Brent Crude Oil | DailyBrent crude has been in a medium-term corrective phase since June 2025. Recent price action suggests this correction is nearing exhaustion.

The latest move below the previous low appears to be a liquidity sweep rather than a true bearish continuation, followed by a quick reaction from the lows, indicating weakening sell-side pressure.

A clear time divergence is present: the corrective leg has taken more time than the prior bullish impulse while achieving less price displacement, a typical sign of corrective exhaustion.

Key resistance zones to monitor on any recovery:

- 62.43 – 63.16 (near-term supply)

- 66.17 – 66.90 (mid-range resistance)

- 69.35 – 70.16 (major overhead supply)

At current levels, selling offers a poor risk-to-reward profile. Bias gradually shifts toward the long side, especially if price breaks the descending trendline or shows structure shift on lower timeframes.

What traders are saying

Brent uptrend supported at 6726The BRENT crude oil remains in a bullish trend, with recent price action showing signs of a consolidation within the broader uptrend.

Support Zone: 6726 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 6726 would confirm ongoing upside momentum, with potential targets at:

7140 – initial resistance

7220 – psychological and structural level

7300 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 6726 would weaken the bullish outlook and suggest deeper downside risk toward:

6580 – minor support

6500 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the Brent crude oil holds above 6726. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Brent Oil Setup: Pre-Talks Correction ScenarioBrent Crude OIL ( FX_IDC:USDBRO ), over the past two months, has been rising due to escalating tensions in the Middle East and the potential for conflict between Iran and the U.S. If these tensions materialize, global oil supply could be impacted—especially given the significance of the Strait of Hormuz.

In the past 48 hours, however, news emerged that Iran-U.S. negotiations are set for Friday at 10 a.m. local time in Muscat, Oman, rather than Istanbul. If these talks yield positive results, oil prices may fall due to reduced tensions. Conversely, if talks fail, oil could spike again. Until then, we can rely on technicals for short-term opportunities.

Let’s quickly check Brent oil’s 4-hour chart. Brent has been in an ascending channel over the past 60 days and is currently near a resistance zone($71.30-$68.00).

From an Elliott Wave perspective, Brent seems to have completed a 5-wave impulse within the ascending channel. We can now anticipate a corrective wave.

I expect Brent oil to decline before the talks, potentially dropping to around $66.40. If agreement is reached, we could see a break of the lower channel line, with prices heading toward $63.64.

First Target: $66.40

Second Target: $63.64

Stop Loss(SL): $61.00(Worst)

Points may shift as the market evolves

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌U.S. Dollar/Brent Crude OIL Analysis (USDBRO), 4-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

The Silence Before the $70 Storm in Brent OilThe Silence Before the $70 Storm in Brent Oil

Look at the chart.

The energy market is holding its breath.

We are witnessing a classic standoff in Brent Crude.

A battle between two massive forces. And right now, nobody is winning.

🤔 On one side, we have the bears. Look at the yellow line.

Descending Trendline Resistance.

Every time price tries to rally, it gets hammered back down. Lower highs. Constant pressure. The sellers are relentless.

On the other side, the bulls are digging in.

Look at the bottom.

Major Support ($58-60). We have a clear Double Bottom. The market refused to go lower. It’s a floor.

⚔️ So, what happens now?

The price is being squeezed. The range is tightening. Volatility is dying.

But a breakout is coming this year.

And why is this happening? Uncertainty, geopolitics, supply chains, wars... unpredictable.

The fundamentals are too complex right now.

There is too much noise . That is why the Smart Money is taking its time. They are waiting for clarity. And you should too.

The $68-70 Zone This is where the magic happens. Look at the white lines on my chart. $68-70. This was previous Support. It should act as new Resistance.

Do not guess. React. You have two clear scenarios.

Scenario A : The Bearish Rejection, If price creeps up to $68-70, we watch. If it stalls? We sell.

Scenario B: The Breakout (The Reversal) But what if the bears fail? If price smashes through $70 and closes above that yellow trendline... everything changes. That is a trend reversal . The "Lower High" sequence is broken.

Do not force a trade in the middle of the range. Sit on your hands. Let the price come to the $68-70 decision point.

If the price goes to $60 area, you do the same. Buy over the resistance with a tight stop loss and if the double bottom is broken just sell.

👇 WANT MORE?

Hit the rocket, read my profile or follow so we can find each other again.

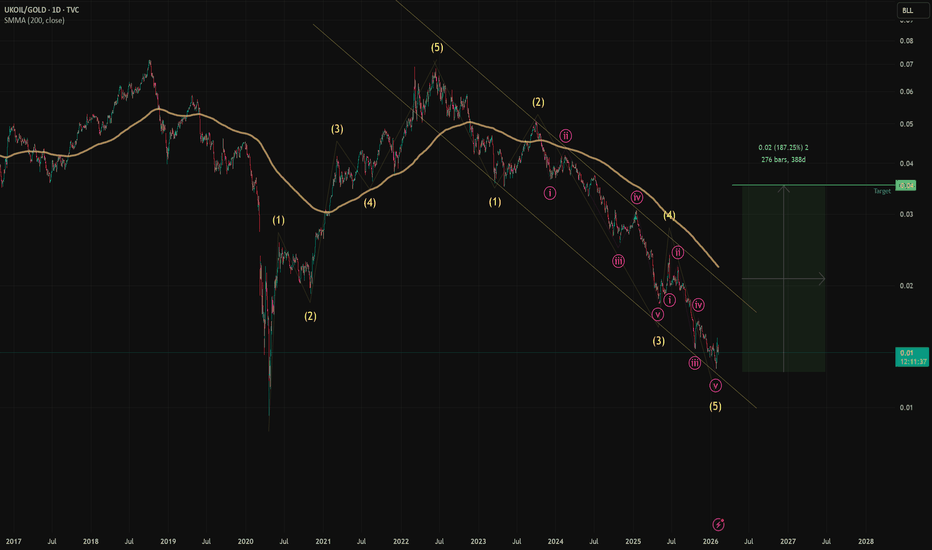

Accelerating Fiat Debasement: The Inevitable Path AheadThroughout history, whenever a new power rises to challenge global hegemony, incumbent nations shift toward protectionism. They raise tariff barriers to shield their internal economies from competition and often resort to conflict—either directly or via proxies—to disrupt their rivals. You can find detailed studies of these cycles in Ray Dalio’s work or in Immanuel Wallerstein’s world-systems theory, which traces the hegemonies of Italy, Holland, Britain, and the USA.

China is now poised to either replace the USA or establish itself as a peer global hegemon. The USA has no choice but to prepare its economy for this new reality. They must create an environment to rebuild local production, much of which has been offshored to Asia since the 1980s. It does not matter who the president is—Trump or anyone else—this structural shift is inevitable. While Trump is executing this strategy aggressively, those still thinking within the old "globalization framework" may view his actions as chaotic. However, the problem lies not with Trump, but with observers who fail to grasp the current moment in the global economic cycle.

Strategic Imperatives for the USA

Rebuild Domestic Production via Tariffs. This is essential, but it carries risks. If the USA isolates its economy while the rest of the world continues to trade freely with China, China’s economy will continue to expand. This is unacceptable for the USA; they must take steps to prevent this divergence.

Disrupt Global Trade. To maintain relative power, the USA needs to hinder competitors. Europe is a major consumer of Chinese goods. How can the USA reduce Europe's trade with China? Europe is heavily dependent on energy from the USA and the Middle East. Consequently, the USA would benefit significantly if a disruption in the Middle East halted energy supplies from that region, forcing Europe into closer alignment with US energy exports.

Debt Burden Relief. From a monetary perspective, clearing the debt overhang is an absolute must to create an environment for future growth. You cannot save and invest if debt repayment consumes a massive portion of your income.

The Debt Trap: Three Options

There are only three ways to resolve the current sovereign debt issue:

Default on the debt. This is catastrophic. One entity's debt is another's collateral. A hard default would lead to total financial chaos and potential revolution.

Austerity (Status Quo). Continue doing what has been done since 2000. This is not a solution—interest payments will eventually consume all GDP growth, stifling investment.

Debase the Currency. Significantly debase the currency via high inflation to make old nominal debt a small fraction of GDP in new, inflated money. This is the only viable way out.

Looking at the Gold chart, debasement started in earnest around 2000. Consider elite sports contracts: decades ago, top players earned $10M; today, contracts exceed $700M. Yet, even this pace is insufficient given the US debt interest bill due in 2026. The speed of USD debasement must be increased significantly! The question is: how to achieve this without sparking riots?

The Perfect Scenario: An Oil Supply Shock

An oil supply shock—such as the closure of the Strait of Hormuz, which accounts for 30% of traded energy—is the perfect scenario for the USA.

It resolves multiple strategic issues simultaneously:

It guarantees massive inflation, accelerating currency debasement to wipe out real debt.

It reduces the purchasing power of the European population, hurting China’s export markets.

It cements Europe's full dependency on US energy supplies, benefiting the US energy sector (a key part of the elite supporting Trump).

China’s economy would starve from energy under-supply, slowing its growth trajectory.

There are so many benefits for the USA in an oil supply shock that I do not see any other outcome from the situation around Iran other than a long-lasting conflict, the main goal of which is simply the disruption of global energy supply.

Technical Outlook

Now, back to the charts. The setup aligns perfectly with the fundamental thesis.

Crude Oil is completing a corrective Wave 2 and is ready to start Wave 3 with shockingly high targets above $500 . If you asked people in 1974, when the price was under $4, that in just 5 years the price would be almost $40, they would have called you crazy. But history rhymes.

Gold : The target for Wave 3 is around $27,000 . There is a long way to go up.

Silver : To complete the massive cup and handle pattern, price should head towards ~$600 .

This oil does not show a good outlook...This oil does not show a good outlook???

It may be due to the policies of seizure (you read theft) of oil wells, and after the seizure of oil, we had up to 3 times the price in history, which has become expensive to cover the costs of shameless war by killing children and men and of course women in certain parts of the world.

In the meantime: a number of countries played the role of executioners (they are still killing)

A number of countries played the role of supplying goods for the world after high oil prices (China)

And a number of countries played the role of sellers of expensive oil and small amounts of goods supplied with expensive oil to some people! (Oil well owners)

With the great theft of Venezuelan oil, this behavior will probably be repeated again!

We will have to spend a lot of time on the road to realize this scenario again

We hope for God's justice to eliminate the corrupt and those who participate in corruption, whether on earth or activists and participants in Ep/stein's personal island

Introduce me to your friends so we can build a bigger community together.

BCOUSD OIL Trend line break out, Low Risk trade LONGHI Traders!

This idea is based on several factors:

- Indicated falling trade line has been broken

- Daily RSI above the 50

-Political situation, and other economical reasons to believe proce will go up

My prediction and speculation on the price is based on Fib levels hence TP as indicated at 88USD, as you see, SL quite low, below the 200EMA

This is just an idea....not a trading advise! Always protect your capital and good luck to you all! There is enough money for everyone :D

Stop!Loss|Market View: BRENT🙌 Stop!Loss team welcomes you❗️

In this post, we're going to talk about the near-term outlook for the BRENT ☝️

Potential trade setup:

🔔Entry level: 70.18

💰TP: 72.97

⛔️SL: 68.96

"Market View" - a brief analysis of trading instruments, covering the most important aspects of the FOREX market.

👇 In the comments 👇 you can type the trading instrument you'd like to analyze, and we'll talk about it in our next posts.

💬 Description: Technically, the situation is favorable for oil buyers. This is confirmed by the price movement within the ascending channel, as well as a likely retest of the 70-degree area, with a subsequent likely upward breakout. Furthermore, we shouldn't forget the geopolitical factor to which oil is very sensitive: the situation in the Middle East, which will likely push the price higher once again.

Thanks for your support 🚀

Profits for all ✅

Oil: A Volatile Playground with Measured Long OpportunitiesOil is an adventure for the faint of heart—gaps on openings and sharp moves are all part of this instrument. Perhaps only natural gas is more unpredictable.

Nevertheless, I currently see a decent opportunity to go long, with a fairly tight stop at 65.20—today’s low.

On the hourly chart, the price sits at the 50-period moving average, and from past experience since early January, we’ve repeatedly bounced up from this level.

Thus, I’ll try—my stop is about 1%—with a first target of 68.20 (around 3.75% gain) and a second target at 72.5, nearly 10 to 11% return.

Brent uptrend continuation pattern developing supported at 6583The BRENT crude oil remains in a bullish trend, with recent price action showing signs of a consolidation within the broader uptrend.

Support Zone: 6583 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 6583 would confirm ongoing upside momentum, with potential targets at:

7140 – initial resistance

7220 – psychological and structural level

7300 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 6583 would weaken the bullish outlook and suggest deeper downside risk toward:

6509 – minor support

6420 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the Brent crude oil holds above 6583. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Brent Crude Oil (UKOIL) — H4 Formation of an ABC Structure + ChaBrent Crude Oil (UKOIL) — H4 Formation of an ABC Structure + Channel Breakout (Trend Continuation)

🔎 Market Structure (H4)

On the H4 timeframe, Brent is forming a corrective ABC structure, and price is attempting a breakout through the channel boundary, which supports a continuation of the broader uptrend.

Key technical points:

A corrective A–B–C leg is developing after the previous push higher

Price action shows a channel boundary break / breakout attempt

The scenario assumes continuation only if price holds above the C-wave low

📐 Higher Timeframe Context

• On the higher timeframe, the move can be interpreted as the formation of a 5th wave (continuation phase) — meaning the market may be preparing for the final impulsive push higher.

• The ABC correction serves as the buildup phase, and the breakout of the channel boundary is the trigger that confirms continuation.

📍 Entry Zone

Entry: 66.648

Entry is positioned around:

The breakout/retest area of the channel boundary

The post-correction stabilization zone after wave C completion

🎯 Target Levels (from the chart)

Upside targets are defined by the marked structural levels:

TP1: 68.534

TP2: 70.485

TP3: 73.232

TP4: 76.071

🛑 Invalidation / Stop

Stop: 65.073

Stop is placed below the low of wave C, which invalidates the ABC-completion / continuation setup if broken.

🧠 Risk & Trade Management

• This setup is continuation-biased — not a reversal trade

• Confirmation improves if price holds above the breakout zone and forms higher lows

• Avoid increasing risk before the structure fully transitions from correction to impulse

• If price breaks below 65.073, the continuation scenario is invalidated

📌 Summary

Brent (H4) is forming an ABC corrective structure and attempting a channel breakout in line with the broader uptrend.

Higher timeframe context supports a potential 5th wave development, with targets mapped above as the continuation path.

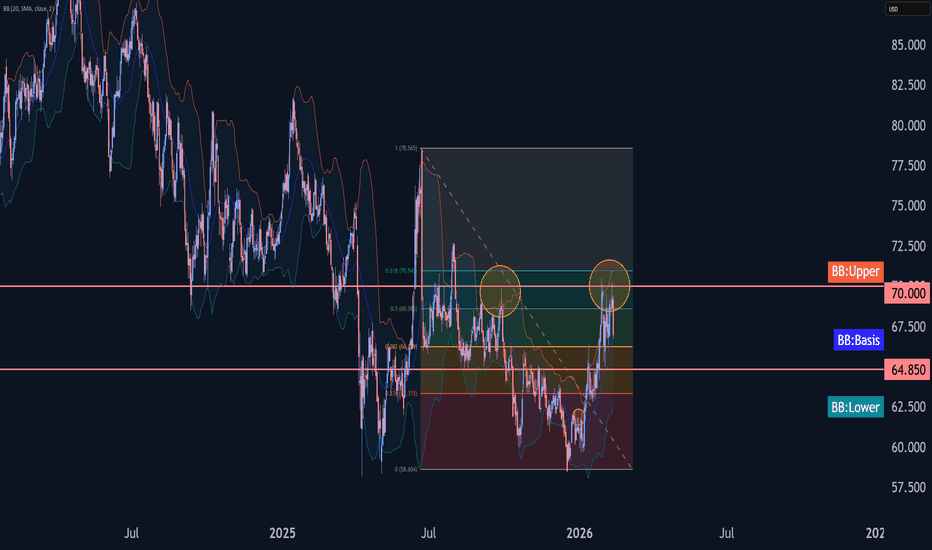

Brent Crude Oil Wave Analysis – 2 February 2026

- Brent Crude Oil reversed from resistance level 69.50

- Likely to fall to support level 64.25

Brent Crude Oil recently reversed from the resistance area located between the pivotal resistance level 69.50 (which has been reversing the price from September), upper daily Bollinger Band and by the 61.8% Fibonacci correction of the downward impulse from June of 2025.

The downward reversal from this resistance area created the daily Japanese candlesticks reversal pattern Long-legged Doji – strong sell signal for Brent Crude Oil.

Brent Crude Oil can be expected to fall to the next support level 64.25 (former resistance from November and January).

#UKOIL - Double bottom, aiming $95Hi guys! 👋

🔔Brent crude has been in a prolonged corrective phase since the 2022 highs, but price action now suggests a potential trend reversal from a well-defined long-term support zone.

🔔 The market has twice defended the $58.7 level, forming a clear double bottom structure and signaling seller exhaustion after an extended downtrend.

🔔 The first rebound occurred near the 0.5 Fibonacci retracement, strengthening the validity of the base and increasing the probability of a sustained upside move.

🔔 Key resistance levels to watch are $72.5, $77, and $86.5, each acting as a structural barrier that must be cleared to maintain bullish momentum.

🔔 A confirmed breakout above these zones opens the path toward the $95–$95.7 target, which represents the measured move of the double bottom pattern.

🔔 From a macro perspective, steady global oil demand growth and persistent geopolitical risk in major producing regions may support higher prices by sustaining a risk premium.

Bias : Bullish above $58.7

Invalidation : Sustained breakdown below the double-bottom base

✊ Good luck with your trades! ✊

• If you like the idea, hit the 🚀 button

• Please ✍️ your thoughts in the Comments section

• And follow me for more updates.

Brent Oil | Conditional Long Into Macro Week🛢🛢🛢

Brent is pressing against the upper boundary of a long-term descending channel. Momentum has picked up, but the market sits ahead of high-impact macro events: US CPI, FOMC rate decision (likely to remain unchanged), and PMI data later this week. These events could either confirm the breakout or trigger a temporary pullback.

🔍 Technical Setup

Price is testing channel resistance and key volume areas.

Daily SMA50 (purple) is being in favor of the upside, with the short-term Gaussian filter showing early trend strength.

Structure allows for two scenarios:

Break & Hold: A decisive close above the channel can open the way toward the next resistance zone (~$73–$74).

Fakeout / Rejection: Failure to hold above resistance may see a pullback to support (~$62–$63), offering a lower-risk long entry or a rotation trade.

⚖️ Macro Considerations

CPI and PMI will influence inflation expectations, impacting both crude demand sentiment and USD positioning.

Fed decision likely unchanged → USD may remain soft, potentially supporting oil upside.

Market sentiment could shift sharply on any unexpected hawkish or dovish signal, so confirmation is key before committing size.

📌 Key Takeaways

Conditional long favored if Brent closes above the channel with follow-through.

Fakeout risk is real, macro events can trigger sharp intraday reversals.

Ideal approach: wait for confirmation, align size with macro confidence, and watch support/resistance levels closely.

Bottom Line:

Brent is at a macro-infused technical inflection point. The trend bias is upward, but news sensitivity is high. Trade accordingly, confirmation first, conviction second.

UKOIL H1 | Potential bearish reversalBased on the H1 chart analysis, we can see that the price has rejected off our sell entry level at 70.87, which is a swing high resistance.

Our stop loss is set at 70.87, which is a pullback resistance.

Our take profit is set at 68.71, an overlap support slightly below the 50% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

Brent Crude Oil Wave Analysis – 12 February 2026- Brent Crude Oil reversed from resistance zone

- Likely to fall to support level 64.85

Brent Crude Oil recently reversed down from the resistance zone between the round resistance level 70.00 (which has been reversing the price from September), upper daily Bollinger Band and the 61.8% Fibonacci correction of the downward impulse from June.

The downward reversal from this resistance zone created the daily Shooting Star, which stopped the earlier impulse waves iii and (3).

Brent Crude Oil can be expected to fall to the next support level 64.85 (low of the previous minor correction ii).

In 2 DaysIn 2 days, we should have some certainty about the direction of oil going forward.

Green Path

If price closes above $69, we will most likely push up to $72 and confirm the new Bull trend that I believe started ~ 16 Dec 2025. The price action as I am writing this is confirming this.

Yellow Path

We are consolidating through the rest of this week in a larger triangle formation before deciding next direction. Could be up or down as far as triangles go. But many signs point to further upside this year and higher highs in oil.

Red Path

If price closes below $67.40, the bullish thesis is in danger and this outlook needs to be reassessed.

UKOIL H1 | Bullish Momentum BuildingBased on the H1 chart analysis, we could see the price fall to our buy entry level at 68.29, which is a pullback support that aligns with the 50% Fibonacci retracement.

Our stop loss is set at 67.28, which is a pullback support.

Our take profit is set at 69.90, which is a swing high resistance.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

OIL What will happen given the tensions?Brent crude oil should reach around 70 dollars, and in my opinion, with rising tensions in the Middle East, it could even hit 80 dollars. There are two scenarios, and both would lead to higher oil prices. The first is that the United States might block Iran’s oil exports, which would push prices up. The second is the possibility of a war in the Middle East, which on its own would be a strong reason for energy prices—including oil—to rise.

From a technical perspective , the price is moving within a bullish flag or wedge pattern, which typically leads to an upward breakout and a continuation of the uptrend. Additionally, with the corrective waves coming to an end, we should expect the formation of new bullish waves.

Best regards CobraVanguard.💚

Brent Crude Oil Wave Analysis – 28 January 2026

- Brent Crude Oil broke resistance level 66.00

- Likely to rise to resistance level 68.00

Brent Crude Oil recently broke through the resistance area between the resistance level 66.00 (which has been reversing the price from October) and the resistance trendline of the daily down channel from August.

The breakout of the resistance level 66.00 coincided with the breakout of the 38.2% Fibonacci correction of the downward ABC correction (B) from June.

Brent Crude Oil can be expected to rise to the next resistance level 68.00 (target for the completion of the active impulse wave 3).