CRVUSDT.P trade ideas

The #1 Bearish Chart PatternThere is something so powerful;

about technical analysis

that's very hard to put together

but once you do piece them together

you will begin to see the power of it

Tracking the price for

these alt coins

has been the best hing

i have ever witnessed.

Seeing the pennant bearish

price pattern

Has been something

i didn't think i would

see

This stuff is starting to get

more and more clear the more

i study about it.

Studying about the reversal pattern

is like reverse psychology

It gives you

the advantage in the market

Because?

Because everyone wants

a bullish signal when

the market is bullish

every one wants a bearish signal

when the market is bearish.

No one wants a correction.

No one wants the reversal.

Think about it how many

times have you seen a sucker

and you know deep down in your heart

that sucker

wont make it

Now imagine a sucker

that makes it in life.

That what this reversal pattern

is all about my man

this is what separates you

from the crowd

because you have hope that one

day that loser guy

you see will make it

think of the buy signal as

the potential you see in that loser

guy friend of yours

You have seen the potential but

no one around

you has..you have seen

it using the buy signal

now you see a big potential

he finally tells you he has made it

because you saw the potential in him

a long time ago and now

he is thanking you for seeing

this potential in him

and vows to help you

with hand outs if you will

ever need one.

That's what this correction is all about

Notice the angles

there all 90 degrees

this chart pattern is

called the pennant bearish pattern

i got it form Steve Nison's book

on Japanese candlestick patterns.

Thats where i first saw

this pattern.

Patterns are important .

If you want to learn more check

out the resources below.

Rocket boost this content to learn more.

Disclaimer:Trading is risky please learn risk

management and profit

taking strategies.Also

feel free to use a simulation trading account

before you trade with real money.

CRVUSDT 1D#CRV is moving inside a falling wedge pattern on the daily chart. Currently, it has bounced nicely from the daily EMA200 and is on the verge of breaking out above the wedge resistance and the daily SMA50. Keep an eye on it. If it happens, the potential targets are:

🎯 $0.8762

🎯 $0.9744

🎯 $1.0538

🎯 $1.1331

🎯 $1.2461

⚠️ Always remember to use a tight stop-loss and follow proper risk management.

The 13 EMA System On Re- Entry (Swing Trading)So am sitting on my computer desk.

Trying to register my publishing business..

then it hit me man.

Its more affordable to start a business

than to get a driving license.

So which one would you do?

Would you start a business or get a driving

license?

Starting a business is something

i wish i did in my younger days.

Those days i had so much imagination

and no guidance on how to monetise

my ideas.

Starting this publishing business

is something am so proud of myself by.

Now look at this chart KUCOIN:CRVUSDT

you will see something called a failure swing.

What is a failure swing?

This is the break even point or the re entry signal.

Dont get sacred of this

its a sign that the next bullish move in KUCOIN:CRVUSDT

is going to be huge!!

Am using the William %R to see this swing

because its my favourite indicator..

Which indicator do you use to see the failure swing?

Do you think this is where the name

swing trading comes from?

If you remember on the last idea

i told you i saw a dragonfly doji as an entry

This failure swing signal is the icing on the cake.

Trade safe.

Rocket boost this content to learn more

Disclaimer:Trading is risky please learn risk managment

and profit taking strategies.Also feel free to use

a simulation trading account before you trade with real money.

Is it a time for CRVUSDT. 30% potential target 1 $

On the 4-hour Curve/USDT chart the market shows a period of sideways consolidation after a recent rebound from the 0.72 USD area. Price is hovering around 0.77 USD, moving in a relatively tight range and testing both short-term moving averages.

The shorter moving average has started to flatten and occasionally crosses above the longer one, a sign that selling momentum is easing. At the same time, the longer moving average still trends slightly downward, so the broader picture remains neutral to mildly bearish until a clear break higher occurs.

A key support zone is visible around 0.74–0.75 USD, where several pullbacks have recently been absorbed. Above current levels, the first notable resistance lies near 0.80 USD, followed by a wider supply zone around 0.86–0.88 USD that previously capped upward moves. A sustained close above those levels, especially with rising trading volume, would indicate strengthening bullish pressure.

Overall, the chart reflects a market that is stabilizing after a decline, with early signs that buyers are trying to build momentum. Further confirmation from price closing above the identified resistance areas and a continued uptick in volume would improve the outlook for additional upward movement.

Potential TP: 1 $

The 13 EMA System Rocket Booster StrategyHave you ever been labelled as a loser?

Thats what happened to me last night.

I was talking to an old buddy of mine.

He told me off.

He said:

"Lubosi you are old, grow up

and leave your parents home."

"Lubosi find a job and get married"

I replied telling him

that i have options.

In this case am talking

about crypto options trading.

Now am not in this trade.But i want to

share it with you because i appreciate

you following me.I think

i saw one of my followers

with a tag from

"the real world" i am humbled

to know that my reach goes

even to you.

You see am not the "cool" guy

but one thing about me man is that

i bust my behind to get isshh done.

Am like the video director

for the real world - That guy is cool

sadly he gets bullied. Once in a while

but they love him, because

he produces good results.

The market doesn't care about

your race, past, or present

All it cares about is what you are

going to give it today.

If you give the market high value.

You will get

high value in return

Thats why am so humbled

to be part of

this community.

My goal is to take you with me on

my journey.

Now look at this crypto KUCOIN:CRVUSDT

its below the William %R -50

that's your entry No negotiation.

You should exit at above the -20

that's your profit taking target and risk

management no negotiation

man do it.

This is called the 13 EMA System

Rocket Booster Strategy

Rocket boost this content to learn more.

Thank you for reading.

P.S.

The entry pattern you are seeing is called the

Dragon Fly Doji

Its got a long wick at

the bottom.

I learnt this from candlestick patterns

book by Steve Nison

Thanks for reading again

remember to rocket boost the content.

So that you learn more

Disclaimer: Trading is risky please learn risk management

and profit taking strategies.Also

feel free to use a simulation trading account

before you trade with real money .

Retail Trap at Resistance📣 Team, get this…

CRV printed 5 green candles, triggered a golden cross, and suddenly every YouTube thumbnail said “TO THE MOON.” 🌝 That’s exactly the kind of retail trap we love to fade. This ain’t DeFi summer, it’s just overheated spaghetti. 🍝

🔥 TRADE SETUP

Bias: Short

Strategy: Retail Trap at Resistance

Entry: $0.98 – $1.03

SL: $1.10

TPs: $0.78, $0.65, $0.50

Why?

– RSI 83 + MACD maxed out = overcooked

– LTF CHoCH after sweeping $1.03

– Positive funding across exchanges → ripe for short squeeze reversal

– Retail buying golden cross = premium exit liquidity

Candle Craft | Signal. Structure. Execution.

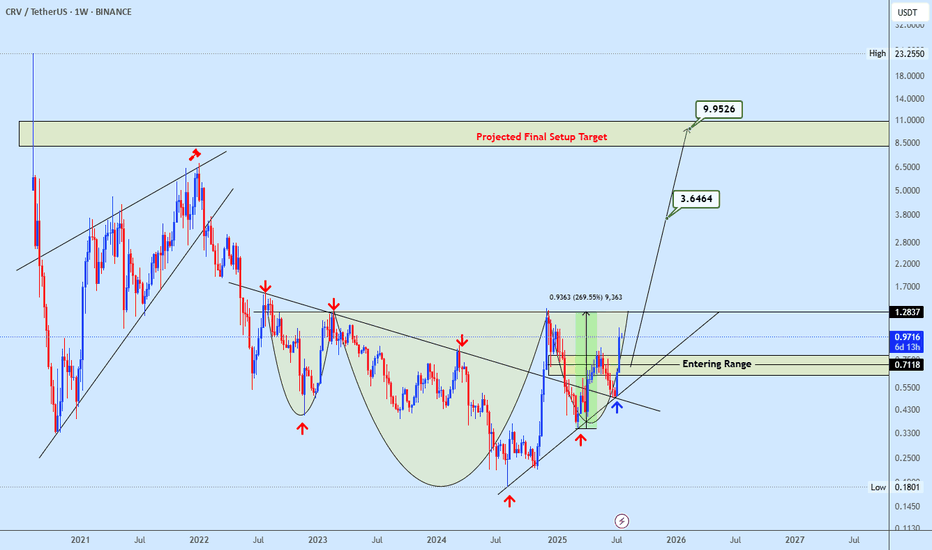

Crvusdt buy opportunityCRVUSDT is forming a potential inverse head and shoulders pattern, with price approaching the neckline zone. The marked entry range offers a strategic buy opportunity for early positioning. A confirmed breakout above the neckline would signal strong bullish continuation, with the final target outlined on the chart. Let us know your thoughts on CRV.

CRVUSDT – Accumulation Breakout Setup After 163% MoveWe nailed a 163%+ move on CRV in the first round — a textbook momentum play. Now, price action is showing signs of breaking out of accumulation, and we’re watching closely for confirmation.

🔍 Key Levels & Setup

Entry Zone: Around $0.80 (support retest)

Breakout Confirmation: Daily close above $0.83

Stop Loss: Daily close below $0.73

Take Profit Targets:

TP1: $0.94

TP2: $1.07

TP3: $1.31

CRVUSDT — Stuck Under the 0.80 CeilingCRV feels like it’s hitting its head on the same doorway every bounce. Each rally into 0.80 gets sold, each dip defended near 0.75. Let’s map the price action.

High Timeframes (Weekly → 2D → 12H)

– Weekly: Corrective drift after 1.0 rejection. Supply 0.92–1.03; demand 0.68–0.72, deeper 0.60–0.66.

– 2D: Lower-highs since Aug; basing 0.74–0.76. Resistance 0.82–0.85, support 0.74–0.76 → 0.70.

– 12H: Range 0.74–0.82. Acceptance ≥0.82 = 0.84–0.86. Break <0.74 = 0.70 → 0.66.

Orderflow / Profile

– POC ~0.76–0.77.

– VAL 0.74–0.75, VAH 0.79–0.80.

– VAH rejections dominate; delta clusters lean distributive.

Derivatives

– OI steady-to-down.

– Funding ~0, CVD net-down.

– No leverage chase, spot flows distributive.

Inter-Market

– BTC mid-range, BTC.D <60%. Alts can rotate, but CRV remains capped unless reclaim ≥0.80.

Conclusion

CRV is balanced-to-heavy around POC 0.76–0.77. Above 0.80 → 0.84–0.86. Below 0.74–0.75 → 0.70, extension 0.60–0.66.

💡 Pro Tip: In markets boxed this tight, grid bots can print profits by automating the support-resistance rotation while waiting for the breakout.

Candle Craft | Signal. Structure. Execution.

CRV-USDT SHORT LAST UPDATE (FULL TARGET)Hello my good friends 😍

I hope you are well 💖

First of all, thank you for giving me the motivation to post more analyses by hitting the 👉boost button👈

Let's go for a quick update of the previous analysis. The analysis I did on the CRV-USDT cryptocurrency and now it can be said that it is fully targeted and you can exit this position and close the position

The targets that I had planned for this analysis, although it took a while, were touched one after the other

💁♂️This analysis was mid-term

Targets of this analysis:

✅TP1: 0.93$ (DONE) 🔥

✅TP2: 0.82$ (DONE) 🔥🔥

✅TP3: 0.73$ (DONE) 🔥🔥🔥

🤔Has anyone used this analysis?

🤔 Are you ready for a new analysis?

🤔Would you like me to put an analysis on Bitcoin?

Share your opinion with me 🙂↕️

To support me, I would appreciate it if you boost the analysis and share it with your friends so that I can analyze it with more energy for you, my dears. Thank you all. 💖

CRV : Will suffering be broken?Hello friends

Well, after reaching a resistance and hitting a higher ceiling, the price has fallen in the two movement logs that we have specified for you.

Now the price has been compressed in a support area and we have to wait for it to move to the specified targets if this range is broken.

*Trade safely with us*

TradeCityPro | CRV: Key Support Test in DeFi Token👋 Welcome to TradeCity Pro!

In this analysis, I want to review the CRV coin for you. It is one of the DeFi projects under Ethereum with a market cap of 1.17 billion dollars, currently ranked 72 on CoinMarketCap.

📅 Daily Timeframe

In the daily timeframe, CRV has a very important support zone, and right now the price is trading near this area.

✔️ The overall trend of CRV can currently be considered bullish because the main highs and lows it has formed are higher highs and higher lows, and at the moment, the price is in the corrective phase of this trend.

⚡️ If the support zone is broken, this corrective phase will deepen, and the price could move toward lower levels. The main supports for this coin in the daily timeframe are 0.497 and 0.349.

💥 Considering the ongoing bullish trend, long positions are currently more logical. If CRV gets supported at this zone, we can look for triggers in lower timeframes to open positions.

📈 The main triggers for long positions on this coin are the breakouts of 1.086 and 1.2502.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

CRV SHORT UPDATE Hello everyone 😍

Let's go for an update on the analysis of the CRV-USDT cryptocurrency

According to the analysis, everything went great and we achieved the first target. After that, we experienced a good price growth, but our analysis did not stop and we moved towards the second target and the second target was touched just now.

TP1: 0.93$ DONE ✅🔥

TP2: 0.82$ DONE ✅🔥

TP3: 0.73$ soon . . .

Did anyone use this analysis?

To support me, I would appreciate it if you boost the analysis and share it with your friends so that I can analyze it with more energy for you, my dears. Thank you all. 💖

CRV still bullish on HTF, but dips are possibleOn higher timeframes CRV still look awesome, although last week's dump increased chances for lower correction. But that still can change if price returns back above 2024 close - in this case only 0.99 will be on the way to breakout.

I don't have any CRV on spot. Not that I don't like it - just not ready to load a bag above 0.75 (might miss it completely, but I don't care)

CRV Price Analysis: Bullish Breakout Targeting $2.64 CRV has been in a long accumulation phase since 2022, suggesting selling pressure has weakened and buyers are slowly gaining control.

The current price is around $1.0436, with RSI at 54.59, indicating mild bullish momentum above the neutral 50 line.

A significant resistance lies at $2.6395, which aligns with a key historical structure and a psychological barrier.

Major supports are found at $0.6001 and $0.4005, both levels from which price has previously bounced strongly.

The chart shows a potential breakout above the short-term blue range, which would confirm bullish continuation.

A monthly close above $1.10 would strengthen the bullish case toward the $2.6395 target.

Long lower wicks on recent candles indicate strong buyer defense at lower prices.

The risk-to-reward from current price to the $2.6395 target is attractive, exceeding 1:2 even with conservative stops.

Holding above $1.00 for consecutive monthly closes will greatly increase the probability of a sustained rally.

Overall momentum and structure lean bullish, with a projected upside potential of over 150% if the breakout holds.