Trade ideas

EUR/HUF 1H Chart: Slight downside potentialThe Hungarian Forint has been appreciating against the Euro after the currency pair reversed from the upper boundary of a medium-term descending channel at 328.40. This movement has been bounded in a short-term ascending channel.

Given that technical indicators still remain bearish in the short run, it is likely that a breakout from the junior channel occurs during the following days. A possible target is the Fibonacci 50.00% retracement at 320.21. This decline, however, should be short-lived, as the pair is located near the oversold territory.

By the large, it is expected that the exchange rate continues its decline until the bottom of the senior-channel line is reached in the 315.00/317.00 area.

EUR/HUF 1H Chart: Targets at 320.30The Euro has been depreciating against the Hungarian Forint gradually after the pair reversed from the upper boundary of a medium-term channel at 328.50.

By the time of this analysis, the pair had breached the support level formed by a combination of the 55– an 100-hour SMAs at 324.72.

The most common scenario for such case would be a surge downwards to the support cluster formed by a combination of the Fibonacci 50.00% retracement and the weekly S2 located circa 320.30.

Also, an important level to look out for is the Fibonacci 38.20% retracement at 322.67.

Buy at support- Ichimoku setup is bullish

- price reached Kijun and spot Kumo support

- Chikou Span (lagging line) is also at past Kumo support

- HA candle body shrinks, indicators may give an early reversal signal soon

- CPI to day at 3,4 % (mkt exp. 3,3 %), but core CPI down to 2,2 % -> NBH is very unlikely to change its extra dovish rethorics any time soon

- European Parlament votes today about triggering Article 7 (strictest sanctions in the EU) against Hungary. In case 2/3 of 751 MPs vote yes, Hungary would lose a lot of funding in coming years.

We added to our longs today.

Watch price action very closely now, use more leverage in case of a clean buy signal.

EURHUF predictive motion track... The exchange rate builds a rising wave structure. It is an extended triple wave structure. Currently, the second wave structure is built. The second wave target price is 331 HUF. Then we are waiting for ABC correction. Graph 1234 indicates a wave structure. Correction can be completed by an ATR axis. The cumulative wave structure may have a target price increase of 45 waves at a level of 341 HUF.

EUR/HUF 4H Chart: Junior pattern is brokenTwo notable developments have taken place on the charts of the EUR/HUF since the last review.

First, the medium term ascending channel pattern, which guided the surge of the Euro against the Hungarian Florin in June, has been broken. Namely, the support line of the pattern was passed on Tuesday.

Secondly, the momentum for the passing of the support level was given by the upper trend line of a massive scale ascending channel pattern, which was drawn on Tuesday.

In regards to the short term future, the rate is expected to decline down to the 325.00 mark in the near future.

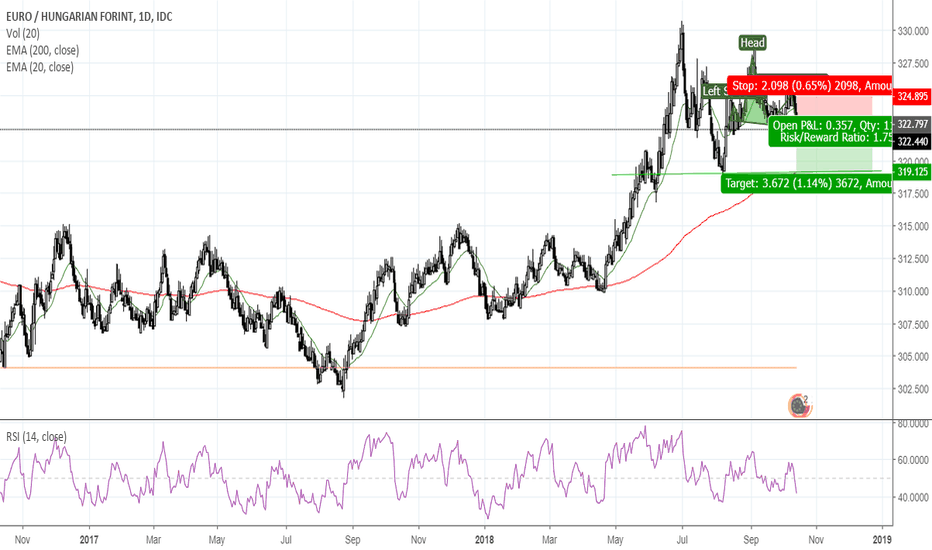

EURHUF - Daily - Watch the level.Trade Alert

Keep a close eye on the 322.25 zone, a break of it could open the path towards the low of the 8th of August at around 319.00 level. Further declines could lead to 316.80-316.40 support area. But once again, we will consider this scenario only if we get a break and a close below the 322.25 zone.

Certainly, the pair could continue traveling higher up until the 325.85 level, where EURHUF could test from underneath the short-term upside support line that it broke through on the 27th of July.

For now, we will stay away from entering any BUY positions, but we would consider the SELL-side if our criteria is met.

Don't forget to put your SL.

EURHUF performs corrective action...EURHUF performs corrective action. This movement is about to end. The exchange rate rises again from around 318.72 HUF. This may be the last wave of elliot. This wave section can be made with steeper movements with greater momentum. The EURHUF target price is around 341.20 HUF.

EURHUF Buy IdeaEURHUF Buy Idea @Weekly Demand Zone (320.110 - 316.846)

Buy Limit: 320.419

Stop Loss: 316.602

Take Profit: 327.017

Risk Management = 0.01/$100

Close partially the contract once it reaches 50% of profit, Move stop loss over the entry level

Close partially the contract once it reaches 80% of the profit

EURHUF - Daily - We can still catch a bit of that dropTrade Alert

Even though the pair has already made a strong move lower from its peak at around 330.70, we can still try and catch that move towards the upwards moving trendline, drawn from the low of the 20th of April. Probably a good idea could be to try and wait for a small retracement back to the 21 EMA and then try to enter SHORT position, with a convenient for you SL. One level to watch for a potential SL could be the 325.35 zone.

Always have your SL in place.

EUR/HUF 1H Chart: Surge after breakoutThe Euro continues to strengthen against the Hungarian Forint since hitting a medium-term channel at 317.00 early in June. This appreciation has been bounded in a more junior channel which has guided the pair out of the senior channel. At the time of this analysis, the Euro was testing the 327.00 mark – its highest level in several years.

Technical indicators have been located in the overbought territory for two weeks, as well as they are starting to converge with the price level. These signals allow to make an assumption that a correction south could follow soon.

Bullish gains should be capped near the monthly R3 at 330.00, thus allowing bears to dominate in the market for a week or two. The nearest support of significance is the 55– and 100-period (4H) SMAs and a channel line circa 322.00. Technical indicators on the 1D chart suggest that this decline might actually prevail for a longer period of time, thus setting the 3.16 level as a possible target for mid-August.