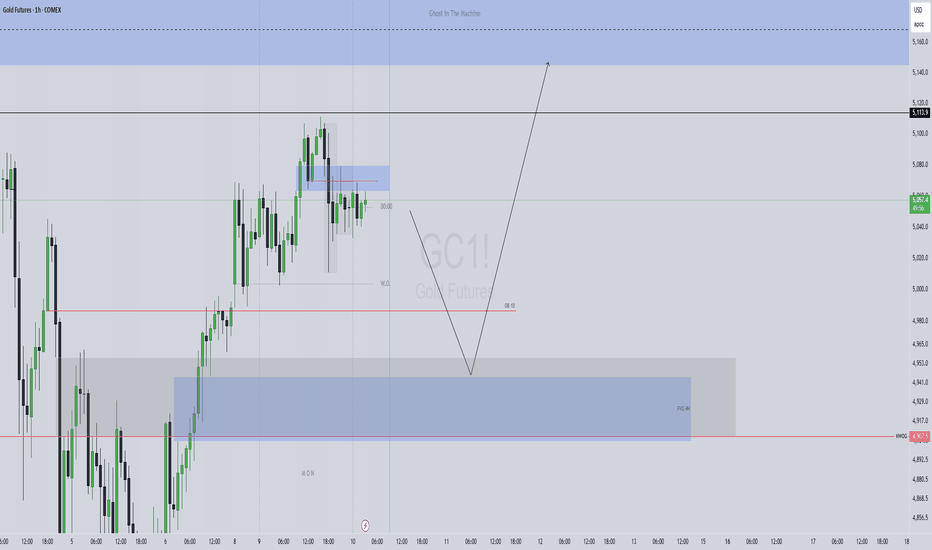

GOLD BREAKOUT - UPSIDE OR DOWNSIDE?Price is compressing near the trendline + technical bounce zone, indicating an impulsive move is coming. Watch for confirmation.

Bullish Breakout

• Buy above: 153,600 (above falling trendline)

• T1 157,800 - T2160,000

• Invalidation - below 152,000

Rejection & Breakdown

• Sell below: 152

Gold Futures

No trades

About Gold Futures

Gold price is widely followed in financial markets around the world. Gold was the basis of economic capitalism for hundreds of years until the repeal of the Gold standard, which led to the expansion of a fiat currency system in which paper money doesn't have an implied backing with any physical form of monetization. AU is the code for Gold on the Periodic table of elements, and the price above is Gold quoted in US Dollars, which is the common yardstick for measuring the value of Gold across the world.

Related commodities

Gold getting ready for next Major Bull RunGOLD Getting ready for the next bull run.

Bull run with little pullback. Levels mentioned- www.tradingview.com

Levels brought up, with technical analysis, including Fib levels at various intervals, previous trend moves, support and resistance levels.

Note: This is purely my idea, I am using for m

Is Copper Next to Rally After Silver and Gold?Last week, we came across news: China calls for more copper stockpiling.

Therefore, is Copper Next to Rally After Silver and Gold?

Why Is China Stockpiling Copper?

Micro Copper

Ticker: MHG

Minimum fluctuation:

0.0005 per pound = $1.25

Disclaimer:

• What presented here is not a recomm

GOLD: Still Bullish? Buy This Massive Dip?In this Weekly Market Forecast, we will analyze Gold (XAUUSD) for the week of Feb. 2-6th.

Gold took a nosedive Friday after Trump's nomination for Fed Chair. The market reacted by a -14% drop, as investors moved funds from metals to the USD.

But is this an opportunity for savvy investors to ente

Gold Futures: A Sharp Drop in Open Interest After Extreme MovesGold futures have seen very violent price action recently. After an exceptional 2025 — with prices nearly doubling — gold is now trading roughly 10% below its all-time high.

While price alone looks dramatic, the more important signal right now comes from Open Interest.

Open Interest is collapsing

more gold volatility ahead likely this FebBased on the current market dynamics, I am expecting a final sell sequence sometime this February to fill the price gaps at $4100-4300 ranges, as evident on the gold daily tf chart view. After that I don't envision anything being able to stop the breakout to 6k this year and ultimately progressing t

Bearish ABC Extension toward 127.2% Target | High RR SetupOverview

Following a significant impulsive leg lower, we are seeing a textbook ABC corrective structure play out. After a temporary relief rally into a established supply zone, the market has broken its corrective trend, signaling a continuation of the primary bearish trend.

Technical Breakdown

How To Change Candle Color And Use Indicator Candle ColoringI get a lot of questions about using the custom candle coloring features on my indicators, so I wanted to make a quick walkthrough on exactly how to change your candle colors and how to get custom indicator candle coloring to show up properly on your charts. I also cover how to change your candle ty

Aggression First, Patience Second: Asian Killzone ExecutionWe opened the week with immediate aggression, breaking above last week’s high without hesitation. That told me early this wasn’t a slow grind environment — this was initiative buying.

Coming into the Asian Killzone, I wasn’t interested in chasing price. After a move like that, I expect some form of

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of Gold Futures is 5,006.6 USD / APZ — it has risen 1.04% in the past 24 hours. Watch Gold Futures price in more detail on the chart.

The volume of Gold Futures is 58.01 K. Track more important stats on the Gold Futures chart.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Gold Futures this number is 283.42 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Gold Futures shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Gold Futures. Today its technical rating is buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Gold Futures technicals for a more comprehensive analysis.