Once unprofitable BTC miners are turning their machines back on — Analyst

Bitcoin miners have likely put their older crypto-mining machines back to work in the first quarter, contributing to a record-setting hash rate as Bitcoin’s price skyrocketed to a new all-time high in early March.

“Improved market conditions have encouraged miners who were previously unprofitable at lower hashprice levels to come back online,” said Nico Smid, founder of Digital Mining Solutions in the firm’s first quarter Bitcoin mining review, published on April 2.

Smid told Cointelegraph he has spoken with industry players who have observed an uptick in less efficient miners turning back on. This position is in line with a recent CoinMetric analysis which suggests more sub 20 J/TH machines have switched back on in 2024.

Bitcoin’s hash price level has moved in a similar trajectory to Bitcoin’s BTCUSD change in price, which has increased 56.8% in 2024 to $66,280 at the time of publication.

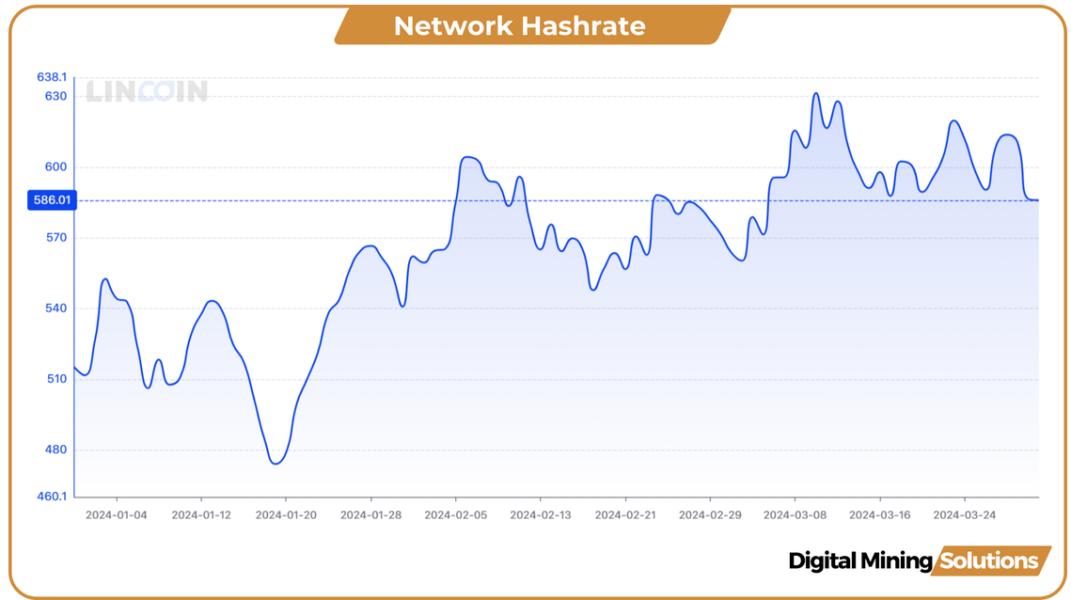

Switching back on these older Bitcoin miners may have contributed to a 14.7% increase in Bitcoin hash rate since the start of 2024.

The deployment of Bitmain S21s and other latest-generation mining equipment also played a role in driving Bitcoin hash rate growth over the first three months.

Bitcoin’s hash rate peaked at 631 exahashes per second (EH/s) on a 7-day moving average on March 11 — a little less than a week after Bitcoin surpassed its previous all-time high price of $68,990.

Bitcoin went on to set a new all-time high of $73,738 three days later on March 14, according to CoinGecko.