Binance is toooo hotBNB price action is very overbought. There is a class A bearish divergence in momentum, suggesting that a consolidation or retracement could be in play soon. The FUD on Binance has also permeated throughout the market, causing the perfect storm to amplify sell pressure. Stay neutral and focus on the chart.

Trade ideas

BNB USDT LONGOf course, here is the English version of the last signal:

🚨 New Signal 🚨

📊 Symbol: BNB/USDT

🐂 Position Type: BUY/LONG

🟢 Entry Point: 1,215.07

🎯 Take Profit (TP):

1,309.34

🚫 Stop Loss (SL):

1,172.06

⚠️ Always practice proper risk management.

📌 Note: This setup is based on Smart Money Concepts (SMC) following a liquidity grab ($$$) and a Market Structure Shift (MSS).

Bnb/Usdt -Symmetrical Triangle Formation With Breakout PotentilBinance Coin (BNB/USDT) is currently forming a symmetrical triangle pattern, indicating a potential breakout setup as price consolidates between converging trendlines.

The resistance zone (R) highlighted in red marks a strong supply area where previous bullish attempts were rejected. Meanwhile, the support zone (S) in blue represents a key demand region that has repeatedly provided a solid base for price rebounds.

At the moment, BNB is trading near the lower trendline of the triangle, suggesting that a decisive move is imminent.

• A bullish breakout above the upper trendline could lead to a continuation toward the resistance zone and the next target area around 1,350–1,375.

• A bearish breakdown below the ascending support trendline would signal potential weakness, with a downward target near the 1,175–1,150 support region.

Overall, the market remains in a neutral consolidation phase, awaiting confirmation from either a breakout or breakdown to determine the next directional move.

BNB — Swing Failure at $1,300 Could Trigger CorrectionBNB price has formed a clean swing failure pattern (SFP) at the $1,300 level, rejecting strongly from the point of control region. This technical setup signals that liquidity has been collected from above the highs and suggests a cooling phase may follow.

Key Technical Points:

- Resistance: $1,300 (SFP + POC confluence)

- Support: $1,160 key level

- Bias: Short-term retracement likely

After breaking the previous high, price quickly closed back below the region, confirming the SFP structure. Historically, such behavior leads to a retracement phase as traders unwind late longs.

If the current candle structure holds below $1,300, the next logical target lies around $1,160, which aligns with prior high-volume nodes and structural support. However, reclaiming the $1,300 level on volume would invalidate this bearish setup and reopen momentum continuation toward higher time frame resistance.

For now, BNB remains technically corrective until proven otherwise, with the $1,160 zone acting as a probable magnet for price.

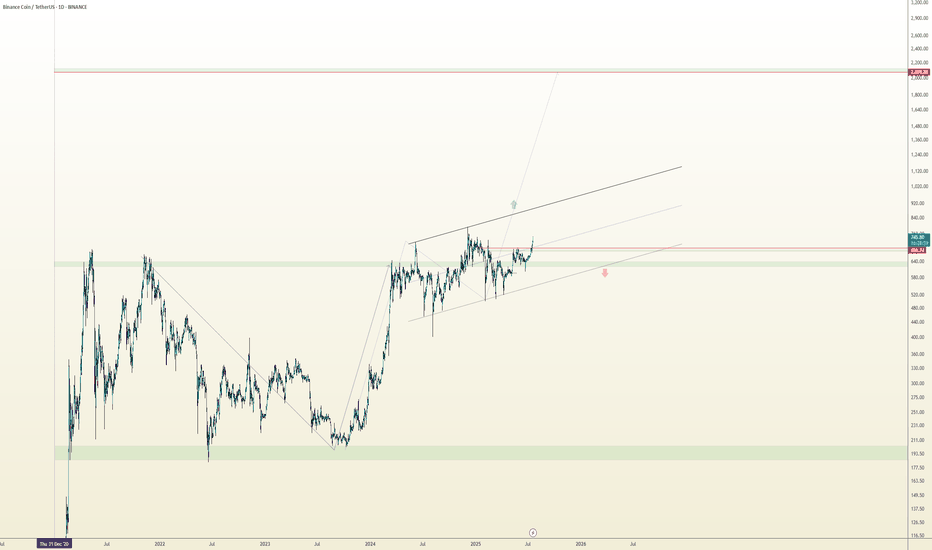

BNB/USDT - STARTING CYCLE 3BNB has started its third expansion cycle 3.

If history repeats again, we could see BNB between 5,000$ - 11,000$ with an average price of 7,000$ aprox.

Monthly Chart so updates will be slow. Just keep an eye on it.

Most cryptos have a similar cycle style. BNB is the first altcoin starting the cycle.

Meaning the altseason might have just set off with the BTC Dominance dropping.

Any likes, boost, and share with your people its appreciated!

BNB/USDT 1D Chart Review🧭 Key technical levels

Resistances:

• 1,344–1,350 USDT – local resistance (last candle highs).

• 1,535 USDT – strong resistance from previous highs.

Support:

• 1,193–1,200 USDT – first strong support (the reaction of the candles is visible).

• 1,080 USDT – another important level, coincident with the yellow uptrend line and EMA50.

⸻

📊 Technical indicators

1.EMA/SMA:

• The red SMA and yellow EMA show that the medium-term trend is up (EMA 50 > EMA 200).

• The price is currently testing the zone between the SMA and EMA - if it stays above ~1,190-1,200, a rebound may occur.

2. MACD (bottom):

• The signal line (orange) crosses the MACD (blue) from above → bearish signal.

• The histogram is starting to flatten - possible end of correction if it lasts for a few days.

3.RSI:

• RSI around 50-55, neutral → no overbought or oversold yet.

• If the RSI rebounds from 50 upwards, it may mean the price rebounds from support.

⸻

📈 Scenarios

✅ Upward scenario (more likely if it maintains support)

• Maintaining above 1,190 USDT → reflection towards 1,344 and then 1,535.

• Confirmation: daily candle closed above 1,344 + increasing volume.

⚠️ Downside scenario

• Loss of the level of 1,190 USDT → correction to 1,080 USDT (EMA 50 test).

• If this support breaks, the next target is around USDT 950-1,000.

BNBUSDT.P - yeah—dead cats don’t bounce foreverWhat did the “biggest liquidation in crypto history” teach me?

'Buy the strong after forced selling. BNB hit ATH 3 days later. Follow the money, not the panic.'

But yeah—dead cats don’t bounce forever, and neither do leaders. Size risk.

What you think of BNB? More straight up or down?

TradeCityPro | BNB Surges Beyond All-Time Highs👋 Welcome to TradeCity Pro!

In this analysis, I’m going to review BNB, the official token of Binance Exchange, which currently holds the #3 spot on CoinMarketCap with a market capitalization of $188 billion.

⌛️ 4-Hour Timeframe

On the 4-hour chart, after the broad market downturn, this coin managed to recover very well. Supported from the 1100 zone, BNB began to move upward again.

📊 A risky long trigger appeared on the lower timeframes around 1143, and if you entered based on that trigger, your position should now be sitting in good profit.

🎲 BNB has now broken through its all-time high after surpassing 1317, and the next corrective wave could potentially begin from here.

✔️ So far, the volume and momentum have both been strong, and there are no signs of weakness in the trend yet—meaning the upward movement can still continue.

✨ However, if this move turns out to be a fake breakout and the price stabilizes below 1317, BNB could enter a longer corrective phase. In that case, with confirmation of the fake breakout below 1317, a short position could also be considered.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Letter to my past self- The day I satayed safeThere were times when every major crypto liquidation meant the same thing for me — total destruction.

I used to lose everything.

Five thousand. Thirty thousand.

Even debt on top of the ashes.

Every crash felt like the end of the road, and every comeback felt like starting from zero again.

Today was different.

It was the biggest liquidation in crypto history — billions erased —

and for the first time, I’m still here.

Safe. Calm.

Ten green days in a row, plus a new high… what was I expecting?

I knew I had to take profit — I knew it.

I got greedy like a pig.

That’s it.

Not revenge. Not panic. Not doubling down.

Just a clean trade that gave everything back because I didn’t lock the gains.

But I’m still here. And that’s new.

What changed?

I stopped treating Bitcoin like an idol and started treating it like a trade.

I stopped chasing redemption and started honoring my rules.

I stopped trying to win everything back — and began protecting what I already have.

I used to think discipline would kill my edge.

Now I know it’s the only thing keeping me alive.

So, to the old me —

the one who over-leveraged,

who believed every bounce was “the one,”

who measured self-worth by PnL —

thank you for the pain.

It built the version of me who can sit through a liquidation

and only regret not taking profit, not losing control.

This is what growth looks like:

Not more wins.

Just fewer disasters.

“The old me would’ve died in this crash.

The new me just took a breath, accepted the loss, and moved on.”

BNB Bullish Flag Formation | Next Move Towards New ATH?#BNB is showing strong bullish momentum — it’s moving in a perfect uptrend with healthy volume supporting the move.

Currently, #BNB is forming a Bullish Flag Pattern on the 4H timeframe, which often signals a continuation of the uptrend after a short consolidation.

Trade Plan:

Wait for a clean breakout above the flag structure.

On breakout confirmation, take a long position with proper risk management.

The breakout could lead us toward a new ATH (All-Time High) if momentum continues.

Key Notes:

Volume confirmation is crucial for a valid breakout.

Watch for fakeouts near resistance levels.

What’s your view on #BNB? Do you think it can reach a new ATH soon?

Let’s discuss!

#BNB #BNBUSD #Crypto #BullishFlag #TradingView #CryptoTrading #Binance #BNBAnalysis #Altcoins #PriceAction #Breakout #TechnicalAnalysis #CryptoBullRun

BNB Daily – Between Resistance and ContinuationBNB Daily – After the Run, Testing Its Range

Since July, BNB has delivered an impressive rally. Back then, price was sitting near the 61.8% Fibonacci level, and from there it climbed all the way to a new all-time high at the 161.8% Fib extension, which is now acting as resistance.

On October 7 and 8, intraday moves briefly pushed above this level, but both sessions failed to close above it, leading to a clear rejection on October 9, confirmed by a large downside volume bar.

From a system perspective, the structure remains in an uptrend, with MLR > SMA > Price > BBc

indicating that despite the pullback, the broader bullish structure is still valid.

Key levels to watch:

Resistance: 161.8% Fib at $1310

Support: BB Center (orange) at $1198

If BNB can hold above the BB Center, it keeps the upper hand and could attempt another move toward its ATH.

However, a daily close below the BB Center would shift the short-term momentum bearish, opening room for further downside.

Periods like this often decide whether a move becomes continuation or distribution: patience around key levels pays off.

Bias:

Neutral-bullish — uptrend intact, but watching the BB Center closely for confirmation.

Always take profits and manage risk.

Interaction is welcome.

BNB hit the ATH and now can dump to 1000$Previous channel resistance broke also retest complete so in result of breakout price can pump like previous channel height and it hit ATH exactly at that point which we expect.

and as we can see when the pump completed now we have reject and correction for a while is ahead also major support and available one is near 1050$ and it would be previous channel resistance which can be now new channel support after a valid retest.

if the support hold we can expect ATH 1500$ else we can expect 850$.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

Perfect Sync: V Reversal Meets Bull Flag

Two clean and classic technical structures:

✅ V-Reversal Formation

✅ Bull Flag – still active and building pressure

After a sharp reversal, the price entered a bullish continuation phase.

Currently moving within the flag structure toward its upper edge.

If we see a breakout to the upside, the move could match the flagpole length, which aligns well with the target from the V-reversal pattern.

📍 Bullish scenario remains valid as long as we stay within structure.

📉 Breakdown below $570 invalidates this setup.

🧠 Important Reminder:

Enter only after a confirmed breakout.

✅ Apply strict risk management

✅ Never risk more than 1% of your capital on a single position.

Everything’s clear. No noise. Just wait for confirmation — let the market come to you.

BNB Pullback May Reset Before $1,550 PushBINANCE:BNBUSDT has cooled about 3.4% from its new all-time high near $1,340, but the structure still favors bulls. On the 12-hour chart, BINANCE:BNBUSDT is replaying a bullish flag fractal that led to past 28% rallies. The price has built a “pole” from around $840 to $1,340 and now seems to be forming the “flag” — a short-term consolidation before another breakout.

A bearish RSI divergence supports a temporary pullback. While price made a higher high, the RSI printed a lower high, signaling slowing momentum. Based on past behavior, a 13%–14% correction toward the $1,190–$1,130 zone would fit the same pattern and complete the flag setup. This region also aligns with key Fibonacci supports.

On-chain data adds to the cooldown case. The short-term holder NUPL has surged 170% since late September, showing traders sitting on high unrealized gains — a typical local top signal. If bulls defend the support range, the next Fibonacci targets remain $1,550 and $1,820. The trend stays constructive unless BINANCE:BNBUSDT closes below $1,130.

Can BNB hit 12% upside and reach $1,455 soon?Hello✌️

Let’s analyze Binance Coin’s price action both technically and fundamentally 📈.

🔍Fundamental analysis:

BNB Chain is stepping up faster blocks, lower supply, and new support for DeFi, AI, and RWA builders. These moves could make BNB more useful and rarer over time. 🚀

📊Technical analysis:

BINANCE:BNBUSDT is showing robust fundamentals and exceptional trading volume, supporting strength beyond pure technical. If key support levels hold, a further 12% upside toward $1,455 is plausible. 📈🚀

📈Using My Analysis to Open Your Position:

You can use my fundamental and technical insights along with the chart. The red and green arrows on the left help you set entry, take-profit, and stop-loss levels, serving as clear signals for your trades.⚡️ Also, please review the TradingView disclaimer carefully.🛡

✨We put love into every post!

Your support inspires us 💛 Drop a comment we’d love to hear from you! Thanks, Mad Whale

Binance Coin Positioned For 16% Upside Toward $1,280 TargetHello✌️

Let’s analyze Binance Coin’s price action both technically and fundamentally 📈.

🔍Fundamental analysis:

BNB burns have cut supply ~30% since 2017, while big holders like BNB Network Company push demand. Less supply and concentrated buying could boost price, as past burns often led to big rallies.

📊Technical analysis:

BINANCE:BNBUSDT has precisely reached its previous target and is trading within a rising channel, now approaching the upper boundary; a breakout could trigger a 16% rally toward $1,280.

📈Using My Analysis to Open Your Position:

You can use my fundamental and technical insights along with the chart. The red and green arrows on the left help you set entry, take-profit, and stop-loss levels, serving as clear signals for your trades.⚡️ Also, please review the TradingView disclaimer carefully.🛡

✨We put love into every post!

Your support inspires us 💛 Drop a comment we’d love to hear from you! Thanks, Mad Whale

$BNB Technical Outlook!CRYPTOCAP:BNB Technical Outlook

BNB continues to mirror Bitcoin’s strength, extending its rally above the 1.3K level. After such an explosive move, a healthy pullback seems likely before the next leg higher.

The chart shows confluence around the $870–$950 zone, aligning with the 0.5 Fibonacci retracement and prior structural breakout area, a potential region for re-accumulation if tested.

As long as BNB holds above the 0.618 zone near $760, the broader trend remains bullish with upside targets toward $1,500–$1,800 over the next swing phase.

Watch for retracements into support rather than chasing highs dips could offer the last accumulation opportunity before the next major expansion.

Bnb/Usdt - Support Bounce And Weak High Target Current price shows a bullish trading setup for Binance Coin (BNB/USDT) on the 15-minute timeframe. The price forms a CHoCH (Change of Character) and crosses above the EMAs, signaling a possible trend reversal. The suggested entry is at the point where the CHoCH and EMA intersect, with a target price set at 1340. The setup is supported by a bounce from a strong support zone, aiming for a move toward the weak high area.