WTI OIL closing its first green month after 5 straight red.One month ago (December 30 2025, see chart below), we gave a strong long-term buy signal on WTI Oil (USOIL), as it hit its 8-month Support on a 1W RSI Bullish Divergence:

The price reacted very positively and is about to close its first green 1M candle after 5 straight red. This is why we bring you this time the same chart but on the 1M time-frame. At the same time pay close attention to the 1M MA200 (orange trend-line), which delivered the last strong rejection for the market, which last time closed a month above it exactly a year ago (Jan 2025).

This is why we stay firm on our $69.00 Target, which isn't only on the 0.618 Fibonacci retracement level (where all 3 previous Bullish Legs of the 2-year Channel Down retraced) but also below the long-term Resistance posed by the 1M MA200.

As a side-note, to get an idea of how bearish the market is on the long-term (and why a sell at the top of the Channel Down is later suggested), Oil hasn't closed a month above its 1M MA50 (blue trend-line) since July 2024.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

WTI

Hellena | Oil (4H): LONG to resistance area 62.545.Colleagues, after a strong upward movement, I decided to observe the price and understand what is happening.

Now I believe that this movement resembles the beginning of an “ABC” correction, which means that the higher-order wave “A” ended at 54.956.

This means that we can expect the upward movement to continue at least to the resistance area of 62.545.

A correction to the support area of 58.890 is possible.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

WTI: False breakout above the range — seller priorityHi traders and investors!

On the 4-hour timeframe, a false-breakout pattern has formed above the upper boundary of the range.

The chart shows that key volume was accumulated above the range high (highlighted by the blue band), after which the price returned back into the range.

The seller initiative is currently active. The initiative target is 59.068, which aligns with a daily level, adding confluence to the scenario.

In the current context, it makes sense to look for short (sell) patterns.

Profitable trades!

This analysis is based on the Initiative Analysis (IA) method.

BRIEFING Week #4 : Look for the Dollar SignalHere's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

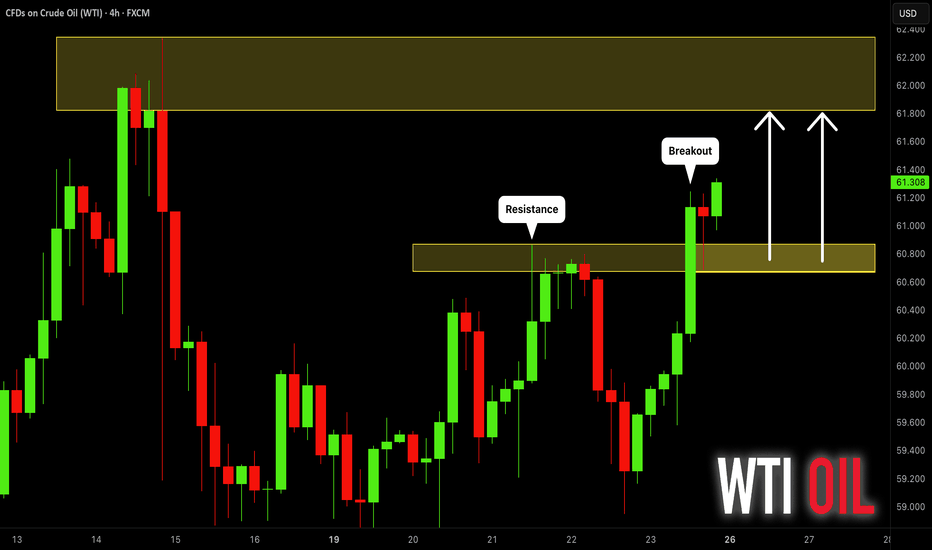

CRUDE OIL (WTI): Bullish Continuation

WTI Crude Oil is going to continue rising, following

a confirmed bullish break of structure on a 4h time frame.

Next resistance - 61.8

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

WTIUSD: Bearish Drop to 54.66?As the previous analysis worked exactly as predicted, CFI:WTI is eyeing a bearish continuation on the 4-hour chart , with price testing resistance after lower highs in a downward channel, converging with a potential entry zone that could spark downside momentum if sellers defend amid recent volatility. This setup suggests a pullback opportunity in the downtrend, targeting lower support levels with approximately 1:4 risk-reward .🔥

Entry between 56.94–57.22 for a short position (entry from current price with proper risk management is recommended). Target at 54.66 . Set a stop loss at a daily close above 57.5 , yielding a risk-reward ratio of approximately 1:4 . Monitor for confirmation via a bearish candle close below entry with rising volume, leveraging oil's volatility in the channel.🌟

📝 Trade Setup

🎯 Entry (Short):

56.94 – 57.22

(Entry from current price is valid with proper risk & position sizing.)

🎯 Target:

• 54.66

❌ Stop Loss:

• Daily close above 57.50

⚖️ Risk-to-Reward:

• ~ 1:4

⚠️ This analysis is the request of one of my followers .

💡 Your view?

Does WTI roll over toward 54.66, or do buyers attempt another squeeze above channel resistance? 👇

Crude Oil (WTI): Short-Term Bullish Correction Before BearishHI!

Looking at the 4H chart for US Crude Oil (WTI), the price action suggests a short-term corrective rally before a continuation of the bearish trend. Below are the key levels and potential scenarios:

Key Levels:

Resistance Area (Green Zone): Currently, oil is approaching a key resistance level near the green zone. This area is expected to act as a strong resistance, potentially halting the recent bullish move and triggering a retracement. A rejection here could lead to a decline back toward lower levels, aligning with the overall bearish trend.

Magnet Area (Blue Zone): The blue zone represents the next critical support level, where price could be "magnetically" pulled towards after testing the resistance area. This zone marks a significant support region, aligning with the ascending trendline, which indicates further downside potential should the price break lower.

Target: $57.4

Geopolitical Considerations:

Ongoing geopolitical concerns, such as tensions in the Middle East, could introduce volatility and affect the price action in the short term. Any sudden shifts in supply expectations could influence the bullish or bearish potential around these key levels.

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

USOIL BULLISH BREAKOUT|LONG|

✅WTI OIL strong bullish breakout above prior consolidation signals a clear shift in market structure. Price holds above former resistance, suggesting continuation toward external buy-side liquidity after brief consolidation. Time Frame 2H.

LONG🚀

✅Like and subscribe to never miss a new idea!✅

WTI(20260123)Today's AnalysisMarket News:

According to data released Thursday, U.S. gross domestic product (GDP), an inflation-adjusted measure of the value of goods and services produced, grew at an annualized rate of 4.4% in the third quarter of last year, the fastest pace in two years.

The report shows that this is one of the two strongest consecutive quarters of growth since the U.S. economy was still in the recovery phase of the pandemic in 2021. After rushing to import goods at the beginning of the year to avoid the implementation of President Trump's comprehensive tariffs, businesses slowed their pace of imports. Despite the volatile trade policy, consumer and business spending remained robust.

With strong growth, a more solid job market, and inflation still above the Federal Reserve's target, the Federal Reserve is expected to keep interest rates unchanged at its meeting next week.

Technical Analysis:

Today's Buy/Sell Threshold:

59.74

Support and Resistance Levels:

61.54

60.87

60.43

59.05

58.61

57.94

Trading Strategy:

If the price breaks above 59.74, consider buying with a first target price of 60.43.

If the price breaks below 59.05, consider selling with a first target price of 58.61.

Crude Oil (WTI) — Daily Structure UpdateOn the daily timeframe, price remains in a tight consolidation regime, with short- and medium-term structure compressing while longer-term trend context remains intact.

The 10 and 20 EMAs have climbed back toward the 50 EMA, with all three now flattening, reflecting momentum stabilization rather than directional expansion. The 200 EMA remains above price, maintaining a neutral-to-cautious longer-term trend backdrop, though slope has begun to stabilize after prior downside momentum.

ATR continues to compress, signaling volatility contraction and energy build-up, consistent with a maturing consolidation phase.

RSI(14) is holding near 52, while longer-term RSI remains near 53, keeping both short- and long-term strength conditions constructive. The slight downward curvature reflects near-term momentum digestion rather than structural weakness.

Rate of Change (ROC) shows a short-term pullback, aligning with RSI behavior and supporting a controlled reset rather than trend failure.

Overall, this remains a compression-driven environment, with volatility contracting as price structure tightens. This phase typically precedes range resolution, with broader trend context remaining the dominant driver.

⭐ Final Clarity Note ⭐

Structure remains coiled rather than broken. Volatility compression and momentum stabilization suggest regime positioning rather than trend exhaustion, keeping focus on structure resolution rather than directional prediction.

UKOIL/BRENT Chart Shows That OIL Can RallyI am using UKOIL/BRENT chart because there is a direct correlation between this and any other USOIL/WTI chart.

What we have are:

1. It has been falling in a wedge pattern and is coiling. Hence a breakout sooner or later is expected.

2. It has reached an FCO zone which is acting as a good support. The price has started to form a possible double bottom this week.

3. We have Trend Line support which price has not been able to break though.

This presents a very good medium to longer bullish opportunity on OIL and associated sectors

Lets wait and watch and always this is not and advice but just an observation. Risk management is extremely important as always.

Follow for more. Please support this analysis by liking, commenting, and sharing with friends, colleagues, traders, and trading communities. Thanks👍🙂

WTI OIL initiating a +10% rally.WTI Oil (USOIL) has been trading within a 1-month Channel Up, whose last Bullish Leg hit and got rejected exactly on the 1D MA200 (red trend-line). The resulting correction/ Bearish Leg found Support on the 4H MA50 (blue trend-line) and given that the 4H MA200 (orange trend-line) was kept intact, we expect that to initiate the new Bullish Leg.

The 1D RSI being above its MA (yellow trend-line) supports further upside and given that the previous Bullish Leg rose by +11.85%, we expect a similar development for the current one, targeting $65.50.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

WTI Outlook: Shifting Geopolitical Risk PremiumsWith headlines shifting away from U.S. strike risks against Iran and refocusing on Greenland acquisition threats—alongside EU opposition and tariff rhetoric—put option volume surged above calls. This occurred amid an overall decline in both volume and open interest in crude oil options, according to CME data for contracts expiring March 2026.

As long as headlines remain detached from short-term supply disruption risks, early 2026 oversupply narratives are expected to dominate, in alignment with tariff risks.

From a weekly perspective, crude prices continue to trade below a key resistance level and under the RSI 50 neutral threshold, reflecting neutral-bearish momentum until a decisive breakout materializes on both price and momentum indicators.

The key level remains the 62.20 high, reached during U.S.–Iran escalation risks. This level also aligns with the mid-zone of a duplicated descending channel, extending between the highs of June 2025 and the lows of December 2025.

A decisive hold above this level would be expected to extend gains toward the upper boundary of the broader downtrend channel in place since 2023, targeting:

• 64.70 (upper channel boundary since June 2026)

• 66.90 (upper channel boundary since 2023)

• These projections are derived using Fibonacci extensions measured between the April 2025 lows, June 2025 highs, and December 2025 lows.

The primary trend bias remains bearish, consistent with structural oversupply risks, unless a sustained hold above the highlighted resistance levels emerges to shift the dominant narrative.

On the downside, 58 and 55 remain critical support levels. A break below these zones could expose the lower boundary of the long-term channel dating back to September 2023, at 53 and 49, offering another potential dip-buying opportunity

- Razan Hilal, CMT

WTI(20260120)Today's AnalysisMarket News:

According to sources who spoke to CNBC on Monday, Federal Reserve Chairman Jerome Powell plans to appear before the U.S. Supreme Court on Wednesday for oral arguments. The case centers on whether President Trump has the authority to remove Federal Reserve Governor Lisa Cook from her post.

Powell's planned appearance comes as he faces a criminal investigation by the U.S. Attorney's Office for the District of Columbia for his involvement in a multi-billion dollar renovation project at the Federal Reserve headquarters and related congressional testimony. The Associated Press first reported Powell's plans.

It is extremely rare for a Federal Reserve chairman to personally appear for oral arguments in such a case. However, the question of whether a president can remove a Federal Reserve governor in the manner Trump has attempted is considered within the Fed to be a potentially fundamental issue concerning the central bank's survival.

Technical Analysis:

Today's Buy/Sell Threshold:

59.14

Support and Resistance Levels:

60.17

59.79

59.54

58.75

58.50

58.11

Trading Strategy:

If the price breaks above 59.54, consider going long with a first target price of 59.79.

If the price breaks below 59.14, consider going short with a first target price of 58.75.

BRIEFING Week #3 : ETH and OilHere's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

Supreme Court tariff decision risk: What to track this week With a potential decision due this week, Treasury Secretary Scott Bessent said it is “very unlikely” the Supreme Court will overturn President Donald Trump’s power to impose tariffs, warning that the Court “does not want to create chaos.”

Assets to watch ahead of the decision

US dollar index

Moves with trade expectations and inflation risk.

US Treasury yields

Particularly the 2 year and 10 year, as uncertainty feeds into growth and inflation assumptions.

US equities

S&P500 and NASDAQ100 for broad risk sentiment, especially trade-exposed sectors.

Chinese equities and yuan

Directly tied to tariff headlines and trade risk.

Commodities

Copper for growth signals, oil for broader risk tone.

Gold

Often the first hedge if uncertainty rises.

WTI(20260116)Today's AnalysisMarket News:

The Bank of Japan will announce its next policy decision on January 23. Officials believe that maintaining the interest rate at 0.75% (the highest level in 30 years) is appropriate. Sources say the committee will make its final policy decision after monitoring economic data and financial markets until the last minute. Sources also indicate that given inflation trends are approaching its 2% target, officials will be watching how the yen affects underlying inflation, including price expectations for households and businesses.

Technical Analysis:

Today's Buy/Sell Threshold:

59.61

Support and Resistance Levels:

61.83

61.00

60.47

58.76

58.23

57.40

Trading Strategy:

A break above 59.61 suggests a buy entry, with a first target price of 60.47.

A break below 58.76 suggests a sell entry, with a first target price of 58.23.

Risk premium on Oil unwinding?A Reuters report yesterday suggested a US attack on Iran was imminent, pushing oil to its highest level since October.

“Iranian Patriots, KEEP PROTESTING, TAKE OVER YOUR INSTITUTIONS!!! HELP IS ON ITS WAY,” Trump posted on Truth Social.

Today, that risk premium is fading as no military action has materialised. WTI is down, erasing two of the last four days of rallies.

The outlook can shift to the upside again quickly if tensions escalate, but traders should weigh the geopolitical risk against the reality of an oversupplied oil market.

WTI D1 Prior Order Block Reaction and Downside Continuation📝 Description

BLACKBULL:WTI on D1 has pushed back into a previous Daily Order Block, where price is showing rejection behavior. This area aligns with HTF supply and the broader descending context, suggesting the recent bounce is corrective, not a structural shift.

________________________________________

📈 Analysis (Scenario-Based | Non-Signal)

With price reacting from the prior OB, downside risk increases as geopolitical tensions ease.

• Rejection from the OB favors a bearish rotation

• Pullbacks into the OB without acceptance reinforce sell-side control

• Downside draw remains toward lower D1 liquidity and FVGs

________________________________________

🎯 ICT & SMC Notes

• Daily OB acting as supply

• Move into OB classified as corrective retracement

• No HTF acceptance above supply

• Liquidity draw favors SSL / D1 FVG below

________________________________________

🧩 Summary

After tapping the previous Daily Order Block, and with geopolitical tensions cooling, WTI is vulnerable to risk-premium unwind. As long as price remains below the OB, probabilities favor further downside toward lower liquidity, rather than continuation higher.

________________________________________

🌍 Fundamental Notes / Sentiment

With geopolitical tensions easing, the risk premium in oil can fade, which typically pressures prices lower. If headlines stay calm and risk-off demand for crude weakens, the rejection from the Daily OB has more room to extend downside.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

WTI Crude Oil Continues to RallyWTI crude oil has now posted a streak of five consecutive bullish sessions, gaining more than 9.5% in the short term and signaling a dominant bullish bias at the start of 2026. For now, strong buying pressure has been supported by the escalation of political tensions in Iran, which has fueled concerns over potential disruptions to global energy supply. Markets are also factoring in the risk that the situation could escalate into a U.S. military intervention, a scenario that has increased upward pressure on WTI prices. As long as this risk-driven environment persists, buying pressure in crude oil is likely to remain firm in the short term.

The Bullish Move Gains Relevance

From the recent lows near $55, buying pressure has become a key driver of WTI price action, allowing prices to break above the psychological $60-per-barrel level. While a degree of short-term sideways consolidation can still be observed in recent price behavior, sustained buying interest could pave the way for a more defined bullish trend in the coming trading sessions.

RSI

The RSI continues to show bullish behavior, holding above the neutral 50 level. As long as the indicator remains below the overbought zone near 70, this setup suggests that buying momentum remains dominant, potentially supporting further upside in WTI over the short term.

MACD

Meanwhile, the MACD is displaying a steady expansion of its histogram above the neutral zero line, indicating that short-term moving average momentum continues to favor buyers. If this behavior persists, it could further reinforce the outlook for a dominant bullish bias in WTI price action.

Key Levels to Watch

$62 – Key resistance: This level aligns with the 200-period simple moving average. Sustained price action above this zone could confirm the formation of a fresh short-term bullish trend.

$58 – Nearby barrier: A level aligned with the 50-period simple moving average. A pullback toward this area could reinforce near-term neutrality and extend the sideways channel that has been present so far.

$55 – Key support: This zone marks the lows of recent months. A return toward this level could reactivate the bearish trend that characterized crude oil price action in prior months.

Written by Julian Pineda, CFA, CMT – Market Analyst