FTX loses $53K every hour on ‘bankruptcy fees,’ latest filings show

In the three months ending Oct. 31, defunct crypto exchange FTX has been burning through approximately $53,000 every hour on bankruptcy lawyers and advisers, the latest round of compensation filings show.

Court filings from Dec. 5 to Dec. 16 show that the bankruptcy lawyers have charged at least $118.1 million between Aug. 1 and Oct. 31. Over the 92 days, this amounts to $1.3 million per day or $53,300 per hour.

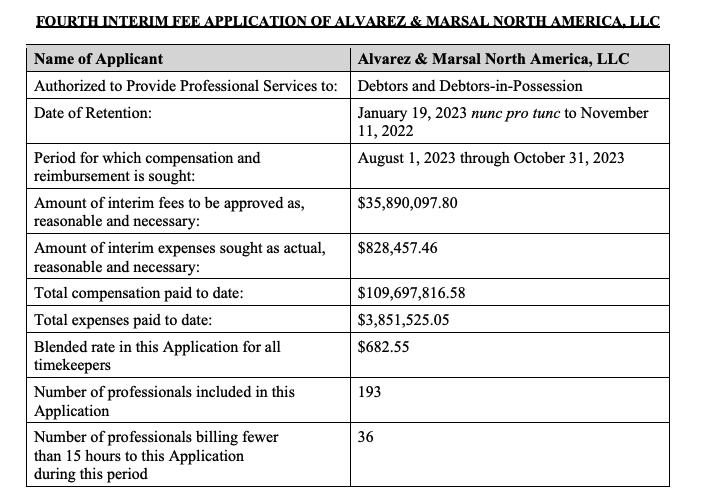

The largest bill came from the management consulting firm Alvarez and Marshall, which charged $35.8 million for its services for the three months.

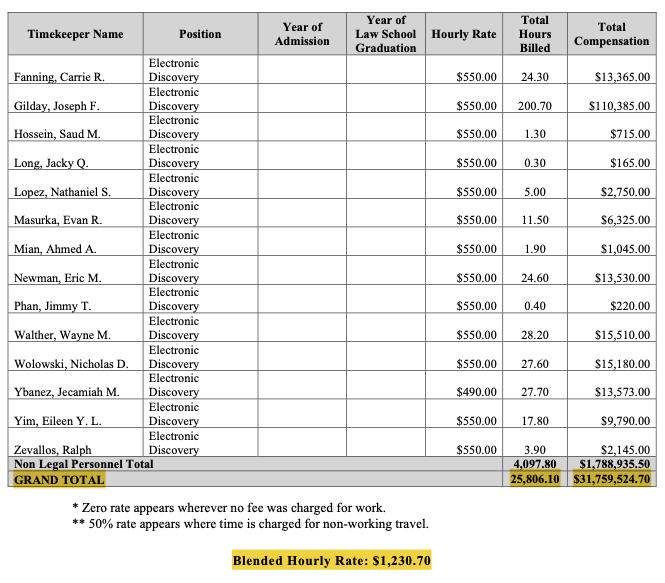

Coming in second place was global law firm Sullivan & Cromwell, which charged $31.8 million for its services. The hourly rate for Sullivan & Cromwell’s services averaged $1,230 per hour.

Global consulting firm AlixPartners charged $13.3 million in the period for professional services relating to forensic investigations. Quinn Emanuel Urquhart & Sullivan charged $10.4 million in the same period, while several other billings from smaller advisory firms added up to over $26.8 million.

Figures shared by a pseudonymous FTX creditor in a Dec. 17 post on X (formerly Twitter) suggest the total legal fees that have been fully paid since the FTX bankruptcy case began is approximately $350 million.

Mr. Purple ️@MrPurple_DJDec 17, 2023BTW @lopp this estimates $1.45B of remaining professional fees for a total of $1.8B. The Estate is currently charging $0.5B per year and bankruptcies are not short endeavors.

To date, here are the fees that have been petitioned in just under 1 year (~$350mm has been paid): https://t.co/fZhMyTE3B1 pic.twitter.com/5p6at5ZbWy

Related: FTX debtors assess value of crypto claims based on petition date market prices

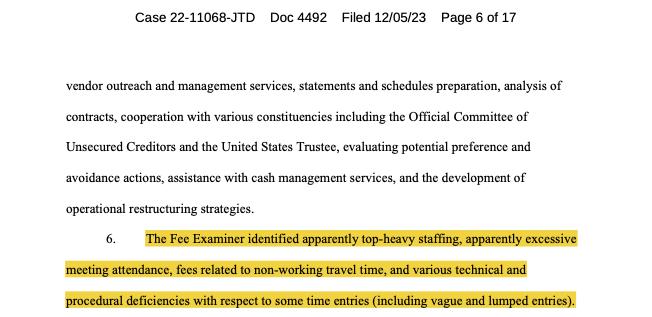

Meanwhile, an earlier report filed on Dec. 5 by the court-appointed fee examiner, Katherine Stadler, identified “significant areas of concern” with the billings submitted by the larger advisory firms, including Sullivan & Cromwell, Alvarez & Marshall and others between May 1 and June 31.

“The Fee Examiner identified apparently top-heavy staffing, apparently excessive meeting attendance, fees related to non-working travel time, and various technical and procedural deficiencies with respect to some time entries (including vague and lumped entries),” states the report regarding the billings submitted by Alvarez & Marshall.

Magazine: Terrorism and the Israel-Gaza war have been weaponized to destroy crypto