CHFUSD short ideagiven how the swiss franc has been showing structural weakness lately i think shorting 6s futures makes sense but only if you stay sharp about risk chf can snap back fast so it’s not a set and forget kind of trade id keep a tight stop manage size carefully and stay on top of any macro shifts it’s on

Related futures

SWISS FRANC vs US DOLLAR ESTIMATES HIGHER, DUE TO YIELD CONCERNSFutures on Swiss Franc vs US dollar (mirrored mode of the OANDA:USDCHF forex pair) currently shows a bullish technical outlook, with the price breaking above the key 1.2500 level and testing new highs amid weak US data and ongoing Swiss franc demand. Most popular technical indicators—including mov

a return to confirmed sellers presents a good =SELL entry 1-> 4 : we create a lower low in a relativly similiar

environment of volatility , this cements number

1 as the big boss of our chart or as I like to call it the solid

major high

5: price returns to the solid major high and rejects strongly,

this is tricky because the strong bullish bar might con

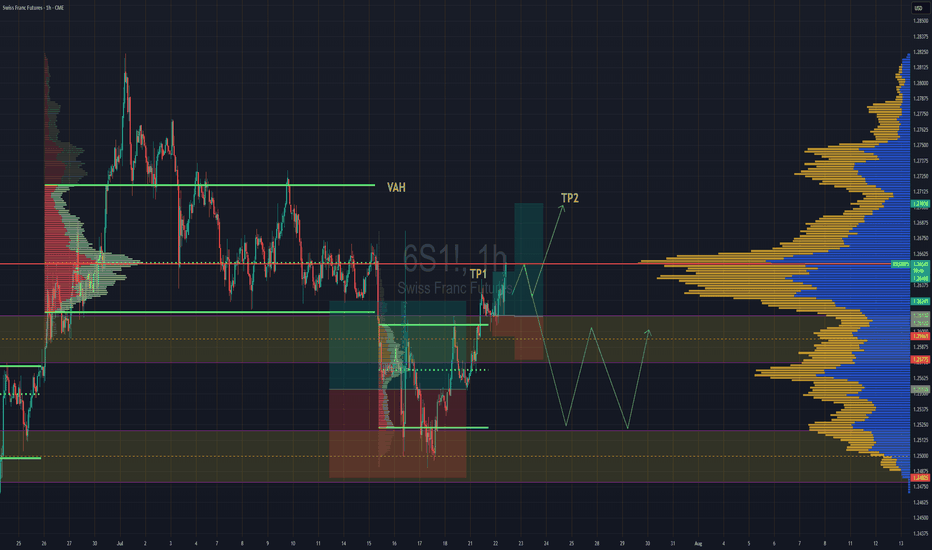

Swiss Gaining Momentum Against The DollarSwiss futures gaining strength against the dollar. We have broken back into previous rotation that was somewhat balanced, but still leaning towards a "b" style volume profile . If we are able to get above the POC, then we''ll go straight for TP2 close to Value are high.

If the POC is really strong

Awaiting Breakout **Martingale Friendly**6S (Swiss Franc Futures) on the 1H chart is coiling within a tight range following a multi-day consolidation. Price action shows signs of compression near the mid-range, potentially gearing up for expansion. The current setup features a bullish R:R of ~1.8, with the entry positioned near support and

Swiss Shield: Buy the DipThe tariff agreement that seemingly fell from the Geneva sky earlier this month convinced investors to pivot toward risk-linked assets, allowing the Swiss currency to retreat temporarily. However, the Franc’s safe-haven status, combined with the fragile balance currently settling over the markets, l

Dollar Decline Against All Major CurrenciesThe Dollar’s decline didn’t start with the recent ‘Liberation Day’ tariffs. In fact, it has been gradually weakening since the 1970s.

More recently, however, the Dollar has lost value against many currencies since January. Why is that?

Why have the USD/CHF and USD/SGD strengthened against the US D

Swiss Franc Futures ShortAfter the recent market volatility caused by tariffs, the Swiss Franc skyrocketed and forced retail shorts to cover. Now those same retail traders have opened long positions at a similar rate. If the market begins to reverse these late retail longs will be forced to close. Therefore, a short positio

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of USD/CHF Futures is 0.78699 CHF — it has fallen −0.58% in the past 24 hours. Watch USD/CHF Futures price in more detail on the chart.

Track more important stats on the USD/CHF Futures chart.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For USD/CHF Futures this number is 2.00. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for USD/CHF Futures shows that traders are closing their positions, which means a weakening trend.