowing wedge. Suddenly, the price breaks above the upper trendline with increased volume, signaling a potential reversal and the start of an upward trend.

USDCAD - Bear Bat Pattern - Aggressive & Conservative ApproachesToday we look at both aggressive & conservative ways to trade a completed bearish bat pattern on the USDCAD using both simple & classic chart patterns such as rising channels & double tops to give us confirmation.

In this video, we also discuss other elements of technical analysis including the Lower Low, Lower Close candlestick combination, the RSI and more.

Akil

Is C3.AI the next AI Giant to Soar? 123% Potential Upside!🚀 Is C3.AI the Next AI Giant to Soar?🚀

123% Potential Upside! 📈

In this video, we dive into NYSE:AI , a powerhouse in the AI sector, currently retesting a Falling Wedge Breakout!

💡 Key Highlights:

-H5 Indicator: Flashing green for a bullish signal

-Volume Insights: Massive volume shelf with a significant gap to fill

-Technical Analysis: Consolidation box formed on WR%

Targets:

🎯$39

🎯$49

📏$58

Don't miss out on the potential explosive growth of $AI! Tune in to see why this stock could be a game-changer!

NFA