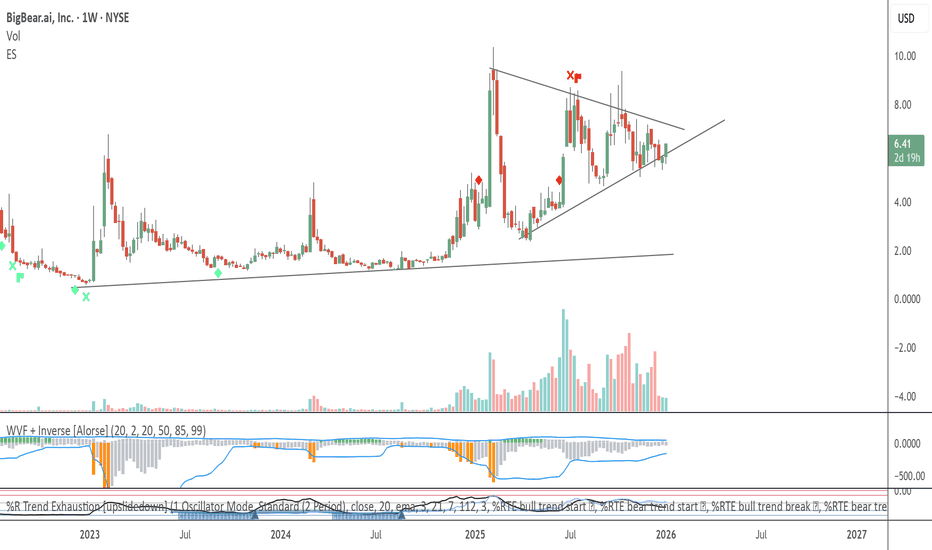

Upper trendline break on BBAI!?OptionsMastery:

🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can c

BigBear.ai, Inc.

No trades

Key facts today

BigBear.ai has partnered with Maqta Technologies, part of AD Ports Group, to seek global business opportunities with customs agencies and port operators.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−1.38 USD

−295.55 M USD

158.24 M USD

431.74 M

About BigBear.ai, Inc.

Sector

Industry

CEO

Kevin McAleenan

Website

Headquarters

McLean

Founded

2020

IPO date

Feb 9, 2021

Identifiers

3

ISIN US08975B1098

BigBear.ai Holdings, Inc. engages in data-driven decision dominance and advanced analytics that provide its customers with a competitive advantage in a world driven by data that is growing in terms of volume, variety, and velocity. The firm operationalizes artificial intelligence and machine learning at scale through its end-to-end data analytics platform. It deploys its observe, orient and dominate products to customers throughout the defense, intelligence, and commercial markets. The company was founded in 2020 and is headquartered in McLean, VA.

Related stocks

$BBAI: From Hibernation to 4X AI rocket ship?🐻🐻🐻

BigBear.ai is no longer just a struggling SPAC; it is positioning itself as the "Palantir for the Rest of Us" in the defense and cargo security sectors.

(at least that is the narrative)

I'm looking at a 4X potential move on #BBAI as it coils at the bottom of a massive #HVF pattern

@TheCryptoSn

BBAI Bullish 200 MAPrice right now is around 5.60.

Bull case is simple: hold the 200 MA and break the range.

Support and risk

5.62 is your near-term pivot. If price reclaims and holds above it, buyers have control.

5.32 is the key higher-low support. Losing 5.32 puts the whole base in danger.

5.06 is the line in the

Structural Compression Phase🔎 Overview

This idea focuses on identifying potential bullish expansion after a multi-day price consolidation inside the EMA 100 High–Low Band.

The structure highlights range compression, swing-based trendline pressure, and rising volume during consolidation, which together can signal a market prep

BigBear.ai vs Palantir: Who Leads in Strategic AI?BigBear.ai (BBAI) is emerging as a key player in the world of advanced artificial intelligence, decision intelligence, and machine learning, with a particular focus on defense, national security, and mission-critical operations. The company transforms complex data into actionable insights, enabling

BBAI to give 100% return in H1 2026I love the setup on BBAI

1. Higher high, higher lows on weekly timeframes

2. Volume build up

3.MACD, Money Flow Indicator bullish continuation divergence

4. %R crossover on 17th Nov 2025

5. Bullish Zigzag structure

Conservation target 15, potentital to reach 20.5 and 26.5, all within 2026

BBAI - Big Bear on the tails of the Bull!=======

Volume

=======

-increasing

==========

Price Action

==========

- supported on the uptrend line

- inverted H&S

=================

Technical Indicators

=================

- Ichimoku

>>> price above cloud

>>> Green kumo budding

>>> Tenken + Chiku - above clouds and moving away

>>> Kijun -

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of BBAI is 4.72 USD — it has increased by 15.69% in the past 24 hours. Watch BigBear.ai, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange BigBear.ai, Inc. stocks are traded under the ticker BBAI.

BBAI stock has fallen by −12.75% compared to the previous week, the month change is a −23.25% fall, over the last year BigBear.ai, Inc. has showed a −36.90% decrease.

We've gathered analysts' opinions on BigBear.ai, Inc. future price: according to them, BBAI price has a max estimate of 8.00 USD and a min estimate of 5.00 USD. Watch BBAI chart and read a more detailed BigBear.ai, Inc. stock forecast: see what analysts think of BigBear.ai, Inc. and suggest that you do with its stocks.

BBAI reached its all-time high on Apr 6, 2022 with the price of 16.12 USD, and its all-time low was 0.58 USD and was reached on Dec 30, 2022. View more price dynamics on BBAI chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

BBAI stock is 17.68% volatile and has beta coefficient of 3.09. Track BigBear.ai, Inc. stock price on the chart and check out the list of the most volatile stocks — is BigBear.ai, Inc. there?

Today BigBear.ai, Inc. has the market capitalization of 2.06 B, it has decreased by −5.15% over the last week.

Yes, you can track BigBear.ai, Inc. financials in yearly and quarterly reports right on TradingView.

BigBear.ai, Inc. is going to release the next earnings report on Mar 18, 2026. Keep track of upcoming events with our Earnings Calendar.

BBAI earnings for the last quarter are 0.01 USD per share, whereas the estimation was −0.07 USD resulting in a 113.64% surprise. The estimated earnings for the next quarter are −0.06 USD per share. See more details about BigBear.ai, Inc. earnings.

BigBear.ai, Inc. revenue for the last quarter amounts to 33.14 M USD, despite the estimated figure of 31.81 M USD. In the next quarter, revenue is expected to reach 33.32 M USD.

BBAI net income for the last quarter is 2.52 M USD, while the quarter before that showed −228.62 M USD of net income which accounts for 101.10% change. Track more BigBear.ai, Inc. financial stats to get the full picture.

No, BBAI doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Feb 7, 2026, the company has 630 employees. See our rating of the largest employees — is BigBear.ai, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. BigBear.ai, Inc. EBITDA is −52.47 M USD, and current EBITDA margin is −21.37%. See more stats in BigBear.ai, Inc. financial statements.

Like other stocks, BBAI shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade BigBear.ai, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So BigBear.ai, Inc. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating BigBear.ai, Inc. stock shows the neutral signal. See more of BigBear.ai, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.