American Battery Technology Company

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.51 USD

−46.76 M USD

4.29 M USD

125.42 M

About American Battery Technology Company

Sector

Industry

CEO

Ryan Melsert

Headquarters

Reno

Founded

2011

IPO date

Oct 15, 2015

Identifiers

3

ISIN US02451V3096

American Battery Technology Co. is a technology company, which engages in the development and marketing of lithium-ion batteries. Its projects include recycling plant, United States Advanced Battery Consortium (USABC), and Tonopah flats. The company was founded on October 6, 2011 and is headquartered in Reno, NV.

Related stocks

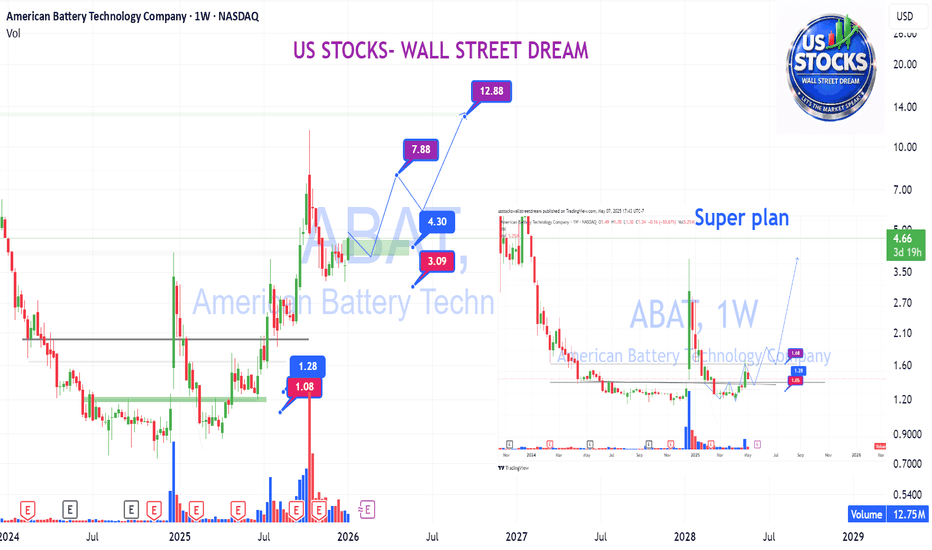

ABAT: Bouncing off Major Support, Eyeing $8.85 Target.ABAT (American Battery Technology Company) is showing signs of a bullish reversal on the Daily timeframe. After a period of consolidation, price has successfully tested and held the key support zone around $4.00 - $4.50.

Key Drivers:

Support Confirmation: Price is bouncing off the 50-period Moving

ABAT LONGABAT 4H — reclaim + squeeze, breakout level is obvious

* Big picture: price is still working inside a larger down-sloping structure, but it just bounced hard off the lows and is now pressing into the underside of prior supply.

* The purple “important level” zone (~4.6–4.75) is the key reclaim area.

Is it time ?Money will be injected into the system like there is no tomorrow (We're talking Trillions)! Rinse and Repeat to keep the status quo afloat. Not only is the pattern identical as you see on the chart, but the circumstances are very similar. Banks stressing and liquidity drying up. Credit crisis. panic

ABATABAT is an American Battery Technology Company, a US-based battery recycling technology company founded in 2011. It specializes in hydrometallurgical processes for recycling lithium-ion batteries and extracting raw materials from primary sources. ABAT develops innovative technologies aimed at susta

American Battery Technology Co. (ABAT) Powers EV RevolutionAmerican Battery Technology Company (ABAT) is focused on building a sustainable supply chain for lithium-ion batteries through advanced extraction, manufacturing, and recycling technologies. By addressing the growing demand for critical battery materials, ABAT supports the electric vehicle revolutio

This has 10X capability if you believeI know...You're asking what is this company?! I dont know either but they are in the right sector at the right time with govt grants. It has gone up a lot so I would not be surprised for a pullback sun $2 but the arc shows that it will be doing well in end of 2027. Put this on your boca radar and d

ABATThe American Battery Technology Company (ABAT) is a U.S.-based battery materials and recycling company focused on domestic production of critical battery minerals, including lithium. It has received significant federal support and attention in recent years tied to strategic initiatives to boost dome

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

394660

MIRAE ASSET TIGER GLOBAL AUTONOMOUS ELECTRIC VEHICLES SOLACTIVE ETF UnitsWeight

0.91%

Market value

740.18 K

USD

Explore more ETFs

Frequently Asked Questions

The current price of ABAT is 3.90 USD — it has decreased by −6.48% in the past 24 hours. Watch American Battery Technology Company stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange American Battery Technology Company stocks are traded under the ticker ABAT.

ABAT stock has fallen by −14.04% compared to the previous week, the month change is a 20.96% rise, over the last year American Battery Technology Company has showed a 176.60% increase.

We've gathered analysts' opinions on American Battery Technology Company future price: according to them, ABAT price has a max estimate of 7.00 USD and a min estimate of 7.00 USD. Watch ABAT chart and read a more detailed American Battery Technology Company stock forecast: see what analysts think of American Battery Technology Company and suggest that you do with its stocks.

ABAT reached its all-time high on Jan 25, 2021 with the price of 73.46 USD, and its all-time low was 0.37 USD and was reached on Jan 10, 2020. View more price dynamics on ABAT chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

ABAT stock is 9.00% volatile and has beta coefficient of 2.08. Track American Battery Technology Company stock price on the chart and check out the list of the most volatile stocks — is American Battery Technology Company there?

Today American Battery Technology Company has the market capitalization of 525.08 M, it has increased by 3.04% over the last week.

Yes, you can track American Battery Technology Company financials in yearly and quarterly reports right on TradingView.

American Battery Technology Company is going to release the next earnings report on Feb 18, 2026. Keep track of upcoming events with our Earnings Calendar.

ABAT earnings for the last quarter are −0.09 USD per share, whereas the estimation was −0.03 USD resulting in a −200.00% surprise. The estimated earnings for the next quarter are −0.05 USD per share. See more details about American Battery Technology Company earnings.

American Battery Technology Company revenue for the last quarter amounts to 937.59 K USD, despite the estimated figure of 20.11 M USD. In the next quarter, revenue is expected to reach 2.00 M USD.

ABAT net income for the last quarter is −10.30 M USD, while the quarter before that showed −10.17 M USD of net income which accounts for −1.26% change. Track more American Battery Technology Company financial stats to get the full picture.

No, ABAT doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Feb 3, 2026, the company has 163 employees. See our rating of the largest employees — is American Battery Technology Company on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. American Battery Technology Company EBITDA is −38.56 M USD, and current EBITDA margin is −892.28%. See more stats in American Battery Technology Company financial statements.

Like other stocks, ABAT shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade American Battery Technology Company stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So American Battery Technology Company technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating American Battery Technology Company stock shows the neutral signal. See more of American Battery Technology Company technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.