Marvell - Marvelous comebackNASDAQ:MRVL price action has seen steady uptrend returning after closing above the US$80.00 psychological level. we expect MRVL to have a good run up 109 and 128 over the longer-term period. Momentum is rising across all short, mid, and long-term indicator. Prices to queue is at 79.75 and 75.00.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.12 USD

−885.00 M USD

5.77 B USD

852.91 M

About Marvell Technology, Inc.

Sector

Industry

CEO

Matthew J. Murphy

Website

Headquarters

Wilmington

Founded

1995

ISIN

US5738741041

FIGI

BBG00ZXBJ153

Marvell Technology, Inc. engages in the design, development, and sale of integrated circuits. Its products include data processing units, security solutions, automotive, coherent DSP, DCI optical modules, ethernet controllers, ethernet PHYs, ethernet switches, linear driver, PAM DSP, transimpedance amplifiers, fibre channel, HDD, SSD controller, storage accelerators, ASIC, and Marvell government solutions. It operates through the following geographical segments: United States, Singapore, Israel, India, China, and Others. The company was founded by Wei Li Dai and Pantas Sutardja in 1995 and is headquartered in Wilmington, DE.

Related stocks

Marvel. Short for now. Long Later.Marvel was a short idea for me at like $77. Now I am looking for lower and potential longs. I will only long in the box if we get there. Its the only sensible yearly and fib level that would justify a long term entry for me. I will wait and if we get there I am in. I create these charts way in

MRVL Hidden Trend: Navigating the Silent DeclineMRVL Bear Flag Pattern

The MRVL chart indicates a bear flag formation, suggesting a continuation of the downtrend from its all-time high of $127.48 in January 2025. After hitting a low of $47.09 in April 2025, the stock consolidated between $47-$85. The recent breach below the sideways channel ref

MRVL Earnings Play--Don’t Miss Out

# 🚀 MRVL Earnings Play (8/28 AMC) 🚀

💎 **Moderate Bullish | 75% Conviction** 💎

🎯 **Trade Setup**

📊 Ticker: \ NASDAQ:MRVL

🔀 Direction: CALL 📈

🎯 Strike: 80.00

📅 Expiry: 2025-08-29

💵 Entry: 2.23 (ASK)

📦 Size: 1 contract (risk 💸 \$223)

🎯 Profit Target: 6.69 (200%)

🛑 Stop: 1.12 (-50%)

⏰ Timing: Pre-e

MRVL $80 Call: Balanced Risk, High-Reward LEAP Trade!

## 💎 MRVL \$80 LEAP – Long-Term Semiconductor Bullish Play! (Sep 2026 Expiry) 💎

### 🔑 Market Summary

* 📊 **Momentum:** Weekly RSI shows short-term bullish recovery; monthly chart signals caution → mixed to moderately bullish

* ⚖️ **Options Flow:** Favorable volatility environment supports LEAP s

MRVL Massive 15-Years Symmetrical Breakout Targets AheadMarvell Technology (MRVL) has just completed a monumental breakout from a 15-years symmetrical triangle, a rare and powerful long-term accumulation structure. This type of macro consolidation typically precedes a major directional expansion, and in this case, the breakout confirmed bullish continuat

MRVL | Ichimoku Breakout Setup with Fractal and MACDMarvell Technology (MRVL) just printed a clean bullish breakout setup across multiple technical systems. Here's the breakdown:

Why This Setup Matters

Ichimoku Cloud: Price has decisively cleared the cloud with bullish Tenkan-Kijun alignment. The Senkou Span A is rising, and the cloud ahead is thin

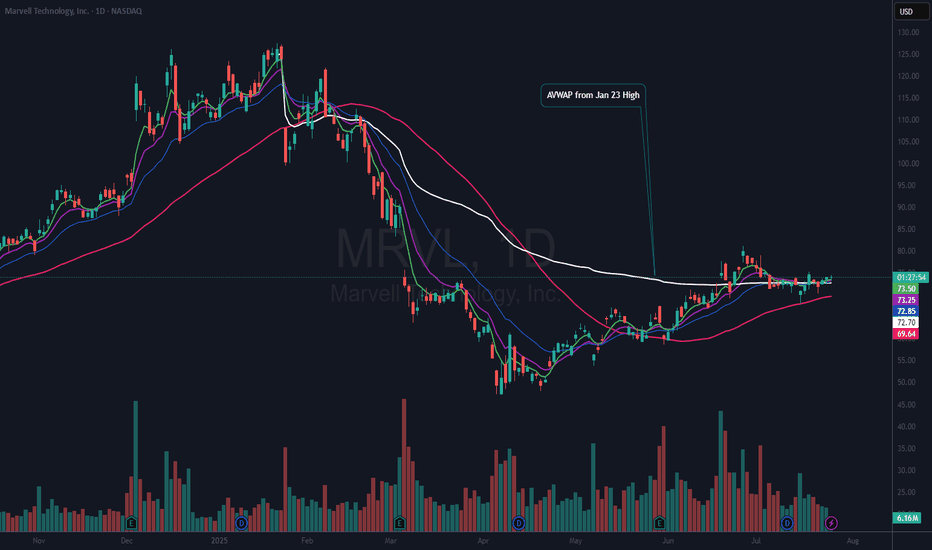

$MRVL Nice Risk Reward HereNASDAQ:MRVL is still basing so this could be quite an early trade. However, I did put on a ½ size position yesterday as it rose above the 21 EMA (blue). I like that it is over the AVWAP from the Jan 23rd all-time high (ATH). That means that by price and volume the majority of stockholders are at or

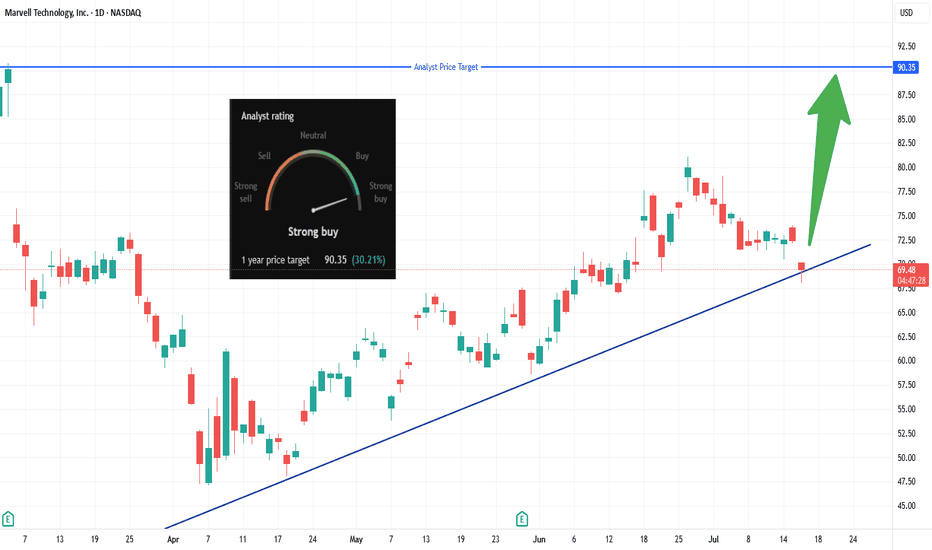

MRVL Long Breakout Setup, Eyes $90 Target!Looking to enter long on a clear breakout above $70.13 (today’s high).

• Entry: Above $70.13

• Stop-Loss: Below today’s low (~$68.50) to protect capital

• Target: $90.35 – per analyst consensus (~+30%)

✅ Why:

📈 Trendline bounce & momentum: Price holding strong above an ascending trendline from Apr

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

MRVL6107490

Marvell Technology, Inc. 5.45% 15-JUL-2035Yield to maturity

5.04%

Maturity date

Jul 15, 2035

MRVL5650452

Marvell Technology, Inc. 5.95% 15-SEP-2033Yield to maturity

4.80%

Maturity date

Sep 15, 2033

MRVL5260819

Marvell Technology, Inc. 2.95% 15-APR-2031Yield to maturity

4.52%

Maturity date

Apr 15, 2031

MRVL6107489

Marvell Technology, Inc. 4.75% 15-JUL-2030Yield to maturity

4.42%

Maturity date

Jul 15, 2030

MRVL5261114

Marvell Technology, Inc. 1.65% 15-APR-2026Yield to maturity

4.42%

Maturity date

Apr 15, 2026

MRVL5650451

Marvell Technology, Inc. 5.75% 15-FEB-2029Yield to maturity

4.34%

Maturity date

Feb 15, 2029

MRVL5305875

Marvell Technology, Inc. 4.875% 22-JUN-2028Yield to maturity

4.26%

Maturity date

Jun 22, 2028

MRVL5260820

Marvell Technology, Inc. 2.45% 15-APR-2028Yield to maturity

4.19%

Maturity date

Apr 15, 2028

MRVL5161847

Marvell Technology, Inc. 2.45% 15-APR-2028Yield to maturity

2.05%

Maturity date

Apr 15, 2028

See all MRVL bonds

Curated watchlists where MRVL is featured.

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on BOATS exchange Marvell Technology, Inc. stocks are traded under the ticker MRVL.

We've gathered analysts' opinions on Marvell Technology, Inc. future price: according to them, MRVL price has a max estimate of 122.00 USD and a min estimate of 58.20 USD. Watch MRVL chart and read a more detailed Marvell Technology, Inc. stock forecast: see what analysts think of Marvell Technology, Inc. and suggest that you do with its stocks.

MRVL reached its all-time high on Dec 17, 2024 with the price of 126.99 USD, and its all-time low was 34.80 USD and was reached on Jan 6, 2023. View more price dynamics on MRVL chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

Yes, you can track Marvell Technology, Inc. financials in yearly and quarterly reports right on TradingView.

Marvell Technology, Inc. is going to release the next earnings report on Nov 27, 2025. Keep track of upcoming events with our Earnings Calendar.

MRVL earnings for the last quarter are 0.67 USD per share, whereas the estimation was 0.67 USD resulting in a −0.52% surprise. The estimated earnings for the next quarter are 0.74 USD per share. See more details about Marvell Technology, Inc. earnings.

Marvell Technology, Inc. revenue for the last quarter amounts to 2.01 B USD, despite the estimated figure of 2.01 B USD. In the next quarter, revenue is expected to reach 2.06 B USD.

MRVL net income for the last quarter is 194.80 M USD, while the quarter before that showed 177.90 M USD of net income which accounts for 9.50% change. Track more Marvell Technology, Inc. financial stats to get the full picture.

Yes, MRVL dividends are paid quarterly. The last dividend per share was 0.06 USD. As of today, Dividend Yield (TTM)% is 0.29%. Tracking Marvell Technology, Inc. dividends might help you take more informed decisions.

As of Sep 30, 2025, the company has 7.04 K employees. See our rating of the largest employees — is Marvell Technology, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Marvell Technology, Inc. EBITDA is 1.76 B USD, and current EBITDA margin is 17.17%. See more stats in Marvell Technology, Inc. financial statements.

Like other stocks, MRVL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Marvell Technology, Inc. stock right from TradingView charts — choose your broker and connect to your account.