Microsoft: a major technical support at $350–$400Should Microsoft stock once again be considered in a DCA zone, after having corrected on the stock market since last November and now being the most expensive (in valuation terms) among the Magnificent 7 stocks?

This is the question I will address in this new analysis on TradingView. Feel free to f

Microsoft Corp.

No trades

Key facts today

Microsoft, alongside Alphabet and Amazon, has committed $68 billion for AI and cloud investments in India by 2030, boosting the nation's goal to lead in AI development.

Microsoft has launched a pilot with eight publishers, including People and the Associated Press, investing over $10 million to simplify licensing for AI-generated content.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

16.05 USD

101.83 B USD

281.72 B USD

7.32 B

About Microsoft Corp.

Sector

Industry

CEO

Satya Nadella

Website

Headquarters

Redmond

Founded

1975

IPO date

Mar 13, 1986

Identifiers

3

ISIN US5949181045

Microsoft Corp engages in the development and support of software, services, devices, and solutions. It operates through the following business segments: Productivity and Business Processes; Intelligent Cloud; and More Personal Computing. The Productivity and Business Processes segment comprises products and services in the portfolio of productivity, communication, and information services of the company spanning a variety of devices and platform. The Intelligent Cloud segment refers to the public, private, and hybrid serve products and cloud services of the company which can power modern business. The More Personal Computing segment encompasses products and services geared towards the interests of end users, developers, and IT professionals across all devices. The firm also offers operating systems; cross-device productivity applications; server applications; business solution applications; desktop and server management tools; software development tools; video games; personal computers, tablets; gaming and entertainment consoles; other intelligent devices; and related accessories. The company was founded by Paul Gardner Allen and William Henry Gates III in 1975 and is headquartered in Redmond, WA.

Related stocks

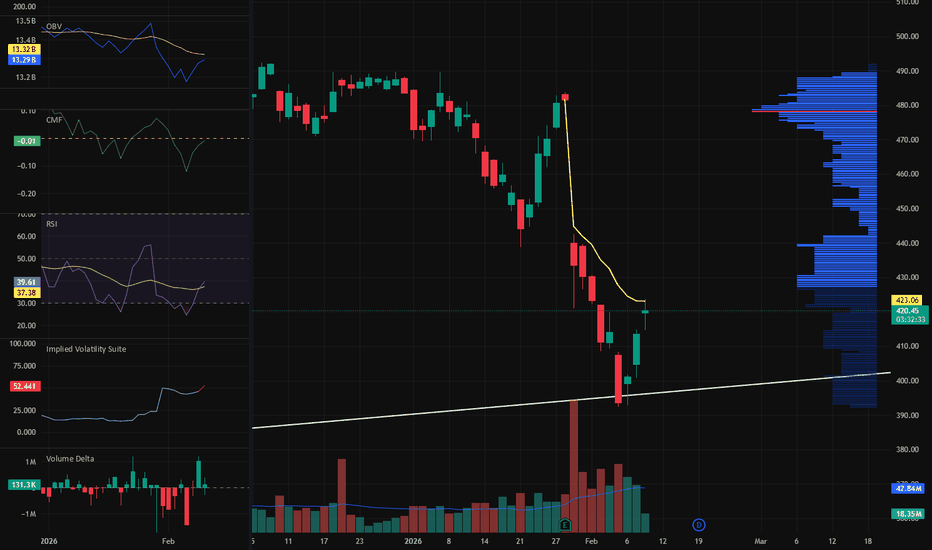

It's a time for MSFT - 15 % potential profit - 480 USDMicrosoft shares are currently in a clear phase of strong sell-off following the peak in October/November 2025 (~$540–550+), where a classic breakout occurred followed by a breakdown of the uptrend. The decline from the high has already reached ~24–25%, and in 2026 alone the stock has lost more than

MSFT 424 Is the Real Test for BuyersJust like I mentioned earlier, 424 is the real test for buyers, and today’s action confirms it. Buyers were much more aggressive yesterday, but once sellers showed up again at 424, the bid clearly softened. That tells me this level is being actively defended and remains the most important area for s

MICROSOFT (MSFT) Market update, Weekly Insight.Fundamental Analysis:

As of today, Microsoft shares are valued are at 404.37, the company market cap stands at 3.09T, with a P/E ratio of 25.30 and dividend yield of 84.1%. an announcement was made on Wednesday that top security leader Charlie Bell will take on a new role, and that Hayete Gallot wi

Microsoft - The worst day in 5 years!🚀Microsoft ( NASDAQ:MSFT ) remains bullish despite the crash:

🔎Analysis summary:

Today Microsoft created its worst day in five years. But at the same time, Microsoft is also approaching a significant confluence of support. And if we soon see bullish confirmation, Microsoft will just create an

MSFT (USA) - About to Bounce Or Heading to the Bottom ?Microsoft has been one of the dominant performers of the past decade, up roughly 630% over the last 10 years and was at its peak before this recent heavy pullback which has wiped out its gains for the year. As a software and cloud computing giant , it still very much sits at the centre of enterp

Microsoft $MSFT finally reached the strong monthly demand $396Microsoft NASDAQ:MSFT stock has finally reached the strong monthly demand $396. We talked about this imbalance a few weeks ago in another analysis after seeing the dark cloud cover bearish piercing pattern in the monthly timeframe.

It took a few months half a year to pull back to this imbalance.

Don't get pissed if $MSFT goes to >$600- NASDAQ:MSFT is behemoth of a company. Some investors were concerned with over reliance on Open AI

- Don't be fooled, These closed source models are getting close to plateau and will reach the plateau in terms of performance in an year or so.

- Open source model will eventually get closed to th

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ATVI4499883

Activision Blizzard, Inc. 4.5% 15-JUN-2047Yield to maturity

6.31%

Maturity date

Jun 15, 2047

ATVI5026499

Activision Blizzard, Inc. 2.5% 15-SEP-2050Yield to maturity

6.19%

Maturity date

Sep 15, 2050

See all MSFT bonds

Frequently Asked Questions

The current price of MSFT is 419.93 USD — it hasn't changed in the past 24 hours. Watch Microsoft Corp. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BCS exchange Microsoft Corp. stocks are traded under the ticker MSFT.

MSFT stock has risen by 0.85% compared to the previous week, the month change is a −11.67% fall, over the last year Microsoft Corp. has showed a 1.79% increase.

We've gathered analysts' opinions on Microsoft Corp. future price: according to them, MSFT price has a max estimate of 730.00 USD and a min estimate of 392.00 USD. Watch MSFT chart and read a more detailed Microsoft Corp. stock forecast: see what analysts think of Microsoft Corp. and suggest that you do with its stocks.

MSFT reached its all-time high on Oct 28, 2025 with the price of 542.02 USD, and its all-time low was 26.43 USD and was reached on Dec 4, 2012. View more price dynamics on MSFT chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

MSFT stock is 3.39% volatile and has beta coefficient of 0.95. Track Microsoft Corp. stock price on the chart and check out the list of the most volatile stocks — is Microsoft Corp. there?

Today Microsoft Corp. has the market capitalization of 2.98 T, it has increased by 0.58% over the last week.

Yes, you can track Microsoft Corp. financials in yearly and quarterly reports right on TradingView.

Microsoft Corp. is going to release the next earnings report on Apr 28, 2026. Keep track of upcoming events with our Earnings Calendar.

MSFT earnings for the last quarter are 4.14 USD per share, whereas the estimation was 3.91 USD resulting in a 6.00% surprise. The estimated earnings for the next quarter are 4.05 USD per share. See more details about Microsoft Corp. earnings.

Microsoft Corp. revenue for the last quarter amounts to 81.27 B USD, despite the estimated figure of 80.31 B USD. In the next quarter, revenue is expected to reach 81.30 B USD.

MSFT net income for the last quarter is 38.46 B USD, while the quarter before that showed 27.75 B USD of net income which accounts for 38.60% change. Track more Microsoft Corp. financial stats to get the full picture.

Yes, MSFT dividends are paid quarterly. The last dividend per share was 0.91 USD. As of today, Dividend Yield (TTM)% is 0.85%. Tracking Microsoft Corp. dividends might help you take more informed decisions.

Microsoft Corp. dividend yield was 0.67% in 2025, and payout ratio reached 24.34%. The year before the numbers were 0.67% and 25.42% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 17, 2026, the company has 228 K employees. See our rating of the largest employees — is Microsoft Corp. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Microsoft Corp. EBITDA is 184.76 B USD, and current EBITDA margin is 57.74%. See more stats in Microsoft Corp. financial statements.

Like other stocks, MSFT shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Microsoft Corp. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Microsoft Corp. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Microsoft Corp. stock shows the sell signal. See more of Microsoft Corp. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.