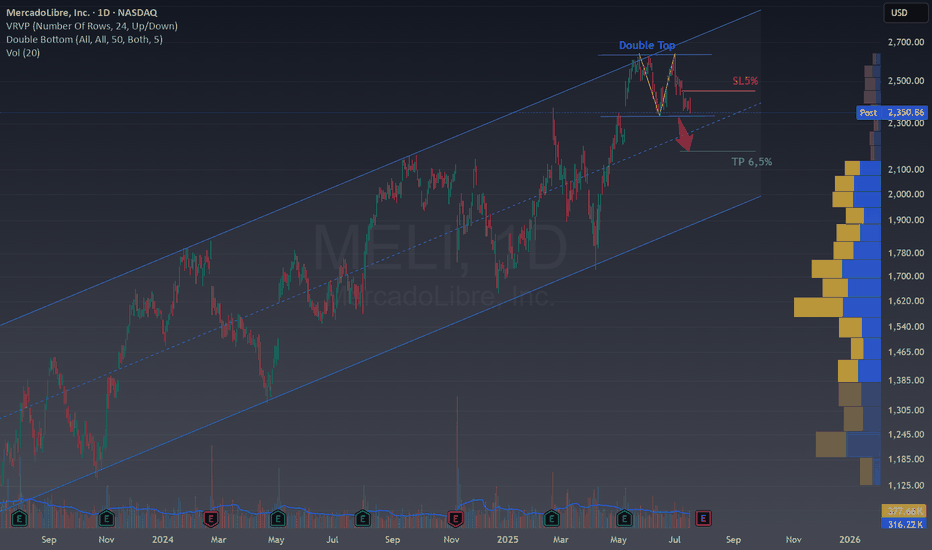

Double Top in MELI – Potential Reversal Inside a Channel🧠 Double Top in MELI – Potential Reversal Inside a Channel

Ticker : MercadoLibre, Inc. (MELI)

Timeframe : 1D (Daily Chart)

Pattern : Double Top

Bias : Bearish Reversal within a Bullish Channel

Technical Breakdown

We're spotting a clean Double Top at the upper boundary of a long-term asc

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

40.50 USD

1.91 B USD

20.78 B USD

46.96 M

About MercadoLibre, Inc.

Sector

Industry

CEO

Marcos Eduardo Galperin

Website

Headquarters

Montevideo

Founded

1999

ISIN

US58733R1023

FIGI

BBG000GQPB11

MercadoLibre, Inc. engages in the development of an online commerce platform with a focus on e-commerce and related services. It operates through the following geographical segments: Brazil, Argentina, Mexico, and Other Countries. The Other Countries segment refers to Chile, Colombia, Costa Rica, Dominican Republic, Ecuador, Panama, Peru, Bolivia, Honduras, Nicaragua, El Salvador, Guatemala, Paraguay, Uruguay, and the United States of America. Its products provide a mechanism for buying, selling, and paying as well as collecting, generating leads, and comparing lists through e-commerce transactions. The company was founded by Marcos Eduardo Galperin on October 15, 1999 and is headquartered in Montevideo, Uruguay.

Related stocks

$MELI: Long term trend activeThe dominant e-commerce and fintech player in Latin America, MercadoLibre, has demonstrated robust growth in the first quarter of 2025.

With a significant increase in gross merchandise volume and total payment volume, the company is capitalizing on the region's digital transformation.

Key metric

MercadoLibre Pulls BackMercadoLibre rallied to new highs last month, and some traders may see an opportunity in its latest pullback.

The first pattern on today’s chart is the $2,374.54 level. MELI first touched that price on February 21 after reporting strong earnings. The stock gapped above the level in May on another s

MercadoLibre setting up for good buy opportunityHello,

MercadoLibre, Inc. engages in the development of an online commerce platform with a focus on e-commerce and related services. It operates through the following geographical segments: Brazil, Argentina, Mexico, and Other Countries.

TECHNICAL ANALYSIS- Checklist

1. Structure drawing (Trend

MELI at Risk from Momentum Shift and High ValuationMELI has gained over 35% since the April dip, but momentum has been fading since September. The slowdown has become increasingly visible, and last week's high may remain the top for some time unless Wednesday’s earnings report surprises the market on the upside.

The consensus estimate for MELI’s re

Technical Analysis of $MELI (MercadoLibre) - For Long TermAfter a thorough analysis of MercadoLibre ( NASDAQ:MELI ) charts on 1M, 1W, and 1D timeframes, here’s a summary covering market context, key levels, trading opportunities, and price phases. Perfect for traders or investors looking for actionable insights.

Market Context

1M/1W: Strong bullish trend

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

M

SXC1O

Mercadopago Servicios de Procesamiento SRL FRN 18-JUL-2026Yield to maturity

—

Maturity date

Jul 18, 2026

See all MELI bonds

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on BOATS exchange MercadoLibre, Inc. stocks are traded under the ticker MELI.

We've gathered analysts' opinions on MercadoLibre, Inc. future price: according to them, MELI price has a max estimate of 3,500.00 USD and a min estimate of 2,600.00 USD. Watch MELI chart and read a more detailed MercadoLibre, Inc. stock forecast: see what analysts think of MercadoLibre, Inc. and suggest that you do with its stocks.

MELI reached its all-time high on Jul 1, 2025 with the price of 2,620.78 USD, and its all-time low was 625.67 USD and was reached on Jun 17, 2022. View more price dynamics on MELI chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

Yes, you can track MercadoLibre, Inc. financials in yearly and quarterly reports right on TradingView.

MercadoLibre, Inc. is going to release the next earnings report on Oct 29, 2025. Keep track of upcoming events with our Earnings Calendar.

MELI earnings for the last quarter are 10.31 USD per share, whereas the estimation was 11.93 USD resulting in a −13.60% surprise. The estimated earnings for the next quarter are 11.04 USD per share. See more details about MercadoLibre, Inc. earnings.

MercadoLibre, Inc. revenue for the last quarter amounts to 6.79 B USD, despite the estimated figure of 6.67 B USD. In the next quarter, revenue is expected to reach 7.25 B USD.

MELI net income for the last quarter is 523.00 M USD, while the quarter before that showed 494.00 M USD of net income which accounts for 5.87% change. Track more MercadoLibre, Inc. financial stats to get the full picture.

No, MELI doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Sep 30, 2025, the company has 84.21 K employees. See our rating of the largest employees — is MercadoLibre, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. MercadoLibre, Inc. EBITDA is 3.65 B USD, and current EBITDA margin is 14.93%. See more stats in MercadoLibre, Inc. financial statements.

Like other stocks, MELI shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MercadoLibre, Inc. stock right from TradingView charts — choose your broker and connect to your account.